7 Best Investment Tools & Analysis Software for 2025

There is no need to subscribe to daily newspapers or call your broker several times for investment opportunities. The best investment tools and analysis software bring opportunities even to beginners who have yet to buy their first stocks or securities. They are easy to use on PCs or mobile devices, with extensive information to learn about any sector that interests you.

This guide will explore the best investment tools and analysis software for 2025. We’ll see their features, including the exclusive benefits they bring to users. With that in mind, let’s begin by ranking the top seven recommended platforms on our list.

-

- AltIndex: Overall Best Investment Tool and Analysis Software

- StockLytics: The Best Investment App for Research

- Stock Rover: The Best Investment Tool and Analysis Software for Portfolio Management

- MetaStock: Best Investment Tool and Analysis Software for Charting

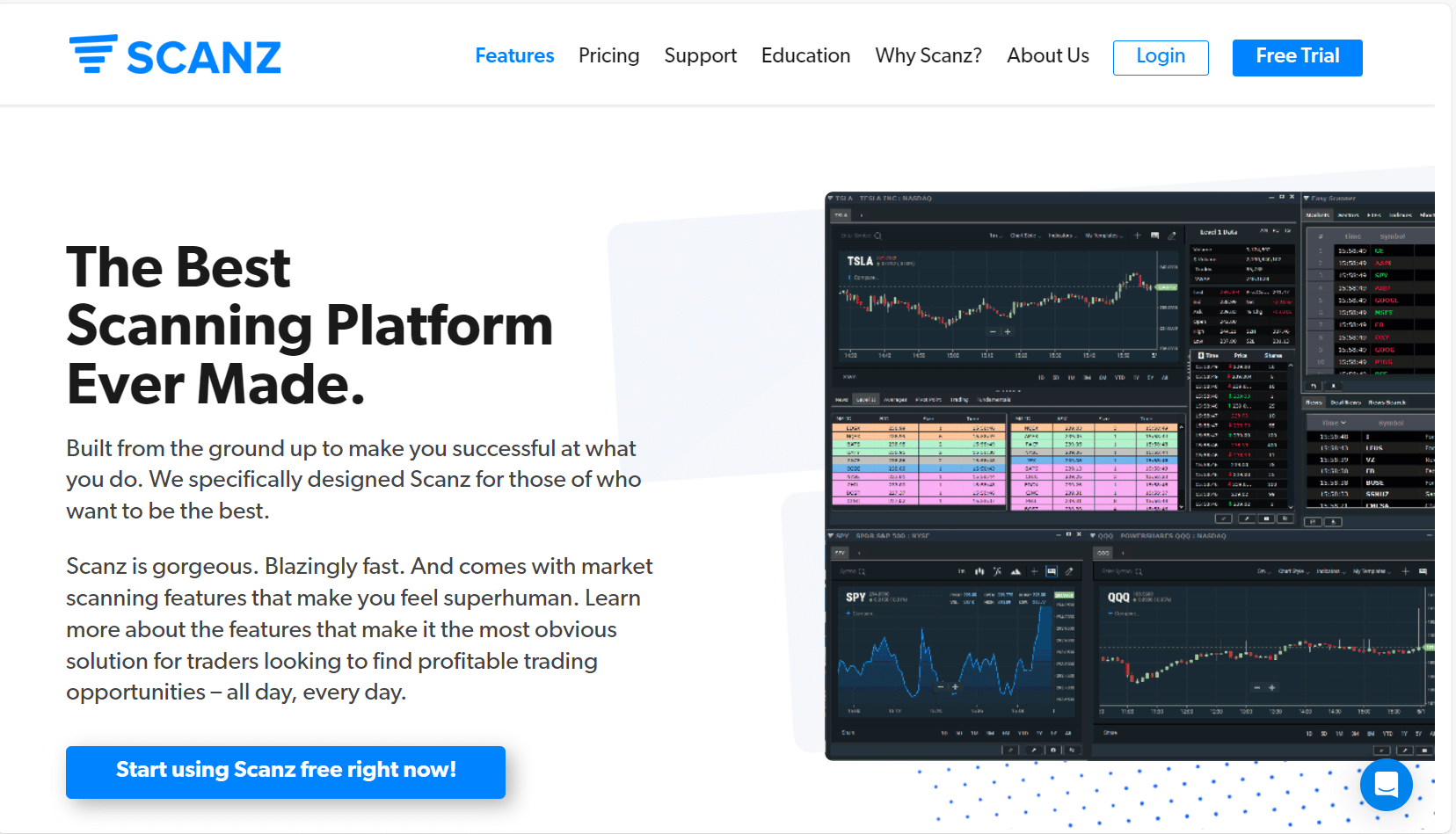

- Scanz: Best Investment Tool for Day Trading

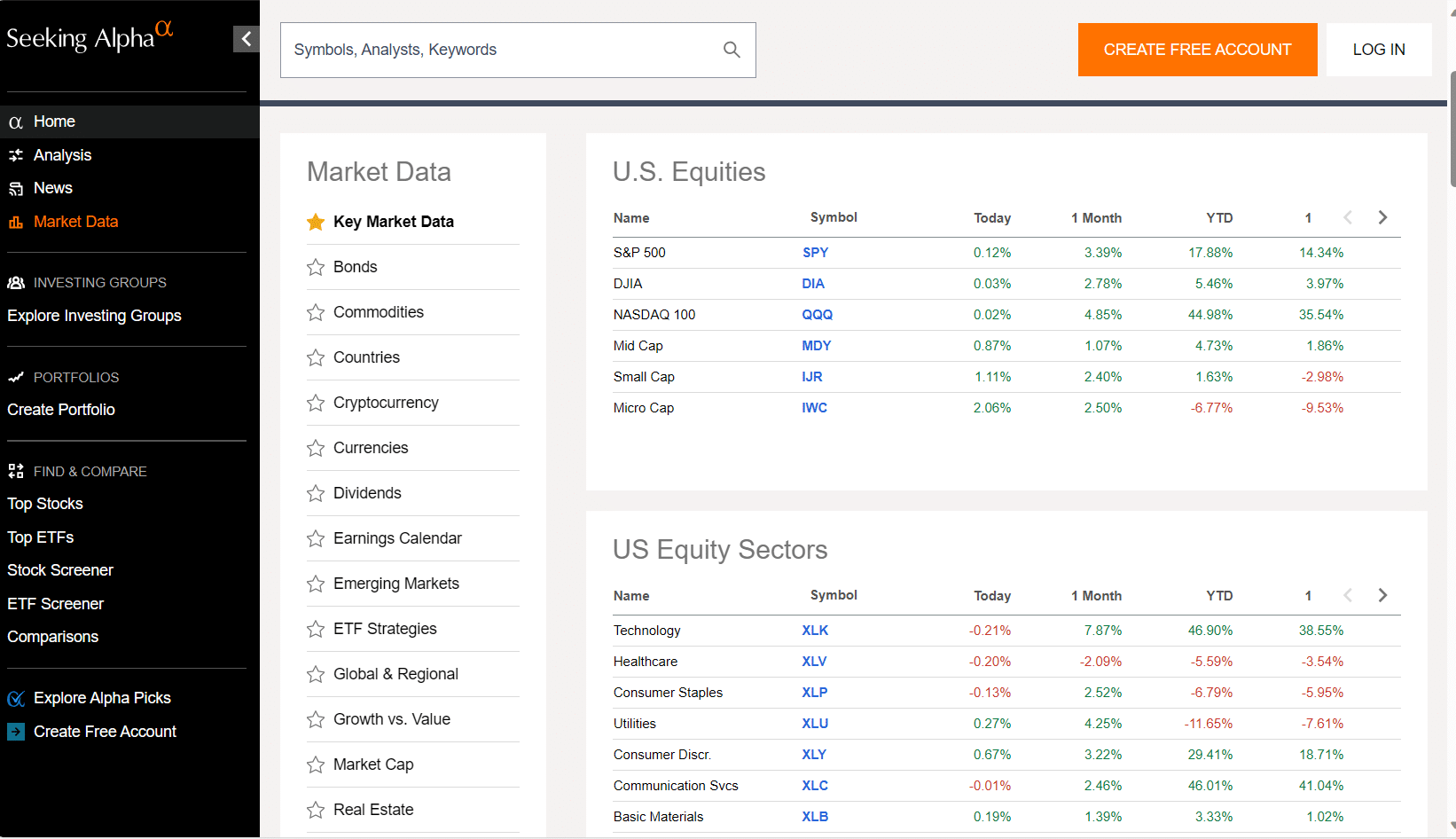

- Seeking Alpha: Best Investment Tool for Group Investing

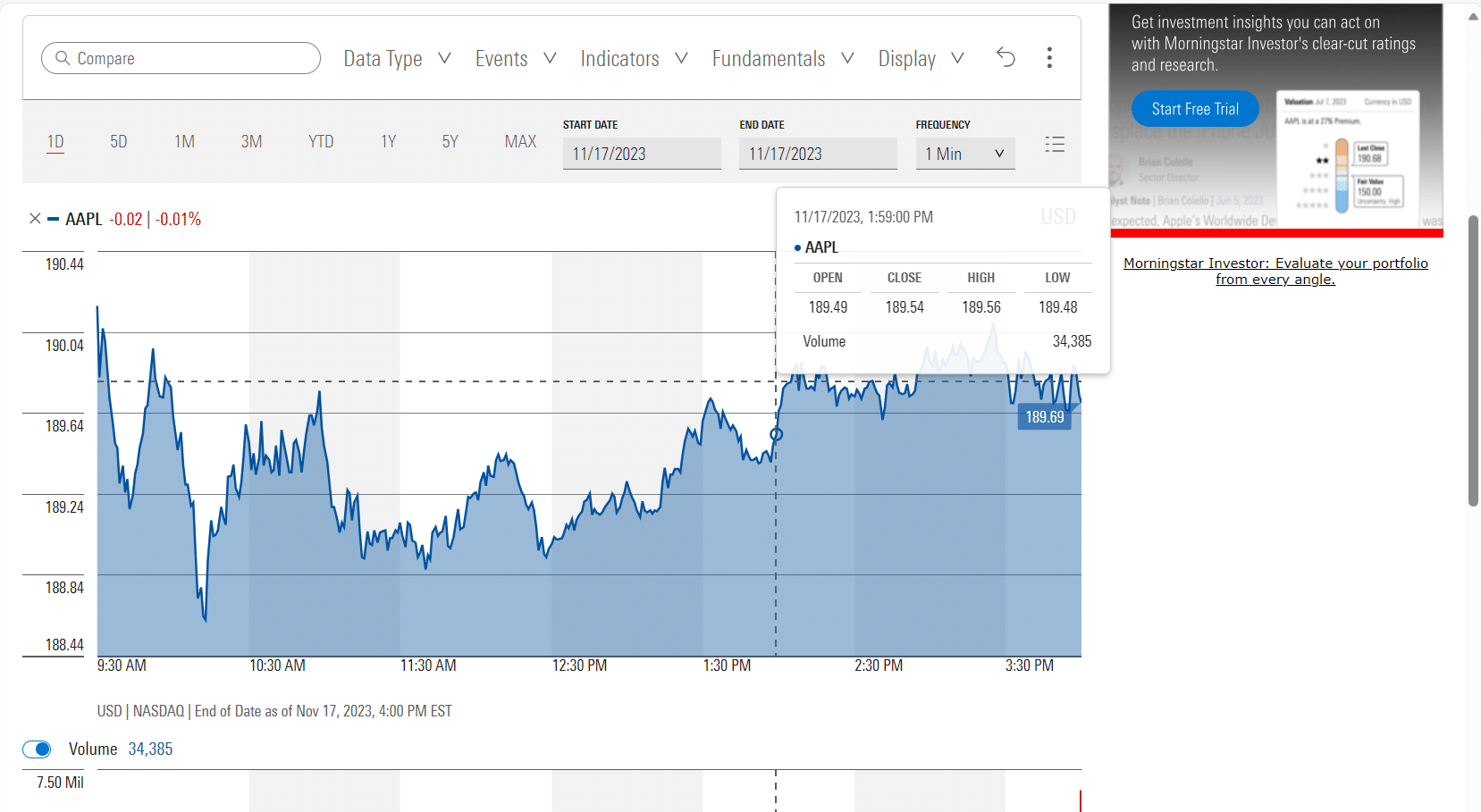

- Morning Star: Best Investment Tool for Research

-

-

- AltIndex: Overall Best Investment Tool and Analysis Software

- StockLytics: The Best Investment App for Research

- Stock Rover: The Best Investment Tool and Analysis Software for Portfolio Management

- MetaStock: Best Investment Tool and Analysis Software for Charting

- Scanz: Best Investment Tool for Day Trading

- Seeking Alpha: Best Investment Tool for Group Investing

- Morning Star: Best Investment Tool for Research

-

The Top Investment Tools & Analysis Software Ranked

