Why do Stocks Split and What is It?

Companies can increase their shares without affecting their overall market capitalization. This goal is achievable through stock splitting, a corporate process to increase a company’s shares. However, that leaves us wondering, why do stocks split?

The business cycle goes through growth, expansion, and maturity as businesses move from startups to blue-chip companies. A company’s share price value increases, growing with increased investor confidence. That becomes challenging for new investors, as the share price might become too expensive.

With fewer investors buying a company’s shares, liquidity decreases as there is less cash flow. That leaves the company in need of a strategy to accommodate new investors. This guide will explore what a stock split is and why it is not unusual for companies to split their stock as they grow.

-

-

Definition and Basics of Stock Splits

Companies’ share prices increase as they become more valuable and integral to their industry. For example, Apple’s share price has increased from $0.54 in 2004 to $185.59 in 2024.

As the price increases, fewer investors are willing to buy in, increasing liquidity. They refrain for various reasons, including high costs or a mature growth phase with minimal stock growth. Unfortunately, companies cannot lower their share prices directly.

Lowering share prices directly will affect a company’s market capitalization, reversing its growth. Hence, businesses use stock splitting to achieve a lower share price and maintain their market capitalization.

This section will explore the stock split definition, its types, and how this strategy has performed over the years.

What is a Stock Split?

A stock split is a corporate action where a company increases the number of its outstanding shares while maintaining its market capitalization. It involves splitting its unit shares into several equal parts. You’ll get the former value if you add the split shares.

Companies can split their stock at any time. The law does not demand they split their stock or prohibit them from doing so. However, companies use this approach in line with the best business practices.

The overall market and trading exchanges guide how and when companies split their stocks. Also, the company’s vision may require stock splitting.

This corporate action splits a stock dividend (for companies that pay dividends). Notwithstanding, shareholders will still earn the same dividends. That is because they still have the same overall share value.

Reviewing splits should be part of your stock research before investing. Some splits might point to financial struggles.

Types of Stock Splits

Let’s assume that a company initially has 1 million shares at $100 per share. Its market capitalization will be $100 million. Now, let’s assume it splits its share into two equal parts.

The cost of the new shares will be $50 per unit. Similarly, the number of shares will increase to 2 million. The market capitalization remains the same (50 * 2 million).

Companies can split stocks in different ways. The example above is a forward stock split. The opposite results in a reverse stock split.

Online brokers, like day trading apps, will handle these splits for you. Hence, you don’t need to worry about adjusting your portfolio or buying new shares.

A forward stock split involves breaking down a share unit into several equal parts. It can be two, three, four, or five equal parts, depending on the company’s goal. Also, the forward approach is more typical of companies than the reverse approach.

So, what is a reverse stock split, and how does it differ from the forward approach? The reverse stock split involves decreasing the number of outstanding shares and increasing the price proportionately. Of course, the price must increase to match the company’s market capitalization.

The table below summarizes the differences between a forward and reverse stock split:

Both approaches affect the stock market differently. Hence, companies use them for different goals.Forward stock split Reverse stock split The process breaks down a unit share into several equal parts The process consolidates several share units into one It results in an increased number of a company’s shares It results in fewer company shares The share price decreasest The share price increases Historical Overview of Stock Splits

The Bank of New York did the first stock split in 1824. Many companies have split their stocks at least once. Some, like Apple and Walmart, have done it multiple times since their initial public offerings (IPOs).

Walmart split its stock 11 times between 1970 and 1999. Similarly, Apple has split its stocks five times since 1970 using different ratios.

We could go on to list several companies that have used this approach. That shows that stock splitting is not novel to the stock market. However, only the company can induce it.

Stock splitting has helped companies over the years. We’ll see some of the ways that happened. Moreover, companies wouldn’t do it if it didn’t have the potential to produce positive results.

Again, let’s refer to Apple. The company split its stocks three times between 2004 and 2023. However, its share price has increased to $185.59 from $0.54.

Your capital is at risk.

Impact of Stock Splits on Shareholders

Companies may split stocks for their overall benefit. However, this action affects shareholders. That can be positive or negative, depending on the market reaction.

You can use stock market research tools to find stock splits, especially the forward split stocks. That can be an opportunity to buy more shares or join a company’s shareholders. Remember that forward splits reduce the share price.

Opportunities still exist if you own shares already. We’ll see how stock splits affect shareholders and profit opportunities.

