What is a Crypto Exchange? – Understanding Key Concepts

Cryptocurrency exchanges are apps where cryptocurrencies can be exchanged for fiat money or other cryptocurrencies. Ultimately, supply and demand determine the value of cryptocurrencies on these online exchanges.

Cryptocurrency exchanges are usually virtual spaces in which cryptocurrencies are bought and sold. Our guide “What is a Crypto Exchange?” provides an overview of the different types of exchanges you can choose from. Find out more by reading on.

-

-

Definition and Purpose of Crypto Exchanges

What is a Cryptocurrency Exchange?

You can buy and sell digital currencies on the best crypto apps, such as Bitcoin, Ethereum, Tether, etc. Currencies can be exchanged using various payment methods, including credit cards, wire transfers, and cryptocurrencies. Cryptocurrencies can also be traded based on their prices and market movements. Cryptocurrency exchanges usually charge fees, offering security, user interfaces, customer support, and liquidity, among other features.

In addition, some cryptocurrency exchanges also allow you to trade NFT. You must always check if you are negotiating with the best NFT apps before investing.

Why Do People Use Crypto Exchanges?

It depends on the users’ goals and preferences. The following are a few common reasons:

- Buying cryptocurrencies with fiat currency like USD or EUR, such as Bitcoin or Ethereum. Having digital assets that can be used for various purposes enables people to enter the cryptocurrency market.

- To sell cryptocurrencies for fiat money or other cryptocurrencies. In this manner, people may exit the cryptocurrency market, liquidate their profits or losses, or diversify their portfolios by trading one digital asset for another.

- To trade cryptocurrencies based on their prices and market movements. Buying low and selling high allows people to profit by speculating on different cryptocurrencies’ value.

- Access to new types of blockchain investments, including decentralized finance, non-fungible tokens, and initial coin offerings. These cryptocurrency products offer new ways to earn income, create value, and support innovation.

- Take advantage of cryptocurrency’s advantages, such as quick payments, low transaction fees, anonymity, security, and resistance to censorship. Those who seek more privacy and control over their money find cryptocurrency attractive.

Your capital is at risk.

Types of Crypto Exchanges

Cryptocurrency exchanges range in number, depending on whether they are new or still in the startup phase, but are currently about 600 on the market.

It is recognized, however, that there are different categories. Among them are:

Centralized Exchanges (CEX) and Their Features

Exchanges in this category allow users to purchase or sell tokens based on market quotations. Regulatory requirements such as anti-money laundering and knowing your customer apply to these apps. Since users must disclose their identity to participate, they are not private apps. These apps include eToro, Binance, Kraken, and Coinbase.

Certain capital limits are set for participation in traditional exchanges, and services are usually charged. Deposits and transfers within the app are also subject to charges based on the method used.

It is generally not necessary to pay a fee when exchanging cryptocurrencies. In contrast, bank transfers and other payment methods may be free or cost up to $25 USD. Reading each exchange’s fee policies is important since these values may vary. As a result of these fees, the app can be operated and generate revenue.

The required minimum amount for trading within an exchange app is another aspect of the app. These trading limits are in place to prevent the trading of very small amounts. Hence, the parties involved do not have to deal with many small transactions.

Decentralized Exchanges (DEX) and How They Operate

Traditional exchanges have evolved into decentralized exchanges or DEXs. Despite their similarity with the latter, they can operate decentralized. As a result, the app is self-sustaining through its programming, and there are no intermediaries.

In addition, DEXs often provide high levels of privacy, even anonymity.

By using smart contracts and decentralizing advanced computational functions through DApps (Decentralized Applications), DEXs have become a reality.

As part of the well-known DeFi boom, Balancer, Curve, AAVE, and Uniswap emerged as highly relevant decentralized cryptocurrency exchanges. Nowadays, there are lots of projects, and you can invest in the best DeFi apps without spending too much money.

Hybrid Exchanges

A hybrid exchange combines features of a Centralized Exchange (CEX) and a Decentralized Exchange (DEX) to provide users with an unprecedented trading experience. By leveraging the strengths of CEX and DEX, these exchanges aim to minimize their weaknesses. Hybrid exchanges have the following key features:

- Order Matching: Hybrid exchanges usually use centralized order matching to ensure fast and efficient trading. As a result, orders are matched quickly, as they are on traditional centralized exchanges.

