Best Free Stock Screeners & Apps for 2026

Being a successful stock trader requires researching large amounts of data to make informed decisions. With thousands of publicly traded companies with shares across various stock exchanges in the US and beyond, it’s almost impossible for traders to cover the available data.

Both new and seasoned stock investors opt for the best free stocks screeners & apps to find new and exciting stock options on the market and conduct thorough research. The best free stock screeners help investors filter through the thousands of stocks and provide opportunities that suit their investment needs and trading styles.

We aim to help traders and investors easily find the most effective options. To that end, this guide reviews the top free stock screeners on the market with high-performance rates.

Many solid stock screeners are available to traders and investors looking for rewarding opportunities in the stock market. To streamline your search, we highlight the 8 best free stock screeners & apps to consider in 2026. 1. AltIndex – Overall Best Stock Screener 2. Sharemarketcap.com – Top Stock Screener for Global Stocks and ETFs 3. TradingView – Reputable Stock Screener for Advanced Research 4. Stock Rover – Best Free Stock Screener for Thumbnail Charts 5. TD Ameritrade – Top Screener for American Stock Traders and Investors 6. Seeking Alpha – Best for Financial Market News and Insights 7. Yahoo Finance – Best for Stock Beginners 8. TC2000 – Free Stock Screener for Students and Day TradersThe Top Free Stock Screeners & Apps Ranked

Reviewing the Free Stocks Screeners & Apps

Now, let’s dive into the details of each stock screener, including their key features, pricing for paid plans, and other information, that make them rank among the best stock screeners for traders and investors.

