What is Yield in Stocks?

When you invest in stocks, the goal is to make profits. The asset class accommodates short- and long-term investment strategies looking to profit from price swings and overall market growth. After buying stocks, a yield measures your profitability over a specified period.

Yield in stocks is the income a stock issuer pays you on your investment. Simply put, a yield is the interest you get for holding an asset over a period, usually a year. However, different factors come into play when calculating stock yields. This guide explores stock yield, how to calculate yield in stocks, and why it’s important to investors.

-

-

Definition and Basics of Stock Yields

Before delving into calculating dividend yield using the yield formula, it’s crucial to understand what yield is and how it works. Doing so will help you assess your investments and returns properly when you begin your stock investing journey.

Your capital is at risk.

What is Stock Yield?

A stock yield is an investment growth measurement metric that stock investors use to determine their earnings on an instrument over a specific period.

If you’re new in the financial markets, you likely got curious and decided to learn how stocks work because they can make you money. However, you probably don’t understand how making money with stocks works.

One of the ways stock investors make money is through yields. As the name implies, a yield represents the total profits from holding a stock, and companies usually pay their shareholders annual yields.

For context, when you invest in Stock A by buying its shares on a stock trading app, you own a stake in the company. That means you have a share in their profits or losses. But since most publicly traded companies declare their earnings annually, your earnings also come as an annual percentage.

The percentage you earn from the firm’s profits is determined by factors like the amount invested and the security’s current market value or face value. In other words, you can know or anticipate how much yield you’ll get from an investment based on its valuation.

Different Types of Stock Yields

Yield in stocks comes in various forms, depending on your investment strategy. The most common yield type is the dividend yield.

What is dividend yield? A dividend yield is a percentage showing how much a stock issuer pays its investors as dividends compared to its stock price.

Simply put, a dividend yield is the amount you get after dividing the total amount of money a business pays its shareholders for holding a share of their stock by the current stock price.

Like stocks, dividends vary by industry. You can expect high dividends from relatively stable companies in the consumer staples sector. These companies have defensive stocks that are minimally affected by market downturns.

Besides a dividend yield, stock investors get profits through an earnings yield. Investors use the earnings yield to determine how much they earn per share. Its value is derived by comparing a stock’s earnings per share (EPS) to its current market price per share.

In other words, you can calculate a security’s earnings yield by dividing its 12-month EPS by its latest closing market price per share.

Comparatively, the dividend yield focuses on a company’s tangible yield and is paid from its net income. However, an earnings yield combines a company’s tangible and intangible yield and is paid per share.

Dividend Yield Earnings Yield Majorly a company’s tangible yield paid from its net income Encompasses a company’s tangible and intangible returns Significance of Yield in Stock Investing

When developing an investment strategy, you need insights into how much you stand to earn by buying a particular security. The stock’s yield provides information about how much a corporation has paid its shareholders as dividends over a period, usually a year.

Note that a stock yield is usually represented by a percentage, not dollar or currency values.

What does this percentage tell you as an investor?

A company with a high yield value generates enough revenue and cash flow to support its operations. In contrast, a low-yield company may experience cash flow issues due to lower revenue. Such companies are usually small-cap corporations with low liquidity and trading volumes.

Low-yield stock companies are highly volatile because they are sensitive to external economic factors like a recession or inflation, making them more suitable for day trading. Such companies experience cash flow issues during economic downturns.

For instance, PepsiCo is a high-yield company because economic challenges hardly impact its operations and revenue generation. However, travel and leisure companies often have unstable finances due to market fluctuations.

Using a yield as the only evaluation yardstick is not the best investment strategy because you can get a high yield from a stock even when its price is falling. Similarly, a low yield also doesn’t automatically mean a stock is not valuable.

Your capital is at risk.

The Role of Yield in Investment Decisions

At its core, a stock yield gives you an insight into a company’s financials and potential stock earnings. As a result, you can leverage a stock yield to make informed investment decisions.

Yield in Stocks as a Measure of Return on Investment

The primary purpose of calculating a dividend yield is to analyze whether investing in a stock is a sound decision. A yield is a major pointer to how much you stand to earn as interest after investing in a stock. From an investor’s standpoint, calculating a company’s yield before investing in it helps you manage expectations and avoid losses.

