What Does Market Cap Mean In Crypto – Explained

You can make smarter investment decisions based on cryptocurrency market capitalization, a simple, straightforward method of determining a currency’s size. CoinMarketCap was the first to introduce the concept of ranking crypto assets based on a coin’s market capitalization.

We have compiled a comprehensive guide that explains what market cap means in crypto. Read on to learn more about it.

What is Market Cap?

Market Capitalization and Its Significance in the Crypto Market

Market capitalization, or market cap, is a financial indicator used to describe the total value of an asset or company in the market. The calculation is based on multiplying the current market price of each share or unit by the total number of shares or units outstanding. The market cap of a cryptocurrency is used to determine its overall value in the crypto market. An important aspect of this metric is that it gives investors and analysts an easy way to gauge cryptocurrencies’ relative size and significance in the broader market. Higher market caps generally indicate that cryptocurrencies are more stable, liquid, and established.

Additionally, the market cap of a cryptocurrency is critical to its ranking and influence in the crypto space, as well as its inclusion in various indices and investment portfolios. When investing in cryptocurrencies, investors often use the market cap as a factor to identify opportunities and risks. When making investment decisions, investors must consider other factors like technology, adoption, use case, and market cap alone.

Market Cap as an Essential Metric for Cryptocurrencies

A cryptocurrency’s market capitalization provides a quick snapshot of its size and importance. Investors can use it to gauge a cryptocurrency’s popularity and liquidity. A cryptocurrency with a larger market cap is generally considered more established and less susceptible to manipulation, making it a potentially safer investment. Moreover, market cap influences investor sentiment and decision-making by ranking cryptocurrencies.

Also, market cap is a very important factor in index inclusion and portfolio management. Market cap is one of the key criteria for including or weighing cryptocurrencies in cryptocurrency indices and investment funds. The market cap of a cryptocurrency can also give an insight into its price potential since lower market cap cryptos may offer a greater upside but are also more volatile and risky. The market capitalization of cryptocurrencies is an important metric to assess their size, importance, and investment potential in an evolving and dynamic market. Based on that, the best crypto presales are often evaluated by their market cap.

Your capital is at risk.

Market Cap vs. Price

How Are They Different?

There is a difference between a cryptocurrency’s market cap and its price. Cryptocurrency prices, also known as token prices or coin prices, indicate the cost of acquiring a single unit in a particular market. Similar to stock prices, it is influenced heavily by supply and demand dynamics, trading activity, and market sentiment. The market capitalization of a cryptocurrency is calculated by multiplying the token price by the number of coins it has in circulation to determine its value.

By comparing the market capitalization of a cryptocurrency to others, you can get a better idea of its overall market value, the relative size of the cryptocurrency compared to other cryptocurrencies, and the significance of it as an investment or asset class. Cryptocurrency prices reflect the individual unit cost of crypto, while market cap measures its overall market value and impact on the crypto industry.

Overall Value of a Cryptocurrency Network

By considering the current price of the cryptocurrency and the total supply of coins and tokens in circulation, market capitalization (market cap) reflects the total value of a cryptocurrency network.

A cryptocurrency’s market cap can be calculated by multiplying its price by its total supply. Using this metric, you can determine how much each cryptocurrency is worth. Market capitalization indicates the size of the cryptocurrency network, its user base, and potential for influence and stability. Moreover, it helps analysts and investors assess cryptocurrencies’ relative importance and size.

Market Cap Calculation

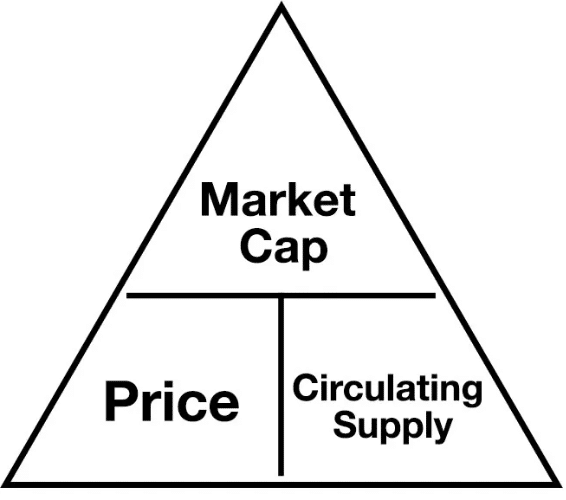

The Formula for Calculating Market Cap

For calculating a cryptocurrency’s market capitalization, we multiply its price per token (or coin) by its total circulating supply. Token price x total circulating supply= market cap. As a key metric for assessing the size and significance of the cryptocurrency ecosystem, this formula quantifies the total value of all units of the cryptocurrency actively trading on the market.

