Rug pull explained and how to stay safe—Trading Guide 2024

The crypto industry had over 364 reported rug pulls and scams in 2022. Developers create hype around their crypto projects, including those that defraud investors. Hence, looking at the rug pull explained how to stay safe, is pertinent.

Experienced investors and traders are familiar with the term “rug pull.” However, these fraudulent projects seem to target enthusiastic new traders who know little about the crypto industry. They gather hype, promise bogus returns, receive massive investments, and disappear before you know it.

We’ll offer an in-depth look at rug pull explained to help you identify and avoid this scam. The tell-tale signs are always present, regardless of how much they try to mimic real projects. With that in mind, let’s begin our “rug pull explained” article with its basic definition.

-

-

What is a Rug Pull?

The cryptocurrency market is projected to have an 11.1% compound annual growth rate between 2021 and 2028. That is possible thanks to growing adoption and project developments in the industry. Many developers create projects to solve real-life problems.

Ship token, Trace token, Amber token, and Trael are prominent examples of crypto projects solving logistics management problems. While these are not recommendations to start trading, we pulled them in to show you the growing adoption of cryptocurrency. Moreover, you can trade on DeFi apps the same way you would traditional stocks and securities.

Let’s see the rug pull definition and how it occurs in cryptocurrency.

Definition and Explanation

Rug pulls are not limited to cryptocurrencies. Hence, our rug pull definition will come from a broader stance.

With that in mind, rug pulls are malicious acts of shutting down a project abruptly after hyping it and drawing in investors. The projected returns become a pipe dream sent down the drain. With the project gone, investors lose their capital with no projected returns.

Those who are involved focus on marketing. They push to pull in as many investors as possible while preparing for their exit. In many ways, rug pulls resemble Ponzi schemes, except that only the creators benefit.

This rug pull meaning props a question on how anyone would be gullible enough to invest. Although not entirely a rug pull, the Enron stock scam shows how uninformed people can lose money to promises of bogus returns. Enron executives sold their stocks to unsuspecting investors who thought they were investing in a vibrant energy company.

Little did they know that the company was sinking in depth. Rug pull creators can go as far as manipulating figures to paint a rosy picture. As seen in the rug-pull meaning in crypto, influencers can endorse rug-pull projects, generating trust.

So, what is the meaning of rug pull in crypto? It involves crypto developers that shut down their projects abruptly to profit off early investors. These projects have little chance of pulling off from the get-go.

Marketing a failing project with the full knowledge of its failure is fraud. Hence, those involved in rug pulls may face jail time and other punishments in the United States. However, we can’t guarantee you’ll get your money back if caught up in one.

How Rug Pulls Occur in Cryptocurrency

Our rug pull meaning in crypto paints an overview. In reality, perpetrators can either go hard or soft. You must understand both to fully grasp this article on rug pull explained.

Hard rug pulls involve coding backdoors that allow developers to exploit the smart contracts. They can use this backdoor to do anything that profits them, leaving the investor with no returns.

Liquidity stealing is another form of hard rug pulling. It involves withdrawing all the coins from a project’s liquidity pool.

Often, most projects limit sales to prevent imminent collapse. Soft rug pulls involve selling off tokens within seconds or minutes. Hence, developers can tweak the codes and sell off their stake quickly.

The rapid sales cause the token’s price to plummet, leaving investors with little recourse to salvage their investments. You should go for the best crypto presales to avoid rug pulls, as they mostly begin with their launch.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Recognizing the Signs of a Rug Pull

The above rug pull definition leaves room to recognize its warning signs. Recognizing hard rug pulls will be challenging, as it requires examining the token’s code. That is something most of us are ill-equipped for.

Even so, some things will stand out. The most obvious sign is the abrupt price crash. However, we don’t want to wait that long for that to happen.

Here are the signs of an impending rug pull:

Sudden Price Drops and Liquidity Drain

Cryptocurrencies are volatile. However, losing over 50% of a token’s value is creepy in the crypto market. Sudden price drops often point to massive asset dumps.

This quick and massive asset dump signifies an ongoing rug pull by our rug pull definition. An understanding of tokenomics in crypto tells us this shouldn’t happen. It means the developers are abandoning their projects.

