What Is a Bull Market in Stocks?

Understanding the financial market is one way to make informed decisions regarding investments. It takes more than mere interest to purchase a financial asset of value. Individuals have to look at the market and economic conditions to determine what securities are best at the time.

Over time, the market has been a determinant of asset prices, whether digital cryptocurrencies or securities like bonds, stocks, commodities, or real estate. Based on a general overview, analysts divided the financial market into two conditions – bearish and bullish.

Our aim, however, is to discuss what a bull market in stocks is, exploring its features, phases, governing policies, opportunities, and risks. We will also identify its signs and teach (potential) investors how to navigate through a bullish environment.

-

-

Bull Market Definition and Characteristics

Bullish vs Bearish markets have been described in several ways, but particularly as an indicator of a financial market’s condition. At different points, assets may face either; investors would have to decide on the next course of action.

Hence, we would provide a decent Bull market definition below.

Defining a Bull Market in Stocks

A bull market is described as a period where individual stocks or stock indexes rise. It simply means the time when the stock market is performing well. This situation may persist for weeks, months, or years.

A bull market enhances consumer confidence because there is a certainty of returns on investments. It also indicates the financial health of the company offering such stock shares, which is usually good. Some people use a stock market calculator to estimate these investment returns.

The name idea “bull” comes from the animal’s physiology itself. Bulls raise their horns into the air, thus symbolizing the rise of stock prices.

Key Features and Indicators of a Bull Market

Your capital is at risk.

First, what does Bullish mean, and what are its key indicators or features?

Bullish describes a market experiencing a rise in stocks. Unfortunately, this rise isn’t consistent; sometimes, there could be falls. What makes a market bullish, however, is its rebound rate – how quickly it could rise again after experiencing a decline.

Also, bull trading occurs more during this period because investors show enthusiasm for buying and holding securities (or stocks) for profitable gains.

That being said, a bullish or bull market in stocks is characterized by the following:

-

Consistent Broad Market Index Increase

One of the key indicators of a bullish market is sustainable growth in stock prices, where broad market indexes (like the S&P 500) increase by more than 20%. This consistency over time is what separates a bull from a bear market.

-

High Consumer Confidence

Also, Consumer confidence is a clear indicator of a financial market experiencing a bullish trend. During this period, individual investors put more faith in stocks, predict a profitable future, and buy as many as they can regardless of the risk.

The hope is that these investments will yield high gains.

-

Economic Growth

A good sign that an economy is doing well is a bull market. If a country’s economy was previously experiencing recession, a bullish trend could be an indicator of change.

Similarly, a growing economy facilitates a high employment (or low unemployment) rate and improves the gross domestic product (GDP).

Bull Bear 20% increase 20% decrease Positive consumer confidence Negative consumer confidence High employment rate Low employment rate Signals growing economy Indicates recession or decline Lasts up to 3 years Lasts up to 10 months A table showing bullish vs bearish markets in stocks.

Historical Examples of Bull Markets

Bull market meaning may not be established properly without citing historical examples. Several cases have been reported across individual stocks and broad indexes like the S&P 500 and Dow Jones Industrial Average.

One of the maior events of bullish conditions in the stock market occurred between 2003 and 2007. During this period, stocks experienced a sustainable increase, even small-cap stocks had decent returns, and stock indexes like the S&P 500 doubled in value

Subsequently, the bull market made a tremendous mark in 2009, which was shortly after The Great Recession. Numerous stocks entered the market during this period and flourished until the global pandemic affected the world’s economy in 2020.

Afterward, some entry points emerged, and there was another bullish trend until December 2021. Unfortunately, this didn’t last as long as the others – it eventually became a bear market.

The reason is that the Federal Reserve announced an increase in interest rates, which affected the economy once again.

Notwithstanding, that won’t be the end of the trend. There is a possibility of occurrence in the future.

Other notable historical examples are the Roaring Twenties, The 1980 Japanese Bull Market, and the Reagan Bull Market.

Your capital is at risk.

