Stock Market Calculator

Our stock market calculator is a great way to work out how effective a long-term investment strategy can be. If anything, it acts as a motivator to ensure you stay on track with your financial goals. After all, investing in the stock markets should be viewed as a long-term endeavour as opposed to a short-term money-making solution.

All you need to do is enter the size of the lump sum that you plan to invest alongside your projected annual yield. By then entering the number of years that you plan to keep your stock position open – you can get an estimation as to what your lump-sum will be worth in the future.

How to Use our Stock Market Calculator

First and foremost, it is important to note that our stock market calculator should be used with caution. That is to say, one variable in particular – the rate of return, cannot be predicted with any certainty. On the contrary, there is no knowing how your stock market investments will perform in the coming years.

Nevertheless, here’s how to use our stock market calculator.

Starting Investment

This is simply the amount that you are planning to invest as a lump sum. For example, if you are planning to invest $5,000 – enter this into the respective box.

Note: Although our stock market calculator is denominated in US dollars – you can use it with any currency. The outcome will be exactly the same. For example, if you plan to invest £1,000 GBP – just enter 1,000 into the box. Although the total return figure will be displayed in dollars, the figure will be the same for GBP (or whichever currency you opt for).

Number of Years

This is the number of years that you plan to keep your stock investment. In other words, you won’t be looking to touch any of your shares throughout this period. As a rule of thumb, you should aim to keep your shares for at least five years. This will allow you to ride out the ups and downs of the financial markets.

Rate of Return

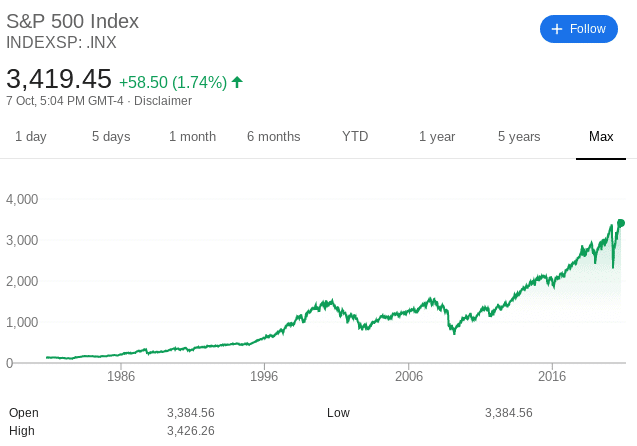

This is the most difficult variable of our stock market calculator. As noted above, this is because there is no way to be 100% sure what your stock investments will return in your stated period. With that being said, the most reliable way to obtain this figure is to assess the average annualized return of your chosen stock market since it was incepted.

For example:

- As of Q2 2020 – the FTSE 100 has returned average annualized gains of 7.75% since its inception.

- Since the S&P 500 was launched in 1926 – it has returned average annualized gains of just over 10%

You can easily invest in either of the above index funds via an ETF on the eToro app – commission-free. For those unaware, the FTSE 100 represents the 100 largest companies listed on the London Stock Exchange. The S&P 500, on the other hand, represents 500 large-cap companies listed on the US stock markets. In both cases, you are investing in a highly diversified portfolio of shares – which is ideal for a long-term financial plan.

Stock Market Calculator Examples

So now that you know how to use our stock market calculator, we are now going to give you a couple of real-world examples. To keep things consistent, we’ll use the average annualized returns of both the FTSE 100 and S&P 500.

FTSE 100

- If you invest an initial lump of $5,000 into a FTSE 100 index over 20 years – and it continues to return an average of 7.75% per year – our stock market calculator gives us a final balance of $22,228.

- Of this figure, $17,228 is your financial gain.

S&P 500

- If you invest an initial lump of $5,000 into an S&P 500 index over 20 years – and it continues to return an average of 10% per year – our stock market calculator gives us a final balance of $33,621.

- Of this figure, $28,621 is your financial gain.

Note: If you were to create a long-term dividend reinvestment plan – the financial gains in the above examples would be even higher. This is because you will be reinvesting dividend payments back into your chosen index as and when they arrive. We explore the effects of compound interest in more detail below.

Making Money from Stocks – Explained

There are two fundamental ways that you can make money when trading and investing on stock apps. Firstly, capital gains – which is when you sell your stocks for more than you originally paid. Secondly, you can make money through dividends – which is when companies share some of its profits with stockholders. As we explain shortly, these two revenue streams can be further amplified through the impact of compound interest.

Capital Gains

Most investors focus on capital gains – as this presents the greatest upside potential from a stock investment. Put simply, when you sell a stock for more than you paid, this is known as capital gains. It’s simply the difference between the buy and sell price of the stock, multiplied by the number of shares that you sold.

For example:

- Let’s say that you buy 1,000 shares in leading pharmaceutical company AstraZeneca

- At the time of the purchase, the shares were priced at $4 each. This takes your total investment to $4,000

- 10 years later, AstraZeneca shares are worth $12 each

- You are happy with your gains so you decide to sell the shares

- On each share, you made a profit of $8 ($12-$4). Multiply that by 1,000 shares and your total profit is $8,000

As per the above, your capital gains amount to $8,000. This is because you originally invested $4,000 and sold the shares for $12,000 five years later. Depending on your location – you might need to pay capital gains tax on the profit.