For instance, you want to invest in stocks from high-yield companies because they are more stable, less risky, and offer significantly higher returns. You can also compare the yields of different companies to find the ones best suited to your investment goals and risk appetite.

However, avoiding making investment decisions based on a stock yield is crucial. Sometimes, a yield may not reflect the actual market reality. For example, if a stock has a high yield without a corresponding price increase, it’s possible that its issuer is paying dividends without increasing earnings. In the long run, such an entity may experience cash flow problems.

So, after getting an idea of a stock’s potential returns using its yield percentage, look more into its fundamentals, including its market cap and the company’s financial reports, before investing.

Importance of Yield in Income-Seeking Strategies

Another reason to calculate dividend yield before investing in a stock is to determine if the security aligns with your investment strategy. You’re in the market to generate income, whether active or passive. So, your portfolio should contain securities that best represent your risk tolerance.

For instance, if you’re an active trader using a day trading app to navigate the markets, low-yield stocks are more suitable for you because of their high volatility. Conversely, you can opt for high-yield stocks if your risk tolerance is low since they are less volatile.

Whether you’re a day trader or a long-term investor, you can leverage the best stock analysis apps to assess various stock options. This will help you understand their market performance after determining their yields.

Yield Considerations in Diverse Investment Portfolios

Besides using stock yields to calculate investment returns, it can also guide you on which stocks to combine in a diversified portfolio. For instance, after determining the yield of various securities, you can arrive at the best combinations for a diversified investment portfolio.

Since low-yield stocks like penny stocks are more volatile and risky, you can combine them with relatively stable high-yield stocks offering high returns. Doing so can help you manage risks because the potential profits from the high-yield securities will offset the unexpected losses from the low-yield options.

Another way to diversify your investments and manage risk is to invest in exchange-traded funds (ETFs) with asset types across low and high-yield securities. This limits your risk exposure because your returns are not dependent on individual stocks.

If you want to diversify your portfolio using ETFs, you can find various options on the best ETF trading apps.

Dividend Yield in Stocks

Now that you know what a yield in stocks is and the importance of dividend yield to investors, let’s analyze how to calculate dividend yield for investment decisions.

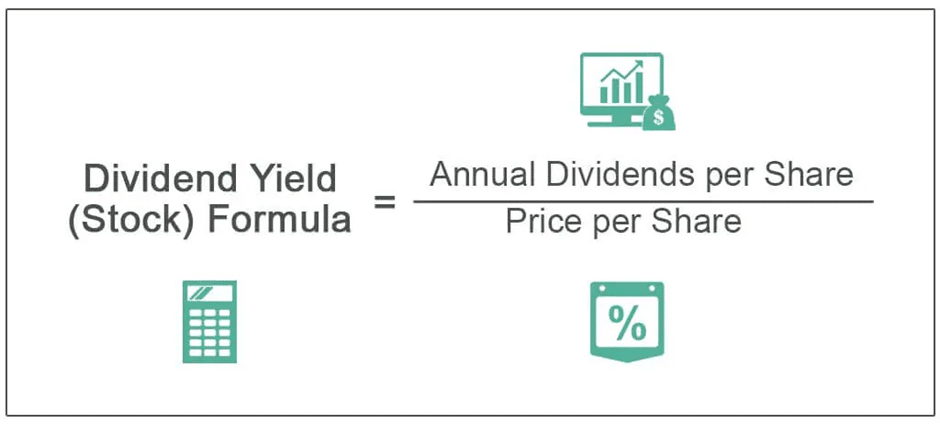

The Formula for Calculating Dividend Yield

As stated earlier, a stock yield gives insight into the issuing company’s cash flow and investors’ returns for holding the asset. You need two details to calculate a stock’s dividend yield: its annual dividend and current share price (most recent closing price).

After getting these, divide the annual dividend value by the stock’s market value.

That is, Stock A’s Dividend Yield = Stock A’s Annual Dividend ÷ Stock A’s Current Share/Stock Price.

For example, if the stock has a current trading value of $100 per share and its annual dividend is $4 per share, its dividend yield will be $4 ÷ $100 x 100% = 4%.

Interpreting Dividend Yield Percentages

What does a dividend yield percentage mean after calculating it? Remember, we said earlier that a stock yield can either be high or low. This is where the distinction comes in.