- Security: Security is often enhanced by incorporating elements of decentralized technology. Blockchain technology might improve the transparency and security of the exchange, reducing the risk of hacking and fraud, even if user funds remain on the exchange.

- User Control: By allowing users to hold their private keys, hybrid exchanges aim to give them more control over their funds.

- Liquidity: To provide users with better liquidity and a wider range of trading options, they may tap into liquidity pools from other exchanges and decentralized networks.

- Compliance: A hybrid exchange often carries out KYC/AML (Know Your Customer/Anti-Money Laundering) procedures like a traditional exchange.

- Anonymity: Some hybrid exchanges prioritize user privacy and provide anonymous trading options.

- Cross-Chain Trading: By allowing users to trade assets across different blockchain networks, hybrid exchanges offer greater flexibility and trading options.

IDEX, Nash, and Loopring are examples of hybrid exchanges. Users of these apps can choose between centralized exchanges, which offer speed and liquidity, and decentralized exchanges, which offer security and control.

Registration and Verification

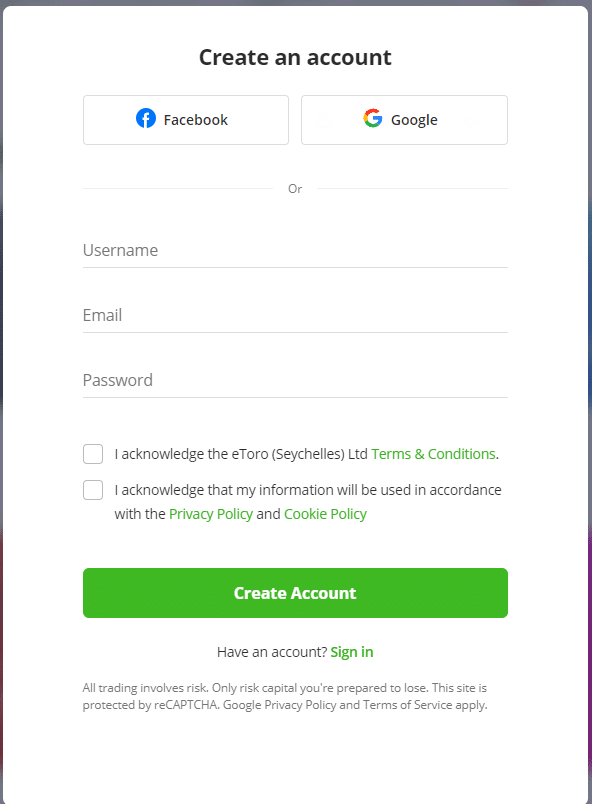

Creating an Account on a Cryptocurrency Exchange

All exchanges follow a similar process. In most cases, the following steps are required.

- Visit the website of the exchange.

- Then click “Sign Up” or “Create Account.”.

- Make sure you provide your e-mail address and create a strong password.

- You may be required to provide personal information, identification documents, and a picture of yourself holding your ID as part of the KYC (Know Your Customer) verification process.

- Accept the terms and conditions of the exchange.

- You’ll get an e-mail with a link to confirm your e-mail address.

- The newly created account can be accessed once it has been verified.

- Make sure the exchange offers two-factor authentication (2FA) for added security.

- Some crypto exchanges are also the best paper trading apps on the market. You can test before trading.

- To begin trading, you must deposit funds into your account.

Your capital is at risk.

Identity Verification and Security Measures

Cryptocurrency exchanges need identity verification and security measures to protect users and the app. The verification process reduces the risk of illegal activities like money laundering by ensuring compliance with KYC/AML regulations. Users’ assets are protected from theft and hacking attempts with robust security measures, including strong passwords and two-factor authentication (2FA). Exchanges could lose funds and damage their reputation without these measures. Users will more likely trust cryptocurrency exchanges when prioritizing identity verification and security.

Deposits, Trading, and Withdrawals

Funding Your Exchange Account with Cryptocurrencies or Fiat

It depends on the cryptocurrency exchange you use. Multiple funding options are available on most exchanges, including:

- Cryptocurrency Deposits: With the exchange app, you can generate a deposit address to transfer various cryptocurrencies (e.g., Bitcoin, Ethereum, Litecoin) directly into an exchange wallet. You can purchase other assets or trade them for another cryptocurrency. Be sure to have one of the best Bitcoin wallets to do this.

