Best Alternative Data Services for Stock Market Investors in 2026

You can get all the analysis you need with the best alternative data services for stock market investors. Information like geo-location tracking, satellite imagery, weather forecasts, credit card transactions, etc., can shed light for investors. Besides having this information at your fingertips, the best data services provide in-depth analysis.

We’ll explore the top seven alternative data services for stock market investors. Some have free subscriptions to get you onboard quickly with relevant information to guide you. With that in mind, let’s begin by ranking those on our list.

-

- 1. AltIndex – Overall Best Alternative Data Service for Stock Market Investors in 2026

- 2. Plaid – Best Alternative Data Service for Transaction Data

- 3. Dataminr – Best Alternative Data Service for High-impact events and cyberattack reports

- 4. Foursquare – Best Alternative Data Service for Contextual Geolocation Insights

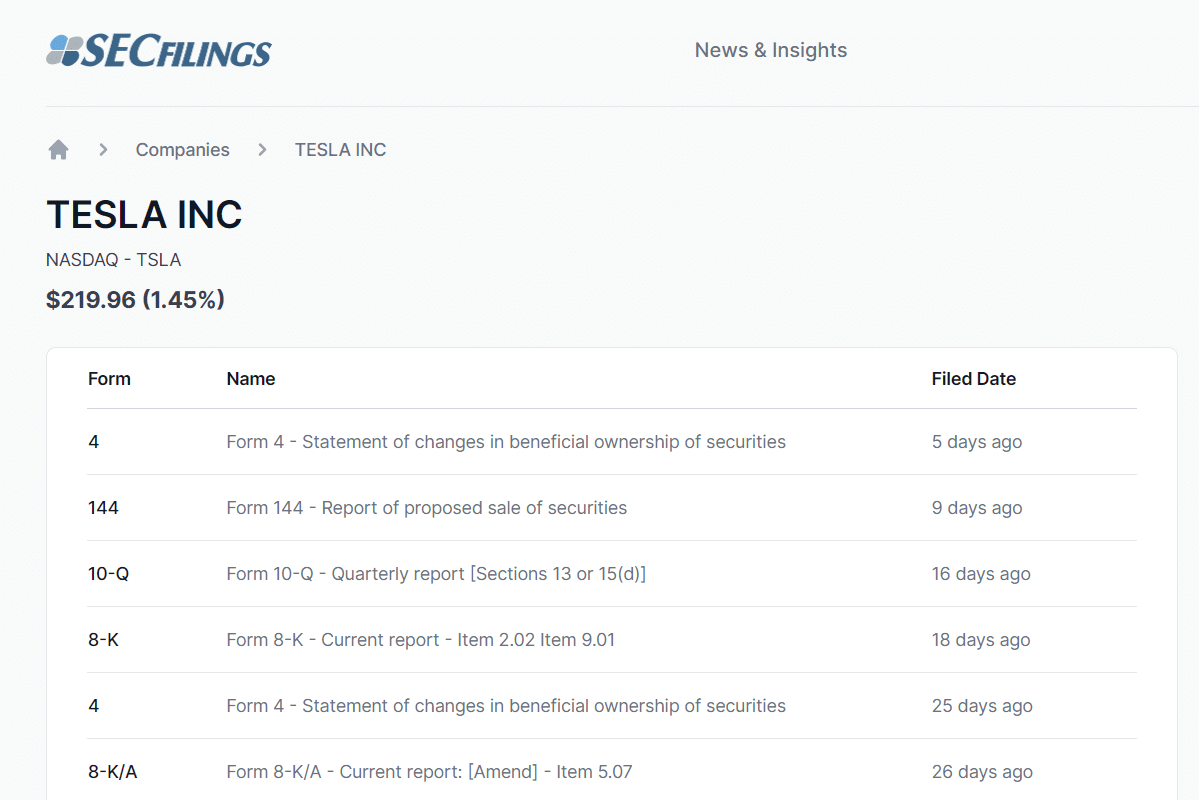

- 5. SECFilings.com – Alternative Data Service for Securities

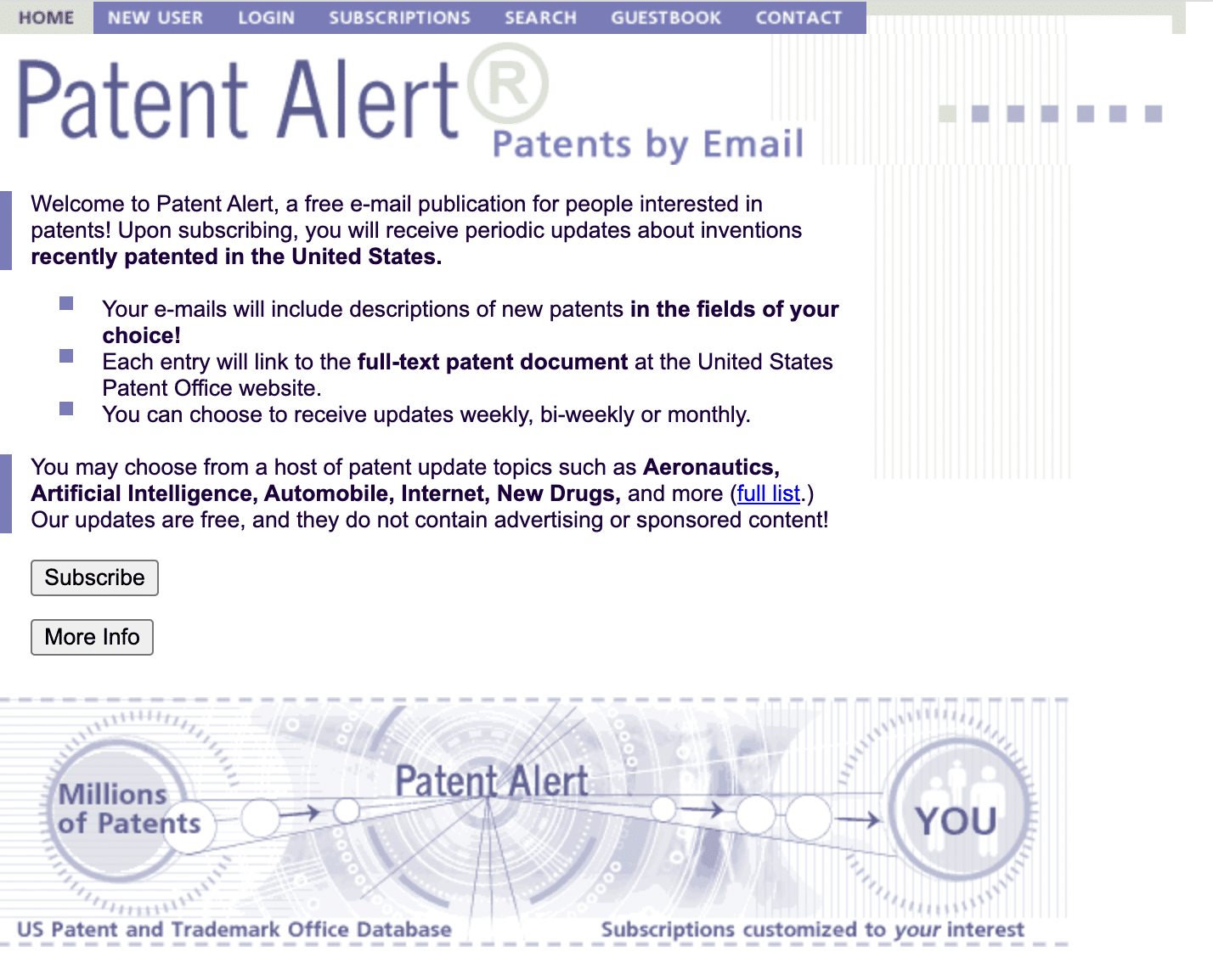

- 6. PatentAlert – Best Alternative Data Service for Patents

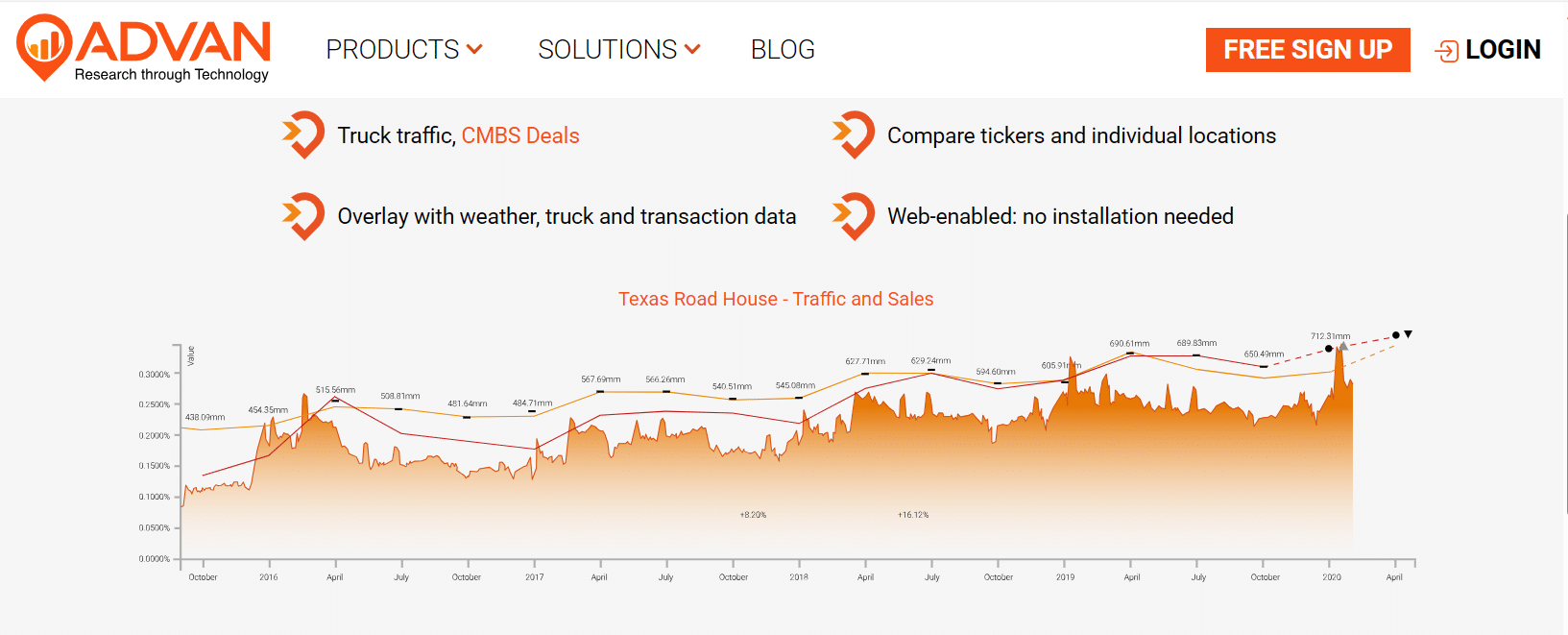

- 7. Advan Research – Best Alternative Data Services for Real Estate Insights