Components of the Market Cap Formula

Two essential components make up the market capitalization formula:

- Price per Token (or Coin): The current market price of a cryptocurrency unit. In a specific market or exchange, it reflects what investors are willing to pay for one cryptocurrency unit. Trading activity, market sentiment, and supply and demand dynamics can cause the price per token to fluctuate rapidly.

- Total Circulating Supply: This is the total amount of coins or tokens currently available for trading and circulation for the cryptocurrency. It consists of all coins issued, mined, and currently traded. A coin’s circulating supply does not include one that is locked, reserved, or not tradable. The total circulating supply is one of the most important factors in determining the potential value of a cryptocurrency network.

Circulating Supply vs. Total Supply

Circulating Supply and Total Supply

Circulating Supply refers to the number of coins or tokens available for trading on the open market and actively in circulation. All coins issued or mined but not locked up, reserved, or otherwise unavailable for trading are included in this category. As a measure of the actual economic value of a cryptocurrency in the market, circulating supply represents the portion available for purchase, sale, and exchange among investors.

In contrast, total supply refers to the total quantity of coins created or generated for a cryptocurrency, including circulating supply, reserves for development, and other coins held off the market. As the circulating supply represents the portion of the cryptocurrency actively participating in the market and influencing its price and value, the market cap is typically calculated using the total supply, which provides insight into the maximum potential supply.

The Impact of Token Distribution

Cryptocurrency market capitalization can be significantly affected by token distribution within an ecosystem; here’s how:

- Concentration of Tokens: There is a possibility that the market capitalization of a cryptocurrency may be skewed if a few entities or individuals hold a significant portion of its total supply. Since a significant portion of the tokens may not be actively traded, the market cap may appear higher than it is. This can create a false impression of the currency’s significance and liquidity.

- Decentralization and Adoption: Token supply distribution often indicates a healthy ecosystem. It indicates a broader base of support and adoption when tokens are distributed widely across various users. As a result, a cryptocurrency’s market cap can increase over time since it suggests a more robust, resilient network.

- Market Perception: Investor perception can be influenced by token distribution. When a cryptocurrency is distributed fairly and equally, it is likely to gain the trust and credibility of investors, leading to increased interest and investment. Alternatively, a heavily skewed distribution may deter investors and raise doubts about the long-term viability of the cryptocurrency.

Your capital is at risk.

Significance of Market Cap Rankings

Why Cryptocurrencies Are Often Ranked by Market Cap?

The market capitalization of cryptocurrencies is often used to rank them within the broader cryptocurrency market to assess their relative size, significance, and popularity. Market cap is a metric that compares and evaluates different cryptocurrencies by combining current price and circulating supply. Making it an important ranking criterion in crypto, it identifies the largest and most established cryptocurrencies. It is a key factor in index inclusion, investment decisions, and market trends.

How Market Cap Rankings Influence Investor Perception and Decision-making

Market cap rankings significantly influence investor perception and decision-making in the cryptocurrency market. Here’s how:

- Credibility and Trust: Cryptocurrencies with larger market caps are frequently regarded as more trustworthy and credible. As a result of their broader recognition and less vulnerability to manipulation, investors may view them as safer options.

- Liquidity: The liquidity of higher-ranked cryptocurrencies makes it easier for investors to buy and sell them. Investors and traders are attracted to this liquidity.

- Investor Sentiment: Market cap rankings can influence Investor sentiment and behavior. The top cryptocurrencies attract more attention and investment because many investors follow the herd.

- Portfolio Allocation: Investors often use The market cap ranking to allocate their portfolios. Higher-ranked cryptocurrencies may be allocated a larger portion of their portfolio since they are perceived as more stable and reliable investments.

- Index Inclusion: Exchange-traded funds (ETFs) and cryptocurrency indices are likelier to include cryptocurrencies with higher market caps. Cryptocurrencies included in this listing can attract institutional investment and boost their market cap further.

Market Cap and Investment Considerations

Market Cap as a Factor in Investment Strategies

A cryptocurrency market’s market capitalization shapes investment strategies. You can use it in the following ways:

- Diversifying their portfolios with the help of market cap benefits investors. Large-cap cryptocurrencies can be allocated a portion of their investment to reduce risk and increase stability. However, smaller-cap cryptocurrencies have greater volatility but can offer higher growth potential. It is possible to mitigate risk and capture growth opportunities by considering large and small caps.

