Capital.com App Review 2024 – Pros & Cons Revealed

Capital.com is an online investment platform where you can buy and sell a variety of financial instruments. The firm is an instruments and CFD broker. CFDs – contracts for differences – are used to provide exposure to asset classes. CFDs are financial instruments that track the value of an underlying asset, such as a share, ETF or an index fund. Capital.com uses CFD instruments to create markets for traders.

In our review of the Capital.com stock app we walkthrough how to get up and running. We also show you how to open a position and close it, and how the app presents the all-important margin, spread and overnight charge fees to the trader.

This review will use as its base the iOS app but the functionality and look and feel is similar to the Android version, albeit not exactly the same.

[toc]What is Capital.com Group?

Capital.com is an online instruments and CFD broker with offices in UK, Cyprus, Gibraltar, Australia and Belarus and a worldwide trading audience that last year traded more than $88 billion of financial assets.

It is part of a generation of new kids on the block among the CFD brokerage community.

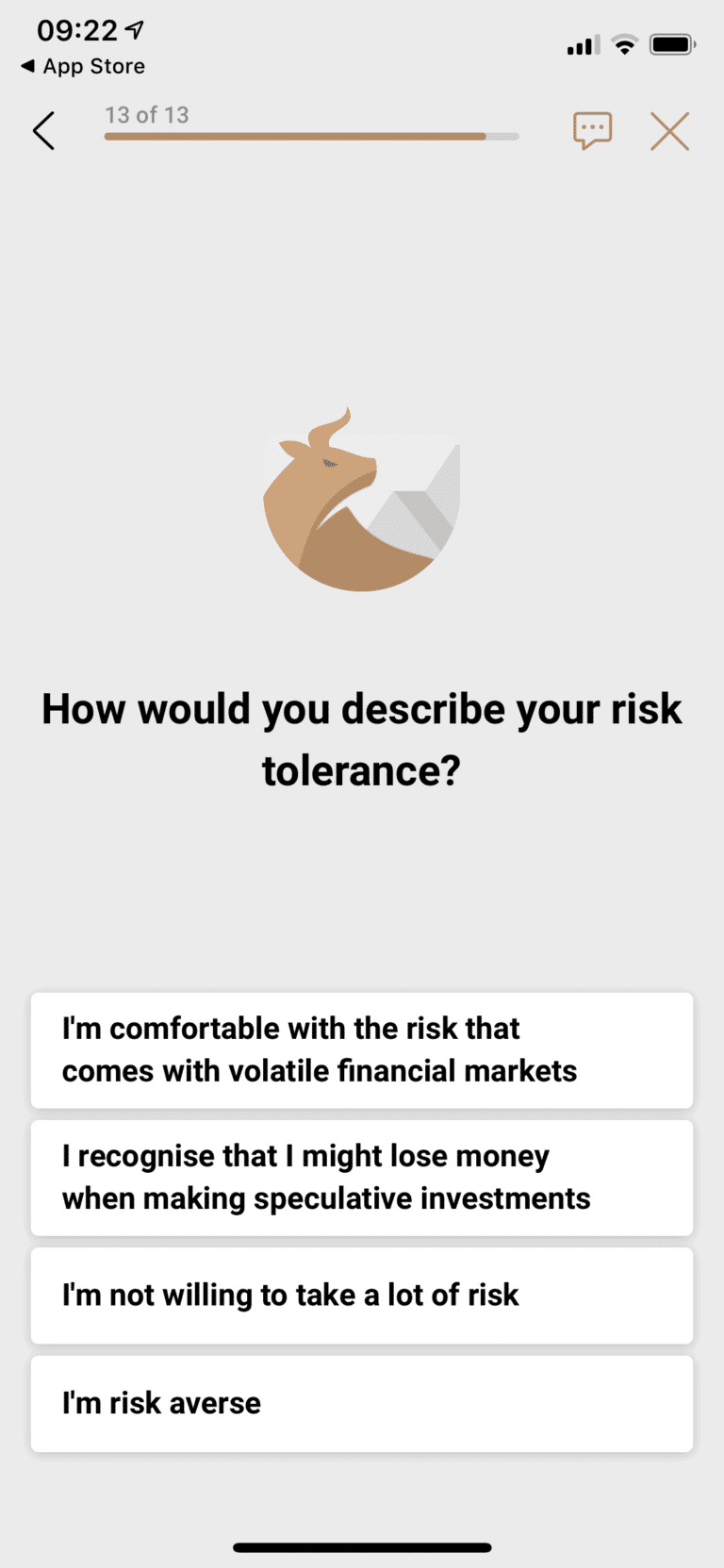

The sector has been criticised by regulators in the past for promoting highly risky and unsuitable products to mainstream investors, some of whom will not understand the extent of the risks involved in trading on margin using leverage. But looking at this app, Capital.com is going the extra mile to communicate risk to its customers. Tight spreads and low charges have kept among the main contenders in the CFD broker space.

The brokerage has over 2,300,000 registrations. around the globe.

Capital.com Group was founded in 2016.

What Instruments Can You Trade on the Capital.com App?

The Capital.com stock app brings access to 3,000 markets you can trade on. The breakdown of instruments includes the following: 3118 shares, 33 indices, 64 commodities and 171 forex markets. That doesn’t add up to 3,000 but the figure is variable by region and this review is for the UK version of the app.

Finding instruments

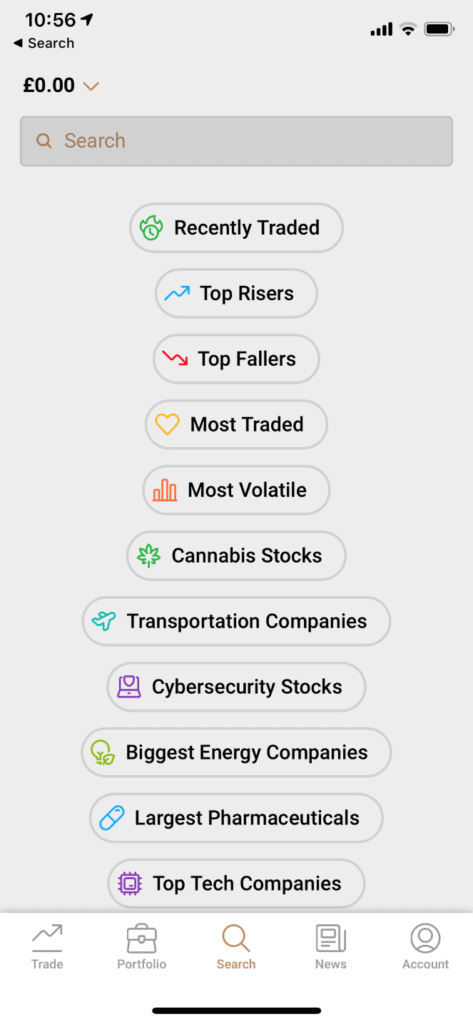

Finding instruments is effortless. Touch the search tab – the middle icon of the five tab bar icons along the bottom of the view. It brings up the field to enter your search query at the top as seen in the screenshot above.

Below the search bar is a helpful listing of easily accessed search groupings such as ‘top risers’, ‘top fallers’ and ‘most volatile’.

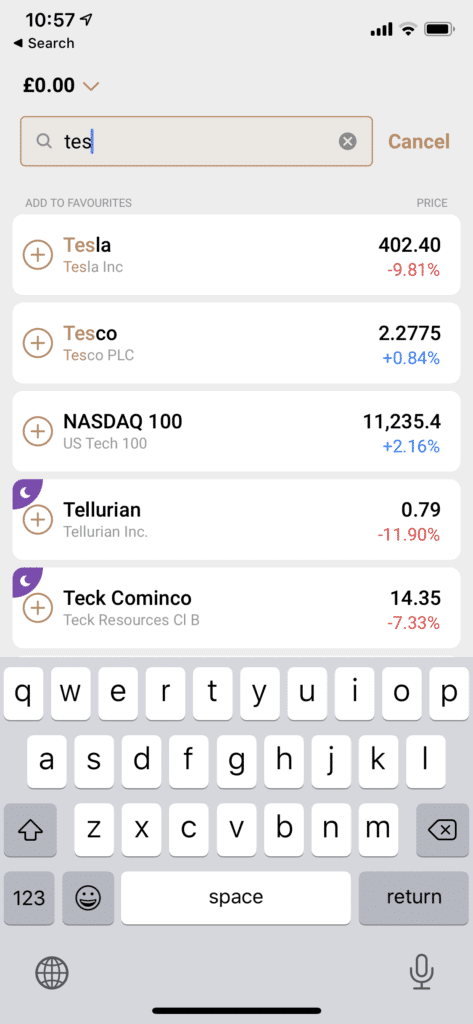

To search for a single stock by simply typing in its name of ticker if you know it. In the screenshot below a search for Tesla is being conducted. After typing the first three letters the instrumentss appears at the top of the list:

ETFs

Exchange-traded funds industry ETFs are cheap (low management fees) providing access to asset classes by tracking and/or creating indices for assets. The issuer of the ETF directly buys asset or uses derivatives products to replicate the movement in prices of the asset. This has led to a proliferation of ETFs – at the end of 2019 there were 6,970 ETFs on the global market, according to data analytics firm Statista.

Today areas that have traditionally been hard to gain exposure to for ordinary traders and investors are now in reach, thanks to ETFs.

