Best ETF App 2026 – Top App Revealed

If you’re a long-term investor that’s looking to buy ETFs at the click of a button – you’ll want to use a top-rated app. This will allow you to build a diversified portfolio with ease – as many ETF apps now permit commission-free trades.

In this guide, we review the best ETF app for 2026 and show you how to get started with a commission-free investment today!

-

- 1. Interactive Brokers – Best for ETF App for Comprehensive Research

- 2. Robinhood – Best 0% Fee ETF App for US Residents

- 3. Charles Schwab – Best ETF App For Highlighting Performing Funds

- 4. Ally Invest – Top ETF App For Trading Commission-Free CFDs

- 5. Webull – Best ETF App for User Experience

- 6. Stash – User-Friendly ETF App With Low Account Minimums

- 7. Fidelity – Best ETF App With Personalized Investment Screener

- 8. TD Ameritrade – Best ETF App for Research and Analysis

-

- 1. Interactive Brokers – Best for ETF App for Comprehensive Research

- 2. Robinhood – Best 0% Fee ETF App for US Residents

- 3. Charles Schwab – Best ETF App For Highlighting Performing Funds

- 4. Ally Invest – Top ETF App For Trading Commission-Free CFDs

- 5. Webull – Best ETF App for User Experience

- 6. Stash – User-Friendly ETF App With Low Account Minimums

- 7. Fidelity – Best ETF App With Personalized Investment Screener

- 8. TD Ameritrade – Best ETF App for Research and Analysis

Top ETF App 2026

A list of the best ETF apps for 2026 can be found below. We discuss each ETF app provider in greater depth further down.

- Interactive Brokers – Best for ETF App for Comprehensive Research

- Robinhood – Best 0% Fee ETF App for US Residents

- Charles Schwab – Best ETF App For Highlighting Performing Funds

- Ally Invest – Top ETF App For Trading Commission-Free CFDs

- Webull – Best ETF App for User Experience

- Stash – User-Friendly ETF App With Low Account Minimums

- Fidelity – Best ETF App With Personalized Investment Screener

- TD Ameritrade – Best ETF App for Research and Analysis

Best ETF App Reviewed

There are several key factors that you need to tick off before joining an ETF app. For example, you need to ensure that your chosen ETF instrument is supported and that the app offers competitive fees and commissions. You also need to explore the minimum investment amount required and, ultimately – how your money is kept.

To help clear the mist, below we review the very best ETF apps in the market right now.

1. Interactive Brokers – Best for ETF App for Comprehensive Research

Interactive Brokers has established itself as a prominent player in the digital brokerage industry over several decades. Their advanced trading technology has consistently placed them at our rankings for the best ETF app. IBRK is particularly noteworthy for its comprehensive ETF research capabilities, as its platforms and tools enable customers and non-customers to delve into real-time, global market data.

One of the key factors contributing to Interactive Brokers’ success is its commitment to offering competitive commissions and fees. The broker has earned a reputation for providing some of the lowest rates in the industry, making it an attractive option for cost-conscious investors.

Interactive Brokers boasts diverse products available across desktop, mobile, and web formats. This extensive selection equips investors with the tools to access global market information and services. As of 2023, Interactive Brokers has surpassed the milestone of 2.22 million customer accounts and reports an impressive $342.1 billion in client equity.

Pros:

- Quality educational materials and research

- Low commissions and fees

- Highly reliable trade execution

- Impressive platform packed with features

- Very wide range of investment offerings

Cons:

- Too advanced for new investors

2. Robinhood – Best 0% Fee ETF App for US Residents

This is because you can invest in an ETF at just a couple of dollars per trade. Perhaps the main drawback with Robinhood is that the app is largely focused on US-listed assets. If, however, you’re planning to build a diversified portfolio of international-listed ETFs – you might need to look elsewhere. Nevertheless, if you choose to remain on the Standard Account at Robinhood, you won’t need to pay any ongoing management fees.

If you want access to more features – you might consider the Gold Account. This will give you access to margin trading tools – as long as you have a minimum account balance of $2,000. You will also be able to earn interest on idle USD cash balances, access research reports, and be able to make larger instant deposits. On top of stocks and ETFs, Robinhood also allows you to trade cryptocurrencies and options. These instruments are also commission-free.

Read our comprehensive Robinhood app review to find out more about what this firm offers.