- Fiat Deposits: Deposits in fiat currency can also be made on most exchanges, including USD, EUR, and local currencies. You can deposit fiat funds into your exchange account using credit/debit cards, bank transfers, or third-party payment processors.

Depending on the exchange, certain deposit options may not be available, and fees and processing times may differ. Ensure you understand your chosen exchange’s deposit methods and associated fees before you fund your account.

Placing Buy and Sell Orders on the Exchange

On a cryptocurrency exchange, you can place buy and sell orders by following these steps:

- Log In: Sign into your exchange account using your credentials.

- Deposit Funds: Your exchange wallet should have the necessary funds in cryptocurrencies or fiat.

- Select a Trading Pair: Choose the cryptocurrency you wish to trade. For example, select the BTC/ETH trading pair to trade Bitcoin for Ethereum.

- Choose Order Type: Place a market or limit order.

- Enter Order Details: To place a Market Order, specify how much cryptocurrency you want to buy or sell. To place a Limit Order, you need to set the price at which the order should execute and the quantity of cryptocurrency you want to buy or sell.

- Review and Confirm: Double-check your order details, such as the trading pair, order type, price (for limit orders), and quantity. Ensure that everything is accurate.

- Place the Order: Place your order by clicking “Buy” or “Sell.” The market order will be executed immediately at the current market price if it is a market order. Limit orders remain open until the specified price is reached.

- Monitor Your Orders: On the exchange, you can monitor the status of your order under “Open Orders” or “Order History.” If you change your mind, you can cancel open orders.

Your capital is at risk.

Withdrawing Funds from The Exchange to Your Wallet

The following steps are typically involved in withdrawing funds from a cryptocurrency exchange into your wallet:

- In the exchange’s user interface, look for an option called “Withdraw” or “Withdrawal.“

- Select the cryptocurrency you wish to withdraw from the exchange.

- Enter the wallet address where you want to send the cryptocurrency. Don’t send it to the wrong address; cryptocurrency transactions are irreversible, and you could lose your money forever.

- Please ensure that all the withdrawal details, such as the destination address and the withdrawal amount, are accurate.

- Some exchanges require you to submit a confirmation code via e-mail or two-factor authentication (2FA) for added security.

- Click the “Withdraw” or “Submit” buttons to withdraw funds.

- Withdrawals are usually confirmed by e-mail.

- The exchange will process your withdrawal request. Depending on the

- Withdrawal history or transaction history pages on exchanges allow you to track the status of your withdrawal.

- Ensure the funds have been successfully deposited in your wallet after confirming the transaction on the blockchain.

Trading Pairs and Marketplaces

Base and Quote Currencies

Understanding the base currency and the quote currency is fundamental to cryptocurrency trading. The quote and base currencies are the two cryptocurrencies that make up a trading pair. When you buy or sell a currency, the base currency is the one you want to use, and the quote currency is the currency you use to trade.

Bitcoin (BTC) is the base currency in the trading pair BTC/USD, and the US dollar (USD) is the quote currency. To buy Bitcoin, you would need USD. Bitcoin’s value is expressed in terms of the amount of USD necessary to purchase one. On the other hand, when you sell Bitcoin, you are exchanging it for USD. This concept applies to whether you trade Bitcoin for Ethereum (BTC/ETH) or any other cryptocurrency combination.

Different Trading Pairs and Their Significance

Cryptocurrency traders must understand the significance of different trading pairs. Here’s how to do it:

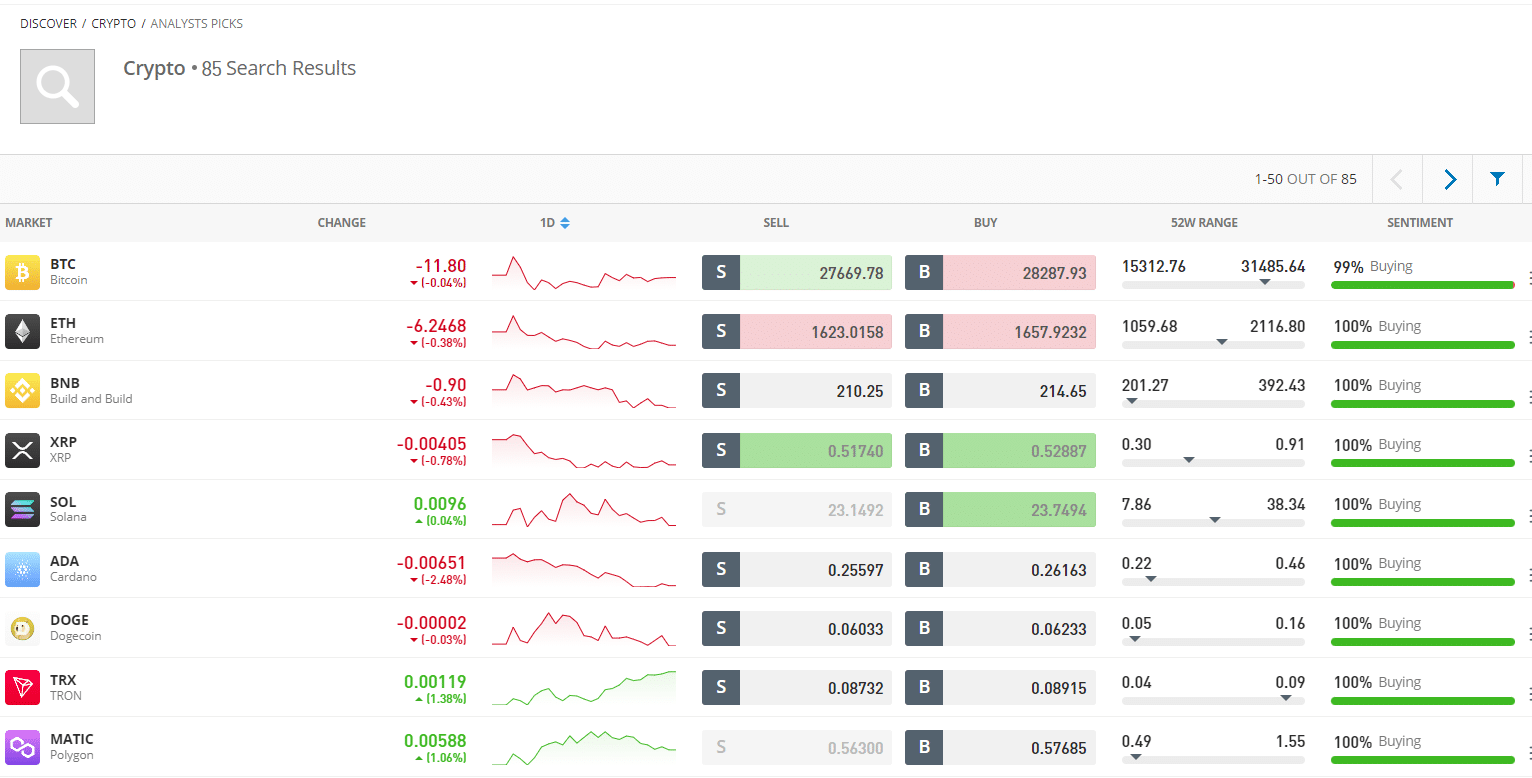

- Choose a Cryptocurrency Exchange: The best place to start is with an exchange that supports many trading pairs, such as eToro.

- Browse the Available Pairs: Explore the available trading pairs on the exchange once you’ve logged in. Their base and quote currencies typically classify pairs on exchanges.

- Research the Pairs: Make sure you research the significance of each pair before trading. The cryptocurrency market must be considered based on various factors, including technology, market trends, and news that may have an impact.

- Analyze Price Charts: Study the historical price movements of the trading pairs you are interested in using the exchange’s price charts and technical analysis tools.

- Keep Up with News: Stay up-to-date on cryptocurrencies and events that might affect your trading pairs.

- Diversify Your Portfolio: Risk can be spread by diversifying your investments across different trading pairs.

- Practice Risk Management: Don’t invest more than you can afford to lose, set clear entry and exit points, and set stop-loss and take-profit levels.

