What is an Automated Market Maker (AMM)? – Crypto Trading Guide 2024

In the cryptocurrency or decentralized finance (DeFi) ecosystem, some key players influence the liquidity of exchanges and estimate prices. One such player is the Automated Market Maker. Its significant role has actively led to the adoption of liquidity pools instead of a market with buyers and sellers.

Today, digital assets can be traded automatically and without permission. These liquidity pools operate using a special algorithm that determines asset prices and helps traders achieve their aims. This article will answer the question, “What is an automated market maker?” and the roles in DeFi/crypto trading.

[toc]Understanding the Role of Market Makers

As we head toward defining “What is an automated market maker?” we must first explain the role of market makers. Understanding these key players will enlighten traders on the need for an automated system rather than the traditional buyer-seller option in the DeFi ecosystem.

Traditional Market Makers in Financial Markets

Since the birth of cryptocurrency, traditional market makers, i.e., buyers and sellers, have been a huge part of the decentralized network. The constant buying and selling of digital assets have kept the financial market running, with these market makers acting as the middlemen.

As these traditional market makers contribute to maintaining price stability and fluidity of the financial markets, they also ensure information flow and market efficiency. Furthermore, they manage crypto asset risks and ensure compliance with regulatory standards.

For example, market makers buy instruments (cryptocurrencies, bonds, stocks, etc.) at lower bids and sell them higher. They profit in this process called “Spreads” and, thus, can influence price stabilization and market allocation. Indeed, their role in financial markets is invaluable.

Adaptation of Market Making in Decentralized Finance (DeFi)

A paradigm shift was ushered toward blockchain-based market-making as the Decentralized Finance (DeFi) system was formed. This transformation surged interest in smart contract platforms, like Ethereum and BNB, as they didn’t automate or execute trades with centralized intermediaries.

Today, some DeFi apps utilize blockchain technology and integrate an Automated Market Maker (Amm) into their system. The protocol uses smart contracts and algorithms to facilitate liquidity pools, allowing trade in the pool automatically and with zero permission.

As DeFi, however, continues to evolve, automated market makers are beginning to take significant roles in ensuring liquidity, market efficiency, and accessibility within the decentralized landscape. Therefore, there wouldn’t be dependence on traditional market makers with this adoption.

Your capital is at risk.

What is an Automated Market Maker (AMM)?

Get familiar with Automated market maker explained – the shift from human to algorithmic market making!

Definition and Overview

An Automated market maker (Amm) is a significant player in the decentralized network system. It is an underlying protocol that uses algorithms or mathematical formulas to allow digital assets (or cryptocurrencies) to be traded by liquidating them and determining their prices.

Unlike traditional exchanges with order books for buying and selling decentralized exchanges on a platform, AMMs use liquidity pools. This software-based protocol eliminates the need for brokers, allowing crypto investment trades to be performed automatically and with zero supervision.

With the mathematical formula, AMMs enable dynamic price adjustments depending on the pool’s situation, i.e., demand and supply. That means if there is a change to the liquidity, there is a significant change to the price equilibrium. In essence, DeFi coins price responds to liquidity conditions.

Transition from Human to Algorithmic Market Making

As artificial intelligence (AI) emerges, new changes in the financial markets include the integration of automated systems based on algorithms. The transition from human-dependent, manual processes to Automated market maker algorithm has facilitated seamless and speedy trading.

Many AI stock trading applications display this potential. Beyond the algorithmic execution of trades, AMMs have ushered in using cutting-edge tools and built-in features to enhance efficiency. That means traders can gain access to data and real-time information quickly.

| Automated Market Maker | Traditional Market Maker |

| Uses decentralized structure | Uses a centralized structure |

| Liquidity pools operation | Order book operation |

| Algorithmic and Smart contracts intervention | Requires human traders |

| 24/7 accessibility | Regular exchange hours |

Fig 1: A table showing the differences between automated and traditional market makers.

Advantages of AMMs in DeFi

Let’s see why AMMs are worth it in the decentralized finance space.

Accessibility and Inclusivity

Automated market maker (Amm) offers a sense of accessibility and inclusivity to every trader. Unlike the traditional method, it means anyone can engage in trading without a central authority. Individuals from diverse backgrounds can participate in the liquidity pool to trade and break financial barriers.