-

-

- 1. AltIndex – Overall Best Alternative Data Service for Stock Market Investors in 2026

- 2. Plaid – Best Alternative Data Service for Transaction Data

- 3. Dataminr – Best Alternative Data Service for High-impact events and cyberattack reports

- 4. Foursquare – Best Alternative Data Service for Contextual Geolocation Insights

- 5. SECFilings.com – Alternative Data Service for Securities

- 6. PatentAlert – Best Alternative Data Service for Patents

- 7. Advan Research – Best Alternative Data Services for Real Estate Insights

-

The Best Alternative Data Services for Stock Market Investors Ranked

Alternative data services have varying strengths. For example, one might be exceptional in geo-location tracking, while another is excellent for weather forecasts.

If you are short on time, here’s a quick ranking of the best alternative data services for stock market investors:

- AltIndex: This service provides a wide range of alternative data, from job postings to app downloads and customer ratings. The daily alerts and a positive 75% win rate on AI stocks make it stand out. You can start with the free version or subscribe for AI stock picks and other analytical features.

- Plaid: If financial transactions are relevant to your portfolio, this would be the alternative data service for you. Plaid links fintechs with financial institutions and banks. With permission from cardholders, you can learn what they buy, how much they spend, their income, etc.

- Dataminr: This alternative data service deals with high-impact events. It delivers information that will make you aware of natural disasters or cyberattacks before they hit traditional media.

- Foursquare: This service pulls geolocation data from 120 million data points and 500 million devices. You can quickly tell which companies have increased or reduced foot traffic. Foursquare can be a helpful addition to AltIndex as you compare customer ratings.

- SECFilings.com: This government platform provides first-hand information on company regulatory filings. You can follow companies in your portfolio to see what they’re filing. Of course, new securities mean they have something up their sleeves that could boost their stock values.

- PatentAlert: You will have direct information on new patents as they are filed with the US Patent and Trademark Office Database. This data is delivered to your email with links to read the full details.

- Advan Research: This is another powerful geolocation tool. You can learn about demographics, employees, foot traffic, stores, etc.

