What Are Blue Chip Stocks?

Reliability, stability, and growth are the essentials for long-term investment, unlike investing in short-term, volatile markets. Knowing what blue-chip stocks are is the key to becoming a long-term investor. While stocks are familiar to most people, the term “blue-chip” might sound novel.

Blue-chip companies do not refer to firms that deal with computer chips in the literal sense. Instead, they refer to nationally and internationally recognized companies that have achieved long-term growth and stability. These companies have weathered several economic downturns and reliably turned in profits year in and year out.

Our guide will explore what blue-chip stocks are, including the best ones, how to identify them, and how to sieve through the risks. Blue-chip companies are not without vulnerabilities. With that in perspective, let’s begin with the primary blue-chip definition.

-

-

Defining Blue-Chip Stocks

The blue-chip meaning is the foundation of understanding blue-chip stocks. Start-ups are companies that enter a new market with just a year or a few years of operation. Conversely, some companies may have been in the same market for years and become household names.

A blue-chip company has the following characteristics:

- A market valuation climbing into billions and even trillions of US dollars

- A long-term presence in its sector or market

- Long years of being profitable, regardless of market conditions

- It often offers dividend stocks to its investors

- It is reputable in its field or sector

- Customers and other businesses in the sector consider it a leader

That primary blue-chip definition places our focus on the best blue-chip stocks. These stocks don’t exist outside of companies with the above characteristics.

Characteristics of Blue-Chip Stocks

You can source blue-chip stocks from trading apps but spotting them can be challenging. They are not necessarily the most expensive shares in the market. Hence, we look at characteristics to know what blue-chip stocks are.

The best approach is to track back to the parent company. With that in mind, here are some prominent characteristics of blue-chip stocks:

- A proven history of success (good performance)

- They are associated with reputable companies that are household names and proven leaders

- Their price movements are relatively stable to market fluctuations

- The stocks have robust balance sheets

- The stocks are associated with companies with healthy cash flow

- They have high liquidity because of their frequent and stable trades

- They are less volatile

- They are associated with companies with little-to-no debt

Blue-chip stocks may yield dividends that you can get from investment tools and platforms. However, that is not a mandatory characteristic.

A large market capitalization is a prominent characteristic of blue-chip companies. However, that is not a mandatory characteristic of what blue-chip stocks are. The key is for the company to be a leader in its sector, with respect from competitors and consumers.

Origin and Historic Significance

Those familiar with the typical poker table know that blue chips hold the highest value on the table. Oliver Gingold used the term “blue-chip” to refer to stocks that traded for $200 or more on the Dow Jones index in 1923. He was an employee of the same index.

While we don’t associate blue-chip stocks with high prices, the Dow Jones Foundation led us to something better. Today, these stocks come from reputable companies on several indexes, including the Dow Jones Industrial Average, the Nasdaq 100, and the S&P 500.

Railroads, oil, and steel were the primary industries that had a monopoly over blue-chip stocks in the early days. General Electric, Standard Oil, and U.S. Steel were the first blue-chip companies because of their long-term stability.

The Great Depression of 1930 was the first major test for blue-chip stocks. Fortunately, these stocks proved their worth by weathering the economic downturn, even as other shares plummeted. Investors felt secure, solidifying their reputation in the market.

Coca-Cola, IBM, and Procter & Gamble joined the blue-chip list, expanding the concept to other industries. The 1970s and 1980s brought expansion into other countries from the United States.

Blue-chip stocks have witnessed a decade of growth and renewed trust. The historic significance is its ability to serve as a wedge against volatile economies. Today, most investors have blue-chip stocks in their portfolio trackers for long-term earnings.

Some early blue-chip companies, like General Electric, have survived until today. These firms boost the confidence of new investors as they source long-term investments. We look to these companies as stable industry leaders with reliable profitability.

Although we don’t recommend trusting blue-chip companies 100%, they have the best chances of surviving acute economic downturns.

Common Attributes Among Blue-Chip Companies

We listed a few characteristics of a typical blue-chip company. That formed the foundation for our blue-chip stock definition. You can refer to them to grasp what blue-chip stocks are.