Pros:

- Heavily regulated in the US

- More than 10 million traders using the app

- Buy and sell stocks without paying any commission

- No minimum deposit in place

- No monthly or annual maintenance fees

- More than 5,000 US stocks supported

- Also invest and trade ETFs, options, and cryptocurrencies

- Perfect for newbie traders

Cons

- Only 250+ foreign stocks listed

- Unable to deposit with a debit/credit card or e-wallet

3. Charles Schwab – Best ETF App For Highlighting Performing Funds

In addition to ETFs, Charles Schwab provides a comprehensive suite of products and services similar to other full-service brokers. These include the ability to trade stocks, including fractional shares, options trading, fixed-income investments, and retirement guidance.

To enhance user experience, Charles Schwab offers three mobile apps: Schwab Mobile, StreetSmart Mobile, and thinkorswim. It’s worth noting that Schwab’s mobile app and thinkorswim have received positive user ratings. Furthermore, Charles Schwab’s ETF Select List assists users in making informed decisions by highlighting the best funds in selected categories.

Pros:

- Commission-free stocks, options and ETF trades

- Robust research and educational materials

- Large mutual fund selection

- Full spectrum of financial assets

- User-friendly ETF trading app

Cons:

- Margin rates are high

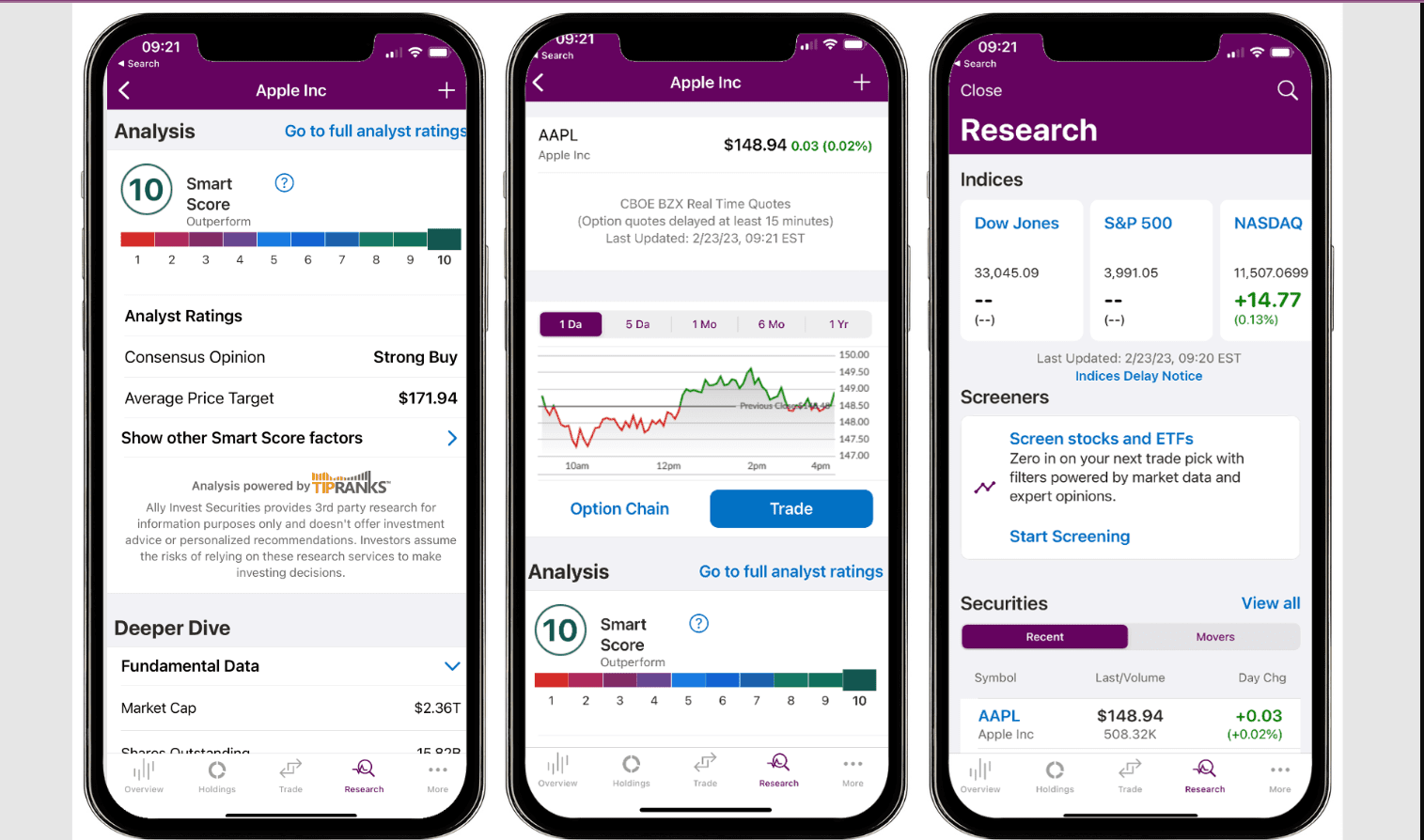

4. Ally Invest – Top ETF App For Trading Commission-Free CFDs

Ally Invest is a versatile bank and online broker that provides various services, including commission-free trading for specific assets. They are known for offering highly competitive pricing on various investment options, such as exchange-traded funds (ETFs), stocks, options, and mutual funds.