Best Alternative Data Services for Stock Market Investors Reviewed

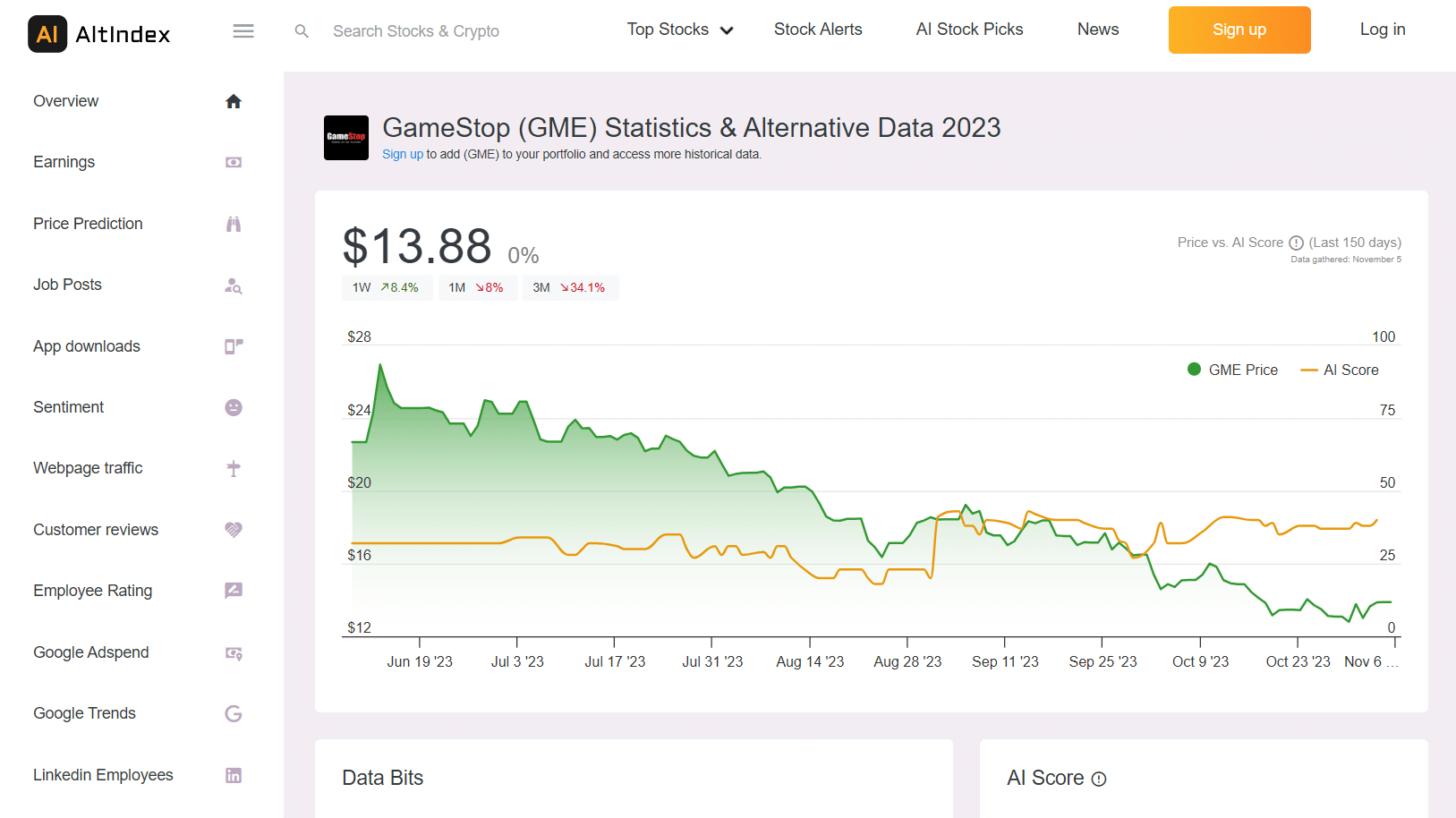

1. AltIndex – Overall Best Alternative Data Service for Stock Market Investors in 2026

You probably have a few companies in your portfolio that you are keen on. AltIndex provides an all-in-one analysis of many companies to give investors unrivaled data on one platform. Currently, it has over 3,000 active users, and that number is growing.

AltIndex easily offers over 100 unique daily alerts and insights to keen investors. With a 75% win rate on AI stocks, it is an unrivaled platform for understanding market sentiments. Alternative data on this service includes job postings, customer satisfaction ratings, social media followers, app downloads, etc.

You can probably get the above information from most app analytics platforms. However, none analyzes the data, compares it over time, and benchmarks it against industry peers for trading insights like AltInsight. The platform is a prominent stock market research and analysis software for short- and long-term trades.

The stock market often has a mix of bullish and bearish trends daily. AltIndex can quickly search out the top-performing stocks at a glance. Step up your investing decisions by following the top and bottom-performing stocks and the alternative data behind them.

How does AltIndex rate a stock? The alternative data service can analyze a company’s likes, shares, and mentions on social media. Then, it will assign a score to the company’s stock.

That doesn’t mean that AltIndex focuses on one alternative set of data. It combines several vital pieces of information to score stocks.

The major downside to AltIndex is the price. You won’t get many features and analyses with the free version. $29 is the starting subscription fee.

The table below summarises the key specs of AltIndex

Spec Overview AI score This is probably the most essential part of this platform. It offers AI scores after analyzing stocks Insights and news Follow market developments and opportunities. Pros:

- Daily alerts and AI predictions are available

- Includes analysis on a wide range of alternative data

- Provides news to follow market developments and opportunities

Cons:

- Specific analysis is unavailable in the free version

- No iOS or Android app

2. Plaid – Best Alternative Data Service for Transaction Data

This platform is among the best alternative data services for stock market investors because it offers financial records. This app-powering platform easily collects data from over 20,000 financial institutions, including banks and apps.

These institutions are in the US, UK, Canada, and Europe. With Plaid, you can quickly analyze consumer spending habits and gain insights into stock performance.

Plaid’s primary feature is its API, which allows applications to integrate seamlessly with banks and financial institutions. Once onboard, you can track credit card transactions and see the category and amount spent.

Alternative data on Plaid includes bank account transactions, income verification, balances, cash flow analysis, etc. Here is how the platform obtains this data securely and transparently.

Plaid allows users to allow apps and services to track their alternative data for better customer satisfaction. An example is allowing a lending app to access your data for better loan rates.

Users can revoke the permissions at any time. Imagine what you can do with information on the users’ spending habits on streaming services. You can quickly tell if they are spending more on Netflix, Apple TV, Prime TV, etc.

We were impressed with Plaid’s custom alerts feature. With it, you can set up daily alerts on metrics regarding your portfolio. For example, you can set alerts for the daily Netflix subscription numbers.

The following are the core specs that make Plaid one of the best data services for stock trading:

Spec Overview API for fintech apps and banks This API allows users to permit fintech apps to track their bank transactions. The data is available for stock trading decisions Custom alerts Select which category, company, and metric you want to receive daily alerts. Pros:

- It supports over 20,000 banks, apps, and financial institutions

- It includes spending categories and amounts to customize the data

- Daily alerts are available

Cons:

- There is no mobile app.