- Risk assessment is aided by market cap. Smaller-cap cryptocurrencies are often more susceptible to market fluctuations and have lower liquidity. Investing in different market cap segments can help investors tailor their risk tolerance. The result is a more risk-appropriate and personalized investment strategy.

- By aligning their investment horizons with their goals, investors can achieve their financial goals. Cryptocurrencies with larger caps are considered more suitable for long-term holdings, while those with smaller caps may be more suitable for trading or speculation. Investing decisions can be based on a person’s time horizon and investment goals.

- Market capitalization’s ranking provides a starting point for research. In addition to market cap, investors should consider factors such as technology, team, adoption, and use case when conducting due diligence on cryptocurrencies of interest. Investment decisions should not be based solely on market cap but can guide investors in narrowing down their choices and building a diversified portfolio with risk management.

Risks Associated with Investing Based on Their Market Cap

Cryptocurrency investing comes with several risks, and the specific risks vary depending on the cryptocurrency’s market cap. Following is a list of risks associated with different market caps:

Cryptocurrencies With a Large Market Capitalization:

- Volatility: The price of large-cap cryptocurrencies can fluctuate significantly, which could result in investors losing money.

- Regulatory Risks: Regulatory changes or government actions can impact large-cap cryptocurrencies’ value and use.

- Market Sentiment: Cryptocurrency prices can fluctuate rapidly due to market sentiment changes.

Cryptocurrencies With a Mid-cap:

- Liquidity Risk: Buying or selling large amounts of mid-cap cryptocurrencies may be difficult due to low liquidity.

- Competition: Small and larger players may compete with mid-cap cryptocurrencies, affecting their market position.

- Development Risk: Because these cryptocurrencies are still developing their technology and ecosystem, there is a greater risk of project setbacks.

Cryptocurrencies With Small Caps:

- High Volatility: There is an increased risk of significant losses with small-cap cryptocurrencies due to their extreme price swings.

- Lack of Liquidity: In small-cap DeFi coins, liquidity is often an issue, meaning it’s difficult to exit positions without substantial price slippage. That’s why you should always check the best DeFi apps before investing.

- Project Risk: Small-cap projects have a higher risk of failure or fraud because they are experimental or early-stage.

- Market Manipulation: Coins with smaller caps are more vulnerable to market manipulation, resulting in price manipulation schemes. This is usually the case with NFT projects. Always make your investments with the best NFT apps to avoid falling into market manipulation.

Your capital is at risk.

Limitations of Market Cap

Factors That Can Distort Market Cap Figures

A cryptocurrency’s value and significance can be inaccurately assessed if several factors distort market capitalization figures. The following factors can distort market cap figures:

- An illiquid token is a cryptocurrency with a limited trading volume and market activity. It is possible for a relatively small trade to experience significant price fluctuations due to a lack of liquidity, resulting in an incorrect estimate of the market cap. As a result, illiquid tokens are more susceptible to price manipulation.

- Manipulating the circulating supply may inflate a cryptocurrency’s market cap. To increase the supply artificially, tokens can be created and distributed, causing the market cap to look larger than it is. A falsely inflated market cap can result from burning or locking tokens, reducing supply and boosting price.

- It is possible for projects to burn or lock tokens to restrict access to a portion of the token supply. As a result, it can be difficult to determine the exact circulating supply, resulting in inaccurate market cap calculations.

- The purpose of wash trading is to artificially inflate trading volumes by creating fake trading activity. In exchanges with high levels of wash trading, market cap figures for cryptocurrency can be distorted since trading volumes do not reflect actual market demand.

- Price manipulation can significantly affect cryptocurrency’s price when a large trade is carried out for a cryptocurrency with thin order books (limited buy and sell orders). Consequently, market cap calculations can be distorted, and valuations can be misleading.

- The price manipulation of cryptocurrencies with low liquidity is more likely. During pump-and-dump schemes, prices can temporarily rise, affecting market cap figures.

- Market cap rankings may be inaccurate due to inconsistencies in cryptocurrency data providers.

Where Market Cap May Not Represent a Cryptocurrency’s Value

Several instances in which a cryptocurrency’s market cap may not accurately represent its value. In the first place, illiquid tokens experience considerable price swings with comparatively low trading volumes, causing their market cap to be distorted. The circulating supply can be inaccurate due to supply manipulation, such as token burns or lock mechanisms. Market cap figures can be unreliable due to price manipulations and exchange wash trading. There is also the possibility of significant price discrepancies resulting from thin order books. Furthermore, the market cap does not indicate a cryptocurrency’s potential utility or adoption, whose levels can vary widely. To assess a cryptocurrency’s true value and potential investment, investors should consider these factors and use the market cap as just one metric among many.

