P/E Ratio: What is P/E in stocks?

The P/E ratio in stocks offers some significant benefits to every investor or analyst, especially when evaluating and predicting a stock’s value. In this article, we aim to discuss the concepts of this evaluation tool, including its types, use cases in various industries, risk considerations, and market analysis.

-

- Analyzing Average P/E Ratios Across Industries

- Factors Influencing P/E Ratios in Different Sectors

- Growth Focus

- Innovation

- Economic Condition

- Risk Factor

- Industry Trends

- Recognizing Industry Trends in Valuation Metrics

- P/E Ratios and Growth Stocks

- Assessing P/E Ratios for High-Growth Companies

- Balancing Growth Expectations with Valuation Metrics

-

-

- Analyzing Average P/E Ratios Across Industries

- Factors Influencing P/E Ratios in Different Sectors

- Growth Focus

- Innovation

- Economic Condition

- Risk Factor

- Industry Trends

- Recognizing Industry Trends in Valuation Metrics

- P/E Ratios and Growth Stocks

- Assessing P/E Ratios for High-Growth Companies

- Balancing Growth Expectations with Valuation Metrics

-

What is the Price-to-Earnings (P/E) Ratio?

The Price-to-Earnings ratio is a key metric in determining the relationship between a company’s financial assets and the company’s generated earnings (earnings-per-share). This tool primarily describes a stock’s value – whether undervalued or overvalued.

Usually, Earnings Per Share (EPS) describes a company’s profitability based on its available assets; however, analysts need to evaluate such assets to determine if they are worth investing in. Indeed, this valuation tool helps them make informed decisions regarding investments.

The price-to-earnings ratio can be applied in various industries. An often-used case is in stocks, which is the basis of our discussion. We will discuss “What the P/E ratio in stocks is?” and how to calculate it to determine a stock market’s value.

Importance of P/E Ratios in Stock Analysis

The P/E ratio in stocks describes a stock’s value with its market price, showing whether it is expensive or cheap. It shows how much individuals will pay for a stock by comparing the price with the company’s EPS.

That means if the stock price is high and the company’s EPS is low, the PE ratio will be high.

Conversely, if the stock price is low and the company’s EPS is high, the PE ratio will be low.

It can be calculated as follows:

P/E Ratio = Stock share price/Earnings-per-Share (EPS)

Let’s say Company X trades stocks at $50 a share and has an EPS of $25; that means the P/E will be $2 ($50/$25).

This tool is widely used in the S&P 500 to measure stock value.

How P/E Ratios Reflect Market Expectations

Similarly, the P/E ratio reflects market expectations. It indicates an organization’s growth and risk and investors’ confidence in the financial asset, i.e., stocks.

For example, a high PE ratio shows a strong market expectation, such that individuals are likely to pay for a stock, showing future earnings growth and a massive potential for good profits. This often comes with minimal risks.

On the other hand, a low PE ratio displays a poor market expectation because individuals may want to steer clear of stocks with the potential to remain the same or decline. This often comes with high risks.

This metric provides valuable insight into the stock market, allowing people to make reasonable investment decisions.

Your capital is at risk.

Different Types of P/E Ratios

There are two main types of P/E ratios, namely Trailing and Forward price-to-earnings ratios. While the two types provide information about a stock’s value, they provide different reports.

Trailing P/E Ratio vs. Forward P/E Ratio

-

Trailing P/E Ratio

Specifically, the Trailing P/E Ratio uses a company’s earnings within the past year (12-month period). It is also called the Trailing Twelve Month (TTM) Earnings Ratio.

Analysts can use a company’s previous performance on the reported earnings to offer a more precise stock valuation.

It is calculated by dividing the current stock share price by the EPS from the past year (previous quarters).

i.e.,

TTM PE ratio = Current stock price/EPS over the last 4 quarters (or 12 months).

Unfortunately, while renowned platforms, such as Reuters, Google Finance, CNBC, and Yahoo! Finance use this approach, it isn’t the best to determine future stock performance/behavior.