Changes in Share Price and Quantity

The most visible impact of splits is the share price change. Forward splits end up with lower prices, while reverse splits result in higher prices. You’ll own more shares, but their overall value remains the same.

Let’s demonstrate with an example.

Company A has a share price of $100, and you own 100 shares. Your total share value is $10,000 ($100 * 100). If the company splits its unit share into two at $50 each, the following will happen:

- Your total shares become 200 (100 * 2)

- Your total worth remains $10,000 ($50 * 200).

Some investors might use this opportunity to buy more shares. Stock splitting doesn’t happen often. Hence, you should be ready to seize the opportunity to increase your share value when the prices drop.

Maintaining Proportional Ownership

As explained above, your total value remains the same; however, you’ll own more shares after the split. Your rights as a shareholder stay the same unless you buy more shares.

The overall taxes on your shares remain the same. Of course, the tax on each share will be reduced proportionally with the split.

Common Ratios for Stock Splits

Companies must split their stocks into equal parts. That results in a ratio when adding the parts to get the former value. For example, halving a share value results in a 2:1 ratio.

Split ratios are often denoted by X:1, where X refers to the number of parts the company splits a unit share into. Hence, you can have 2:1, 3:1. 4: 1, 7:1.

Apple once made a 7:1 stock split in 2014. That means the company splits one unit into seven equal parts.

Stock ratios are pronounced X for one. Hence, you will have 2 for one, 4 for one, 7 for one, etc.

Companies determine the split ratio, as there is no general rule. However, they must do it in a way that still agrees with the terms and conditions of the stock listings. For example, the Nasdaq National Market requires at least $1 per unit share for listing.

Again, online trading platforms and brokers like eToro will automatically adjust your shareholdings. For example, they will double your holdings if a company splits its stock in a 2:1 ratio.

Your capital is at risk.

Improving Liquidity and Accessibility

As mentioned earlier, a company’s shares might become too expensive for individual investors. That restricts cash flow as fewer trades occur. There will be more willing sellers than buyers.

Like tokenomics in crypto, companies must regulate their shares to maintain cash flow. Stock splitting is one way to achieve that. Although splits occur among shareholders, they have far-reaching effects on the stock market.

Let’s see how stock splitting improves trading activity and liquidity.

Enhancing Trading Activity and Liquidity

Increased trading activity yields a corresponding increase in liquidity. The latter ensures a healthy mix of sellers and buyers. We know that stock prices fall when the number of sellers exceeds the number of buyers.

Shareholders can purchase more shares as their values drop. You’ll notice increased trading activity, provided the company remains valuable to the public. More investors will be encouraged to buy more shares.

This benefit (enhanced trading activity) comes primarily from forward stock splits. Reverse stock splits can increase trading activity as people perceive a higher value for the stock. However, we won’t count on that happening as often as forward stock splits.

Lowering the Entry Barrier for Retail Investors

Retail investors buy shares in smaller quantities, unlike institutional investors. Hence, they prefer affordable options that won’t eat deep into their pockets.

Forward stock splits result in lower share prices. Retail investors can easily buy shares. Institutional investors can also buy more shares, but the entry barrier doesn’t affect them as much as retail investors.

Facilitating Options Trading on the Stock

Splits will cause market shifts that result in price movements. Of course, other factors contribute to the resulting bull or bear runs. These price movements open an opportunity for options trading.

The price swings will likely be broader than before the split. Hence, investors and traders can speculate better on the direction.

Options trading involves contracts to buy or sell shares at a specified price and period. It can be a way to make quick trades. We have several options trading apps if you want to take this path.

Forward and reverse stock splits can facilitate options trading. Both can cause price swings, although in varying capacities.

Psychological Impact on Investors

Perception changes when a company splits its stock. That can be for good or bad. Hence, a company can gain more perceived value or lose it after a split.

Judging from experience, companies cannot rush stock splitting to gain value. Contrarily, forward splits can dash investor confidence, resulting in a share price fall.

Let’s see how different traders and investors react to stock splits.

Reducing Perceived Overvaluation

Some traders may perceive an overvaluation as a company’s share price increases. The latter impedes trade as fewer people are willing to trade.

Overvaluation also dashes investor confidence. Some might believe the company’s value is plateauing, with an imminent drop. They will refrain from buying the company’s shares, while others might sell their holdings.