With that in mind, here are typical attributes blue-chip companies have:

- They are often pioneers in their sectors or markets

- They have little debt

- They report consistent and growing profits

- They have survived multiple economic downturns

- They produce high-quality products or have brands with high-quality products

Examples of Blue-Chip Stocks

Several companies have defined what blue-chip stocks are because of their consistency. However, some that started as blue-chip businesses have fallen or plummeted in value over the years. Survival is not guaranteed but must be worked on continually.

We won’t go into specific business strategies that enabled some blue-chip companies to survive. However, we’ll explore those who have survived and become icons in their respective industries and the global market.

Iconic Blue-Chip Companies in Various Sectors

The table below lists several blue-chip companies in their respective industries:

Company Sector Apple Inc. Technology Boeing Co. Aerospace and Defense Caterpillar Inc. Construction and Mining Equipment Coca-Cola Co. Beverages ExxonMobil Corp Oil an Procter & Gamble Co. Consumer Goods Verizon Communications Ltd. Telecommunic American Express Co. Financials Intel Corp. Technology Chevron Corp. Oil a General Electric Co. Conglomerate Historical Performance of Select Blue-Chip Stocks

A few companies readily come to mind when sourcing reputable firms. That is because of their proven industry prowess and the production of reliable products. Let’s review a few to give more perspective on what blue-chip stocks are.

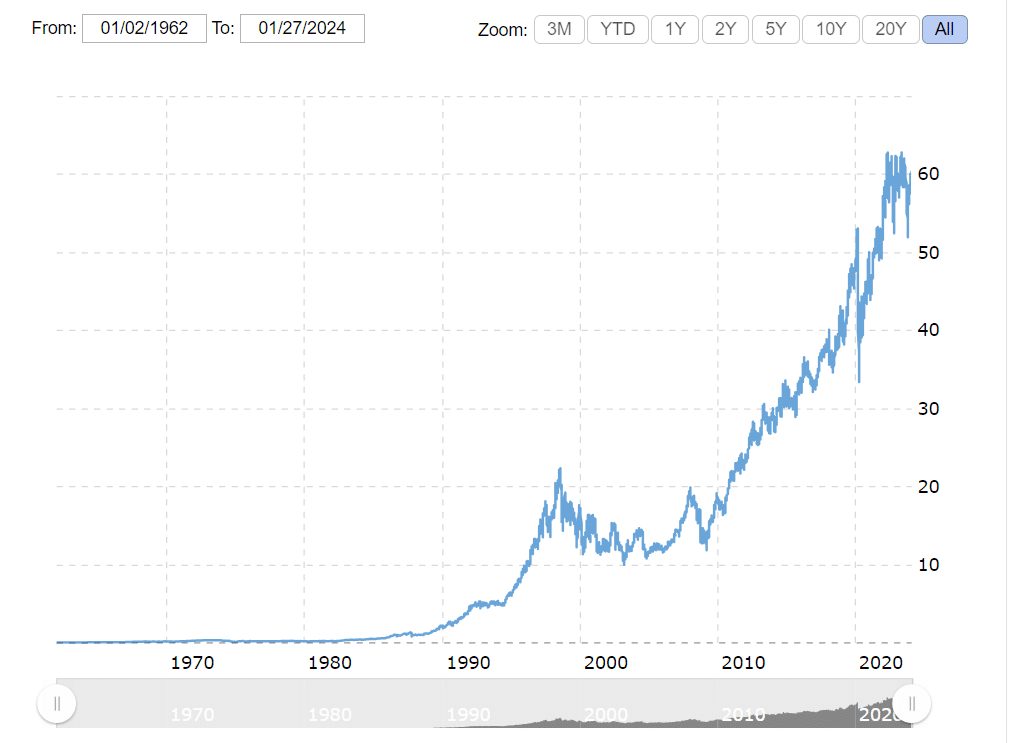

Coca-Cola

This company reached a $59.36 stock price on January 26, 2024. It is one of the most successful blue-chip companies, with a 62-year growth. A glance at its price history shows consistent stock growth since its inception.

