Revolut App Review – Pros & Cons Revealed

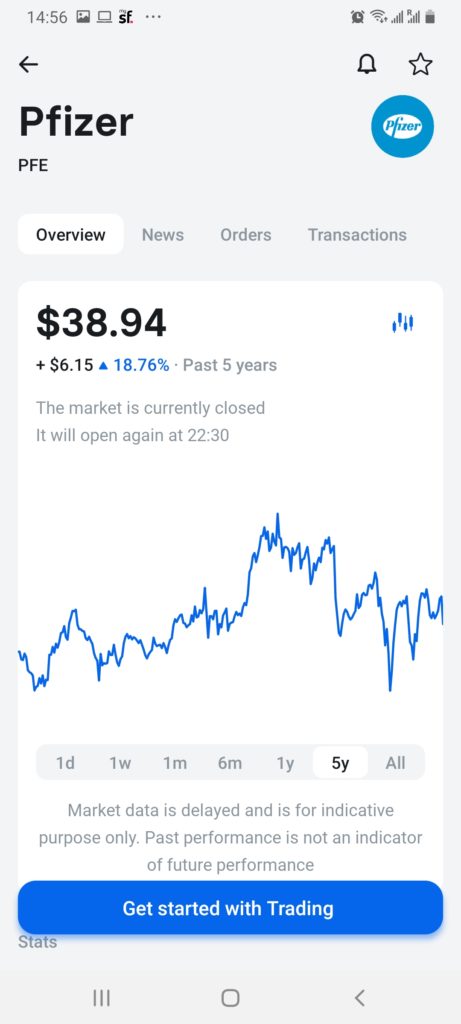

Revolut is best known for its digital mobile banking services. However, did you know that the hugely popular app now allows you to buy shares at the click of a button?

In fact, the app also supports cryptocurrency and commodity investments – so you have the chance to diversify into other asset classes with ease.

With Revolut also claiming to offer super low-cost investment fees, we sought to explore whether or not this platform should be considered.

In this Revolut Trading App Review – we cover everything there is to know. We explore what assets you can invest in, the types of fees and commissions you should expect to pay, how user-friendly the app is, and whether or not your money is safe.

-

-

What is Revolut?

Revolut is a mobile-only digital bank that allows you to avoid traditional financial institutions. That is to say, no longer do you need to visit a physical banking branch – as Revolut offers a full range of everyday financial services at your fingertips. For example, the application gives you unique local bank account details from several locations.

Revolut is a mobile-only digital bank that allows you to avoid traditional financial institutions. That is to say, no longer do you need to visit a physical banking branch – as Revolut offers a full range of everyday financial services at your fingertips. For example, the application gives you unique local bank account details from several locations.This includes the UK, Europe, Australia, and now the US. This means that you can receive money by giving somebody your personal Revolut details. And of course, the Revolut app also allows you to send money with ease. Not only does this include domestic payments, but international transactions, too.

To complete the package, Revolut also offers Visa and MasterCard debit cards. This ensures that you can make purchases online and in-store. Outside of its main banking features, Revolut offers a plethora of other exciting tools. For example, you can create personalized savings pots, exchange currencies at mid-market rates, and now make investments.

Regarding the latter, this includes the ability to buy shares in over 750+ US companies. Depending on which account type you are on, you will get 3, 8, or an unlimited number of commission-free trades. You can also invest in cryptocurrencies like Bitcoin and Ripple, Litecoin, and Ethereum, as well as precious metals such as gold and silver.

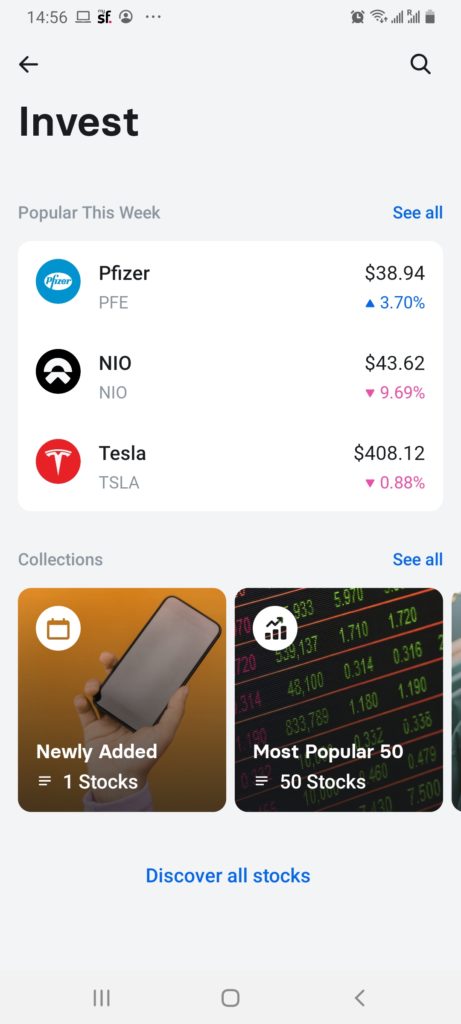

What Stocks Can You Trade on the Revolut Trading App?

Revolut is only going to be suitable if you are looking to target stocks listed in the US. This is because it only gives you access to two exchanges – the New York Stock Exchange and the NASDAQ.

While this does mean that you will be unable to invest in other key markets – such as London, Europe, Tokyo, and Sydney – the aforementioned platforms contain some of the largest firms globally.

This includes:

- Tesla

- Disney

- Nike

- IBM

- Microsoft

- Amazon

- Square

- JPMorgan

- Apple

- And hundreds more

As noted above, the Revolut stocks and shares platform gives you access to over 750+ companies. But, the application is known to add new stocks on a regular basis.

Fractional Shares

What we really like about the Revolut trading app is that it allows you to buy ‘fractional shares’. This is a phenomenon that is getting more and more popular in the investment app space. For example, this is something that is also offered by the likes of eToro, Robinhood, and Stash.

If you’re completely new to stock trading apps, let us explain how the fractional share process works at Revolut. So, let’s suppose that you want to invest in Amazon shares. At the time of writing this Revolut Trading App Review – Amazon stocks are priced at $3,131 on the NASDAQ.

Now, if you were to use a traditional online stock broker, you would have no choice but to meet a minimum investment amount of $3,131. In fact, some old-school platforms even impose a minimum share quantity – meaning you would need to stump up even more of your hard-earned cash just to get a look in.

But, by using the Revolut trading app, you can invest in Amazon – or any of its 750+ stocks for that matter, from just $1. But how? Well, the fractional share phenomenon means that you are buying a ‘fraction’ of a stock. Sticking with the same example, this means that a $31 investment in Amazon would result in you owning just over 1% of a single share.