Continuous Liquidity Provision

Another advantage of AMM is establishing a liquidity system for anyone contributing to the pool. As there is continuous provision of liquidity, trading becomes more effortless.

In response to market fluctuations and geographical differences, investors can adjust prices to adapt to new conditions.

Mechanics of AMM Algorithms

Potential traders must first know the mechanics to understand the Automated market maker algorithm. These mechanics are based on three fundamental elements – liquidity pool, reserve ratio, and constant equation-based pricing.

Liquidity Pools and Reserve Ratios

-

Liquidity Pool

Liquidity Pool is a collection of funds users contribute to facilitate decentralized trading. The funds are locked in smart contracts or pairs of tokens to provide liquidity for trades. This pool-based system is an alternative to order books and works efficiently to ensure seamless exchange.

-

Reserve Ratios

For each token pair, there is a percentage of assets in the liquidity pool. These asset percentages are called Reserve Ratios. They determine the price of tokens with others available in the pool and find a way to balance them. The AMM algorithm relies on this parameter to calculate exchange rates.

The supply and demand of assets determine the ratio as trading commences.

Price Determination through Constant Equation

The Automated market maker algorithm operates using a constant equation to determine cryptocurrency (or digital assets) prices. Constant product models, like Uniswap, use a pricing equation for decentralized trading.

Uniswap maintains a similar quantity of two tokens and achieves equilibrium by adjusting the price of one for another.

Your capital is at risk.

Balancing Supply and Demand

Also, on Automated Market Maker explained, we highlight the importance of Arbitrage and how trade execution affects asset pricing.

Utilizing Arbitrage for Price Stability

Generally, Arbitration is defined as a profit-making scheme whereby digital assets are exploited for their price differences on various markets or exchange platforms. This Arbitrage, however, can be used to maintain stability in the prices of cryptocurrencies with AMMs.

That means price stability is achieved when traders buy relatively low bids and sell for higher on another platform where the value appreciates more than the former.

Impact of Trades on Token Prices

Conversely, Automated Market Maker (AMM) trades influence token prices – positively or negatively. It affects the reserve ratios of assets in the pool, impacting the supply of more assets when there is a higher demand for one. So, that means prices are liable to change in response to this supply.

Impermanent Loss and Risk Management

Further, this “Automated Market Maker explained” article describes impermanent loss and a significant risk management strategy to mitigate losses.

Understanding Impermanent Loss

Impermanent Loss is described with liquidity in DeFi platforms, whereby the value of assets locked in the pool diverges from what could have been in personal holdings. This temporary loss of value is “impermanent.” Fortunately, it can be removed gradually as price equilibrium stabilizes.

Mitigating Loss through Incentives

Knowing how impermanent loss could potentially cause a token to lose its value overtime, an excellent method of mitigating such risk is through incentives. This can be done by offering liquidity mining programs or establishing yield farming, where liquidity providers get token rewards.

This strategy would offset losses that may have accumulated as a result of impermanent losses, causing a value/price stabilization.

Constant Product (x*y = k) Model

Explanation of the x*y = k Formula

As aforementioned, the Automated market maker algorithm operates using a formula. A good example is the Uniswap AMM which uses the x*y = k formula. This represents the Constant Product Market Maker (CPMM) equation.

The parameters of this formula are;

- x – first asset

- y – second asset

- k – constant value

There is an inverse relationship between the two assets in the liquidity pool, such that as x increases, y decreases to keep a constant value of k.

AMMs recalculate prices based on this CPMM equation.

Uniswap as a Pioneering Example

In this Automated market maker explained, Uniswap is a pioneering example of integrating DeFi and the AMM model. It utilizes liquidity pools instead of the traditional order book while using the CPMM equation to adjust price to maintain equilibrium as buying and selling occur.

ETH and BTC are common examples of tokens with the Uniswap AMM. The two token quantities are similar, but their prices are sure to change to maintain equilibrium. That means as the price of ETH increases due to high demand, the price of BTC decreases.