- Stay Informed: Make adjustments to your trading strategy based on the performance of your chosen trading pairs.

Your capital is at risk.

Order Types and Trading Tools

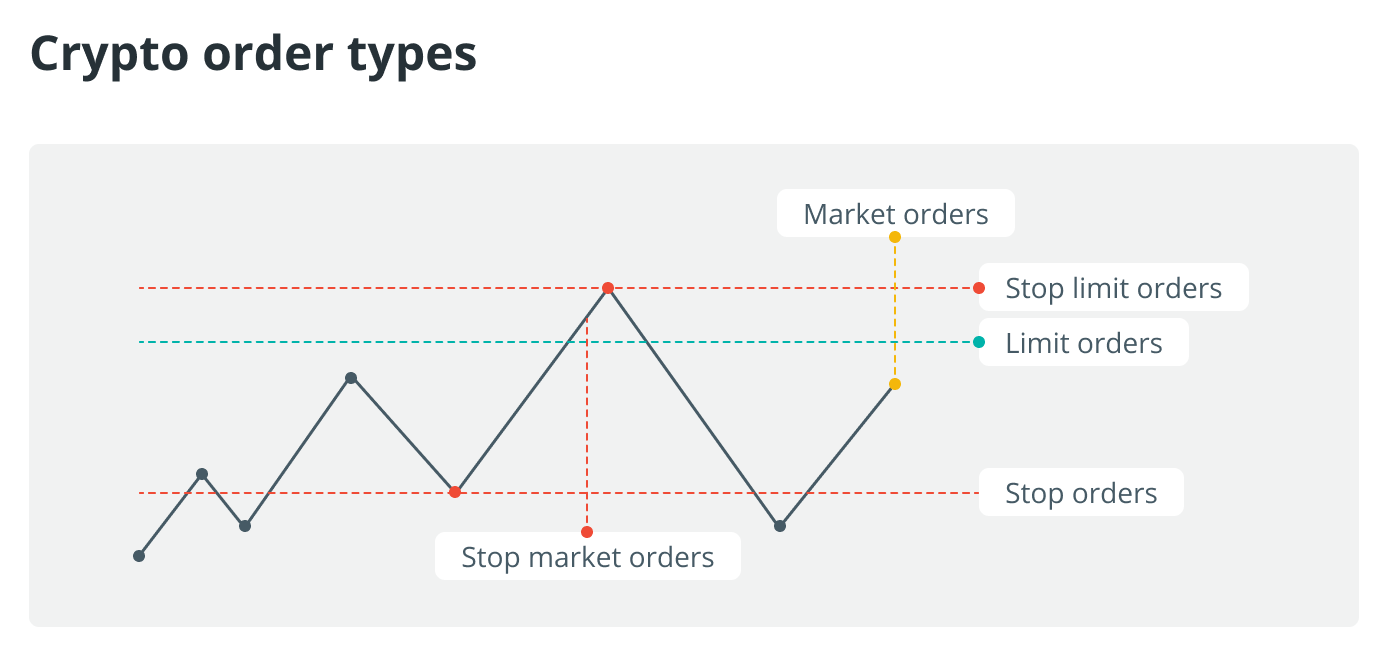

Market Order

Market orders involve buying or selling assets at the current market price. Market orders are executed immediately because they prioritize speed over price. You’re saying, “I’d like to buy (or sell) this asset right now at the best available price.”. Depending on the market and liquidity, the execution price may differ slightly from the current market price.

Limit Order

A limit order is a purchase or sale of an asset at a specific price or better. Place a buy-limit order by specifying your maximum price. When placing a sell limit order, specify the minimum price you will accept. The order book stores limit orders, and the market will only execute them when the specified price is reached.

Stop Order

A stop order may trigger a trade or limit potential losses when a price level is reached. Stop orders come in two types:

- Stop-Market Order: Stop-market orders become market orders when the market reaches a specific price (the “stop price”).

- Stop-Limit Order: Limit orders become active when the stop price is reached. There is a stop price and a limit price that you set. Orders become limit orders once the stop price is reached.

Advanced Trading

Futures contracts and margin trading are advanced trading tools that can be used to:

- Margin Trading: You can borrow additional funds for trading by depositing a certain amount of cryptocurrency or fiat as collateral. To avoid liquidation, maintain a sufficient margin balance and be aware of the risks since losses can exceed your initial deposit.