Let’s look at how this would work in practice when using the Revolut trading app:

- You invest $31 into Amazon

- You hold on to your shares for several years

- When it comes to cashing out your investment, Amazon shares are worth $9,393

- This means that the shares have grown by 200%

- On your original $31 purchase, this means that you are cashing out the investment at $93

Revolut Stock Dividends

On top of its fraction ownership offering, Revolut is also useful if you are looking to buy dividend stocks. The process here works like any other trading platform, insofar that the company in question will forward your share of dividends to Revolut.

Then, the banking app will update your balance to reflect the payment. We should make it clear that you will still be entitled to dividends even if you do not own a full share. This is because your dividend payment will be proportionate to the amount you invest.

For example:

- Let’s say that you invest $100 into Microsoft stocks

- At the time of the purchase, the shares were priced at $217 on the NASDAQ

- This means that you own 46% of a single Microsoft stock

- Over the course of the year, Microsoft distirbnutes $8.68 in dividends

- This means that you will receive 46% of this payment – which is $3.99

As you can see from the above, it doesn’t matter if you invest $1, $100, or $10,000 on the Revolut app – you will still be entitled to your share of any dividend payments.

Short Selling Shares and Leverage on Revolut

A lot of trading apps now give you access to sophisticated tools like short-selling. This allows you to speculate on the value of a stock going down. However, as the Revolut trading app does not support CFD instruments, you won’t be able to go short at the platform.

Similarly, a lack of support for CFDs means that you won’t be able to apply leverage to your stock trades. If this is something that you are interested in, you might want to consider eToro. The stock trading app allows you to trade stocks with leverage of up to 1:5 – as well as the ability to go short on over 1,700+ shares.