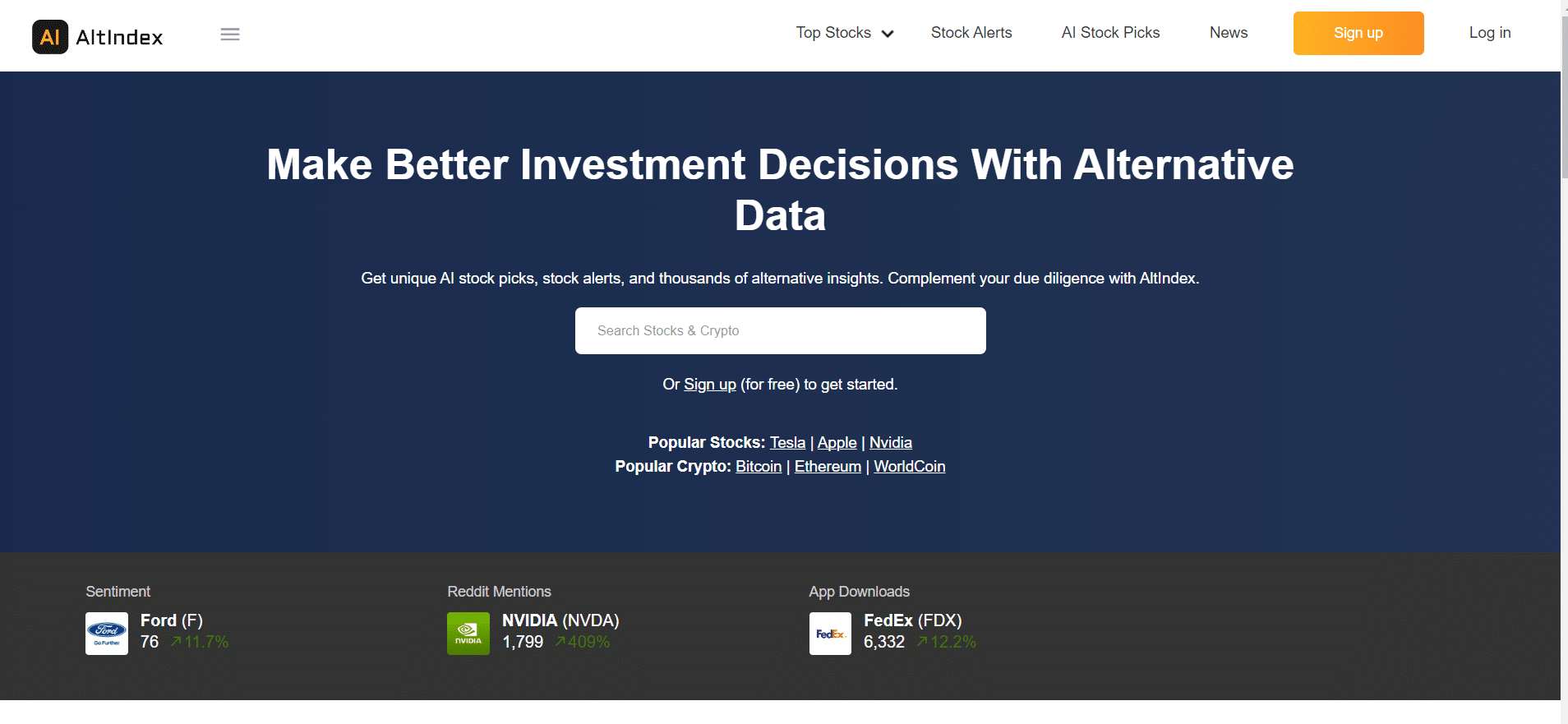

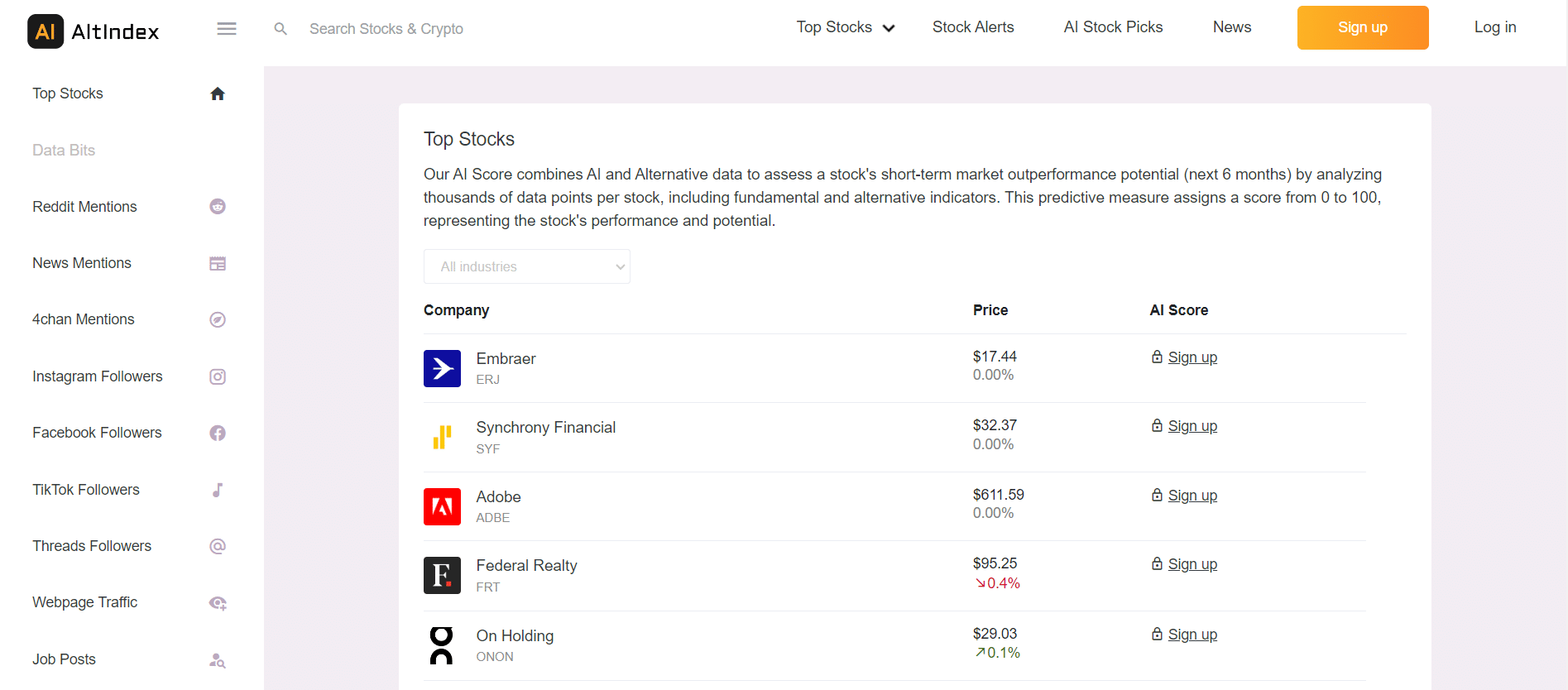

1. AltIndex – Overall Best Stock Screener

AltIndex sits at the top of our list of the best free stock screeners in 2026. The platform prides itself as a leading alternative data provider that uses sophisticated algorithms and advanced artificial intelligence (AI) to curate actionable market insights for its users.

The AI-driven stock screener researches and filters stocks based on certain parameters the user sets, including stock price, app downloads, job postings, and other quality metrics. Afterward, it aggregates the collected data to provide well-researched insights that investors can infuse into their strategies.

AltIndex doesn’t function like the regular data provider. As its name suggests, the provider curates data from reputable third-party platforms or sources like social media, websites, job listings, and other online sources. The goal is to accurately determine the overall market sentiment on a specific stock and give it a score.

For instance, AltIndex can analyze a stock’s mentions, likes, followers, and shares on Reddit to determine its overall market outlook. If the stock has a positive public sentiment, AltIndex will give it a high score, or vice versa.

On top of that, AltIndex can analyze individual company growth to determine whether or not it’s worth investing in. For instance, the data aggregator can analyze a company’s job postings and employee satisfaction metrics. This is done over a specific period to understand whether its human resources are increasing or reducing.

These data can be used to generate top stock recommendations for AltIndex users. According to its website, the platform has a high win rate for its recommendations, with about 75% of its top picks yielding good returns.