Phases and Duration of Bull Markets

Phases and duration characterize bull trading, which is the same as bear trading.

Both market trends follow an economic cycle – trough, contraction, peak, and expansion. The purpose is to deliver valuable insight into stock markets and allow investors to decide their next move. This, however, is timebound.

Identifying the Different Phases of a Bull Market

Each phase of a bull market in stocks represents what investors must understand about the economy to develop a sentiment of approach. They include;

-

Expansion (Early and Middle Bull Market Phase)

The Expansion phase indicates a growing economy, where all factors influencing a bull market are set. During this phase, investor confidence grows, and they develop a positive sentiment to buy as many profitable stocks as possible on broad indexes.

-

Peak (Late Bull Market Phase)

The Peak phase symbolizes the highest point of economic activity, and some signs of full capacity emerge. One of them is slow growth. At this phase, investors develop a speculative sentiment because the bull market may continue but show signs of vulnerability.

Investing in stocks becomes risky at the peak stage, and individuals have to evaluate if they want to pursue or stop.

-

Contraction (Bear Market Phase)

The Contraction phase describes when the bull market has now become a bear market. It shows all signs of a bearish trend, such as a high unemployment rate, GDP decline, and poor economic activity.

At this point, investors develop a negative sentiment. They become skeptical about investing in stocks even if the prices drop because there is a higher risk.

-

Trough (Back to Bull Market Phase)

After a period of Contraction, the stock market is expected to make a return from Bearish to Bullish. It reaches the end/beginning of the economic cycle, and a new market emerges with improved consumer confidence.

Phases Trend - Expansion

Typical bullish market - Peak

Apex point of a bullish market - Contraction

Transition into a bearish market - Trough

End of bearish and start of new bullish market A table showing the different phases of a bull market and their trends.

Average Duration of Bull Markets

Previously, bull markets were reported between 2009 to 2020. This record of 11 years was the longest so far.

However, based on other historical trends or data (since 1932), the average duration of bull markets is 3.8 years (1,011 days).

Transitioning to and from Bull Markets

Generally, bullish trading markets are characterized by several factors; hence, a transition is inevitable. These factors are usually economic, geopolitical, or financial.

From the phases above, individuals can see that Contraction marks the end of a bull trend and the beginning of a bear trend. This, however, lasts for a couple of months until policy changes or positive economic data influence it.

During this economic recovery phase, investment sentiments change, giving people the confidence to buy stocks once again.

Economic Conditions and Growth

As we explore “what does bullish mean,” we would take a look at how the economy plays a huge role in determining market condition, i.e., bullish or bearish.

Positive Economic Indicators in a Bull Market

Economic indicators solely exist for a major reason – to indicate when a country’s economy is well-performing. However, they can be divided into positive or negative to determine the growth of an economy.

Positive economic growth often leads to higher corporate profits, low interest rates, and increased investment capacity from innovative companies. It spans other industries with value-added services or processes.

Using this indicator, price stability is maintained to prevent inflation. The Federal Reserve uses a Consumer Price Index (CPI) technique to measure price changes during this period.

GDP Growth and Employment Trends

Other economic indicators are employment, gross domestic product, and inflation or recession. Now, depending on the situation, these trends can determine whether a market is bearish or bullish.

For instance, a high employment rate and a booming GDP are signs of a growing economy, which ultimately produces a bull market.

Conversely, a high unemployment rate and declining GDP often result in a bear market.

Consumer and Business Confidence in Bull Markets

Lastly, Consumer and business confidence describe economic activity. They show spending patterns and optimism or pessimism for investing in stocks.

For example, in a growing economy with a bullish trend and corporate profits increasing, consumers will likely show more business confidence. They believe there is a chance at profitable gains over a period, so they seize the opportunity.

On the contrary, in a declining economy with a bearish trend and corporate profits dropping, consumers will likely hold back from taking the risk of investing. If there isn’t any hope of substantial gains, there won’t be any reason for buying more stocks.