Creators can withdraw the coins from a liquidity pool, destroying the stability for smooth transactions. Liquidity drains are exit strategies, leaving worthless assets behind. You’ll find them more on DeFi platforms because of the fewer regulations.

Developer Anonymity and Lack of Transparency

Satoshi Nakamoto might remain anonymous to this day, but Bitcoin became a prominent crypto project. That shows that anonymity does not always point to an impending rug pull. However, we must weigh anonymity with other factors, like a lack of transparency.

From our rug pull definition, you can tell why fraudulent creators will want to keep their identities a secret. They are aware of the legal blowbacks, hence the secrecy.

Stay away from any crypto project if the creators hide their identities. Find out their track record in the crypto community. Review the whitepaper and the transparency of their operations as they reach new milestones.

Real-Life Examples of Rug Pulls

We’ve dealt with the theoretical rug pull meaning in cryptocurrency. As mentioned earlier, celebrities can endorse rug-pull projects. They ride on their popularity to convince people to invest, even when they know what’s about to happen.

Rug pulls differ from crypto whales that buy large amounts of tokens. Hence, don’t view such large sales as a rug pull.

Historical Cases of Notable Rug Pulls

The table below shows prominent rug pulls in history:

Project The rug pull Squid game The rug pull made SQUID lose value from over $3,000 to $0 in five minutes. Investors could not sell in the open market because of the anti-dumping feature. Tital token Panic sell-offs and liquidity drains caused the value to plummet from $65 to almost $0. PandaSwap This project promised high yields. However, the developers drained the pool, resulting in a collapse. Marble.Cake This popular meme coin existed during the Dogecoin hype. However, the creator, Jared, drained the liquidity pool, causing a rug pull. Lessons Learned from Past Incidents

The biggest lesson from past incidents is the need to do your own research (DYOR), regardless of who is involved. Examine the whitepaper and see the project’s viability. Some projects promise things that are technically impossible or too challenging.

Other lessons from these incidents include the following:

- Be skeptical of bogus promises

- Be patient when learning about new projects

- Review the creators’ track records

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Anatomy of a Rug Pull

Let’s tear down the rug pull definition to its different stages. The fraud begins with the project launch and works its way up to building investor confidence. Then, the pull occurs.

During the launch, the creators market innovative and mind-blowing features. These present a lucrative opportunity to make high returns.

Then there is hype. Some projects use influencers and other market tactics to generate hype. They can advertise massive airdrops to get everyone pumped.

The sales begin, and investors buy in, generating liquidity. Massive sales occur. However, this stage is preparing the creators to manipulate the token prices.

Manipulating Token Prices

Price manipulation is typical to give the developers as much liquidity as possible. They can act as whales, creating scarcity to increase the token’s value. This stage gets more people into the trap as the lure of making massive profits becomes more irresistible.

Draining Liquidity from Pools

The developers will continue building trust. They might show their commitment to the project by fulfilling some milestones. Even so, they keep asking for more money.

Then, the liquidity drain comes. They can also use the soft rug pull approach. Either way, the token loses its value significantly, to the point of being worthless.

The Role of Developers and Promoters

From our rug pull definition, you can tell that these projects need promoters to gain as much influence as possible. The developer’s popularity can also aid in its spread and trust in the crypto community. A personality like Vitalik Buterin will receive widespread acceptance for any project he endorses.

Developer Influence on Token Value

Some developers can have massive influence in the crypto industry, like Vitalik Buterin, Ethereum’s co-founder. They can use this popularity to lure unsuspecting investors to purchase their tokens. Also, their track record might not give off any warnings, as they have clean sheets.

Besides popularity, developers can use their technical knowledge to manipulate prices. They can build backdoors in the smart contracts, allowing them to control the market.

Influencer Marketing and Pumping

Most crypto projects turn to influencers for promotions. These influencers market the projects to their audience and fans. They hype up the projects so much that not investing feels like you are missing out on the next big thing.

Influencers already have a loyal fanbase. Hence, they are easy targets for pump-and-dump schemes.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Ponzi Schemes and Exit Scams

The rug pull meaning relates closely to Ponzi schemes. For example, influencers can benefit from their initial stakes while late investors lose. Let’s review Ponzi schemes and how fraudulent developers perfect their exit strategies.