Other Metrics for Evaluating Cryptocurrencies

Alternative Metrics and Indicators to Consider Alongside Market Cap

Alternative metrics and indicators must be considered alongside market capitalization to understand cryptocurrencies’ value and potential better. Consider these key metrics:

- Trading Volume: It tells you how liquid a cryptocurrency is and how much interest it has. A high trading volume may indicate active market participation and lower price manipulation risks. Positive signals include consistent and significant trading volume.

- On-Chain Activity: The number of transactions, value of transactions, and active addresses provide information about a cryptocurrency’s network usage and utility. There may be a growing adoption and a thriving ecosystem on a blockchain with high on-chain activity.

- Developer Activity: Assess a cryptocurrency project’s health and progress by monitoring GitHub repositories and developer activity. The long-term success of a cryptocurrency can be attributed to a vibrant development community.

- Community and Social Media Engagement: Social media engagement and community support can reveal a cryptocurrency’s popularity and growth potential. You should look for active discussions, followers, and positive sentiments.

- Adoption and Partnerships: Ensure the product has been adopted and partnered with established companies or organizations. Collaborations like these can validate a cryptocurrency’s use case and mainstream acceptance.

- Tokenomics: Consider the number of coins available, the inflation rate, and the distribution of a cryptocurrency to analyze its tokenomics. A well-balanced distribution and low inflation can be positive signs. Learn more about this with our What is Tokenomics? guide.

- Utility and Use Case: Consider the utility and use case of the cryptocurrency. Is it purely speculative, or does it solve a real-world problem? A strong use case can drive long-term demand.

- Market Sentiment: Track social media sentiment or use sentiment analysis tools to assess market sentiment. It is possible to predict potential price reversals based on extreme sentiment.

- Technical Analysis: Using technical analysis indicators and chart patterns to identify potential entry and exit points. It is possible to complement fundamental analysis with technical analysis.

- Regulatory Environment: Make sure you know the regulatory environment in which cryptocurrencies operate. Its value and legality can be affected by regulatory changes.

The Holistic Approach to Cryptocurrency Analysis

To analyze cryptocurrency holistically, multiple factors beyond market cap must be considered. You can better understand a cryptocurrency’s value, potential, and risks using it. Investors can make informed decisions when they assess metrics like trading volume, on-chain activity, utility, community support, and regulatory considerations. Market capital alone does not capture the full picture so that it can be misleading. Investors must take a holistic approach to the cryptocurrency market to mitigate risks and identify valuable opportunities.

What Does Market Cap Mean in Crypto? – eToro Tutorial

Now that you understand the market cap better, you will see why privacy and security are essential for crypto traders and investors. Trading on regulated, reputable apps is the key to staying safe in crypto apps. eToro is not only one of the best stock trading apps but also one of the best crypto exchanges. Follow these steps to sign up for eToro.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

- Step 1: On the eToro website, click “Join Now“

- Step 2: Please enter your e-mail address, username, and password.

- Step 3: Ensure you’ve read the Terms and Conditions, the Privacy Policy, and the Cookie Policy.

- Step 4: Select ‘Create Account. eToro is also one of the best paper trading apps. So, give it a try before trading.

- Step 5: Check your inbox to verify your e-mail address.

What Does Market Cap Mean in Crypto? – Conclusion

With our What Market Cap Means in Crypto? guide. We could learn that market capitalization plays a vital role in separating the giants from the upstarts so that investors can distinguish more stable and liquid cryptocurrencies from those that are more nascent. Cryptocurrencies like Bitcoin and Ethereum dominate despite market turbulence, indicating their influence and resilience. Market capitalization is not just a vanity metric; it also impacts investment decisions, index composition, and portfolio allocation. By emphasizing the utility of market cap, it facilitates the identification of trends and opportunities by helping traders navigate the complex and dynamic world of digital assets.

Despite this, it’s important to remember that market cap is only a starting point and does not provide exhaustive information about a cryptocurrency. Cryptocurrency investors should consider trading volumes, on-chain activity, use cases, adoption, regulatory factors, and market cap analysis. Including these metrics in a balanced approach empowers investors to make informed choices, manage risks, and make the most of the cryptocurrency market’s diverse offerings.

Your capital is at risk.