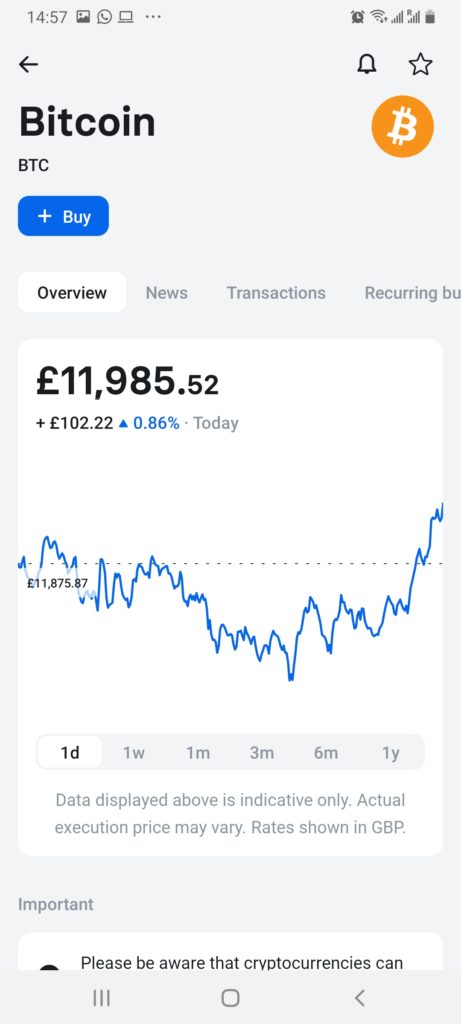

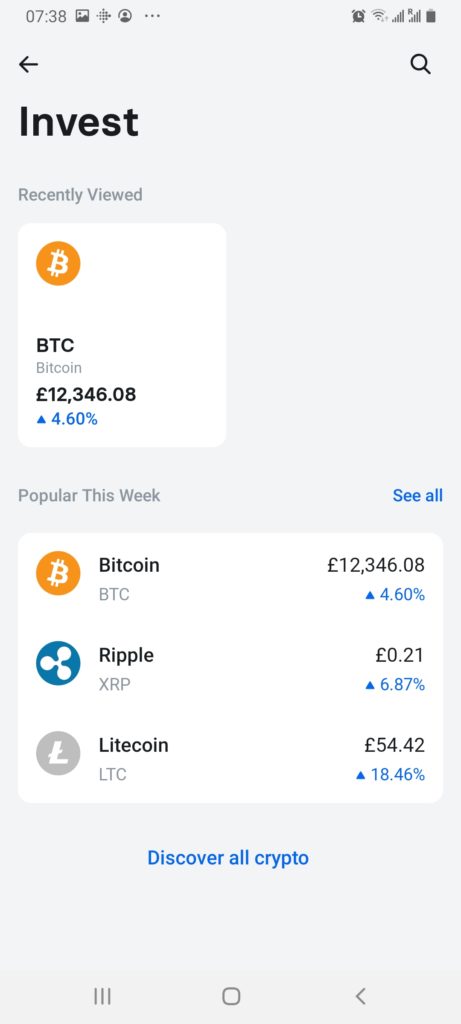

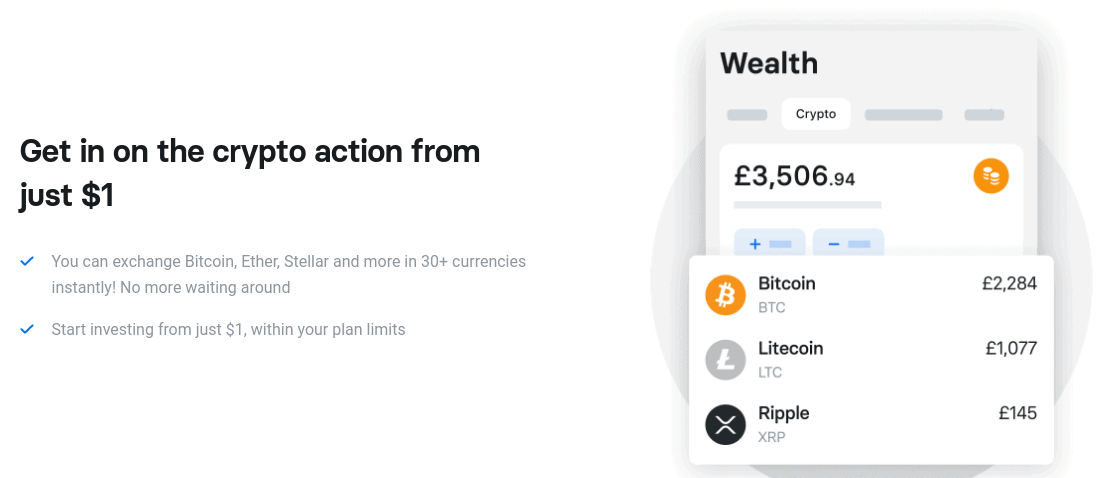

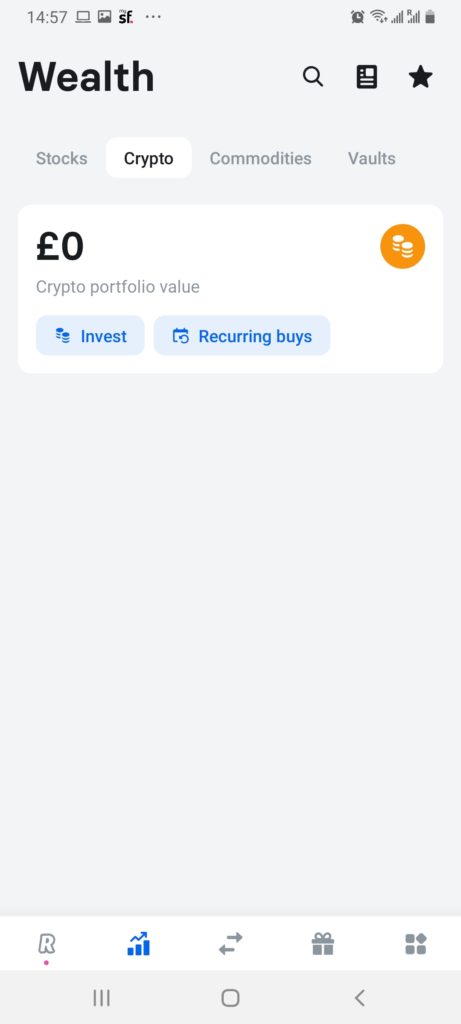

What Cryptocurrencies Can You Trade on the Revolut Trading App?

On top of stocks and shares, the Revolut app also covers cryptocurrencies. At the time of writing, you will be able to trade the following digital coins on the app:

- Bitcoin

- Ethereum

- Litecoin

- Ripple

- Bitcoin Cash

- Stellar

The above cryptocurrencies can be traded against 25 different currencies – including the US dollar, British pound, and the Euro. The cryptocurrency trading service offered by the Revolut app has mixed reviews in the online space. In terms of the positives, never before has it been so easy to investment in cryptocurrencies like Bitcoin and Ripple.

After all, if you have a Revolut bank account with a positive balance, you can make the purchase in a matter of seconds. This avoids the need to go through a cryptocurrency exchange – which can be both time-consuming and costly. On the other hand, a lot of users do not feel comfortable with the way in which Revolut sells its six supported crypocurrencies.

This is because of the ownership structure that the app employs. Put simply, when you invest in your chosen cryptocurrency, you personally own the coins in question. In other words, you are not purchasing a CFD contract. But, what you won’t be able to do is withdraw the coins out to a private wallet.

This is problematic for some people, as it means that you need to trust Revolut to safely store your digital funds. The mobile banking app does note that it utilizes institutional-grade security in keeping your cryptocurrencies safe, albeit, there is no sure-fire way of truly knowing how safe its systems are.

On the other hand, you need to ask yourself whether you really need to withdraw the coins out if your sole purpose of investing in a cryptocurrency is to make financial gains. For example, it is far more convenient just to buy your chosen cryptocurrency and allow it to sit with Revolut until it’s time to cash out.

When the time does arise, you don’t need to worry about transferring your coins from a private wallet over to a third-party exchange. Instead, you simply need to click on the ‘Sell’ button and the sale will be executed instantly. In fact, the proceeds will be added to your Revolut bank account in a matter of seconds.

Fractional Crypto Assets

The fractional ownership feature isn’t just reserved for stocks and shares. On the contrary, you can also buy a fraction of a cryptocurrency. While this likely won’t be of interest on low-value coins like Ripple and Stellar, this feature can be hugely beneficial if you want to invest in Bitcoin.

For example, at the time of writing this Revolut Trading App Review, buying a single Bitcoin will cost you over $16,500. Fancy investing that much into a highly unproven and speculative asset class? Probably not. But, the good news is that by using Revolut to make the purchase, you can invest from just $1.

Here’s an example of how a fractional crypto investment works on the Revolut trading app.

- You invest $200 into Bitcoin

- When you make the purchase, Bitcoin is worth $16,500

- You leave your Bitcoin in your Revolut trading account for three years

- When you get around to cashing your Bitcoin investment out, the digital currency is worth $50,000

- This translates into an increase of 203%

- This means that your original $200 investment is now worth $606

- You complete the sale and the funds are instantly added to your Revolut bank account

What we also like about the Revolut cryptocurrency service is that it is great for diversification purposes. For example, let’s suppose that you want to invest $1,000 into the wider cryptocurrency scene. You could take a weighted approach that might see your cryptocurrency portfolio look like the following:

- Bitcoin: $650 (65%)

- Ethereum: $150 (15%)

- Litecoin: $50 (5%)

- Ripple: $50 (5%)

- Bitcoin Cash: $50 (5%)

- Stellar: $50 (5%)

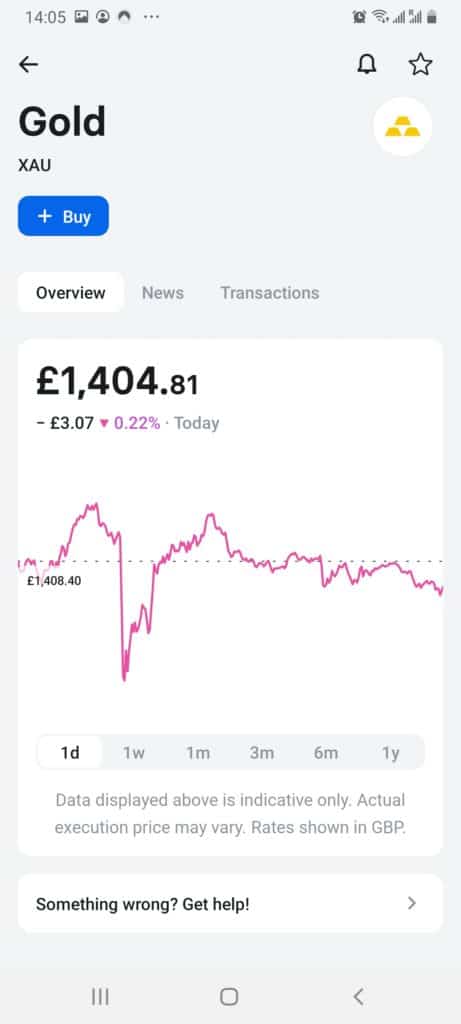

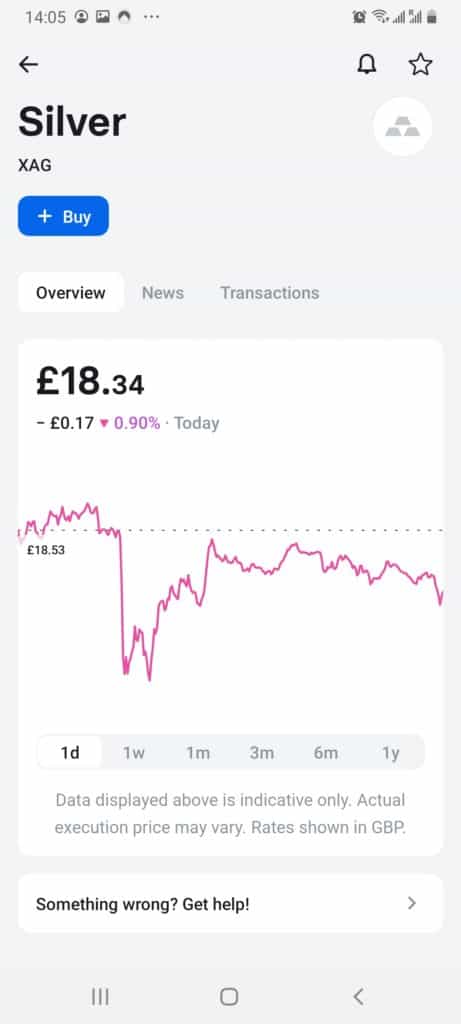

What Commodities Can You Trade on the Revolut Trading App?