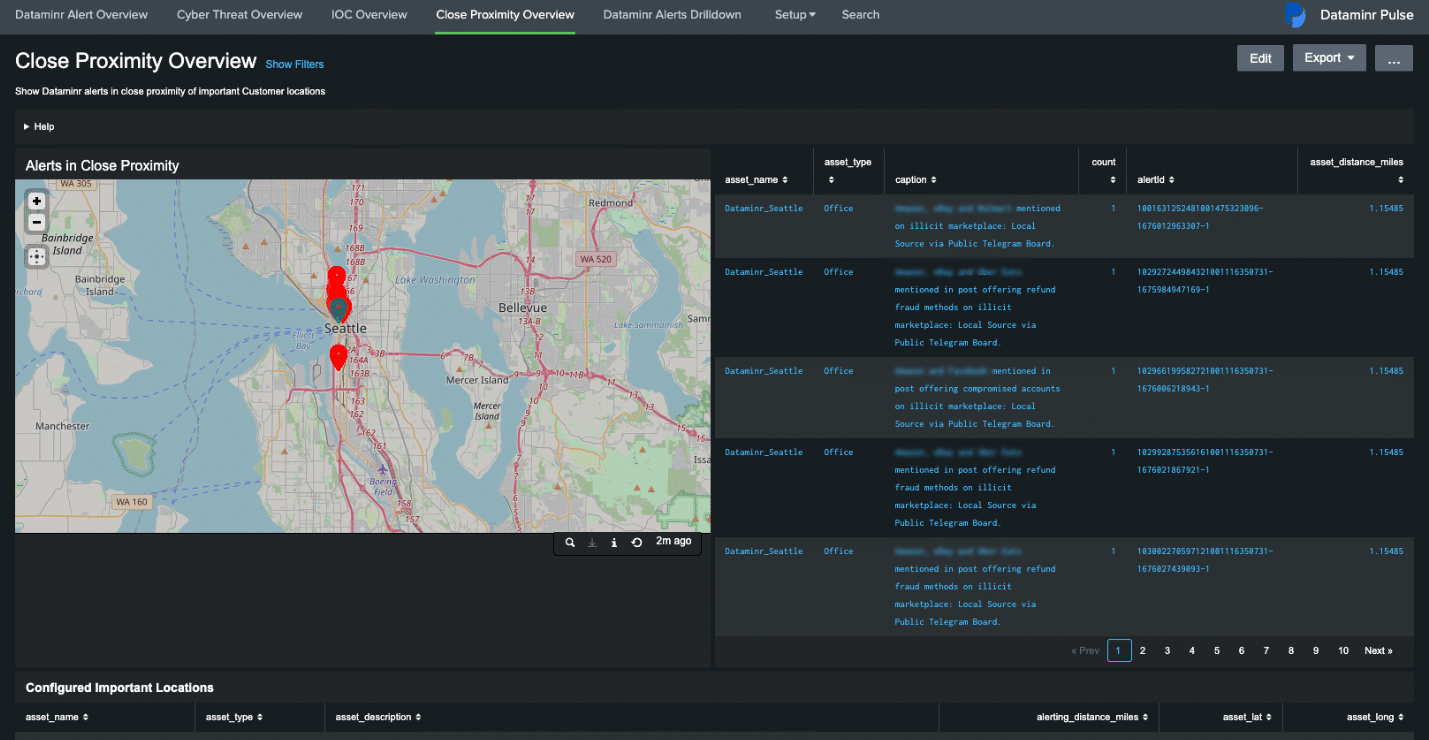

3. Dataminr – Best Alternative Data Service for High-impact events and cyberattack reports

The New York Times and other news media rely on events to develop their stories. They might analyze these events but offer few predictions. Dataminr takes risk management to another level by using AI to determine emerging risks from events.

It’s not like Dataminr predicts the future. However, you will receive the earliest signals for high-impact events. These could be earthquakes, wildfires, tsunamis, hurricanes, etc.

The real-time, AI-powered intelligence allows investors to act quickly based on the signals received. Besides natural disasters, Dataminr can also track and report on cyber attacks. Imagine having a first-hand, real-time alert on the cyberattack on Sony in June 2023.

You can quickly gauge the market response and make an informed trading decision. For natural disasters, Dataminr analyzes climate data and satellite images to find hot spots. We are not encouraging natural disasters, but Dataminr lets you stay on top of them.

Besides climate data and satellite images, Dataminr has a leading real-time AI platform that detects global events. It does that by processing billions of daily public data inputs in different formats. The platform’s distinct data sources total over 150,000.

Dataminr processes data inputs, including text, video, images, public IoT sensor data, and sound. The platform’s AI models use natural language processing, sound and audio detection, computer vision, and anomaly detection. It does this in machine-generated data streams.

You can use Dataminr’s AI for modern newsrooms to see potential breaking news. This real-time solution can help you identify investment opportunities.