-

Forward P/E Ratio

On the other hand, Forward P/E Ratio uses a company’s earnings over the next 12 months. It is also called the Leading Earnings Ratio.

It allows analysts to estimate a company’s future earnings (over the next 4 quarters) by leveraging current earnings, and margins, forecasting sales, and thorough stock market research.

It describes how a company expects to perform in the following year based on current stock value.

It is calculated by dividing the current stock share price by the estimated future EPS.

i.e.,

Forward P/E = Current stock price/Estimated EPS over the next 4 quarters (or 12 months).

Unfortunately, while platforms like Marketwatch, Bloomberg, and Morningstar, use this approach, understating or overstating the estimated future EPS could be an issue.

Trailing Forward - Depends on last 4 quarters’ performance

Uses current performance to determine estimate next 4 quarters’ performance - Offers more precise stock valuation

Limitations include overstatement or understatement of stock value - Less volatile

More volatile - P/E ratio formula = stock price/previous EPS

P/E ratio formula = stock price/estimated future EPS A table showing the differences between TTM and Forward Price-to-Earnings Ratios.

Calculating P/E Ratios for Individual Stocks and Indices

Likewise, P/E ratios apply to stock indexes.

For example, the S&P 500 has a current PE ratio of 23.27 (24.59 (5.34% decrease) in the last quarter; 19.17 (21.43% increase) from the previous year).

This data shows that P/E ratios for individual stocks and indices follow suit as stock prices change.

That being said, here is how to calculate P/E ratio for:

Individual stocks;

- P/E Ratio = Current stock price/EPS (over the next or within the past 12 months)

Stock indexes;

- P/E Ratio = Total market capitalization for index/EPS for index components (over the next or within the past 12 months)

Comparative Analysis Using P/E Ratios

Comparatively, the PE ratio in stocks is used to choose between organizations for stock share investments. The reason is that stock prices aren’t enough to determine these companies’ overall value.

Thus, there is a need to consider an additional factor, which in this case, the Price-to-earnings ratio becomes effective. It provides valuable insight into these companies’ investment values.

For example, Ventas and Rubicon Technology have PE ratios of 4,772.77 and 1.8, respectively. In this case, using comparative analysis, analysts see Ventas as a growth company and Rubicon Technology as a value company. Their varying PE ratios influence decision-making.

Relationship Between P/E Ratios and Stock Prices

Stock prices aren’t enough determinants of a company’s value; investors also use the P/E ratio. Hence, establishing a relationship between both metrics is consequential.

With this understanding, people can see the impact of market sentiments and identify expensive and cheap stocks.

Understanding P/E Ratios in Relation to Stock Value

First of all, the P/E ratio in stocks has a relationship with a company’s stock value with the help of another metric called the PEG ratio. This describes how price/earnings and future earnings growth rate are connected so analysts and investors can understand stock valuation.

Price-earnings-growth ratio (PEG) = PE/projected growth rate.

That means individuals can determine a financial asset’s value by analyzing current earnings with the company’s future/expected growth rate. In this case, the future could be any later than 12 months.

Usually, a lower PEG ratio means an undervalued stock, while a higher PEG means an overvalued one.

For instance, if company ASV has a current PE of 48 and the three-year projected growth rate is 13% and company BCK has a current PE of 24, the three-year projected growth rate is 9%.

i.e., PEG:

ASV = 48/13 = 3.69; BCK = 24/9 = 2.67

In comparison, ASV has overvalued stocks, while BCK has undervalued stocks. However, while this may be enough to ultimately determine valuation in the future, further analysis may have investors decide brilliantly.

Company PE Projected growth rate PEG ratio Stock Valuation ASV 48 13 3.69 Overvalued BCK 24 9 2.67 Undervalued A table showing stock valuation based on PEG ratio

Impact of Market Sentiment on P/E Ratios

Also, Market sentiment is an indicator of stock purchase. It describes the general mood/bias of investors or brokers about a stock on the market.

The market sentiment factor works using the bullish and bearish mechanism.

If the market sentiment is bullish, that means stock prices are rising; on the other hand, if it is bearish, it represents stock prices are declining.