Lowering the share price reduces overvaluation. It allows investors to relate more to the actual company value. As a result, they are more willing to trade or buy the company’s shares.

Let’s face it. We do have a perceived worth in our minds when we hear a company’s name. Seeing the actual company numbers (market capitalization or evaluation) can either reinforce our perceived worth or cancel it.

We may perceive companies with a higher evaluation than our perceived worth as being overvalued.

Attracting More Retail Investors

Not everyone can purchase a $1,000 share. Instead, some pick more affordable options, especially as they hope to build a portfolio.

Let’s assume a retail investor is willing to buy shares at $500, but Company A’s share is at $1,000. Splitting the stock with a 2:1 ratio reduces the price to $500, bringing the company within the retail investor’s purchasing power. That happens during stock splits, as more retail investors can purchase the stock at the new price.

As the share prices decrease, more retail investors buy in. Besides the price, the lower prices bring a perceived value for growth.

Most retail investors prefer short-term growth. Hence, they’ll buy affordable shares from companies with stellar growth potential. You can imagine what would happen if Apple split its stocks at $40 per share.

Boosting Investor Confidence and Perception

As discussed in the previous section, investors perceive more room for growth. A company’s stock can reach a point where it has minimal growth. It still grows, but the growth is less pronounced and more stretched out into months.

Investors will be more willing to buy if they think a company’s share price will rise to its former value before splitting. That is what stock splits do. They restore investor confidence and create a positive perception.

Your capital is at risk.

Corporate Strategic Considerations

Companies cannot jump up and split their stocks. Those who do so do it for a reason. Hence, corporate strategic considerations underline stock splits.

The reasons for stock splits vary from one company to another. However, the primary aim is to increase the company’s value. That shows that stock splits can happen to large and small-cap company stocks.

Let’s review some strategic considerations companies take before splitting their stocks:

Aligning Stock Price with Peers in the Industry

Investors would go for competitors if a company’s share price rose markedly beyond the competition. To them, the competitors still have room for growth.

Companies often lower their stock prices through splits to align with their industry peers. Again, this action boosts investor confidence in the company’s growth prospects. It also places the company’s stocks within reach, like other competitors.

Responding to Market Trends and Investor Preferences

Besides revealing companies with more trading activity, trends reveal the price bracket at which most trading occurs. For example, 80% of investors and traders may buy shares within the $100 and $400 price brackets. That reveals investor preferences.

Companies can seize that opportunity and increase their liquidity. Hence, they can split their stocks to lower the prices to the preferred bracket. They’ll see an uptick in their trading volume as more investors buy and sell their shares.

Enhancing Corporate Image and Visibility

Most retail investors and traders have their preferred price segment for trades and investments. Companies above that price bracket remain out of their radar, regardless of the positive news and events. Lowering share prices brings companies within an investor’s trading field.

That increases visibility as more investors become aware of their presence in the stock market. Also, the increased trading volume increases publicity inside and outside the trading platforms. That can result in positive events as market sentiment shifts in the company’s favor.

Companies can redefine their image through stock splits. Blue-chip businesses can place themselves in the affordability bracket through forward splits. Contrarily, mid-cap companies can paint a blue-chip image through reverse stock splits.

Forward splitting can negatively impact a company’s image. Some companies might view it as a signal for an impending crash, especially if the stock is already affordable. Hence, stock splits must be done with care and detailed consideration.

Effects on Market Capitalization and Valuation

Stock splits do not affect market capitalization and valuation primarily. However, what follows could produce effects. Let’s see how that works.

Adjustments in Market Cap After a Stock Split

Forward splits can result in increased trading volume. The latter can cause demand to outweigh supply, driving the stock price upward. When that happens, the market capitalization increases.

Market capitalization only changes when the unit share price changes. Let’s see an example.

Company A has 2 million shares at $50 after splitting it in a 2:1 ratio from $100 per share. The market capitalization remains at $100 million.

A $10 increase in share price will result in a $120 million market capitalization ($60 * 2 million). You can use the same approach for reverse stock splits.

Impact on Valuation Metrics (e.g., Price-to-Earnings Ratio)

A company’s valuation does not change immediately after a stock split. However, a few things will happen to influence its change. Remember that valuation covers a company’s assets and earnings.

