Moneybox App Review – Fees, Features, Pros & Cons Revealed

Trading apps have become increasingly popular as users are looking for more convenient methods to enter the stock markets and effectively manage their funds. One trading app that has captured the heart of many investors is Moneybox, a smartphone app that enables users to buy thousands of shares as well as other financial instruments like funds, bonds, and portfolios.

In this Moneybox app review, we explain the pros and cons of the Moneybox investment app. We’ll also analyze its features, products, fees, regulation, payment methods, and more.

-

-

What is Moneybox?

Moneybox was founded in 2015 by Ben Stanway and Charlie Mortimer as a savings and investing app that enables users to get quick access to financial tools directly from their mobile phones. The app has more than 450,000 users worldwide and it has won numerous awards in recent years including the Best Consumer Investment Awards 2019, Best Money App 2019, and the Best Digital Wealth Manager App 2019.

In simple terms, Moneybox is an investing and saving app that was specially designed for beginners who either want to start investing or for those struggling to find saving solutions. Moneybox is also very popular for the ease in which anyone can get started and the simplicity of the app’s functionality.

Moneybox is a trademark of Digital Moneybox Limited, which is regulated and authorized by the UK’s Financial Conduct Authority (FCA) under registration number 712935. The company is located at 1-2 Hatfields, South Bank, London SE1 9PG, United Kingdom and employs 125 employees as of Sep 2020.

What Stocks Can You Trade on the Moneybox App?

Our Money app review found that the app allows you to invest in thousands of shares and funds from various exchanges around the world. Users can choose the Stock and Shares ISA account that lets them invest in thousands of global companies such as Microsoft, Facebook, Netflix, Disney, Nintendo, Apple, L’Oreal, Amazon, and many more.

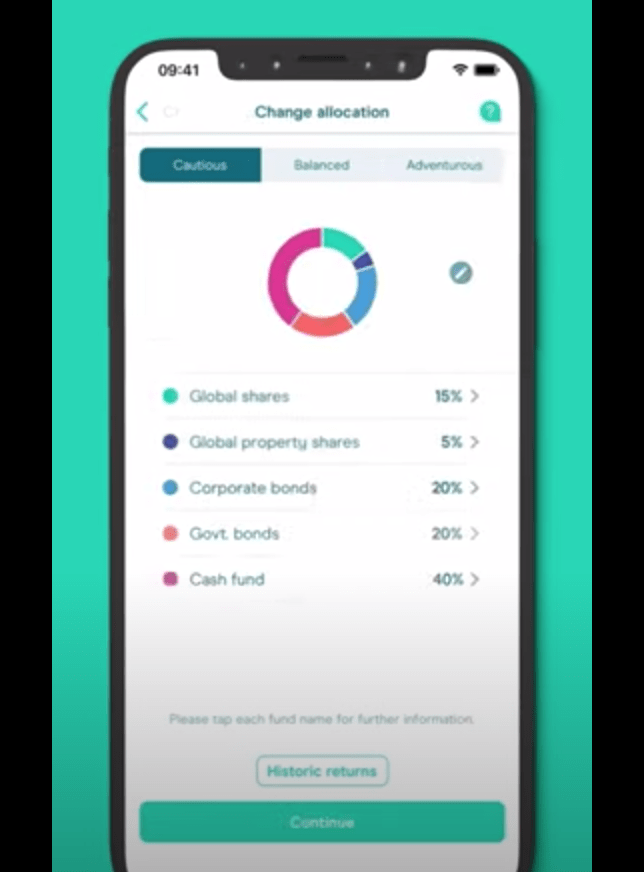

On top of that, users can also invest in a range of tracker funds that follow an index of stocks and shares, government or corporate bonds, and global property shares. Each fund comes with its own risks, and with a plethora of investment options. As such, you’ll be able to choose between the cautious, balanced, and adventurous funds.

With this in mind, Moneybox is more focused on the new trend of micro-saving and thus, allowing users to get exposure to the stock market. This means that it is not a trading app that comes with trading platform and leverage, but in fact, it is an investing/saving mobile app.

Moneybox Account Types

The Moneybox stock app comes with a range of account types. Below we briefly explain the account types offered on this platform.

Investment Accounts

General Investment Account – This account type lets you invest in thousands of global companies via a range of tracker funds. If opting for the GIA account, you will only pay tax on gains above £12,300.

Stocks & Shares ISA – On this account, you can invest in the stock market up to £20,000 per year, with gains that are completely tax-free.

Stocks & Shares ISA LISA – The Lifetime Saving Account (LISA) is an Individual Savings Account that helps people increase their savings. Basically, you can get a bonus of up to £1000 per year from the government if choosing the ISA LISA saving account.

Junior ISA – The JISA is a savings and investment account for children up to the age of 18.

