7 Best AI Stock Picking Services And Software for 2026

This article reviews the top AI stock-picking services available in 2026. We evaluated each service based on its track record, transparency, price, asset coverage, and features. Our rankings highlight the best AI stock pickers for every type of investor, from beginners to active traders. While AI stock picking has limitations, these services can generate valuable insights and ideas much faster than traditional methods.

By combining human discernment with the processing power of AI, investors can make more informed decisions and save time. Whether you’re looking for long-term portfolio picks or short-term trade signals, this guide explores the leading AI stock-picking options for 2026.

-

- AltIndex: The Best AI Stock Picking Software for Stock Investors

- Danelfin: Best AI Stock Picking Service with Explanations

- Candlestick.ai: The Best AI Stock Picking Software for Candlestick Patterns

- Trade Ideas: The Best AI Stock Picking Software for Stock Trading Simulation

- Tickeron: The Best Fully Automated Stock AI Picking Software for Trading Strategies

- Kavout: The Best AI Stock Picking Software for Long-term Portfolio Management

- TrendSpider – Best AI Stock Picking Service For Technical Analysis

- Comparison of the 7 Best Stock Picking Services

-

-

- AltIndex: The Best AI Stock Picking Software for Stock Investors

- Danelfin: Best AI Stock Picking Service with Explanations

- Candlestick.ai: The Best AI Stock Picking Software for Candlestick Patterns

- Trade Ideas: The Best AI Stock Picking Software for Stock Trading Simulation

- Tickeron: The Best Fully Automated Stock AI Picking Software for Trading Strategies

- Kavout: The Best AI Stock Picking Software for Long-term Portfolio Management

- TrendSpider – Best AI Stock Picking Service For Technical Analysis

- Comparison of the 7 Best Stock Picking Services

-

The Top AI Stock Picking Services Ranked

The AI stock-picking sector has exploded with new services and models. We researched and ranked the leading AI stock-picking services based on performance, features, and cost. They are as follows:

- AltIndex leads our list as the best AI stock-picker overall. This service analyzes alternative datasets and social media sentiment to generate stock ratings and identify hidden opportunities. AltIndex is affordable, easy to use, and supports stocks and cryptocurrencies. Its unique approach to leveraging AI for social analytics gives it an edge.

- Danelfin: This platform offers detailed explanations behind each recommendation, appealing to investors who want to understand the logic. Danelfin’s models utilize hundreds of technical, fundamental, and sentiment indicators. It covers US and European stocks and ETFs.

- Candlestick.ai: This stock-picking service secures the third spot with its smartphone-only app. At just $7 per month, it provides weekly stock picks filtered to each user’s preferences. Alerts come with earnings data and entry prices for easy execution.

- Trade Ideas: This platform makes the list for active traders needing real-time scans, alerts, and automated signals to pinpoint setups. It has numerous AI strategies for picking stocks but is one of the priciest.

- Tickeron: This service fully automates stock-picking using fundamental and technical strategies. It covers other assets like crypto and forex and generates trading ideas and signals with entry, stop-loss, and take-profit levels.

- Kavout: The software focuses on long-term portfolio picks. It uses alternative data and machine learning algorithms and is tailored for large institutional investors and high-net-worth individuals. You must subscribe for at least $49 to use this service.

- TrendSpider uses AI to identify emerging technical trends in real-time. It is ideal for short-term traders who rely on technical analysis; it covers over 65,000 financial assets, including stocks, ETFs, and crypto. Also, it provides chart pattern recognition and trend analysis.

Best AI Stock Picking Services Reviewed

With AI stock-picking services proliferating, diving into comprehensive reviews is essential. This section will explore the features, advantages, and potential limitations of the seven best AI stock-picking services.