Ultimately, market sentiment impacts the PE ratio.

That means if market sentiment remains positive, i.e., bullish, a firm’s PE ratio will be high; if it is negative, i.e., bearish, a firm’s PE ratio will be low. In that case, individuals will want to consider investing in stocks with potential growth.

Identifying Overvalued and Undervalued Stocks

Additionally, overvalued and undervalued stocks are identified based on other factors. They include;

-

Future Earnings

Usually, people believe stocks with higher PE ratios offer good future earnings and expectations, and vice-versa. This may be permissible in some situations to describe stock valuation.

For instance, if Company X has a high PE ratio with a potential for high future earnings, such a stock will be considered overvalued (growth stocks). However, Company X with a low PE ratio and a lesser potential for future earnings will be regarded as undervalued (value stocks).

-

Positive or Negative Value

A high or low PE ratio may not describe a firm’s stock value completely, but a positive or negative value could.

For instance, comparing companies in the same industry, the one with a negative P/E ratio in stocks can be seen as undervalued. In contrast, the other with a positive P/E ratio in stocks can be seen as overvalued.

-

P/E. vs Earnings Yield

Furthermore, Earnings Yield could be the indicator of stock valuation in some circumstances.

For instance, let’s say Company V has a P/E of 12 and Company W has a P/E of 27, does that always mean the latter is overvalued and the former is undervalued?

Earnings Yield (E/P) decides the final judgment on valuation as it distinguishes both companies based on share earnings on net profits. It is presented in percentage (EPS/stock price x 100).

This metric isn’t often used compared to the P/E ratio but shows the returns on stock investment, which could describe its value.

P/E Earnings Yield Measures a company’s stock value Shows returns on investment Depends on stock price and EPS Depends on P/E and stock price (in %) A table showing the differences between P/E ratio and Earnings Yield.

Your capital is at risk.

Sector and Industry Variances in P/E Ratios

Ideally, P/E ratios vary from one sector or industry to another. It is only standard to expect that some industries have a higher price to earnings than others. They could also potentially show better growth potential than them.

In this “P/E ratio meaning” article, we will analyze various sectors and industries and report distinct characteristics or factors that influence their ratios.

Analyzing Average P/E Ratios Across Industries

So far, major industries worldwide are finance, technology, healthcare, and retail. Each comprises certain elements that determine its average P/E ratio.

For instance, financial institutions are governed by regulations and influenced by key players, such as market conditions, economic stability, interests, etc. This contributes to them having a higher PE ratio with a good potential for exponential growth over the next decade.

Similarly, the technology industry shares the same fate as financial institutions. Due to the increase in innovations and the rising demand for technology, many tech organizations can boast of a higher PE ratio.

On the other hand, healthcare and retail companies may face certain challenges around demand/supply, product cost, etc., which may impact the PE ratio adversely.

Factors Influencing P/E Ratios in Different Sectors

Usually, P/E ratios work when comparing two industry-related companies offering similar stocks. However, some factors influence the value and they can vary from one sector to another. They include;

Growth Focus

Most sectors are growth-focused. However, it wouldn’t be surprising to see that some industries are hell-bent on this more than others. In that case, they will likely have higher PE ratios and witness earnings growth more.

Innovation

Some sectors invest wholly in innovation. For example, technology companies spend a huge amount of money and time developing new systems that would benefit the world. Undoubtedly, they are the most innovative sector and will likely perform better than others (higher P/E).

Economic Condition

Every sector has its experience with economic conditions. While some are impacted negatively, some are influenced positively. For instance, during periods of economic growth, financial institutions may have higher PE ratios due to increased demand for services.

On the contrary, an economic downturn will adversely affect them and other sectors, such as retail, resulting in low PE.

Risk Factor

Risk is an important factor and it influences various sectors participating in the stock market. Some high-risk sectors, like healthcare, may have lower PE ratios due to regulatory requirements, research and development costs, and other challenges along the way.

Industry Trends

Industry Trends may play a pivotal role in determining PE ratios across different sectors. For example, new technology to speed up the drug development process in healthcare may cause a shift in its P/E ratio from low to moderate or high.

