7 Best Stock Analysis Apps for 2026

Stock market apps reshape how people invest and trade. They’re user-friendly and accessible, making them popular among investors of various ages and backgrounds. However, the trading app market is fiercely competitive. To attract more users, companies frequently update their apps with new features.

Two essential functions define a top stock analysis mobile app: access to real-time market data and the ease of trading from anywhere. While the market is crowded, the best stock analysis apps stand out due to their unique features, advanced technology, and superior user experience.

When choosing a stock analysis app, looking at different apps and seeing which fits your investment needs best is good. We’ve listed seven of the best stock analysis apps to help you in your search.

-

- Altindex: The Overall Best Stock Market Analysis App

- Sharemarketcap: Top Choice for Analyzing Global Stocks

- Benzinga Pro: Top Choice for Stock Market News Analysis App

- Motley Fool Rule Breakers: Best App for Long-Term Investments

- MetaStock: Top Choice for Stock, Forex, and Fund Analysis

- Seeking Alpha: The Best App for Fundamental Stock Analysis

- Morning Star: Best Stock Market Research App

-

-

- Altindex: The Overall Best Stock Market Analysis App

- Sharemarketcap: Top Choice for Analyzing Global Stocks

- Benzinga Pro: Top Choice for Stock Market News Analysis App

- Motley Fool Rule Breakers: Best App for Long-Term Investments

- MetaStock: Top Choice for Stock, Forex, and Fund Analysis

- Seeking Alpha: The Best App for Fundamental Stock Analysis

- Morning Star: Best Stock Market Research App

-

The Best Stock Analysis Apps Ranked

Wondering what is the best stock analysis app? Here’s a quick overview of the top stock analysis apps for investors:

- AltIndex: AltIndex tops the list with its innovative market approach. It uses alternative data like social media sentiment and web traffic for stock and asset class analysis.

- Sharemarketcap: Known for its vast asset library, Sharemarketcap analyzes over 6,000 stocks and nearly 3,000 ETFs from 11 global exchanges.

- Benzinga Pro: Benzinga Pro offers real-time financial news and technical analysis for various stocks and funds.

- Motley Fool Rule Breakers: Motley Fool Rule Breakers is perfect for those looking for high-growth stocks. It’s a go-to for long-term investors wanting insights into future growth potential.

- MetaStocks: MetaStocks combines technical and fundamental analysis, providing real-time data and analytics to help investors make informed decisions.

- Seeking Alpha: Focusing on fundamental analysis, Seeking Alpha analyzes thousands of stocks and ETFs and identifies those likely to outperform the market.

- Morningstar: Morningstar is great for accessing mutual funds and ETF analysis. It also covers a wide range of stocks, aiding investors in making timely decisions.

Top Stock Analysis Apps Reviewed

Each app offers something unique, making it stand out in the competitive world of stock trading. By looking closer, we can see what sets these apps apart and why they’re snowballing in popularity. This insight will help you decide which app fits your investment needs best.

With that in mind, let’s jump into the details of these seven best stock analysis apps.