The valuation will increase if the company reports more earnings after its stock split. That also adjusts the price-to-earnings ratio, which measures how much investors are willing to buy the shares. The P/E ratio divides the company’s share price by the earnings per share.

Analyzing the Post-Split Price Performance

The post-split price performance relies heavily on market sentiment. You’ll need technical indicators and expert trading platforms to fully grasp the changes. Notwithstanding, a simple candlestick chart should reveal the overall performance.

Schaeffer’s Research did not report a significant bull run after researching several stock splits. That is disadvantageous to day and short-term traders who hope to profit from quick price swings. Nonetheless, the lower-priced stock can rise in the long run, surprising its parent value before the split.

Your capital is at risk.

Investor Considerations and Decision-Making

Companies must consider how stock splits will affect their shareholders. This approach fell out of favor but is returning to the mainstream stock market.

The first step is gauging how the market reacts to the current share price. Then, the company must gauge how the market will react to the new stock price. Investors and shareholders might not be affected primarily, but the split can change sentiments.

How Stock Splits Affect Existing Shareholders

Existing shareholders do not lose share value after a stock split, whether forward or reverse. They will own more or fewer shares, but their overall value remains the same.

Their voting rights remain the same. However, they might be willing to buy more shares as the price decreases.

Shareholders may see more liquidity in the market as more buyers come in. Those who hoped to sell their shares before will find more willing buyers.

With the above, shareholders remain shielded from stock splits. The most important thing is what happens to the unit share value after the split.

Investors with dividend shares will still receive the same total yield. However, each share will have a lower yield than before.

Evaluating the Impact on Dividend Payments

Stock dividends increase and increase depending on the split type. After all, they depend on the unit share value, which increases or decreases after a split.

The overall dividends will remain the same. Let’s assume Company A had a 5% yield and a profit per share of $100. The initial dividend will be $5.

Splitting the shares into two reduces the profit per unit share to $50. Since the yield remains the same, the new dividend will be $2.5 (5% of $50). An investor who previously owned a $100 share will still earn $5 from the two shares after the split.

Assessing Long-Term Implications for the Stock

Again, we can only fall back on market sentiment to assess the long-term implications of stock splits. The share becomes more affordable and, not necessarily, more valuable.

Market forces take over after the stock split. They determine how the price swings. Of course, other factors affect a stock’s price beyond the market forces of demand and supply.

Company news and significant events can trigger a bull or bear run. We recommend alternative data services to keep up with the company after a stock split.

Companies continue to grow after splitting their stocks. Hence, the value can increase and surpass its previous value. That can necessitate another split, depending on other economic and business factors.

Potential Drawbacks and Criticisms

When required, stock splits must occur under legal oversight and regulations. The market capitalization must remain the same during the split without any influence.

Stock splits are not all positive. Some investors criticize the approach when other ways exist to increase a company’s outstanding shares.

Perceived Short-Term Gains vs. Long-Term Value

Companies may gain a short-term push after splitting their stocks. However, the share value depends primarily on how the market perceives it and is willing to pay for it. Market sentiments and other factors take over the long-term share value after a split.

Schaeffer’s research shows an overall lax stance of stocks from splits to beat the overall market. That shows the long-term results compared to the short-term results, where liquidity increases.

Criticisms of Stock Splits as a Corporate Strategy

Should companies use stock splits as a corporate strategy? We would say yes to that, but there is more to it. Stock splits are essential for increasing liquidity but also do other things.

The following are criticisms of stock splits as a corporate strategy:

- Investors may interpret the split as a company’s struggles with growth

- The split can be expensive as it calls for regulations and legal expenses

- Investors may view it as worthless, as splits do not add value to the company

- The company’s value might fall, reducing the share price below the minimum threshold for stock listing

- It might discourage institutional investors

Investor Skepticism and Market Reaction

Skepticism increases after stock splits, but it is a two-way street. Some investors might expect new growth potential, while others expect a market crash for the stock. Hence, companies should only split after reviewing market sentiment thoroughly.

The trading volume after a split will help you gauge the market. An increased volume with more purchases shows good market sentiment. That can be the start of a bull run as the new stock price begins to climb.

Decreased trading volume indicates a lack of interest. We don’t recommend investing in such stocks. You can use the MACD indicator, the supertrend indicator, and other technical indicators to gauge market reactions.

Your capital is at risk.