Recognizing Industry Trends in Valuation Metrics

When analyzing the P/E ratio in stocks across several industries, individuals must recognize certain trends in these valuation metrics.

First of all, consumer behavior is a significant industry trend. It describes how consumer preferences may influence such sectors or companies. It constantly changes, causing an occasional shift in stock performance.

Another trend in valuation metrics is the industry’s structure. Sometimes, companies may appear cyclical or defensive and this plays a pivotal role in stability. Individuals must understand where such a firm belongs to determine what metric tool can be used to assess its stock value.

Subsequently, valuation metrics are affected by changing regulatory requirements across several industries. This change often affects different areas, including stock prices, company earnings, and market conditions.

P/E Ratios and Growth Stocks

Generally, Growth Investing involves investors finding firms with strong earnings growth and purchasing their stocks. These stocks are called Growth Stocks and they are believed to grow faster than other options available.

Due to the nature of this investment strategy, as opposed to its alternative, Value Investing, individuals hope to make profits when these stock shares appreciate. That means they are overvalued stocks, which ultimately means a high PE ratio.

This PE ratio is an important distinguishing factor between both investment strategies.

Assessing P/E Ratios for High-Growth Companies

As mentioned earlier, the Price Earnings ratio is vital for growth investing; however, analysts have to assess it when choosing between high-growth companies.

This metric assesses an organization’s stock value while considering its earnings growth potential. Thus, the higher the earnings growth potential, the more valuable the growth stocks are.

Significantly, a high PE ratio means a high market expectation.

Balancing Growth Expectations with Valuation Metrics

Ideally, various valuation metrics exist to determine stock value. They include Price-to-earnings ratio, Price-to-book ratio, free cash flow, debt-to-equity ratio, and PEG ratio.

However, balancing growth expectations is crucial, regardless of the valuation metric an investor decides to use. This would help people make relevant decisions, avoid overvaluation, and manage risks.

Furthermore, this strategy will allow investors to maintain a decent margin of safety with stocks having high growth expectations.

Overall, stocks purchased at moderate or high valuations tend to perform well in the long run.

Your capital is at risk.

Earnings Stability and Consistency

The Role of Stable Earnings in P/E Ratios

Earnings stability (or Stable Earnings) measures earnings’ consistency over time. It is often used in sectors where growth follows a predictable pattern over time.

Stable Earnings are active in determining the PE ratio – especially in the Trailing type. It can be used to predict the PE ratio of a company over the next couple of years based on previous performances.

Based on reports, stocks with stable earnings show resilience even during market volatility or economic uncertainty. They can withstand challenging market conditions and maintain a high PE ratio regardless.

Undoubtedly, these stocks offer a long-term investment appeal to individuals.

More so, stable earnings instill confidence and allow investors to reasonably compare stock prices and PE ratios between companies.

Analyzing Earnings Trends and Patterns

Trend analysis allows people to make reasonable investment decisions.

Some critical considerations during this analysis include:

- Consistency in earnings growth to determine sustainability. Often, consistent companies have higher P/E ratios.

- Earnings volatility could adversely affect the company’s PE ratio and growth performance.

- Negative or Positive Earnings surprises can affect the P/E ratio – a positive surprise facilitates optimism and a negative surprise often leads to pessimism.

Impact of Cyclical Earnings on P/E Ratios

Cyclical earnings are generated from firms dependent on the market economy’s strength. That means revenues generated are more during economic growth, while in economic downturns, they are low.

Automatically, Cyclical earnings will affect Price-earnings ratio. Such a company will show different valuation metrics at different business cycle periods.

Market and Economic Conditions

Interest Rates and Inflation’s Influence on P/E Ratios

Typically, interest rates and Price to earnings ratio share an inverse relationship.

For example, interest rates are essential in financial institutions and influence the discount rate used in various models. So, that means the higher the interest rate, the lower the P/E ratio in stocks.

Conversely, stock prices ripple when inflation hits the economy, forcing individuals to need a higher return rate to maintain buying power. Ultimately, a higher return rate causes a decline in the Price to earnings ratio.