Ally Invest’s ETFs are just one component of its extensive lineup of investment products. They also offer diverse U.S.-listed equities, options, mutual funds, fixed-income products, and foreign exchange trading opportunities.

To cater to the needs of different traders, Ally Invest has developed a web-based trading platform using HTML 5 technology. This ensures that the platform functions seamlessly on screens of all sizes, whether large or small. Additionally, mobile traders can download Ally Invest’s mobile app, available for both iPhone and Android devices.

Pros:

- No account minimums

- Very low trading commissions and zero spreads

- Thousands of shares, ETFs, and funds supported

- Strong web-based platform

- Easy and fully digital account opening

Cons:

- Limited trading tools

5. Webull – Best ETF App for User Experience

There is no minimum deposit requirement when using Webull to buy ETFs and you can fund your account fee-free when doing so via ACH. You will, however, be charged $8 to deposit funds via a US wire transfer and $25 to make a withdrawal. Nevertheless, the Webull app is generally preferred by traders with little to no experience in this space.

It’s really simple to use and finding a stock or ETF to invest in could not be easier. In terms of safety, Webull is regulated by the SEC and FINRA. Most importantly, US traders are protected by the SIPC – which covers you up to the first $500,000 ($250,000 limit for cash) if Webull collapsed.

Read our comprehensive Webull app review to find out more about what this firm offers.

Pros:

- 5,000+ US stocks and ETFs

- 100% commission-free trading

- Very affordable margin rates

- Advanced technical charts with modifiable parameters

- Integrated stock screener with day trading filters

Cons:

- Few stock discovery features

- Only accepts deposits by bank transfer

6. Stash – User-Friendly ETF App With Low Account Minimums

For example, the platform categorizes markets by their core characteristics – such as whether you want to invest in an ETF that tracks commodities, bonds, or diversified global markets. However, you will need to pay a monthly fee to use the app. Fortunately, this costs just $1 per month.

But, if you want access to greater account features – such as access to traditional IRAs, you will need to pay a higher monthly fee. For example, at $3 per month, you’ll get personalized retirement advice and access to Smart Portfolios. The highest account plan – at $9 per month, also allows you to invest on behalf of your children, comes with premium research and advice, and will get you $10k life insurance via Avibra.

Still not convinced about the Stash app? Read our comprehensive Stash review to find out more about what this great ETF app offers

Pros:

- No minimum deposit

- Offers fractional stock

- More than 1,200+ stocks and ETFs

- Best-suited for newbie traders

- Heavily regulated

- Round Up feature and personal finance tips

- Avialable on both iOS and Android

- Lots of educational resources

Cons:

- Monthly fee of between $1 and $9 depending account type

- Does not support instant deposits with a debit/credit card or e-wallet

7. Fidelity – Best ETF App With Personalized Investment Screener

Fidelity is an established brokerage firm with a popular investment app that can be downloaded free of charge on iOS and Android devices. The app will get you access to thousands of ETFs – which cover US and international-listed markets. In fact, at Fidelity, you can invest in ETFs from over 25 different countries.

We like Fidelity for its trusted and long-standing track record in the investment scene. Plus, we also like the ETF screener that the app comes with. This makes it really easy to find an ETF that is suited for your financial goals and attitude to risk. This comes with a filter of more than 100 metrics – such as the type of instrument you wish to invest in and whether you have a particular market in mind.

In terms of fees, Fidelity allows you to invest in ETFs without paying any commission if it’s listed on a major US exchange. If your chosen ETF is listed elsewhere, you will pay a flat fee. This will vary depending on the country in question – so be sure to check this out before opening an account. There is no minimum deposit requirement at Fidelity – which also makes the ETF app attractive to small level investors.

Pros:

- Great selection of long-term investment products

- Access US-listed stocks, ETFs, and investment options commission-free

- Covers thousands of markets in 25 different countries

- Excellent reputation and heavily regulated

- No minimum lump sum requirement

- Top-rated research and educational materials

- Advanced analysis tools available for seasoned pros

Cons:

- Account opening process can be slow

- No debit card deposits/withdrawals

8. TD Ameritrade – Best ETF App for Research and Analysis

There are also stock and trading education tools such as articles, guides, videos, and webcasts. In terms of supported ETFs, you’ll have thousands to choose from at TD Ameritrade. This covers markets in the US, Europe, Asia, Australia, and more. If you are investing in a US-listed ETF, you will be doing so on a commission-free basis.