Pension Accounts

Moneybox also allows users to transfer an old or exiting pension fund and choose one of three investment options: Fidelity Index World Fund, the Old Mutual MSCI World ESG Index Fund, or BlackRock LifePath Fund.

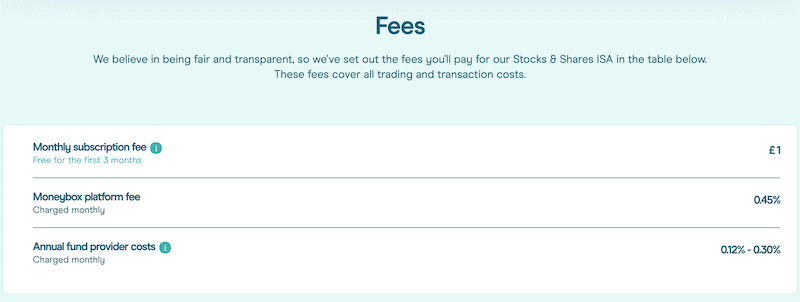

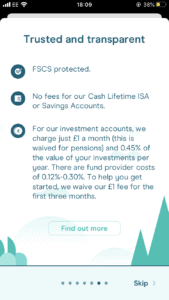

Moneybox Fees & Commissions

Our Moneybox app review found that its fees and commissions are a bit higher than other UK stockbrokers that give you access to a free commission share trading platform. Nevertheless, its commission structure is fair and transparent, so you won’t have to deal with any hidden costs. Essentially, the costs vary based on the type of account you choose.

For investment account, Moneybox charges the following fees:

Fixed subscription fee: £1 per month regardless of the number of investing accounts you have with Moneybox. This fee is charged at the end of each month, however, bear in mind that the first three months are free of charge.

Platform fee: Moneybox also charges a platform fee of 0.45% of the total amount invested throughout the year.

Fund provider fees: This fee ranges from 0.12% to 0.30% per year and is essentially a fee charged by fund providers.

For the Moneybox pension account, you’ll have to pay the following fees:

Platform fee: Moneybox charges a platform fee of 0.45% for the first £100,000 in your account and 0.15% if you have a balance of over £100,000.

Fund Provider fee: You will also be charged with an annual fund provider fee that ranges between 0.12%-0.30%.

Keep in mind that Monetbox does charge any fees for the 45 Day Notice Account and the 95 Day Notice Account nor for the Moneybox Cash Lifetime ISA. Further, you will not be charged with any fees in case you have an account balance of £0 and Moneybox does not charge any deposit and withdrawal fees.

Moneybox App User Experience

One of the strengths of Moneybox is the outstanding user experience and the simplicity of use it provides to users. And even though the app is more suited for beginners, experienced investors can also benefit from the Moneybox app. This can be attributed to the interface that is neat and clean with a search bar and a pull-down menu that allows you to choose the account type and products you wish to invest in.

As you can see on the image, you can easily choose the account type and the option you wish to invest in. Further, you’ll be able to change the allocation of your assets, add funds to your account and monitor your account directly from your mobile phone.

Moneybox Trading Tools and Features

As we mentioned previously, Moneybox is not a trading app but more of an investing and saving platform that helps you save your funds and get better investment decisions. As such, you’ll have access to a number of useful features:

Tracker Funds

Generally, tracker funds are becoming more widely used by individual investors. As a result, Moneybox joined the trend and has developed tracker funds with three risk categories: cautious, balanced, and adventurous. On its platform, you’ll be able to change the asset allocation and decide the type of investment you wish to conduct. For example, if opting for the cautious tracker fund, you will get a 15% exposure to global shares, while if choosing the adventurous tracker, you will increase your global shares exposure to 80%.

Socially Responsible Investing

Moneybox partners with Old Mutual Investment Group in order to introduce a Socially Responsible fund. This means you can invest in companies that score well based on the ESG (Environmental, Social, and Governance) scoring process.

Time Machine

Moneybox also features the time machine, which is a unique tool that helps you keep your savings on track. This tool, which is available on the Cash Lifetime ISA account, increases your regular weekly deposits and shows you what your money will be worth in a certain future date.

Moneybox App Education, Research and Analysis

Moneybox is an investment and saving app tailored for beginner investors that lack the knowledge to manage their finances and as such, Moneybox efforts to offer plenty of educational resources and research tools. First and foremost, Moneybox has an ongoing blog to help bring tips and up to date news on how to effectively manage your money. This includes a huge selection of guides, updates about the company’s new products and services, and investment suggestions. You will also get access to the Moneybox Academy, which is an online and offline education series of 8 lessons.

When it comes to research tools, you won’t get access to the same research and analysis tools you may get on other trading platforms such as Robinhood. This is mostly because Moneybox offers a different type of investment app that wraps up all the materials to pre-selected funds. Nevertheless, the app is functional, useful, and intuitive so you will easily be able to easily manage your funds.

