Best Stock Tips Services for 2026

Investors are usually advised to delegate stock selection to experts with sufficient resources and a team of analysts. With the volume of data and market analysis, these expert stock tipping services often outperform the market.

In this article, we will present the best 8 stock picking services. Our experts have chosen them based on performance, reputation, pricing, and approach. Read on if you need a high-potential stock tipping service that might help you generate positive financial outcomes.

The Top Stock Tips Services Ranked

In a world where many investors are interested in what stocks are and how they work, stock tips services are critical resources investors use to beat the market. Such services offer quality opinions based on experience, suggestions, and professionalism when dealing with stocks. The following are the best stock tip services in the marketplace;

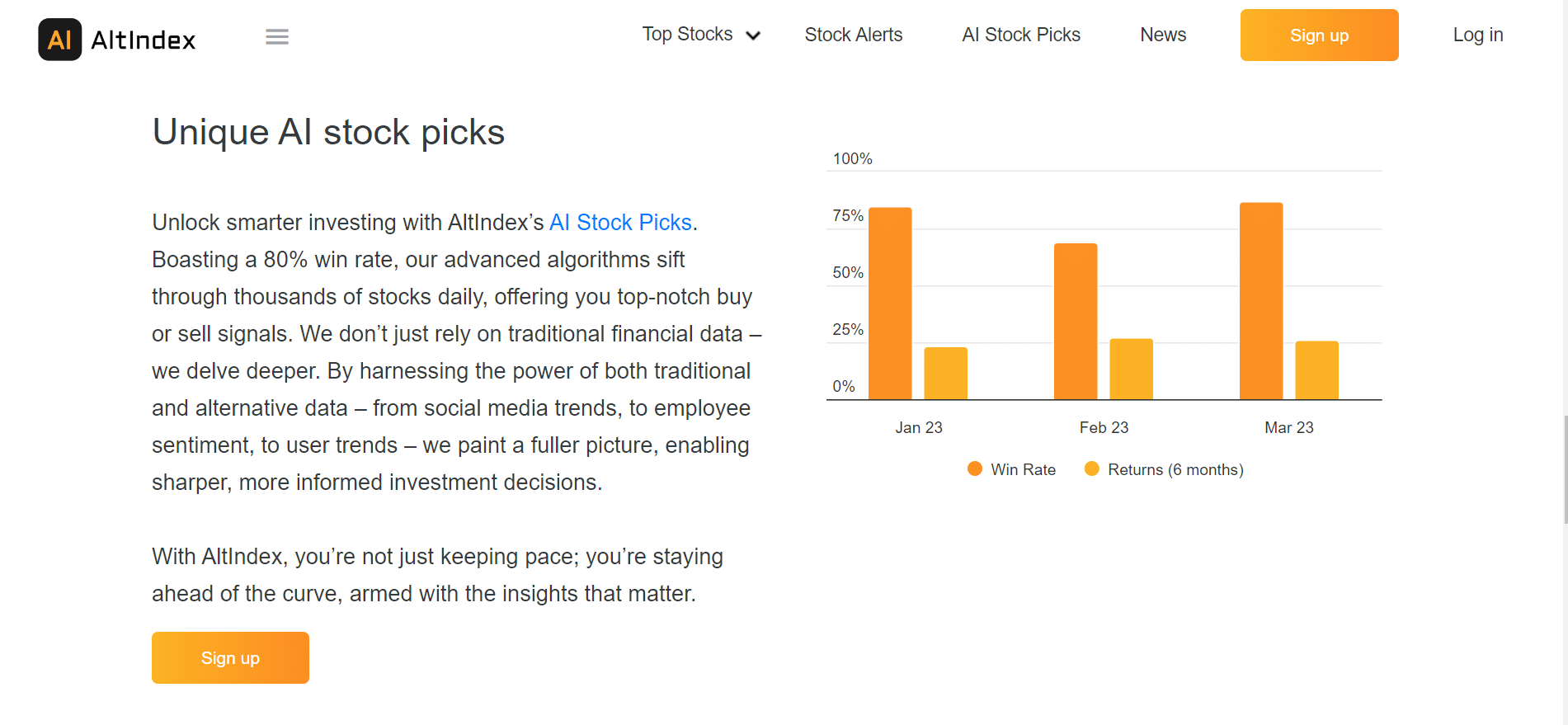

- AltIndex: Trusted alternative data providers like AltIndex deliver stock recommendations powered by AI. Using a comprehensive 0 to 100 ranking system, it has averaged 24% returns over six months. The subscription price is competitive, starting at $29 per month.

- Stocklytics: ShareMarketCap delivers real-time stock/ETF data across global markets, offers AI-driven technical ratings and SMC scores for performance prediction, and features an advanced stock screener with price forecasts and analyst insights.

- Motley Fool Stock Advisor: For about 30 years, The Motley Fool’s Stock Advisor has quadrupled the S&P 500’s returns, impressing over a million subscribers with exceptional long-term stock picks. Subscription costs $199 annually, and investors benefit from a 30-day money-back guarantee.

- Seeking Alpha: Seeking Alpha is a powerful package of market intelligence tools designed to help you become the best investor or trader. For an annual $199, Seeking Alpha Premium offers unlimited expert content, exclusive ratings, earnings calls, stock screeners, and investment tracking tools.