That also means during rising inflation, the P/E ratio in stocks falls.

Economic Indicators and Their Correlation with P/E Ratios

Economic indicators, such as GDP, consumer confidence, government policies, and inflation rate have had several uses over the years. Still, a significant one is in predicting trends in the stock market.

It provides useful insights into a company’s financial health and helps people decide what and where to invest.

These indicators correlate with P/E ratios in varying ways. For instance, the GDP in a growing economy enhances higher earnings. However, when this GDP becomes extremely high, it impacts the PE ratio negatively.

Consumer confidence is another – it is linked to spending habits. If there is high consumer confidence, corporate earnings will increase, automatically fostering a reasonable PE ratio.

Lastly, government policies play a huge role in economic growth. If there are stringent policies, firms in different sectors may suffer the consequences, causing a negative P/E ratio.

Market Sentiment and P/E Ratio Volatility

As highlighted above, market sentiments can be positive or negative and are usually linked to Price to earnings ratio volatility.

Positive market sentiments mean analysts and investors are optimistic about the value of stocks in the future. In this situation, the P/E ratio shows low volatility as there seems to be a willingness to pay more valuation for stocks.

Conversely, Negative market sentiments make investors and analysts concerned about stock value in the future. In this situation, the P/E ratio may show high volatility and become risk-bound due to this uncertainty.

Using P/E Ratios in Investment Strategies

P/E Ratios as a Screening Tool for Stock Selection

Subsequently, Price Earnings ratios can be used actively in selecting stocks.

Some AI stock picking software exist, but this screening tool allows individuals to set a range of ratios and choose which company meets their requirements.

In this process, company valuations are compared – especially if the firms are in the same industry.

Incorporating P/E Ratios in Value Investing Strategies

Alternatively, the P/E ratio in stocks can be used in Value Investing (other than Growth Investing). Its incorporation into various strategies will help analysts view an organization’s financial situation, growth potential, and trends.

This idea of a company’s underlying value will help make decisions about investing.

The Importance of P/E Ratios in Portfolio Construction

Certainly, diversifying asset portfolios is one of every investor’s mindset.

Different people take various approaches to achieve this. However, anybody who wants to benefit greatly from stock investment must utilize this valuation tool actively, starting from using a portfolio tracker.

The P/E ratio in stocks offers a unique valuation assessment so that individuals don’t go around investing in every asset they see. This metric will help assess the valuation of individual stocks, showing which is undervalued and overvalued.

It also provides insights into relative valuation when comparing different stocks within the same industry.

Lastly, it helps to manage risks.

Your capital is at risk.

Risks and Limitations of Relying on P/E Ratios

Pitfalls of Solely Relying on P/E Ratios for Investment Decisions

P/E ratios for investment decisions are good, but they come with limitations.

First of all, the P/E ratio in stocks (for example, futures stocks) depends solely on the company’s earnings, making vulnerable and easy to manipulate. It doesn’t become an honest metric for stock valuation when it can be tweaked to meet the company’s goals.

Secondly, Price to Earnings is influenced by several factors, including economic indicators, growth prospects, innovation, dividend payouts, etc. This makes it impossible to predict the accurate value of stocks.

Finally, firms with negative earnings or zero growth prospects may not find the PE ratio useful.

Accounting for One-Time Events and Adjustments

One-time events, also known as non-recurring items usually affect a company’s reported earnings. Examples include legal fees, impairment costs, profits or losses from asset sales, etc.

However, since these earnings are used to determine the P/E ratio in stocks, it is important to account for these events or adjustments. A good way to do that is to use adjusted ratios, (i.e., adjusted EPS) when calculating price to earnings ratio.

Integrating P/E Ratios into a Comprehensive Analysis

A comprehensive analysis of financial assets gives valuable insight into a business model and industry dynamics. If this metric tool is integrated into this analysis strategy, a company’s earnings quality can be assessed more accurately, alongside growth and sustainability.

On the other hand, use a stock market calculator to get the price.

Key Takeaways and Summary

Key takeaways from this “What is P/E ratio” article are:

- P/E ratio is a useful valuation metric in two main types – Trailing and Forward.

