How to Day Trade Crypto – Essential Tips

Among the traditional markets, including the forex and stock markets, day trading is one of the most popular trading styles. The cryptocurrency market, however, is becoming increasingly popular for day traders due to its lucrative opportunities.

Read our guide and start using this trading style in your trading strategy if you want to learn how to day trade Crypto.

-

-

Introduction to Day Trading

What is Day trading?

The concept of day trading refers to a short-term trading strategy in which individuals purchase and sell financial assets on the same day. Day traders seek to profit from the market’s volatility within one trading session by exploiting small price movements. Day traders often use technical analysis, charts, and various indicators to make quick decisions about when to enter and exit positions. As a result, some traders use strategies like scalping and momentum trading to make quick, small profits.

Day trading differs in several ways from other trading strategies, such as swing trading or long-term investing. First, traders must constantly monitor their positions throughout the day, which requires high attention and concentration. In day trading, multiple trades are often made daily, which can increase transaction costs and have tax implications. Moreover, day traders must have strict risk management strategies due to day trading’s focus on short-term price fluctuations. Long-term investing involves buying and holding assets for a long time rather than holding positions for a few days or weeks, as swing trading does. A less active role is usually required in these strategies, and the risk-return profile differs.

Why Trade Cryptocurrencies Specifically?

The following are some of the benefits of day trading cryptocurrencies:

- Volatility: Cryptocurrencies are among the most volatile assets in the financial markets. Day traders can profit from both upward and downward price movements due to this volatility, which can cause frequent and significant price fluctuations within a single day.

- 24/7 Market: Trading activities can be carried out anywhere, even on weekends and holidays, on cryptocurrency markets, unlike traditional stock markets. This constant availability can be advantageous for those who prefer flexible trading hours.

- Liquidity: There is typically a large volume of trading activity among major cryptocurrencies like Bitcoin and Ethereum. Trading positions can be entered and exited quickly without affecting market prices significantly because of this liquidity. Be sure to use the best Bitcoin apps to start trading it.

- Accessibility: Several cryptocurrency exchanges have low entry barriers, making cryptocurrency markets accessible to a global audience. As a result, day traders with limited capital can start day trading cryptocurrencies more easily. In addition, those who prefer a more independent investment can try the best DeFi apps in crypto.

- Low Barriers to Entry: Cryptocurrency day trading has relatively low entry barriers compared to traditional financial markets. Exchanges offer user-friendly interfaces and don’t require substantial capital to get started.

- Diversification: Diversifying a trading portfolio with cryptocurrency is possible. Traders who hold stocks, forex, or other assets can benefit from their low correlation with traditional assets.

- Technological Tools: To make quick decisions and execute trades more efficiently, cryptocurrency day traders use advanced trading tools, bots, and technical analysis software.

Setting Up Your Trading Environment

Choosing a Reliable Cryptocurrency Exchange

When it comes to day trading, selecting a reliable cryptocurrency exchange is crucial because it directly impacts the security of your funds, how your trades are executed, and your overall trading experience. Ensure the safety of your assets with robust security measures provided by a reputable exchange. In the highly volatile cryptocurrency market, it also provides fast and reliable order execution. Traders can also enter and exit positions with minimal price impact when trading on reliable exchanges due to their high liquidity. A day trader may be prevented from making profits if they use unreliable or unregulated exchanges because of security breaches or operational issues.

Select the Right Trading App and Tools

Choosing the right app and tools in day trading is paramount to successfully analyzing markets, executing trades, and managing risk. The best crypto apps with robust features provide real-time market data, advanced charting, technical indicators, and order types, which help traders make informed decisions. Trading tools such as stop-loss orders and risk management features are essential for limiting potential losses. Due to the fast-paced nature of day trading, the app’s speed and reliability allow you to take advantage of short-lived opportunities. To be successful in day trading, you need the right app and tools, but selecting the wrong ones could result in missed trading opportunities, suboptimal execution, and increased risk.

Ensure Fast and Stable Internet Connectivity

You need fast and reliable internet connectivity to execute timely and accurate trades. Momentary interruptions or slowdowns in the internet can result in missed opportunities, delayed order execution, or costly errors in day trading. To be successful in day trading, a stable internet connection is essential for reacting quickly to market movements, placing orders as needed, and maintaining control over your trading activities.

Technical Analysis

Key Technical Indicators

Day traders must understand key technical indicators such as RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Moving Averages to understand market trends and trading opportunities better. A brief explanation of these indicators follows:

RSI (Relative Strength Index):

- An indicator such as the RSI determines whether a price has overbought or oversold conditions based on the magnitude of recent price changes.