If you want to learn how stocks work, these platforms have features to help you start investing from scratch. You can also follow the expert recommendations and copy their trades. Some investing apps use artificial intelligence to make predictions on potential investment opportunities.

With that in mind, here are the seven best investment tools and analysis software we recommend for 2025:

- AltIndex: This AI-driven platform brings extensive information about company stocks, including alternative data services. It also features cryptocurrencies with detailed analysis to guide trading decisions. You can see company earnings, a valuable resource to determine how the stock will perform.

- StockLytics: The major features of this platform include the screener, alerts, technical signals, smart portfolio, score, and candle and chart patterns. StockLytics covers over 5,000 stocks and 2,400 ETFs with AI predictions and analyst ratings.

- Stock Rover: This is a robust platform to screen the market, compare stocks, and manage your portfolio. You can link your portfolio to your online brokerage for automatic updates.

- MetaStock: This platform is ideal for backtesting trading strategies. It provides daily charts for after-trade analysis and real-time service for day trading.

- Scanz: The over 70 real-time market scanners can help you identify surging stocks in real-time and identify multi-day gainers. You can use the pre-built scans or create a customer one. Also, alerts on news and SEC filings are available.

- Seeking Alpha: This platform provides extensive analysis of different sectors. It takes the news, analyzes it, and determines if there is an investment opportunity.

- Morning Star: This platform is ideal for researching stocks, ETFs, funds, etc. It provides an extensive analysis of these securities, including recommendations on the best.

Investment Tools & Analysis Software Reviewed

Below are the seven top investment tools and analysis software:

AltIndex: Overall Best Investment Tool and Analysis Software