Constant Sum (x + y = k) Model

Different Approach and Use Cases

Alternatively, this “Automated market maker explained” guide introduces the Constant Sum Market Maker (CSMM). It is a similar model but a different approach, often used by other AMMs, unlike Uniswap. The idea is to ensure a constant total of the tokens in the liquidity pool.

The formula is: x + y = k

Where,

- x – first token

- y – second token

- k – constant.

A linear relationship exists between the two assets, such that as traders buy x, the quantity of y decreases.

AMMs are designed to maintain a specific price ratio between two assets based on this CSMM equation.

Examples of AMMs Using the Constant Sum Model

Curve Finance and Bancor are two examples of AMMs using the CSMM model. The former is used for stablecoin trading, where low-slippage swaps are provided between two stablecoins. It aims to maintain a 1:1 stability between the tokens in the pool.

The latter, however, transitioned from CPMM to CSMM with its V2 version. Bancor V2 involves liquidity providers contributing a single token to the collection pool to create a predictable price curve while the weight sums remain constant. It also aims to maintain price stability with proper token swaps.

| Constant Product Model | Constant Sum Model |

| x*y = k | x+y = k |

| Exposure to impermanent loss | Reduced impermanent loss |

| Supports single token pairing | Supports multiple token pairing |

| Well-suited for fixed tokens | More flexible for multiple tokens |

| Example – Uniswap | Example – Bancor V2 and Curve Finance |

Fig 2: A table showing the differences between CPMM and CSMM.

Your capital is at risk.

Curve Finance and Stablecoin Pools

Curve’s Focus on Stablecoin Liquidity

As mentioned, Curve Finance supports stablecoin liquidity with AMMs in the DeFi ecosystem. This decentralized exchange protocol gained recognition for its low-slippage trading and straightforward swapping. So far, stablecoins like DAI, USDT, USDC, and sUSD have been beneficiaries.

Also, Curve Finance focuses on capital efficiency by giving attention to these stablecoins or stable cryptocurrencies because of their low volatility compared to major cryptocurrencies. Furthermore, it incentivizes providers with reduced trading fees and CRV tokens.

Role of Stablecoin Pools in DeFi Ecosystem

Curve Finance has become a significant part of the broader DeFi landscape because it integrated stablecoin pools. It offers traders a more secure and less volatile collection system achievable by yield farming or lending.

More so, many decentralized applications (DApps) and protocols use them for stablecoin swaps and predictable liquidity provision. Thus, we cannot overemphasize the role of this stablecoin-based liquidity pool.

Evolution of AMMs and Protocol Innovation

With the evolution of Automated Market Maker (AMM) to replace traditional market makers, some observable benefits are;

Enhanced Efficiency and Reduced Slippage

One of the main problems of traditional exchanges is efficiency and slippage. However, the birth of AMMs solves that problem. Today, mathematical models and stablecoin-based liquidity pools exist to enhance efficiency and reduce slippage.

Also, AMMs operate on blockchain technology, which means there is 24/7 accessibility, contributing to better efficiency. Consequently, there is precision with swaps, allowing a proper trade of assets at known prices. Overall, this guarantees a seamless trading experience.

Introduction of Dynamic Fee Structures

Another benefit of this innovation is fee restructuring. There is a dynamic fee structure that would allow traders to set transaction fees involved in a trade based on some user-defined parameters, such as asset volume, volatility, and even financial market conditions.

Overall, this fee implementation strategy inspires flexibility and responsiveness.

AMMs and Decentralized Exchanges

Let’s look at the integration of Automated Market Makers into decentralized exchange platforms and how to enhance their trading experience.

Integration of AMMs in DEX Platforms

Generally, an Automated market maker (Amm) was fundamentally developed to change trade processes, and this was linked with decentralized exchange (DEX) platforms. This link eliminated order books and intermediaries, replacing them with liquidity pools without a central authority.

This new technology leverages the automated market maker algorithm to create price adjustments dynamically based on the digital assets available. In the process, a more decentralized system with easy accessibility to anyone was built.