Additionally, crypto enthusiasts can use the best alternative data services for stock market investors to gather data on top cryptocurrencies like Bitcoin, Ethereum, and WorldCoin. With a simple user interface to match, AltIndex is a decent stock screener for beginners and pro stock investors.

| Screener Name | AltIndex |

| Free Version | Yes |

| Key Features | Stocks and crypto analysis, Alternative data generation, 75% win rate |

| Pricing Information | Starting from $29 per month |

2. Sharemarketcap.com – Top Stock Screener for Global Stocks and ETFs

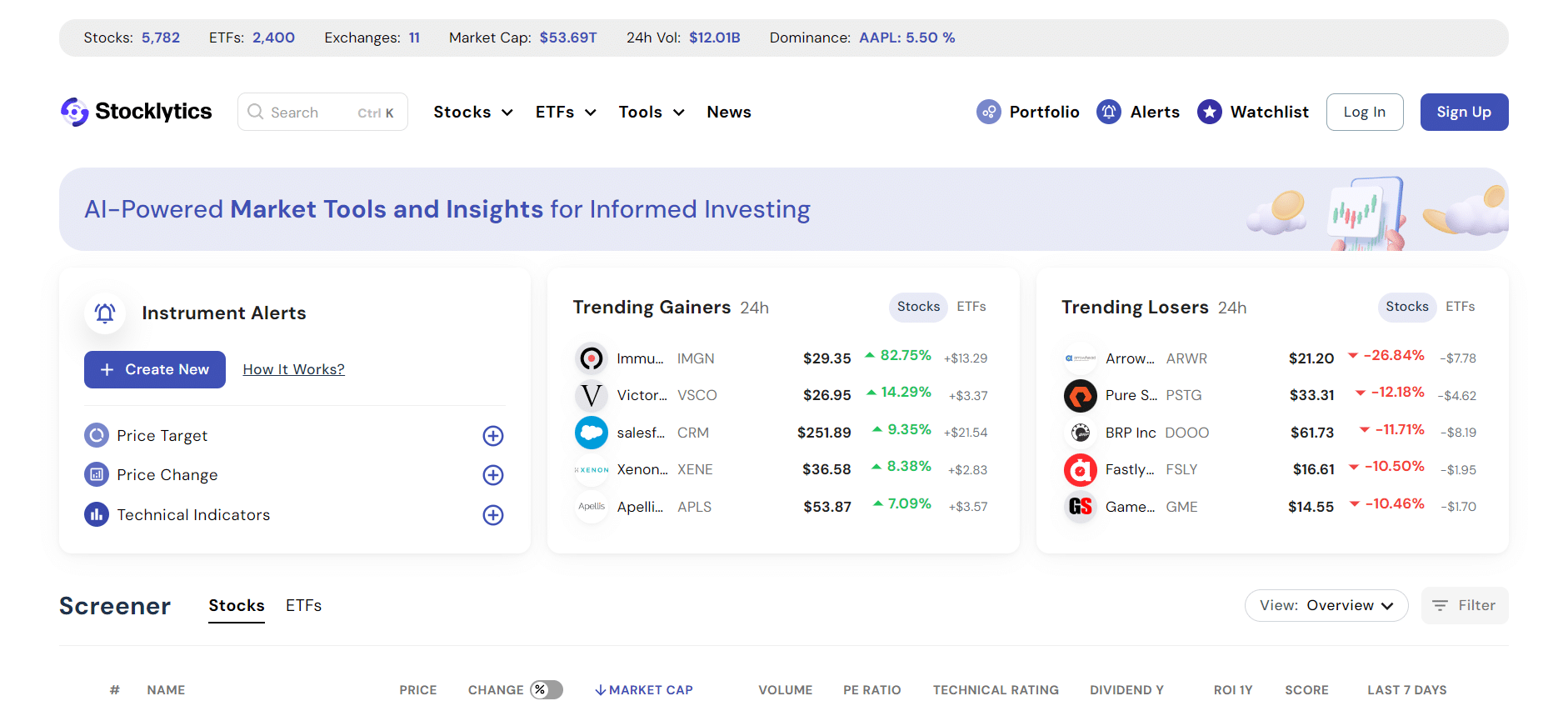

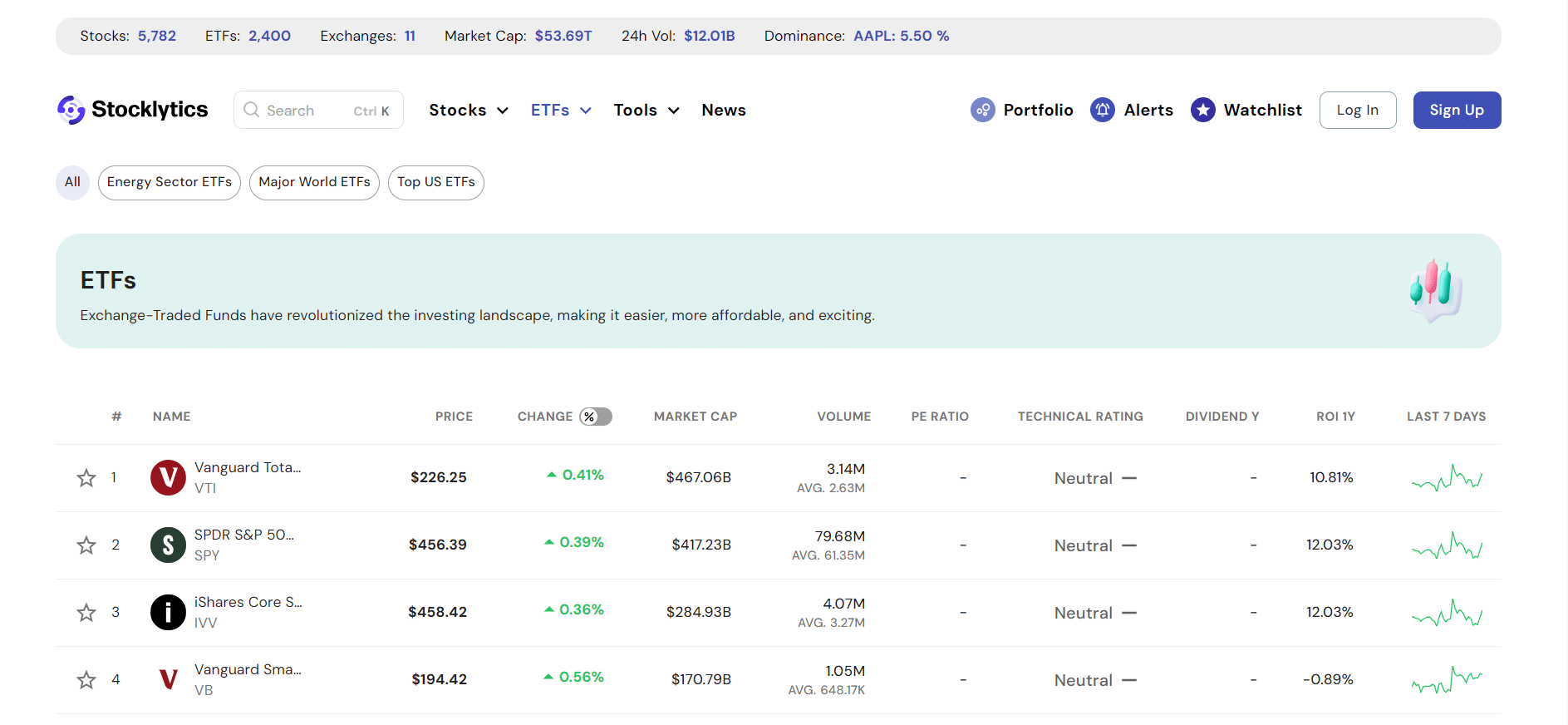

Next on our list of the best free stock apps and screeners is Sharemarketcap.com. Though the stock screener has rebranded as Stocklytics, it remains one of the top stock screeners free to consider for stock trading and investing.

Like AltIndex, Stocklystics uses AI-powered market tools to generate insights and help users make informed trading and investing decisions. The best stock portfolio tracker is best suited for investors looking for the best global stocks to buy.

In other words, you’ll find shares of top publicly traded US companies on the New York Stock Exchange (NYSE) and other companies listed on the Toronto Stock Exchange (TSX) and NASDAQ. These include over 5,780 stocks from global brands like Apple, Tesla, Meta, and Amazon.

Another reason stock traders choose Stocklytics is because the free screener extends its data research to exchange-traded funds (ETFs). Therefore, risk-averse investors looking to diversify their portfolios instead of investing in individual stocks must invest in high-performing ETFs.

There are 2,400 ETF options, including the top US ETFs, global ETFs, and ETFs from the energy sector. So, Stocklytics users can gather data on various asset classes in one place and leverage tools like alerts, the best stock trading signals, and Smart Portfolio to make the most of their experience.

Investors can leverage the Stocklytics stocks forecast feature to determine the best shares to buy, hold, or sell at a given period. To do this, the screener gauges the average market sentiment and obtains a result using its AI-backed analyst rating system.

Stocklytics also caters to mobile-first users with its dedicated mobile app for iOS devices. The best investment app makes it easy to track the performance of selected stocks and manage one’s investment portfolio using a smartphone. At a time when many stock screeners lack a mobile app, Stocklytics stands out with this feature.

| Screener Name | Sharemarketcap.com (Stocklytics) |

| Free Version | Yes (Free for life) |

| Key Features | Stocks and ETF research, Dedicated mobile app, Sophisticated forecast feature |