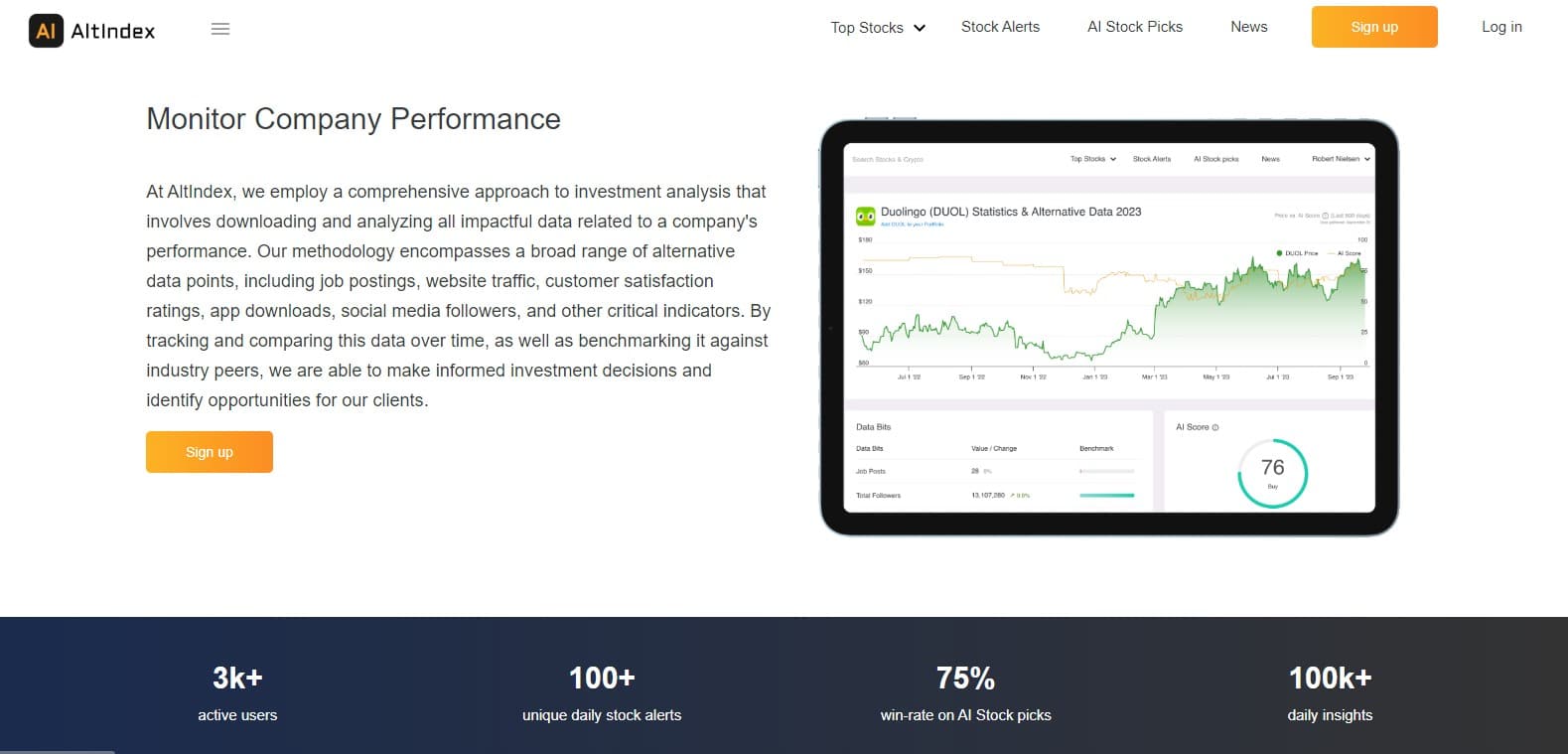

Altindex: The Overall Best Stock Market Analysis App

The app applies natural language processing to gather data from social media. This includes social media platforms like Facebook, Twitter, and Reddit.

AltIndex evaluates public opinion on a stock by examining factors like followers, likes, mentions, and shares. It then uses machine learning to turn this data into valuable insights. This helps gauge market sentiment for thousands of stocks.

AltIndex goes further than just analyzing social media. It also tracks how long users stay on websites and which pages they visit. This is particularly insightful for stocks with a solid online presence.

Additionally, AltIndex studies employee satisfaction and job posting trends. When a company is hiring more, it often indicates expansion plans.

After collecting data, AltIndex uses artificial intelligence to score stocks. It scores stocks on a scale from 0 to 100. Stocks scoring between 70 and 100 are likely to surpass market performance.

On the other hand, stocks with scores below 30 might not do as well compared to the overall market. This rating system makes AltIndex the best stock analysis app for beginners.

AltIndex is not only valuable but also affordable. The starter plan is $29 per month for ten stock picks.

This platform is the best app for stock market research. The specs are shown in the table below

Spec Overview Fear and Greed Index This tool evaluates stock market fluctuations to assess the fairness of valuations Trending Stocks This feature list trending stocks in different sectors Pros:

- Utilizes alternative data for stock analysis

- Cost-effective

- User-friendly

- Offers stock rating system

Cons:

- Limited to stocks and cryptocurrencies only

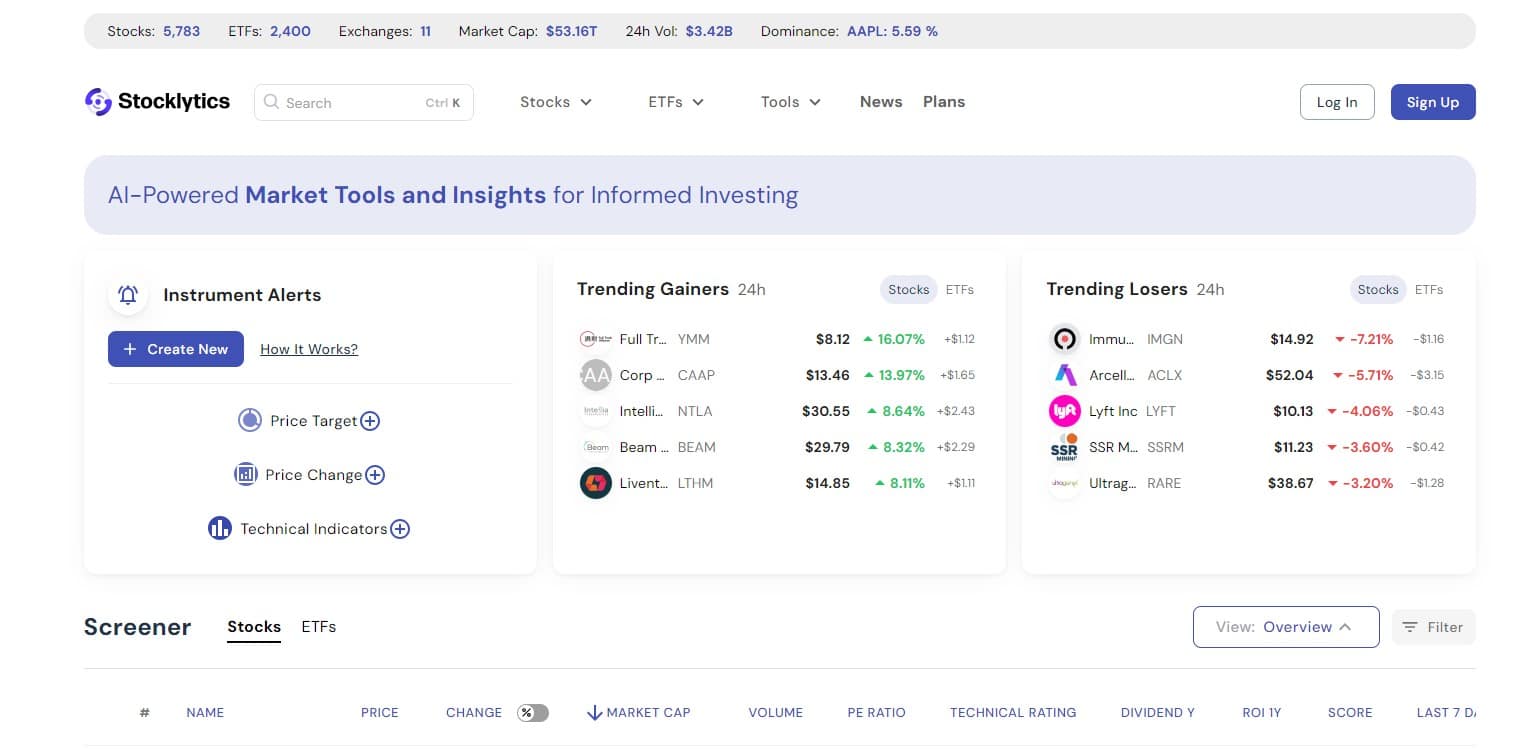

Sharemarketcap: Top Choice for Analyzing Global Stocks

ShareMarketCap is an excellent choice for investors with international interests. It covers over 6,200 stocks and 2,700 ETFs from 11 global markets, including the US, UK, Europe, India, and Canada.

This platform uses technical analysis, making it a valuable stock market research software for pros and beginners. It focuses on stocks and ETFs, providing technical ratings to help investors identify potential market performers.

Users of ShareMarketCap have access to essential data like price performance, trading volume, P/E ratios, and dividend yields. While it emphasizes technical analysis, the app also offers fundamental data. Integrations with Yahoo and Barrons provide round-the-clock news, informing users about market changes.

ShareMarketCap also offers a comprehensive stock and ETF screener. You can filter investments by market capitalization, exchange, price, sector, or industry.

The app uses AI for technical ratings, indicating if a stock is a buy, sell, or hold. Custom alerts are another feature that allows you to set notifications for specific technical indicators.