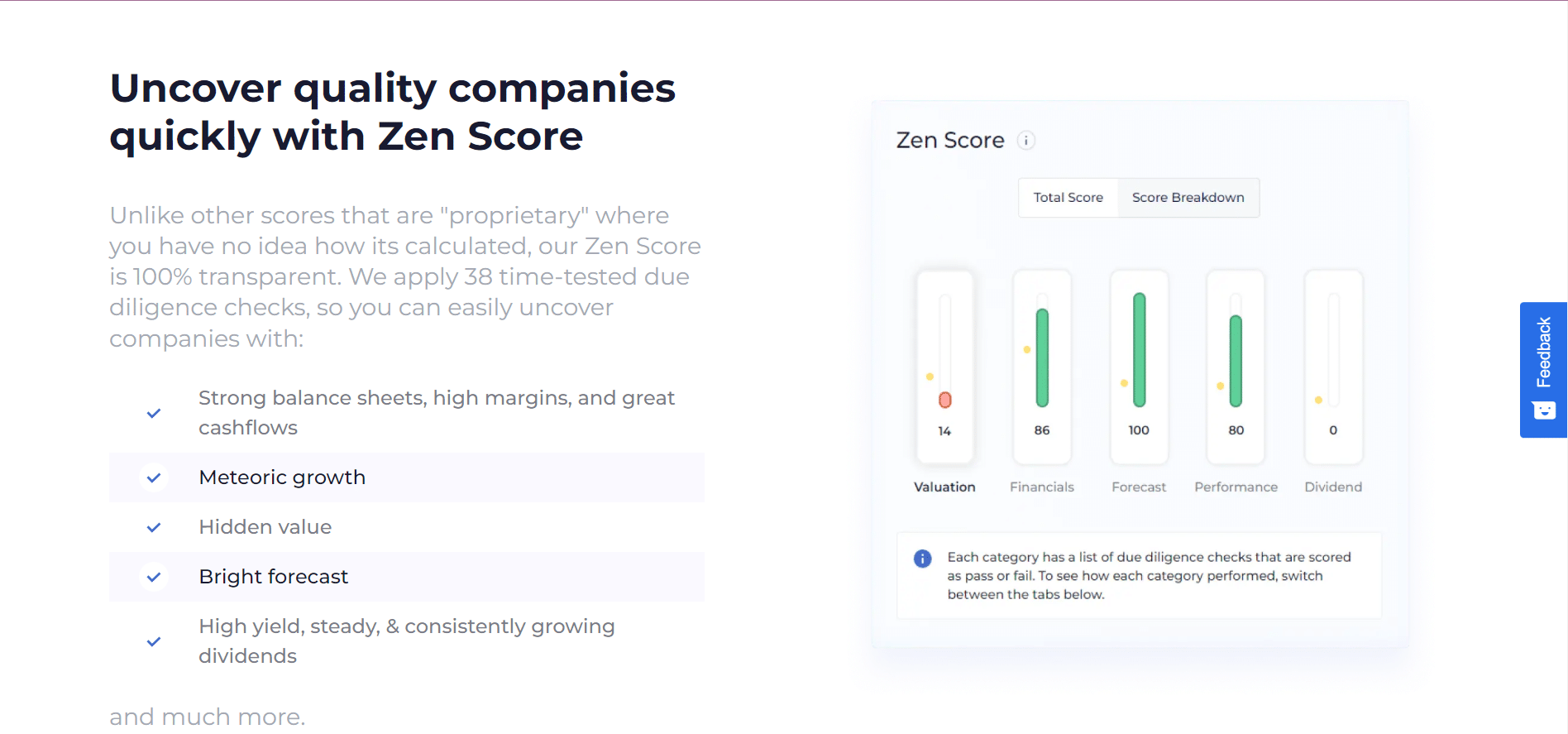

- WallstreetZen: WallstreetZen makes investing simple for people who don’t have expertise with short stock analysis at $19.50/month billed annually. By enabling one to filter trusted analysts and provide access to track records, it ensures that an informed decision is made.

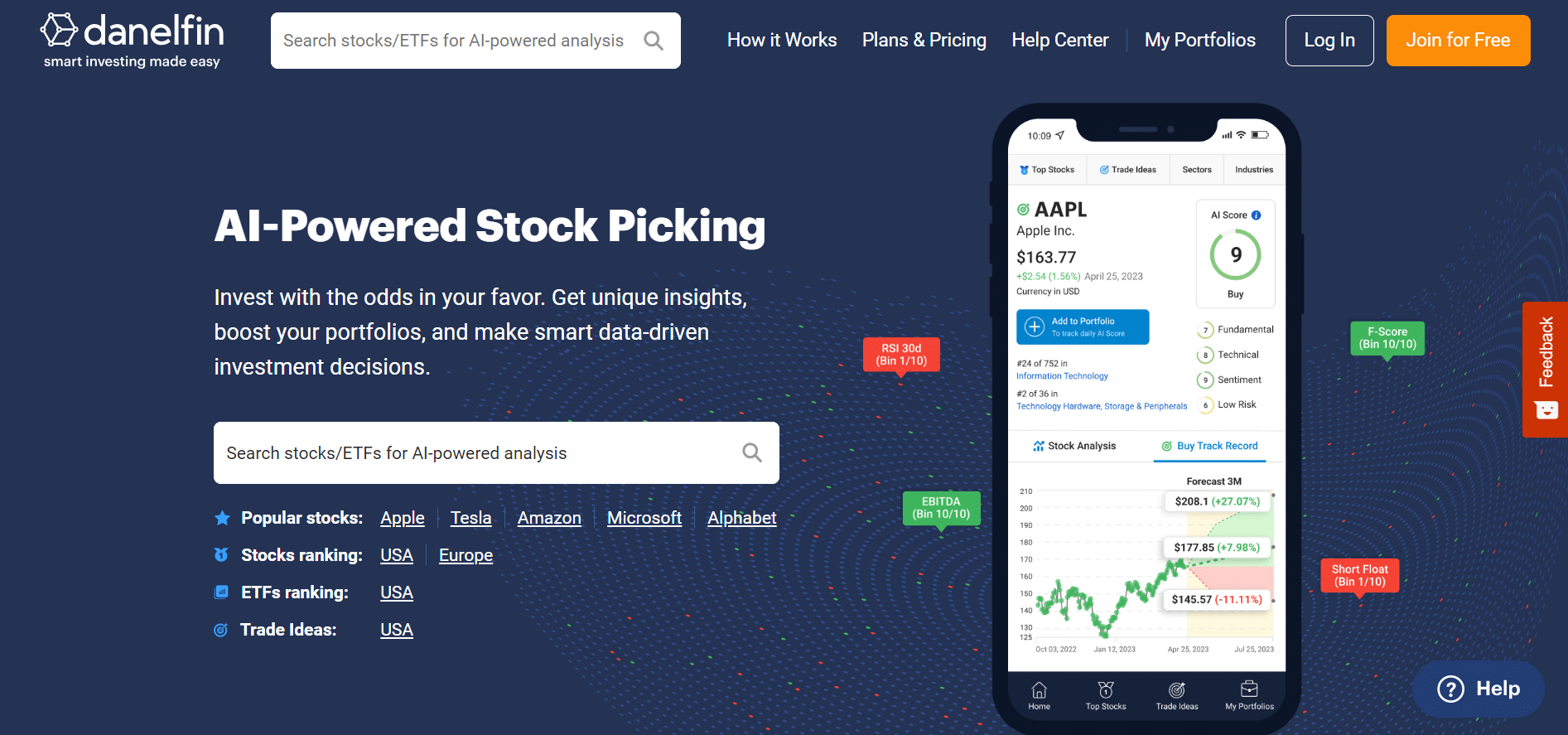

- Danelfin: Danelfin, an AI-driven stock tipping service, has guided investors since 2017 with its extensive coverage of US and European stocks and ETFs. Based on ‘Explainable’ AI, Danelfin meticulously evaluates a range of technical, sentiment, and fundamental indicators.