| Pricing Information | $25 per month |

3. TradingView – Reputable Stock Screener for Advanced Research

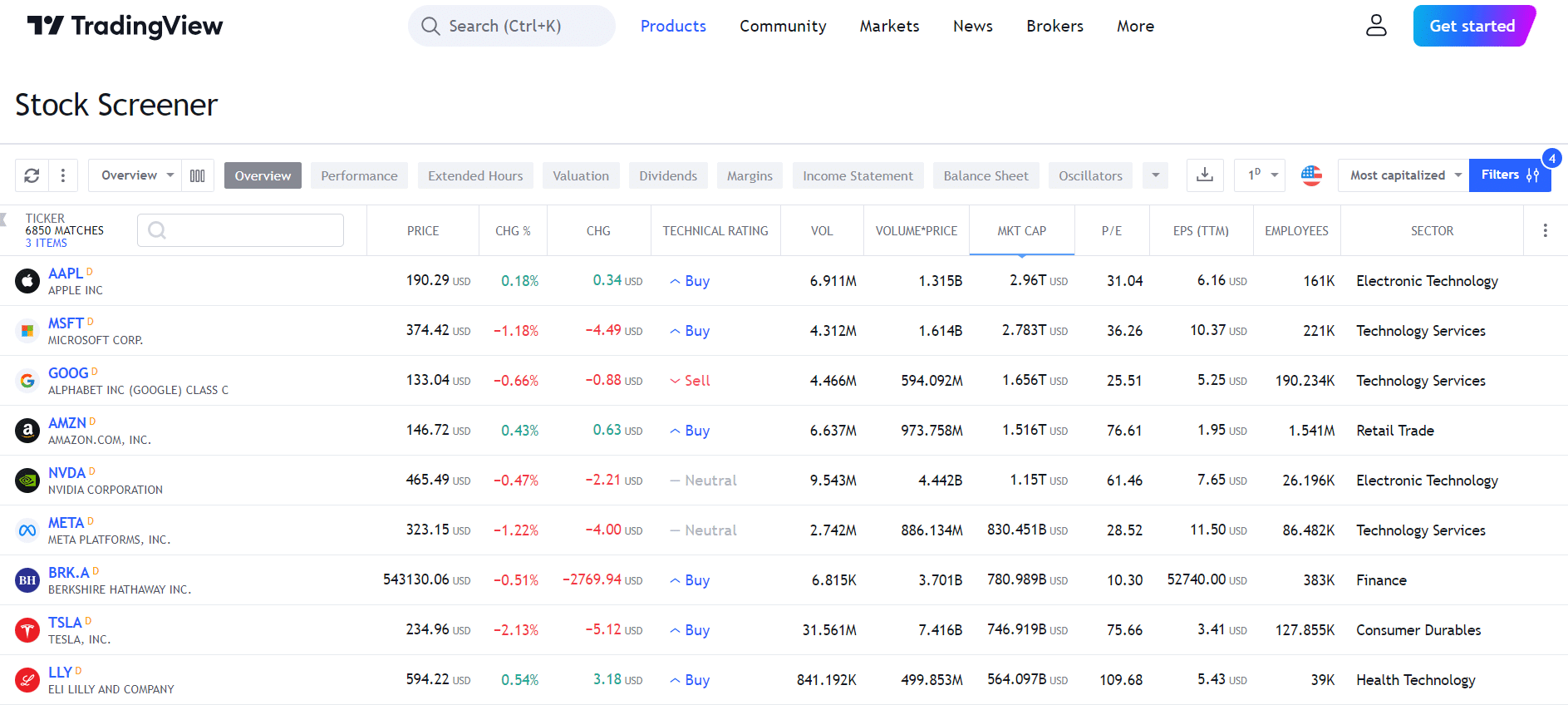

TradingView needs no introduction among stocks and cryptocurrency traders. The reputable screening site stands tall with its perfect blend of data and simplified user experience, making it a top choice for beginners and pro stock investors alike.

The most significant appeal to TradingView is its deep screening feature that combines data and chart signals for better results. On top of that, the TradingView software offers in-depth details like a company’s stock performance, valuation, and financial statements to help investors analyze it better and make informed decisions.