Here are the key specs that will benefit your stock investments:

Spec Overview Dataminr pulse This provides early signals for high-impact events and cyberattacks. It offers quick alerts contextualized with geospatial data. First Alert Although, for first responders, you can use it to track events even before they appear on the news. Pros:

- AI predictions for breaking news are available

- Ideal for quick alerts on geospatial data

Cons:

- No free trial

4. Foursquare – Best Alternative Data Service for Contextual Geolocation Insights

We’ve explored the best alternative data services for stock market investors, tackling market sentiments, transactions, high-impact events, etc. Foursquare joins this list with robust POI data and a place API for stock investments. One way of assessing company stocks is to know where people go.

You can gauge the popularity of companies by analyzing how many people visit them. That could, in turn, give you insights into the stock movements during trading.

The data at Foursquare includes 120 million global points of interest and over 500 million devices. With this, the platform can accurately detect real-world visits and movement.

Foursquare can be a valuable tool if you are interested in retail businesses for your portfolio. You can learn how many people visit your specified retail stores. Combined with other alternative data on purchase behavior, you can quickly pick out high-performing stocks.

To take your analysis further, you can use Studio to visualize large-scale geospatial data and prepare it for examination. You can start with a free Foursquare Studio account, but you’ll need the Enterprise level to unlock valuable features.

Here are the top specs of Foursquare

Spec Overview Foursquare Studio A robust platform to analyze and visualize large-scale geospatial data Pros:

- It can visualize geospatial data

- Real-time insights are available

Cons:

- It requires expert knowledge

- It is not affordable for casual investing

5. SECFilings.com – Alternative Data Service for Securities

This alternative data service allows you to track companies’ security and regulatory filings in real-time. When used right, SECFilings.com can be a formidable asset and one of the best data services for stock trading. You can gain insights into how companies in your portfolio are doing from the regulatory papers.

Companies can file regulatory papers for several reasons, which include the following:

- To register new securities for public offering

- To report the financial condition of their businesses

- To report management changes in their businesses

- To report essential transactions that may affect their businesses

These reports can cause company stocks to climb or fall. For example, a company’s stock may appreciate if a new and popular CEO comes on board. The same can apply when a company adds new securities to its portfolio. When paired with other stock alerts services, SECFilings can be a powerful tool to stay ahead of trades.

With the SEC’s EDGAR system processing 3,000 filings per day, this platform offers better and faster insights than traditional media. It is a valuable tool for stock market investors who want information before it hits news platforms.

The table below shows the key specs of SECFilings.com

Spec Overview Filings Find out what companies in your portfolio are submitting to the SEC News & Insights Read the news on insider, activist, and fund filings. Pros:

- Real-time alerts are available

- You can check the filing history of specific companies

Cons:

- Filings require expert knowledge

6. PatentAlert – Best Alternative Data Service for Patents

Have you rolled out your investment apps but are unsure where to invest? PatentAlert might be what you need to keep up with new patents that hit the floor. It alerts you to patent filings in a personalized way through emails.

Each email alert will contain a brief description of the patent. Notwithstanding, you can use the link to see the complete patent report at the US government patent website. The patent updates are available weekly, biweekly, or monthly.

PatentAlert retrieves information from the US Patent and Trademark Office database. You can pick a range of industries, including aeronautics, automobiles, the internet, artificial intelligence, etc.

You must be an expert in interpreting patents to make sense of the updates. Also, updates are only available via email.

PatentAlert lets you select which industries and companies to receive alerts on their patents. With the paid subscription, the list expands to 400 updates on science and technology. You can streamline further by adding updates from innovation-leading companies.

This platform lets you build your alerts by including the company name and patent class. The table below shows the platform’s most essential specs

Spec Overview Email updates Patents are sent to your email with brief descriptions Pros:

- Provides patent updates on up to 400 sectors

- You can select which companies or industries you want to receive updates

Cons:

- Only suitable for experts who can interpret patents

- No additional analytical information for trading

7. Advan Research – Best Alternative Data Services for Real Estate Insights

With 300 billion monthly data points, Advan Research stands tall as an alternative data service for business and consumer trends. It caters to the real estate industry, but it is equally powerful for financial experts.

This alternative data service has over 150 million buildings in its analysis. You can get analysis on over 5,000 companies and 300 sectors. Advan Research is a robust tool targeted at the financial market and the real estate industry.

If you deal with a portfolio outside the real estate and finance industries, Advan Research might be of little use to you. In addition, you don’t know how much the service costs until you contact the platform. These were our primary concerns with Advan Research.

The key specifications of the service are shown in the table below:

Spec Overview Financial Terminal This provides analytical tools for corporate and consumer behaviour REveal This is a real estate GIS service with ranks for locations and visitor demographics. Pros:

- Ideal for analyzing corporate and consumer behaviour

- Monthly updates are available

- Tailored for real estate investors

Cons:

- No general pricing. Only custom quotes are available

- It has little use for investments outside the real estate and finance industries

How do Alternative Data Services for Stock Market Investors Work?

Events as unrelated as a feud within a CEO’s family can cause the company’s stock prices to fall. Stock trading apps try to analyze as much valuable data as possible to help traders. However, they are limited in their information sources, often falling back on the price movement over time.