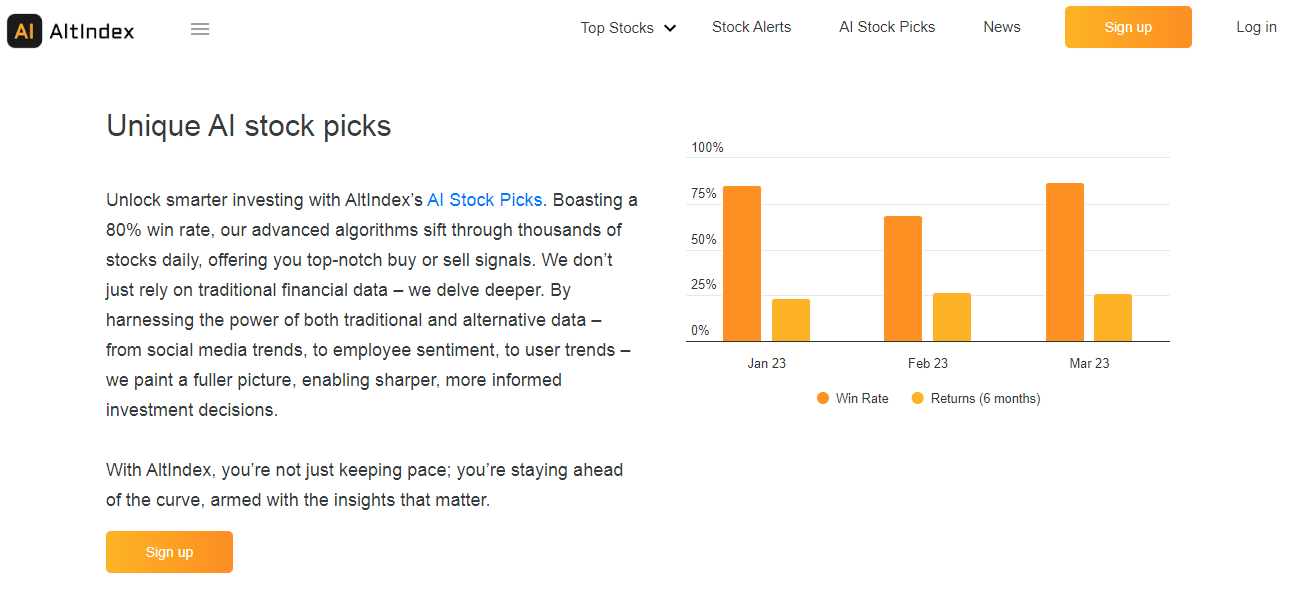

AltIndex: The Best AI Stock Picking Software for Stock Investors

AltIndex earns the top spot for its unique social media analytics approach to stock picking. This service utilizes natural language processing to track and analyze billions of data points across platforms like Reddit, Twitter, and StockTwits. The data is used to gauge sentiment and conversations around individual stocks.

It ingests vast amounts of unstructured text data and processes it with advanced machine-learning algorithms. By doing so, AltIndex can get a real-time pulse on investor buzz, interest, and emotions surrounding stocks. This provides valuable behavioral insights that traditional stock analysis apps might omit.

Powerful AI models combine this social sentiment data with other alternative data sets. That includes data on web traffic, job postings, and Google searches to generate actionable insights on thousands of stocks. AltIndex assigns each stock a proprietary rating from 0 to 100 based on evolving social sentiment, momentum, and quality metrics.

According to current market psychology, stocks rated over 70 have high upside potential, while those under 30 face headwinds and may underperform. Ratings and top-pick lists are continually updated as new data is analyzed.

Currently, AltIndex focuses primarily on U.S. stocks but also covers some widely discussed cryptocurrencies. With customizable alerts and clear buy/sell signals based on rating changes, the platform especially appeals to active traders seeking an edge. Pricing starts at just $29 per month for the basic plan.

Spec Overview Sentiments indicator It shows a graphical analysis of the average stock sentiment across social media Stocks predictor It analyzes market trends and financial statements to predict future stock prices Pros:

- Uses social sentiments to select stocks

- Affordable pricing

- Supports thousands of stocks and cryptocurrencies

- Users can receive stock alerts via email

- Easy to use for beginners

Cons:

- It does not cover other asset classes like ETFs and commodities

Danelfin: Best AI Stock Picking Service with Explanations

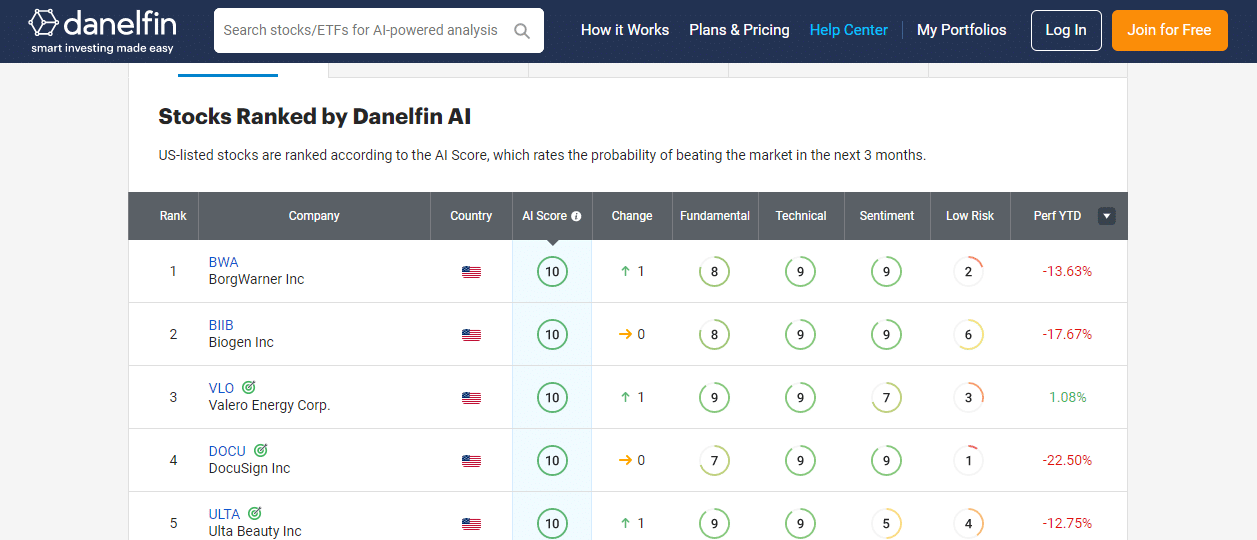

For those wanting more transparency, Danelfin is a top choice. This service delivers detailed explanations behind each recommendation, revealing the logic behind the AI’s picks. Danelfin specifically highlights which technical, fundamental, and sentiment indicators its proprietary machine learning models utilize to analyze and score individual stocks and ETFs.

Some examples of the hundreds of quantitative factors Danelfin examines include earnings growth, P/E ratios, profit margins, institutional ownership, short interest, etc. Investors can better evaluate these AI’s trading signals by comparing technical, fundamental, and sentiment metrics.

Danelfin also assigns a weighted AI score ranging from 1 to 10 for every stock and ETF it covers. The higher the score, the more significant the upside potential the AI predicts for that asset compared to the overall market. Scores are continually updated in real-time as new data is processed.

With customizable plans ranging from $17 to $49 per month, Danelfin offers an affordable solution. The wealth of quantitative data provided adds complexity for users to analyze. But for investors prioritizing education, transparency, and customization in an AI stock-picking service, Danelfin stands apart from the competition.

Danelfin’s strength lies in analyzing over 10,000 features daily to make its ratings. Each stock has over 900 indicators to provide robust analysis. These include technical, fundamental, and sentiment indicators.

Spec Overview Portfolio diversity score It tracks AI score changes for your assets, with daily alerts to help you improve Average AI score This feature averages the AI scores on your assets for easier comprehension Pros:

- Explains the process behind stock recommendations

- Uses hundreds of technical, fundamental and sentiment indicators for analysis

- Affordable with a free plan available

- Covers numerous US and European stocks and ETFs

- Allows users to track AI Scores of stocks in portfolios

Cons:

- A large amount of data generated can be overwhelming

Candlestick.ai: The Best AI Stock Picking Software for Candlestick Patterns

Candlestick.ai secures a top spot among AI stock pickers for its easy mobile accessibility and low price point. At just $7 per month, this service provides stock picks optimized for smartphone users. Candlestick.ai is only available via iOS and Android mobile apps.

The service leverages artificial intelligence specifically trained to recognize candlestick patterns in stock charts. These visual patterns can signal momentum shifts and trading opportunities. The AI processes real-time data on over 6,000 U.S. stocks to detect formations and technical indicators foreshadowing upside moves.

While Candlestick.ai offers daily picks, you can control what stock types you want to see. Whether you use the Android or iOS version, the platform is fully customizable.

The Candlestick Advisor is a yet-to-be-launched feature on the site. It will explain the AI picks and answer your questions using generative AI. The language model is built on GPT-4.

You can view the results of recent picks and analyze their entry and exit. Most importantly, this AI stock-picking software is easy to use. Combined with other investment apps, it could offer valuable AI-powered insights to build a portfolio.