Coca-Cola has had stock splits and dividends over the years. While the stock has not had explosive bull runs, its consistency gives investors confidence.

Despite its credibility, the company isn’t folding its hands and sitting on the sidelines. Its moves into healthy options, like coffee and sparkling water, are charting a new direction that ensures its longevity.

General Electric

This company has been featured in the Dow Jones Industrial Average for over a century. It began in 1892, weathering several economic downturns with consistent dividend payments to shareholders. However, its journey hasn’t been as smooth as Coca-Cola’s.

General Electric has had several crashes in the early 2000s, the 2008 recession, and the 2020 pandemic. However, it has climbed back up after each crash. Its recent stock price (as of January 26, 2024) is a far cry from its all-time high in 2000.

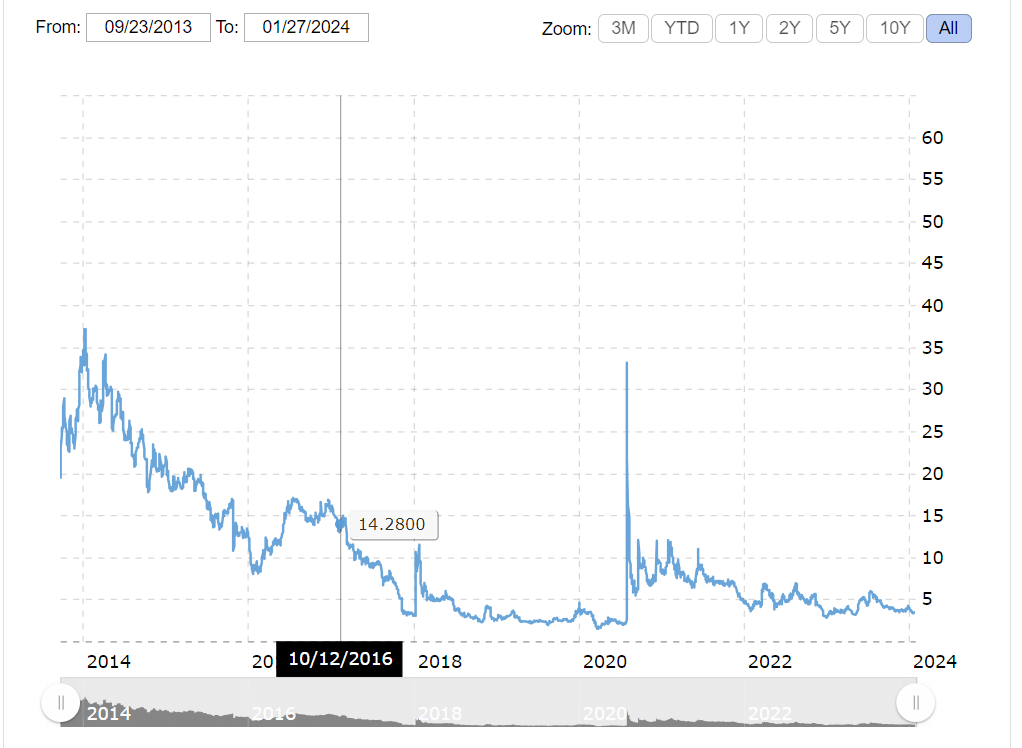

Eastman Kodak

We’ve included this blue-chip stock to show you that longevity is not always the case. Some companies can crash even after being at the top of their markets.

This company once led the photography industry. However, its slow adaptation to digital photography spelled its doom. While consumers shifted to digital photography, Kodak still offered traditional film cameras.

The chart above shows a consistent stock decline since 2013. Things look abysmal compared to Coca-Cola’s steady growth.

Diverse Industries Represented by Blue-Chips

The following are prominent industries with blue-chip representations:

- Technology: Apple, Intel, Cisco, IBM, Microsoft, etc. are reputable blue-chip companies representing the technology industry.