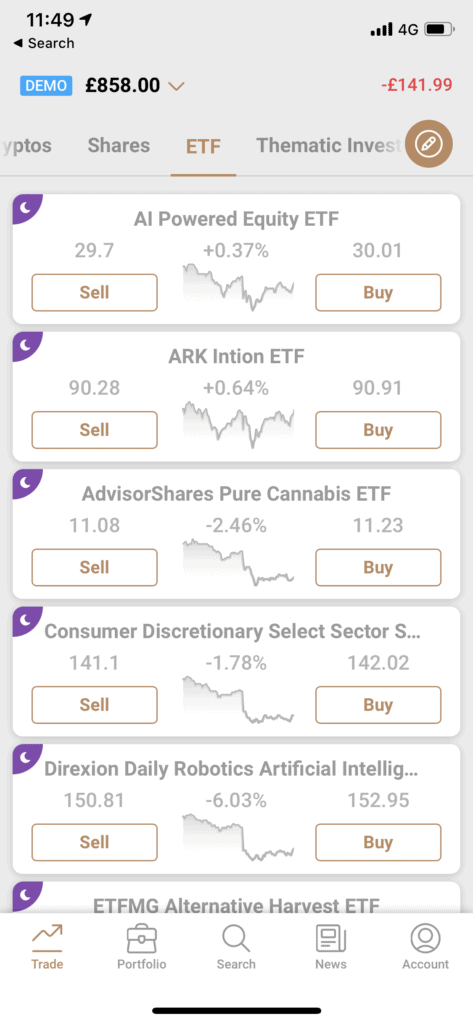

In the screenshot above, see the themes and sectors that ETFs are able to home in on and specialist areas. In the view above you get a flavour of this breadth: AI Powered Equity ETF – uses algos to guide portfolio management of equities

Take the ARK Innovation ETF listed above. It invests in companies that are “disruptive innovators”. Purchasing the ETF with Capital.com’s CFDs, will give you exposure to a portfolio that includes Tesla, Crispr, Square, Teladoc Health, Zillow and Roku among its top 10 holdings.

Other Asset Classes

Our Capital.com app review found that it has one of the most extensive number of markets in forex but not all of the pairs are available through the app. The same would appear to be the case with many other instruments. Nevertheless the range and quality of available markets is still good.

Indices: 33 indices of various types are available on the app. To get to them, when on the Trade section (left button on tab bar at bottom of view), slide the category names left or right to find ‘indices’. Alternatively just swipe left or right to switch between instrument categories.

In addition to all the indices for the major markets, such as the FTSE 100 Dow Jones 30 and the S&P 500, there are also smaller ones like the Swiss SMI 20. Asian Indices include China exposure through the FTSE China A50.

Forex: Capital.com lists 137 major and minor currency pairs according to research by stockapps.com. Major pairs are those of the most heavily traded currencies globally.

In this section f the app there are buttons for the most popular currencies that can be scrolled through, just below the scrolling category names. Taping on a currency button will bring up all the market pairs for the currency.

Commodities: There are 64 commodities instruments to trade on. Markets include oil, gold, silver, coffee and palladium. But in addition to the ‘normal’ commodities, there are also ‘commodities options’ (oil, gold natural gas). In addition to all the major soft and hard commodities traded globally, there is an interesting inclusion of Carbon Emission, which tracks the spot price of the EUA carbon credits. The EUA is the European Union Allowance and is a tradeable unit. The holder of an EAU has the right to release one tonne of carbon dioxide or equivalent gases into the atmosphere.

Other categories of assets shown in the app, in addition to shares and those highlighted above are: Futures, thematic investments (for example, Berkshire 10 Index and US Cannabis Index) and oil markets (oil company shares).

Note: if a market is closed, this is indicated with a crescent moon icon in the top left corner of the instrument card.