Spec Overview Candlestick.ai Alert This feature provides notifications that contain quarterly earnings reports Pros:

- Very affordable at only $9.99 per month

- Optimized for mobile access via iOS and Android apps

- Provides three stock picks per week

- Covers over 6,000 US stocks

- Alerts include earnings data and recommended entry price

- It can filter AI picks based on preferences

- Simple and easy to use

Cons:

- Only available on mobile devices; no web access

- Focused solely on technical analysis

- Limited to US stocks

- Not ideal for investors wanting more in-depth analysis

Trade Ideas: The Best AI Stock Picking Software for Stock Trading Simulation

Trade Ideas is a robust AI stock-picking service tailored to active traders seeking an edge. With real-time scanning, alerts, and pattern recognition, the platform helps pinpoint opportunities across thousands of stocks. Trade Ideas stands out for its numerous proprietary AI strategies for selecting stocks.

The service provides trading signals, watch lists, risk management tools, and a stock trading simulator. Integration with leading brokers allows automated execution based on Trade Ideas alerts. While pricing starts at $84 per month, the platform is packed with features active traders need to capitalize on volatility.

Trade Ideas may overwhelm new investors with its complexity. But for technically skilled traders wanting reduced research time and enhanced risk management, Trade Ideas delivers. The AI capabilities and its arsenal of screening tools make it a top choice.

This platform can serve as a day-trading application thanks to its brokerage integrations.

Spec Overview Stock races This feature helps in identifying momentum Streaming alert This real-time scanner notifies you when an event changes Pros:

- Numerous stock-picking strategies for active traders

- Real-time scanning and alerts

- Automated trading integration with brokers

- Robust charting, screening, and risk management tools

Cons:

- Expensive subscription plans

- Complex platform with a steep learning curve

- It is overkill for casual investors just seeking a few picks

Tickeron: The Best Fully Automated Stock AI Picking Software for Trading Strategies

Tickeron stands out for its automated, AI-driven stock-picking and analysis approach. This service offers access to prebuilt strategies utilizing technical and fundamental factors to scan markets and generate actionable trading ideas. Tickeron’s algorithms evaluate thousands of stocks to identify opportunities in real time.

Once a trade meets the criteria defined in a selected strategy, Tickeron provides entry, stop-loss, and take-profit levels. This makes it easy for investors to execute. With diversified technical and fundamental strategies, customizable scanning, and transparent backtesting, Tickeron is ideal for investors seeking automation.

However, the platform’s complexity has a learning curve, and costs can add up at $90 per month. But for investors who want AI that continually generates informed trade ideas 24/7, Tickeron delivers.

Tickeron is one of the best AI stock-picking services for quick trading decisions. It is ideal for investors wanting automated analysis and signals.

Spec Overview Marketplace This feature allows you to view other people’s trades Stock portfolio wizard The feature uses algorithms to help you create a portfolio based on your investment criteria Pros:

- Automated scanning and trade signals

- Technical and fundamental strategies

- Transparent track record of strategies

- Customizable filters to hone ideas

- The service covers stocks, crypto, forex, and ETFs.

Cons:

- There is a steep learning curve for first-time users

- Expensive subscription pricing

- Strategies must align with the investing style

Kavout: The Best AI Stock Picking Software for Long-term Portfolio Management

Kavout is an AI stock-picking service tailored to institutional investors and high-net-worth individuals seeking long-term portfolio management. The platform utilizes alternative datasets and machine learning algorithms to generate automated stock portfolio recommendations designed to outperform the market.

Kavout offers model portfolios with varying risk levels and return objectives. The AI continually monitors and rebalances thousands of stocks to optimize the portfolio 24/7. With a monthly subscription of $49, Kavout provides a hands-off solution for large investors to simplify investing.

However, the high investment minimums put Kavout out of reach for most retail traders. And the black box approach provides little visibility into the AI’s logic. But for qualified investors wanting fully automated portfolio management, Kavout delivers.

Kavout fits in as a portfolio tracker, but its diagnosis and adjustment feature gives it an edge over others.

Spec Overview Portfolio Builder You can use popular weighting schemes to construct our portfolio Multi-factor screener This feature can select and rank stocks using five major features Pros:

- Fully automated, 24/7 portfolio rebalancing

- It supports long-term strategies ideal for buy-and-hold

- Covers thousands of US and Chinese stocks

- caters to large investors

Cons:

- High minimums beyond most retail traders

- Lacks transparency in the indicators used

- Expensive for smaller investors

- Limited customization or control

TrendSpider – Best AI Stock Picking Service For Technical Analysis

TrendSpider excels at helping short-term traders capitalize on emerging technical patterns and trends. This AI stock-picking service specializes in real-time pattern recognition across charts using machine learning and alternative data.