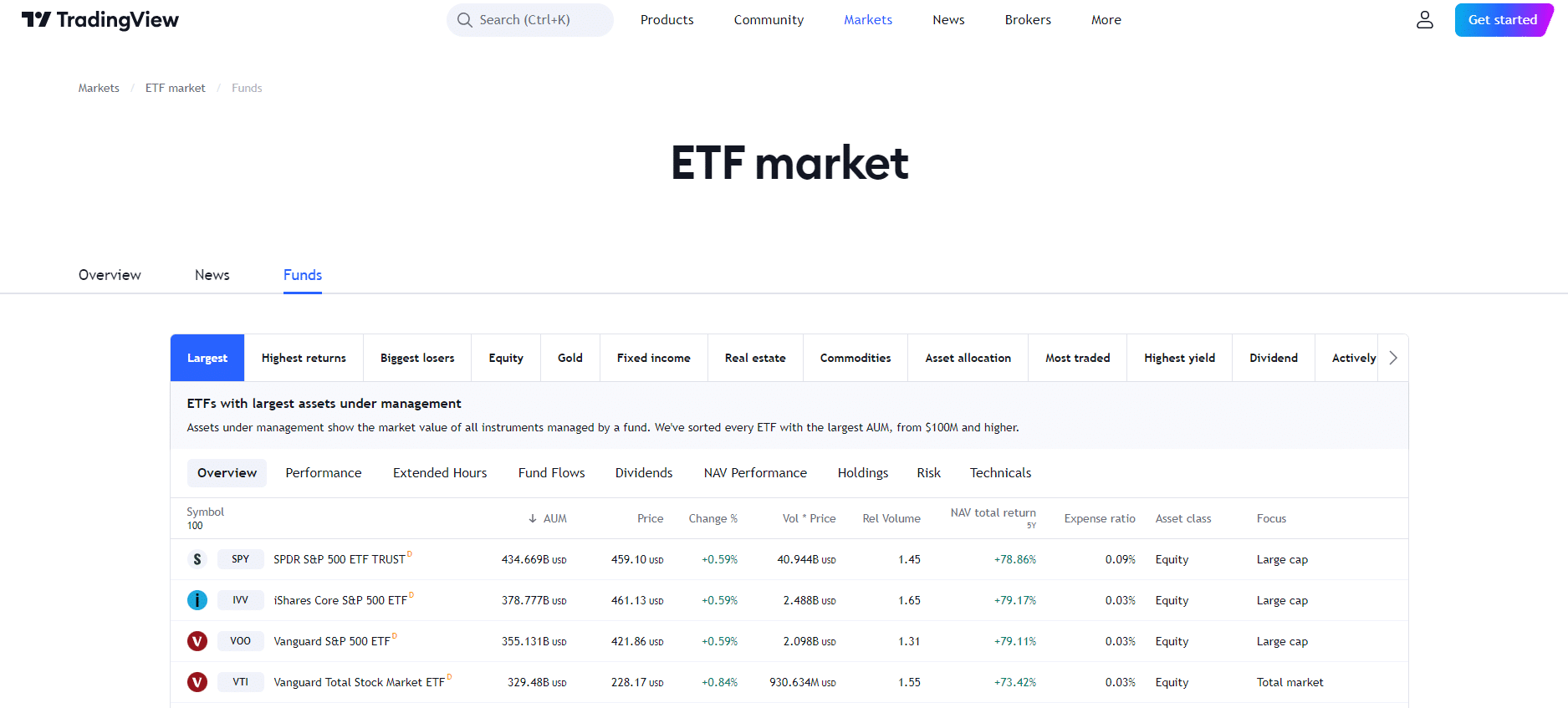

TradingView isn’t limited to the stock market only. The available markets cut across foreign exchange (Forex), crypto, ETFs, indices, futures, bonds, and other securities. In other words, TradingView also ranks as one of the best ETF apps for screening the ETF market. All kinds of traders can also use the screener – thanks to its advanced charts, candlesticks, and other technical analysis tools.

Since it’s one of the best day trading apps, TradingView is best suited for short-term analysis. Additionally, the robust platform offers excellent social integration, news, and access to data from the global stock exchange.

The TradingView app is also available for all devices, including desktop, Android, and iOS, with high interaction rates on the various platforms. The mobile app ensures seamlessness in management of portfolios, monitoring of trades, and execution of other activities on the go.

| Screener Name | TradingView |

| Free Version | Yes ($0 forever) |

| Key Features | Advanced charting, Diverse markets (including stocks, ETFs, and crypto), Global stock screening, Trend Following |

| Pricing Information | Starting from $12.95 per month |

4. Stock Rover – Best Free Stock Screener for Thumbnail Charts

Stock Rover is a one-stop shop for everything from stock screening to investing research to portfolio management. Like other research tools on our list, Stock Rover helps stock traders and investors screen various assets to discover trading and investing opportunities they can harness.

The stock screener executes in-depth research and curates analyst ratings using its sophisticated algorithm. Users can leverage these ratings to make trading decisions in the stock market.

Beyond its stock charting feature, Stock Rover offers news alerts across a variety of investment options. However, a significant downside to the platform is its exception of additional markets like forex, crypto, futures, and options. So, Stock Rover doesn’t rank among the best options trading apps on the market.

All you’ll find are stocks, ETFs, bonds, and commodities, making Stock Rover limited compared to competitors like TradingView. Similarly, Stock Rover is only available on browsers at the time of writing. The market research software has no mobile app. So, the platform is standard, with no unique selling points over other options in this review.

Stock Rover is limited to the American market at the moment. Investors looking for global opportunities may consider Stock Rover alternatives like AltIndex. Nonetheless, the best stock market research and analysis software is ideal for both new and experienced day traders. You’ll also find free and paid accounts to suit your needs.

| Screener Name | Stock Rover |

| Free Version | Yes |

| Key Features | American stocks, Real-time text and emailing, Stock and ETF screening |

| Pricing Information | Starting from $7.99 per month |

5. TD Ameritrade – Top Screener for American Stock Traders and Investors

TD Ameritrade is another top consideration when thinking of the best stock screeners free apps for your trading needs. The screener offers in-depth investment research using data from third-party providers and Schwab experts. In other words, the platform makes screening, comparing, and analyzing market data seamless.

Additionally, TD Ameritrade is one of the screening platforms with a built-in brokerage for traders to buy and sell stocks and other assets. Creating a brokerage account is straightforward, and TD Ameritrade charges no stock commissions for trades or monthly fees like many online stock brokers.

Besides stocks, TD Ameritrade allows users to filter through options, ETFs, options, bonds, forex, and mutual funds to find the best opportunities in the market. To streamline your search and get accurate data, search for these assets by sector, industry, performance, price, and other metrics .

Another exciting feature of TD Ameritrade is its ability to trade on its exchange directly using the data gathered from its screener. This makes it easy for users to automate trades or save time by manually executing trades using a few clicks. However, the TD Ameritrade platform has now been merged into Charles Schwab after it was acquired in 2020.

| Screener Name | TD Ameritrade |

| Free Version | Yes |

| Key Features | Schwab equity ratings, Access to real-time market data, $0 commission for stocks. Mobile and web trading |

| Pricing Information | $0.65 per contract fee and $6.95 commission for OTC stocks |

6. Seeking Alpha – Best for Financial Market News and Insights

Seeking Alpha is another stock market analysis tool for traders and investors looking for free stock screeners. The trading tool was launched in 2004 and has become one of the most popular stock screeners on the market after nearly two decades of existence.

One of the significant attractions of Seeking Alpha is its strong community. The screener works by collecting crowd-sourced content, including stock market news, investing insights, market analysis, charts, and earning calls, to help users create a good portfolio.

Additionally, Seeking Alpha spreads its screening services across the US and global markets, focusing on diverse assets like stocks, ETFs, futures, commodities, and treasuries. The available markets on Seeking Alphas are limited compared to top screeners like AltIndex and TradingView. But it remains one of the best commodity trading apps.

Nonetheless, you can create a new account and access the basic Seeking Alpha features for free. These include creating new portfolios, exploring investing groups, and finding the best stocks and ETFs. Alternatively, you can opt for the paid versions for unlimited access to premium analysis and news, stock and ETF screeners, and VIP perks.