The app displays the best and poorest performing stocks from the last 24 hours. This feature is excellent for identifying trending stocks with significant momentum.

AI also powers price predictions, updated daily for a 7-day and 1-month outlook. A daily newsletter suggests stocks to consider before the market opens.

The ShareMarketCap free plan offers several features. It tracks global stocks and ETFs but doesn’t support commodities, currencies, or cryptocurrencies.

Spec Overview Stock and EFT Screener The feature filters investments by different metrics, including market cap and industry. AI ratings It determines if a stock should be bought, sold, or held. Pros:

- It covers stocks and ETFs in the US, UK, Europe, Canada, etc.

- The app performs both technical and fundamental analysis of assets

- Provides technical stock ratings and AI-based price predictions

Cons:

- It does not support commodities and cryptocurrencies

Benzinga Pro: Top Choice for Stock Market News Analysis App

Benzinga Pro is an excellent analysis app for around-the-clock access to stock market news. As a leading financial media outlet, it offers top-notch stock analysis.

You can choose your favorite stocks and receive tailored news and market updates. This includes company earnings, the latest SEC filings, and daily news.

While Benzinga Pro primarily focuses on fundamental analysis, it also includes technical analysis tools like charting and indicators. The app features a trading chat room, allowing investors to share insights and learn from one another. This makes it easy to trade high-growth stocks, particularly penny stocks.

As an investor, you may prefer filters focused on financial metrics like price, volume, and market cap. Benzinga Pro allows you to use all these filters for tailored trading and investment strategies.

Benzinga Pro is also budget-friendly for retail investors. The Basic plan is priced at $37 per month. However, more comprehensive plans like Essential and Options Mentorship are available at higher prices, $197 and $457 monthly.

The stock calendar helps you keep track of tickers. Benzinga Pro offers over 12 calendars, including analyst ratings, mergers and acquisitions, secondary offerings, SEC filings, unusual options activity, etc. Furthermore, you can apply several filters to these calendars to suit your portfolio and interests.

Another notable feature is the chat room. You can ask questions and learn from expert traders or those sharing similar portfolios. The feature also supports video calls for more close-up communications and explanations.

Spec Overview Movers This feature shows the biggest gainers and losers daily Signals This alert tool will notify you of price hikes, opening gaps, block trades, etc. Pros:

- Offers comprehensive fundamental analysis

- Includes additional features like indicators and charting tools

- Well-suited for long-term investors

Cons:

- Limited range of asset classes

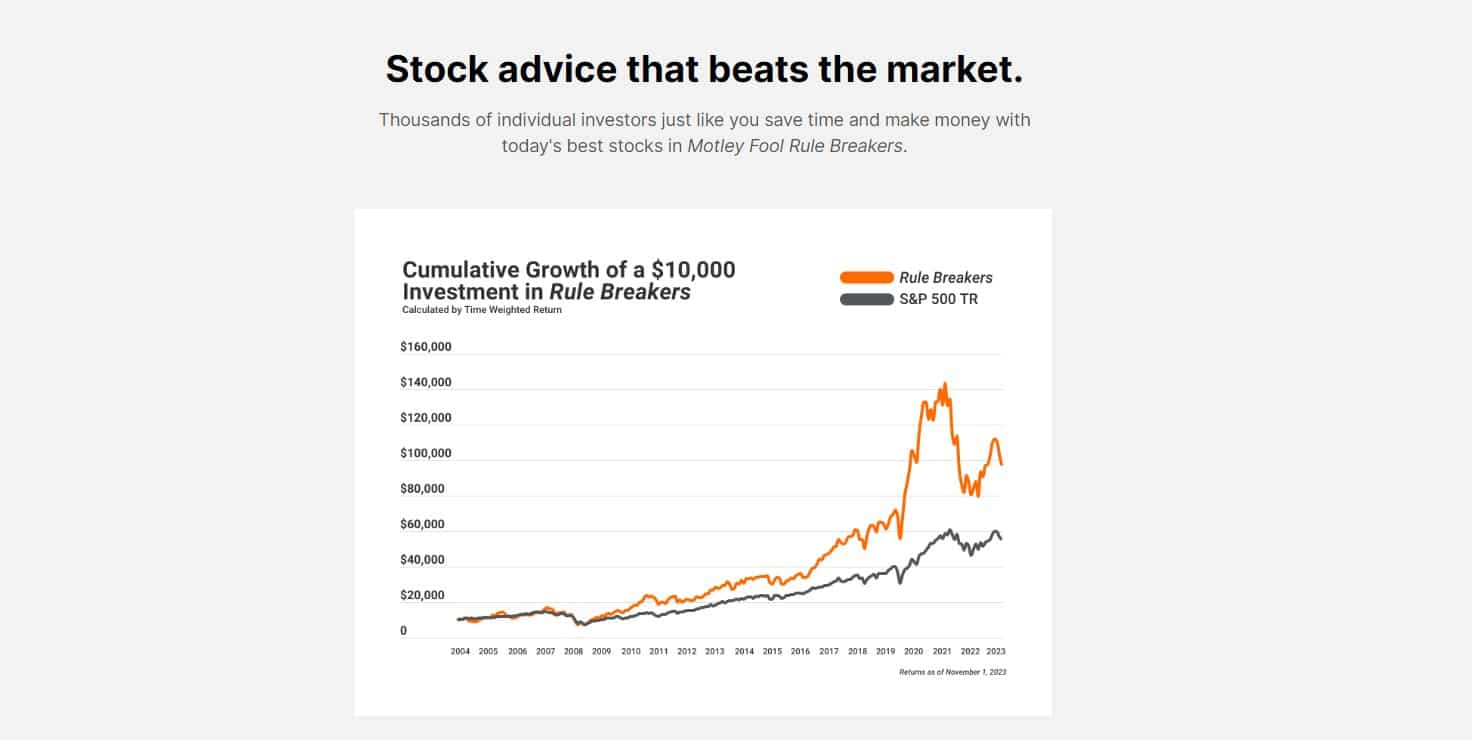

Motley Fool Rule Breakers: Best App for Long-Term Investments

The Motley Fool suggests owning at least 25 stocks and keeping them for five years. The platform employs both fundamental and technical analysis to recommend stocks. When you use the app, you see the day’s top moving stocks, followed by tailored articles. The “My Portfolio” section lets you track your stocks’ performance and the latest news impacting your investments. Adding stocks to your portfolio is easy with just a click.

The app sends paid subscribers daily alerts and updates on chosen stocks. Premium members also get exclusive stock picks, comprehensive research on trends, insights from expert Foolish Investors, stock rankings, and various investing tools.

Additionally, they have access to Motley Fool’s newsletters, research reports, and investment management services.

The Motley Fool Rule Breakers portfolio includes about 200 stocks. Over the past 20 years, it has outperformed the S&P 500 significantly. The Motley Fool Rule Breakers subscription fee is $299 annually, with a special first-year discount of $99.

Spec Overview Portfolio It allows you to track the performance of your assets. Pros:

- There is a special first-year discount price of $99

- Monthly stock analysis and recommendations

- Impressive performance over the years

Cons:

- The renewal price is relatively high

- Focuses on volatile, high-growth stocks

MetaStock: Top Choice for Stock, Forex, and Fund Analysis

MetaStocks merges technical with fundamental analysis for various financial assets. It covers stocks, forex, ETFs, and mutual funds. Users of the MetaStock app can access up-to-date financial news, analytics, and data. The platform boasts over 300 technical indicators for market analysis.

Investors can enhance their strategies with MetaStock PowerTools. These tools help in backtesting strategies, generating signals, and filtering markets. AI is used in the app to forecast prices for stocks, ETFs, and other asset classes.

The latest MetaStock version includes improvements to OptionScope and the Power Console. It also adds two new trading systems at no extra cost. The popular Performance Systems Plus and Daryl Guppy ATR indicators are now included for free.

The platform is primarily for PCs, though it can work on Macs with PC emulation software. Installing MetaStock requires setting up specific data feeds for desired markets, which might take longer than other apps.

MetaStock is a strong option for traders seeking a comprehensive technical analysis tool. It sources robust data from Refinitiv and worldwide news from Thomson Reuters.

Spec Overview PowerTools They provide backtesting for strategies, generate signals, and filter markets Pros:

- It integrates fundamental and technical analysis for stocks and ETFs

- It covers a diverse array of financial asset classes

- It features a straightforward user interface

- It enables the generation of trading signals and strategy backtesting

Cons:

- The Subscription is relatively costly for casual traders

- It is not suitable for beginners

Seeking Alpha: The Best App for Fundamental Stock Analysis

Seeking Alpha app specializes in analyzing stocks and ETFs, covering thousands of each. As a financial media platform, the app publishes regular reports on various ETFs and stocks. This helps investors make informed decisions.