Leverage levels by asset type

- Major currency pairs 30:1

- Minor currencies 20:1

- Gold and major indices 20:1

- Other commodities and minor equity indices 10:1

- Instruments 5:1 for individual equities and other reference values

81.40% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

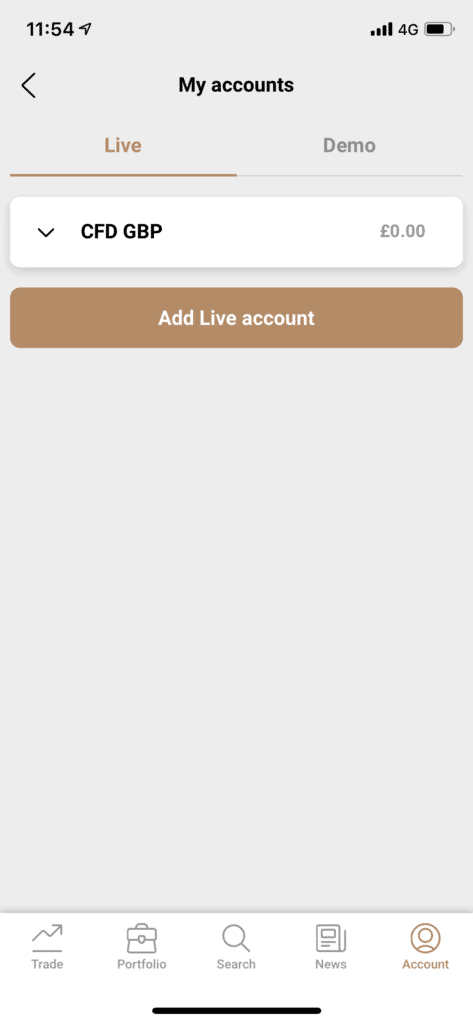

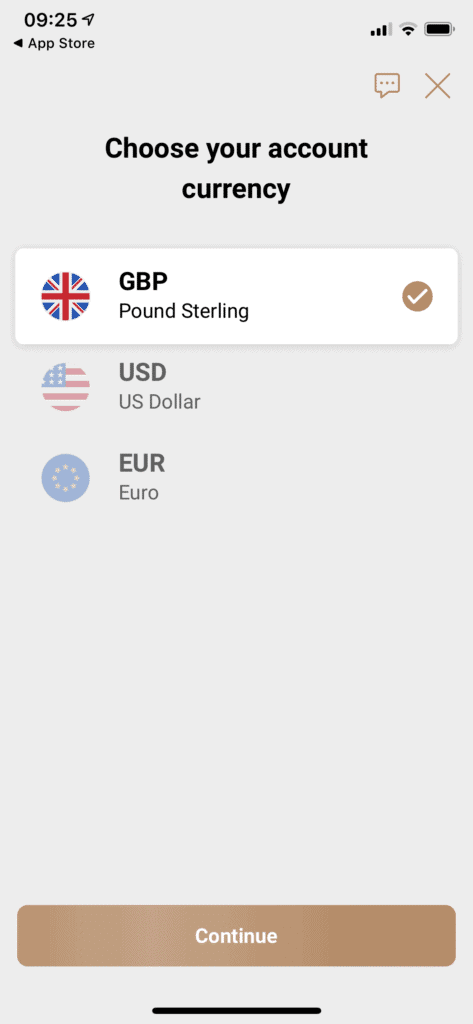

Capital.com Account Types

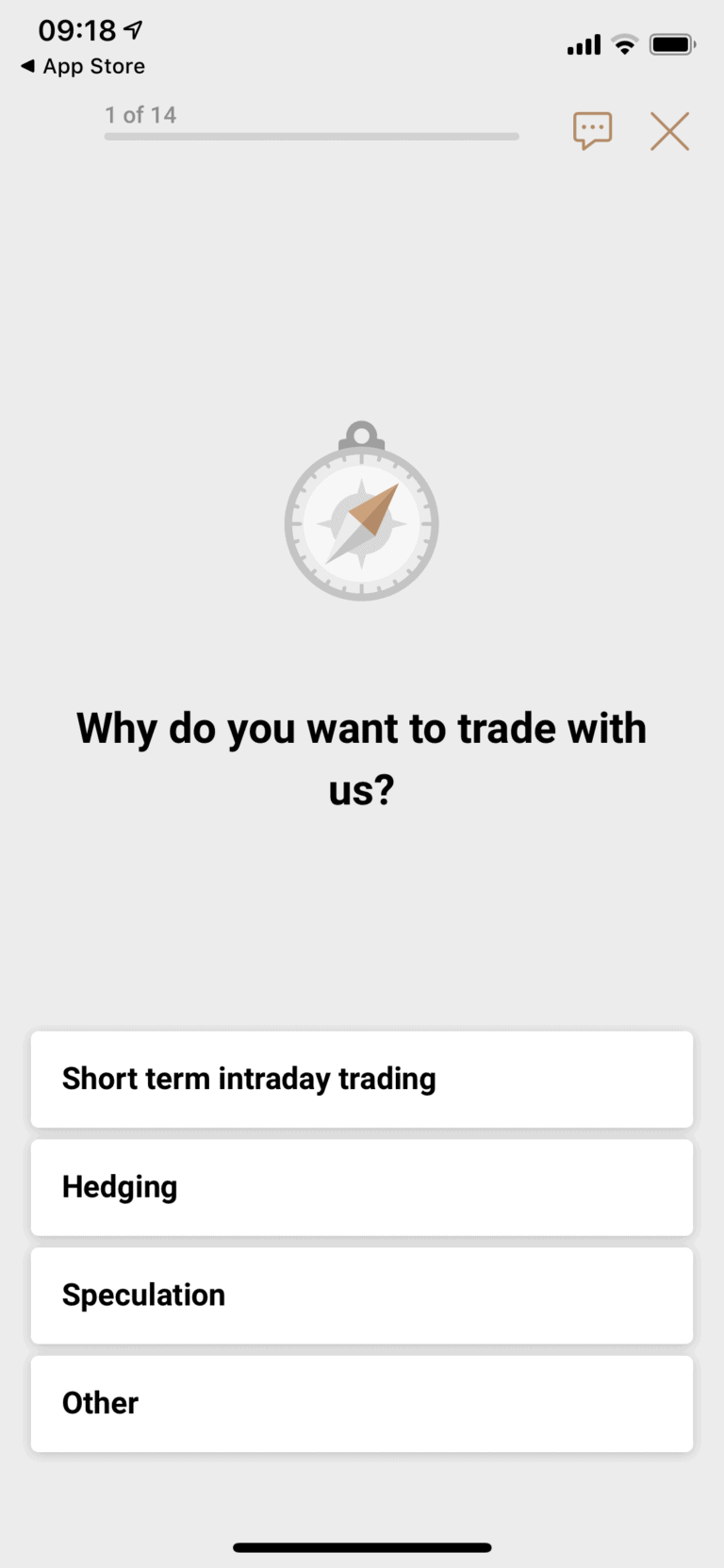

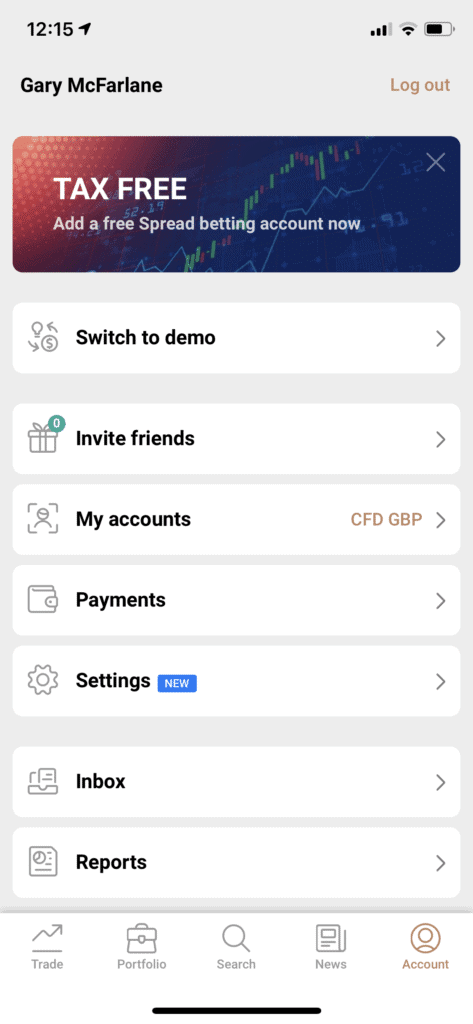

Our Capital.com review found that in the onboarding process, you are asked to choose between either setting up a CFD account or a spread betting account only available for CC UK clients.

Capital.com has a spread betting account but it is not covered by this review.

A spread betting account must be bolted on as a separate account. Spread betting provides traders with exposure to the price movements of assets and gains are tax free as it is treated as a form of betting by UK tax authority, HM Revenue & Customs.

Disclaimer: It should be noted though that professional clients may lose more than they deposit and they are generally not afforded the same level of regulatory protection. Tax treatment depends on individual circumstances and change or may differ in a jurisdiction other than the UK.

If a client wants to be an on a professional account, they must contact Capital.com support first.

Either select from the amounts shown in the grid or type ’20’ into the amount field and pay with your chosen method. See screenshot below:

CFD traders generally don’t hold the instruments for more than a matter days – or if talking about a day trader, hours – and the risks of leverage means you’ll be magnifying both potential losses and gains.

Be sure to have sufficient funds available in your account to cover your positions should the profit and loss on your balance go into the red.

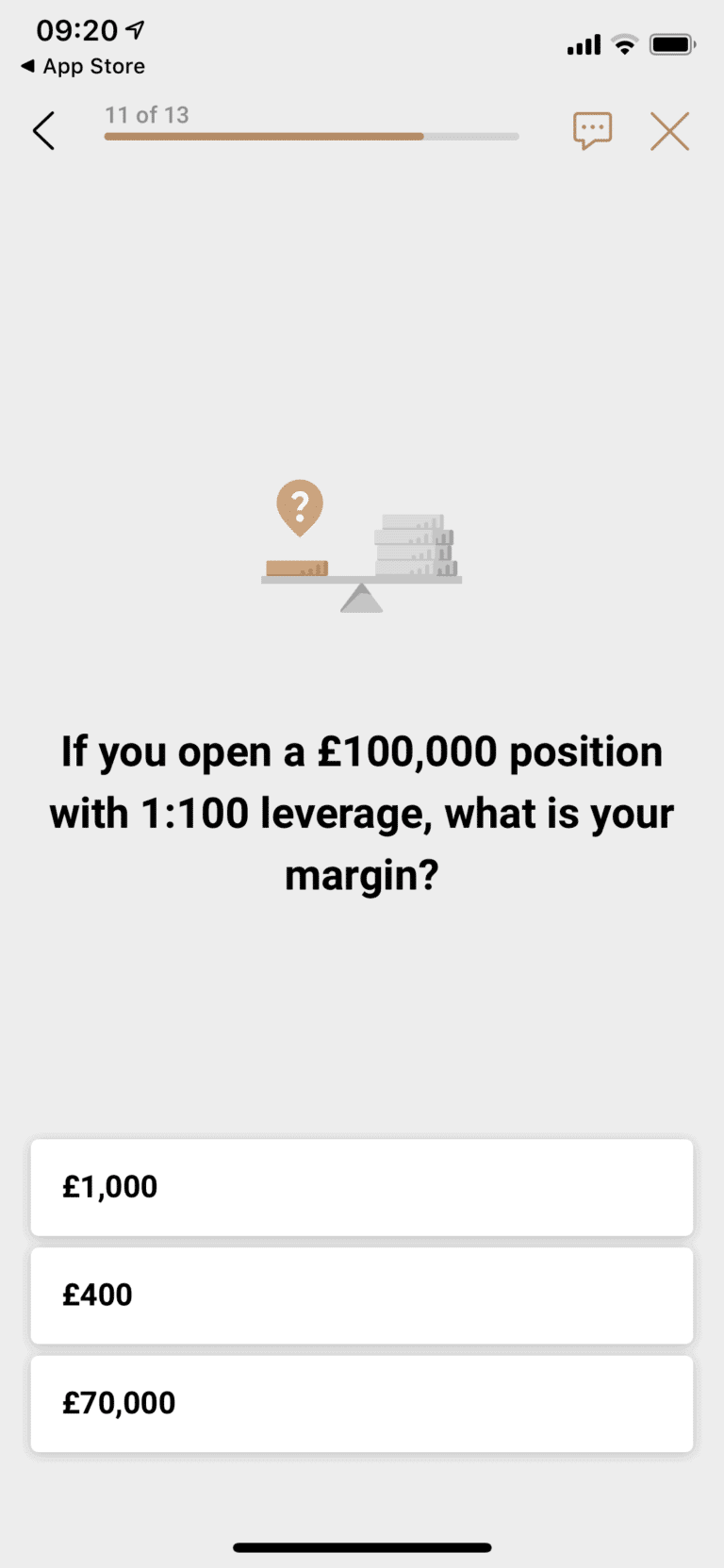

All accounts come with up to 30:1 leverage. Leverage is where traders borrow to enable them to allow a relatively small sum to set in motion and control a much larger position – this can magnify trading gains, but also losses.

81.40% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Capital.com Fees and Charges

Capital.com charges 0% commission for trading & tight spreads, which begs the question where does it get its revenue from?

As is the case among its CFD broking community peers, Capital.com make money from the spread on the quoted price. The bid-offer (bid-ask) spread is the difference between the buying and selling price and this is passed on to the trader through incorporation into the share price.

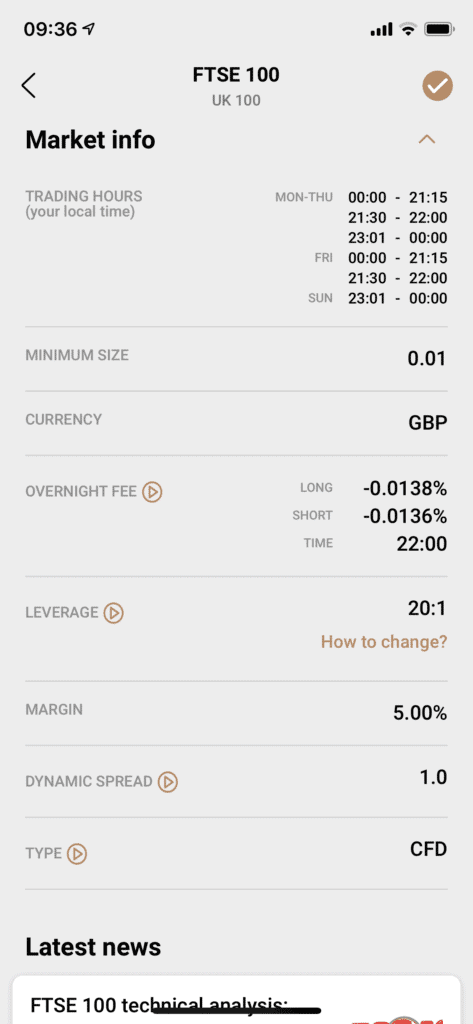

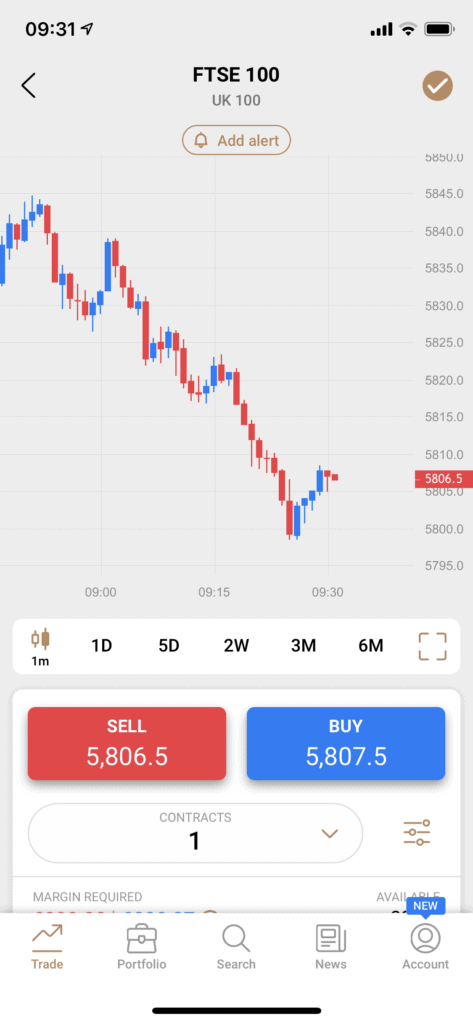

See below the costs associated with the FTSE 100 index market.