Enhancing Trading Experience with AMM Liquidity

The revolutionary changes brought to the DeFi landscape by AMMs are highly significant. They have enhanced trading experience maximally by improving liquidity using different strategies, such as;

- Continuous liquidity provision: As providers continually contribute assets to facilitate trading, transactions can be executed seamlessly – even in low trading periods.

- Minimal slippage pools: Some AMMs use mathematical constant product formulas like CSMM and CPMM to reduce slippage to the least minimum. This allows traders to execute trades with reduced price impact.

- Diversified Asset/Portfolio: Traders can use a diverse asset portfolio to exploit AMM liquidity. The landscape continually evolves, and the more assets contributed, the better the trading experience.

- Incentives: As AMMs incentivize liquidity providers with reduced fees or tokens, they are encouraged to contribute to liquidity pools. It ultimately enhances the trading experience.

- Real-time Data: Some DEX platforms with AMMs now have built-in features, including real-time metrics, historical data, current trades, etc., equipping users with sufficient information for a good trading experience.

Your capital is at risk.

Regulatory Considerations and Challenges

Certain regulatory standards bind traditional market makers, some of which might have been inconvenient. However, AMMs were established to meet some demands for DeFi while providing an avenue for seamless trading. Below are certain regulatory considerations and their limitations.

Navigating Regulatory Frameworks in DeFi

Some important regulatory considerations or requirements in the framework of the DeFi space are;

- Geographical Requirements: Regulatory requirements vary from one geographical location to another. Different countries set standards that must be followed to operate or invest in DeFi projects in their location.

- License and Registration: A significant yardstick distinguishing between a legitimate and illegitimate DeFi project is its license and jurisdiction. Platforms must be registered with appropriate bodies that deal with financial activities.

- AML and KYC Requirements: Privacy policies are also a must with DeFi projects. The two most well-known policies are anti-money laundering (AML) and know-your-customer (KYC). Independently, they protect financial and personal data and prevent illicit activities.

- Smart Contracts Audits: Regular smart contract audits are also consequential for security and safety. It would help DEX platforms protect users from fraud or other risks and develop proactive measures against vulnerabilities.

- Education and Awareness: As technology advances, it becomes difficult to keep up; thus, a more informed approach is important. Users can scale and skill up effectively through education and awareness in major DeFi projects.

Balancing Decentralization with Compliance

In this section of the Automated market maker explained, we can see that balancing decentralized exchange platforms and complying with regulatory standards is quintessential.

These measures prioritize safety, security, autonomy, privacy, and transparency. Indeed, it would allow most beginners to trust and adopt the new software-based protocol.

Continued Education and Adoption

Educating the Community about AMMs

Education is one of the key elements in the revolution and survival of AMMs in the DeFi space. It is a new concept that not everyone would find understandable at first. Hence, it is necessary to educate traders about how to use it to advantage and prevent potential losses during trading.

Educating the community about AMMs can be done in various ways, such as webinars, seminars, or beginner-friendly lessons and materials. As users learn about this protocol and its benefits, they strategize better and make informed decisions using user-defined parameters when trading.

Encouraging Responsible Use and Investment

Trading and investment in the DeFi landscape are high-risk businesses. There is no guarantee of profits or losses. Notwithstanding, users are encouraged to use AMM-integrated DEX platforms responsibly and strategize properly before joining a trade.

Some effective measures are diversifying asset portfolios, conducting research with materials, historical trends, and resources, and developing risk management techniques. They would help traders maintain a credible ecosystem and enjoy asset trading on crypto trading apps.

