Dividend Stock: How to Invest in Dividend Stocks

Short-term traders prefer buying and selling stocks to make as much profit as possible. They might hold the stock for months, but their profit model boils down to selling it for a higher price. Knowing how to invest in dividend stocks presents another opportunity, albeit slower, to profit from a company’s progress.

Some companies, like Meta, Alphabet Inc. A, Booking Holding Inc., etc., prefer to reinvest their profits into their businesses. For them, short-term stock trading is the best approach. Investing in dividend stocks involves buying stocks for future dividends from the company.

You’ll continue receiving dividends, provided the company profits and you hold your stock. We’ll take you through the basics of dividend stocks, their types, and crucial considerations. Then, you’ll learn about the risks of investing in stocks that pay dividends.

-

-

What are Dividend Stocks?

Some companies reward their investors with a share of their monthly or quarterly proceeds. The frequency of payments depends on the company and is not fixed or forced. To share the profits, these companies turn to stocks that pay dividends.

What exactly is a dividend? It’s a portion of a company’s profits paid to shareholders, typically monthly, quarterly, or annually.

Dividend stock investing often suits long-term investors, serving as potential retirement income. Yet, they come with drawbacks alongside benefits for long-term traders. Notably, mature companies typically pay dividends, having stabilized in society. Younger, smaller companies often reinvest profits to spur growth.

Advantages of Investing in Dividend-Paying Companies

Here are a few advantages to investing in dividend-paying companies:

- Stocks have lower volatility, which presents lower risk

- You can earn regular income from dividend payments

- You can benefit from capital appreciation

- Compounding returns from reinvesting your dividends can help grow your investments

- You can get lower taxes on qualified dividends

- They can act as stable cushions during periods of market volatility

The crucial step to enjoying these benefits is knowing how to invest in dividend stocks. Let’s see how stocks that pay dividends have performed historically.

Historical Performance of Dividend Stocks

Dividends were crucial for early 1900s returns but faded in the late 1900s as companies favored profit reinvestment.

The dot com bubble renewed interest in dividends. Yale’s report indicates that S&P 500 dividend stocks returned 9.25% compared to 5.45% for non-dividend stocks from 1927 to 2018.

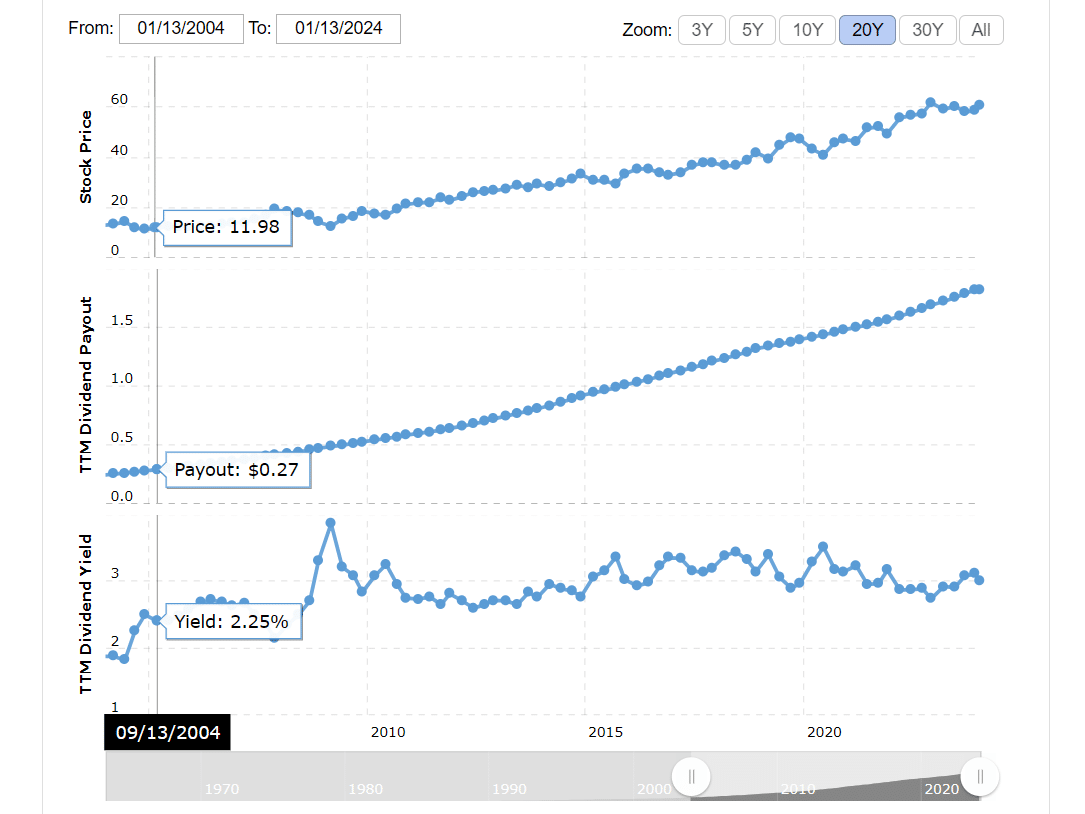

Today, investors seek dividend stocks for portfolio stability amidst market volatility. The graph displays Coca-Cola’s consistent dividend growth since 2005, reflecting a common trend among companies.