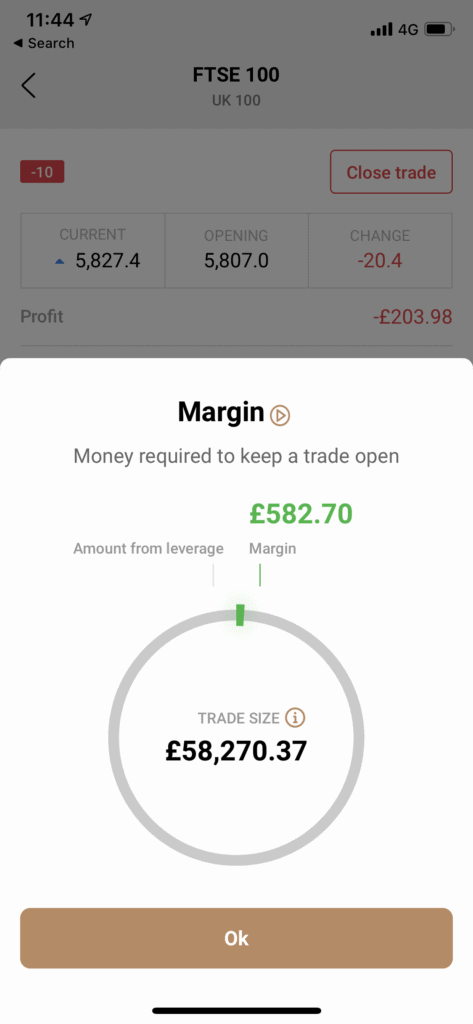

The main charges to be concerned with are the margin and overnight charge.

Spreads

Our Capital.com app review found that spreads average about 0.6 pips but the exact level will depend on the instrument traded.

You can find the fee details in the market info section of an instrument, as seen above for the FTSE 100 CFD instrument.

CFD Trading

CFD trading is commission-free but there is the spread and non-trading fees, such as overnight charges and currency conversion to pay.

Because a CFD is issued by a financial institution and is a contract for a specificed time, there is effectively an interest charge levied by the trading platform, known as the overnight charge.

You can use leverage of up to 1:30 when trading CFDs, depending on the instrument type. Making use of leverage will add to your costs. Remember, leverage magnifies losses as well as profits. Trading CFDs on leverage is risky, even more so in periods of heightened market volatility.

There are no fees for deposits or withdrawals or for other essential features such as real-time quotes. Capital.com’s excellent educational materials also come free and include polished and informative videos integrated into the app.

Non-Trading Fees

Overnight Funding

Capital.com beats out its competitors with its lower charges for keeping positions open ‘overnight’ (when markets are closed). As with all such brokers, holding open positions on margin for clients entails incurring interest expenses. The amount to be paid depends on how long after the Overnight Funding Time a position is left open. The exact charges vary for each instrument.

With Capital.com the charge is based on the leverage and not on the value of the total outstanding position.

Therefore to work out the overnight funding cost on Capital.com:

Trade leverage size x opening rate x daily overnight funding percentage.

See screenshot in CFD trading section above for the FTSE 100 CFD. See the details of the deal under ‘info’. Overnight funding percentage for sell orders (short) is 0.0136% and 0.0138% for buys (long).

Capital.com App User Experience

When you open the app you are presented with a ‘tabbed’ layout as seen in the screenshot of the home screen below. The buttons are: trade; portfolio; search; news and account, and can always be reached from anywhere in the app.

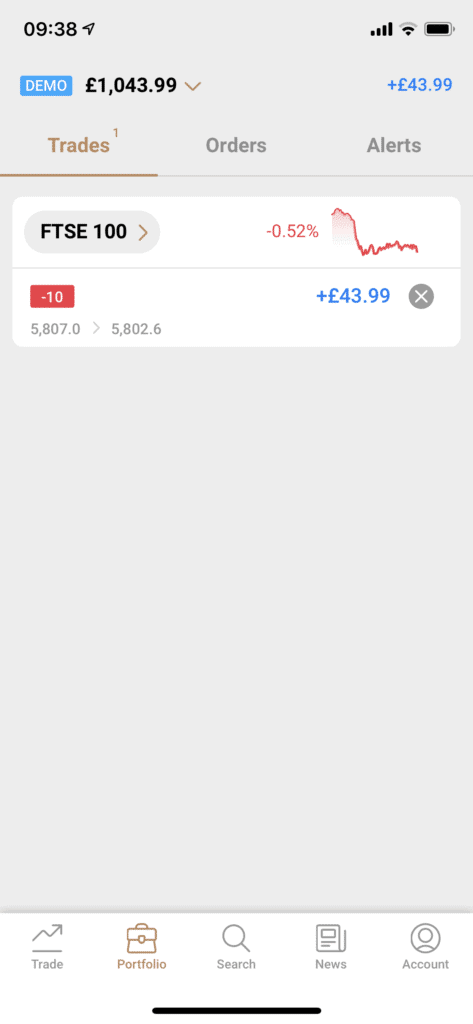

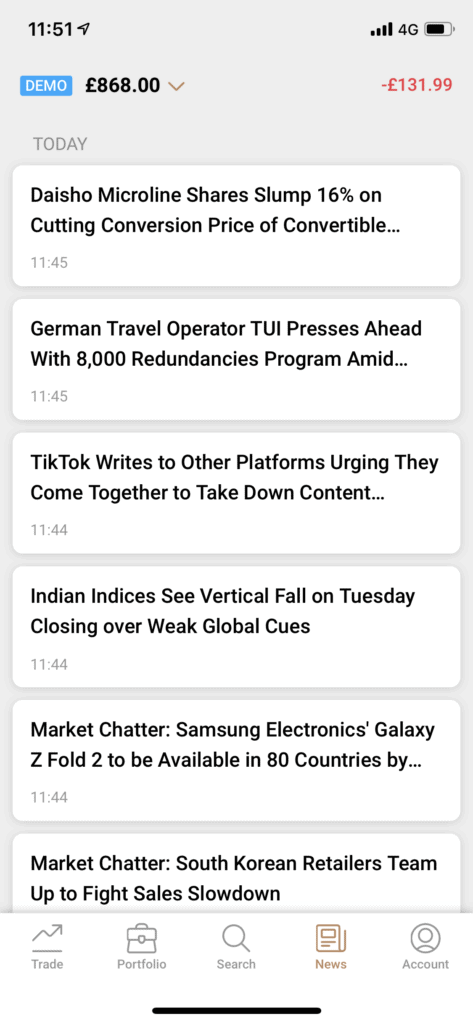

At the top of the screen, left, is the real-time update of the funds in your account (equity) and on the right the running profit and loss position (in red or green) showing the profit and loss for your account, (see screenshot below).

The view presents individual instruments as cards in a scrolling view and you can swipe left and right to move between instrument categories such as ‘favourites’, ‘popular’ and ‘shares’.shares

A circular ‘watchlist’ button is always in view floating on the top level of stack, so you can quickly add instruments of interest.

Clicking on an instrument in the category view brings up the chart with sell and buy buttons underneath.

Scroll down to see the instrument’s market info covering the following areas:

- trading hours

- minimum size

- overnight fee

- leverage

- margin

- dynamic spread

- type

Now let’s take a deep dive into the trading tool features.

Spread betting accounts are only available for UK clients

Capital.com Trading Tools and Features

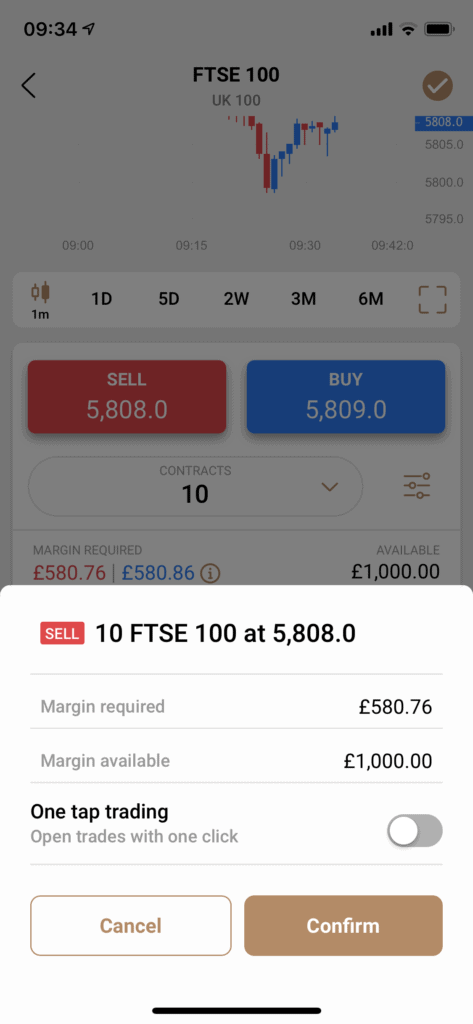

To assess the trading tools and features, let’s open a position in the FTSE 100.

Sell the FTSE 100 index CFD instrument at 5807 (the entry price is the level of the FTSE 100)

The smallest unit amount is 0.1. Let’s open a 1.0 point position.

With 10x leverage, the margin is $582.70 (a tenth of 5827 – the current level of the index).

The information the trader needs to know is presented graphically with a doughnut showing the margin as a proportion of the total value of the position.

Shortly after opening the position, the trade is in profit by $43 this is the view in the portfolio view reached by touching the briefcase icon for the portfolio section.

Click the grey FTSE 100 button shown in the screenshot below and you are taken back to the instrument page for the FTSE 100 index.

