Earnings-Per-Shares Explained: What is EPS in Stocks?

Investing in the stock market is one of the most profitable businesses, which could help grow wealth. Statistics report that there is a 10% return on stocks every year, which is higher than most investments. Thus, there is a gradual increase in the number of stock investors.

While taking this business pathway is an intelligent decision, investors should equip themselves with adequate knowledge of metrics and terms. Understanding its broad concept can help investors make proper investment decisions – an important one is the Earnings Per Share (EPS).

EPS serves as a significant financial tool, offering valuable insight into a firm’s profitability with stocks. In this article on “What is EPS?” we will discuss its importance, formula & calculation process, and analyze various trends and factors impacting its use.

-

-

Definition and Significance of EPS

We would kickstart this guide by defining Earnings per Share (EPS) and highlighting its importance for investors.

What is Earnings-per-Share (EPS)?

EPS is a financial metric describing a publicly traded company’s profitability. It is often used by a diverse range of investors, including metric investors, spectators, dividend investors, and growth investors, to assess a stock’s value on a per-share basis before buying stock shares.

Earnings per Share is a financial ratio where the NET income available to common shareholders is divided by the total number of outstanding shares. Indeed, it describes a company’s financial health, prompting investors to invest or otherwise.

In several cases, investors use this financial ratio as an evaluation tool to compare a company with a few others – similar companies in the same sector. It will help them determine the fairness in stock pricing and value over time.

Your capital is at risk.

Why is EPS Important for Investors?

Below are significant reasons why investors and analysts use EPS.

-

Profitability Insight

EPS offers analysts and investors insight into a company’s stock profitability. It allows them to determine the most potentially lucrative business to invest in. So, if a firm’s EPS is high, they are more profitable.

Stock market research and analysis software can be used to research stock shares and their potential before investing.

-

Making Informed Decisions

EPS is a good decision-making tool. It could be employed in a comparative system where investors can measure various company’s profitability and choose the best option to meet their goals. Likewise, in portfolio diversification, this financial ratio helps make informed decisions.

-

Risk Assessment

Every business comes with its own risk. However, EPS stock can help evaluate such investment risk, allowing individuals to focus on profitable ventures. Most companies with constantly growing Earnings per Share are likely to pose less threat than an unstable one.

-

Financial Health Indicator

As aforementioned, EPS stock will help evaluate a company’s financial health. This indicator proves that such an enterprise could sustainably generate profits over time.

-

Stock Pricing and Valuation

Earnings per Share plays a significant role in determining stock price. If there is positive growth, stock prices will increase, and vice-versa. Additionally, it will help individuals discover stock value, i.e., whether it is undervalued, overvalued, or fairly priced.

Basic Calculation of EPS

Since we’ve defined the concept and discussed its importance, let’s learn how to calculate earnings per share.

EPS Formula and Components

The calculation process of earnings per share for stocks takes two forms;

- Earnings per share: it uses total outstanding shares to calculate EPS

- Weighted earnings per share: it uses weighted average outstanding shares.

However, the latter is the basic Earnings per Share formula:

i.e.,

EPS = Net Income – Total Dividends on Stock/Average Outstanding Shares.

Example:

Suppose a software firm has a net income of $5 million in the third quarter of 2013 and announced preferred dividends of $1 million. What will be the EPS if the average number of shares outstanding is $10 million?

Using the EPS formula,

EPS = ($5,000,000 – $1,000,000)/$10,000,000 = $0.4.

Different Types of EPS (Basic vs. Diluted)

EPS stock is divided into two main types – Basic and Diluted.

-

Basic EPS

Basic EPS focuses on the total earnings available to common shareholders. It is a straightforward method of calculating earnings on a per-share basis.

-

Diluted EPS

Diluted EPS uses a higher number of shares than the basic type. While it is a comprehensive measure, it focuses on the dilutive effects of common shares – from securities, such as convertible bonds and employee stock options.