Alternatives to Traditional Stock Splits

Companies that wish to increase liquidity have other ways than splitting their stocks. The aim is to encourage investors to trade more. We believe a company can achieve that in the following ways:

Fractional Shares and Brokerage Innovations

Trading platforms may not offer fractional shares. However, you can find them at major brokerages.

Traditional fractional shares lower the entry barrier for retail investors like stock splits do. Instead of buying one unit, traders can buy fractional units at a lower cost. This approach can increase liquidity the same way stock splits do.

Assessing the Popularity of Stock Buybacks

In the 2022 third quarter, an estimated one in five companies in the S&P 500 bought back their stocks. They witnessed increased earnings per share. That has renewed interest in stock buybacks.

This approach can help reduce a company’s outstanding shares in circulation. That is equivalent to a reverse stock split. However, it avoids the requirement to change the stock price.

We expect more companies to follow the buyback approach. Nonetheless, improving a company’s worth is not a foolproof strategy.

Evaluating the Effectiveness of Alternatives

A company’s growth relies on other factors besides the stock market. You can refer to the company’s unique selling point, positive events like appointing a new CEO, government regulations, etc. Hence, we can give 100% certainty to the alternatives in the previous sections.

Fractional shares and stock buybacks do not reduce the unit share price. That allows the company’s share to continue at its current price instead of starting life at a lower or higher value.

Key Takeaways and Summary

- Stock splits involve dividing a unit share into several equal parts.

- The divided parts now become the new unit share

- Reverse stock splits consolidate several unit shares into one.

- The share price and quantity change after a split, but the market capitalization remains the same.

- Stock splits can increase liquidity as more investors come into the market.

- Investors may perceive growth potential after a split

- Stock splits do not affect long-term gains

- Fractional shares and stock buybacks are alternatives to forward and reverse stock splits.

What is a Stock Split? – eToro Complete Guide

Trading continues after stock splits. Hence, you need a robust platform to seize the opportunity of purchasing shares at lower prices. We recommend eToro for beginners and expert traders.