- When the RSI is above 70, the asset may be overbought, signaling a price reversal.

- In contrast, an RSI below 30 indicates an oversold asset, potentially signaling a price recovery.

- RSI is often used as a confirmation indicator in conjunction with other indicators.

MACD (Moving Average Convergence Divergence):

- It is a trend-following momentum indicator consisting of two lines: the MACD line and the Signal line.

- MACD lines crossing above Signal lines suggest upward momentum, regarded as bullish.

- When MACD crosses below the Signal, a bearish signal appears, indicating possible downward momentum.

- Additionally, MACD can detect divergences between momentum and price, which may indicate reversals.

Check our full educational guide about what the MACD indicator is. You will understand more about its importance in the technical analysis.

Moving Averages:

- Traders can identify trends using Moving Averages, which smooths out price data over a specified period.

- A Simple Moving Average (SMA) calculates the average closing price over a specified period.

- A more responsive indicator of current market conditions is the Exponential Moving Average (EMA).

- It can detect trend changes by crossing over shorter and longer-term moving averages.

- As moving averages approach, prices often react when they approach these levels, acting as support or resistance.

Check our full educational guide about what are moving averages in trading. You will understand more about its importance in the technical analysis.

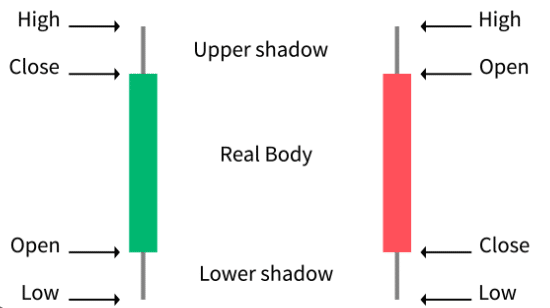

Candlestick Patterns for Entry and Exit Signals

Day traders use candlestick patterns to make entry and exit decisions in cryptocurrency day trading. Master common candlestick patterns like dojis, hammers, and engulfings to understand how the market feels. It is recommended to use these patterns in conjunction with various timeframes, especially shorter ones like 1-minute or 5-minute charts, which are more suitable for day trading.

Take note of relevant candlestick patterns on your cryptocurrency price chart as possible trade signals. The reliability of your decisions will increase if you confirm these signals with other technical indicators such as RSI, MACD, or moving averages.

Trade with discipline, use risk management tools such as stop-loss orders and establish clear entry and exit points. Candlestick patterns can be used successfully for cryptocurrency day trading when learning, adapting, and managing risks prudently. In addition, use one of the best day trading apps to implement candlestick patterns properly.

Identify Support and Resistance Levels

You can make informed decisions on entry and exit when identifying support and resistance levels for day trading cryptocurrency. Here are some tips for identifying them effectively:

- Analyze historical cryptocurrency price data on your chart. The price should be examined for significant price points where the price has repeatedly reversed direction, either up or down. These are potential resistance and support levels.

- Identify swing highs (peaks) and swing lows (valleys) on the chart. Swing highs often set resistance levels, while swing lows usually set support levels.

- There is a psychological effect on cryptocurrency markets due to round numbers (for example, $10,000, $50,000). Due to their psychological significance, these levels often serve as strong support and resistance.

- As support and resistance levels, moving averages, especially longer-term ones like the 50-day and 200-day moving averages, can act dynamically.

- Connect consecutive swing highs and lows with trendlines. These trendlines can serve as dynamic support and resistance levels in trending markets.

- Be aware of the trading volume at certain price levels. It can indicate strong support or resistance at a price level if a high trading volume exists.

- Based on the previous day’s price data, pivot points can identify support and resistance levels for the current trading day.

- The 38.2%, 50%, and 61.8% Fibonacci retracement levels are often used to identify support and resistance zones.

- Observe market sentiment and news. Sudden news events can trigger price reactions at key levels.

Fundamental Analysis for Crypto

Research and Analyze Cryptocurrency Projects

Cryptocurrency investment decisions are heavily influenced by fundamental analysis. The feasibility, market potential, technology, team, and tokenomics of cryptocurrency projects must all be researched and analyzed. The real-world applications of a project, the support of the community, compliance with regulatory laws, security, and economic trends are critical to its success. In the volatile cryptocurrency market, it aids in making informed decisions and managing risks effectively by distinguishing between promising projects and potential pitfalls. Proper decision-making requires thorough fundamental analysis in an environment characterized by innovation and speculation.