Basic EPS Diluted EPS - Offers insight into each attributed common share from a firm’s earnings

Offers hypothetical insight into each attributed common share from a firm’s earnings where dilutive securities are converted. - Larger

Smaller - EPS formula:

Net income – preferred dividend/weighted average number of outstanding shares

EPS formula: Net income – preferred dividend/weight average number of diluted common outstanding shares

A table showing the differences between Basic and Diluted EPS

Your capital is at risk.

How to Interpret Earnings-per-Share (EPS) Data

The answer to “What is a good EPS?” is understanding and interpreting its data.

A nearly accurate or precise interpretation of EPS data is quintessential for investors, not only because it offers valuable insights into profitability and financial health but also to make informed decisions.

More so, first-time investors may only understand how stocks work, but may find it difficult interpreting some concepts.

Below are factors to consider to interpret EPS stocks data successfully.

-

Positive or Negative EPS

Earnings per share are often identified by their value, which can be negative or positive. If the value is negative, such an organization is experiencing losses; however, if the value is positive, it is profitable.

-

Higher or Lower EPS

In a situation where EPS doesn’t fall under the positive or negative category, it can be interpreted based on its number value.

A higher EPS number means a profitable organization, while a lower EPS number shows losses. This interpretation comes in handy when comparing different companies to invest in.

-

Earnings Surprises

Earnings Surprises can be used to interpret EPS data. It occurs when a company’s profits are compared to an analyst’s or investor’s expectations, which could be positive (above) or negative (below).

If there is a positive earnings surprise, EPS will be high, ultimately showing a firm’s ability to generate profits. On the other hand, if negative, EPS will be low, showing losses.

-

Trend Analysis & Consistency

By analyzing trends and observing consistency, EPS can be interpreted. A company with consistent EPS growth over time will likely perform better than an unstable one.

Analyzing EPS Trends

Going further in this “What is EPS in stocks?” article, let’s see how to analyze trends based on historical performance. There is valuable information to obtain from this data before investing in an organization’s stock shares.

In the course of observing historical performance, it is crucial to identify growths and declines. Certain key elements will help interpret either scenario.

Historical EPS Performance

A comprehensive EPS performance can be explained through the S&P 500, a stock index, tracking share prices of the largest 500 public companies in the U.S. These companies include Apple, Microsoft, Alphabet, Amazon, and Tesla.

This Standard & Poor’s 500 Composite Stock Price Index has a renowned reputation for being an effective tool for tracking U.S. stock performance. Its mechanism represents performance by tracking large-cap stock prices with total outstanding shares of over $10 billion.

That means investors can discover futures stocks valuations based on this concept. It supersedes other indexes, such as the Nasdaq 100 and Dow Jones Industrial Average, with company focus and market cap, respectively.

Historical evidence of S&P 500 Earnings per Share performance showed significant milestones. It once reached an all-time high of 197.91 and a low of 0.16, with an average value of 1.54. This means that the value range fluctuates between 89.13 and 157.51.

At the beginning of June, 2023, the S&P 500 index had an EPS of 181.17, which showed a -5.77% decrease compared to the corresponding period a year prior.

Overall, this data provides valuable insight into EPS performance trends.

Your capital is at risk.

Identifying Growth or Decline in EPS

As mentioned earlier, different investors use EPS for various purposes. However, what binds them is the ability to identify growth and decline. It is vital to assess an organization’s financial health and performance and discover its trajectory for the next quarter or financial year.

EPS growth is simply measuring a company’s growth rate using its earnings. To possibly identify the growth rate, however, the following factors are considered;

-

EPS Compare Periods

One of the easiest ways to measure a company’s growth or decline is to compare its EPS periods. Every organization has to set a standard to determine whether they are making more earnings or having losses.

A typical standard is comparing EPS figures quarterly – or annually. For instance, the organization compares the EPS score for the first quarter with the second quarter. If there is a significant increase, the company performs well, and vice-versa.

-

Year-Over-Year Change

Also, when comparing EPS figures, another popular method is observing a year-over-year change. It simply involves comparing a new EPS score at a particular period with a corresponding period of the previous year. If there is an increase, it means growth; if there is a decrease, it means decline.

This method suggests a broader evaluation and significantly shows how seasons may play pivotal roles in an organization’s EPS in stocks.