All of these features are available on the Seeking Alpha app for Android and iOS devices, making the screener platform a decent option for mobile-focused traders and investors.

| Screener Name | Seeking Alpha |

| Free Version | Yes |

| Key Features | Premium market news and analysis, Quant ratings, Investing Groups, Crowd-Sourcing |

| Pricing Information | Starting from $199 per year |

7. Yahoo Finance – Best for Stock Beginners

If you’re familiar with stock trading and investing, you must have heard of Yahoo Finance. The financial arm of the Yahoo franchise offers comprehensive stock screeners that users can leverage to find investing opportunities by industry, index membership, and over 150 other screening criteria.

While you can find screeners for stocks, mutual funds, ETFs, futures, and indices to access top-performing investment options, Yahoo Finance offers users access to undervalued growth stocks with massive potential. There are also screeners for small-cap stocks with high growth rates and other different categories with unique opportunities.

The available markets cut across the US and international exchanges. The platform also provides users with real-time data to make informed decisions. On top of that, you can get market news and insights from Yahoo, one of the best news platforms globally. However, the screener platform is available on the web only, whether you’re using a mobile device or desktop.

| Screener Name | Yahoo Finance |

| Free Version | Yes |

| Key Features | 150+ screening criteria, High and low-cap stocks, Screeners for ETFs, indices, and futures |

| Pricing Information | Yahoo Finance Plus starts from $20.83 per month (billed annually) or $29.16 per month (billed monthly) |

8. TC2000 – Free Stock Screener for Students and Day Traders

The top screener was founded in 1997, but besides its long-standing record in the investing space, TC2000 is a great choice among traders and investors because of its massive range of investing tools, including watchlists, options analysis, and charting. These tools are handy for technical and fundamental analysis of the supported stock markets.

Additionally, users can set custom alerts to get notified when preset events happen. For instance, you can set an alert for the screener to notify you when a specific stock hits a certain price, making TC2000 the best screener for day traders.

TC2000 caters to all user categories with its web and mobile versions. The platform also has a free version for students and paid versions for other users.

| Screener Name | TC2000 |

| Free Version | Yes (For students) |

| Key Features | 100+ screening criteria, Custom alerts, Advanced charting and investing tools |

| Pricing Information | Starting from $9.99 per month |

Comparison of the Best Free Stock Screeners & Apps

Below, we compare the best 8 stock screeners that make it into our list to see how they stack up side-by-side.

| Stock Screener | Subscription Plan | Exchanges Covered |

| AltIndex | $29 per month | US and Global |

| Sharemarketcap.com | $25 per month | US and Global |

| TradingView | $12.95 per month | US and Global |

| Stock Rover | $7.99 per month | US |

| TD Ameritrade | N/A | US and International |

| Seeking Alpha | $199 per year | US and International |

| Yahoo Finance | $29.16 per month | US and Global |

| TC2000 | $9.99 per month | US and Canada |

What Are Free Stock Screeners & Apps?

Stock screeners are tools used in the stock trading world and financial markets to find stocks and other assets with exciting potential for good yields. A stock screener uses AI and sophisticated algorithms to sift through the thousands of stocks and other financial instruments on different stock exchanges and highlight solid options using preset metrics.

These metrics usually include market capitalization, financial stability, earnings per share (EPS), return on investment (ROI), and price. With these metrics, investors can find stock options and other securities that align with their preferences and investment goals.

Typically, stock screeners and apps come with different features unique to individual investors. For instance, some screeners have basic screeners and tools for beginners. Others have sophisticated charting tools and other technical and fundamental analysis features.

As such, seasoned traders and investors will opt for more sophisticated screeners. Screeners with features like advanced charting and insight tools help investors to get the kinds of data they desire.

A value-biased investor can configure their screener apps to find stocks with high dividends. A growth-focused investor may opt for screeners that find stocks with rapidly growing profits.

Whatever the case is, getting the best results from stock screeners requires configuring as many metrics as possible. Interestingly, some of these screeners offer free plans with basic screening features to users.

As the name implies, these free stock screeners & apps require no fees or subscriptions to register and start using their products. We’ve highlighted some of the best AI stock trading apps for screening above.

The free versions are best suited for beginners looking for decent screeners to gather data for trading and investing needs. However, the screeners also often offer paid versions with more robust tools and features. It’s advisable that experienced investors choose paid versions of stock screeners to get the best results.

It’s important to note that some screeners can be used for ETFs, bonds, mutual funds, indices, and other financial instruments outside the stock markets. Such screeners are ideal for all kinds of traders looking to diversify their investments with non-stock options and expand their opportunities.

Overall, free stock screeners are priceless tools in the hands of investors looking to efficiently find stocks or other securities that perfectly align with their investment strategies. With these screeners, investors save time normally spent on filtering through thousands of investment options and arrive at spot-on results.

How Do Stock Screeners Work?

Now that you know what stock screeners are, let’s look at how they work. At their core, stock screeners are software tools that leverage AI technology and sophisticated algorithms to filter and streamline a collection of stocks from the vast number currently existing in the US and global stock markets.

However, stock screeners do not work on their own. They scan and narrow down stock options based on the criteria their users select. These criteria can be fundamental, technical, or a combination of both.

The fundamental criteria include financial-related details like earnings per share (EPS), price-to-earnings (P/E) ratio, debt-to-equity ratio, revenue growth, and dividend yield. Conversely, the technical criteria are the data related to the stock price and volume. Some of these are moving averages, relative strength index (RSI), and other technical indicators.