The Seeking Alpha stock screener utilizes a broad range of metrics for market analysis. Moreover, the app rates stocks and ETFs, focusing on growth and value metrics. The Seeking Alpha Premium plan costs $199 per year, while the Pro plan costs $2,400 annually.

Seeking Alpha benefits investors at all levels, offering information and financial tools suitable for any investment stage. A portfolio tracker is available to keep tabs on your assets. However, the sheer volume of data and tools might be daunting for new or intermediate investors.

The free Basic plan is an excellent place to begin if you’re just starting. Once you require more detailed information, you can upgrade to the Premium or PRO plans, which are subscription-based.

Spec Overview Stock screener It has pre-built stock screeners, but you can build your own Stocks comparison tool Compare stocks on various financial statistics Pros:

- Specializes in stock and ETF analysis

- Rates stocks and ETFs based on value and growth metrics

- Utilizes AI for stock picking

Cons:

- The pro plan, priced at $2,400, is expensive

Morning Star: Best Stock Market Research App

Morning Star is the best stock market research app for long-term value investors. It’s popular among both retail and institutional investors.

The software offers detailed financial data, analyst reports, daily updates, news feeds, and newsletters. While Morningstar does include stock fundamentals, it mainly focuses on mutual funds and ETFs. It provides extensive, independently sourced data, giving users confidence in the depth of research behind each data point.

Morning Star Premium offers tools for various financial needs, including tax planning, asset allocation, personal finance, retirement, and education investing.

You have two subscription options: Basic and Premium. Following a 7-day free trial, the Premium subscription is available for $199 per year.

Spec Overview Investor This feature provides research and tools to strengthen your research strategy Pros:

- Perfect for ETF and mutual fund analysis

- Provides access to various investment tools

Cons:

- Best suited for long-term investors only

How does the Stock Analysis App Work?

Besides picking the best app, it’s always helpful to understand how stocks work to make the most of them. First, let’s discuss what a stock analysis app is.

What Is a Stock Analysis App?

Stock analysis apps are crucial tools for traders and investors. It helps them stay ahead in the fast-changing world of finance.

This software provides essential tools for understanding the complex stock market. Features typically include live data feeds, customizable charts, technical indicators, and screening tools. These help spot trading chances, manage risks, and refine investment strategies.

The software combines technical, fundamental, and market sentiment analyses. This mix offers deep insights into individual stocks and the overall market. In simple terms, stock analysis software is a computer program designed specifically for traders and investors. It helps analyze and interpret various financial data. This enables users to make informed decisions about their investments.

How Do They Work?

Now that you know what stock analysis software is, let’s see how it works. These tools process a huge amount of financial data and market information. Here’s a breakdown of how they do it:

Data Collection

Stock analysis tools gather data from many places. This includes stock trading platforms, historical price records, and financial news sites. They look at stock prices, trading volumes, company finances, and economic indicators.

Technical Analysis

These apps use technical analysis. This method looks at past price and volume data to guess future prices. They study old price charts and use different technical indicators and patterns, helping traders see possible trends and changes.

Fundamental Analysis

Besides technical analysis, these tools also use fundamental analysis. This means they look closely at a company’s financial health. They check earnings reports, balance sheets, and more. This helps to figure out a stock’s actual value and growth chances.

Market Sentiment Analysis

These tools use natural language processing to understand market moods. They scan news, social media, and financial reports. Knowing the current sentiment helps traders guess market changes.

Real-Time Data Feeds

The software offers live data from stock exchanges and news outlets. This ensures users get up-to-the-minute market information and news that could influence their trades.

Customizable Charts

Top stock analysis tools and trading platforms, like the eTORO app, provide charts you can change as needed. Users can make charts that show specific technical indicators and patterns. This helps you see where the trading chances might be.

Screening Tools

Many tools have features to sort and find stocks that fit specific needs. This could be looking for stocks with a certain price-to-earnings ratio or specific technical patterns. These tools are excellent for traders searching for new opportunities.

Stock analysis software is a powerful ally for traders and investors. It offers a complete set of tools to analyze, judge, and plan in the fast-paced world of finance. These tools help find trading chances, handle risks well, and shape investment strategies based on solid data.