Fundamental Analysis of Dividend-Paying Companies

A company’s yield will mean little if the earnings are low. Moreover, most companies would not pay dividends when operating at a loss.

Stock portfolio trackers can help you track companies’ stock prices.

We’ve identified a few parameters to analyze when picking dividend-paying companies. They include the following:

Earnings and Revenue Stability

Companies with the best dividend stocks can cut them or stop paying them. Earnings are crucial to regular payments and the better the earnings, the more consistent the payment will be.

Some companies will periodically step up the yield as they earn more. While earnings refer to monetary value, revenue stability deals with consistency.

It will mean little to have good but inconsistent earnings or revenue. Inconsistency means you can get $2 today and less or more in the next payment cycle.

Dividend History and Consistency

You can find a company’s earnings on trading platforms and company records. However, we recommend the EDGAR system on the SEC platform for the most accurate financial statements.

Once obtained, you can review the consistency. The first thing to pay attention to is growth. Each financial statement should be higher than the previous one.

You can calculate a company’s growth rate from its yearly financial statements. Don’t expect mind-blowing figures like those in high-growth companies. Instead, watch out for consistency.

The dividend history will likely follow the company’s earnings history. A few shakeups (downward trends) might occur, but the overall picture should show growth.

Besides the value, analyze the payment cycles. Companies that pay on time are worth investing in. These are essential to researching stocks adequately before purchasing.

Debt Levels and Cash Flow in Dividend Assessment

A strong cash flow is a positive sign that a company will keep its dividend obligations. It also raises the assurance of on-time payments. Again, you can find information on a company’s cash flow in its financial statements.

The top dividend stocks often come from companies with less debt. High debt ceilings could point to possible cuts in dividends. That is because the company will use more cash flow to service its debt, leaving little or nothing for dividend payments.

We must analyze cash flow and debt with other factors. They are helpful, but we don’t recommend basing your decisions solely on them.

Your capital is at risk

Sector and Industry Considerations

Volatility varies from one sector and industry to another. For example, companies in the crypto industry have more volatile stocks than those in the utilities or facility maintenance industries.

While selecting the best dividend stocks, you must consider the industry. Large and small-cap stocks can pay dividends if the company is profitable.

Let’s see how trends affect dividend stocks and how industries present specific risks and opportunities.

Sector Trends in Dividend Stocks

Rising interest rates favor dividends in the banking and financial sectors. Banks can have higher returns on loans and business deals. Hence, they’ll happily pay higher dividends.

Mature industries like utilities, consumer staples, and telecommunications can afford higher dividends. Companies in these industries have settled into a rhythmic and largely predictable growth pattern. Hence, they can put up reasonable dividend yields without fear.

Contrast that with high-growth industries like fintech. The latter prefers lower dividend yields to spare more cash for growth.

These trends play crucial roles in dividend yields and sustainability. Hence, you must consider them before investing.

Risks and Opportunities

The table below shows different industries and the opportunities and risks they bring to investing in high-dividend stocks:

Industry Opportunities Risks Utilities Stability and mature growth present high-dividend yields Regulations can bring sudden changes, lowering yields. Financial Rising interest rates on loans favor good dividends The central bank can increase or lower interest rates, affecting yields Technology The sector is generally high growth, presenting opportunities for long-term investments It can change rapidly, resulting in volatile stock prices Healthcare Businesses in this sector often have reasonable dividend yields New regulations and policies can change the trend drastically Dividend Diversification for Stability

The table in the previous section reveals the need for diversification. Even stock traders know too well to buy stocks from highly volatile and less volatile sectors.

We recommend starting with stock analysis apps. Then, you can review alternative data to see market sentiments towards the company. Use this approach to identify high-risk and low-risk industries.

Purchase stocks from different sectors. You should spend more on low-risk sectors to offset your losses in high-risk sectors.

Diversify and create a portfolio. Ensure you track your portfolio meticulously. Of course, you won’t be on it as frequently as a day trader.

Keep your ears on major events that can crash a company. Subscribe to news sites to receive updates about companies and industries in your portfolio.

Your capital is at risk

Building a Balanced Dividend Portfolio

We mentioned purchasing high- and low-risk dividend stocks. That is one approach to creating a balanced portfolio. Notwithstanding, you still need a few more considerations.

Do your research and make it thorough. You can take insights and advice, but remember that the risk rests solely on your finances.