After determining the specific criteria the screeners should work with, the user must input them into the analysis tool before setting things in motion.

For example, an investor looking for stocks with a P/E ratio below a certain value, a dividend yield above a certain percentage, or stocks that have recently crossed their 50-day moving average must enter the selection criteria the tool should work with.

Afterward, the stock screener will scan through an existing database of stocks. Usually, the stock database is from third-party financial data providers. The screener highlights stocks that meet the initially specified criteria. The unqualified stocks are then filtered out by the best investment tools and analysis software. As a result, this leaves a list of only the stocks that match the investor’s preset preferences.

The screener then displays the results in a list format, highlighting the relevant information about each stock that makes the list. Screeners like AltIndex also give each qualified stock a score for easier ranking from high to low.

Investors can then analyze the selected stocks further using other research mechanisms like the company’s financial health, industry trends, news, and market insights or opinions from top voices to make informed decisions.

Interestingly, some stock screeners have built-in trading platforms or brokerages. These allow users to automatically move from the stock selection process to instantly executing trades. Other screeners also integrate with third-party trading platforms to help users automatically execute trades.

However, it’s essential that users set up alerts, as the tools offer the best stock alerts services. Alternatively, they can regularly monitor and update their criteria in line with the constantly changing market conditions. This can help to mitigate the risk of losing money to volatility.

With numerous free stock screeners and apps on the market, stock traders and beginners need help choosing the best options. Finding the right stock screener for you isn’t as complicated as it seems. Below, we highlight the key factors to consider when choosing a free stock screener or app for your trading and investment needs. Free stock screeners require no registration fees or commissions. All you have to do is visit the screener’s website and create a new account. However, the free versions are often limited to basic features, and you may not get the maximum experience. To elevate your experience, you may need to opt for a paid version of your best AI stock picking service provider. As such, you want a cost-effective option that offers maximum value for money. For instance, paid plans on Stock Rover start from $7.99 per month, which is relatively low compared to most of the alternative options in this review. Whether you’re using a paid stock screener or the free version, you want to get the best user experience, as this determines successful trades. When choosing a screener, look for a platform that prioritizes easy usability. Usually, such platforms have an intuitive interface and a clean design that makes navigation easy regardless of your experience level. The best free stock screeners & apps in this review have user-friendly interfaces and designs. This making them excellent options for beginners and seasoned stock investors and traders alike. Some stock screeners integrate with online brokerages to allow users to automate trades after the software selects stocks using preset metrics. The automation also aids usability, as investors do not have to enter trades manually. If you fancy this feature, you can find screeners with built-in or third-party brokerages to automate trades and save time. There are many criteria to input into a stock screener before finding the best stock options. These criteria vary from one screener to another. So, you should check the available screening criteria on a stock screener – including its supported fundamental and technical indicators – to determine if it suits your investment strategy. Similarly, the best stock screeners & apps allow you to customize your screening criteria to your taste. That means you should find screeners with flexible criteria. This ensures that you can configure them to fit your preferences, risk appetite, and investment style. You can also set up alerts and notifications based on your screening criteria to stay updated on market trends without constantly staying on your device’s screen. Charting and analysis tools are equally important when finding the best stock screeners & apps. The tools help with more detailed market analysis, as they offer users better insights. However, not all stock screeners have charting features. So, you want to find the best stock analysis apps or screeners like TradingView with additional charting and analysis tools. The charts can help you visualize stock performances and trends, which can be used to make informed decisions. Note that these tools leverage real-time data to get accurate results. So, ensure the screener you choose has timely updates on stock prices, financials, and other essential information. Finally, search the internet for reviews and recommendations from other users. Knowing what other people say about a screener can help assess its pros and cons and ultimately determine its efficiency. You can check platforms like Trustpilot for existing user reviews on their overall experience. If you prioritize monitoring trades on the go, you should check that the screener platform has a mobile app. You should also check the app ratings and reviews on the Apple App Store or Google Play Store to determine its interaction rate among users. With the factors mentioned above, you can find a free stock screener or app that perfectly suits your investment goals and offers the required tools to conduct effective stock screening and analysis.How to Choose the Best Free Stock Screeners & Apps

Pricing

User-Friendliness

Supported Screening Criteria

Charting and Analysis Tools

Reviews and Recommendations

Conclusion

Many stocks abound on the US stock exchange and the global stock market. Stock screeners are valuable tools for short and long-term stock investors. This is because they can sift through complex data and process large databases. They also provide users with a list of stocks that align with their criteria or investment needs.

We’ve reviewed the best free stock screeners & apps to help investors find suitable options for trading and investment needs. Some of these screeners are ideal for day traders, while others are perfect for investors. AltIndex, however, is our overall best free stock screener because it offers features suitable for both categories of users.

References

- https://www.britannica.com/money/how-to-analyze-a-stock

- https://money.usnews.com/investing/articles/how-to-pick-stocks-things-all-beginner-investors-should-know

- https://www.linkedin.com/pulse/how-ai-transforming-stock-trading-appentus-technologies?utm_source=share&utm_medium=member_android&utm_campaign=share_via

- https://en.m.wikipedia.org/wiki/Day_trading

- https://en.wikipedia.org/wiki/New_York_Stock_Exchange

- https://en.wikipedia.org/wiki/Toronto_Stock_Exchange