In short, stock analysis software is vital for anyone wanting to do well in the complex and changing world of stock trading and investing.

Is It Legal To Use Software To Analyze Stocks?

Yes, using stock analysis software for trading and investing is entirely legal. These tools are developed to help traders and investors make data-driven decisions. They use technical indicators to aid in optimizing investments, operating within the bounds of legality.

However, using these tools wisely and adhering to financial regulations and guidelines is essential. You should always perform your due diligence. It’s vital to only depend partially on software for trading decisions and to cross-check data from various sources.

In addition to stock analysis software, incorporating social trading platforms and manual research strategies can be beneficial. This approach helps in risk mitigation and promotes informed decision-making in trading activities.

Knowing that some stock analysis tools might not be regulated is also crucial. While using unregulated platforms isn’t illegal, considering regulated alternatives is advisable for added security.

How to Choose the Best Stock Analysis App

The idea of less stress, more personal time, and increased income is appealing. We’ll review some key aspects to consider when selecting an app, whether for day trading analysis or long-term investment. Remembering these will help you confidently pick the right app for stock market analysis.

User Interface and Ease of Use

An app that still relies on old methods like moving averages, Bollinger bands, RSI, or other indicators isn’t simplifying your analysis. The goal is to speed up and ease the process of finding opportunities, planning trades, and executing them.

You should feel at ease and confident in your analysis, regardless of your experience level. This means the app should turn complex data and insights into something straightforward and easy to understand.

You’ll spend less time trying to understand complicated charts and more time making well-informed decisions. A good example is Altindex, which differs from other solutions with its simple stock-rating system. It presents crucial information in three straightforward ratings.

Efficient Portfolio Management Tools

Finding opportunities is just the start. The real profits come from managing your investments over time. The best stock analysis app should offer customizable alerts and notifications. These keep you updated on significant market movements, news, or shifts in your portfolio’s performance.

Such features help you act quickly and make smarter decisions. Choose an app that lets you set personalized alerts. These could be for price changes, earnings announcements, or shifts in technical indicators. With this tool, you’ll always be ready to jump on significant market opportunities.

Technical and Fundamental Analysis Tools

Access to technical analysis tools in stock analysis apps is crucial. These tools provide the necessary information for making informed and data-driven investment decisions. Key tools to look for include moving averages, RSI (Relative Strength Index), and volume analysis.

Equally important, the top stock analysis apps offer a variety of fundamental analysis tools. Look for features like economic calendars and news sections. These provide vital information on interest rates, current news, inflation outlooks, etc.

This combination of technical and fundamental tools equips you with a comprehensive view to guide your investment choices.

Personalized Guidance and Education

It’s not just about having the right tools; your chosen app should also guide and educate you. This guidance is crucial for maximizing your success in trading.

This means more than just a basic tutorial or a blog with a few tips on trading. The best app for stock analysis will offer comprehensive learning resources.

Look for platforms that host regular webinars, provide in-depth courses, or even offer group classes. Learning alongside others can be very beneficial.

The level of education and personalized guidance an app offers firmly indicates its quality. It shows the app’s commitment to your trading journey and success.

Proven Success Record for Verification

The app you select must have a proven, verifiable history of success. You should be able to review its performance over the past year, five years, or even longer. This review will show how well the system has managed through various economic ups and downs.

The app must provide full transparency about its historical performance. This openness allows you to check the accuracy and effectiveness of its past stock ratings, market timing signals, and investment advice. A clear record of success is a vital factor in choosing the right app.

Cost and Accessibility

Before deciding on a stock analysis app, consider its cost. If the app’s fees are eating into your profits, it might be time to look for a more affordable option.

Also, ease of access is crucial. Choose an app that is user-friendly and easily accessible, fitting seamlessly into your investing routine.

Why You Need the Best Stock Analysis App in Your Investment Strategy

Having the best stock analysis app is critical to your investment success. It’s like having a reliable guide in the complex world of stock trading. This next section will explore why these apps are essential for your investment strategy.

- Reducing Stress in Stock Investing

Buying and selling stocks can be stressful, especially with outdated methods. Doubting every trade is not a good mindset for investing.

The right app brings confidence to your trades, offering clear insights and well-structured data. It allows for easy, well-informed decisions, reducing stress and screen time.