If you wish to purchase an ETF that is listed outside of the US – this is classed as an OTC (Over the Counter) trade. In turn, you’ll pay a fee of $6.95. Although TD Ameritrade does not have a minimum account balance policy in place, you might want to stick with US-listed ETFs if you are planning to invest small amounts – as the OTC fee might make the process unviable. Nevertheless, on top of ETFs, this trading app also offers stocks, options, futures, forex, mutual funds, and even crypto.

Pros:

- Enormous selection of stocks and options

- Commission-free trading

- Two mobile apps available

- Fully customizable indicators with thinkorswim scripts

- Analyze 4-leg options trades

Cons:

- Only accepts bank transfers for payment

- Relatively pricey margin rates

What are ETFs?

Exchange-traded funds (ETFs) are popular with investors that seek long-term financial gains in a passive and diversified manner. The ETF that you opt for will be managed by a large-scale institution – with the likes of Vanguard and iShares dominating this space. The main concept is that through a single ETF investment – you’ll be indirectly buying hundreds of different assets.

In some cases – such as the Vanguard Total Stock Market Index Fund ETF – you’ll be investing in thousands of individual equities. Either way, once you have completed your ETF investment, there is nothing more for you to do. The fund manager will determine which assets to buy and sell – which allows you to sit back and let your capital work for you.

There are many types of ETFs in the market, albeit, the most common are as follows:

- Index Fund ETFs: This will track a stock market index like the S&P 500, NASDAQ 100, or FTSE 250.

- Dividend Stock ETF: This type of ETF will track a basket of established dividend stocks.

- Growth Stock ETFs: If you want to gain exposure to a basket of growth stocks, there are several ETFs to choose from.

- Bond ETFs: There are hundreds of bond ETFs in the market – covering a combination of corporate and government-issued instruments

- Commodity ETFs: One of the best ways to invest in a commodity like gold or silver is through a managed ETF, you can also do this through a commodity trading app.

Unless you are investing in a commodity ETF, you will be able to make money via two different income streams. Firstly, you will be entitled to your share of dividend payments that the ETF receives. For example, this might be because the ETF holds a basket of dividend stocks or bonds.

Secondly, if and when the value of the assets held in the ETF increases, so will your investment. ETFs are represented as stock on a public exchange – which should rise and fall in conjunction with the ETF’s Net Asset Value (NAV). The fact that ETFs are publicly listed also means that you can cash out your investment at any given time.

When it comes to fees, you’ll pay an expense ratio when you invest in an ETF – even if your chosen app is commission-free. The good news is that is often in the region of 0.1%-0.4% per year – which is very competitive.

Why Invest in ETFs?

If you’re wondering why ETFs are popular with investors of all shapes and sizes – check out the many benefits discussed below.

Diversification

When you invest in an ETF you will be buying a large number of assets through a single trade.

- For example, if you invest in the SPDR S&P 500 ETF, you are essentially buying all 500 stocks from the respective index.

- In another example, if you invested in the Vanguard Total Bond Market Index Fund ETF, your portfolio would consist of over 10,000 bond instruments.

Attempting to purchase this many assets on a DIY basis would be super time-consuming and costly.

Access All Markets

Although retail investors can easily access large-cap stocks listed in the US and UK – this isn’t always the case with other marketplaces. For example, if you wanted to buy shares in companies based in South America or Asia – you will either find it challenging or very expensive.

This is where ETFs really shine – as you can invest in a diversified basket of emerging stocks and bonds with ease. A prime example of this is the iShares MSCI Emerging Markets ETF – which gets you access to over 800+ stocks from a variety of markets – such as China, Taiwan, South Africa, South Kore, and more.

Various Risk Levels

There are ETFs to suit investors of all types. For example, if you are a conservative investor that likes to take a low-risk approach – you might prefer an ETF that buys high-grade assets. This might consist of an ETF that tracks blue-chip stocks or US Treasuries.

If you want to target more attractive financial returns and are happy taking on more risk – then you might opt for an ETF that tracks bonds from the emerging markets or US-listed growth stocks.

Combine Dividends and Capital Growth

When investing in an ETF, you can earn capital in two forms. As we noted earlier, this comes via dividends and an increased NAV. The former is particularly useful, as you can reinvest your dividends back into the ETF every time you receive a payment (typically every three months).