The third and final asset class offered by the Revolut trading app is that of commodities. Take note, you won’t have access to a highly extensive library of instruments like oil, natural gas, wheat, and copper. Instead, the app supports just two precious metals – gold and silver.

The good news is that you will have access to these two commodities at the click of a button. There is no requirement to take physical ownership of the asset, as Revolut stores its gold and silver at a regulated financial institution. There is also no need to invest large amounts.

On the contrary, the fractional ownership process also remains constant in the commodity department. This means that you can invest from just $1 into gold and/or silver. Don’t forget, both of these asset classes can act as a great hedge against falling stock markets.

This is especially the case during economic recessions – where the value of both gold and silver typically goes northwards. In terms of the specifics, you have no legal right to take delivery of your chosen precious metal, nor can you transport it to another person or entity.

Instead, the overarching purpose of investing in gold or silver on the Revolut trading app is to make a profit when the asset grows in value. You can then cash out your investment and the process will be added to your Revolut account. Equally, investing in gold or silver at Revolut can also result in a financial loss if the respective asset goes down in value.

Nevertheless, here’s a quick example of how a commodity investment on the Revolut trading app works in practice:

- You decide to invest $200 into gold and $100 into silver

- 3 months later gold is worth 30% more

- Silver, on the other hand, is 10% down

- As such, you decide to cash out your gold investment but leave the silver position open

- This means that your $200 investment is now worth $260 – which is added to your Revolut bank account at the time of the sale

- You wait a further 3 months to see if the price of silver recovers. It doesn’t, and your investment is now 15% down.

- You decide to cut your losses and cash out the investment. In doing so, your $100 investment is now worth just $85.

As you can see from the above, you are simply speculating on the future value of your chosen precious metal. While you made a $60 profit by investing in gold, you lost $15 on your silver trade.

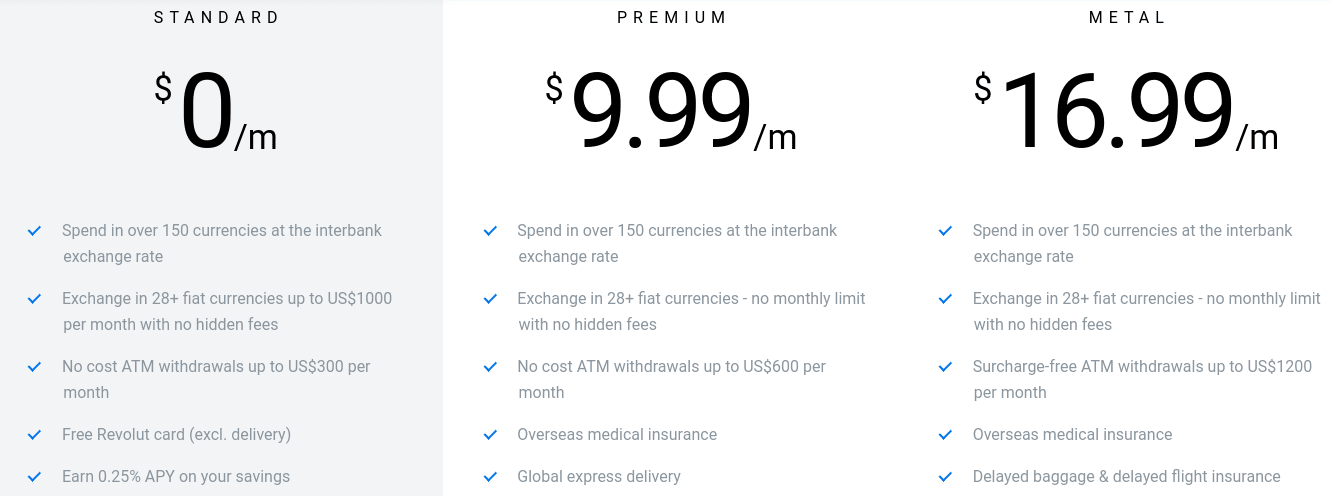

Revolut Trading Account Types

In order to trade on the Revolut app, you first need to open a bank account with the provider. The process usually takes less than 10 minutes, as it’s just a case of providing some personal information and taking a snapshot of your government-issued ID. Once you complete the registration process, you will automatically be placed on the Standard Revolut Account – which is 100% free.

As we cover in much more detail shortly, the free account allows you to make 3 commission-free stock trades per month. You will also be able to invest in cryptocurrencies and commodities, albeit, at a less favorable commission rate than the paid-for accounts.

There are two paid-for accounts to choose from on the Revolut app – Premium and Metal. It is important to have a firm understanding of what you get in each account, as this will need to mirror your banking requirements and investment goals.

Note: The Revolut plans below are based on opening an account as a US citizen. Although similar in price and features, opening an account from an alternative location will result in some slight variances.

Standard Account – FREE

By sticking with the standard account, you will get the following perks:

- Local bank account number

- Ability to send and receive money domestically and overseas

- Revolut debit card for online and in-store purchases

- Exchange currencies at the click of a button

- Earn 0.25% APY on your savings

- 3 x commission-free stocks trades per month

- 1.5% commodity trading commission

- 2.5% cryptocurrency trading commission

Premium Account – $9.99 per month

By upgrading to the Premium account at Revolut, you will get all of the features listed above – plus

- No month limit on mid-market rate currency exchanges

- Overseas medical insurance

- No cost ATM withdrawals up to US$600 per month

- Global express delivery

- Priority customer support

- Earn 0.50% APY on your savings

- 8 x commission-free stock trades per month

- 0.25% commodity trading commission

- 1.5% cryptocurrency trading commission

Metal Account – $16.99 per month

The most expensive option at Revolut is the Metal plan. This comes with the following perks:

- Surcharge-free ATM withdrawals up to US$1200 per month

- Revolut Junior accounts for up to 5 kids

- 1 free SWIFT transfer each month

- Unlimited number of commission-free stock trades per month

- 0.25% commodity trading commission

- 1.5% cryptocurrency trading commission

As you can see from the above, the most enticing benefit that you get with the Metal plan is an unlimited number of commission-free stock trades per month. This can be highly beneficial if you are looking to trade stocks on a super-regular basis.

Additionally, this account type is handy if you are looking to use Revolut as your everyday checking account. Crucially, you can withdraw up to $1,200 per month without paying a transaction fee.