After calculating a stock’s dividend yield, it must fall in either category. The industry’s average dividend yield ranges from 2% to 6%. In other words, any security whose yield falls within this range is considered healthy. Conversely, a low dividend yield is below 2%.

The example above shows a high 4% dividend yield, meaning the stock can be a viable investment choice. However, stocks with a dividend yield over 4% should be treated cautiously, as a high yield may indicate revenue instability and an impending fall in stock price. Hence, you want to examine its candlestick charts and other technical analysis tools to determine its market performance.

Also, look into the company’s floating stocks to determine the number of its shares remaining for public purchase.

Assessing Dividend Sustainability and Growth

A company paying dividends is one thing, but sustaining and scaling its dividends is more important. As its name implies, dividend sustainability is a metric to assess whether a company can sustain its dividend payments over time. Investors use the metric to analyze a company’s financial health, as companies with a strong history of sustainable dividend payments usually have steady cash flow.

So, when a company fails to sustain its dividend payments, it is a sign of financial weakness, usually caused by a fall or an inconsistency in its revenue.

At the same time, sustainable companies generating good revenue grow over time, resulting in increased stock prices and better dividends. From an investor’s perspective, choosing companies with dividend sustainability and growth prospects will help maintain a steady income, especially from long-term investments.

Earnings Yield as an Investment Metric

We mentioned earlier that earnings yield is another common stock yield. Also known as earnings per share, the earnings yield determines a company’s EPS percentage to inform investors about its expected return.

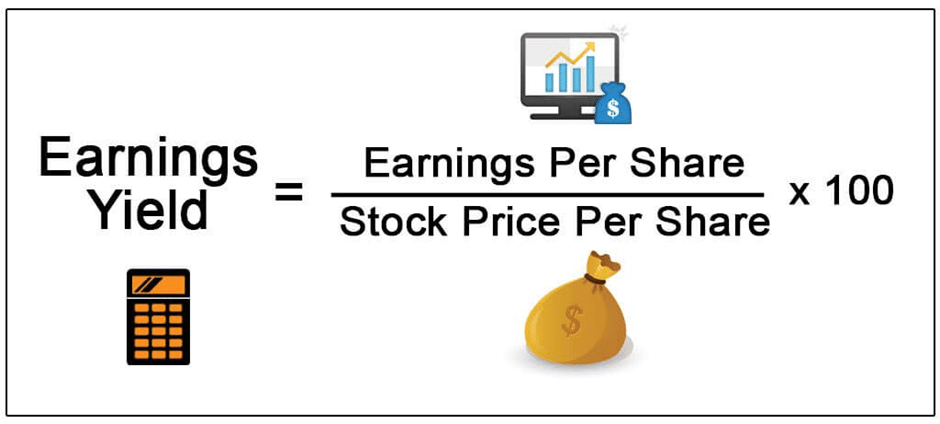

Calculating Earnings Yield and its Formula

Since earnings yield is a predictive returns metric that highlights how much a company expects to earn from its stocks, investors can leverage it for better insights into its financials.

What is the formula for calculating earnings yield? For this calculation, you need two details: a stock’s earnings per share and its market price per share. You can derive a company’s EPS from its most recent income statement, and the market price per share is the same as its stock price.

After getting the information, divide the stock’s earnings per share by its market price per share.

Earnings Yield = Earnings Per Share ÷ Stock’s Market Price Per Share x 100%.

Now, let’s get practical. Suppose an XYZ stock trades at $10 per share, and the company’s earnings per share over the previous 12 months is $0.25. The stock’s earnings yield will be $0.25 ÷ $10 x 100% = 2.5%

In other words, for every dollar an investor puts in XYZ stock, the company generates 2.5 cents. You can use the same formula for other stocks before deciding which to invest in.

Note that a stock’s earnings yield is indirectly related to its price-to-earnings (P/E) ratio.

Earnings Yield vs. Dividend Yield – Comparisons and Contrasts

Dividend and earnings yields are metrics for evaluating a company’s financial position before investing. Though both metrics aim to guide investors’ decision-making process, they differ in operation.

On the one hand, a dividend yield analyzes a company’s stock to understand how it pays its investors returns or interests for holding its stocks, usually after a year. On the other hand, an earnings yield highlights how much a stock company makes from each stock it lists in the open market.