Ideal for momentum and breakout-style traders, TrendSpider identifies chart formations and signals opportunities. With robust screening tools to scan markets, traders can quickly find assets exhibiting bullish or bearish technicals. The AI recognizes candlestick patterns, chart patterns, and indicators signaling high-probability setups.

TrendSpider is best for experienced traders due to its advanced functionality.

Spec Overview Pattern Recognition It can quickly run up to six scans to spot trades that match your strategy SmartCharts It includes automated technical analysis Pros:

- Surface emerging chart patterns quickly

- Real-time screening for technical setups

- Covers thousands of stocks, forex, and crypto

- Ideal for short-term momentum trading

Cons:

- Complex tools demand technical skills

- Expensive subscription plans

- Not ideal for long-term investing

- Focused solely on technical analysis

Comparison of the 7 Best Stock Picking Services

Here is a table comparing the best AI stock picking services:

AI Stock Picking Service Asset Classes Supported Price AltIndex Cryptocurrencies and Stocks $29 and $99 per month Danelfin Stocks and ETFs $17 and $49 per month Candlestick.ai Stocks $7 per month Trade Ideas Stocks $167 and $84 per month Tickeron Stocks $90 per month Kavout Stocks $49 per month TrendSpider Stocks, ETFs, ETNs, and cryptocurrencies. From $39 per month How do AI Stock Picking Services Work?

AI stock-picking services utilize advanced algorithms and models to analyze data and identify potentially profitable trades and investments. These services gather vast amounts of market data, process it using techniques like machine learning, and generate insights and recommendations for investors.

This section will explore how AI stock pickers work in more depth with this step-by-step approach:

Data Gathering and Processing

The first step for AI stock-picking services is gathering data from diverse sources. This includes fundamentals like financial statements, earnings reports, and filings. They can also utilize pricing, news, macroeconomic data, and alternative data like social media sentiment.

Powerful computers ingest these massive, disparate datasets and process them using natural language processing to handle unstructured text data. Machine learning algorithms then detect patterns and relationships between data points humans can’t easily spot.

Neural networks help uncover nonlinear interconnections and train predictive models. Backtesting on historical data validates the patterns discovered by AI algorithms. By combining fundamentals, sentiment, technicals, and alternative data, AI services gain a more complete, predictive view of markets.

The massive data processing capabilities of AI far surpass human limits. This allows stock-picking services to continuously analyze the torrent of available data to gain an informational advantage over traditional methods. Advanced AI techniques help transform raw data into informed, actionable insights.

Identifying Patterns and Opportunities

A key advantage of AI stock-picking services is identifying patterns, relationships, and opportunities in data that humans cannot detect easily. The algorithms are designed to find hidden correlations and trends that signal trading or investing potential.

For example, machine learning models can uncover links between earnings reports, news events, web traffic, and price movements. The AI may recognize chart patterns like heads and shoulders or flags that typically foreshadow bullish or bearish breakouts. In addition, the algorithms can forecast future price action and overall market direction by processing millions of data points.

The best AI stock-picking services generate trading signals like buy, sell, or hold recommendations. These actionable ideas help investors capitalize on the patterns and relationships uncovered by the AI models. The algorithms also quantify their confidence in each pattern they detect, assisting investors in evaluating trade certainty.

Ranking and Rating Stocks

To assist with decision-making further, AI stock pickers use the patterns, correlations, and insights they generate to score and rank stocks. Stocks are programmatically assigned ratings or grades based on their expected performance.

Factor models weigh multiple data points, like earnings growth, sentiment, quality, value, momentum, technicals, etc., to derive an overall AI ranking. Investors can sort and filter the ranked stocks to identify the most promising candidates.

Some services rate stocks on a simple scale, like 1–10 or 1–5. Others use more granular 100-point or letter-grade systems.

The quantitative AI ratings allow easy comparison of investment prospects. As new data emerges, stock ratings update in real time.

By combining the scoring capabilities of AI with investor filters and preferences, stock-picking services enable efficient screening and discovery of stocks with high upside potential. AI eliminates emotion and bias from the analysis.