- Futures Contracts: Decide on your cryptocurrency futures contract’s expiration date and leverage level. Markets rising (long) or falling (short) can be profitable. Monitor the market closely to manage your positions effectively and understand how leverage affects risk and returns. Avoid physical delivery of underlying assets by rolling over or settling contracts before expiration.

Security and Regulations

Security Measures Implemented by Exchanges

Review cryptocurrency exchanges’ security policies and features to understand their security measures. Ensure the company uses robust encryption protocols, two-factor authentication (2FA), cold storage of funds, and regular security audits. Find out if they’ve had any security incidents and how they responded. In addition, check the exchange’s reputation and user reviews. Providing transparency, reducing risk, and protecting user assets are key indicators of a secure exchange. Whenever you share personal information or transact on an app, be careful to enable all security features available.

Regulatory Considerations and Compliance with Laws

Cryptocurrency exchanges must comply with regulatory considerations and laws. Understanding the exchange’s regulatory framework and jurisdiction is the first step. In many cases, licenses and approvals indicate that an exchange is committed to complying with local laws. Keep track of customers and follow AML/KYC regulations to prevent money laundering.

Ensure the exchange takes the necessary steps to protect user information and assets while complying with data protection laws. Check if the exchange offers tax reporting tools and know your jurisdiction’s tax obligations regarding cryptocurrency trading. Lastly, ensure you understand and comply with all applicable regulations by reading and understanding the exchange’s terms of service and privacy policy. The trading environment is typically more reliable and safer on transparent exchanges prioritizing compliance.

Factors to Consider When Choosing an Exchange

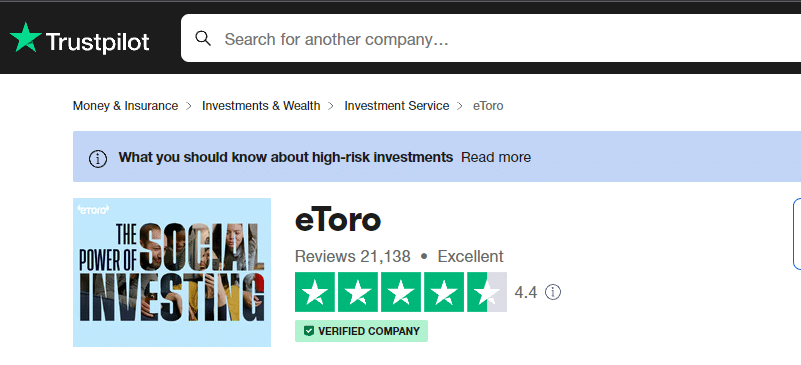

Reputation and User Reviews of the Exchange

Cryptocurrency exchanges should be chosen based on their reputation and user reviews. Strong reputations are indicative of trustworthiness, reliability, and safe operations. A user’s review provides valuable insight into the exchange’s performance, customer service, and past issues. To minimize scams, hacks, and poor customer experiences, choose exchanges with an established track record and favorable user feedback.

Supported Cryptocurrencies and Trading Pairs

Choosing an exchange requires considering the cryptocurrencies and trading pairs it supports. As a result, you can trade a wider range of assets and diversify your portfolio more easily. Many cryptocurrency exchanges offer various assets and trading pairs, allowing you to exploit emerging assets and trading opportunities. Trading or investing in specific assets requires choosing an exchange that matches your investment goals.

Exchange Fees

Cryptocurrency exchange fees, such as trading and withdrawal charges, are critical when determining which exchange to use. Trading fees can significantly impact your profitability, especially if you are a frequent trader. Identify your trading volume, frequency, fee structure, and maker and taker fees. You should also consider withdrawal fees when moving assets to your wallet since they can reduce profits. You can maximize your returns and manage trading costs effectively by choosing an exchange with competitive and transparent fee structures.

Your capital is at risk.

User Experience and Interface

User Interface and Ease of Navigation

Cryptocurrency exchanges should be evaluated based on their user interface and ease of navigation. The trading experience is enhanced by a user-friendly interface and intuitive navigation, which makes it more efficient and reduces the risk of costly errors. Trading orders, accessing market data, and managing accounts are seamless through a clear, responsive design and accessible tools and features. The ease of use of an exchange is especially important for novice and experienced traders seeking to make informed decisions quickly and accurately.