Once again, we must make it clear that the above features and perks can and will differ if you are opening an account from a different location. But, the core trading specifics – such as the number of commission-free trades and crypto/commodity commission remains constant across all supported countries.

Revolut Trading Fees & Commissions

Although we have briefly covered some of the fees and commissions that you are likely to incur when trading at Revolut, this section will break everything down clearly. After all, it can be challenging to know exactly what you are required to pay when using the app.

This is because there are heaps of different rates depending on which plan you are on. Furthermore, you often need to do a lot of digging to find out the specifics surrounding trading fees – which is what we ourselves needed to do to compile this Revolut Trading App Review.

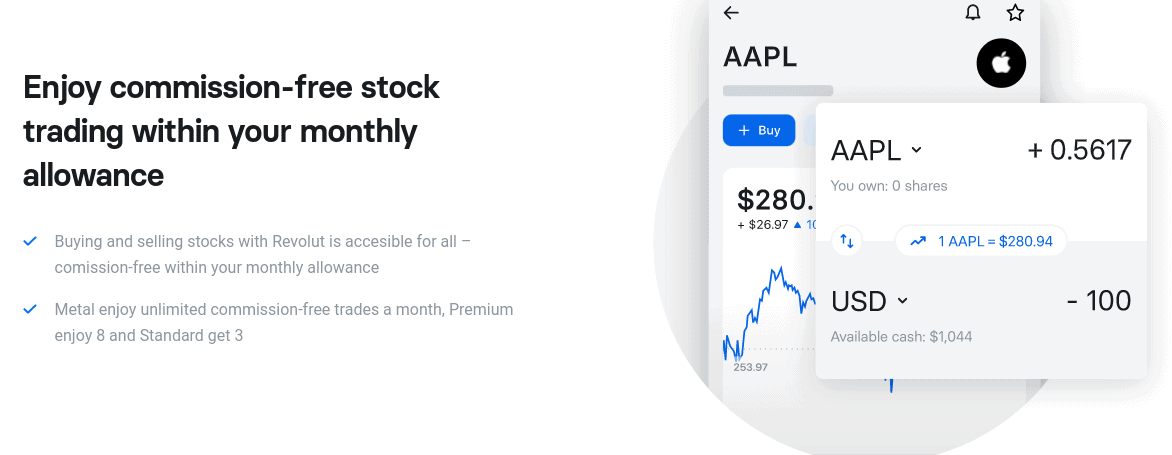

Commission-Free Stock Trading

As we covered earlier, you will get a certain number of commission-free stock trades each and every month on the Revolut app. To clarify, that’s 3 trades on the Standard plan, 8 on the Premium plan, and an unlimited number on the Metal plan. Put simply, this means that by staying within your allowance, you won’t pay a single cent when buying your chosen stock.

So how does this compare? Well, we should make it clear that Revolut isn’t the only app in the investment scene that offers commission-free stock trades. For example, this is something offered by both eToro and Robinhood.

However, the key difference with the aforementioned apps is that there is no limit to the number of commission-free trades you can place. That is to say, you are not required to pay $16.99 per month for the privilege of placing an unlimited number of fee-free trades.

With that being said, by using Revolut to buy and sell shares, you will likely be utilizing the app’s banking features, too. As such, although you need to pay a fee to benefit from an unlimited number of commission-free trades, you need to think about what else you are getting for your money.

For example, you can completely do away with a traditional checking account and instead use Revolut to send and receive funds, as well as make purchases online and instore with the debit card. In addition to this, you’ll have heaps of other perks on the Metal account like an unlimited amount of mid-market FX exchanges, airport lung access, and even travel insurance.

Annual Stock Trading Fee

We should make it clear that all accounts on the Revolut app will incur an annual fee when trading stocks. This is known as a ‘Custody Fee’ and it will cost you 0.1% per year.

The amount is based on the size of your investment portfolio and charged on a rolling monthly basis. For example, let’s suppose that in the month of March you have $10,000 worth of stocks in your Revolut trading account.

This would end of costing you just $0.83 for the month ($10,00 x 0.1% / 12).

Revolut Cryptocurrency Fees

When it comes to cryptocurrency trading fees, Revolut does not offer any commission-free trades. If this is something you’re after, you might want to consider the eToro app. Nevertheless, you will pay a variable fee that is charged on every purchase or sale that you make. As we briefly covered earlier, your commission rate is depending on the account type you hold.

- Standard account holders will pay a variable commission of 2.5%

- Premium and Metal account holders will pay a variable commission of 1.5%

As per the above, let’s suppose that you are on the free account and you buy $500 worth of Ripple. When you make the purchase this will cost you 2.5% in commission – or $12.50. If you then sold your Ripple investment when it was worth $1,000 – you would again pay 2.5% in commission – of $25. This totals $37.50.

In the same scenario, Premium and Metal account holders would pay 1.5% – so that a buy and sell fee of $7.50 and $15, respectively. This means that the paid-for accounts would cost you $22.50 in total, saving you $15 compared to the standard plan.

So, how do the above two fees stack up?

Well, this depends on where you go. For example, Coinbase charges a variable commission of 1.5% – which matched that of the Premium and Metal Revolut accounts.

However, Coinbase also charges a hefty 3.99% when you deposit funds with a debit card. You can avoid this by transferring funds from your bank account, but of course, this will take several days to process. By this point, you might have missed a profit-making opportunity.

On the other hand, we should make it clear that Revolut notes in its terms and conditions that it does apply a mark-up when you buy cryptocurrencies on the app.

This is because Revolut might obtain its digital currency holdings from a third-party like Bitstamp. In doing so, this means that you will incur an additional fee in real terms. The banking app does not make it clear what this mark-up amounts to, although some users in the online space state that this can fluctuate between 2-5%.

With this in mind, you might be better off using eToro is your sole purpose is to invest in cryptocurrencies. After all, you can invest commission-free with no limits – and the spread typically amounts to just 0.75%. But, if you are also planning to use Revolut for its core banking services, then again, it could be worth paying the slightly higher fee purely for the convenience that this provides.

Revolut Commodity Fees

Things get a bit more confusing when it comes to commodity trading prices on the Revolut app. This is because there are two fees to take into account – much like the cryptocurrency department. However, there is also a surcharge that you need to factor in if you buy or sell a commodity over the weekend.

Here’s the lowdown of what you will pay when you invest in gold or silver at Revolut:

- If you are on the Premium or Metal account, you will pay just 0.25% in commission during the week.

- If making a purchase or sale on Saturday or Sunday, this commission increases to 1.5%

- If you are on the Standard account, you will pay a commission of 1.5%

- Standard account holders will then pay a surcharge of 2.25% if buying or selling commodities over the weekend

In terms of whether or not this is competitive, this will largely depend on your account type and the day of the week that you are making the trade.