-

Negative or Positive Percentage

Calculating percentage change is also recommended to discover EPS growth or decline. It involves comparing EPS between two periods and getting a positive or negative percentage value. A negative value means a decline, while a consistent positive value means sustained growth.

-

Dividend Payout Ratio

Dividend investors often use the Dividend Payout Ratio to calculate growth or decline. It uses an EPS formula – dividends per share/EPS (for a particular quarter or year).

That means there is growth if dividends are maintained proportionally with EPS; however, if the dividend payout ratio increases where EPS decreases, there is a decline.

Comparing EPS Across Companies

Unfortunately, EPS figures cannot be compared successfully across companies due to the inconsistency and dissimilarity of stock shares. It varies significantly across industries.

Industry Benchmarks for EPS

As stated earlier in this “What is EPS in stocks” article, EPS varies from industry to industry due to differences in finances, economic capacity, capital, and business model. Thus, there is a benchmark for every existing industry for sustainability, profitability, and growth.

Below are major world industries and the description of their EPS benchmarks.

Industry EPS Benchmark Healthcare Varying EPS due to specific subsectors (pharmaceuticals, biopharma, etc.) Technology Lower EPS but focuses on revenue growth and innovation Finance High EPS as impacted by interest rates, regulations, economic conditions, etc. Retail Lower EPS due profit margin – for instance, Amazon shares A table showing some industries and their EPS benchmarks

Interpreting EPS Relative to Market Expectations

Generally, stock analysts and investors have market expectations; they guess the stock’s EPS and revenue. It is called the consensus estimate. However, once the EPS is reported, they compare with the consensus estimates.

Below are some noteworthy concepts to interpret EPS relative to market expectations.

-

Consensus Estimates

It is a published report of what analysts or investors hope the EPS will be. This forecast is often based on historical trends and research.

The published EPS estimates are compiled into a consensus forecast to represent market expectations for an organization’s earnings.

Usually, some day trading apps allow users to buy or sell the earnings reports – regardless of whether the EPS matched the consensus estimates or not.

-

Surprise Factor

Surprise is described as the percentage difference between the reported EPS and the consensus estimate.

If a company reports a higher EPS than the consensus estimate, it is a positive surprise called a “beat.”

Conversely, if the reported EPS is lower than the consensus estimate, it is a negative surprise called a “miss.”

-

Market Reaction

With the surprise factor established, a market reaction could likely be used to interpret EPS. A beat will always lead to a higher stock price, while a miss may result in a decline in stock price.

EPS and Stock Valuation

An often-asked question in EPS and stock evaluation is, “What is PE, and how does its ratio affect stocks?” See below for an explanation. Further, we will discuss how EPS can be used to evaluate investment opportunities.

Price-to-Earnings (P/E) Ratio

The price-to-earnings Ratio (P/E or PE ratio) compares a company’s stock price to its total annual generated earnings. This ratio describes stock valuation – fairly priced, overvalued, and undervalued. It shows whether the stock price accurately reflects its value with time based on the company’s earnings.

P/E ratio = Stock Price/Total Annual Generated Earnings on each share

For instance, suppose a company trades a stock at $80 per share, generating $2 per share in annual earnings; the company’s stock price-to-earnings ratio becomes 40 (i.e., 80/2). In essence, this means it will take the company 40 years to accumulate earnings on its investment cost.

Using EPS to Evaluate Investment Opportunities

One of the benefits of Earnings per Share is its ability to help investors make informed decisions as investment opportunities present themselves. EPS is a key metric, and apart from stock valuation, other ways it influences investment decisions are:

-

Providing Insight into Growth Prospects

Before investing in stocks, growth prospects are a key element to consider. Investors believe that buying stocks with the potential to grow and help them make profits in the future is a smart idea. So, they use EPS to determine which firm grows or declines.

Increasing EPS means consistent and sustainable growth while fluctuating EPS means a likely decline. Investors choose companies with the former rather than the latter.

-

Performing Risk Assessment

Stock investment is a high-risk business. That is why investors are often advised to perform a thorough risk assessment before buying stocks from a company.