Monetary Policy and Interest Rates

Apparently, market sentiments don’t depend on monetary policy; however, they both influence market trends. These policies, however, are some strategies that would position the country’s economy in favorable or unfavorable conditions.

Role of Central Banks in Fueling Bull Markets

Monetary policy is a tool that the central bank uses to monitor circulated money. It is also used to maintain or improve a country’s economic growth.

For example, the Federal Reserve Monetary Policy uses the CPI to monitor prices during inflation to ensure stability. However, these policies impact the economy positively or negatively.

Speaking in terms of a bullish vs bearish trend, the U.S. Reserve’s Monetary Policy announced an increase in interest rates in 2021 to improve borrowing and spending. Unfortunately, this affected the financial markets, contributing to the transition from bull to bear.

Lower Interest Rates and Their Impact on Stocks

Conversely, lower interest rates offer good advantages, especially for stocks.

First, it reduces borrowing costs, allowing companies to generate capital expenditures and embark on more projects. Ultimately, this is designed to increase corporate earnings exponentially.

Secondly, stocks gain more value with lower interest rates. The consistency of cash flow helps in achieving this so that even with high stock prices, individuals can still invest.

More importantly, when stock prices benefit from low-interest rates, economic growth is substantial.

Evaluating Yield Spreads and Market Sentiment

A strategy often used in the analysis of financial market sentiments is to evaluate the yield spreads. It involves comparing two stocks or securities and finding out the differences in their yield.

These differences provide valuable insight into investor sentiments and economic conditions so that informed decisions can be made.

For instance, yield spreads show inflation expectations while providing information on what to expect from interest rates. That means high inflation could result in increased interest rates and vice-versa.

Likewise, strong economic growth often results in high interest rates and vice-versa.

As this understanding facilitates decision-making, individuals can choose to invest in stocks now or in the future.

Corporate Earnings and Investor Sentiment

Positive Earnings Reports and Market Optimism

Usually, companies provide earnings reports over a period. This aims to inform the public about their financial performances, allowing individuals to decide whether they are in a healthy or poor economic condition. That means the reports could either be positive or negative.

Ideally, positive earnings reports will drive market optimism. Investor sentiments are bound to be driven towards getting stocks from the company because they are doing well. Besides, it contributes to positive growth expectations and more corporate earnings in the future.

Investor Confidence and Risk Appetite in a Bull Market

In a bull market, investor confidence is high even with rising stock prices. They believe the company can deliver returns to shareholders, so these investors are willing to take risks.

Certainly, there will be an increased risk-taking behavior, but people shouldn’t always jump at every offer. Sometimes, analyzing the stocks available and investing in the higher returns options is advisable rather than in higher-risk assets.

Mergers, Acquisitions, and Corporate Expansion

Mergers, Acquisitions, and Corporate Expansion are popular in the bullish market. They are strategic business activities used to drive company growth by boosting earnings. Each activity, however, has its own objectives.

For instance, mergers involve partnerships with other companies to increase competition and gain new stock markets cost-effectively. Acquisitions, however, involve acquiring another company in an attempt to gain access to new stock markets.

Corporate expansion, on the other hand, involves increasing a business’s size, scale, or presence. It aims to increase the company’s position in the market rather than merge or acquire another firm.

Your capital is at risk.

Asset Allocation and Portfolio Strategies

Diversification and Risk Management in Bull Markets

Potentially, Bull Markets come with higher risks compared to Bear markets. The reason is that these risks are associated with consumer confidence. Hence, investors are advised to consider risk management practices like diversification and asset allocation.

Quintessentially, Diversification is a risk management approach that allows individuals to spread their investments around different stocks. The diversified portfolio reduces market volatility and ensures stocks are not overly exposed to a bullish trend.

Balancing Between Equities, Fixed Income, and Other Assets

Subsequently, Asset allocation or rebalancing is a typical portfolio management strategy that deals with distributing investments across different assets, i.e., apart from equities (stocks), such as fixed income (bonds), commodities, and real estate.

It depends on factors like risk tolerance and financial objectives to achieve a complete portfolio.