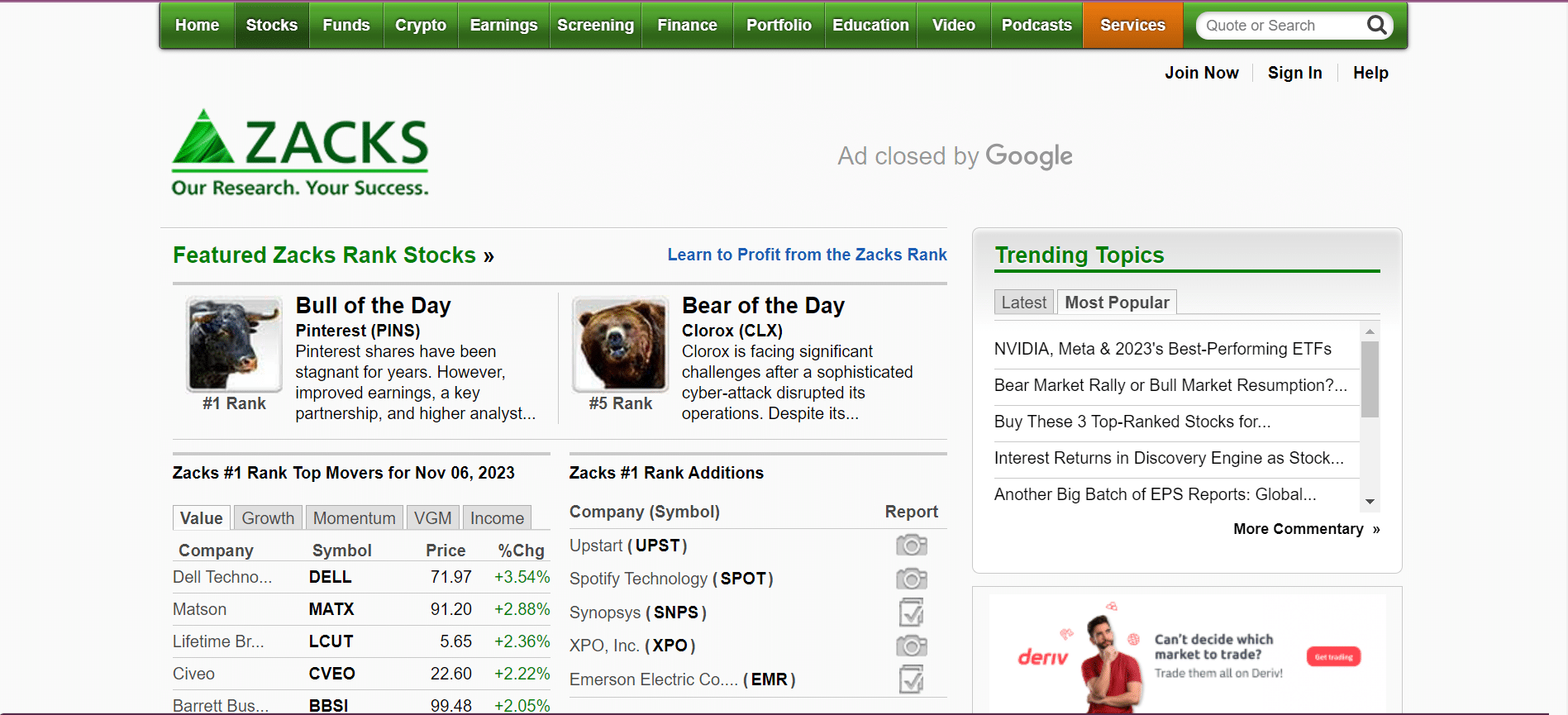

- Zacks: Zack offers stock analysis, research reports, and portfolio tools for stocks, mutual funds, and ETFs. Its services range from free limited access to premium features, with prices from $249 to $2995 annually. Historically, it has reported a 24.32% annual return.

- Candlestick.ai: Candlestick.ai started its operations in 2022 and issued three weekly trading tips for only $9.99 monthly on average, with an annualized return of approximately 23%. Candlestick.ai provides trading suggestions regarding a thousand securities.

1. AltIndex – Overall Best Stock Tip Service Provider in 2026

Essentially, billions of data points are extracted by AltIndex from websites, news articles, Google searches, and social media networks like Facebook and Reddit. After that, this enormous dataset is carefully examined and deciphered to reveal important consumer and social patterns. With its unmatched strategy, AltIndex has solidified its position as a dominant player in the industry.

AltIndex uses artificial intelligence methods in addition to its data analytic capabilities to evaluate its results and rank equities based on their growth prospects. By providing investors with up-to-date information, this innovative approach directs them toward the stocks with the greatest promise for acquisition.

AltIndex adopts a different strategy than other stock selection services, as it picks stocks based on sentiment rather than fundamentals. As a result, investors can identify trade opportunities before the general public.