- P/E ratio can be used alongside other valuation metrics to determine stock value more accurately.

- Factors influencing price to earnings include economic indicators, such as GDP, interest rates, inflation rate, and market conditions.

- Price to Earnings ratio may vary from one company to another, depending on the sector or industry.

What is P/E in Stocks? – eToro Complete Guide

Finding out the P/E ratio meaning is one thing; utilizing it effectively is another.

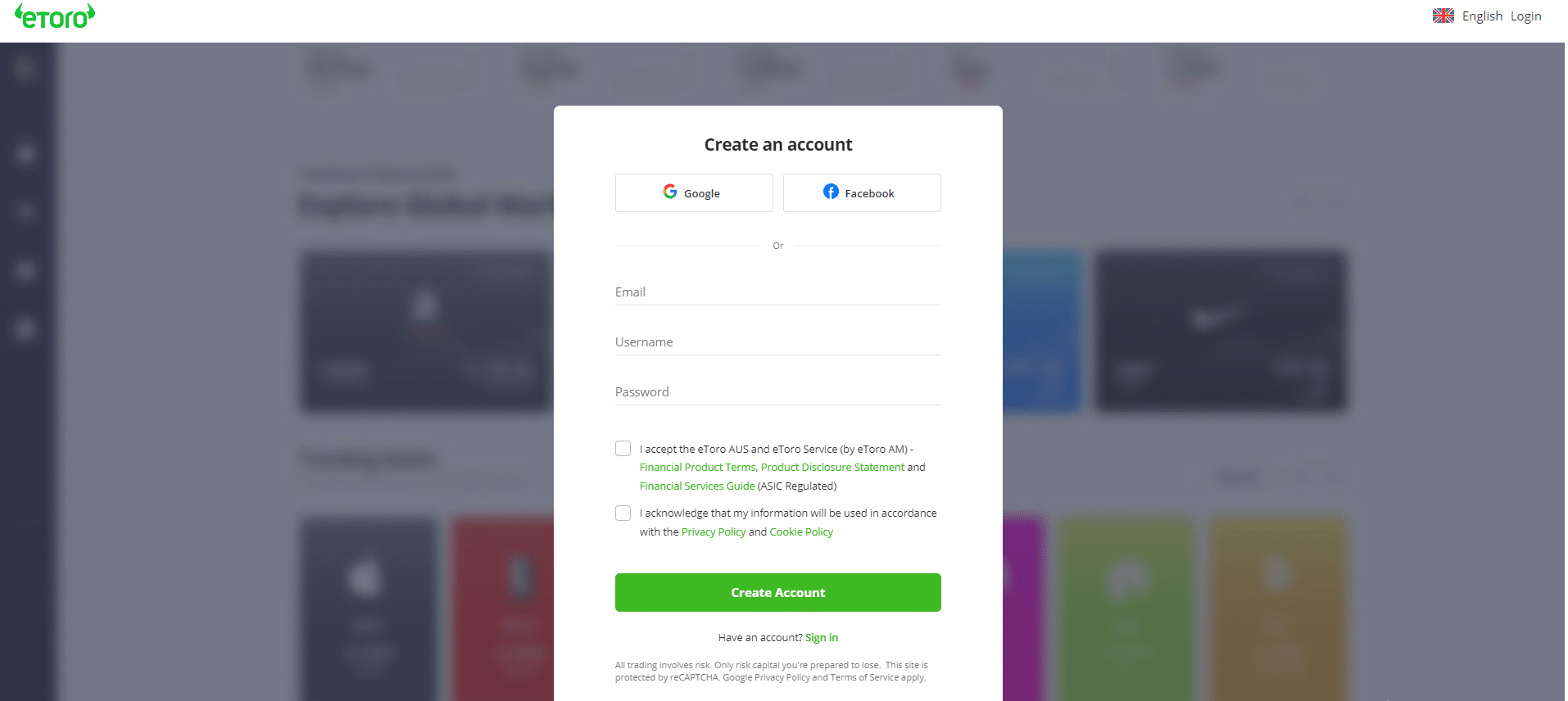

eToro is a digital stock trading app that accepts individuals worldwide.