Pyramid Structures and Unsustainable Returns

A pyramid structure is where the creators pay early investors with money received from new investors. It is unsustainable, as the entire structure depends on new investors. Sooner or later, investors will dry out, leaving late investors without pay.

Early investors can recover their capital, but many more will leave with little or nothing. How sustainable can the returns be? With over $7 billion lost to crypto Ponzi schemes in 2022, you can’t afford to fall victim.

Luring Investors Before Disappearing

The success of Ponzi schemes falls primarily on the creators’ persuasive powers. They achieve this through several marketing techniques. The promised profits are often unrealistic when closely examined.

Dogecoin and Shiba Inu gained massively. Hence, Ponzi schemes build off that to portray feasible returns. Then, they disappear once investors stop joining.

The process often begins with delayed payments. You’ll hear several excuses before payments stop.

Conducting Thorough Research

Doing your research is the best approach to counter rug pulls. As our rug pull definition shows, these developers prey on ignorance. They might even use technical jargon to portray a fully developed project.

Here’s how to conduct thorough research:

Evaluating the Team’s Credibility

The rug pull meaning points mostly back to the developers. Genuine projects don’t mind sharing the identities of the team members. Look them up and review their history.

Checking the Token’s Use Case and Whitepaper

This section might sound more technical than evaluating a person’s track record. Notwithstanding, take time to study the token’s use case and whitepaper.

The use case will reveal the token’s viability for broad acceptance. You’ll learn how the developers hope to achieve the use case in the whitepaper.

Analyzing Tokenomics and Liquidity

Tokenomics is a crucial aspect of any crypto project that involves tokens. The most important is the token distribution. That shows how the liquidity pool is generated to sustain the ecosystem.

Understanding Token Distribution

The developers, early investors, and the general public will gain portions of the tokens generated. Some projects generate the tokens from the start, while others have an ongoing generation process through mining. Find out how much developers and other stakeholders have.

Funneling more tokens to the developers can signify an impending rug pull.

Verifying Liquidity Locks and Pool Ownership

Some projects lock up their liquidity pools to prevent incessant withdrawals. This way, they ensure the sustainability of network operations. Notwithstanding, this lock is often for a specific period.

Developers can lock in liquidity to prevent early investors from exiting the project. However, you must verify this approach. Its presence can be a green flag to invest in.

Relying on Reputable Platforms

Our rug pull meaning won’t hold if you don’t trade the associated tokens. You need a trading platform, like a Bitcoin trading app, to buy and sell these tokens. That raises the need for a reputable platform.

Using Established Exchanges for Trading

You can do your research and still fall victim to rug pulls if you trade on illegal platforms. We understand that DeFi apps are not centrally regulated like traditional trading platforms. However, you must find those with a good reputation.

Review their reputation with other users. Examine the founders and their track records for fairness and transparency.

Verifying Smart Contracts on Trusted Websites

Etherscan, Hardhat, Brownie, and Celoscan are reputable websites to verify smart contracts. Use them to validate the DeFi project before trading on it.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Trusting Your Instincts

Only trust your instincts after following our advice in previous sections. You will be ill-informed without sufficient research. We’ve covered that in-depth in our rug pull meaning.

Avoiding High-Pressure Sales Tactics

High-pressure marketing tactics should ring bells. These are designed to prevent sufficient rational reasoning. Hence, you might make costly mistakes.

Being Skeptical of Unrealistic Returns

Massive returns shouldn’t excite you. Instead, it should draw you in for further research. If your instinct doesn’t trust the financial model to generate such returns, you shouldn’t trust it either.

Diversification and Risk Management

Stocks are not the only securities you can diversify. There are investment tools and analysis software to help you pick out ideal assets.

Spreading Investments Across Different Assets

The best approach is to balance high-risk and low-risk assets. Invest in coins that have high and low volatility. Share your resources so that the low-volatility coins can offset your losses on the high-volatility coins.

Allocating Only What You Can Afford to Lose

Our rug-pull meaning reveals the craftiness of fraudulent investors. Hence, investing what you can afford to lose is prudent.