EPS is a good tool to perform this evaluation – a negative result is a likely failure, while a positive result shows promising potential.

-

Measuring Dividend Potential

Dividends share a relationship with EPS. A higher EPS means a good dividend potential, often beneficial to income-seeking investors. Conversely, a lower EPS may result in low dividend potential.

Your capital is at risk.

Revenue and Profitability Impact

As we explain “What is EPS in stocks?” we also have to mention the relationship between Earnings per Share and Revenue. Let’s take a look at the impact on profitability and how it can influence an investor’s decision when investing in a company’s stocks.

Relationship Between Revenue and EPS

Revenue per Share (RPS) measures a company’s annual revenue with its average number of outstanding shares per year. It is also called “Sales per Share.” It describes a company’s productivity based on ownership by each shareholder.

If the company has a good RPS, it means resources have been used effectively to generate sales in the year.

If the company has a bad RPS, it means sales-generating resources are underperforming or lacking.

On the other hand, EPS measures a company’s profitability based on its remaining revenue for shareholders (profits/earnings) to the total number of outstanding shares.

Relationship: Earnings (Profits) = Revenue – Expenses.

Differences:

RPS EPS Represents the company’s annual revenue Measures company’s financial performance/profitability on each share of stock Determines the company’s valuation Determines stock’s valuation Requires using resources to generate sales Various factors determine stock prices A table showing the differences between Revenue and EPS

Profit Margins and Their Effect on EPS

Like EPS, Profit Margins assess a company’s profitability. For instance, a Post-Tax Profit Margin measures remaining revenue as earnings once tax has been deducted. It gives a better understanding of how a company could generate profits even while managing taxes.

Regarding profit margins and EPS:

- A higher (post-tax) profit margin is highly favorable and can positively impact EPS. It means that such an organization offers valuable external and internal services, excellent cost management, and increased pricing power.

- However, a lower (post-tax) profit margin is unfavorable and will impact EPS negatively.

Share Buybacks and Dilution

Impact of Share Repurchases on EPS

Ever wondered why companies do share buybacks? Or what will these buybacks impact on the earnings per share?

Well, common knowledge is that share repurchases or buybacks will reduce the number of existing shares, ensuring they are valued more.

When that happens, if the price value of stock shares remains constant, it will automatically affect the EPS figure, which also increases. The reason lies in the P/E ratio – it decreases.

Dilution Effects on EPS Calculation

Diluted EPS removes preferred dividends from a company’s net income and divides it by the weighted average of outstanding shares. It focuses on the dilutive effect of securities into common stock.

On EPS calculation, the dilution effects include reducing an organization’s EPS and devaluing a shareholder’s existing equity.

External Factors Affecting EPS

With the stock market’s volatility, it is impossible not to have some key players influencing pricing and valuation. Regarding earnings-per-shares in stocks, external factors affecting EPS value are economic conditions, industry trends, and regulatory changes.

Economic Conditions and Industry Trends

Economic downturns and industry trends will tremendously affect EPS. For instance, when consumers reduce spending, it will eventually affect the organization, resulting in low sales, revenue, and net income. Ultimately, a low net income automatically causes a drop in EPS.

Alternatively, industry-specific trends, such as increased competition, changes in market dynamics, and industry growth, will potentially affect EPS negatively or positively.

For example, high competition in a tech industry will increase margin pressures, which some tech companies could benefit from and others won’t. Those that gain with the margin end up with good EPS, and vice-versa. Stock analysis apps are recommended to match up with this competition.

More so, organizations leading in innovation are likely to experience an increase in net income, which will impact EPS positively.

Regulatory Changes and Their Influence on EPS

Existing businesses comply with global or domestic standards for operation. However, these standards are liable to change, which could affect companies positively or negatively. When an imposed regulation affects net income adversely, EPS will reduce.

Often, investors are advised to closely monitor these regulatory changes and proactive measures to navigate them to make informed decisions on investment.

Using EPS in Investment Decision-Making

In this section of the “What is EPS in stocks” guide, we will highlight how Earnings per Share is incorporated into the fundamental analysis. We will also look at a popular and successful EPS analysis example that would inspire good decision-making.