In a bullish trend, asset allocation maintains a balance so that asset investment fits perfectly into financial or investment goals.

Tailoring Portfolios to Capitalize on Market Trends

With these two strategic approaches, individuals can make informed decisions regarding asset investment whenever they are needed. The main thing, however, is to analyze market trends using fundamental or technical analyses regularly to tailor their portfolios.

Portfolio management, in a bull market, often involves considering what asset (stocks or other assets) to invest in, even with the changing nature of the financial market. Once this has been discovered, investors may potentially stay ahead of the market, even in prevailing situations.

Identifying Opportunities in a Bullish Environment

In this “What is a Bull market” article, we also aim to identify opportunities instead of challenges. Our understanding of privileges presenting itself is by looking beyond a particular sector or industry.

Sectors and Industries That Typically Outperform

Some industries or sectors perform better than others, and investing in their stocks is reasonable. They include:

-

Technological Companies

Innovation is what drives technology companies, and this has put them ahead of other sectors or industries. There will likely be bullish trends in this tech stock due to the rising high demand for products and services.

-

Healthcare Organizations

Most countries heavily invest in their healthcare system, and this has influenced the economy positively, including increasing the employment rate. Due to the high demand for new medicines and therapies, it is bound to face a bullish condition.

-

Financial Institutions

Institutions like investment banks, loan companies, insurance firms, etc., benefit greatly from the growing economy of a country. So, if the Federal Reserve decides to increase interest rates, financial institutions are one to take advantage of it and experience a bullish trend with their stocks.

-

Retail Industry

The retail industry is a consistently growing sector, and due to the demand and supply of goods or commodities, economic activity is influenced positively. This, in turn, affects stock prices – they rise.

Other performing industries are energy companies, real estate, and telecommunications.

Growth Stocks and High-Beta Securities

Growth stocks are traded shares with market expectations to grow more than the market’s price. More often than not, individuals invest highly in growth stocks because of their earnings potential. The major limitation is that they are high-risk investments.

Alternatively, High-Beta Securities (or Beta stocks) consider market fluctuations and often rise during bullish conditions. Due to this effect, it experiences constant price changes – thus, it has a high price volatility.

However, it shows an aggressive growth potential, and individuals with rapid growth expectations usually pick them. High-beta stocks guarantee potentially higher returns than growth stocks.

Growth Stocks High-Beta Securities - Focuses on a company’s earnings growth and expansion

Focuses on stock’s sensitivity to market fluctuations - Shows good performance in various market conditions

Specifically, it shows growth in bull markets. - High risk

Higher risk with high volatility A table showing the differences between growth stocks and high-beta stocks.

Tactical Strategies for Bull Market Investing

Some tactical strategies for bull trading or investing are:

- Investors need to develop a risk-tolerant attitude toward the bull market in stocks. There is no 100% certainty that a stock share will continue doing well, so whatever happens should be seen as an opportunity.

- Investors should choose a specific investment strategy and follow it. An ideal way to remain focused is to consider long-term goals.

- More importantly, bull market investing requires portfolio diversification to reduce exposure or over-concentration on a particular asset.

Risk Mitigation and Exit Strategies

Monitoring Overvaluation and Market Froth

Majorly, overvaluation is a problem that the bull market condition faces. It sets a high expectation for the stock price, and if a problem occurs, investors could face a huge loss.

Similarly, market volatility impacts a bullish market, such that when there are fluctuations, they could cause losses and affect consumer confidence.

To mitigate this risk, monitoring overvaluation and market froth is consequential.

Setting Realistic Profit Targets and Stop-Loss Orders

Another risk management strategy is setting realistic profit targets and utilizing stop-loss orders. So, while an investor expects a higher return, expectations should be set at a threshold level.

The preparedness with stop-loss or limit orders protects against potential reversals in the market.

Preparing for the Eventual Transition to a Bear Market

The phases of a bull market establish a single fact – there is a likelihood of transitioning into a bear market. This could take a while. So, what investors can do is develop an exit strategy if this transition from bull to bear seems inevitable.