The swish design implementation of the charting tools makes using the tools intuitive for the most part.

Touch the little square icon immediately below the table in the instrument page view and the chart expands to fill the screen. Here select the add button (bottom right) to select from the impressive array of indicators in addition to the usual drawing tools.

Below is a screenshot of the landscape view. It is straightforward to add indicators to the chart – for the most part.

As you can see in the screenshot, setting a 200-day moving average was difficult using the slider – its sensitvity was such that the neearest I could get the moving average to 200 was 202 (see chart). When you touch the number to change it by inputting manually, whatever number you put in returns 1,000, so looks like there’s a bug that needs squashing there.

Capital.com App Education, Research and Analysis

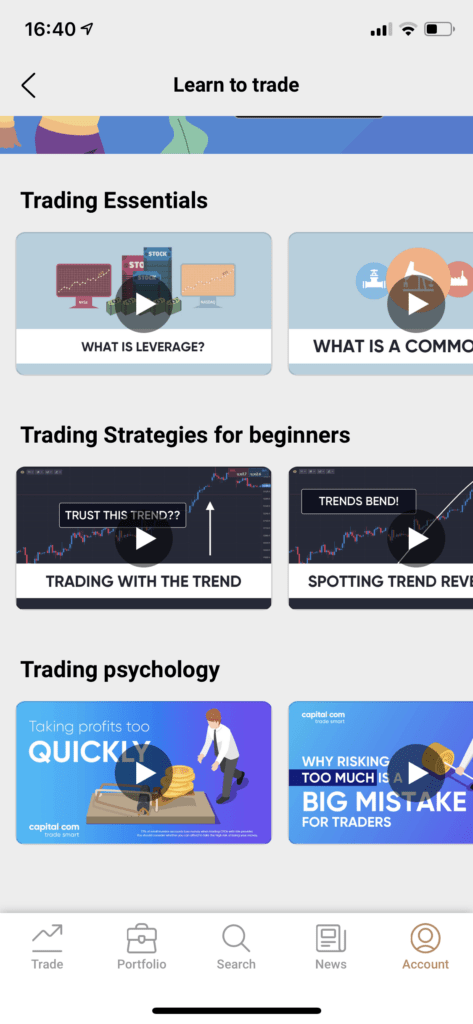

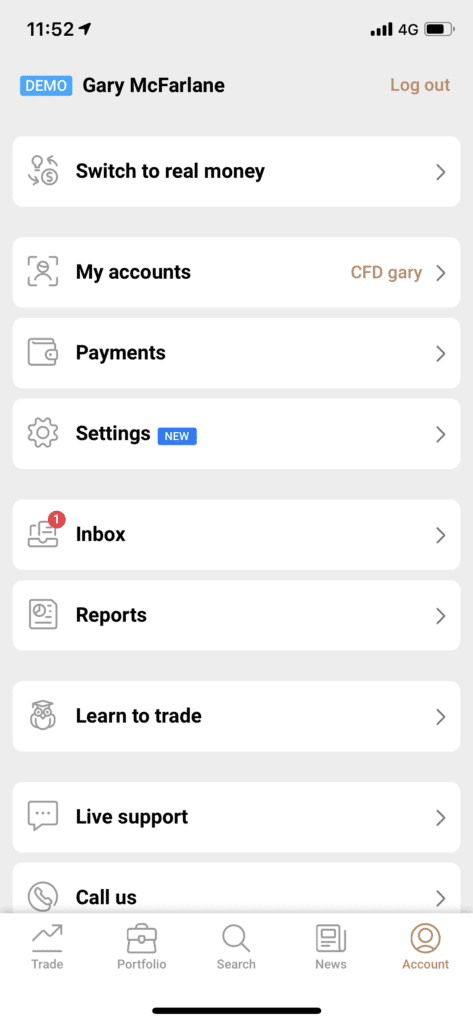

You can find the education in the app by going to ‘account’ and clicking ‘learn to trade’ from the list of account features.

Videos

Our Capital.com app review found that there are lots of videos covering everything from margin calls to types of charts.

The videos are broken up into essentials, strategies for beginners and psychology and easily browsed through wiping horizontally (see screenshot above).

For some the videos alone will make Capital.com stand out from the crowd and the team are to be applauded for their commitment to educational resources and tools.

News algo

Capital.com has built a news algorithm into the app, where your recommendations are fed into AI systems to hone news content to fit your requirements.

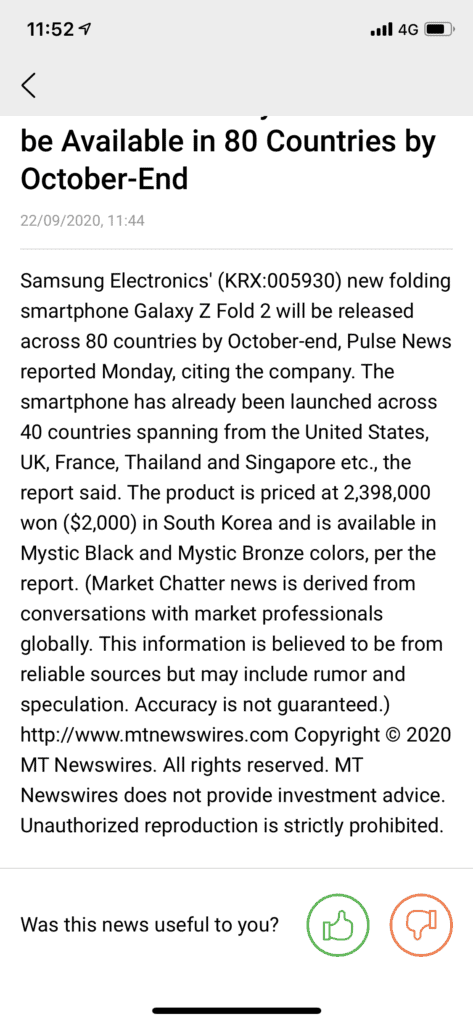

Click on the headline card to open the news item:

Appreciated by those looking for an emphasis on research tools will be the integrated news feed. This innovative feature provides a prompt for the user to give a thumbs up or down asking for feedback from the user as to whether the news item was useful (see screenshot immediately above).

When you click on a news item it brings up a pop up containing either a news story clipping, headline, broker note reference or link.

With this information, the algorithm presumably acting on this data will recommend ever-more accurately aligned news items with your interests.

Learn To Trade video section is head and shoulders above much of the opposition in terms of investment in engaging educational tools, especially the appreciation of the importance of video for precisely this sort of educational role.

Capital.com Demo Account

Our Capital.com app found that the demo account has most of the functionality of the live real money version, there you can trade paper money before making real trades, this is why Capital.com is a best paper trading app in our to picks. Many of the instruments under the ‘new category will not be available in the demo account. You can switch between the two easily from the account section.

A small but welcome touch is the blue badge that indicates when you are in demo mode – you don’t want to accidentally open a position when you thought you were in demo mode!