On a 6-month basis, AltIndex has generated average gains of 24% since its launch. In terms of cost, AltIndex provides several plans. The amount of stock suggestions you get each month depends on the package you choose. For instance, you get 25 stock tips with the $99/month subscription. AltIndex might be expensive to certain traders, but considering its historical performance, it provides good value.

| Key Specifications | Past Performances | Pricing |

| Stock recommendations generated by AI based on social media sentiment, website analytics, and other alternative data sets. | Average 6-month gains of 24%. | Free plan: 20 visits; Starter: $29/month; Pro: $99/month |

Pros:

Pros:

- Best stock tips service for AI-powered recommendations

- Covers short and long positions for optimal adaptability

- Leverages AI and alternative data to outperform the market

Cons:

Cons:

- Untested in extended bear market circumstances

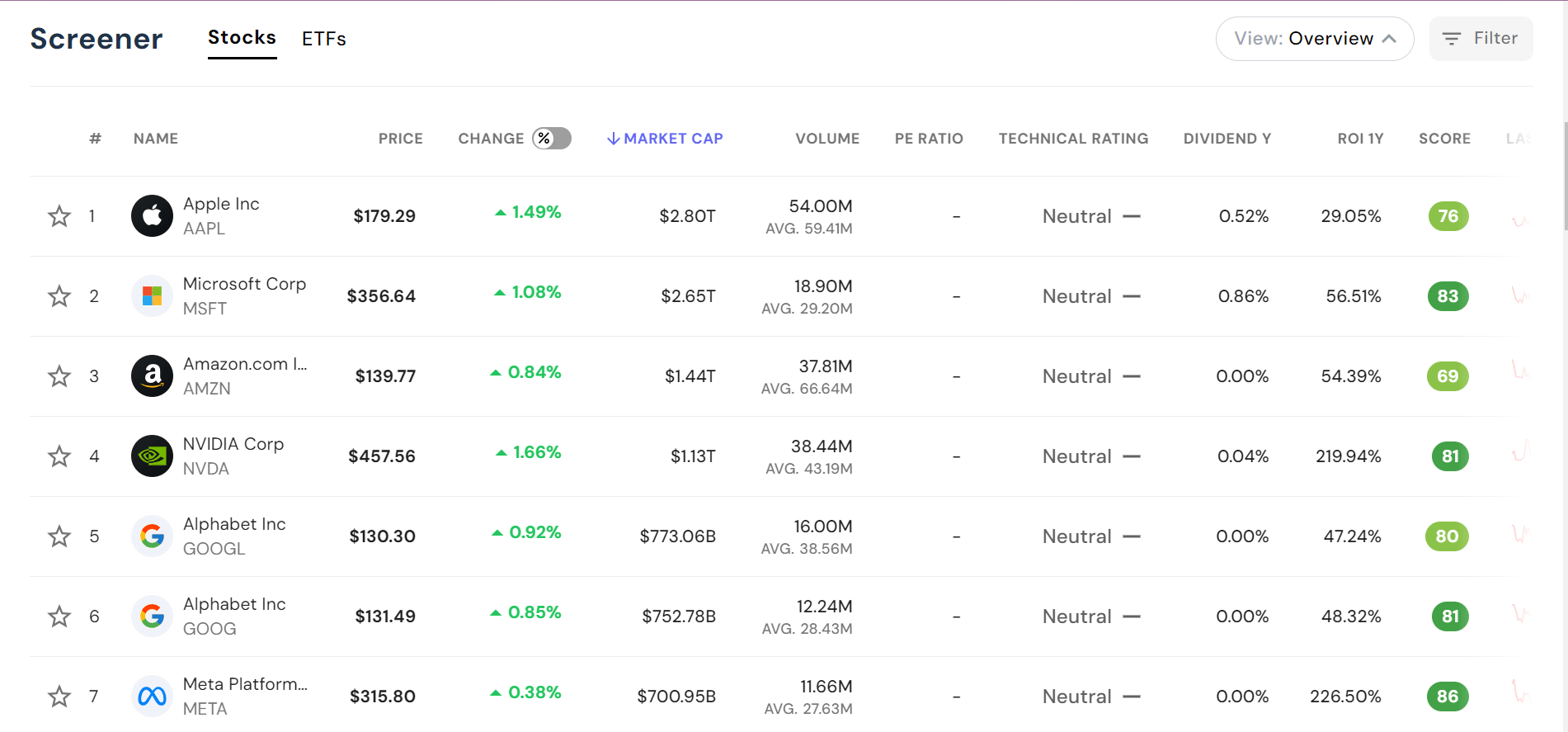

2. Stocklytics – Free Technical Ratings on Thousands of Stocks and ETFs

Also known as ShareMarketCap, Stocklytics offers a huge assortment of stock market data unparalleled in the industry. The service provides investors with access to a variety of essential information by supporting 11 major exchanges and covering over 5,800 equities.

This includes detailed information on pricing, valuations, dividend yields, and key financial measures.

Furthermore, Stocklytics has one of the best stock portfolio trackers accessible. You can add your stocks and receive real-time price and target alerts. Although Stocklytics does not provide stock tips, it does provide information that can help you routinely outperform the market. It has, for example, created a proprietary SMC scoring system (from 0 to 100) that uses AI.

While many providers in the market charge fees, Stocklytics sets itself apart by offering its services completely free. It’s important to note that as a new entrant in the market, this may change in the future.

| Key Specifications | Past Performances | Pricing |

| Hot stock tips based on Technical evaluations, SMC scores, and AI-generated price forecasts. | N/A | Free |

Pros:

Pros:

- Analyses of thousands of stocks for free

- Leverages AI to generate price predictions

- Solid methodology that focuses on the fundamentals

Cons:

Cons:

- No information on its past performance

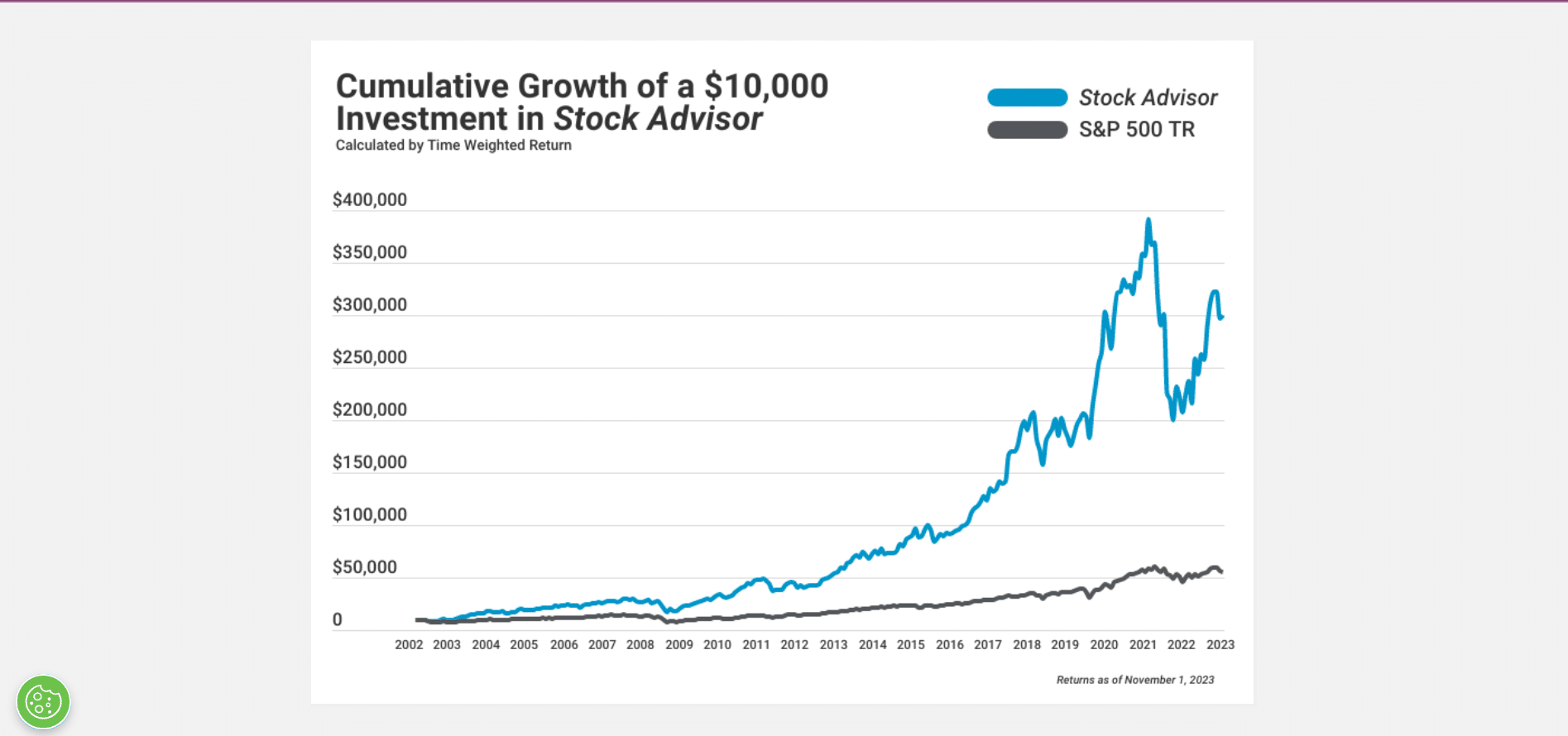

3. Motley Fool Stock Advisor – Premium Stock Buying Tips Service

The Motley Fool has been giving stock market advice for close to three decades now. One of their best products is Stock Advisor, which lets you pick professional stocks to beat the market. Motley Fool has established a reputation in the industry for providing detailed, easy-to-read investment research reports.

Motley Fool separates itself from other stock tips service providers by using a different technique. Unlike some firms that try to study and research every stock or fund, their team looks for stocks expected to perform better than the S&P 500 in the long run.

With more than a million subscribers, it has performed spectacularly. The service has a one-year annual subscription price of $199. They offer a 30-day refund policy; therefore, you can try the entire monthly cycle and decide whether to stay or leave.

| Key Specifications | Past Performances | Pricing |

| Designed to help investors find and invest in high-quality stocks that have the potential to grow significantly over time. | Outperformed the S&P 500 by an average of 15% per year | $199 per year |

Pros:

Pros:

- Long-term track record of success

- Recommendations based expert research and analysis

Cons:

Cons:

- Limited number of recommendations

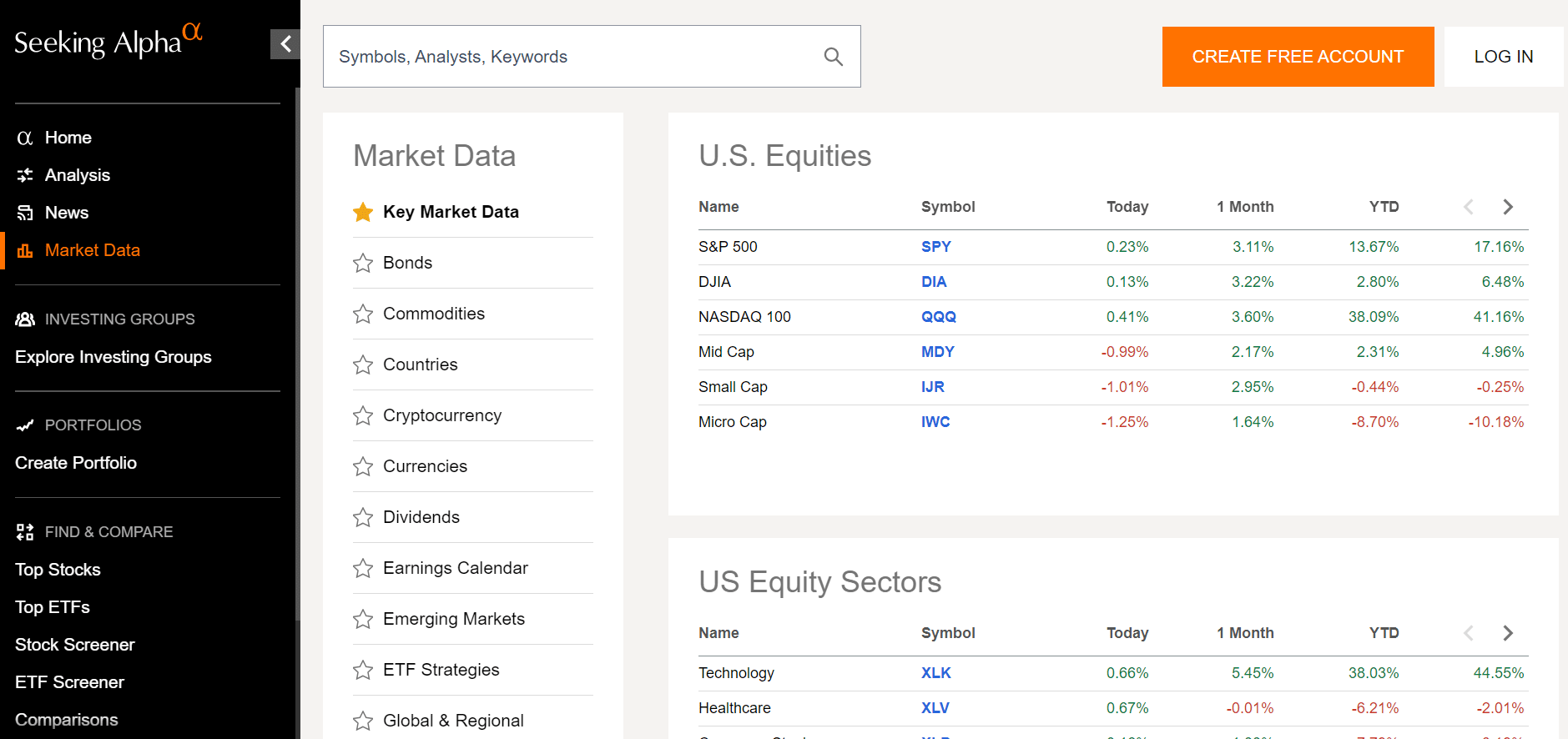

4. Seeking Alpha – Best Data-Driven Stock Tips Service

Seeking Alpha Premium is a compelling set of market intelligence tools meant to turn you into the best investor and trader, or the two in one. One of the top stock-selecting services for long-term investors is Seeking Alpha. Its strategy looks at revenue growth, price-to-earnings, dividend performance, and valuations of these securities.

Seeking Alpha clearly has a methodology. Its stock picks have a minimum share price of $10. However, it only recommends stocks whose market cap value exceeds $500 million. Additionally, Seeking Alpha deals only with shares traded in the US, thus depriving investors of global diversification.

In terms of pricing, Seeking Alpha has a fair subscription plan that attracts first-time customers. Initially, they pay $99 annually, which becomes $199 after one year. It offers great value to be considered with these consistent returns generated by Seeking Alpha.

| Key Specifications | Past Performances | Pricing |

| Provides a comprehensive suite of tools and resources for the in-depth commentary and analysis on stocks. | 470% since the service launched in 2010. | $99/year for new subscribers, increasing to $199 after the first year. |

Pros:

Pros:

- Comprehensive news and analysis

- Advanced stock screening tools

Cons:

Cons:

- Only focuses on US-listed stocks

5. WallstreetZen – Best Stock Tips Service for Daily Insights

Among the most reliable stock tips services to track smart money is WallStreetZen. It provides different daily insights into which stocks are ‘strong buys.’ WallStreetZen only includes stock recommendations from the most successful fund managers and investors on Wall Street.

The model can be viewed for the stock-pick, price target, and average returns the analyst produces. Besides, a risk-reward rating will be provided for a premium member on every stock pick. Secondly, high-class members can also acquire information on bullish insider buys. In short, this indicates stock purchases made by company executives – indicating the insiders’ optimism about the prospects of the firms they run.

The other alerts that WallStreetZen offers are the best stocks under $10, undervalued companies, and volatile penny shares. Premium plan costs $150 per year. Another free option is available, although this is subject to little information.

| Key Specifications | Past Performances | Pricing |

| Assess which stocks have a ‘strong buy’ rating, ranked by the average return of the respective analysis | N/A | $199 per year |

Pros:

Pros:

- Daily insights from the best-performing fund managers

- Alerts on stocks with a ‘strong buy’ rating

Cons:

Cons:

- Focuses exclusively on US-listed stocks

6. Danelfin – Stock Recommendations Based on an Explainable AI Methodology

Danelfin is another emerging force in the stock market. The platform is an exceptional AI stock selection service that is well worth considering. It uses the state-of-the-art ‘Explainable AI’ methodology, which examines thousands of stocks and ETFs. The procedure analyzes over 900 indicators carefully taken from various data sets. These indicators include technical, fundamental, and sentiment indicators.

Danelfin has a free plan with a daily newsletter if you’re interested. Each day, it delivers the top ten stocks to buy based on its AI rankings. A premium plan is required if you want limitless stock and ETF reports, additional trade ideas, and alpha indications. Depending on how much functionality you need, this can range from $25 to $70 each month.

| Key Specifications | Past Performances | Pricing |

| Analyzes data from fundamental, technical, and social sentiment indicators | 191% since January 2017 | Ranges from $25 to $70 each month |

Pros:

Pros:

- Supports thousands of stocks across Europe and the US

- Daily updates on the best stocks to buy and sell

Cons:

Cons:

- Doesn’t cover the emerging markets

7. Zacks – Top Mover with Stock Tips Services

Zacks is a well-known stock tipping service that has an unrivaled track record that speaks for itself. This service has regularly provided exceptional annualized returns of 24.2% since its introduction in 1988.

What distinguishes Zacks Ultimate is its capacity to accomplish such excellent outcomes even during difficult circumstances, such as major recessions.

However, at $299 a month, Zacks Ultimate is also among the priciest stock-tipping services. By purchasing an annual plan, this is lowered to $250. Traders have a $1 trial option before making any financial commitments. This provides you with 30-day access to Zacks Ultimate.

| Key Specifications | Past Performances | Pricing |

| Covers both long and short-term investment strategies across many stock types. | Achieving 24.2% annualized returns since 1988 | $299 per month or $2,995 annually. |

Pros:

Pros:

- Covers short and long-term investment strategies

- 30-day trial for just $1

Cons:

Cons:

- Not suitable for casual investors

8. Candlestick.ai – AI-Driven Stock Tips for iOS and Android Users

Candlestick.ai is one of the most recent stock tip providers on this list. It debuted in early 2022 and focuses on AI-driven stock recommendations. Candlestick.ai provides the greatest stock tips for smartphone consumers. It has native mobile apps for iOS and Android, both of which are user-friendly.