In other words, a dividend yield looks at a company’s financial strength from the investor’s angle, while an earnings yield analyzes its finances from its income from selling stocks.

Earnings Yield Dividend Yield Analyzes a company from its internally generated revenue from shareholders Explores a company from its external payments to shareholders It is a company’s predictive returns metric It is an investor’s predictive returns metric Significance of Earnings Yield in Fundamental Analysis

Earnings yield is a good ROI metric that helps investors measure a stock’s return rate. It shows how much money a company makes per share on the stock market. When conducting a stock’s fundamental analysis, you can use its earnings yield to determine if it is undervalued or overvalued.

A low earnings yield percentage indicates that a stock may be overvalued at the time. In contrast, a high earnings yield suggests that a company’s shares are likely undervalued and worth considering.

Companies with promising potential usually have higher valuations, often resulting in low yield levels. So, before deciding which stock to buy, do your own research on each company to understand their drivers and growth potential.

Your capital is at risk.

Other Yield Metrics in Stocks (e.g., Free Cash Flow Yield)

Another popular metric investors use in analyzing a company’s financial position when investing is the free cash flow yield. But how does it work, and what does it mean for investors?

Understanding Free Cash Flow Yield

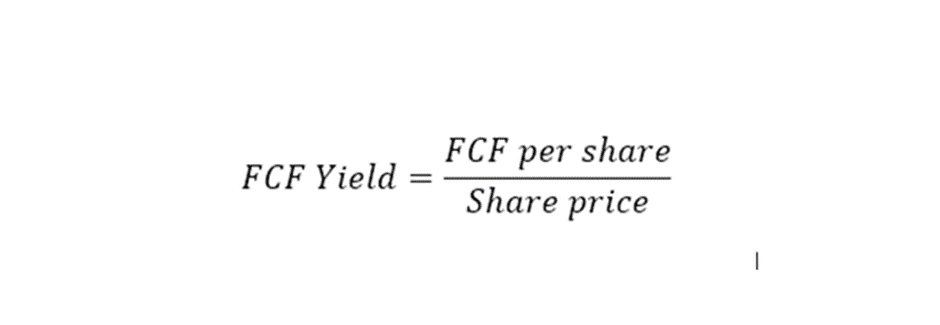

The Free cash flow (FCF) yield is a financial metric businesses use to analyze their cash flow compared to their business size or market capitalization. It is calculated by dividing a company’s free cash flow it should earn per share by its market value per share (market cap).

Free Cash Flow Yield = Company’s Free Cash Flow (per share) ÷ Market Cap or Stock Market Value

The cash flow information is usually available in the company’s financial statements, making it imperative that investors scrutinize the documents during stock market research.

Application of Free Cash Flow Yield in Valuation

The free cash flow yield helps investors understand a company’s financial solvency. As such, they can value such a company accordingly. A high FCF yield indicates that a company generates enough money to sustain its operations and obligations, like dividend payouts.

Conversely, a low FCF yield represents financial struggles because it means the company may not have enough funds to operate and pay its obligations to investors.

When you invest in a high FCF stock, you’ll get more valuable dividends than the low returns from low FCF stocks. You can find the best free cash flow stocks and opportunities using efficient, data-enhanced stock screeners and apps.

Analyzing Different Yield Metrics for Holistic Insights

Different yield metrics offer insights into a company’s cash flow from different perspectives. Since one metric cannot give a clear picture of a corporation’s finances, combining multiple yield metrics for fundamental analysis is a great step for better insights.

Company-Specific Factors

Though yield in stocks can help you predict your earnings from a stock investment or a company’s sustainability, this may not be true for every company. Each business has unique strengths and policies that may impact their yields.

Financial Health and Stability

Companies operate at different financial levels due to their sizes, products and services, operating sectors, and economic realities. As a result, their yields and valuations can vary. For instance, a newly listed company with limited cash flow will likely pay low dividends due to financial instability.

Dividend and Earnings Payout Policies

Another internal factor that impacts a company’s returns is its dividend or earnings payout structure. Companies with stable dividend and earnings payout policies offer shareholders steady yearly income, making them more appealing to investors. Conversely, a company with a low dividend payout policy offers less returns because it keeps most of its profits.

Management Decisions Impacting Yields

Management policies and decisions also affect companies’ yields because they make a statement to the public. Effective leadership from the top can result in increased revenue and stock prices. This is because such decisions boost investor confidence and increase the company’s stock demand.