At one end of the spectrum, being a Premium or Metal account holder and investing in gold or silver between Monday and Friday is hugely competitive at 0.25%. This means that you can buy $100 worth of gold and be charged just $0.25!. In fact, even if you only want to invest the minimum of $1 – it’s still super-competitive as you are benefiting from a low, fixed commission structure.

At the complete opposite side of the spectrum, being a Standard account holder and buying gold or silver over the weekend is going to cost you a whopping 2.25%. We have to say that this does make the process hugely expensive.

This is especially the case if you are a short-term trade and looking to make quick, snappy profits. After all, you would need to pay 2.25% when you open the trade over the weekend – and then an additional commission of 1.5% or 2.25% when you exit the position – depending on the day of the week.

This once again brings us back to the importance of selecting the right Revolut plan for you and your financial goals. For example, if you are thinking about using the app as your primary bank account – then it could well be worth upgrading to a Premium or Metal account.

In doing so, a byproduct of this is that you will not only benefit from additional perks like insurance and monthly cashback, but you’ll also get the lowest rate possible when trading commodities and cryptocurrencies. And of course – you’ll get either 8 or an unlimited number of commission-free stock trades, depending on whether you go for the Premium or Metal account.

Revolut Trading App User Experience

Although Revolut isn’t the most extensive of trading apps, it is one of the most user-friendly. After all, the firm targets everyday retail clients through its simple and convenient digital banking services. As a result, you don’t need to have any prior experience of buying stocks, cryptocurrencies, or commodities to gain exposure to your chosen financial marketplace.

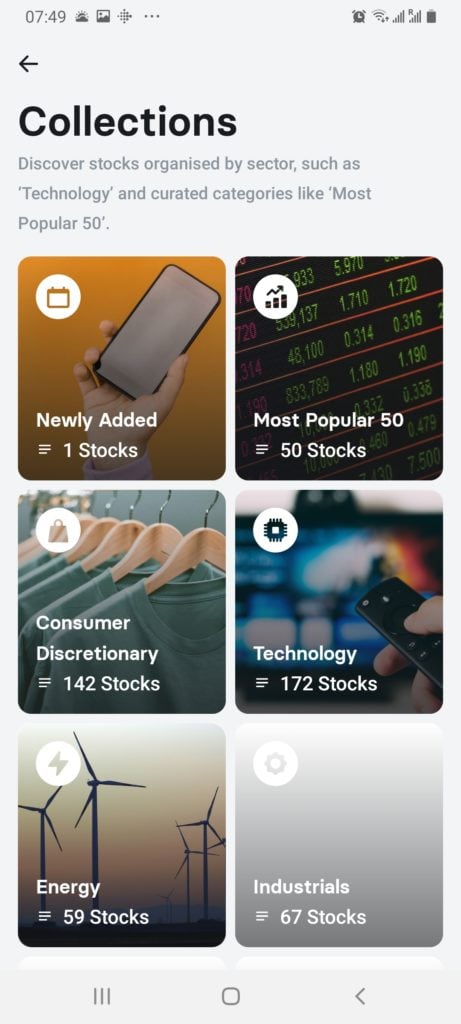

For example, once you click on the ‘Wealth’ icon button on the app’s main dashboard, you then need to choose the asset class you are interested in. If opting for shares, there is no requirement to scroll through 750+ stocks to find the company you are interested in. Instead, you can simply enter the name of the company into the search box.

In doing so, you will be taken straight to the respective investment page. Or, you can use the ‘sector’ filter that Revolut offers. This breaks the stock library down by the relevant niche – such as retail, tech, or energy. Once you click on the asset you are interested in buying, you will then be presented with a wealth of information – such as current prices in chart format.

To complete the end-to-end investment process, you just need to enter the amount that you wish to stake. For example, by entering $200 and confirming the order, Revolut will deduce this amount from your primary account and proceed to make the purchase on your behalf! Ultimately, even if you have never traded before, you should have no issue navigating the Revolut app.

Revolut Trading App Tools and Features

So now that we have covered fees and commissions, the next part of our Revolut Trading App review is going to look at what investment tools and features you will have access to. Take note, all of the perks listed below are available on all account types – including the free plan.

Recurring Investments

Ask any seasoned investor what their secret sauce is and they will tell you consistency and continuity. That is to say, by engaging in a long-term investment plan that involves adding more funds to your portfolio each and every month – you stand the best chance possible of building a large nest egg.

This can be difficult when using a traditional stock broker, as you will need to be disciplined. This is because you will need to manually deposit funds at the end of each month. However, this isn’t the case at all with Revolut – as the banking app supports an innovative ‘recurring investment’ feature.

As the name implies, this allows you to automatically invest a specified amount every day, week, or month. You can select the exact investment that you want to make, too. For example, you might decide to invest $100 into Apple every month and $25 into Bitcoin.

When the day and time comes around, Revolut will automatically take the funds from your bank account and make the purchase. Take note, you will need to ensure that you have funds in your Revolut bank account to cover the investment. This is because the app is unable to manually take the funds from your non-Revolut debit card or checking account.

Round-Up Debit Card Purchases

This particular Revolut trading app feature is nothing short of awesome. In a nutshell, the app allows you to set up an automatic debit card round-up plan. This means that the app can round up purchases to the nearest dollar (or the respective account currency), and use the balance the invest in gold or silver.

For example:

- On Monday, you buy a cup of coffee for $3.10 with your Revolut debit card

- Revolut takes $4 from your account

- The $0.75 is used to invest in gold

- On Tuesday, you buy a newspaper with your Revolut card for $1.50

- Revolut takes £2 from your account and uses the $0.50 balance to buy more gold

As you can see from the above, this Revolut feature allows you to make inconsequential commodity investments. Crucially,. while you might not miss a few cents here and there – over the course of many months and years you could really build up a sizable commodity portfolio.

Auto-Exchange

This Revolut trading app feature is somewhat similar to the recurring investment tool that we discussed a moment ago. But, the key difference here is that you will be automating your investments when your chosen asset hits a specific price.

For example:

- Let’s suppose that you are investing in a volatile asset like Bitcoin.

- You want to regularly make investments, but only when the price hits $10,000.

- In turn, you set up an auto-exchange order on the Revolut trading app at $100.

- This means that every time Bitcoin goes up or $10,000 – Revolut will automatically debit $100 from your account and make the Bitcoin purchase

- Later down the line, you might decide to amend the auto-exchange order or simply cancel it altogether.

The auto-exchange order can be used on all financial markets offered by the Revolut trading app.

Mobile Alerts

Whether you’re interested in stocks, cryptocurrencies, or commodities – the financial markets can move in an unpredictable and often volatile manner. As such, it’s crucial that you are kept abreast of any key developments regarding price changes. This is where the Revolut trading app can assist through mobile notifications.

Firstly, you can elect to receive an alert on your phone when a specific asset goes up or down in an abnormal manner.

- For example, if Facebook shares decrease by 5% in a single day of trading, you’ll be sure to receive an alert.

- If you select this option, all of your current investments will benefit from pricing alerts by default.