What makes AltIdex so good is the range of information captured for a company’s stock. Besides the technical analysis of these securities, the platform provides information as an alternative data service. You’ll find information on the company’s earnings, sentiment, job postings, Google AdSpend and trends, patents, ESG, lobbying costs, etc.

With the correct API key, you can get more information on public companies. This feature can help determine which companies outperform their stocks, which mobile apps are the most popular, etc. You’ll get this feature as a PRO or Enterprise user.

Another prominent feature of AltIndex is the Fear and Grid Index, which tracks the performance of 579 companies. It uses several distinct indicators to assess the market and give it an overall score.

AltIndex is one of the best investment tools for beginners. You can quickly see which stocks are trending on popular platforms like Reddit, WallStreetBets, StockTwits, etc. These can provide ample investment opportunities, even as you use the analytical tools to learn more about them.

The AI stock picks are the most prominent feature of AltIndex. They have a 75% win rate, among the best in the industry. Furthermore, you can get over 100,000 insights to guide you.

Spec Overview AI Stock Picks The algorithm analyzes several signals to predict future price movements of publicly traded companies Stock Alerts Provides updates on important events, like when a company becomes popular on Reddit News Includes news and analysis to determine investment opportunities Pros:

- It provides an analysis of each piece of news to determine whether a stock or cryptocurrency is worth buying.

- It includes the stocks and cryptocurrencies traded by US congress members and senators.

- It offers daily stock alerts

- It provides an API to obtain more information

Cons:

- It is limited to only stocks and cryptocurrencies

StockLytics: The Best Investment App for Research

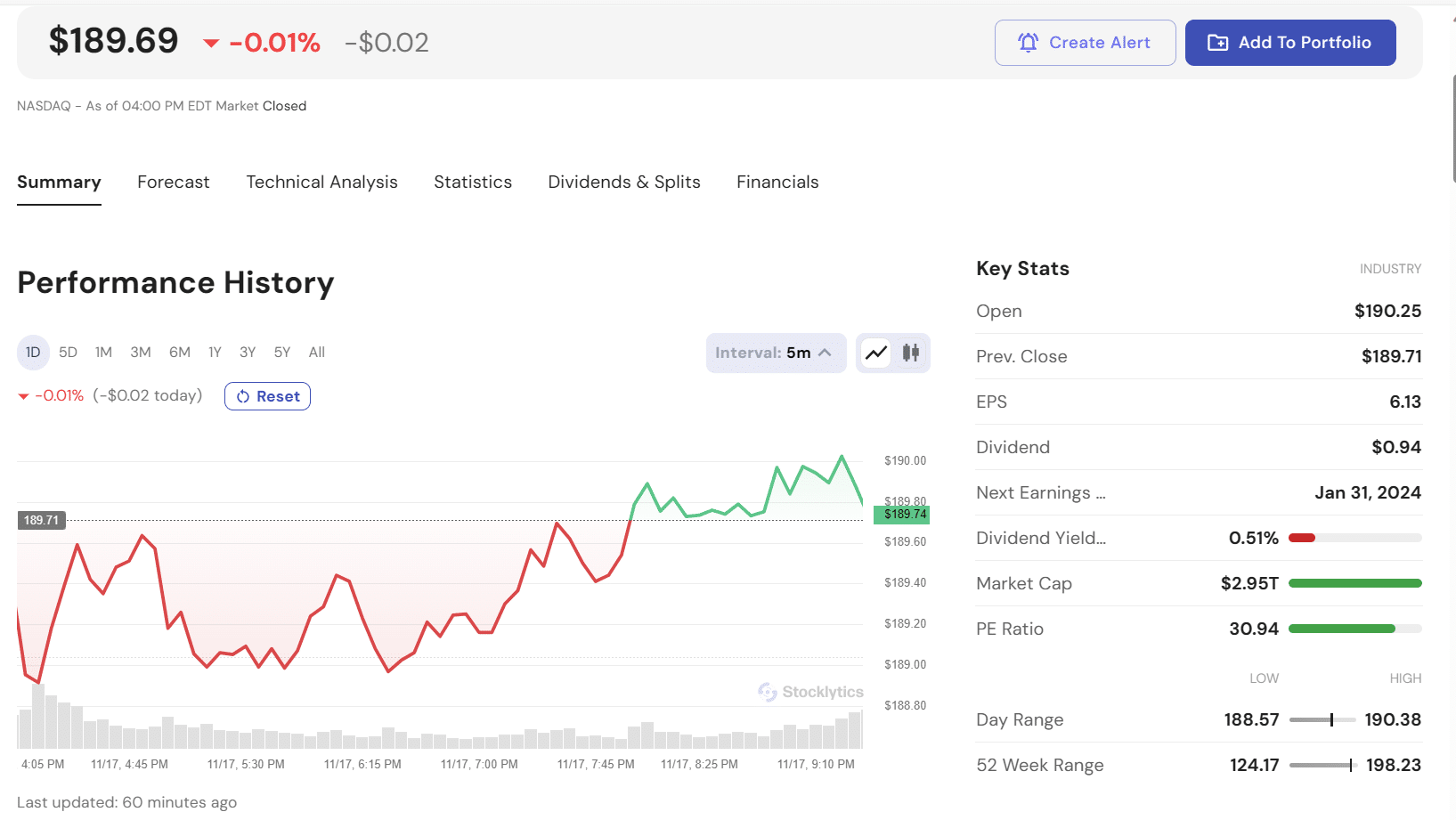

Stock market research tools are vital to building a portfolio and making profitable trades. StockLytics provides data on stocks and ETFs. Additionally, it sorts them into various categories, including 52 weeks high, most expensive, high volume, AI companies, big tech, etc.

The significant features of this platform include the screener, alerts, technical signals, smart portfolio, score, and candle and chart patterns. These tools give an all-around research opportunity to research stocks and ETFs. You can master the candle and stick to gain predictive insights, mitigate risks, and make informed decisions.

StockLytics has over 5,000 stocks and 2,400 ETFs. The platform is AI-powered, with different insights, including trending gainers and losers. Each stock or ETF has a summary page with additional information in the financials, statistics, dividends and splits, forecast, etc. pages.

The financial forecast includes AI predictions and analyst ratings. You’ll see which stocks or ETFs are recommended for purchase. You can add stocks to your watchlist to aid in trading decisions if necessary.

StockLytics provides stock screeners to help when researching new investment opportunities. Its screeners have several filters for advanced customizations. You can search for stocks with specific traits or technical patterns and signals.

The available indicators during stock searches can help you find stocks that perfectly align with your investment goals. These indicators include open price, free cash flow, 24-hour high, PEG ratio, etc.

Stock alerts provide timely updates when price movements or major events affect your portfolio. You can set up alerts for price and percentage changes, technicals, trailing amounts, other assets, etc.

Spec Overview Screeners This feature allows you to customize your searches for stocks. It provides advanced filters, including technical indicators Watchlist Keep your portfolio close with real-time updates on crucial influencing events Pros:

- It offers a free version for casual investors

- It covers over 5,000 stocks and 2,400 ETFs

- It provides news updates

Cons:

- StockLytics does not cover cryptocurrencies and commodities

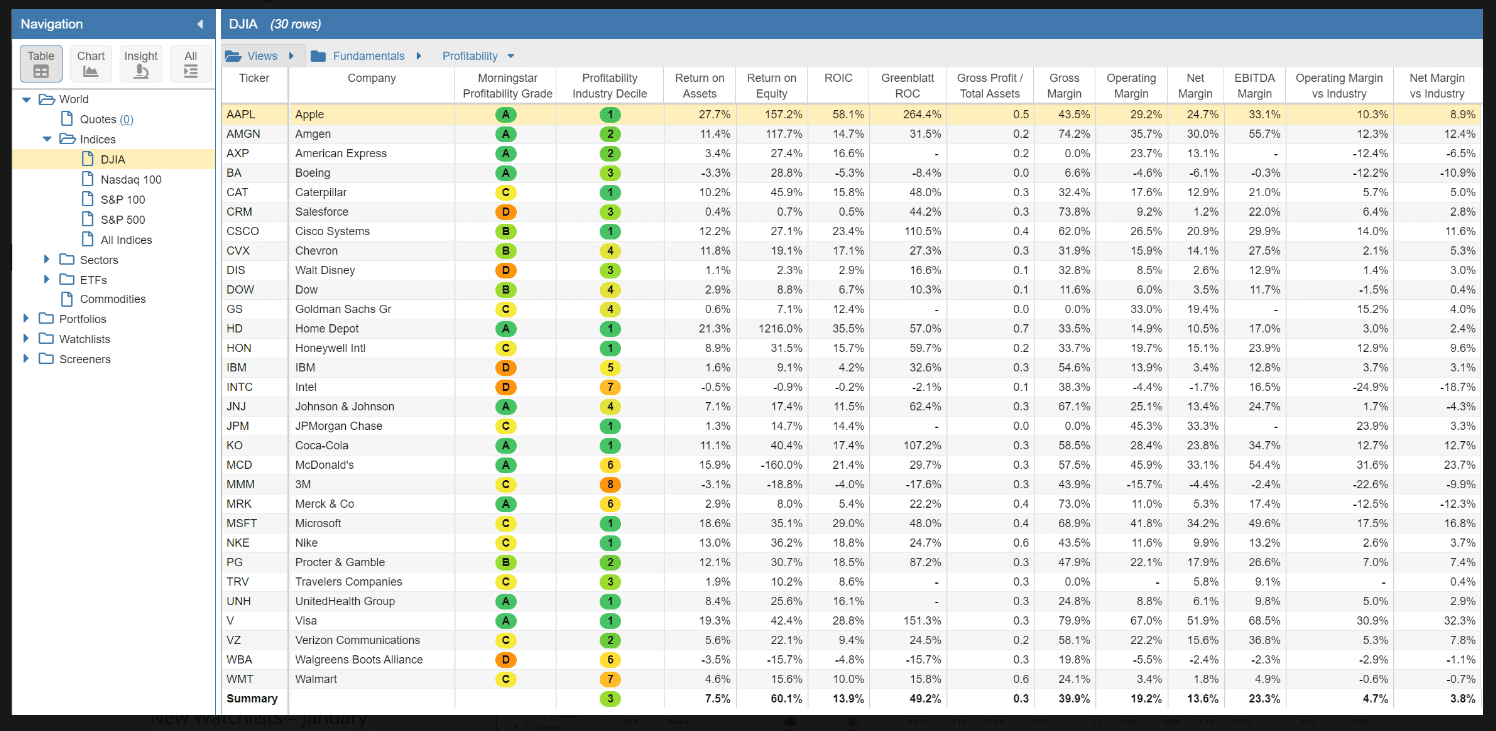

Stock Rover: The Best Investment Tool and Analysis Software for Portfolio Management

This platform should be among your top investing apps as a beginner. It might not provide many charts for trade analysis. However, it has key strengths in screenings, comparisons, and portfolio management.

Stock Rover lets you link your portfolio to your online brokerage for automatic updates. These performance metrics can be valuable in trading. Most importantly, you can import your portfolios from online brokerages through its integration feature.

This platform adds a few capabilities once your portfolio is created. You can activate daily, weekly, or monthly reports for your portfolio, including stocks with target buys and sells.

The future income tool projects your future portfolio dividend income. That can be a helpful addition to stock portfolio trackers, keeping you informed.

Stock Rover’s highlight feature is the comparison tool. It has the feel of a spreadsheet, but you can filter, sort, and comment. Most importantly, it uses the stocks and companies’ up-to-date pricing data and financials.

You can compare stocks using the table or the tile format. Both are powerful ways to see how stocks or EFTs in a group compare in terms of performance.

There is a warning feature for investors, making Stock Rover one of the best investing apps. This feature analyzes trends like declining sales, unstable balance sheets, low earnings, etc. Also, you can customize the warnings to ensure you only receive those that concern your investment goals.

Stock Rover provides stock ratings, grading performance in growth, financial strength, dividends, efficiency, and momentum. This section gives you a quick overview of the investment opportunities worth taking.

Spec Overview Research reports Tracks and reports on over 7,000 stocks Portfolio charting Adds your portfolio to the dashboard chat Pros:

- It covers stocks, ETFs, and funds

- It provides news and press

Cons:

- It lacks advanced chart analysis

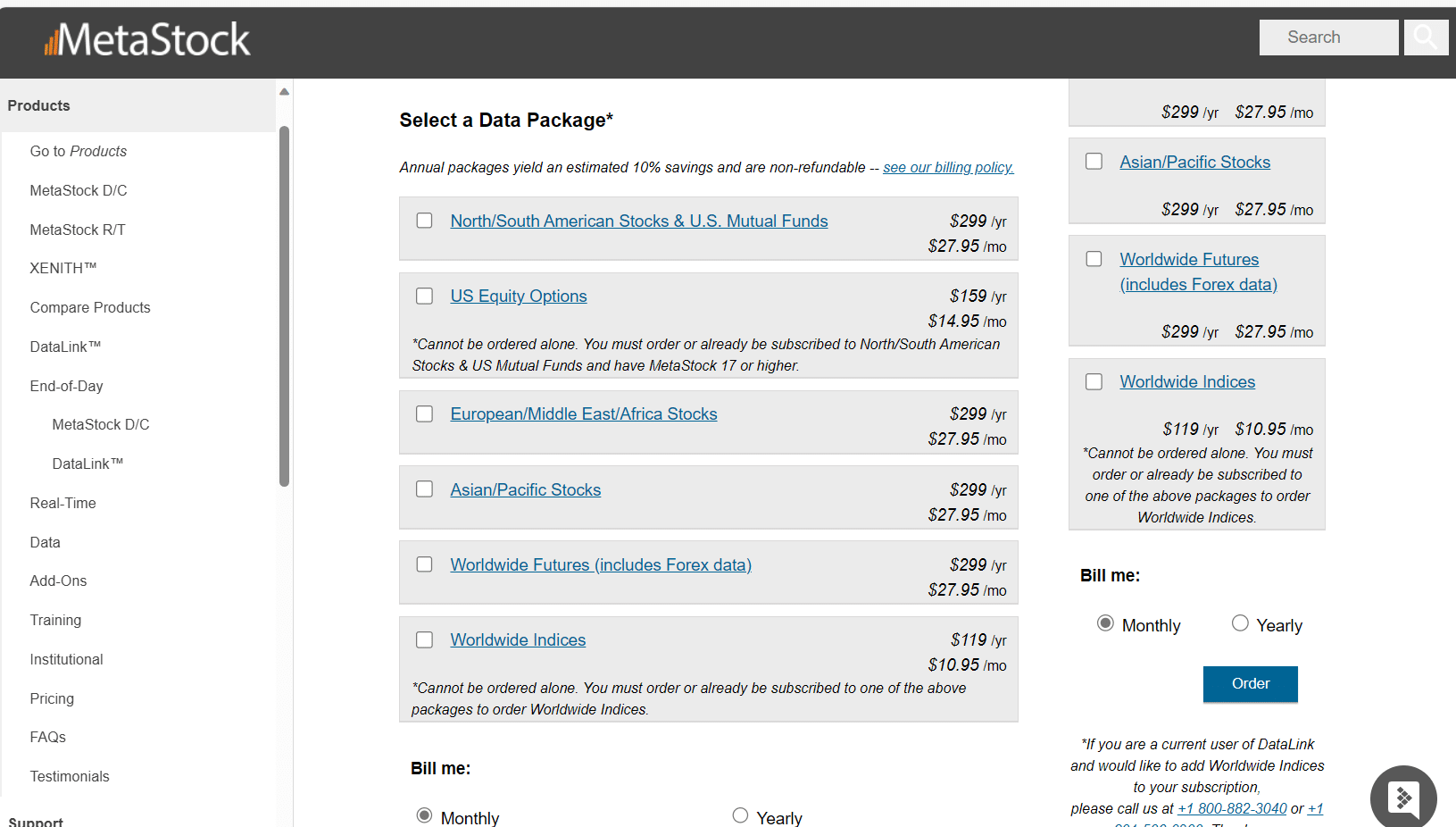

MetaStock: Best Investment Tool and Analysis Software for Charting

This platform is ideal for self-directed traders. You might need a bit of learning if you are new to trading. Nonetheless, MetaStock simplifies its features as best as it can.

MetaStock covers stocks, futures, options, forex, etc. It backs them up with several valuable features, including the ability to backtest and confidently analyze different markets. These powerful analytical tools produce buy-and-sell signals you can count on.

MetaStock has several features, starting with the MetaStock Daily Charts. This feature serves traders who do their analysis after the market is closed. With it, you can scan the market for investment opportunities, backtest your approach, predict future prices, monitor performance, etc.

MetaStock Real Time is on the other end, providing real-time data. It functions like a day-trading app, bringing out-of-the-box solutions to everyday trades. You’ll need a paid subscription or an outright purchase to use this feature.

Spec Overview MetaStock Daily Charts It provides analysis after the day’s trades MetaStock Real Time It is used for active day trading Pros:

- MetaStock covers day trading and after-trade analysis

- You can backtest your strategies

- It provides tools for forecasting

Cons:

- MetaStock Real Time is only available with a paid subscription

- It is relatively expensive for casual investors

Scanz: Best Investment Tool for Day Trading

This platform gives you access to over 70 real-time market scanners. It is one of the best investment tools & analysis software because of its ability to monitor live, market-moving activities. Alerts, news, SEC filings, brokerage integrations, and other customizations are available on this platform.

With Scanz, you can quickly identify stocks that surge in real-time, find the most active ones, identify the multi-day gainers, etc. Go to the prebuilt scans and select the one you need.

You can create custom scans if you are well-versed and know what you want. This feature is available in the Pro Scanner, allowing you to add stock types, the number of markets, the day’s volume, the day’s high, etc.

News traders can use the news scanner to filter and sort updates relevant to their portfolios. Scanz also offers trade signals and charts to help you access opportunities early.

Spec Overview Pro Scanner Build custom scans or use any from the over 70 real-time market scans available News Scanner Compiles information from over 100 sources with filters Pros:

- A 14-day free trial is available

- Provides powerful scans for stocks and news

- It has advanced technical indicators, customizable annotations, and drawing tools

Cons:

- The monthly subscription is relatively high for beginners

- No alternative data support

Seeking Alpha: Best Investment Tool for Group Investing

This platform’s extensive market data, analysis, and news coverage make it one of the best online investment tools. Seeking Alpha provides quick trending analysis to help you identify investment opportunities.

Seeking Alpha sorts its analysis by sectors, including energy, real estate, communication services, tech, utilities, healthcare, financials, etc.

The news section is another valuable tool for investors. You can sort the updates based on which sector your portfolio is in. With that, you have cryptocurrencies, commodities, earnings, graphical news, IPOs, notable calls, market pulse, etc.

Seeking Alpha provides an exclusive ETF screener and analysis. You can create new custom screens or use the pre-built screeners. Editor’s picks are also available to guide you on what experts think are the best opportunities.

This platform offers free access, but you will get limited features. The Premium subscription starts at $4.95 for 30 days, while the PRO subscription is $2,400 per year.