Spread your investment across altcoins, NFTs, metaverse projects, and DeFis. Sum them up and ensure the amount is within your budget. Avoid borrowing to invest in crypto projects.

Staying Informed and Educated

If there’s a point we’d hammer on continuously in this article (rug pull explained), it’s the need to be informed. Find out as much as you can about the industry and its technicalities. That way, crafty technical promises won’t blow you away.

Keeping Up with Crypto News and Trends

The crypto industry is fast evolving, with innovations and increasing adoption. Hence, new regulations will pop up, and new altcoins will trend. Have a reputable news platform you can turn to for current news and trends.

Don’t focus on the excitement alone. Instead, spread your reach to regulatory agencies and even the judicial system. A project’s developer could be facing lawsuits while promoting a rug pull.

Learning from Others’ Experiences

You can find several stories of rug pulls on the internet. Read them and learn from the experiences of other investors. Doing that could reveal patterns that indicate an impending rug pull.

Learning from other’s experiences will help you take steps toward vetting projects more.

Reporting and Taking Action

This rug pull-explained article is not only to help you recognize rug pulls. Upon discovery, you should report it to the appropriate authorities. It could be as simple as reporting to the DeFi or crypto exchange that provided the launchpad.

You don’t have to wait until the fraudsters achieve their goals. We owe it to others to warn them of rug pulls and scams. Here’s how to do that:

Reporting Suspicious Activities and Scams

The Federal Trade Center (FTC) and the Internet Crime Complaint Center are reputable platforms to report scams. Use the FTC’s complaint form on its website.

Report to your state regulator if the platform is registered for trading. Find out which regulatory body best suits the case.

Raising Awareness in the Community

Once reported, inform the crypto community. That could mean returning to the Discord, Telegram, or Twitter channels to discredit the developers and reveal their scams.

Rug pull explained: eToro Complete Guide

One essential thing to grasp from our “rug pull explained” piece is the need for trading on reputable platforms. We’ve identified eToro as a reputable and fully registered body for trading cryptocurrencies. It also provides tools to help you analyze the market before trading.