- Saving Valuable Time

Time is precious, and investing was perhaps a path to more personal freedom for you. Yet, managing investments can feel like a full-time job, with endless hours spent tracking indicators and news and monitoring your portfolio.

You could earn more while spending less time on analysis. The best stock market analysis apps make this possible. They provide quick, comprehensive insights, turning what used to take hours into minutes. This frees up time for your personal life, and you still increase your profits.

- Boosting Your Profits

The ultimate goal of investing is to grow your wealth. A top-tier stock analysis app can significantly impact this goal. It gives you accurate, real-time data and analysis tools, making it easier to spot profitable opportunities.

It also helps manage risks with timely market signals, advising when to buy, hold, or sell. With a sophisticated stock analysis app, you’re equipped to make smarter decisions, leading to higher profits and long-term financial success. This gives you a significant edge in your trading strategy.

Comparison of the Best Stock Analysis App Reviewed

The table below compares the seven best stock analysis apps:

Stock Analysis App Asset Classes Supported Price AltIndex Cryptocurrencies and Stocks From $29 monthly Sharemarketcap Stocks and ETFs From $240 yearly Benzinga Pro Stocks From $27 per month Motley Fool Rule Breakers Stocks $199 per year MetaStocks stocks, options, FOREX, commodities, eminis, and foreign currency From $499 Seeking Alpha Stocks and ETFs From $199 per year Morningstar Stocks, markets, funds, ETFs, and bonds From $344.95 Cost of Stock Analysis Apps

The stock analysis apps we’ve covered are reasonably priced, though some are more budget-friendly than others. They provide various features aimed at enabling quicker and more efficient stock analysis.

AltIndex and Sharemarketcap are among the leading stock analysis apps globally. AltIndex is priced at $29 monthly, while Sharemarketcap costs $240 annually, making them both accessible options.

The other apps mentioned also have valuable features. When selecting an app, it is important to weigh its features, cost, and the types of assets it supports.

There are also stock analysis apps tailored for institutional traders and investors. These typically offer a broader range of features and services and are priced higher than the ones we’ve discussed.

Conclusion

The best stock analysis app is a game-changer for any investor. It simplifies the complex world of trading, offering tools for success. The process begins with gathering data from reputable sources.

Then, the app runs fundamental and technical analysis to gain insights from the data. The results are presented in charts and graphs for easy comprehension. Also, AI-powered platforms may make predictions, pick high-potential stocks, and forecast stock prices.

Among these, AltIndex stands out as a noteworthy choice. With its unique approach using alternative data, AltIndex provides deep insights into the market, making it an excellent option for new and seasoned investors.

AltIndex is an excellent app for analysis. You’ll find charts and extensive data to help you understand a stock. Most importantly, the app ends its analysis with a rating to guide you on promising stocks.

Start with the free plan today to analyze two stocks in your portfolio and receive one AI stock pick. Otherwise, pay $29 for the starter pack and increase your portfolio to ten stocks.

References

- https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/stock-analysis/

- https://www.foxbusiness.com/technology/chatgpt-can-predict-stock-market-understand-fed-statements-studies-claim

- https://www.datasciencecentral.com/artificial-intelligence-making-waves-in-the-stock-market/

- https://consumer.ftc.gov/articles/how-evaluate-online-reviews

- https://www.cnbc.com/select/biggest-investing-mistakes/

FAQs

Which platform is best for stock analysis?

AltIndex ranks highly as a stock analysis app. But the other apps we’ve discussed are also great for providing valuable analysis to their users.

Is there software that tells you when to sell and buy stocks?

Yes, the seven tools we’ve covered perform analyses that assist traders in deciding the correct times to buy and sell stocks.

Who is the best predictor?

While all the tools mentioned offer stock analysis, AltIndex is particularly notable for its stock prediction capabilities.

Can anyone really predict the stock market?

Stock analysis apps can’t guarantee perfect predictions, but they do offer highly accurate forecasts of stock market trends.

Jeremiah Awogboro

View all posts by Jeremiah AwogboroJeremiah Awogboro is an experienced content writer with over 8 years of experience. He has a qualified MBChB degree and a keen interest in the stock market and the finance industry. His background in the industry has provided him with valuable experience in this field. Awogboro is dedicated to assisting and reaching out to as many people as possible through his writing. In his spare time, he enjoys music, football, traveling, and reading.

VISIT ETOROYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2026

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up