81.40% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

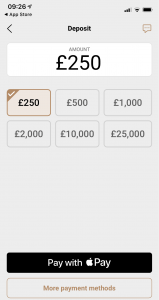

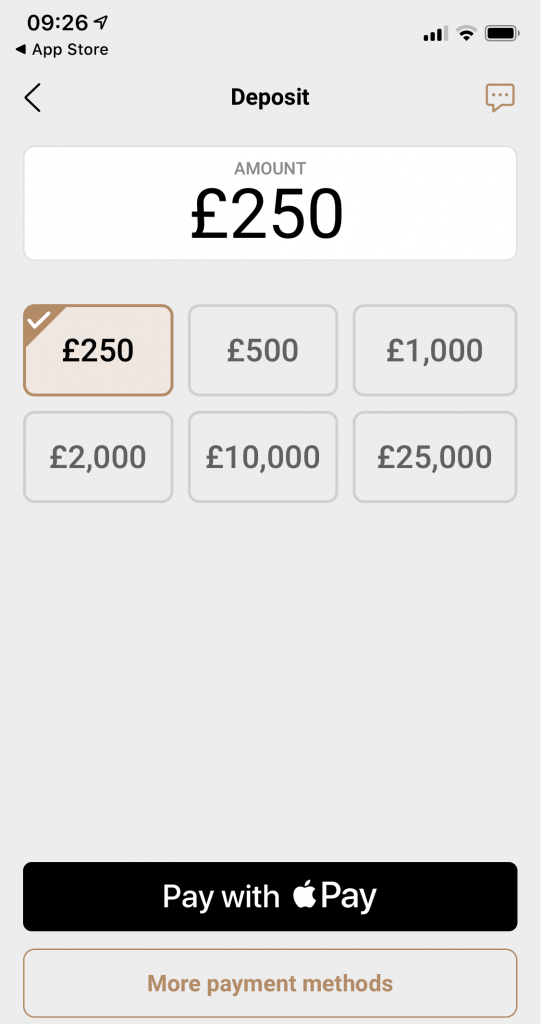

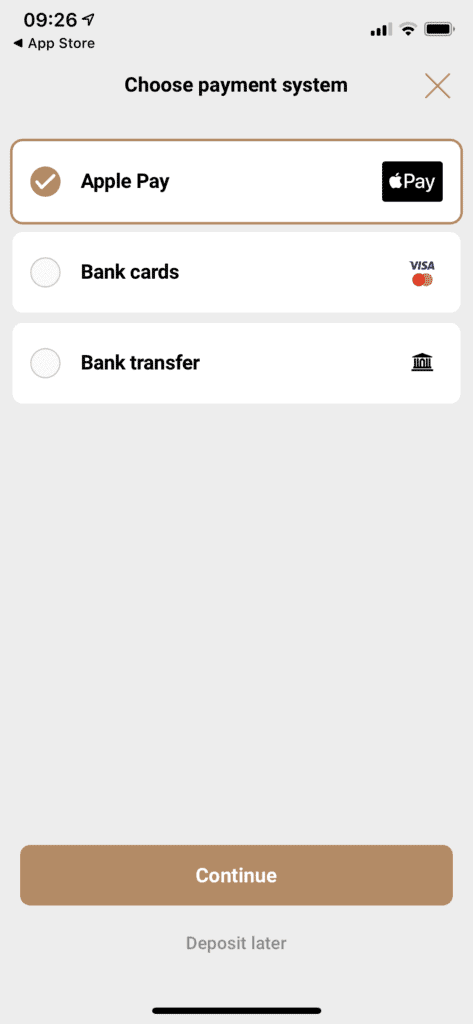

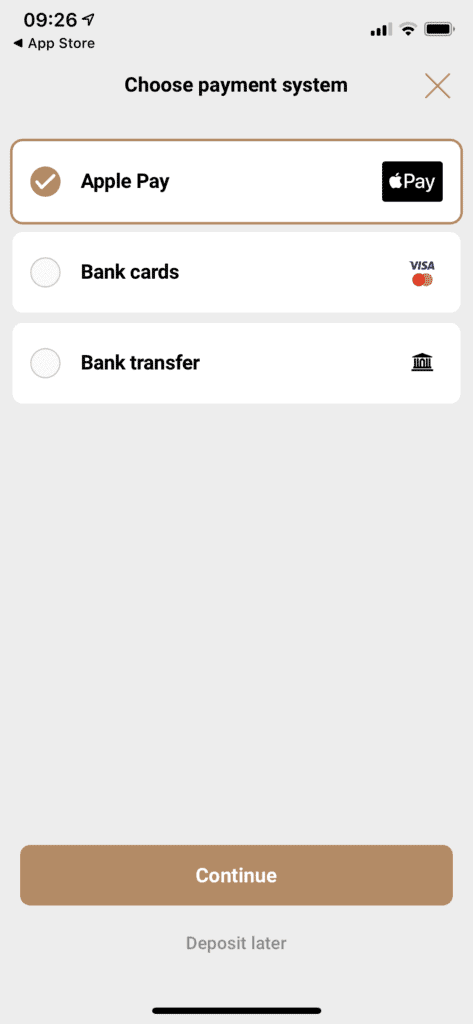

Capital.com Payments on the Stock App

You can opt-out of depositing during the sign-up journey.

When in a real money account, if you haven’t funded your account you will see a green wallet icon and the call to action: “Fund your account to start trading”

You will be asked to choose a payment system if you haven’t already done so:

Deposits are accepted via several payment types (for UK customers), although these will vary depending on region:

- Bank Wire

- Credit Card

- Apple Pay

- PayPal

- Trustly

- Open Banking

The minimum deposit using the app is $20, $250 for bank wires and there are no deposit or withdrawal fees.

Capital.com Contact and Customer Service

First-rate customer service: telephone support, WhatsApp and Telegram, live chats and email.

This reviewer received a phone call after signing up, which is important in creating a bond of trust and reassurance for the customer knowing there is someone to reach out to – alternatively, you might see it as a sales call (which of course it is) intrusion, and as such a nuisance.

Whether they are as quick at contacting you when there has been made an error made on a customers account may have a different response time compared to the firm looking to get new sign-ups trading as soon as possible.

Is Capital.com Group Regulated?

Capital.com has entities regulated by the UK’s Financial Conduct Authority, in Cyprus by the CySEC, ASIC, and the NBRB.