For instance, a management’s decision to float more stocks will boost its liquidity, reduce volatility, and attract more investors, resulting in high yields.

Market and Economic Influences

External factors like market trends and economic policies also impact stock yield. These market influencers affect investor sentiment and can drive stock prices up or down.

Interest Rate Movements and Yield Dynamics

Interest rate policies from the central bank can affect stock prices positively or otherwise. When interest rates are high, stock prices and earnings usually fall. This is because businesses service debts with more money, and investors have less money to spend – both of which affect the bottom line.

Conversely, lower interest rates cause increased stock prices and yields because debt-servicing is cheaper and investors’ purchasing power increases.

Economic Conditions and Their Effect on Yields

Other macroeconomic factors affect stock prices and yields. For instance, inflation and unemployment rates are high in an economic recession. With consumers’ purchasing power reduced and more people out of jobs, stock investments will suffer.

On the other hand, strong economic conditions make the markets less volatile due to increased demand for securities and companies’ goods and services.

Industry Trends and Yield Variances

Market uptrends and downtrends also impact yield in stocks. If the investor behavior or sentiment is positive, there’s a bullish trend, while fear and uncertainty drastically impact stock prices and earnings.

Developing Yield-Oriented Investment Strategies

Using yield data for investment decisions is one way seasoned investors navigate the financial markets. Market data-backed decisions about stock investing can help improve your strategies.

Strategies for Income-Seeking Investors

If your goal is to generate income from stock yields, you can build a portfolio with noncyclical stocks offering decent yields. That way, you’ll get a steady annual income with limited risk exposure.

Active traders can also find high-yield, volatile stocks with the potential to profit from their price swings.

Balancing Yield and Risk in Investment Portfolios

Whether you take the short or long-term approach, stock investing is risky. However, a viable way of balancing risk and rewards is by creating a diversified portfolio with low and high-yield stocks.

Diversifying Across Yields and Asset Classes

Diversification also helps manage risks when investing in stocks for yields. A balanced portfolio combines different asset classes. For example, you can spread your capital across stocks, bonds, and mutual funds. Similarly, risk-averse investors can consider ETFs containing assets offering both yield levels to investors.

Your capital is at risk.

Risks and Limitations of Relying on Yields

Besides economic and company-specific limitations, investing in stocks based on yield metrics is risky. Below, we highlight the downsides to yield-backed investments.

Uncovering the Pitfalls of Chasing High Yields

Yield chasing is a common strategy among investors aiming for high returns from stock investments. Though the profits can be significant, chasing high-yield stocks is risky because it often entails investing in more volatile assets. Similarly, yield investing is speculative, and the markets may not favor you, resulting in losses.

Finally, high-yield chasing can be risky because yield metrics don’t show the complete market picture. For example, you can’t judge the broader market sentiment with a dividend or earnings yield calculation. So, there might be cases when a stock’s dividend is high, but the issuing company is in distress or financial trouble.

Yield Traps and Warning Signs for Investors

Another downside to using yield metrics for investment decisions is the strategy’s value trap. While trying to get more value from your stock dividends, avoid potential traps like investing in a company solely because of its high yield. Sometimes, a company paying a significantly higher yield than the market average may be doing so to attract more investors due to cash flow issues.

In essence, don’t hunt high yields without closely examining the company’s financial health and ability to meet obligations like dividend payments.

The Importance of Holistic Analysis Beyond Yields

As stated earlier, reviewing a stock based on its yield alone can be misleading. High yields don’t always represent financially healthy companies. It’s best to combine your yield metric with additional market research and analysis to mitigate risks. Leverage fundamental and technical analysis for better market insights. Also, scrutinize the company’s financial statements and management policies to determine if investing is right for you.

Key Takeaways and Summary

- A stock yield measures an investment’s return over a selected period, usually a year.

- High-yield stocks often convey lower risks than low-yield stocks.

- Earnings yield analyzes a company’s potential earnings per share.

- Dividend yield measures investors’ returns for holding a stock.

- Yields are viable sources of annual steady income.