Moneybox App Bonus

Our Moneybox review found that this investment app does not currently offer a bonus for new or existing clients.

Moneybox Demo Account

At the time of writing, Moneybox does not offer a demo account or paper trading.

Payments on the Moneybox Stock App

Moneybox keeps it simple when it comes to payment options. You’ll be asked to link your debit card to the mobile app and once you’ve done that, Moneybox collects your weekly savings on Wednesday at midday, and then debit this amount from your bank account via direct debit early the following week.

Moneybox Minimum Deposit

Effectively, Moneybox does maintain a minimum deposit requirement. Users can start using all accounts with just £1.

Moneybox Customer Service

As a genuine fintech company, Moneybox has an innovative approach to quality and customer care. If you need to contact the support team, you can chat with an agent through the Moneybox app or you can contact them by email or phone. Keep in mind that the Moneybox support team is available 7 days a week between 9-5:30 pm GMT. On top of that, the FAQ section is the go-to destination for finding answers to specific questions about their product.

Is Moneybox Safe?

Moneybox is authorized and regulated by the Financial Conduct Authority (FCA) under reference number 792703 (the firm is registered under Digital Moneybox Limited). This means that Moneybox must comply with the regulator’s requirements including the protections of clients’ funds. As such, Moneybox is also a member of the Financial Services Compensation Scheme (FSCS) which gives any investor protection of up to £85,000.

If you have concerns about your privacy at Moneybox, it uses 256-bit TLS encryption to protect your personal information and claims to never share your details with third parties without users’ consent.

How to Use the Moneybox App

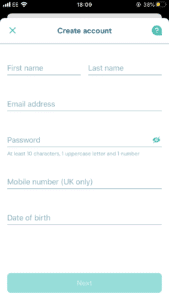

Our Moneybox app review found that opening an account with Moneybox is extremely simple and is done on the mobile app. In this section, we’ll walk you through the process to set up an account at Moneybox.

Step 1: Download and Install the Moneybox AppFirst, visit the Moneybox website and click on the ‘Get App’ button, or search for the app on the Google or Apple store.

Step 2: Open an AccountOnce the app is installed, you will then need to enter your personal information including your National Insurance number and then insert your bank account details in order to set up a direct debit. You will also be asked to verify your email and use a five-digit pin created by Moneybox in order to get access to your account.

Step 3: Select the Account Type and Deposit FundsOn the next step, you’ll have to decide the type of account you wish to begin with and then add funds. If opting for the Stocks and Share ISA account, you’ll then have to decide the starting option based on the risk level – Cautious, Balanced, and Adventurous. Bear in mind that you can start investing with as little as £1.

Moneybox Stock App Pros & Cons

Below you will find an overview of our Moneybox stock app findings.

Pros

- Excellent user interface – Easy to use

- Provides different allocations of a range of tracker funds based on risk

- Safe and regulated by the Financial Conduct Authority (FCA)

- Suitable for beginners

- Offers many rewards opportunities

- A wide range of saving and investing account types

- Offers plenty of educational resources

Cons

- A limited selection of markets and products

- Fixed monthly fees

The Verdict

In summary, Moneybox offers a great solution for long-term conservative investors or savers who are looking to put money in a saving account. Simply put, the Moneybox investment app makes it easy for anyone to start saving and investing funds via a simple to use and extremely innovative mobile app.

The bottom line, MoneyBox is known as one of the UK’s most exciting startups companies, and for a good reason – it actually provides a new modern way of money management.

FAQs

Is Moneybox available in the US?

No, Moneybox is not available in the United States and other regions in the world. In fact, the Moneybox app is only currently available in the United Kingdom.

What stocks does Moneybox offer?

Moneybox offers a huge selection of US and UK shares via its tacker funds that includes Microsoft, Facebook, Netflix, Disney, Nintendo, Apple, L’Oreal, Amazon,and many more.

Can you short-sell stocks on the Moneybox app?

No, unfortunately you will not be able to short sell stocks on the Moneybox app. If you are looking for a trading platform that allows you to short sell shares and other financial instruments, we suggest checking out eToro.

Is Moneybox regulated?

Yes, Moneybox is authorized and regulated by the FCA in the United Kingdom. It is also a member of the government’s Financial Services Compensation Scheme that protect clients funds up to a limit of £85,000.

Is Moneybox available on iOS?

Yes, Moneybox mobile application is available on both iOS and Android for UK residents.

Tom Chen

Tom Chen

Tom is an experienced financial analyst and a former grains derivatives day trader specializing in futures, commodities, forex, and cryptocurrency. He has over 10 years of experience in the Finance industry spanning across a day trader position at Futures First, and a web content editor and writer at FXEmpire. Tom has has also written for The Motley Fool, FX Empire, Yahoo Finance InsideBitcoins, and Learnbonds.View all posts by Tom Chenstockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2026

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up