Secondly, you can also set up specific pricing alerts.

- For example, let’s suppose that you are tracking Square stocks. You think that the tech company has long-term potential, but you don’t want to enter the market at the current price of $180 per share.

- Instead, you want to invest when a market correction comes into play. As such, you set up a pricing alert at $160.

- If and when Square shares decrease to this figure, the Revolut trading app will send you a notification in real-time.

You can turn mobile notifications on and off as you please.

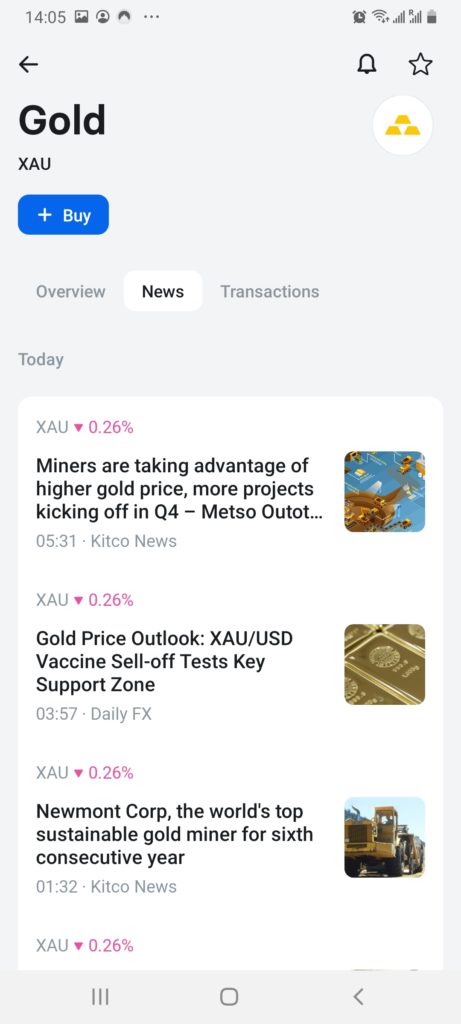

Revolut Trading App Education and Research

When it comes to educational resources, we were somewhat surprised to see that the Revolut app falls short here. This is because the application offers virtually nothing in the way of trading guides or explainers. With that said, you can easily find the information that you need in the online space without needing to rely on Revolut for this purpose.

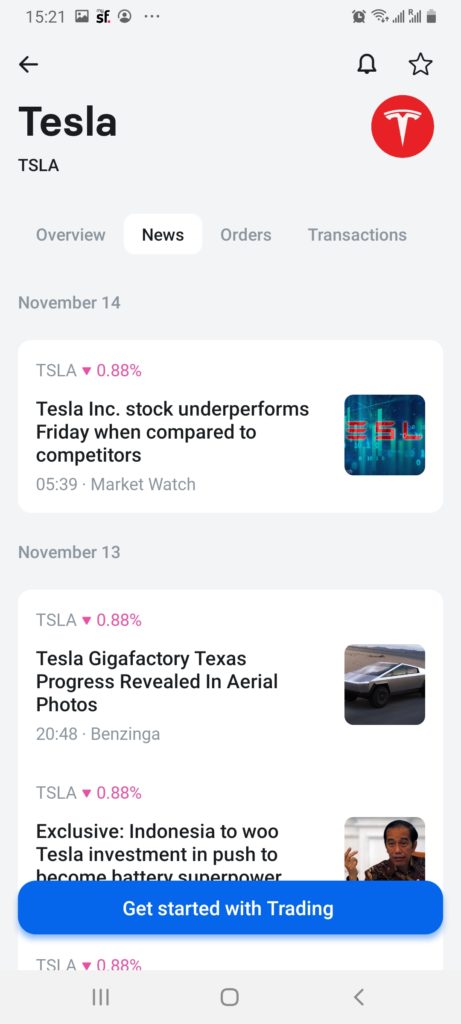

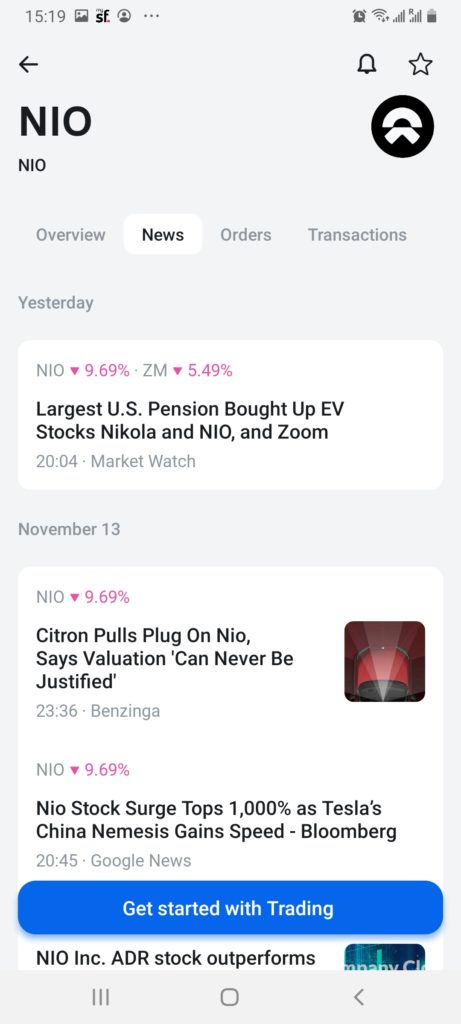

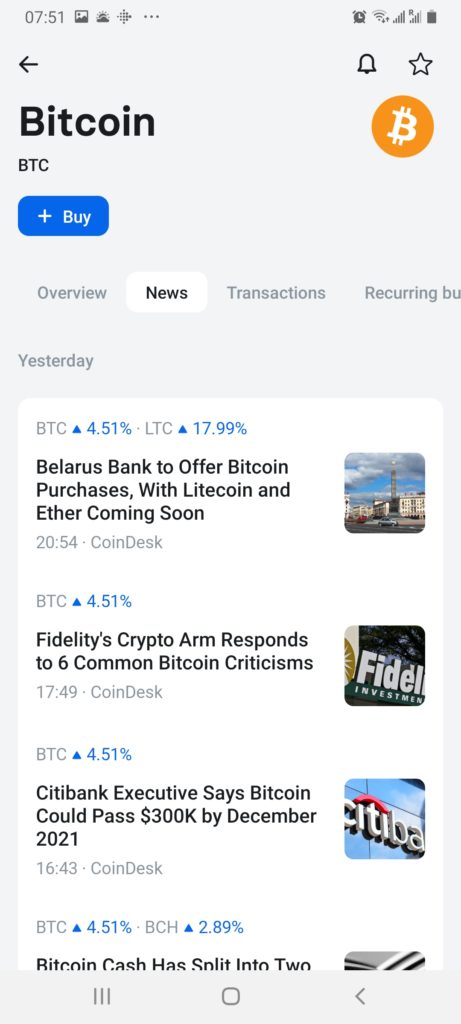

While education isn’t the app’s strong point, Revolut does excel when it comes to fundamental research. This is because the app has decided to integrate its trading arena with top-rated news platforms. For example, upon clicking on your chosen stock – followed by the ‘News’ tab, you will see a list of stories that are relevant to the company in question.