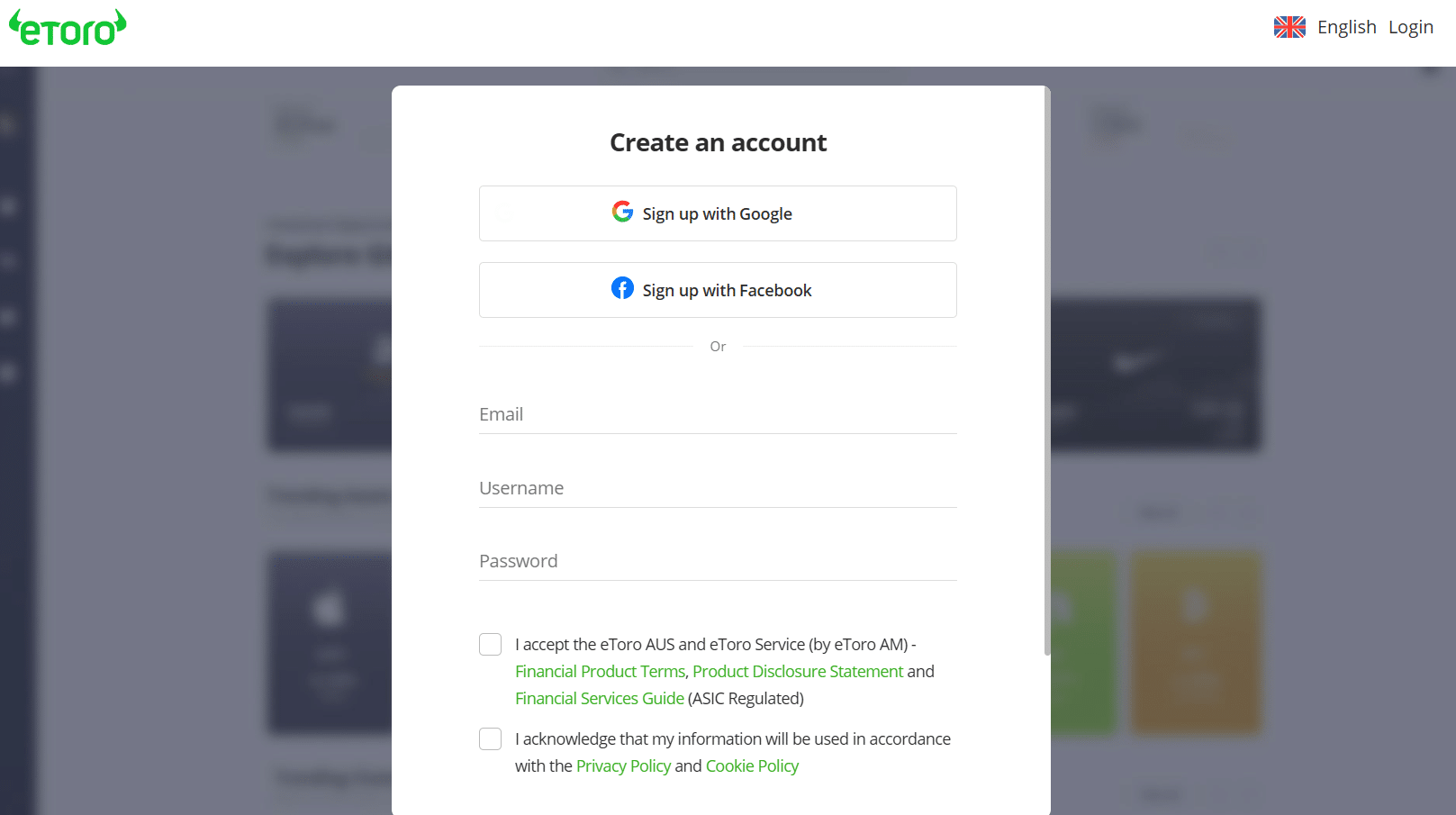

Follow the steps below to start trading on eToro:

For illustration purpose only

Step 1: Open a new accountGo to the eToro homepage. You can use the eToro website or download the application to your mobile device. Then, click “Join eToro” to begin the registration process.

Step 2: Fill out the registration formUsername, email, and password are typical registration details on most platforms. That is all you need to register with eToro. Fill out the form and proceed to the next page.

Step 3: Verify your email and log inEnter the verification code from your email. You should receive a message indicating successful verification. Log in with your email and password.

Step 4: Fund your account and start tradingBeginners can start with the $100,000 virtual account. Otherwise, upload the required documents and fund your account. Go to the trading dashboard and click on your preferred instrument to start trading.

Conclusion

Stock splits offer buy-in opportunities to retail investors and traders. You can purchase stocks at lower prices while boosting the market’s liquidity. Also, the increased trading activity may trigger bull runs for valuable companies.

Register with eToro and start trading with technical charts and tools. Follow trader updates and see what others think.

Your capital is at risk.

References

- https://finance.yahoo.com/quote/AAPL/history?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuYmluZy5jb20v&guce_referrer_sig=AQAAANDH6bj5tQepnvCzahq6-xIOL

- https://www.macrotrends.net/stocks/charts/AAPL/apple/stock-splits

- https://www.forbes.com/advisor/investing/taxes-on-stocks/

- https://money.stackexchange.com/questions/127787/why-do-stock-exchanges-have-minimum-share-price-requirements

- https://money.stackexchange.com/questions/18843/how-does-a-public-company-issue-new-shares-without-diluting-the-value-held-by-ex

FAQs

Is a stock split good or bad?

This approach can be good if investors become more confident in the stock. It can also be bad if investors perceive the move as a sign of financial struggles.

What is the advantage of stock splits?

BThe primary advantage is increased liquidity for companies. Conversely, retail investors can buy more shares at affordable rates.

Is it better to buy before or after a stock split?

Buying before a split does not give you extra value. However, buying after a split allows you to purchase at a lower price.

Do stocks do better after a split?

There is no significant effect of stock splits on their performance. However, growing and valuable companies will perform well in the long run.

What is a 1 to 10 stock split?

This means that the company has split one unit share in ten ways. For example, a $100 stock split in a 1 to 10 ratio results in a $10 unit share.

Jeremiah Awogboro

View all posts by Jeremiah AwogboroJeremiah Awogboro is an experienced content writer with over 8 years of experience. He has a qualified MBChB degree and a keen interest in the stock market and the finance industry. His background in the industry has provided him with valuable experience in this field. Awogboro is dedicated to assisting and reaching out to as many people as possible through his writing. In his spare time, he enjoys music, football, traveling, and reading.

VISIT ETOROYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2025

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up