Overcoming Complacency and Behavioral Risks

The Dangers of Investor Overconfidence

Complacency is self-satisfaction – it breeds investor overconfidence. Consistent periods of generating returns from stocks in a bull market could make individuals relaxed and unprepared for changes.

However, a stock trading tip is to understand the dangers and overcome them.

These dangers are more behavioral than financial. For example, individual investors may find themselves dealing with behavioral biases in every action they take after experiencing a loss. It could also impact their emotional wellbeing, such as stress and anxiety.

Impact of Speculative Behavior in Bull Markets

Contrary to popular opinion, speculative behavior is an inherent trait in the financial market, and it requires a great deal of work to use it to advantage. It can show positive or negative impacts in bullish trading.

The positive side of speculative behavior is that it results in high trading volumes and liquidity. It sometimes also creates a positive feedback loop so that more investors are attracted, and a stock’s price rises.

The negative side of speculative behavior is that it requires excessive risk-taking and is subject to market manipulation. Also, investors may find themselves overconfident with zero preparedness for market fluctuations.

Navigating Through Excessive Risk-Taking

Since speculative behavior causes excessive risk-taking, some incredible ways to navigate through it are:

- Creating a diversified asset portfolio

- Utilizing a disciplined investment strategy

- Performing regular risk assessment on assets.

Your capital is at risk.

Recognizing the Signs of a Bull Market Peak

As we go through this “What does bullish mean,” an important aspect to consider is the signs of the market reaching its peak phase.

Many investors fail to recognize certain investing or trading signals for stocks and find themselves at a point where they need to make difficult decisions about whether to keep investing or not.

Identifying Market Signals of Potential Reversal

Some market signals of potential reversal are:

-

Overvaluation Indicators

Using the Price-to-earnings (P/E) ratios, investors can find out if stocks in a bull market are overvalued or undervalued. If they are, there is a significant reason to believe the bull market has reached its peak phase.

-

Technical Analysis Indicators

Using technical indicators like the Moving Average Convergence Divergence (MACD) or Relative Strength Index, individuals can track a stock’s price trend. If there is a deviation from the price trend, it means a weak signal, which ultimately means the bull market has reached its maximum capacity.

-

Economic Indicators

Using economic indicators, such as employment rate and global gross domestic product (GDP) growth data, analysts can determine if the bull market has reached its peak stage for potential reversal.

Behavioral Indicators and Sentiment Shifts

Subsequently, Behavioral indicators could be used to recognize a bull market at its peak.

Indicators such as investor sentiment, volatility index, and put-call ratio can be used to get this information.

Historical Patterns Leading to the End of Bull Markets

Additionally, historical patterns can be used to identify trends. It could determine the end of bull markets or the start of bear markets.

Examples of historical patterns include high P/E ratios (more than averages), an inverted yield curve, an increase in interest rates, and a decline in economic indicators.

You can read our detailed guide on how to research stocks to guide your market analysis.

Key Takeaways and Summary

Here, in this bull market in stocks guide, key takeaways are:

- Bull markets signify an increase or rise in stock price, as opposed to bear markets, which symbolize a fall.

- Bull markets have shown historic patterns, and some examples are seen between 2003 and 2007 and in 2009 after The Great Recession.

- Four phases exist in a bullish market, with each showing different economic activity – expansion, peak, contraction, and trough.

- Understanding opportunities and risk mitigation techniques will help investors get through a bullish trend in a stock market effectively.

What is a Bull Market in Stocks? – eToro Complete Guide

By the Bull Market definition, you should already know that investors are interested in anything that brings profits. You can be one of those smart individuals, however, when you register on eToro.