What is Yield in Stocks? – eToro Complete Guide

With a detailed understanding of stock yields, including dividend yield, earnings, and free cash flow yields, you have enough knowledge to navigate the stock market using various yield metrics. eToro is the best place to find high-yield stocks to invest in. Follow the steps below to get started on the free stock app.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

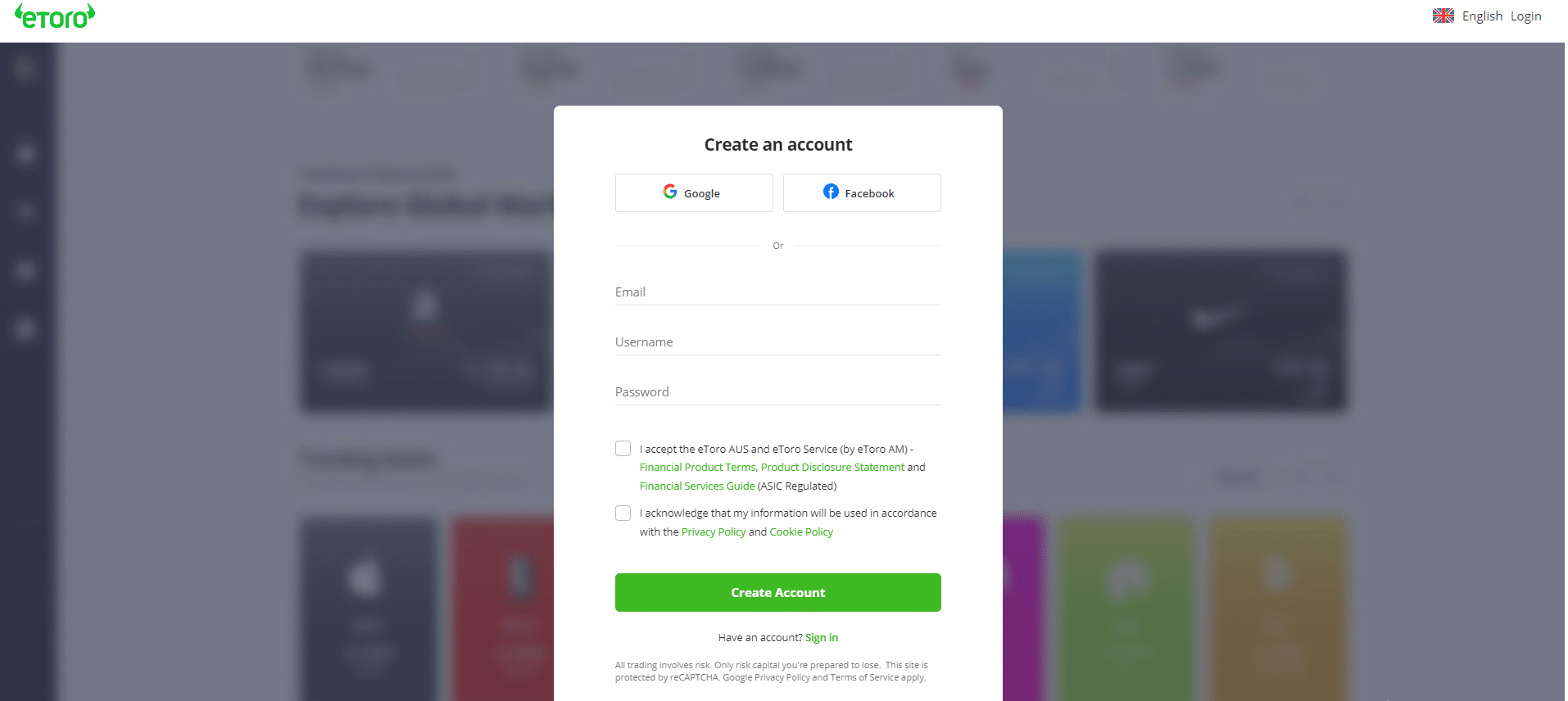

Step 1Sign up on eToro by visiting the official website and completing the registration form. Enter information like your email address and a unique username. Also, create a new password and click “Create Account” to create a new eToro trading account.

For illustration purpose only.