Alternative data services are where you will pick up information like the family feud mentioned earlier. They aggregate data from broader sources to help guide stock trading decisions. Some will analyze the data and identify the top-performing stocks, like AltIndex, while others leave the application to you.

Data used in the best alternative data services for stock market investors includes web traffic, social media likes, shares, and follows, foot traffic in office buildings, satellite images, geospatial data, etc. Once the data is compiled, the real work begins.

This is how alternative data services for stock market investors work:

- First, the data services compile the data. They often have past and real-time data to keep users updated.

- Then they analyze and visualize the data using graphs, tables, etc.

- They can make suggestions on the top-performing stocks, like AltIndex.

- Users find information on specific companies in their trading portfolio

- The users use the information to determine if a trade (buy or sell) is a prudent move

The best data services for stock trading use several advanced algorithms to analyze alternative data. This ensures the analysis is free of errors.

Artificial intelligence is becoming popular in predicting stock performance from alternative data. Let’s see a few examples.

You can use patent filings to gauge a company’s innovative edge and stock performance. Similarly, you can use visits (foot traffic) to gauge a company’s popularity.

Besides investing, alternative data also helps in risk management.

Famous Alternative Data That Crashed Company Stocks

Although other factors may have contributed to the stock crash, these events played a significant role. Here are some famous events that led to a substantial drop in company stocks:

- Merck’s recall of Vioxx in 1999 resulted in several lawsuits amounting to $5 billion. The stock halved from $48.88 following the company’s delayed response to the recall.

- United Airlines PR disaster following an unfortunate struggle between Dr. David Dao and aviation security officers cost the company $1.4 billion. This fall followed comments by the company’s CEO blaming Dao for the conflict.

There are many more cases littered across history. That makes alternative data services for stock market investors more essential.

How to Pick Alternative Data Services for Stock Market Investors?

You may have your eyes on specific companies. Their stocks are affordable, and the initial analysis shows an upward trend. The question remains: how do you know which alternative data you need to assess the stock market?

To illustrate this point, you don’t need satellite images if your target stock is for a gaming app.

Some alternative data come with complete analysis to ease decision-making. Others, like patents, leave you to decide if the company’s stocks are worth investing in. You might need multiple alternative datasets to make a well-informed decision.

If you are not into stock market investing for the long term, you have little need for alternative data services. These platforms help investors build long-term investment strategies rather than day-trading decisions. Of course, they can also help with the latter, but it takes time to analyze alternative data to find an opportunity.

Here is our guide to picking the best alternative data services for stock market investors:

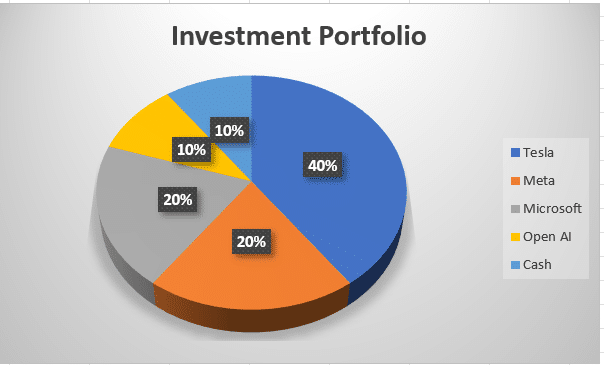

Have a Stock Portfolio

The kind of alternative data you need depends on your stock portfolio. If you have no portfolio or preferences already, you can’t tell which type will be helpful for investment decisions.

If you are new to the market, you should learn how stocks work to build your portfolio. Once you have adequate knowledge, you can decide which companies to add to your portfolio. Some stock market investing platforms have AI predictions of the top-performing stocks.

Your portfolio could contain two or more companies, depending on how much you have to invest. You don’t have to start investing just yet. Moreover, the whole idea of alternative data is to see the viability of a company’s stock for investment.

You can start with AI stock-picking services and software to add stocks to your portfolio. Some offer free services, but you can pay for more features.

Check for Reliability

Several alternative data services will pop up, but not all are reliable. Traditional services often have stricter regulations than those in the alternative data industry. The latter might show compliance with regulators, but that doesn’t paint the whole picture.

It is up to you to test the platform’s reliability (consistency, validity, and accuracy). You can read reviews from experts and users to see the platform’s strengths and weaknesses. Services with satisfied clients tilt more toward the reliable side.

For government platforms like SECFilings.com, reliability will often not be a concern. Nevertheless, you can still do your verifications before basing your stock investment decisions on them.

How to Check for Reliability

Checking for reliability is crucial to picking the best data services for stock trading. Our recommended approach is as follows:

- Review the data source: Most alternative data services collate data from multiple sources. Reliability begins at the root. Hence, you must review how trustworthy the sources are. For example, Plaid compiles transaction data from financial institutions and banks. You can backtrack to these banks and financial institutions.

- Compare with other sources: This simple litmus test can quickly reveal a reliable source. The data is most likely genuine if multiple independent sources say the same thing. You can also look for primary sources, like interviews and original documents, to validate the platform.

- Evaluate the methodology: How is the data collected? The method is one of the primary determinants of quality.

- Test the reliability: Test-retest and inter-rater are popular testing techniques for reliability. The former involves carrying out the exact measurements several times, while the latter involves bringing in third-party raters. You might not have the means for this, but if you can, do it.