Investment Goals and Time Horizons

Dividends don’t have high returns like short-term stock trading. Hence, you should avoid them if you can’t hold on for the long term. That brings us to the first considerations; investment goals and time horizons.

Do you want to use dividends as a yearly income or a retirement fund? Your investment goals determine which sectors to invest in and how often you reinvest. They will also determine whether you pick cash or stock dividends.

Those with yearly goals will opt for high-dividend stocks in high-growth sectors. Contrarily, those with retirement goals will opt for mature industries that do not necessarily have high dividends.

Write out your goals and start your analysis from there. Find dividends that align with your projected returns.

The time horizon will determine whether you pick quarterly or annual payments. We are sure you’ll find good deals in both divisions.

Diversification Strategies for Dividend Investors

The following are our recommended strategies for dividend investors:

- Invest in different sectors: This approach spreads risks and reduces exposure to one sector. Moreover, volatility differs from one industry to another.

- Invest in different companies: This approach also helps spread your risks.

- Pick stock dividends for the long term: Opt for stock dividends to compound your share in the company.

- Reinvest your dividends: You can reinvest part or all of your dividends to compound your investments.

- Select companies from different regions: Most brokers feature companies from different regions. This approach will help you minimize exposure to one region. For example, new regulations may destabilize one region while the other continues to maintain stability.

Balancing Growth and Income in the Portfolio

Dividends bring growth and income opportunities. You can have both in your portfolio, but they should be balanced.

Some companies progressively increase their dividends. Conversely, others have stable dividend yields for many years. Add both to your portfolio.

Add more growth dividends to your portfolio if you are concerned about retirement or the long term. Conversely, add more stable dividends to your portfolio if annual income is your priority.

We encourage a healthy mix of the two. However, the ratio depends on your investment goals.

Summary

Knowing how to invest in dividend stocks is not exclusive to the older generation. However, it requires those with long-term investment strategies.

Don’t expect monthly returns with dividend stock investing. Hence, your risk tolerance should accommodate long-term losses.

Consider the following when evaluating dividend stocks:

- The company’s financial health

- The yield and payout ratio

- The economic and market outlook

- Volatility

Diversify your dividends. Mix high-growth and stable companies into your portfolio. Notwithstanding, expect risks in your investments.