Dividends

Most companies on major stock markets like the NYSE, NASDAQ, and London Stock Exchange pay dividends. This is where the company shares some of its profits with stockholders. If the company is a dividend payer – then it usually releases a payment every three months.

In most cases, the size of the payment will reflect the wider performance of the company. That is to say, if the company is performing well, then in theory, the size of the dividend payment should follow suit.

At the other end of the spectrum – a company that isn’t performing as well as it had hoped might decide to cut – or outright suspend its dividend policy. This became evident this year in the midst of the coronavirus pandemic – where heaps of large-cap stocks either cut or suspended their dividend payments.

Here’s an example of how you can make money from dividends:

- You own 500 shares in Exxon Mobil Corporation

- In Q1 – the firm pays a dividend of $0.60 per share

- This means that you will receive a payment of $300 (500 x $0.60)

- All being well, you will receive an additional dividend payment in Q2 (and each quarter thereon)

Dividend yields – which refers to the amount you receive in relation to your investment, can vary widely in the stock markets. To give you a ballpark figure, FTSE 100 companies pay an average yield of between 4-5% per year.

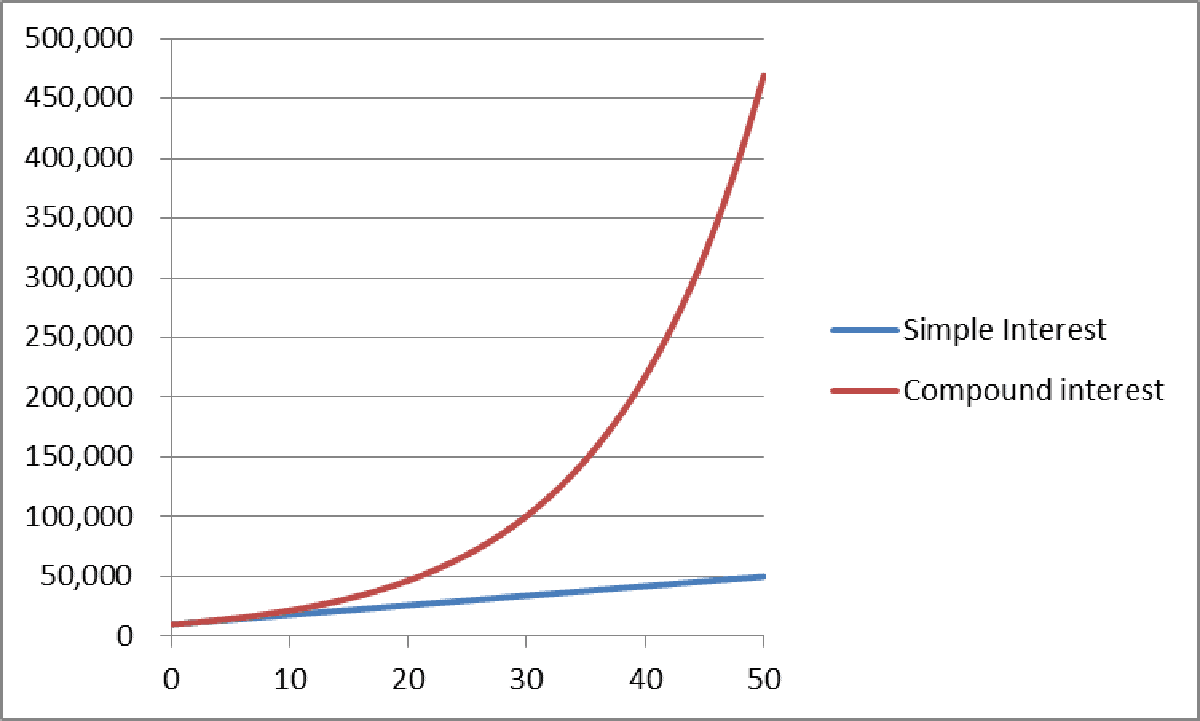

Compound Growth

As we briefly alluded to earlier, compound growth (often referred to as compound interest) allows you to grow your money faster. This is because you will be reinvesting your dividend payments as soon as you receive them.

In doing so, you will effectively be earning interest on the interest you stand to make in the future. This is because you will be buying more shares (or investing more into an ETF/mutual fund) with the dividends you receive.

- For example, let’s suppose that you invest $10,000 into the FTSE 100

- At the end of year one, you receive 10% in dividend payments

- On a total investment of $10,000, this works out at $1,000

If you were to invest that $1,000 back into the FTSE 100 – you would now have a total investment of $11,000

- Assuming that at the close of year two you also receive a further 10% in dividends, this would amount to $1,100

- As you can see, this is $100 more than you would have received had you withdrawn the dividends

The longer the above process is repeated, the faster your money can grow