- Consumer goods: Coca-Cola is a headliner in this industry. Others include Procter & Gamble and Johnson & Johnson.

- Finance: Goldman Sachs, American Express, and JP Morgan Chase are prominent in this industry.

- Retail: We can quickly point to Amazon, Walmart, and Target.

- Energy: Chevron and ExxonMobil

Financial Stability and Performance

Stable growth and consistent results are the hallmarks of blue-chip stocks. Hence, examining these parameters is essential. These will form your analytical basis when selecting stocks for your portfolio.

The growth curve might not be smooth. However, the general trend will always be bullish. Hence, you should view the price performance over long periods (years) instead of years.

Fortunately, you can get these details from stock market research and analysis software. Take time to review each stock before settling. Here are things to consider when picking blue-chip stocks:

Consistent Revenue and Earnings Growth

Coca-Cola’s quarterly revenue grew from $7,169 million in 2009 to $11,953 million in 2023. That shows growth, although it may not be consistent between these periods.

By consistent revenue, we do not imply companies stay stock around the same figure. However, they should show growth, whether minuscule or exponential.

You can review these stats on most stock trading platforms. Go to the historical data section and click on earnings or revenue. Some apps have line diagrams, while others use histograms and bar charts.

Strong Balance Sheets and Low Debt Levels

Start-ups are prominent for their high debt levels. They borrow money to drive their operations and achieve high growth. However, debt should decrease as the company matures.

Blue-chip companies have low debt levels. That means their assets and income fund most of their operations. Occasional debt may come in during research, development, or expansion.

Company debt is public knowledge. Finding them is critical in how to research stocks the right way.

Stock trading apps may not reveal many details. You can turn to SEC filings for more information on a company’s debt and emerging technology.

Prominent indicators to consider on a company’s balance sheet include the following:

- Debt to equity ratio

- Total debt ratio

- Liquidity

- Inventory

The balance sheet will reveal the difference between a company’s assets and liabilities. Assets should outweigh liabilities. You’ll notice that as you analyze what blue-chip stocks are in your preferred industry.

Dividend Payment History and Policies

Companies can cancel dividends during challenging periods. However, blue-chip stocks have better dividend performance. This information is available on major stock trading platforms, especially those for long-term investors.

Review a company’s dividend payment history and its consistency. Dividends should grow with the stock price and the company’s earnings.

Pick companies with an upward curve in their dividend payments. Avoid those with significant fluctuations and inconsistencies. The latter covers the allocated payment periods and the company’s commitment to keeping them.

Market Capitalization and Dominance

Blue-chip companies do not necessarily need large market capitalization. The latter begins at the $10-billion mark, rising into trillions of dollars. While it is commendable, you might miss out on smaller companies with better growth potential.

Market dominance is a striking feature of these companies, and we can’t leave it out when defining what blue-chip stocks are. With that in mind, here’s how to use market capitalization and dominance to identify blue-chip companies:

Large Market Capitalization as a Common Feature

Apple clinched the top spot in 2023 with a market capitalization of $2,746.21 billion. Microsoft followed, along with Saudi Aramco and Alphabet. One highlight about these companies is that they are proven leaders in their industries.

They’ve also been on the scene for decades, achieving longevity despite harsh economic cycles. A large market capitalization is a typical feature of blue-chip companies. You can consider companies with billions of dollars in market capitalization.

Market Leadership and Dominance in Industry

Microsoft is unmatched in PC software. It is a dominant player in this industry the same way Coca-Cola is in the consumer goods industry. Their dominance comes from longevity as much as it comes from innovation and quality delivery.

Look towards market leaders to identify blue-chip companies in a specific industry. The market regards their products or services as pacesetters in the sector. Hence, they have a large customer base.

Global Presence and International Operations

Apple, Microsoft, IBM, ExxonMobil, and Coca-Cola are prominent international brands. Their products and services are available far beyond their base of operations.

It’s unlikely for a company to become blue-chipped without achieving global prominence. The larger their global presence, the more significant they are in their respective markets.