- Apply caution: Always apply caution when using data. If necessary, make decisions based on multiple datasets.

Check for Relevance to Your Portfolio

Do you need foot traffic information to see how famous a company is? That might work for hotels, restaurants, and other hospitality services. However, the same data could be misleading for companies that provide online services and probably use a co-working space.

Based on your portfolio, you should know the types of alternative data relevant to your investments. Use that as the basis for filtering alternative data services.

A stock portfolio tracker can help you quickly compare alternative data with price movements.

Review the Analytical Tools

As seen from our list of the best alternative data services for stock market investors, not all services have analytical tools. AltIndex has prominent analytical tools and AI predictions that ease the decision-making process. Conversely, SECFilings and PatentAlert only present information on the latest securities and patents.

Again, the amount of analysis you need depends on your portfolio. You can also enhance your efficiency by opting for platforms that offer visualizations. That will help you make sense of the data quickly.

Align the Pricing with Your Budget

The ultimate determinant of which alternative data service you will use is the cost. Some services offer free subscriptions, but those often come with limited features.

Compare multiple alternative data services to see their costs. You might get away with essential features like the AltIndex AI score. However, that depends on how much information you need for your portfolio.

Have a budget before you search for the best alternative data services for stock market investors. Only exceed it when the risk is worth taking and the returns are significantly better.

While budgeting to purchase alternative data, keep your investments in mind. The table below compares the pricing for the alternative data services on this page:

Alternative Data Service Pricing AltIndex $29 – $99 Plaid Pay as you go Dataminr Custom pricing Foursquare $60 SECFilings Free PatentAlert $5 Advan Research Custom pricing Ethics in Alternative Data Collection

Alternative data, like credit card transactions and purchasing habits, require strict ethics and compliance. These are private details one wouldn’t know unless people let them out. If your portfolio requires analyzing these details, you must ensure the alternative data service is held to high standards.

Plaid, as listed on this page, only uses credit card transactions with the authorization of the cardholders. The same applies to the financial institutions and banks providing the data for linking with fintechs. If there is no convincing evidence to show cardholder authorizations, you should look elsewhere.

Conclusion

Alternative data is essential for real-time insights. The information can help shape your stock market investment decisions, especially with unstable stocks. In addition, you can perform better risk management when investing considerable amounts in a company stock.

You can get alternative data on various data points, including social media followers. Trends can help you identify market sentiments and help you weigh the possibility of a bullish or bearish market. AltIndex is a robust platform for this information, including AI predictors to help you decide the top stocks for investments.

We recommend combining alternative data with traditional information. You can still use the analysis from the stock trading platforms while broadening your considerations with alternative data.

Ensure the data services are reliable, with adherence to business and privacy ethics. Get started quickly with the best alternative data services for stock market investors for 2026.

AltIndex tops our list and for a good reason. It offers a broad range of alternative data that covers market sentiment through metrics like social media followers. You will also gain insights into a company’s financial strengths through job postings and ratings.

If you need one place to get started with stock market investing, AltIndex is our top choice. Register for free today to enjoy AI-predicted top-performing stocks and consumer and company data analysis.

References

- https://fortune.com/2017/04/11/united-airlines-stock-drop/

- https://www.npr.org/series/5033105/vioxx-the-downfall-of-a-drug

- https://www.sec.gov/edgar/about

- https://www.dataminr.com/news

- https://online.hbs.edu/blog/post/data-ethics

- https://knowledge.wharton.upenn.edu/article/investor-sentiment-and-stock-prices-explaining-the-ups-and-downs/

FAQs

What are alternative data sources for stock trading?

Alternative data sources are secondary information outside of what investors and analysts typically use to assess a company or investment. It often stays outside traditional media but is very helpful in recognizing market sentiments and consumer behavior. Examples of alternative data include job postings, foot traffic, satellite images, social media followers, credit card transactions, etc.

How much does alternative data cost?

Some alternative data services for stock market investors have free subscriptions with limited features and analysis. Even when paid, you can still find affordable options like PatentAlert, which expands its service for a $5 subscription. Another cost determinant is the volume of data you require to analyze the market better.

How do I get alternative data?

Alternative data is available on platforms that compile the information for easy comprehension. Setting up your portfolio is the first step to getting the correct alternative data. Find out which companies and stocks interest you and search for data based on their industry and sectors.

Who buys alternative data?

Stock market investors and other market participants often buy alternative data for one reason or another, including trading decisions. These include real estate brokers, news media, hospitality investors, stock market traders, asset managers, hedge fund managers, etc. There are little to no restrictions on who can buy alternative data, provided you register and verify your identity.

Jeremiah Awogboro

View all posts by Jeremiah AwogboroJeremiah Awogboro is an experienced content writer with over 8 years of experience. He has a qualified MBChB degree and a keen interest in the stock market and the finance industry. His background in the industry has provided him with valuable experience in this field. Awogboro is dedicated to assisting and reaching out to as many people as possible through his writing. In his spare time, he enjoys music, football, traveling, and reading.

VISIT ETOROYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2026

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up