This stock market news is provided by Google and Market Watch. Not only does this mean that you will have access to heaps of relevant news stories throughout the day, but these are provided by top-rated sources. Real-time financial news isn’t only available on supported stocks and shares.

On the contrary, the Revolut trading app has also partnered with some of the biggest and most reliable cryptocurrency news platforms.

This includes the Cointelegraph and Coindesk – which are often the first to break crucial crypto-related news developments. All in all, we are surprised that other leading trading apps haven’t followed suit by integrating their platform with trusted news platforms – so this is most definitely a thumbs up for Revolut.

Revolut Trading Demo Account

Unlike other top-rated investment apps, Revolut does not offer demo accounts. This means that you won’t be able to ‘practice trade’ in a risk-free environment. Instead, you will need to dive straight in with real-money investments.

With that said, this shouldn’t really cause you any issues when you consider the fractional ownership system offered by Revolut. In other words, as you invest from just $1 into stocks, cryptocurrencies, and commodities – this is a non-consequential amount to be risking!

Furthermore, we would argue that staking small amounts is a much more effective way of learning the trading ropes that relying on a demo account. After all, you will be financially involved and thus – be somewhat forced to improve your trading knowledge!

Payments on the Revolut Trading App

When it comes to payments on the Revolut trading app, everything is linked to your primary bank account. It doesn’t matter if you have funds spread over several currencies, as anything you are holding can be used to invest in assets. This is probably one of the best things about using Revolut to trade.

By this, we mean that there is no longer a requirement to deposit funds from a personal bank account into a third-party broker. Instead, everything is facilitated by the underlying bank provider – Revolut.

This means that as long as you have a positive balance – you can invest at the click of a button without ever needing to worry about making a deposit. With that said, there might come a time where you need to top up your Revolut balance if you do not have enough money to fund a specific investment.

If this is the case, you have two options:

- Debit Card: You can instantly deposit funds with a debit card issued by an external bank

- Local Transfer: You can also perform a local bank transfer. For example, if you’re in the EU then this will go via SEPA. American users can opt for ACH.

In terms of cashing out your investments, the funds are simply sent to your primary Revolut bank account. If you don’t use Revolut as your main bank account, then you can transfer the funds out instantly.

Once again, this is a major advantage of using the Revolut app to trade, as you never need to worry about withdrawal delays. Instead, everything is facilitated at the click of a button.

Revolut Minimum Deposit

Revolut does not install a minimum deposit amount, which is great if you want to start trading with small amounts.

Revolut Contact and Customer Service

If you want to speak with a member of the Revolut customer support team, you can do this via the app. All you need to do is click on the ‘Help’ icon and then request a new chat. Revolut will try to lump you with an AI chat bot, which in our view – is pretty useless.

As such, you will need to request a live agent. Once you do, you might need to wait a few minutes before you connected with somebody, as Revolut often experiences huge demand around the clock. To confirm, you can use the Revolut live chat feature 24 hours per day, 7 days per week.

Although you might come across a phone number for Revolut, this is only for reporting a card as stolen. Even then, the telephone line is automated. Crucially, live chat is by far the most convenient way of contacting the customer service team, so we are not too concerned about a lack of telephone support.

Is Revolut Safe?

The safety of customer funds at Revolut is an interesting talking point in the online space. Before we get to that, it is important to note that the country in which you are resident will determine which regulatory body you are covered by.

For those unaware, this would cover your money up to the first €100,000 in the event Revolut went bust. In the UK and Ireland, you are covered by the Financial Conduct Authority (FCA). But, this protection does not include the UK’s Financial Services Compensation Scheme (FSCS) – which normally covers you up to the first £85,000.

The reason for this is that FCA authorized Revolut as an e-money provider and not a bank. On the flip side, Revolut must keep your money in segregated bank accounts. For this purpose, Revolut uses Lloyds.

This means that Revolut cannot use client funds for its own day-to-day operations. Is this a surefire safeguard? Unfortunately not. With that said, there is no reason to believe that Revolut will run into financial difficulties – but of course, this is never guaranteed.

Revolut Trading App Pros & Cons

Below you will find an overview of our Revolut trading app review findings.

Pros

- Buy and sell over 750+ US-listed stocks

- Invest in cryptocurrencies, gold, and silver

- Minimum investment of just $1 – regardless of which asset you are buying

- Unlimited commission-free stock trading on the Metal Account

- Combine everyday banking with investments into the financial markets

- Perfect for inexperienced investors

- Great financial news integrations

Cons

- No stocks outside of the US markets

- Unable to withdraw cryptocurrencies to a private wallet

- Standard account only gets you 3 commission-free trades per month

- Too basic for experienced investors

The Verdict

If you’re a complete newbie and you are looking for a simple way to access stocks, cryptocurrencies, gold, or silver – the Revolut trading app might be worth considering. Make no mistake about – the application is somewhat basic in trading terms. But, if you simply want to make a few investments in a burden-free manner – Revolut can be a great stepping stone.

One of the main attractions is that Revolut allows you to buy shares commission-free. But, this will be limited to 3 and 8 fee-free trades per month if you are on the Standard or Premium account. As such, you’ll need to upgrade to a $16.99 per month Metal account if you want unlimited commission-free stock trades.

However, if you’re looking to make unlimited trades with 0% commission, we recommend using the eToro stock app. eToro allows you to buy over 800 shares and ETFs without paying any commission whatsoever! It also offers innovative copy trading tools, meaning you can copy the entire portfolios of top stock investors at the click of a button.

So, while Revolut is good, it doesn’t match up to eToro.

eToro – Invest in Stocks with 0% Commission

67% of retail investor accounts lose money when trading CFDs with this provider.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

FAQs

What device is the Revolut app available on?

Revolut is compatible with all Android and iOS devices. If you don’t have a phone backed by one of these operating systems, you won’t be able to use Revolut.

What shares can you buy on the Revolut app?

The Revolut app only gives you access to the US stock markets. This does, however, include over 750+ stocks.

Is the Revolut app legit?

Yes, Revolut is a legitimate digital banking app that is now home to 12 million users.

What payment methods does the Revolut app support?

If your Revolut account already has a balance, you can use your available funds to invest without needing to make a deposit. But, if you don’t have enough cash in your account to cover your Revolut trade, you can deposit money via a debit card or local bank transfer. .

What cryptocurrencies does Revolut support?

The Revolut trading app supports 6 digital currencies. This includes Bitcoin, Litecoin, Ethereum, Ripple, Stellar, and Bitcoin Cash.

Kane Pepi

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane PepiVISIT ETOROYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2025

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up