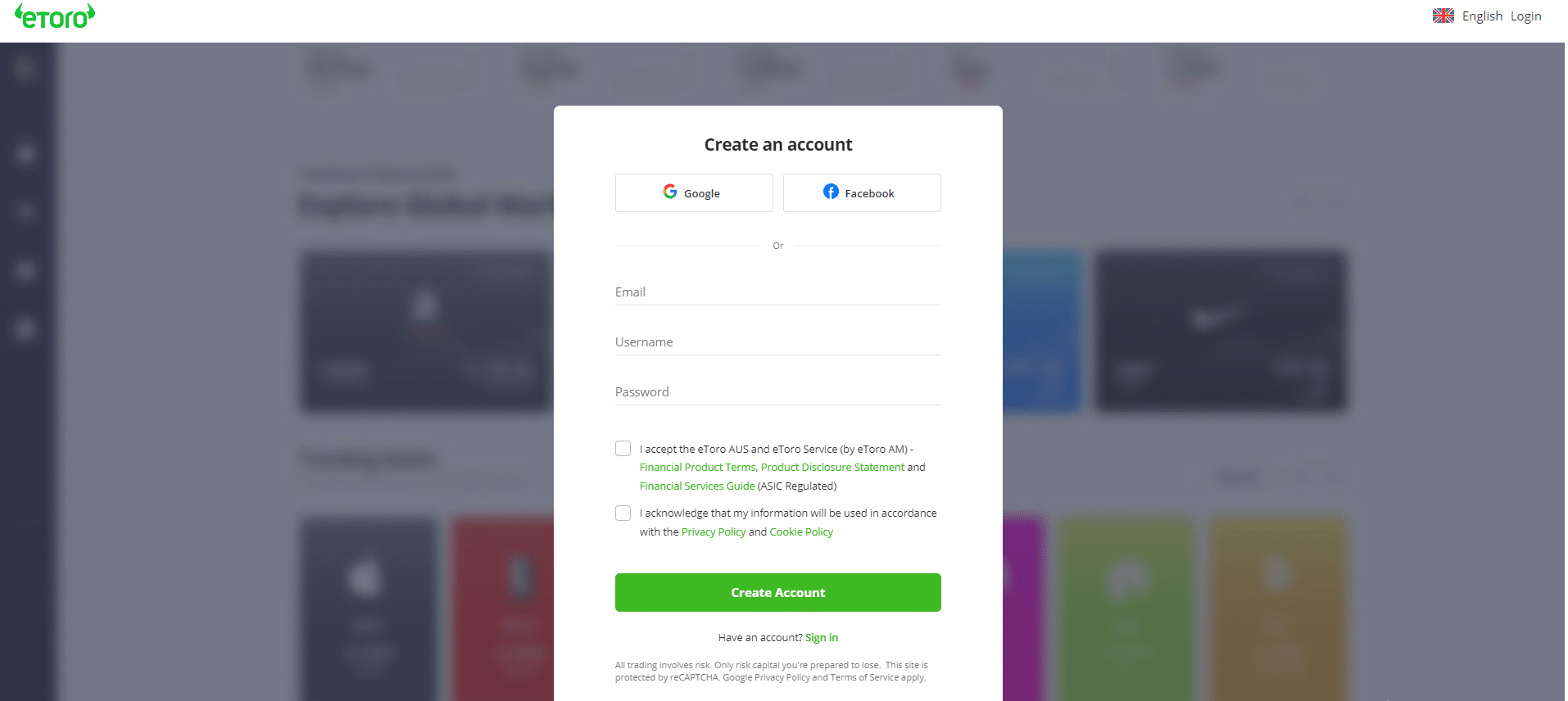

eToro is a stock trading app that allows people to invest in the financial market seamlessly. All you have to do is join by taking the following steps;

Step 1Visit the eToro site on your smartphone or PC

For illustration purpose only.

Step 2Register your account with a unique username, email address, and password.

For illustration purpose only.

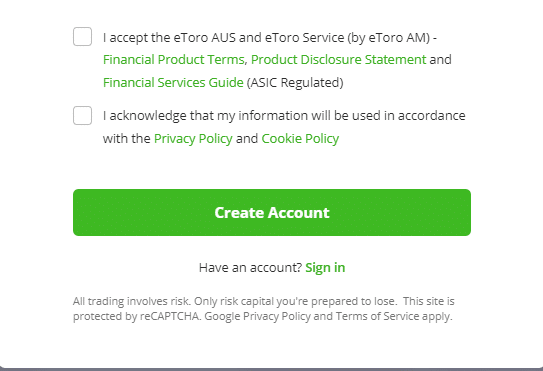

Step 3Agree to the platform’s terms and conditions

For illustration purpose only.