For a monthly fee of $9.99, this service offers weekly trading suggestions on the best stock trading apps with the help of AI. The AI system analyzes multiple factors and offers up to three weekly stock picks. The patented algorithm used by Candlestick AI is based on machine learning models that were trained on vast price data.

| Key Specifications | Past Performances | Pricing |

| Tips from over 6,000 companies. Each week, you’ll get three stock tips, with notifications sent to your smartphone. | Achieving 23% annualized returns. | $9.99 per month. |

Pros:

Pros:

- Best stock tips services for iOS and Android users

- Costs just $9.99 per month

Cons:

Cons:

- Relatively new in the industry

In order to rank the top stock tips services for 2026, we employed the following approach:Our Methodology When Ranking the Best Stock Tips Services

What is a Stock Tips Service Provider?

Stock tip services provide investors with valuable tips for deciding what equities to purchase or sell off. It also removes the necessity of investors studying the markets themselves, making it most attractive to beginners and traders who are short on time. Some providers even give alerts pinpointing individual stocks with an elaborate recommendation analysis.

For instance, the platform may recommend acquiring Alphabet stock because it believes the company is currently overvalued in the marketplace. Offerings such as these grant investors the ability to make knowledgeable decisions, thereby helping them steer through the stock market with relative ease.

Some stock tips platforms are based on fundamental analysis, considering essential elements such as revenue growth, operating income, and profit margins. However, other platforms take the opposite approach and employ alternative data sources to get the upper hand over competitors. For instance, consider the case of AltIndex, which scrutinizes information obtained from social media platforms and web metrics.

With AI readings, AltIndex recommends stocks, enabling buyers of shares to take advantage of the unique potential of the first mover position. By innovatively using data, investors can remain ahead of the same curve and arrive at smarter investment decisions.

Advantages of Services Offering Stock Tips

Let us clarify why a stock tips service might be the right solution for your portfolio if you still doubt it can support your investment purposes. They can also be quite beneficial, especially to starters who may need clarification on where to begin and what data is reliable. These signals give you information on which investments are worthwhile and also teach you how to invest.

Accessibility: One of the most compelling advantages is accessing expert advice at a cost way less than the usual consultation service. It gives you the convenience of making informed investment decisions without extensive research since they are conveniently delivered to your inbox or mobile device.

Passive Investing: If you aspire to invest in stocks but lack the time to trade actively, stock tips services can be your greatest ally. These services streamline the stock selection process, allowing you to choose the right stocks for your portfolio swiftly.

Advice from Experts: In the investment world, it is rare to find expert advice at a cheaper cost. Despite this, the stock tips service offers valuable suggestions from seasoned experts at a pocket-friendly price.

The Significance of Demo Testing Stock SignalsWe encountered numerous stock signal services that make bold claims about their profitability, but validating these assertions can often be challenging. Consequently, it is crucial to assess a stock signal service using a demo account before risking any actual funds. Leading online stock brokers provide free demo accounts that replicate real market conditions on the best demo trading apps. One of such brokers is eToro. These demo accounts enable users to execute stock trades using virtual funds whenever they receive a new signal. By repeating this process over several weeks, one can evaluate the performance of the signals. If the results are satisfactory, traders may then consider implementing the signals with real capital. Conversely, if the results are unsatisfactory, they have the option to cancel their signal subscription. |

What are Stock Trading Signals?

Stock trading signals offer a valuable tool for navigating financial markets by helping traders recognize promising opportunities to profit. Whether just starting or a seasoned pro, these signals aim to aid investors by recommending particular assets to buy or sell at targeted prices and moments. Employing the best stock trading signals can help you improve your trading operations and increase your profits.

Stock trading signals harness both artificial and human intelligence to decipher financial markets. Advanced algorithms scrutinize inputs like stock trading charts & technical indicators, fundamental news, and sentiment gauges across timeframes. Through these techniques, traders discern short-term fluctuations and long-term inflections. Traders are then informed of these signals via easy-to-use methods, including push notifications, email, and SMS, guaranteeing prompt access to relevant information.

How do Stock Buy and Sell Signals Work?

Stock buy and sell signals are tools used by traders and investors to make informed decisions about buying or selling stocks. These signals are generated by various technical indicators and algorithms that analyze market data, trends, and patterns. Understanding how stock buy and sell signals work can empower investors to make more informed decisions and improve their investment outcomes.

At its core, a stock buy signal indicates that it may be a favorable time to purchase a particular stock. Conversely, a stock sell signal suggests that it may be a good time to sell or exit a position in a specific stock. These signals are derived from technical analysis, fundamental analysis, and market sentiment.

Technical analysis involves studying historical price and volume data to identify patterns and trends. Technical indicators, such as moving averages, oscillators, and trend lines, are commonly used to generate buy and sell signals.

Questions about technical indicators such as “what are moving averages in trading” or “uses of trend lines in trading” are often asked by investors. A moving average crossover occurs when a short-term moving average crosses above or below a longer-term moving average, signaling a potential buying or selling opportunity.

Fundamental analysis, on the other hand, involves evaluating a company’s financial health, industry trends, and other important factors. Buy and sell signals based on fundamental analysis may consider factors such as earnings growth, revenue trends, valuation metrics, and competitive markets. For instance, a positive earnings surprise or a new product announcement could trigger a buy signal, while deteriorating financials or regulatory challenges might bring on a sell signal.

Market sentiment, often referred to as investor psychology, also plays a role in generating buy and sell signals. This involves assessing the overall mood and sentiment of market participants, including factors such as investor optimism, fear, or market exuberance. Buy and sell signals based on market sentiment can be derived from indicators like the Volatility Index (VIX), investor surveys, or sentiment analysis of news and social media.

It’s important to note that stock buy and sell signals are not foolproof predictors of future price movements. The stock market is dynamic and influenced by numerous factors, including economic conditions, geopolitical events, and unexpected news. Therefore, investors need to use buy and sell signals as part of a comprehensive investment strategy, incorporating risk management techniques and considering other relevant information.

Additionally, investors should be cautious of relying solely on automated buy and sell signals without critically evaluating the underlying analysis. It’s crucial to understand the methodology and assumptions behind the signals and consider them in the context of one’s investment goals, risk tolerance, and time horizon.