Stay Informed about News and Events that Can Impact Prices

Successful cryptocurrency trading and investing requires staying informed about news and events that can impact cryptocurrency prices. There is great sensitivity to breaking news, regulatory changes, technological developments, and macroeconomic developments regarding cryptocurrencies. Investors and traders can make better decisions, reduce risks, and seize opportunities by staying up-to-date with this information. This is relevant when checking the best crypto presales on the market. You must stay informed about all aspects of the rapidly evolving cryptocurrency landscape, whether it’s government regulations, security breaches, adoption by major companies, or market sentiment shifts, to maximize your chances of profitability.

Fundamental Analysis with Technical Signals

In cryptocurrency trading, it is beneficial to integrate fundamental analysis with technical signals. Moving averages, RSI, and candlestick patterns give traders a holistic view of market dynamics by combining a project’s underlying strength and market potential with technical indicators. The fundamental analysis provides information about the “what” (the quality of the project), while the technical analysis provides information regarding the “when” (the entry and exit points). The RSI may indicate a buying opportunity for a fundamentally strong project if it shows oversold conditions. In addition to aligning with the project’s fundamentals and short-term price trends, this synergy helps traders make better trading decisions.

Trade Planning and Management

Setting Clear Profit Targets and Stop-loss Levels

Trade planning and management in cryptocurrency day trading require setting clear profit targets and stop-loss levels. Technical analysis should be used to determine profit targets, considering key resistance levels, historical price data, and market sentiment. Targets are price points at which you plan to exit a trade and take profits. You should also define a stop-loss level to limit potential losses by exiting a trade at that price. Trading strategies and risk tolerance should be considered when selecting stop-loss levels, which are often placed below technical support levels.

In volatile price swings, traders should avoid making emotional decisions to effectively implement their profit targets and stop-loss levels. These predetermined levels assure a structured and methodical approach to cryptocurrency day trading, which helps maintain discipline, manage risk, and protect capital.

Properly Sizing Your Positions to Manage Risk

Effective risk management in cryptocurrency day trading requires proper sizing of your positions. You should generally risk no more than 1% to 3% of your total trading capital on each trade. The risk percentage, the entry price, and the stop-loss level determine the position size. If the trade goes against you, you will be protected from a substantial loss, preserving your capital for future trades. In addition, you may need to trade smaller positions when dealing with more volatile cryptocurrencies.

Do not allocate too much capital to one trade. Instead, diversify your portfolio. The impact of potential losses on your portfolio is reduced when you spread your risk across multiple positions. Long-term success in cryptocurrency day trading requires consistent application of position sizing principles and disciplined risk management.

Trailing Stops to Maximize Gains

Utilize trailing stops effectively in cryptocurrency day trading to maximize profits. Set a trailing stop order below the current market price after entering a profitable trade. Trailing stops automatically adjust as the price rises to maintain a set distance below the highest price reached (such as a fixed percentage). If the market reverses, you can capture significant gains during favorable price movements while protecting profits. When market conditions change, trailing stops help you maximize gains and minimize losses as you ride the uptrend.

Timing and Order Types

Market Orders vs. Limit Orders

Choosing between market orders and limit orders in cryptocurrency day trading depends on timing and strategy. An order placed on the market will be executed at the current market price, allowing for immediate execution, but it may be at a different price from the last traded order. Timing is crucial in fast-moving markets. On the other hand, a limit order allows you to set a specific price to purchase or sell at. However, it does not guarantee immediate execution. Still, it gives traders more control over the price. It is often used during low volatility or when employing specific strategies, such as scalping or swing trading, to enter or exit positions at a specific price. You can use market orders for quick execution or limit orders for price precision, depending on your trading style and objectives.

The Importance of Timing in Day Trading

A day trader’s understanding of timing is crucial. The precise entry and exit timing in this fast-paced environment can decide profit or loss. For traders to identify the best timing for their trades, various factors must be considered, including market volatility, news events, and technical indicators. By using effective timing techniques, traders can minimize exposure to risk and maximize opportunities, allowing them to take advantage of short-term price movements and make the most out of their day trading strategies.

Navigating High Volatility Periods

Day trading requires the ability to navigate high-volatility periods. A rapid and unpredictable fluctuation in cryptocurrency prices can occur during these times. To avoid impulsive decisions, successful traders set tighter stop-loss orders to manage risks, stay informed about market news that could trigger volatility, and maintain discipline when dealing with market news. When markets are volatile, it’s important to have a well-defined strategy and risk management plan to survive and thrive.