Blue-chip companies often have offices in different countries and continents. That can be a crucial factor when picking stocks for your portfolio. Review how many international markets the company has penetrated.

Besides availability, consider receptibility. The more receptive a market is to a company, the more dominant the company becomes.

Long-Term Track Record and Reliability

Performance is essential to short- and long-term trading or investment. Day traders review a stock’s track record to forecast its price movement. The same thing happens in long-term investing.

Knowing what blue-chip stocks are, we can’t call a stock blue-chipped without reviewing its track record. This performance data must span years and decades to see its long-term reliability. Most importantly, we must review the stock’s performance during general market crashes or recessions.

Three things are crucial when analyzing a stock’s reliability, and they are as follows:

- Historical performance during economic cycles

- Longevity

- Consistent price movement and dividend payment

Historical Performance During Economic Cycles

Review stocks during the worst economic cycles. Prominent financial disasters in the world include the following:

- The 1873 long depression

- The 1929 Great Depression

- The 1970 Economic Crisis

- The 2008 Great Recession

Review the stock performance during these pivotal points in financial history. We don’t expect stellar performance. However, the stock should recover quickly and resume its upward trajectory.

Blue-Chip Stocks as Reliable Long-Term Investments

Most investors turn to blue-chip stocks for long-term investments. That is understandable, given the consistent and growing returns these instruments are known for. You can do the same with adequate research.

Consistency in Stock Price and Dividend Growth

Stock prices increase as companies gain market value. Similarly, the stock dividends will increase, both in yield and payouts.

You can refer to Coca-Cola’s stock price (the chart is available in the previous section). A flat stock price movement shows a sideways market. Such is not ideal for long-term investment.

Open the price history to years and review the stock performance. Invest only if the overall trend is upward.

Income Generation and Dividend Investing

Generating income is the primary aim of stock investing. As such, we look for the best-performing stocks to trade. We can generate income through short-term or long-term investing.

Long-term investment strategies differ from what you’ll need with day-trading apps. Dividends are long-term investment strategies. That is because of consistent (growing) annual payments, even with stock splits.

Using blue-chip stocks for income generation and dividend investing requires thorough analysis. Refer to previous sections to master how to identify high-performing and promising blue-chip stocks. In the meantime, let’s explore how we can use them for long-term income generation.

Blue-Chips as Reliable Dividend-Paying Investments

Companies in this category often generate high profits. Of course, investors (shareholders) get a chunk of the profits through dividends. Their reliability reduces uncertainty when investing.

Blue-chip businesses often have large cash flows (liquidity). That is because of the large inflow from high-net investors and global players.

Furthermore, businesses in this category are often mature. This maturity brings a reliable business model that guarantees consistent growth.

Dividend Reinvestment Strategies with Blue-Chip Stocks

A few dividend reinvestment strategies that work with blue-chip stocks include the following:

- Automatic dividend reinvestment plan (DRIP): This strategy is prominent and easy to implement. Most online brokerages have these programs that reinvest your dividends as they come.

- Company–managed DRIPs: This program allows you to start investing without previously owning a company’s shares. However, you cannot sell the shares in the secondary market.

- Brokerage firms administered DRIPs: This strategy is ideal if the primary company does not have an in-house dividend reinvestment plan. However, these plans do not allow cash purchases.

Balancing Income and Growth Objectives

Maximizing growth and income can be two opposites. For example, a company might invest in a new product line that does not generate short-term income but has the potential for long-term growth.

Investing for income means finding the best way to get the highest income. Conversely, investing for growth means finding the best way to grow.

Those who opt for income often prioritize more volatile blue-chip stocks. Investors who prefer growth often think of long-term growth trends.

Balancing income and growth objectives boils down to your portfolio. Notwithstanding, you can combine short-term trading with long-term investment.

Portfolio Diversification with Blue-Chips

Most investors have a healthy mix of stocks, indices, metals, and cryptocurrencies. These instruments serve different purposes, thanks to their unique markets. For example, cryptocurrencies are very volatile and ideal for short-term, high-profit trading (although risky).