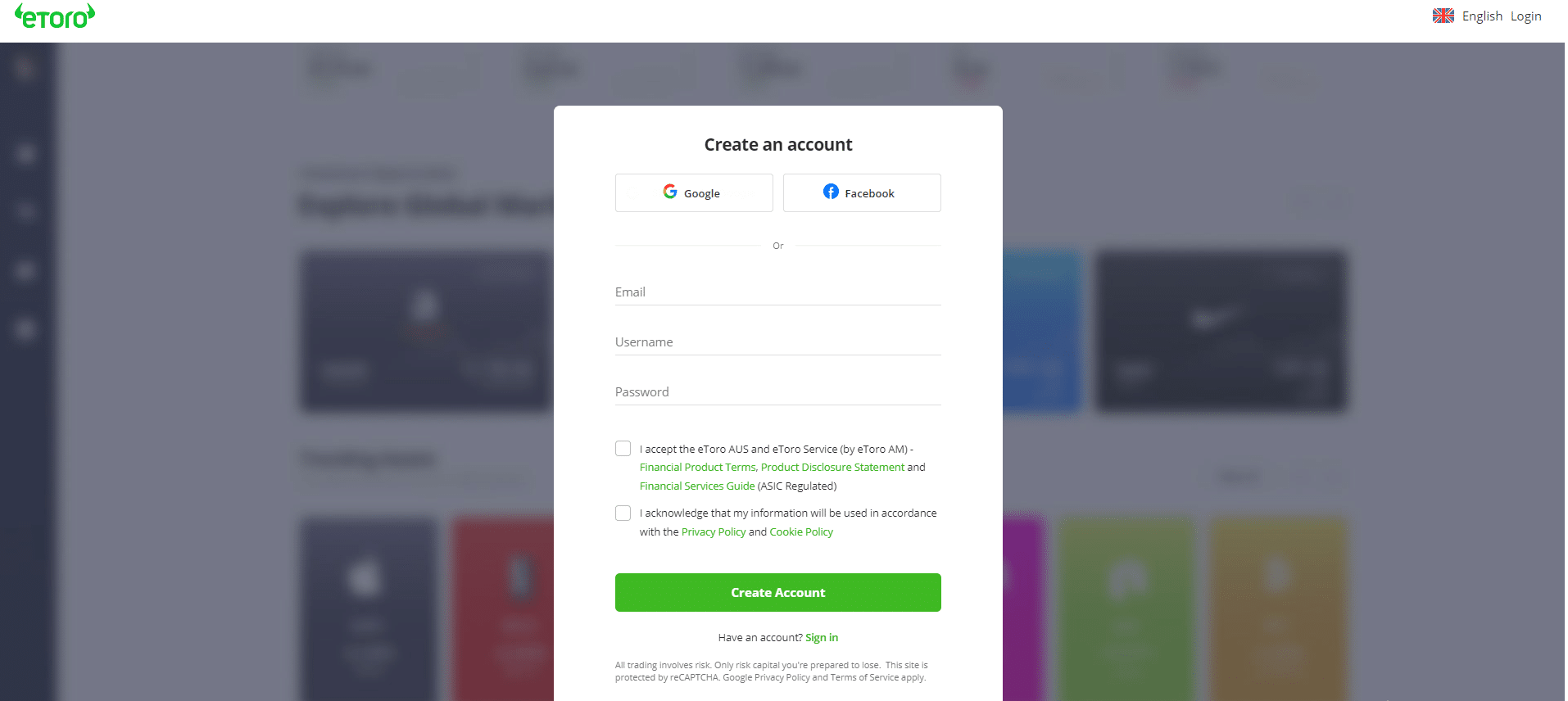

With this information on Automated Market Makers, trading just got better! One of the best paper trading apps to use is eToro. This platform provides users with all kinds of next-level trading benefits, including using AMMs. Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum. Here is a step-by-step guide on how to create an eToro account.What is an Automated Market Maker (AMM)? – eToro Complete Guide

Your capital is at risk.

What is an Automated Market Maker? – Conclusion

Was the Automated market maker explained in this guide?

Yes. The above is a comprehensive overview of what AMMs are and their various benefits over traditional market makers. From this article, there is no doubt that it is quite revolutionary, as it offers a simpler approach to day trading – or overall, trading experience.

As this new protocol is integrated into DEX platforms, we recommend users create an eToro account, invest in the best-buy cryptos, and enjoy next-level crypto trading.

References

- https://academy.binance.com/en/articles/what-is-an-automated-market-maker-amm

- https://chain.link/education-hub/what-is-an-automated-market-maker-amm

- https://learn.bybit.com/glossary/definition-automated-market-maker-amm/

- https://www.ledger.com/academy/glossary/automated-market-maker

FAQs

What is an example of an automated market maker?

What are the benefits of automated market makers?

How is a market maker different from an automated market maker?

What are popular automated market makers?