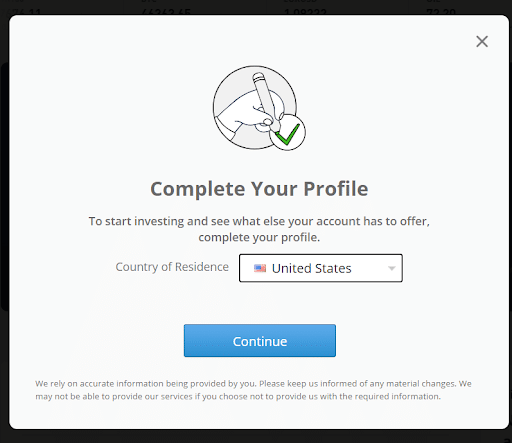

Step 2Complete eToro Verification by submitting proof of identity and address documents. Note that this is a mandatory step to access the platform’s trading tools and features.

For illustration purpose only.

Step 3Deposit funds using the supported payment methods on eToro. The online brokerage supports payments via ACH bank transfers, digital wallets, or cryptocurrencies. If you’re a beginner investor, eToro offers a paper trading tool. We recommend leveraging it to build confidence before diving into the financial markets.

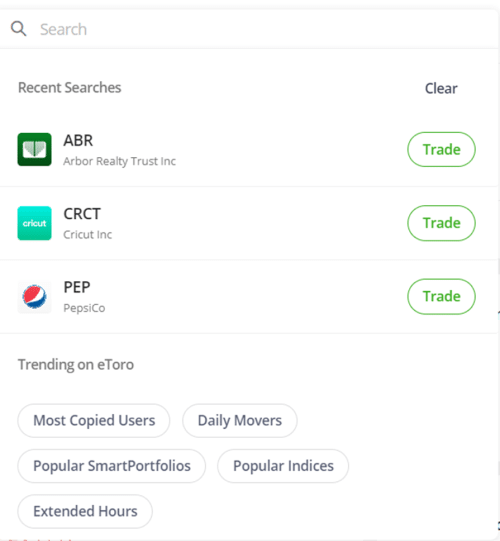

Step 4Search for your preferred high-yield stocks by entering the ticker symbol in the search box at the top of the user dashboard.

For illustration purpose only.

Step 5Start trading recession stocks on eToro by clicking the green “Trade” button.

For illustration purpose only.

What is Yield in Stocks? – Conclusion

Yield in stocks is a measure for calculating risks in the stock market. It helps investors analyze how rewarding a stock is and its issuing company’s financial stability for informed investment decisions.

eToro is a regulated US stockbroker offering high-yield stocks. The online brokerage supports zero-commission trading, over 4500 tradeable instruments, and a range of trading tools. However, remember that stock trading using yields is risky. Balance your investments with a diversified approach.

Your capital is at risk.

References

- https://en.wikipedia.org/wiki/Exchange-traded_fund

- https://corporatefinanceinstitute.com/resources/accounting/dividend/

- https://fastercapital.com/content/Dividend-Sustainability–Ensuring-Long-Term-Growth-amid-Dividend-Drag.html#:~:text=Dividend%20sustainability%20refers%20to%20a,likely%20to%20have%20sustainable%20dividends.

- https://corporatefinanceinstitute.com/resources/valuation/free-cash-flow-yield/

- https://capital.com/how-do-interest-rates-affect-the-stock-market

FAQs

What is a good yield for a stock?

Dividend yields vary across companies. However, the average healthy dividend yield ranges from 2% to 6%.

What does a 4% yield mean?

A 4% stock yield is a high dividend yield. It means an investor gets a 4% return on every share they own in a company. However, the actual cash value depends on the stock’s market price.

Is yield the same as dividend?

A dividend is what an investor gets as interest for holding a security and is usually represented by a dollar value. However, a dividend yield represents how much returns a company pays its shareholders and is represented by a percentage value.

Is a 3% yield good?

Since yields between 2% and 6% are considered good, a 3% yield falls in the average range. So, it is a considerable dividend yield.

Is a 20% yield good?

A 20% dividend looks good on paper but is often risky. Companies with ridiculously high yields are likelier to underperform or fail their financial obligations.

Adewunmi Adedayo

View all posts by Adewunmi AdedayoAdewunmi Adedayo is a seasoned finance and cryptocurrency writer with a passion for demystifying financial and crypto concepts to her readers. She has written several content for top websites such as IBtimes UK and The Nigerian Tribune. Adewunmi's style entails transforming technical topics into simple, captivating, and concise content for her audience.

VISIT ETOROYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2025

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up