How to Invest in Dividend Stocks – eToro Complete Guide

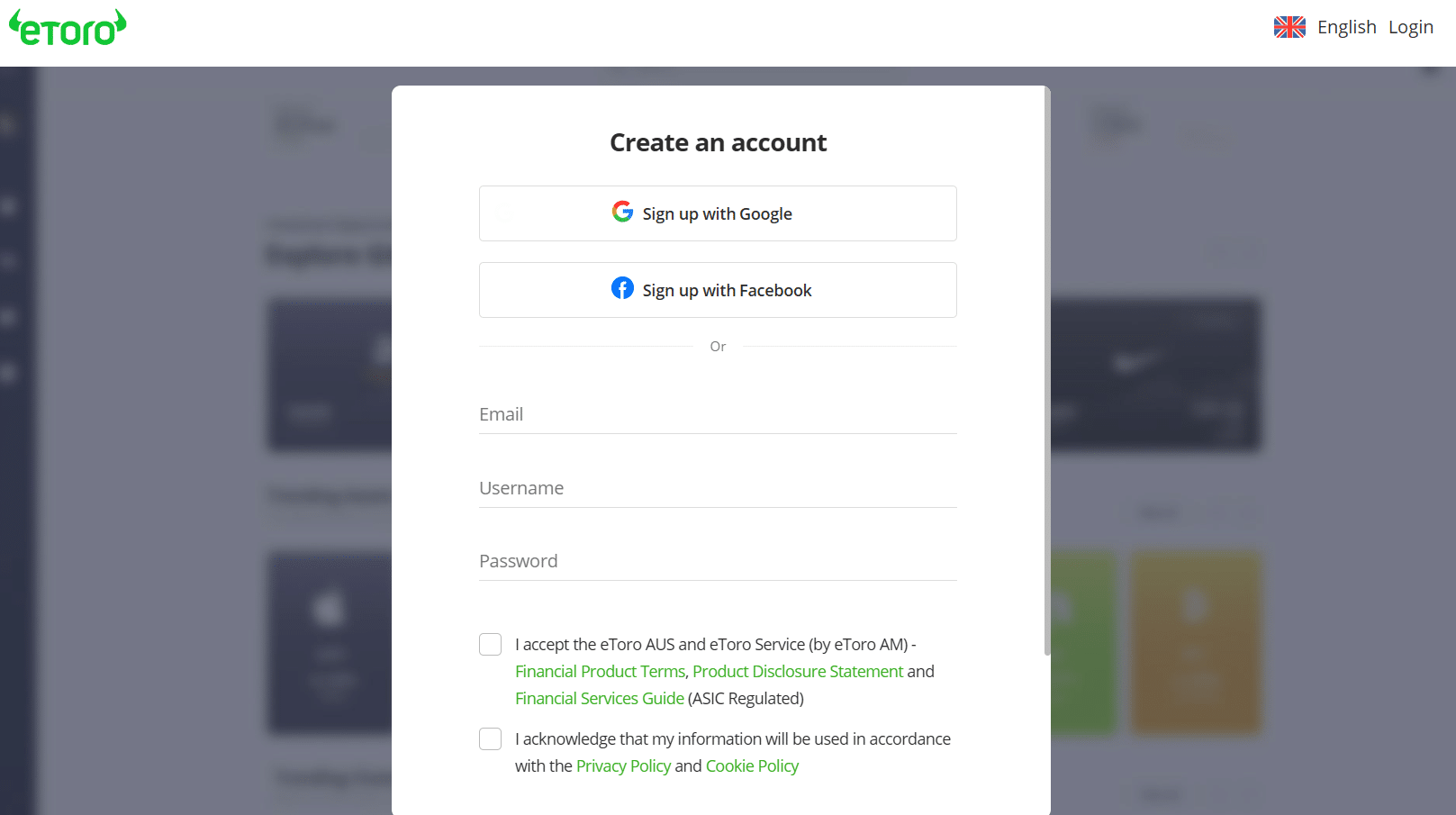

eToro offers an excellent start for new investors. It also has expert tools for experienced investors to log in and trade without losing a beat.

For illustration purpose only

We recommend eToro because of its simplicity. Most importantly, the trading platform is available on all devices, from desktops to smartphones and tablets.

Here are the steps to open your eToro account and start trading:

Step 1: Go to the eToro homepageClick on the links provided on this page to open the official eToro website. Ensure you are on the homepage. You can use your desktop or smartphone to access the site.

Step 2: Open the registration pageClick “Join eToro” to open the registration page. You can also access the registration page from the login section. Once there, select “Create new account” to redirect to the registration page.

Step 3: Fill out the registration formeToro requires a few details to get you settled on the platform. These include your username, email, and password. Ensure you use a strong password to protect your account.

Step 4: Complete registrationAccept the terms of service and the privacy policy to complete the registration. Click “Create account” to close the registration page. Your account is ready, but you must verify it on the next page.

Enter the email verification code to verify your email address. Then, log in and proceed to the home page.

Step 5: Use the demo account or verify your identity to deposit and tradeYou can use the virtual account with $100,000 to practice simulated trades. Your trades will be in markets with real-time prices. Then, you can verify your identity and start trading with real money.

Conclusion

Knowing how to invest in dividend stocks can set you up for long-term income. The compounding possibilities of reinvesting bring even more returns. Moreover, you can earn cash or stock dividends.

Set out your investment goals and study the market and companies thoroughly. Invest according to your risk level. Visit eToro and open a new trading account to get started.

Your capital is at risk

FAQs

How do I start investing in dividend stocks?

The first step is researching companies that offer dividends. Then, find brokers and buy the company shares. Wait for the first dividend payment and continue investing.

How do I buy a stock to get the dividend?

You must purchase stocks that pay dividends, as only some do. Register with an online broker that supports the company you want. Fund your account and buy the stock.

How do you make $100 a month in dividends?

Consider the dividend yield when investing. Also, most companies pay quarterly and annual dividends.

How much is $10,000 invested in Apple 20 years ago?

If you invested $10,000 in Apple stock 20 years ago, in 2004, the share price was around $4. That $10,000 bought you roughly 2,500 shares. Today, in 2024, with Apple stock at $185.92 per share, those original 2,500 shares will be worth over $464,000. So, your original $10,000 investment is now worth over $450,000.

How to make $1,000 a month with dividend stock?

Find a company that offers high dividend stocks. Consider the dividend yield to calculate what you must invest to get a $1,000 monthly return. Refer to our section on understanding dividends.

References

- https://www.hartfordfunds.com/insights/market-perspectives/equity/the-power-of-dividends.html

- https://www.nasdaq.com/market-activity/stocks/ko/dividend-history

- https://www.sec.gov/edgar/about

- https://www.forbes.com/advisor/investing/how-to-build-investment-portfolio/

- https://www.investor.gov/introduction-investing/getting-started/assessing-your-risk-tolerance

Jeremiah Awogboro

View all posts by Jeremiah AwogboroJeremiah Awogboro is an experienced content writer with over 8 years of experience. He has a qualified MBChB degree and a keen interest in the stock market and the finance industry. His background in the industry has provided him with valuable experience in this field. Awogboro is dedicated to assisting and reaching out to as many people as possible through his writing. In his spare time, he enjoys music, football, traveling, and reading.

VISIT ETOROYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2026