Incorporating EPS into Fundamental Analysis

Usually, Fundamental Analysis is used to evaluate a stock’s intrinsic value based on a firm’s data analysis – financial or economic. It measures a company’s growth and performance, reflected in the value of stock shares.

EPS is incorporated into fundamental analysis to help investors make good financial/investment decisions.

Below are some ways it is integrated.

-

Profitability Assessment

EPS incorporation into fundamental analysis will help investors discover a firm’s profitability status. It allows them to analyze EPS trends over time and discover if the company can generate consistent earnings.

-

Comparative Analysis

EPS in fundamental analysis will facilitate comparative analysis. That means investors can evaluate and pick the best firm performer from firms in the same industry. It also deepens the knowledge of a company’s competitive ground for investors to decide.

-

P/E Ratio

Apart from knowing “What is PE,” EPS in fundamental analysis will allow investors to calculate the P/E ratio more accurately. Finding the correct figure or value will help them determine if a firm is overvalued or undervalued.

Case Studies of Successful EPS Analysis

A case study of a successful EPS Stock analysis is the Manhattan Associates (MANH). This company is experiencing rapid earnings-per-share growth, which was reported to have grown by 27% per year in the last three years.

Manhattan Associate uses Earnings Before Interest and Tax (EBIT) margins to evaluate its growth over the years. It rose from 18% to 22% between December 31, 2022 and December 31, 2023.

Most investors may want to join this bandwagon, as the company’s successful run has been shown based on its year-to-year growth with stock shares.

Risks and Limitations of Relying on EPS

Moving from “What is EPS” to knowing its risks and limitations is the next step forward. Here are some things investors should know before relying on this metric.

Potential Pitfalls in Interpreting EPS Data

EPS Stock is calculated using net income, automatically considering all expenses, including non-cash like amortization and depreciation. Eventually, removing these expenses causes variations in a firm’s net income at different times.

Also, it doesn’t consider the impact of inflation on a company’s net income. Thus, it becomes nearly inaccurate. In fact, on several occasions, organizations have manipulated their earnings to achieve a set EPS level, making this metric unreliable for analysts and investors.

Furthermore, when interpreting EPS data, it doesn’t show the quality of earnings – it may be impossible to know if earnings generated from the firm’s operations are sustainable.

Considering Other Metrics Alongside EPS

EPS offers a significant advantage in determining a company’s financial performance regarding stocks. However, with certain limitations, such as the possibility of manipulation and lack of reflecting quality of earnings, using other metrics alongside is advised.

Other metrics that will effectively help investors to make informed decisions about stock shares include return-on-equity (ROE), price-to-earnings (P/E) ratio, and price-to-sales (P/S) ratio. Overall, gaining precise knowledge about a firm’s financial health could be achieved.

Future Trends in EPS Reporting

As stock analysts learn how to calculate earnings per share, gaining perspective into EPS reporting’s future is also paramount. Here are some changes to expect soon.

Evolving Standards and Reporting Practices

Transparency may have been one of the factors limiting the efficiency of the EPS metric, and a good way to solve that is by introducing non-GAAP (Generally Accepted Accounting Principles) measures.

With this technology, companies won’t be able to manipulate earnings to meet set EPS levels that would trick investors. Additionally, Beta in stocks will provide individuals with a better overview of stock’s volatility compared to the market.

Also, sustainability reporting practices may be incorporated in investment apps to ensure proper adaptation to external factors (including environmental, social, and governance) affecting a firm’s EPS consistency.

Technological Advances Impacting EPS Analysis

With emerging technology, EPS Stock analysis may become even better. It will solve many problems individuals face when investing in the financial market.

Utilizing data analytics, AI stock picking software, and blockchain technology to analyze patterns, maintain earnings reporting and verification, and interpret data will be revolutionary.

Besides, stock portfolio trackers now exist on desktops and mobile devices to meet investment needs.

Indeed, stock investment will become beginner-friendly.

Recap of Key Takeaways

- What is EPS in stocks? – Earnings-per-share measures a publicly traded company’s profitability. There are two significant types – basic and diluted.