Spec Overview ETF screener Offers screens to sort and filter ETFs Investing Groups Paid service to join high-performing investing groups. Pros:

- It provides an exclusive ETF screener

- Offers daily analysis for new investment opportunities

Cons:

- It lacks advanced technical analysis with indicators and charts

- The PRO subscription is relatively expensive

Morning Star: Best Investment Tool for Research

The user interface might seem overwhelming, but Morning Star is unlike other software platforms on this page. It provides extensive analysis of stocks, funds, ETFs, and bonds. You’ll also find exclusive insights on the best investments, companies to own, and ETFs to buy.

For a beginner looking for the best investment research tools, we’d recommend Morning Star. It simplifies things, adds charts, and brings real-life insights to help you make the best decisions.

Each stock or security listed on this platform has several sections for insight. You can view charts with different data types, choose events, add several technical indicators, and customize the display. Overall, Morning Star is one of the best investment tools & analysis software for beginners and expert investors.

Spec Overview Market This feature provides real-time tracking of major indexes Managed portfolios Gives access to fee-based financial advisors Pros:

- It provides extensive charting with technical indicators and other customizations

- It is ideal for beginners and expert investors

- It offers real-life advice on the best investments.

Cons:

- Some tools can look clunky

Comparing the Best Investment Tools & Analysis Software

The following table compares investment apps by price and assets covered:

Software name Price Asset classes supported AltIndex From $29 monthly Stocks and Cryptocurrencies StockLytics $240 yearly Stocks and ETFs StockRover From $179.99 per year Stocks and ETFs MetaStocks From $499 stocks, options, FOREX, commodities, eminis, and foreign currency Scanz $169 Stocks Seeking Alpha From $239 Stocks and ETFs Morningstar From $34.95 Stocks, markets, funds, ETFs, and bonds How do Investment Tools & Analysis Software Work?

Investment tools and analysis software let you research stocks, bonds, funds, forex, ETFs, and cryptocurrencies for investment opportunities. They provide tools for comparative market analysis, allowing you to weigh investment opportunities. Some feature backtesting capabilities to test your trades in real-time with real-market conditions.

The best investment tools & analysis software use different approaches to provide information. However, three things are expected: data, analysis, and recommendations.

Summarily, here is how these tools and software work:

- They gather historical price and sentimental data on securities (stocks, futures, forex, bonds, ETFs, etc.)

- They analyze this data through charts and expert insights.

- They provide analytical tools (technical indicators) to customize the information you want to learn about an asset.

- They provide expert recommendations by rating the securities to determine their potential for buy-in.

Investing apps will provide data on thousands of securities. However, you will decide which ones to add to your portfolio. The ultimate research and final pick are left to you, although recommendations may be available.

Besides doing as described above, the best investment tools & analysis software add secondary features to simplify the process. These features are often directed at portfolio management. Once you’ve selected which securities offer the best investment opportunities, you can keep up with them through portfolio management.

Features of Investment Apps

The following are popular features in investment apps:

- Charts: Most analyses you’ll find will occur in charts or graphs. The simplest form is a basic chart showing an asset’s price history. However, there will be added functionalities, like adding technical indicators and other lines to help predict the price movement.

- Alerts: With the US Securities and Exchange Commission’s EDGAR system processing 3,000 filings daily, you need alerts to keep up. These notifications can be sent to your email to keep tabs on assets in your portfolio. You can set up alerts for price movements or use different criteria allowed on the platform.

- AI predictions: Some investment apps, like AltIndex, add AI predictions to their analyses. They use machine learning and complex algorithms to analyze alternative data and predict an asset’s performance. You’ll still need to do your homework, but AI predictions can provide valuable starting points.

- News: This feature provides information on events that can affect the market. Some platforms allow users to customize their news feed and see updates only on events related to assets in their portfolios. The news feature is also a way to discover new investment opportunities.

- Editor’s picks: Some platforms provide the top picks by expert editors. Although that does not guarantee success, it is a quick way to see what the editors think about trending assets. These picks are often made after extensive analysis.

How to Pick the Best Investment Tools & Analysis Software

Budget constraints are one of the core reasons for picking one or a few investment apps out of the many available. Some of the platforms recommended on this page can effectively serve as portfolio trackers, eliminating the need for extra services. However, there is much to consider before settling for one.

Here is a step-by-step guide to picking the best investment tools & analysis software:

- Sign up with the free version of your preferred platform, if available

- Review the assets database to see if it matches your goals

- Review the features (most advanced features will be unavailable for free users)

- Pay the subscription fee when you are satisfied

With that in mind, the following are the top things to consider when choosing an investment tool and analysis software:

Investment Goals

The first question you must answer concerns your investment goals. This will determine what risk levels you are willing to take and the assets that match that risk tolerance. Your investment goals will be part of your overall financial goals.

Common reasons people invest include retirement, education, diversifying income stream, buying a house, funding educational expenses, etc. These call for different risk tolerances.

For example, someone hoping to diversify their income stream with a steady paycheck has more risk tolerance. Compare that with the person who doesn’t have stable pay. It will be challenging for the latter to take on more risky assets.

You can learn how stocks work to refine your investment goals if you are new. Other assets include cryptocurrencies, forex, futures, ETFs, bonds, etc. You don’t need to rush when setting your investment goals.

Consume educational materials to understand the market better. Fortunately, the platforms on this page have educational sections to help you learn about assets.

Time Tolerance

This consideration involves how long you are willing to invest. Again, time will determine which assets you need and your risk tolerance. Short-term investments often require lower-risk assets, while long-term investors don’t mind taking on more risks.

Your investment goal should determine how long you need. Once you have this information, you can start reviewing investment tools & analysis software.

Asset Class

Your goals and time tolerance will determine the assets you need to invest in. For example, cryptocurrencies have higher volatility than stocks. That makes them ideal for short-term investments, even though their volatility increases risk.

The asset classes you can invest in include stocks, cryptocurrencies, bonds, ETFs, funds, futures, forex, etc. These have varying risk levels and returns. A simple rule of thumb is that the higher the risk, the higher the reward.