Mobile App Availability and Usability

Cryptocurrency exchanges should offer mobile apps and be easy to use. Trading on the go is easier with a well-designed and functional mobile app in today’s fast-paced environment. For users who prefer to trade from their smartphones, a mobile app should offer the same features and security as the desktop version. Cryptocurrency traders who value flexibility and accessibility should consider it when managing their investments. Moreover, traders are more into crypto day trading. Find one of the best day trading apps for your crypto trading needs.

Customer Support and Additional Services

Availability and Responsiveness of Customer Support

Customer support is among the most important factors when selecting a cryptocurrency exchange. It is imperative to have access to a responsive customer support team in the cryptocurrency world, where transactions can be complicated and technical issues may arise. In addition to resolving issues, clarifying doubts, and ensuring a smoother trading experience, timely assistance can facilitate this process. It is crucial for traders seeking a dependable app to have reliable customer support, which signifies the exchange’s commitment to promptly addressing user concerns.

Additional Features

The value proposition of a cryptocurrency exchange can be enhanced significantly by additional features such as staking, lending, and more. As a result, users can generate passive income, diversify their crypto holdings, and maximize their returns. Long-term investors can benefit from these services, especially if they want to put their assets to work beyond trading. These additional services can give users more flexibility in managing their crypto portfolios and can be a deciding factor when selecting an exchange.

What is a Crypto Exchange? – eToro Complete Guide

With your knowledge about crypto exchanges, you now understand why privacy and security are critical for crypto investors and traders. Staying safe in crypto trading requires trading on reputable, regulated apps. eToro is not only one of the best stock apps but also a crypto trading app which is among the world’s most reputable and regulated. To sign up for eToro, follow these simple steps.

- Step 1: Click “Join Now” on the eToro website

- Step 2: Enter your e-mail, username, and password.

- Step 3: Check the boxes next to the Terms and Conditions, Privacy Policy, and Cookie Policy.

- Step 4: Then click ‘Create Account’.

- Step 5: Verify your e-mail address by checking your inbox. You can also access a demo account.

- Step 6: Once you have funded your account, you can start trading crypto. Remember that many of the best crypto presales require ETH. At eToro, you can trade it faster.

What is a Crypto Exchange? – Conclusion

Anyone involved in the crypto market should understand the advantages and disadvantages of cryptocurrency exchanges. The exchange you choose can significantly impact your trading success, security, and overall experience. You can leverage these apps effectively if you know their advantages, such as liquidity, diversity of trading pairs, and additional services. Conversely, avoiding potential pitfalls can be accomplished by understanding risks, including security vulnerabilities and fee structures. Cryptocurrencies are fast-evolving and sometimes volatile, so you must make informed choices to avoid unforeseen challenges and maximize your opportunities.

Your capital is at risk.

FAQs

What does crypto exchange do?

Cryptocurrency exchanges facilitate the buying, selling, and trading of cryptocurrencies. This app is an intermediary for users to exchange cryptocurrencies or convert them into fiat money. Liquidity and price discovery mechanisms are provided by cryptocurrency exchanges in the crypto ecosystem.

What are the 3 main types of crypto exchanges?

CEX, DEX, and hybrid are the three main types.

Is Coinbase a crypto exchange?

Yes, Coinbase is an exchange. Cryptocurrencies such as Bitcoin, Ethereum, and others can be bought, sold, and traded using fiat currency and digital assets. Besides offering wallet services, it has an easy-to-use interface.

What is the difference between crypto and crypto exchange?

Digital currencies like Bitcoin and Ethereum are referred to as cryptocurrencies. On the other hand, crypto exchanges are apps where users can buy, sell, or trade cryptocurrencies. In exchanges, cryptocurrencies can be exchanged for each other or converted into traditional fiat currencies like USD or EUR.

Jhonattan Jiménez

English Language professional with a vast experience teaching English as a second language, English translator to Spanish, Cryptocurrency enthusiast, interested in geopolitics and economy.View all posts by Jhonattan Jiménez

stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2024