Portfolio diversification involves investing in different stocks with different performances. That could be having volatile stocks on one hand and stable ones on the other.

You can use blue-chip stocks creatively in your portfolio. Their reliable performance and consistent growth provide stable grounds for most investors. Here’s how you can make the most out of these stocks:

Blue-Chip Stocks as Core Holdings in a Portfolio

Resource allocation is vital in portfolio diversification. Some stocks will have more money while others will take less resources. The question is knowing which stocks you should invest more in.

Blue-chip stocks have stability and growth that can guarantee long-term returns. Hence, they should form your core holdings. You can use them as hedges for your more volatile investments.

Besides long-term stability, dividends can provide income while you hold these stocks. The annual payments, with reinvestment plans, can build your earnings and give you extra resources to trade high-volatility stocks.

Diversifying Across Different Blue-Chip Sectors

We recommend having high-volatility stocks with blue-chip stocks. Even so, you can diversify your blue-chip portfolio across different sectors. We saw these companies in the technology, consumer goods, oil and gas, conglomerates, etc. industries.

Some sectors are more stable than others. For example, the technology industry adapts rapidly with innovative drive than oil and gas. The latter has had several volatile seasons because of political instability.

Review different sectors to gauge their stability and growth rate. Then, spread your resources across blue-chip companies in these sectors. Opt for technology-inclined companies for faster growth.

Reducing Portfolio Risk with Blue-Chip Investments

We know what blue-chip stocks are. Their stability brings lower investment risks. Hence, they can reduce your portfolio risk level.

These investments are ideal for those with low-risk tolerance. They can give you a sense of security while allowing you to launch into more volatile sectors.

Navigating Market Volatility with Blue-Chips

Charts and indicators help us gauge the market. You can see a market’s volatility from its price movement and trends. However, we still need to invest and make the most of the market.

Trading volatile markets requires high-risk tolerance. Even so, experienced traders know the best way to hedge their trades. Blue-chip stocks can provide a hedge for your risks as follows:

Blue-Chip Stocks as Defensive Investments

Allocate resources to blue-chip stocks so that their returns can cover your losses in volatile markets. That ensures you remain in business with capital to invest in future trades.

Again, refer to your portfolio allocation. Simple mathematics should help you calculate your losses (capital) and reveal how much you must make to cover them.

How Blue Chips Perform During Economic Downturns

Blue chips can either weather economic downturns without significant losses or experience temporary crashes. The latter often ends in a rebound because of the strong credibility and growth model these companies have.

While the stock prices decrease, review other aspects, like debt profile, balance sheets, leadership news, etc. You can use alternative data sources to know more about what happens to a company behind the scenes.

Strategies for Weathering Market Storms with Blue-Chips

Here are a few strategies to weather market storms with blue chips:

- Diversify into different sectors

- Invest in blue chips that pay dividends

- Invest in blue-chip companies with strong fundamentals

- Hold your investments for longer periods

Assessing Valuation and Overvaluation Risks

Market capitalization is one of the ways to gauge a company’s size. Valuations are other ways. Both approaches affect a company’s stock price.

Common Pitfalls of Overpaying for Blue-Chip Stocks

Typical pitfalls for overpaying for blue-chip stocks include the following:

- Lower returns in the long run

- The risk is higher

Overvalued stocks often plummet in value when the bubble bursts. You can refer to the 1990s dot com bubble and the 2008 housing market crash.

Evaluating P/E Ratios and Other Valuation Metrics

Thorough research will help you avoid overvalued stocks. You must decide beyond the fear of missing out, even as the market rushes or entices traders to buy specific stocks.

Do your own research to review the valuation metrics. One of the most important metrics is the P/E ratio (price-to-earnings ratio).

The P/E ratio reveals how much the market is willing to pay for a company’s stock. It is derived by dividing the share price by the earnings per share.

Market Sentiment and Impact on Blue-Chip Valuations

Market sentiment is crucial to blue-chip valuations. You can use trend indicators to gauge market sentiment. However, that may not be enough to get the entire picture.