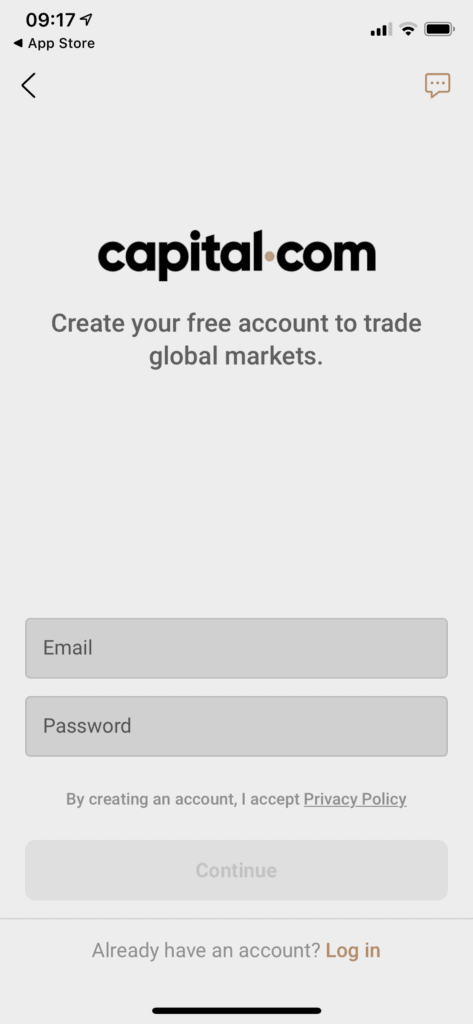

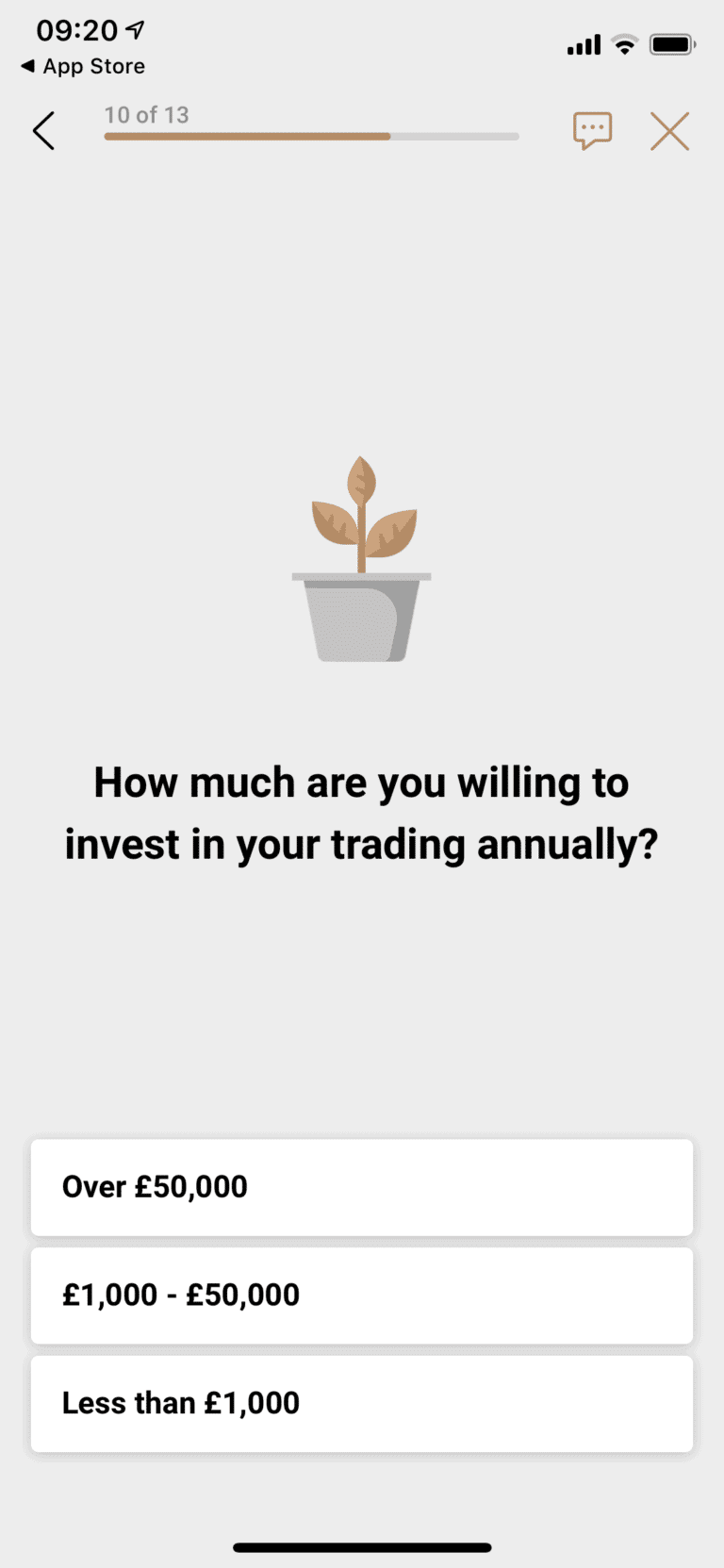

How to Use the Capital.com App

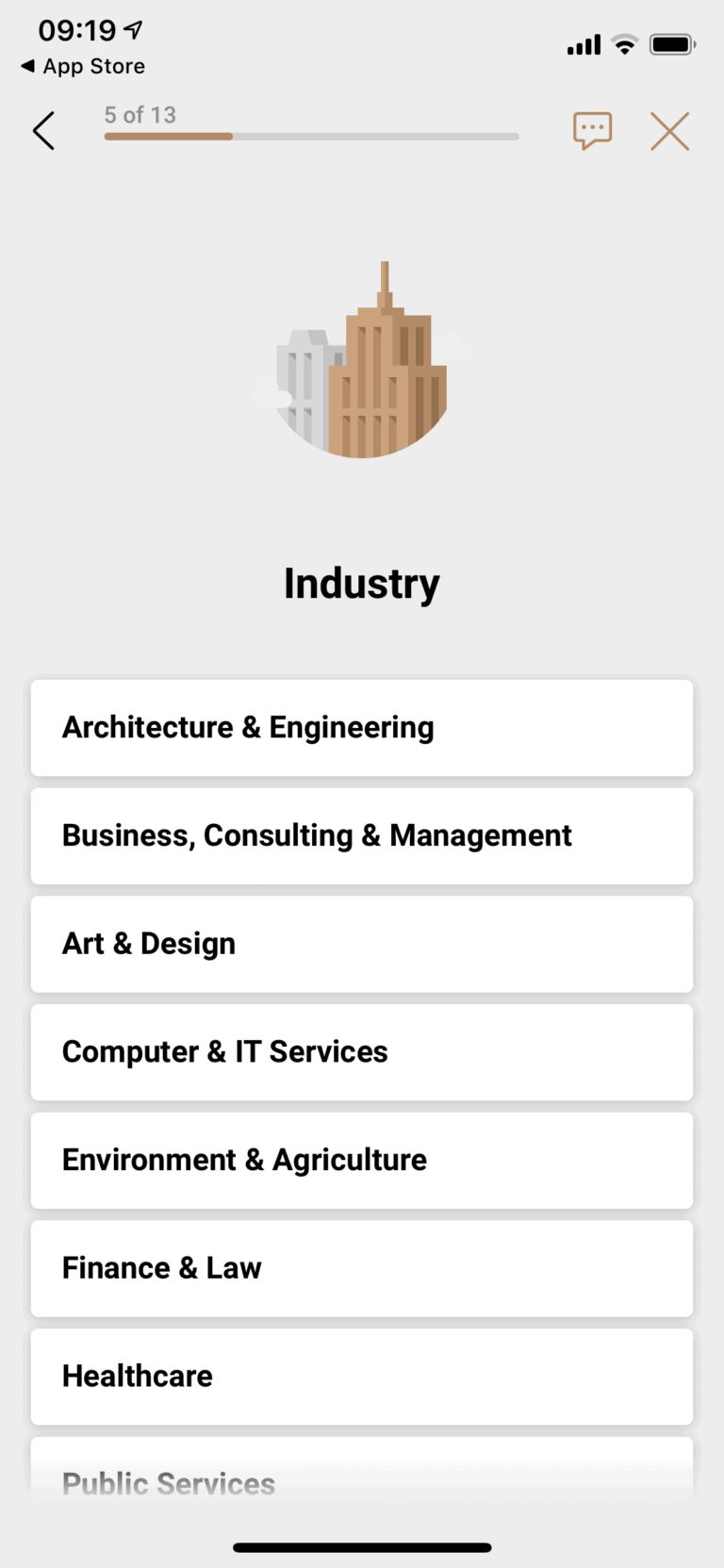

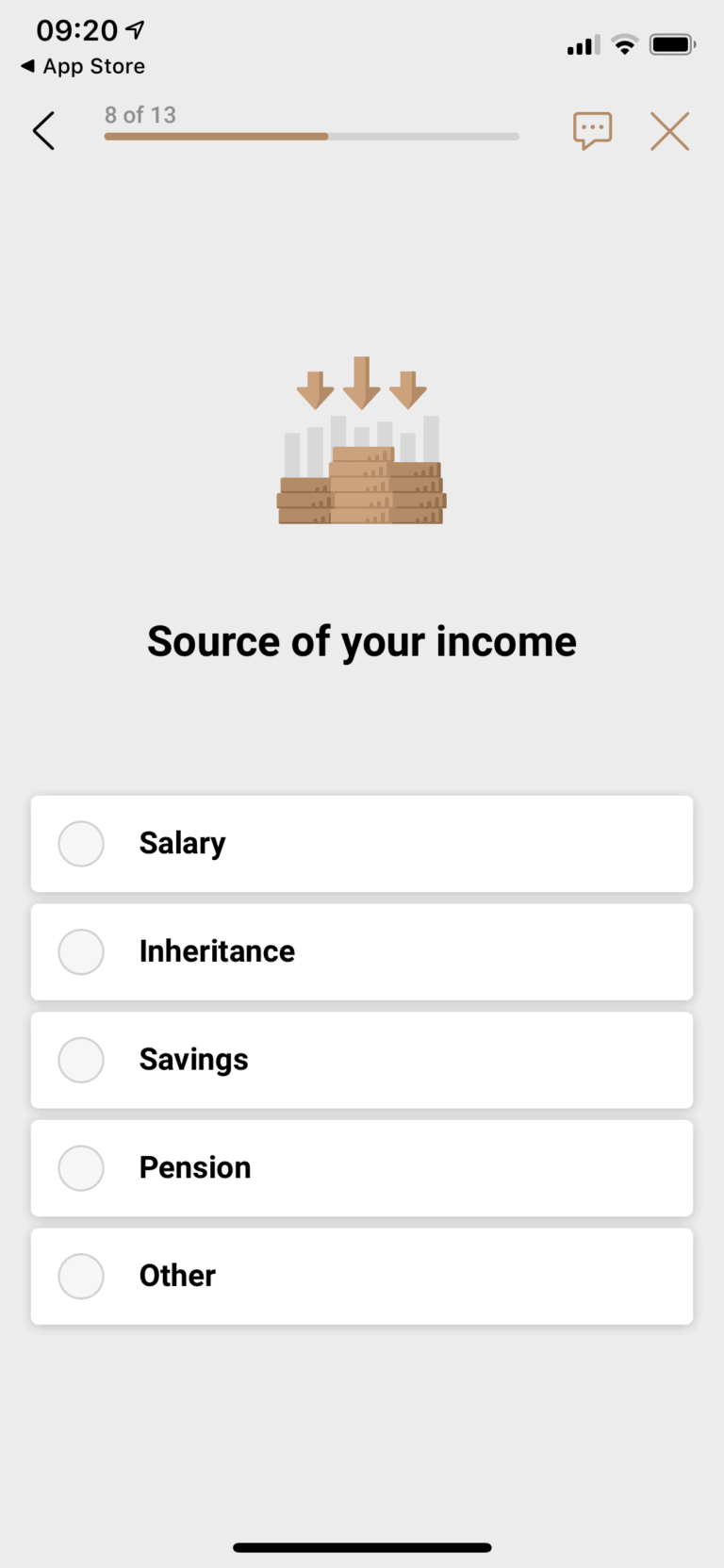

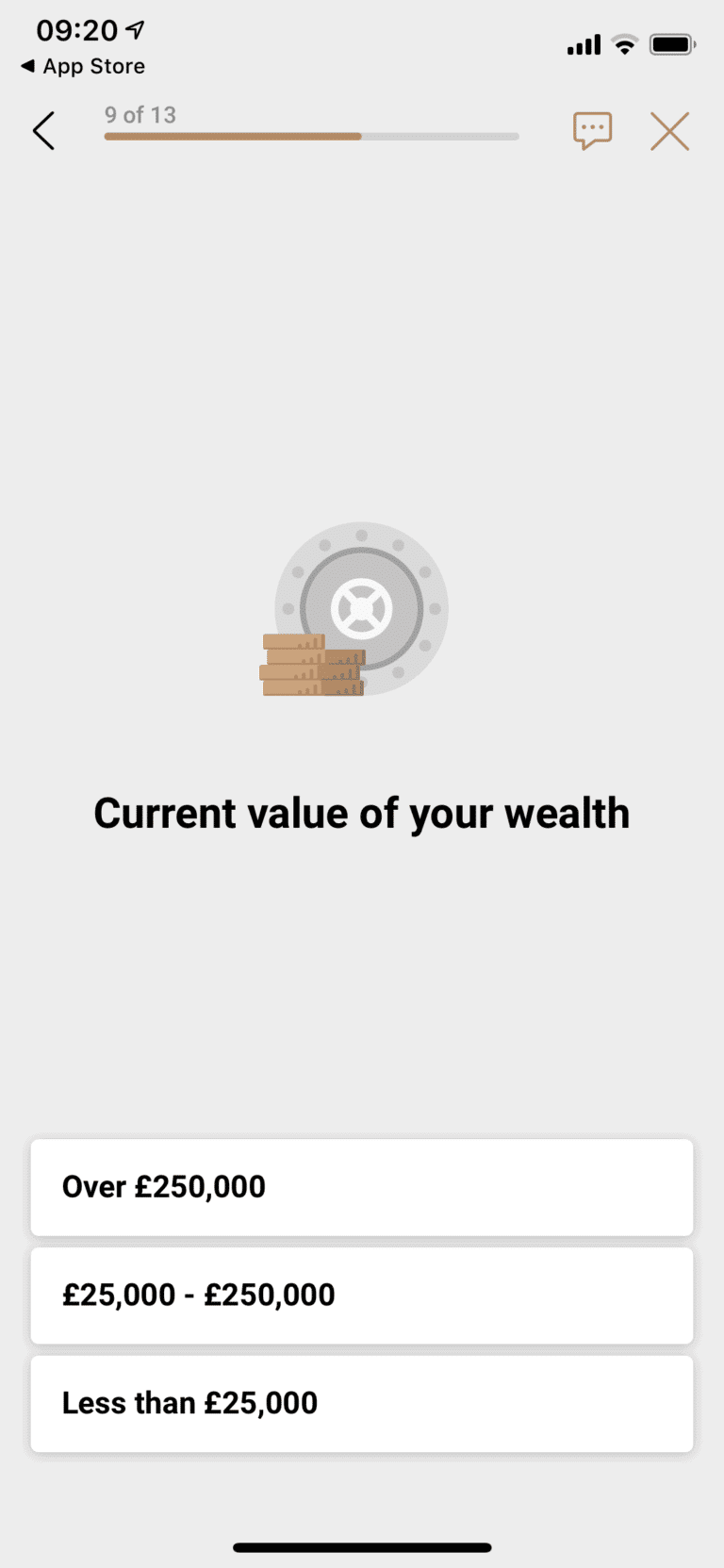

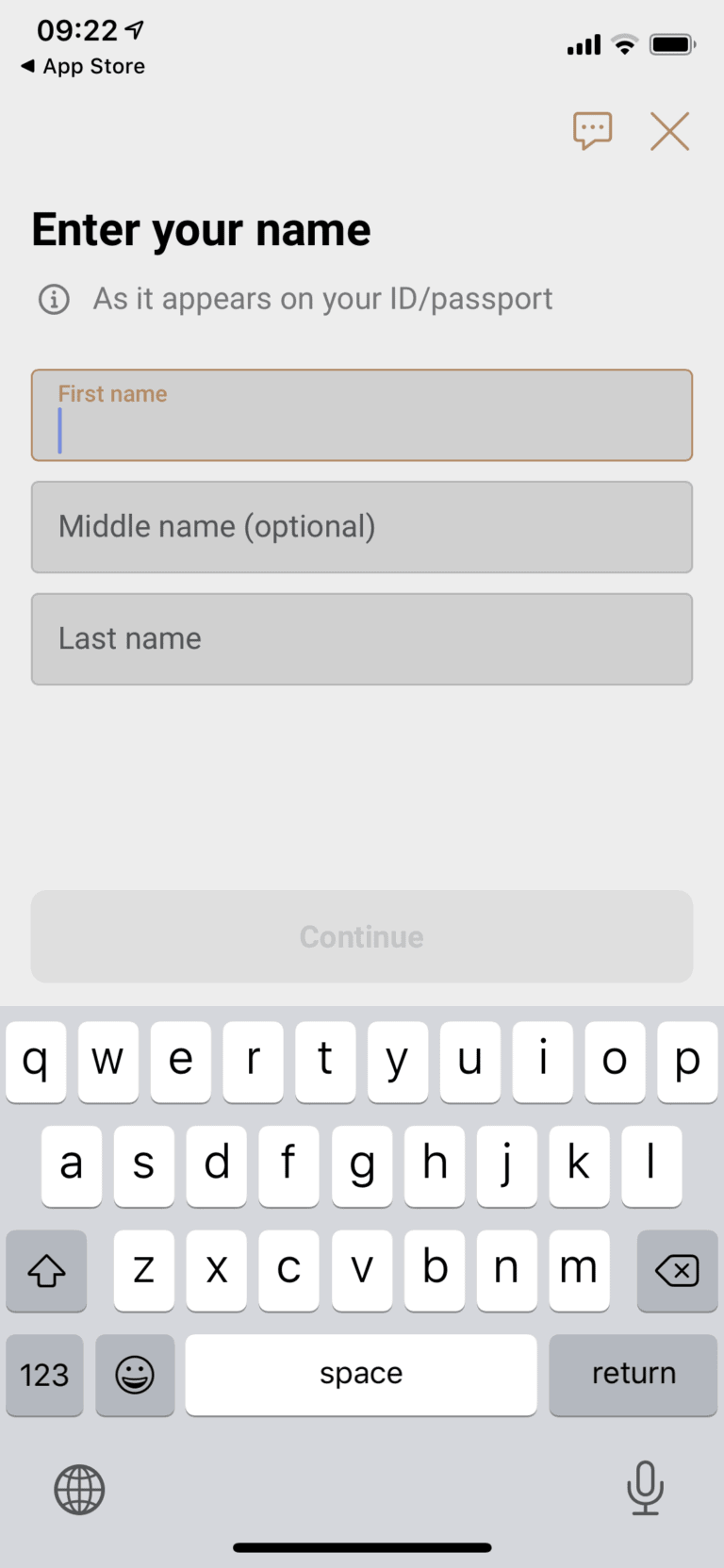

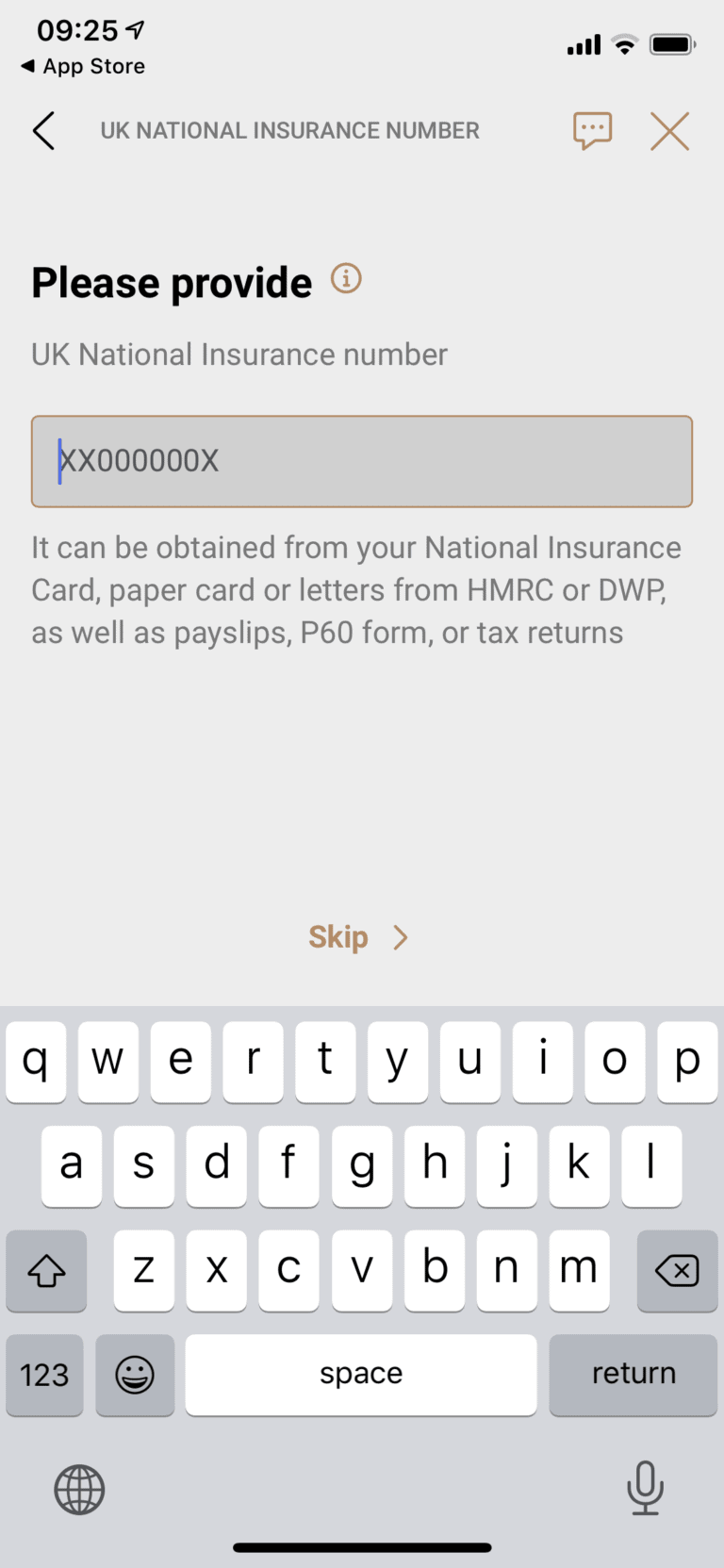

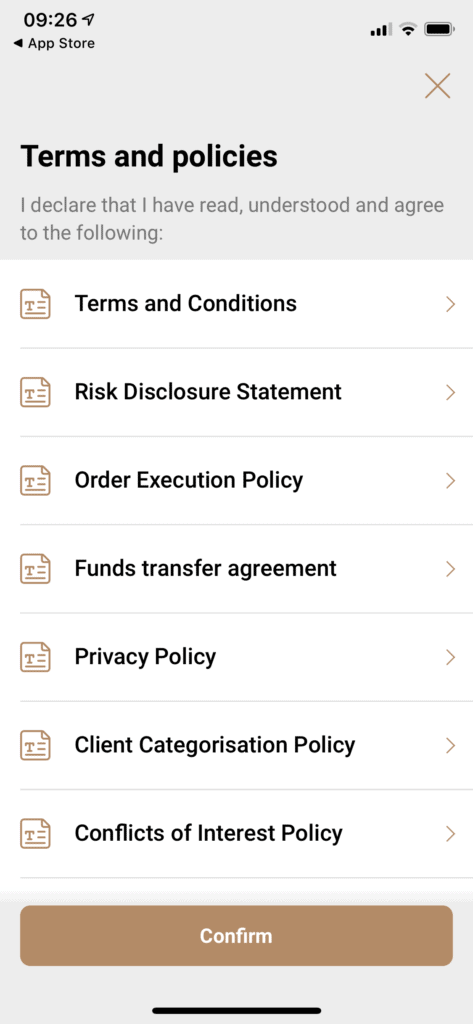

App account creation walkthrough

How to Sell on the Capital.com App

Sell instruments by either closing an open position or by hitting the red sell button on the instrument page to intate a new sell position.

Capital.com Stock App Pros & Cons

- Slick ‘swiping’ app design

- Low $20 minimum deposit amount by card

- Smooth and fast customer onboarding

- Pay 0% commission tight spreads

- +6,500 financial instruments to choose from

- Competitive overnight charges

- Educational videos

- Fully featured demo account

- Negative balance protection

- Referral programme

- Only offers CFDs, spread betting (only available in the UK), and real instruments

The Verdict

Capital.com has won a number of industry awards in innovation and transparency from Shares magazine and The European newspaper, to name but two. You can see why with the attention to detail that brings to the fore all the most pertinent information ad data in a utility-packed and modern app.

Tight spreads and the policy of charging for overnight on leverage amount and not the total value of a position makes Capital.com highly competitive. Charges can eat into returns, which is one of the reasons why many traders are loathed to hold positions open between sessions.

Capital.com has one of the best trading apps among the growing cohort of CFD brokers and is certainly worth a spin. CFD trading is risky but this app does its best to help you not to make silly and costly mistakes with a well-stocked library of videos for beginners and intermediate levels to that is first-class.

Capital.com – Trade Stock CFDs with Tight Spreads

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81.40% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

You should consider whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk. Crypto Derivatives are not available to Retail clients registered with Capital Com (UK) Ltd. The value of shares and ETFs bought through a share dealing account can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results.