Follow the steps below to buy futures or meme stocks on this platform.

Step 1Go to eToro online website.

For illustration purpose only.

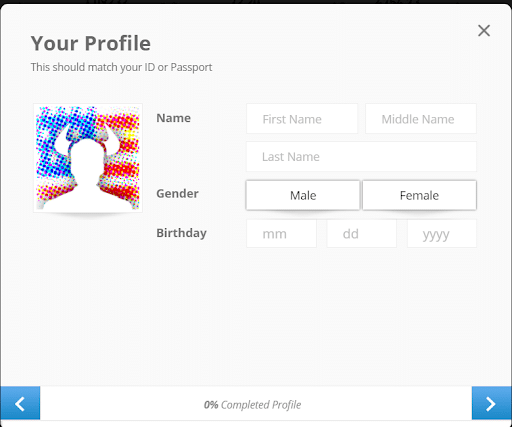

Step 2Fill in the required details, such as username, email, and password.

For illustration purpose only.

Step 3Accept the site’s Terms and Conditions.

Step 4Complete the further verification process.

For illustration purpose only.

Step 5Deposit money into your eToro account.

Step 6Start investing in stocks.

Conclusion

At the end of this article on “What is a good P/E ratio,” you should know its key concepts, types, benefits, pitfalls, and use cases in various industries.

Also, it has actively provided information on how to calculate P/E ratio, alongside stock tips, so you don’t have to worry about choosing between stocks to invest in.

This metric tool offers a great advantage over most valuation metrics and you must consider using it to make informed investment decisions regarding stocks.

After using the P/E ratio to decide between stocks, you can proceed to eToro to buy. Join this platform today, get stock alert services, and meet your stock investment goals!

Your capital is at risk.

References

- https://zebrabi.com/guide/price-to-earnings-p-e-ratio/#Limitations_of_PE_Ratio_as_a_Valuation_Metric

- https://fastercapital.com/content/Economic-Indicators–Predicting-Market-Trends-with-the-PE10-Ratio.html

- https://www.nerdwallet.com/article/investing/pe-ratio-definition

- https://www.forbes.com/advisor/investing/what-is-pe-price-earnings-ratio/

- https://www.miraeassetmf.co.in/knowledge-center/what-is-pe-ratio

- https://corporatefinanceinstitute.com/resources/valuation/price-earnings-ratio/

- https://www.fool.ca/investing/what-is-price-to-earning-ratio/

- https://www.schwab.com/learn/story/stock-analysis-using-pe-ratio

- https://smartasset.com/investing/what-is-a-good-pe-ratio

FAQs

What is a good PE ratio for stocks?

No intricate value describes a ‘good’ PE ratio for stocks. However, you can tell a good one by comparing it with the average ratio of companies offering similar stocks in the same industry.

Is a low PE ratio good?

Usually, a low PE ratio doesn’t necessarily mean it is bad for investment. In some situations – for instance, value investing, a low ratio may be good. Investors believe that such stock could appreciate in the future.

Is PE ratio a good indicator?

Price to Earnings ratio is one of the best indicators for stock valuation. However, it shouldn’t be used only to determine stock value. Sometimes, collaborating with other valuation metrics helps.

Is a 200 PE ratio good?

As far as positive and negative P/E ratios are concerned, 200 is good. It is considerably high but often comes with high risk

Is 30 a bad PE ratio?

Likewise, deciding whether 30 is a good or bad ratio is at the investor’s discretion of what the industry looks like. If there are other stocks in the sector with much higher ratios, then it could be bad.

Adewunmi Adedayo

View all posts by Adewunmi AdedayoAdewunmi Adedayo is a seasoned finance and cryptocurrency writer with a passion for demystifying financial and crypto concepts to her readers. She has written several content for top websites such as IBtimes UK and The Nigerian Tribune. Adewunmi's style entails transforming technical topics into simple, captivating, and concise content for her audience.

VISIT ETOROYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2026

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up