Delivering Insights to Investors

Once AI stock-picking services generate data-driven insights, they deliver actionable recommendations to investors through user-friendly interfaces. Investors can access computer-generated buy/sell signals, daily stock picks, model portfolios, and updates on demand via web and mobile apps.

To enable quick execution, many services offer real-time trade alerts that notify users when a new opportunity arises. Investors can customize the platform to align with their strategy, asset classes, and risk preferences. As the algorithms process new data, they update ratings and rebalance portfolios as markets evolve.

Some platforms allow easy automated trading by integrating with leading online brokerages. Rather than manually implementing each signal, investors can directly execute the AI-generated trades through linked brokerage accounts. This hands-free approach allows seamless activation of data-driven picks and strategies.

In summary, AI stock-picking services leverage potent data processing capabilities to uncover hidden insights faster than humans can alone. These platforms can identify opportunities and guide data-driven investing by combining alternative data, fundamentals, technicals, and machine learning.

The Limits of AI Insights

AI has limits. Hence, prudent investors should view its recommendations through the lens of their analysis and risk tolerance. When used correctly, AI can enhance investment decision-making.

These AI software programs can be prone to errors, overfitting, and hacking. They are not magic bullets but require constant monitoring and evaluation. AI trading software also needs human supervision and intervention to ensure ethical and legal compliance.

Natural disasters can cause stock prices to fluctuate. Also, unseen world events, like wars, can affect the market. These events may be outside the predictive reach of AI models used for stock picking.

It is best to add alternative data services to your trading apps. They can provide news on events outside the range of most stock-pickers.

How to Pick an AI Stock Picking Service

Choosing the right AI stock-picking service takes research. You want a platform aligned with your goals and strategy. Here are key factors to evaluate:

Evaluate Performance & Approach

Choosing an AI stock-picking service starts with reviewing historical performance across bull and bear markets. The best services will have a multi-year track record of generating profitable recommendations through various cycles. Backtested and verifiable results help validate the accuracy of the AI models.

Look to understand the foundational investment strategy and indicators for stock selection. Algorithms based purely on technical analysis may perform differently than services focused on fundamentals or alternative data. Ensure the approach aligns with your philosophy and goals.

A blended methodology incorporating fundamentals, technicals, sentiment, quality, and alternative data provides a more complete analysis. Avoid black-box services that lack transparency in their selection process. The ideal AI clearly explains the key drivers behind its recommendations.

Evaluate how often recommendations are updated as well. Services that generate fresh ideas more frequently are better suited for active traders.

Meanwhile, those focused on long-term, buy-and-hold portfolios may trade less but still deliver value. Again, ensure alignment with your intended trading activity.

Risk Tolerance for Stock Investments

The use of AI in selecting stocks to buy or sell calls for risk tolerance. You must consider the terms of the trade and how much you are willing to risk. Tolerance often boils down to the following:

- How much you have to invest

- How long you have to invest

The more money you put in, the more risk you take. We recommend investing with your spare cash and not your entire income. Regardless of an AI stock-picking software’s success, investing with its predictions will always have risks.

Assess Platform Features & Ease of Use

Look at the breadth of assets the AI stock picker covers. Some focus solely on stocks, while others expand into ETFs, mutual funds, cryptocurrencies, and other alternatives. Broader coverage provides more opportunities. Evaluate if the assets match your needs.

Compare subscription costs in balance with the features provided. More expensive services often justify the price with added functionality for active traders. But casual investors may only require simple stock screens and essential educational resources.

Seek out platforms that make taking action on recommendations easy. Mobile apps, email and text alerts, and the ability to automate trading through brokerage integration increase convenience. Avoid pickers that seem overly complex or are challenging to navigate.

User experience should align with investor technical proficiency. Novices may prefer simpler interfaces with guided tutorials, while professionals desire more customizable tools. Evaluate the learning curve required.

Look for educational resources that help you interpret the AI’s outputs. Performance attribution, explanation of models, and transparency into selection factors enable better understanding. Don’t rely on “black box” systems entirely.

Test drive the interface through free trials. Hands-on experience lets you gauge the utility and convenience before subscribing. Determine if the platform seems intuitive or if usability issues exist.

Validate with Third-Party Reviews & First-Hand Experience

Look to third-party customer reviews and feedback for unbiased insights into AI stock-pickers’ real-world pros, cons, and performance. But beware of fake reviews and seek out honest, independent sources. Reddit, YouTube, and industry publications can provide helpful qualitative evaluations.