Managing Risks Effectively

Diversifying Your Trading Portfolio

Spreading risk in cryptocurrency day trading requires diversifying your trading portfolio. Multi-asset trading reduces the impact of potential losses on your capital by not focusing solely on one asset. You can enhance your chances of long-term success by diversifying your investments against the volatility and uncertainty inherent in cryptocurrency markets.

Avoiding Over-leveraging and Managing Margin Responsibly

The key to preventing substantial losses in cryptocurrency day trading is to avoid over-leveraging and manage margins responsibly. If prices move against your position, excessive leverage can lead to margin calls and liquidation. In volatile market conditions, if you manage margin responsibly and do not overextend your positions, you can increase your chances of long-term profitability by reducing the risk of wiping out your trading capital.

Dealing with Losing Trades and Minimizing Potential Losses

Cryptocurrency day trading requires minimizing potential losses and dealing with losing trades. The ability to accept losses and implement stop-loss orders helps limit the impact of unfavorable market movements, preserving your trading capital and avoiding catastrophic losses that can lead to derailment of your trading career.

Embracing the Psychology of Trading

Controlling Emotions

To successfully trade cryptocurrency, it is essential to embrace the psychology of trading, particularly in controlling emotions like fear and greed. As a result of fear, traders may make impulsive decisions, such as exiting positions prematurely or avoiding taking calculated risks. Alternatively, greed may lead to overtrading and ignoring risk management, resulting in significant losses. To make rational decisions, traders must maintain emotional discipline, set stop-loss orders, and keep track of their trades. Cryptocurrency markets are highly volatile and emotionally charged, so consistency is essential.

Practicing Discipline and Patience in Your Trading Decisions

Managing your trading decisions with discipline and patience is essential in cryptocurrency day trading. Discipline prevents impulsive actions driven by emotions by adhering consistently to your trading strategy and plan. You can avoid premature trade entry by patiently waiting for favorable setups and confirmatory signals. Both qualities in the fast-paced and often unpredictable cryptocurrency markets enhance your ability to manage risk, make better decisions, and improve your chances of achieving profitable outcomes.

Maintaining a Trading Journal

Cryptocurrency day traders need to maintain a trading journal. In addition to recording and analyzing your trades, it allows you to document entry and exit points, the reasons behind the trade, and what happened. By reviewing your trading journal frequently, you can identify weaknesses and strengths in your strategy and improve it continuously. Tracking patterns of successful and unsuccessful trades and refining your techniques can improve your overall performance.

How to Day Trade Crypto? – Conclusion

The thrilling world of cryptocurrency day trading comes with enticing benefits and lurking risks. On the upside, traders seeking substantial profits within one day are attracted to this volatile market because of the potential for rapid gains. Cryptocurrency markets are available 24/7, accessible to global traders, and offer diversification opportunities. Technical and fundamental analysis can also be combined to craft well-informed trading strategies.

Great opportunities, however, come with great risks. In addition to presenting profit opportunities, volatility can also cause significant losses. A lack of proper management of emotions such as fear and greed can be detrimental. Furthermore, cryptocurrency markets are unpredictable and lack regulation, which exposes traders to fraud and manipulation. Day trading cryptocurrency requires balancing calculated risk with disciplined, data-driven decision-making. The key to unlocking the full potential of this exciting yet treacherous industry is diligent research, prudent risk management, and continuous learning.

FAQs

Is it possible to day trade Crypto?

Yes, it is possible to day trade cryptocurrencies. A day trader capitalizes on short-term price fluctuations by buying and selling crypto assets simultaneously.

Is it profitable to day trade crypto?

Some traders make money trading cryptocurrencies daily, but it is important to note that a significant risk is involved. An effective trading strategy, skill, and risk management capability determine a trader’s profitability. A well-researched approach and preparation for potential losses are crucial for traders who experience both gains and losses. Crypto day trading success often requires combining technical and fundamental analysis, disciplined execution, and continuous learning.

Can you make $1000 a day trading Crypto?

If you choose the right exchange, use the right trading strategies, and trade crypto on a volatile market, you’re likely to make $1000 every day. The opportunities are limitless if you possess the necessary knowledge and mindset. Stay disciplined and keep learning!

What is the best way to day trade crypto?

Combining thorough research with a well-defined strategy is the best way to trade crypto day. Identify entry and exit points using technical and fundamental analysis. Establish strict stop-loss and take-profit orders for risk management. Keep your skills and knowledge up-to-date, practice discipline, and avoid emotional trading.

Jhonattan Jiménez

English Language professional with a vast experience teaching English as a second language, English translator to Spanish, Cryptocurrency enthusiast, interested in geopolitics and economy.View all posts by Jhonattan Jiménez

stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2026