- Basic earnings per share formula is earnings (net income – preferred dividend) divided by the weighted average number of outstanding shares.

- EPS growth can be measured using patterns – positive or negative; higher or lower.

- What is PE? – Price to earnings ratio is another financial metric used to determine the value of a stock based on a company’s earnings.

- Future trends in EPS stock mechanism include better AI stock trading apps, data analytics, and blockchain technology.

What is EPS in Stocks? – eToro Complete Guide

Now that you are enlightened on “What is EPS in stocks?” you should get started with investing in stock shares.

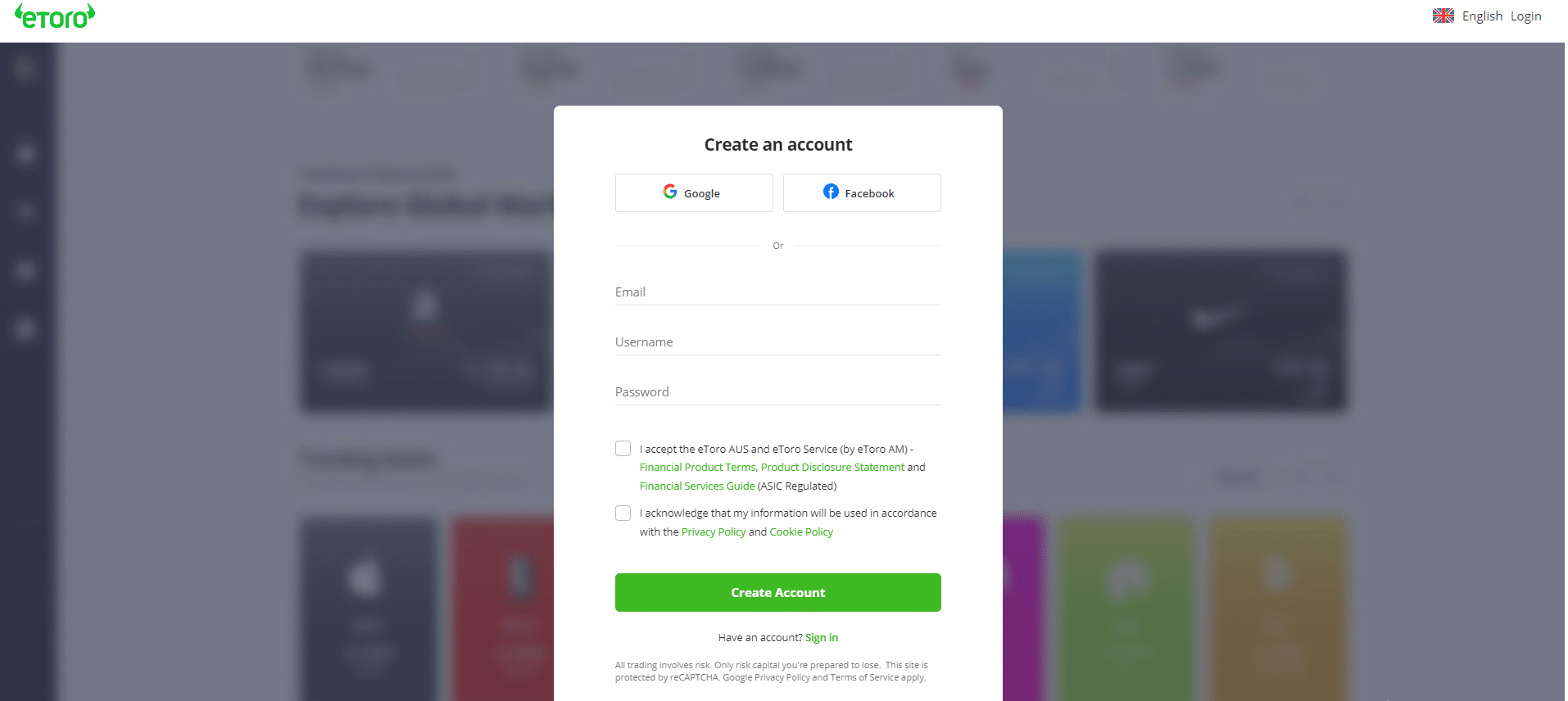

Use eToro, one of the best digital platforms, to buy meme stocks and other options from various geolocations. You can start by creating an account following the steps below.