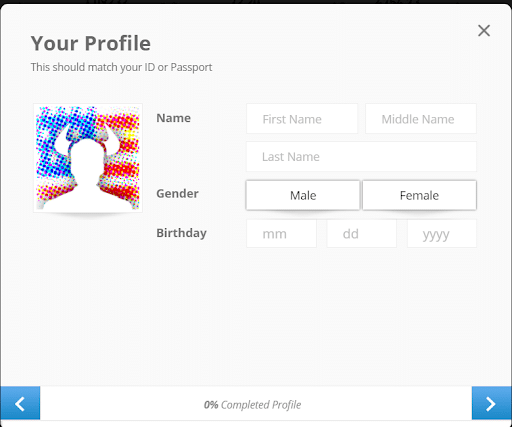

Step 4Meet further verification requirements.

For illustration purpose only.

Step 5Deposit funds into your newly created account.

Step 6Start buying meme or futures stocks.

Conclusion

So, here is everything about “What is a bull market?” If there is anything you must have gained, it is that this market condition is favorable, but it comes with its own risks. Therefore, investors need to consider the reward-risk ratio before anything else.

To seize an opportunity of the bull market in stock investing, eToro is a useful tool to use. This AI stock trading app offers a wide range of stocks at 0% commission alongside several features and tips. Join eToro today and kickstart your stocks investing adventure!

Your capital is at risk.

References

- https://www.bankrate.com/investing/what-is-a-bull-market/#what-is

- https://corporatefinanceinstitute.com/resources/equities/bull-vs-bear/

- https://www.fisherinvestments.com/en-us/resource-library/market-cycles/bull-markets

- https://www.rocketmoney.com/learn/investing/bull-market

- https://medium.com/@hedgeco.app/risk-management-strategies-for-investors-from-bull-markets-to-bear-markets-f0e30cca32e5

- https://www.usbank.com/investing/financial-perspectives/market-news/how-do-rising-interest-rates-affect-the-stock-market.html

- https://www.thrivent.com/insights/investing/what-you-should-know-about-investing-during-a-bull-market

- https://centerpointsecurities.com/how-to-identify-stock-trend-reversals/

- https://www.tickertape.in/blog/high-beta-stocks/

- https://fastercapital.com/content/Analyzing-Market-Sentiment-with-Nominal-Yield-Spreads.html#Importance-of-Nominal-Yield-Spreads-in-Market-Sentiment-Analysis

FAQs

Is a bull market good or bad?

The answer to this is subjective – it depends on an investor’s sentiment and financial goals. While it may improve consumer confidence and indicate economic growth, it causes complacency and overvaluation

What happens during a bull market?

In a bull market, stock prices increase with other indicators, such as high employment rate, low volatility, high trading volume, and grossing GDP.

How long do bull markets last?

Typically, bull markets last up to 3 years (1,011 days).

What is a bear market vs bull market?

Bullish vs Bearish markets are opposing sides of market conditions – the former describes economic growth, while the latter indicates economic decline. Each comes with its benefits and limitations.

What if you invested $1,000 in Netflix 10 years ago?

A decade ago, Netflix stocks (NFLX) were $9 per share. If you had invested $1,000, it would be worth $10,189 (approx. 918.97% increase) now.

Adewunmi Adedayo

View all posts by Adewunmi AdedayoAdewunmi Adedayo is a seasoned finance and cryptocurrency writer with a passion for demystifying financial and crypto concepts to her readers. She has written several content for top websites such as IBtimes UK and The Nigerian Tribune. Adewunmi's style entails transforming technical topics into simple, captivating, and concise content for her audience.

VISIT ETOROYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2024

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up