You can use the free versions of our recommended tools to research different asset classes. Find out what makes them unique and how they align with your goals.

Fortunately, preliminary analysis with the right investment tools can reveal opportunities. The final list of assets you choose will determine which software you need.

Data Type

Price historical data is often at the foundation of technical analysis. The tools, including technical indicators, work with the price movement of an asset over time. However, that is not the only data you need.

It is crucial to get quality and reliable price information. This should be non-negotiable when selecting the best investment tools & analysis software.

Alternative Data for Investments

AltIndex is our top choice for getting an alternative data service. Several things can influence an asset price, including company earnings, customer feedback, employee ratings, new product launches, etc. Even the hiring rate can affect an asset’s price.

When considering investment tools & analysis, include the alternative data you need for your portfolio. Ensure you have a tool to review market sentiments. That can help you predict when an asset is set for a bullish run.

Budget

How much you have to invest will determine which assets you can buy. For example, some stocks cost above $1,000. The same thing applies to other investments.

Your budget will also affect which investment tool you pick. Some require higher subscription fees than others. You’ll see the price requirements in the pricing section.

If necessary, you can email the software for a custom quote. Ensure your budget aligns with your overall goals. The last thing is to spend too much on an investment tool, leaving little for actual trades.

Mobile Compatibility

You should consider an investment tool compatible with mobile devices (smartphones and tablets). Try using the tool on your mobile device to see its responsiveness—test as many features as possible, especially brokerage integrations for automation.

You might not find many investment tools with mobile applications. However, web applications have become more advanced and seamless, like mobile apps. Test the page loading speeds and charts to ensure smooth operations when researching or analyzing.

User Interface

Pick apps with easy-to-understand user interfaces. Regardless of how many features they have, the interface should be clutter-free.

The user experience is essential when skimming through thousands of stocks during your research stage. Navigation should be smooth as you open different pages or sections during your research. Also, the charts should appear simple to understand, with the technical indicators showing clearly when added.

Analytical Functions

Depending on your investment strategy, you may require investment software with advanced analytical tools. It could be a backtesting function with real-time market conditions or the ability to apply a method to an ongoing investment.

Go to the analysis section and review the functions available. If there isn’t much there, go to the pricing page. The subscription plans will show which features are available for each level.

Compare the features with your investment goals. Add the platform to your list if it delivers the required results.

The Benefits of Using Investment Analysis Software

Regardless of your level as an investor, investment tools and analysis software are vital. You can subscribe to newsletters from popular news agencies. However, none will analyze an event to see if there is an investment opportunity or if you should sell your current assets.

The following are the benefits of using the best investment tools & analysis software:

- Filtered and sorted news updates about your preferred business sectors or companies.

- Analysis and expert insights on events in your selected business sectors.

- All-in-one platform for alternative data and analytical reports.

- The presence of analytical tools to assess an asset’s performance based on its price movement over specific periods.

- AI predictions and ratings to give you insights into potential high-performing assets.

- Email alerts and notifications to keep tabs on assets in your portfolio.

- Group investing opportunities to join others with the same investment goals.

Conclusion

The best investment tools & analysis software are crucial to finding high-potential investment opportunities. While they are more suitable for long-term investors, you can still get information for short-term trades. These tools allow you to pick assets, build a portfolio, analyze price movements, and manage your investments.

Some of the tools recommended on this page have online brokerage integrations. Hence, you can trade directly on their platforms or set automatic updates based on various criteria.

Selecting the best investment tools & analysis software boils down to your goals and the platform’s features. Opt for applications with the features to produce your preferred results or insights.

AltIndex provides a balanced approach to investment and analysis. On one end, it offers extensive insights into alternative data regarding your asset (stock or cryptocurrency). Then, you can use the technical tools to analyze price movements.

Our top recommendation is AltIndex. This investment tool is affordable, yet it adds AI support for predictions, forecasts, and ratings. It has a 75% win rate on AI stock picks.

Register with AltIndex today to begin your investment journey. Explore its features and set up alerts to monitor your assets.

References

- https://www.sec.gov/edgar

- https://www.cbsnews.com/news/the-impact-of-news-events-on-market-prices/

- https://www.forbes.com/advisor/retirement/how-to-set-financial-goals/

- https://corporatefinanceinstitute.com/resources/cryptocurrency/cryptocurrency-vs-stocks/

- https://www.entrepreneur.com/business-news/how-innovations-in-mobile-trading-have-changed-the-way-we/411815

FAQs

What tools do professional traders use?

Professional traders use investment and analysis software to review their assets beyond price fluctuations. These tools provide insights into events that may influence the market. The popular ones include AltIndex, StockLytics, Stock Rover, MetaStock, Seeking Alpha, Morning Star, Scanz, etc.

Which method is the best to analyze an investment?

The best investment analysis method depends on your time preference and risk tolerance. For short-term investors, advanced technical analysis with different technical indicators is required to generate signals. Long-term investors can stick to fundamental analysis without dabbling much in charts.

Which software is used for stock analysis?

The software used for stock analysis collects data on price fluctuations, including news and market sentiment, that can influence prices. It contains technical tools like drawing functions and indicators to analyze a stock within a given period. The software listed on this page can be used for stock analysis to varying degrees, depending on your expertise.

Jeremiah Awogboro

View all posts by Jeremiah AwogboroJeremiah Awogboro is an experienced content writer with over 8 years of experience. He has a qualified MBChB degree and a keen interest in the stock market and the finance industry. His background in the industry has provided him with valuable experience in this field. Awogboro is dedicated to assisting and reaching out to as many people as possible through his writing. In his spare time, he enjoys music, football, traveling, and reading.

VISIT ETOROYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2025

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up