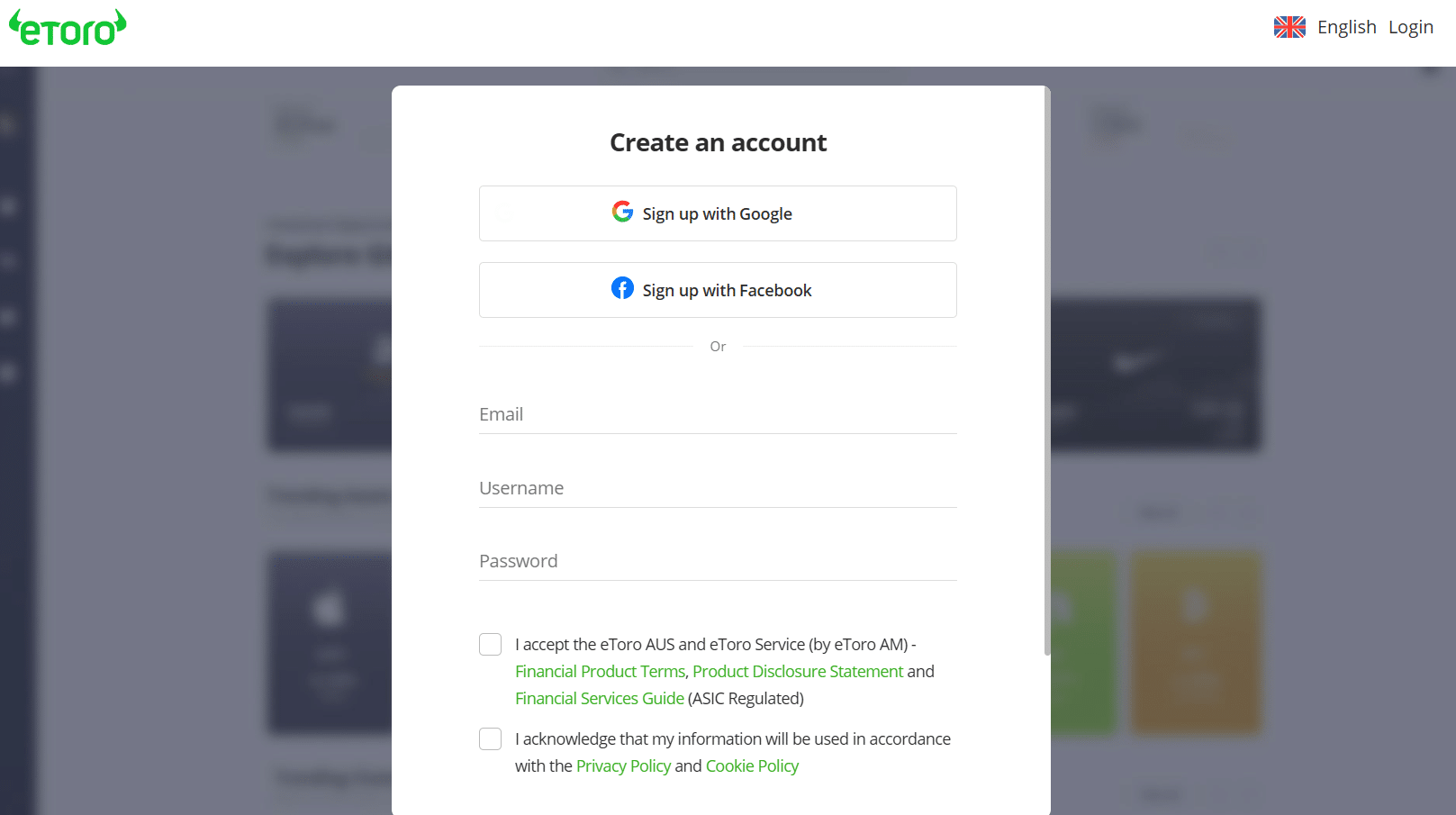

eToro is available on mobile devices for quick trades. Here are the steps to opening an eToro account:

Step 1: Visit the eToro homepageWe’ve provided several links to take you to the official homepage. That ensures you register with the real eToro platform. Click “Join eToro” to start the registration process.

Step 2: Fill out the formsYou need a few details to start the registration process. That includes your username, password, and email. eToro also provides a faster option through Gmail and Facebook.

Step 3: Verify your emailFill out the registration form, accept the privacy policy and the terms and conditions, and click “Continue.” Input the email verification code sent to your inbox.

Step 4: Fund your account and start tradingYou can switch to the $100,000 virtual account to practice and sharpen your skills. Then, fund your account to trade real cryptocurrencies.

Rug pull explained: conclusion

We’ve covered much in our “rug pull explained” article, from how they work to recognizing them. While regulatory agencies and exchanges step up to prevent rug pulls, they can still occur. Always do your research and follow our guide to recognize them.

When it’s time to trade, use eToro. Register today to get started.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

References

https://fortune.com/2022/03/02/crypto-scam-rug-pull-what-is-it/

https://www.fortunebusinessinsights.com/industry-reports/cryptocurrency-market-100149

https://businessfirstfamily.com/biggest-stock-market-scams/

https://finance.yahoo.com/news/crypto-ponzi-schemes-cost-victims-120000975.html

FAQs

Why are rug pulls illegal?

They are illegal because they involve knowingly defrauding investors. The developers can plan from the start by building backdoors into their codes.

What are the signs of a rug pull?

Anonymous developers, allocating most of the tokens to the developers, the absence of liquidity locks, suspicious yields, etc., are typical signs.

Is a rug pull a pump and dump?

Pump and dump projects are soft rug pulls, where developers hype investors to invest. Then, they exit the project with the investments.

How do I protect myself from a rug pull?

Do your research on projects before investing. Look out for the signs mentioned in this article (rug pull explained).

Jeremiah Awogboro

View all posts by Jeremiah AwogboroJeremiah Awogboro is an experienced content writer with over 8 years of experience. He has a qualified MBChB degree and a keen interest in the stock market and the finance industry. His background in the industry has provided him with valuable experience in this field. Awogboro is dedicated to assisting and reaching out to as many people as possible through his writing. In his spare time, he enjoys music, football, traveling, and reading.

VISIT ETOROYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2024