You might need alternative data services to fully grasp how the market feels about a company. The fear and greed index is a prominent indicator of market sentiments.

Here’s how the market sentiment impacts blue-chip valuations:

- Bullish sentiment results in high valuations

- Bearish sentiment results in low valuations

Industry-Specific Risks and Technological Shifts

Blue-chip stocks do not have 100% security (that is, they cannot lose value). These companies might be industry leaders. However, new businesses might spring up with disruptive technologies.

Technological Disruptions and Blue-Chip Vulnerabilities

Airbnb is a prominent example of technological disruption in an industry. It changed the housing market and threatened typical real estate firms.

Another example is Tesla with electric vehicles and fast charging stations. Most prominent car manufacturers had to readjust their production goals to accommodate these developments.

Analyzing Industry Trends and Competitive Pressures

Get a reliable news platform to keep up with new developments. You can also check SEC filings to see new technologies and gauge competition.

Adapting to Changing Market Dynamics

Your investments should adapt to market dynamics. Times will come when you should let some stocks go from your portfolio. Other times, you may need to buttress your position by increasing your investment in particular stocks.

Best Blue-Chip Stocks

The following are the best blue-chip stocks to add to your portfolio:

Apple (AAPL)

This company continues its giant strides in the technological industry. With the Vision Pro release, its stock is about to go head-to-head with other technological giants.

Walmart (WMT)

The price movement shows a quick recovery from downtrends. Hence, it remains a viable blue-stock chip for long-term investors.

JPMorgan Chase & Co. (JPM)

The stock went bullish in November 2023 and maintained its run till January 2024. It made a 24% increase within this period.

Coca-Cola (KO)

This company remains a titan in the consumer goods industry. While it has had its peaks and lows, the stock remains bullish, with quick comebacks.

Procter & Gamble Co (PG)

The current price movement seems to edge towards the 2022 all-year high. PG is reliable for long-term investments.

Summary of Blue-Chip Investing Principles

Here’s a summary of blue-chip investing:

- Look for industry leaders, companies with prominence

- Review their valuations to avoid overpaying for stocks

- Use blue-chip stocks to hedge the more volatile investments

- Diversify your blue-chip stocks into different sectors

- Stay-up-to date with technological disruptions and market sentiment

Conclusion

We’ve explored what blue-chip stocks are and how essential they can be to investment portfolios. This investment approach is ideal for long-term investors. Nonetheless, be flexible and diversify your portfolio to include a few volatile stocks for quick gains.

References

- https://www.statista.com/statistics/263264/top-companies-in-the-world-by-market-capitalization/

- https://www.businessinsider.com/the-greatest-economic-collapses-in-world-history-2012-7?r=US&IR=T

- https://www.livescience.com/worst-financial-disasters#

- https://www.pwc.nl/en/insights-and-publications/services-and-industries/energy-and-utilities/oil-gas-sector-volatility-continues.html

- https://www.history.com/news/2008-financial-crisis-causes

What are considered blue-chip stocks?

The stocks belong to companies that lead their industries or sectors. They are often large-cap companies, although medium-cap firms can also have blue-chip stocks.

Is Apple a blue-chip stock?

Apple is a blue-chip stock because of the company’s size and acceptance. The market regards it as a leading force in technology

Which blue-chip stock is best?

Apple, JPMorgan Chase & Co., Coca-Cola, Walmart, etc. are reputable blue-chip stocks to buy.

Is Walmart a blue-chip stock?

Walmart qualifies as a blue-chip stock because of its position in the retail industry. It is an industry leader and a pacesetter.

Is Cosco a blue-chip stock?

Cosco is a blue-chip stock because of its contributions to the consumer goods industry.

Jeremiah Awogboro

View all posts by Jeremiah AwogboroJeremiah Awogboro is an experienced content writer with over 8 years of experience. He has a qualified MBChB degree and a keen interest in the stock market and the finance industry. His background in the industry has provided him with valuable experience in this field. Awogboro is dedicated to assisting and reaching out to as many people as possible through his writing. In his spare time, he enjoys music, football, traveling, and reading.

stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2025