Take advantage of free trials that allow first-hand experience using the platforms before subscribing. Examine the layout, tools, asset coverage, alerts, and overall convenience. Develop an informed opinion by directly testing different services yourself.

When first using a new AI stock-picking service, invest smaller amounts as you gauge real-money performance. Limiting early risk lets you objectively evaluate accuracy and ROI before trusting the algorithms with more significant amounts of capital.

Let your direct experience guide which aspects and platforms fit your investing needs, philosophy, and style. It’s possible that an AI picker that other people rate highly won’t meet your needs. Hands-on use lets you determine where human discernment must override machine intelligence.

By combining extensive due diligence with your own user experience, you can identify the top AI stock-picking services providing the best opportunities for your situation. Don’t rely on claims alone; validate through verified history, reviews, and first-hand testing.

Tips on Getting the Most from the Best AI Stock-Picking Services

The following are tips and considerations to get the most out of AI stock-picking software:

- Don’t over-rely on the AI stock-picking software.

- Verify the sources and methodologies employed by the service, and exercise your judgment before making any investments.

- Be mindful of the fees, risks, and potential conflicts

- Get extensive education on how stocks work.

- Pair with other market analysis software programs.

- Contact customer service is anything is unclear to you.

Conclusion

This guide has explored the top AI stock-picking services that leverage big data and machine learning to enhance investing in 2026. While limitations exist, using quality AI platforms like AltIndex can provide an edge. Their algorithms process immense datasets to uncover opportunities and direct data-driven trading faster than an individual could alone.

Artificial intelligence is transforming how investors research and trade stocks. Rather than relying solely on traditional fundamental and technical analysis, many investors now leverage AI algorithms to scan markets for promising trades. These AI stock-picking services use advanced machine-learning models to process massive amounts of data.

AltIndex emerges as the leading affordable AI stock-picking service based on its unique integration of alternative data and social media analytics. By scanning stock-specific conversations across platforms like Reddit, AltIndex ratings reflect evolving investor sentiment.

Sign up for a free AltIndex account to receive daily stock alerts, access a community of active traders, and benefit from its proven AI stock ratings. New users can opt for the premium subscription and unlock unlimited AI picks, price alerts, sentiment indicators, and more.

The power of data science and machine learning is accelerating intelligent investing. Tap these capabilities through AltIndex to enhance your stock research and trading strategy.

References

- https://www.washingtonpost.com/opinions/2023/09/10/ai-future-power-imperfection-technology/

- https://www.indeed.com/career-advice/career-development/fundamental-vs-technical-analysis

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6407467/

- https://lens.monash.edu/@politics-society/2023/03/29/1385545/so-sue-me-wholl-be-held-liable-when-ai-makes-mistakes

- https://www.brown.edu/news/2023-02-23/artificial-intelligence-chatbots

FAQs

What AI is best for picking stocks?

One of the best AIs for picking stocks is AltIndex. AltIndex is an AI-powered platform that uses alternative data to analyze company performance and consumer sentiment. Alternative data includes social media, web traffic, app downloads, and more.

Are stock picking services worth it?

Using stock-picking services can be beneficial if they offer impartial and prompt information. They can assist in streamlining your stock research process and uncovering opportunities. Additionally, these services provide access to expert insights, analyses, and recommendations.

Does AI trading software really work?

An AI-powered trading software can be effective in high-frequency trading, arbitrage, and trend-following scenarios. It can analyze large amounts of data, identify patterns, and execute trades faster and more accurately than humans. In addition, AI trading software is adaptable to changing market conditions. It can even learn from its performance.

Do AI stock bots work?

The short answer is yes! They work, but you also have to be careful when using them. Technical hiccups, ethical problems, and market volatility can all have an impact on them.

While AI bots do work, they do not guarantee success and involve risks and challenges. Their performance is based on the quality and reliability of their data, algorithms, and platforms.Jeremiah Awogboro

View all posts by Jeremiah AwogboroJeremiah Awogboro is an experienced content writer with over 8 years of experience. He has a qualified MBChB degree and a keen interest in the stock market and the finance industry. His background in the industry has provided him with valuable experience in this field. Awogboro is dedicated to assisting and reaching out to as many people as possible through his writing. In his spare time, he enjoys music, football, traveling, and reading.

VISIT ETOROYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2026

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up