Step 1Visit eToro’s website

Step 2Complete registration by providing username, email address, and password

Step 3Accept eToro’s terms and conditions

Step 4Proceed with further verification

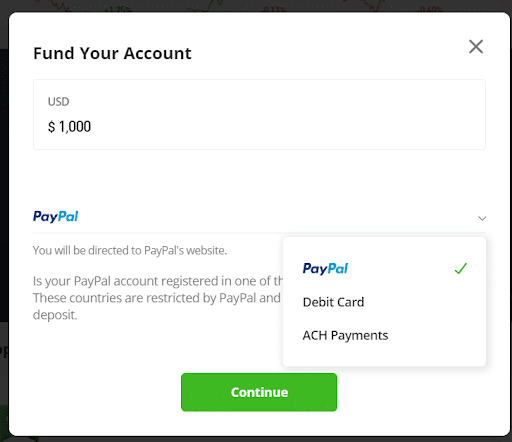

Step 5Deposit funds in your new account

Step 6Use stock market calculator to determine investment growth over time.

Step 7Buy the best stocks.

Conclusion

At the end of this article, you should have answers to “What is EPS in stocks” and “What is a good EPS.” This comprehensive guide explored this financial metric in detail, so that new stock analysts and investors enjoy a good experience with stock investment.

More so, you can use stock tips services to get quality information regarding how to navigate the system and generate good outcome.

If you want to begin this journey, start by creating an account on the stock trading app, eToro, today. Get into the world of stock shares and use every resource at disposal to maximize good profits from investing.

Your capital is at risk.

References

- https://www.financestrategists.com/wealth-management/accounting-ratios/earnings-per-share/

- https://www.fool.com/terms/e/earnings-per-share/

- https://corporatefinanceinstitute.com/resources/valuation/earnings-per-share-eps-formula/

- https://smartasset.com/investing/earnings-per-share

- https://www.nirmalbang.com/knowledge-center/earnings-per-share.html

- https://www.forbes.com/advisor/investing/what-is-pe-price-earnings-ratio/

- https://www.gurufocus.com/economic_indicators/58/sp-500-earnings-per-share

- https://www.td.com/ca/en/investing/direct-investing/articles/eps

- https://academy.musaffa.com/know-what-revenue-and-earnings-per-share-tell-investors/

- https://fastercapital.com/content/Earnings-per-share–How-After-Tax-Profit-Margin-Affects-Earnings-per-Share.html#Impact-of-After-Tax-Profit-Margin-on-Earnings-per-Share

- https://finance.yahoo.com/news/eps-growth-important-manhattan-associates-130535612.html

FAQs

What is a good EPS for a stock?

There is no definite answer. However, if interested in investing in stocks, compare companies and observe how EPS is trending and meets up with a competitor’s earnings.

Is EPS better than a PE ratio?

EPS and PE ratio are two metrics that can co-exist to help investors make good decisions. The former shows profitability per share, while the latter indicates stock’s value over time.

Is it good to have EPS?

EPS is useful in determining a company’s financial performance based on its earnings and total number of outstanding shares. It is often good to choose companies with a positive or higher EPS because it shows more profitability.

What are the downsides of EPS?

EPS has a few limitations, one of which includes a direct indication of whether the stock is good to buy or not. Also, it doesn’t display the quality of earnings and companies may manipulate them to achieve goal.

Should I buy a stock with a negative EPS?

No, it isn’t advisable. Stocks with negative EPS are underperforming and you may lose money. There is no guarantee that it will be a good investment in the future.

Adewunmi Adedayo

View all posts by Adewunmi AdedayoAdewunmi Adedayo is a seasoned finance and cryptocurrency writer with a passion for demystifying financial and crypto concepts to her readers. She has written several content for top websites such as IBtimes UK and The Nigerian Tribune. Adewunmi's style entails transforming technical topics into simple, captivating, and concise content for her audience.

stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up