Stock Picking Strategies

Stock picking services employ a range of strategies to select promising stocks. Let’s explore some of the most prevalent approaches.

- Fundamental Data refers to information that is easily understandable, even for novice investors. It revolves around key aspects such as sales, earnings forecasts, gross margins, competitor analysis, and income growth.

- Sentiment Data takes into consideration how public opinion influences stock prices. Some services rely on sentiment data as a factor in stock-picking.

- Technical Data is designed for experienced investors who are interested in delving into the intricate details of a stock’s historical performance. It does not focus on a stock’s true value but rather on analyzing its historical patterns.

How to Choose the Best Stock Trading Signals Provider

Like any other service, stock tip services can vary in quality, and individuals have unique reasons for choosing the best stock-picking service that suits their needs. However, the differences between the stock tips services go beyond just their quality; they also vary in terms of their specific focus.

Several stock tip services cater to the needs of swing traders making use of the best day trading apps by offering insights to identify stocks that are likely to experience significant price movements within a day or the upcoming week. Conversely, some services target long-term buy-and-hold investors, recommending stocks they believe will exhibit rapid growth in the years ahead.

In this section, we will discuss how to choose the best stock tips service in 2026.

Historical Performance

Stock tip services vary significantly in their ability to deliver returns that surpass the broader market. While no provider can guarantee consistent success, diligent investors do well to consider both the longevity and prowess of a given tips service track record.

Analyzing the performance of suggested investments over time compared to well-known benchmarks is a wise approach. Longevity provides the comfort of a tried-and-true method, especially for inexperienced traders, as market knowledge develops slowly. Simultaneously, the extent and reliability of prior achievements act as substitutes for a stock tips service provider’s market knowledge.

Fees

Premium stock trading signals can surpass market performance without personal research. However, they incur monthly fees, necessitating a check on their return on investment. For instance, AltIndex’s ‘Starter’ plan is $29/month, promising a 24% return over 6 months.

With a $3,000 investment ($500 monthly), you’d see $720 in gains, subtracting $174 in fees, netting $546. Yet, investing $100 monthly wouldn’t cover the expenses, leading to losses despite a 24% return. Thus, stock signals benefit those investing substantially more than the cost of the service; small-scale investors might find the fees prohibitive.

Target Stock Markets

Although many stock signal providers focus on well-known US stocks like Apple, Tesla, and Amazon, expanding into less prominent markets may offer better prospects. Services that focus on foreign and small-cap companies expose investors to industries that are evolving quickly.

However, trading on the best penny stock app means that volatility is increased, and not all online brokers support these types of stocks. It’s essential to consider the potential challenges and limitations if you decide to pursue low-cap stocks with a signal service. Ultimately, selecting a stock signal service that aligns with your financial goals requires thoughtful consideration.

Strategy and Methodology

The top stock tip providers are extremely transparent about how they create recommendations. This is significant since it ensures you invest with your eyes open. Understanding the underlying strategy can instill confidence when acting on stock-buying recommendations. AltIndex, for example, employs an approach based on alternative data.

By not using standard sources such as earnings reports and financial ratios, its members get a first-mover advantage. Instead, they employ online analytics, social media, job advertisements, and other methods. Machine learning then analyzes the data and generates an artificial intelligence stock rating.

Tip Duration and Frequency

When selecting a stock tips service, two important factors to consider are the average trade duration and tip frequency. The average trade duration refers to when stock recommendations remain open before being sold. Additionally, the tip frequency determines how often you will receive stock tips from the provider.

For passive investors, it is advisable to choose a provider with a long-term outlook. This means you will receive fewer tips, and the recommended stocks will remain active longer. On the other hand, if you prefer active investing, you may opt for a provider specializing in short-term positions.

Can You Really Make Money with Stock Trading Signals?

Stock trading signals are recommendations or alerts provided by professional traders, analysts, or automated systems that suggest when to buy or sell stocks. These signals are based on various technical and fundamental indicators, aiming to help traders make informed decisions and generate profits.

The Potential to Make Money

It is possible to make money with stock trading signals, as many signal services have a track record of consistently outperforming the broader markets. The best providers often have strategies and algorithms to identify profitable trading opportunities.

However, it’s important to note that not all signal services are equally reliable or profitable. Some signal services make bold claims about their historical returns without providing credible data to back them up. Therefore, it’s crucial to thoroughly research and evaluate the reputation and performance of a signal service before subscribing to it.

Factors to Consider

Your ability to make money from stock signals will depend on several factors, including your capital resources and the cost of the signal subscription. If you have a substantial amount of capital to invest and the signals generate a sizable return, you could make good money. On the other hand, if you’re investing small amounts, the returns might not be sufficient to cover the subscription costs.

Before paying for a signal service, it’s essential to analyze the projected return on investment. Consider factors such as the historical performance of the signals, the fees charged by the service, and the potential risks involved. Keep in mind that historical returns are averaged out over time and may not guarantee future success.

Remember, investing in the stock market carries inherent risks, and no trading strategy or signal service can guarantee profits. It’s advisable to diversify your investments, stay informed about market trends, and seek professional financial advice when making investment decisions.

Conclusion

Many individuals on the internet provide stock advice to others, even though they lack any knowledge or experience in investing. To effectively evaluate stocks you are considering purchasing, it is advisable to rely on experts’ opinions in the field.

The websites in this guide select investment recommendations from professional analysts who have established a track record of trustworthiness over time. However, it is important to remember that stock trading is inherently risky. Therefore, it is recommended to invest in stocks as part of a well-diversified portfolio that takes into account various factors.

AltIndex is regarded as the top stock tips service for the year 2026. Since its inception, AltIndex has consistently outperformed the S&P 500 and other benchmarks, boasting an impressive average 6-month return of 24%. The service offers stock tips generated by artificial intelligence and is available at a starting price of just $29 monthly.

References

- https://www.forbes.com/advisor/in/investing/how-to-invest-in-share-market/

- https://www.investor.gov/introduction-investing/investing-basics/investment-products/stocks

- https://www.finra.org/investors/investing/investment-products/stocks

- https://finred.usalearning.gov/Saving/StocksBondsMutualFunds

- https://www.sec.gov/oiea/investor-alerts-and-bulletins/iastockrecommendations