Every time you do, you will increase the size of your investment in the ETF, and thus – your dividend yield will attract a higher monetary payment. For example, let’s say you invested $5,000 into an ETF and yielded 10% in dividends in year one.

A reinvestment strategy would mean that in year two – your investment in the ETF would stand at $5,500. In turn, a 10% yield would translate to $550 as opposed to the $500 you would have received had you cashed your dividends out.

Ideal for Small Investments

If you want to create a long-term investment portfolio but don’t have a larger amount of capital – ETFs are ideal. In fact, the best way to approach ETFs, is to follow a long-term dollar-cost averaging strategy.

This means that you can invest a little bit of spare cash that you have at the end of each month – subsequently growing your exposure to the financial markets consistently.

Great for Commodity Investments

ETFs are, without a doubt, the best way to invest in commodities. For example, if you wanted to invest in gold and opted for the traditional method of buying and storing bars or coins – this would be costly. On top of the obvious security concerns, it would also make it challenging to cash your gold investment out.

But, by opting for an ETF like the SPDR Gold Shares, you can invest in this precious metal without needing to worry about storage. You would also be able to cash out your investment at any given time – as ETFs are traded as public stocks. There are commodity ETFs available on other instruments too – such as silver, oil, and natural gas.

Are ETFs Safer Than Stocks?

ETFs are often considered a safer investment option compared to individual stocks due to their inherent diversification. One key advantage of ETFs is that they typically comprise a basket of various securities, such as stocks, bonds, or commodities, which helps spread the investment risk. By holding a diversified portfolio within a single investment, ETFs can mitigate the impact of adverse events affecting specific companies or sectors. Unlike investing in individual stocks, where the fortunes of a single company can heavily influence the investment outcome, ETFs provide exposure to a broader range of assets. This diversification helps to reduce the risk associated with the performance of any single security.

Additionally, ETFs can track broad market indices, such as the S&P 500, providing investors with exposure to a wide range of companies and sectors. This diversification, coupled with the ease of buying and selling ETF shares on the stock exchange, makes them an attractive and relatively safer option for investors seeking to spread their risk across multiple securities. It is important to note that while ETFs offer diversification benefits, investment risks still exist, and investors should carefully assess the specific ETF’s underlying assets, management fees, and historical performance before making investment decisions.

Difference ETFs Stocks Management Can be actively or passively managed, but most are passively managed to track an index Represent ownership in individual companies Trading Traded on stock exchanges throughout the day, prices can fluctuate Bought and sold at market prices, prices can also change throughout the day Diversification Provide exposure to a diversified portfolio of assets, helping spread risk Represent ownership in a single company and are not inherently diversified Fees Generally have lower expense ratios compared to actively managed mutual funds No expense ratios, but investors may incur trading fees Investment Approach Often favored by investors who prefer a more passive approach, aiming to match index performance Allow investors to take an active approach, selecting individual companies based on research and analysis How to Choose the Best ETF App for You

We have discussed the top 10 ETF apps in the market right now. But, it’s also a good idea to perform a bit of research of your own before proceeding to sign up on the best forex apps. This will ensure that you choose from the best ETF app for your personal needs and requirements.

The most important factors to look out for are discussed below:

- Regulation: All of the best ETF apps discussed on this page are regulated. US-based apps like Robinhood, Webull, and Stash are regulated by the SEC and in many cases – members of the SIPC

- User Experience: Make sure that your chosen day trading app is easy to use on your respective operating system. Most apps are built for both iOS and Android – so you should find that the user experience is seamless.

- Tradable ETFs: It goes without saying that your chosen investment app should support the ETF that you want to invest in. You can usually check this by visiting the provider’s website to see what ETFs are available.

- Fees: The best ETF apps discussed today allow you to invest commission-free.

- Trading Tools: We found that the best investing apps come with various tools and features that can enhance your trading decision-making process.

- Payment Methods: You will need to deposit funds before you can invest in an ETF.

- Customer Service: The best ETF app providers of 2026 allow you to speak with a customer support agent via Live Chat. Others are limited to just email or a support ticket – so check this before signing up.

As you can see from the above, there are many things to cross off to find the best ETF app for your needs.

References

- https://www.schwab.com/etfs/understand-etfs

- https://m.economictimes.com/definition/etf

- https://www.forbes.com/advisor/in/investing/what-are-etfs-and-how-do-they-work/

- https://www.bloomberg.com/features/2016-etf-files/toy/

FAQs

What is the best ETF app?

Some of the best ETF apps that we came across include Robinhood, Acorns, Betterment, Libertex, and Stash. With that said, eToro stands out for us - as the app allows you to invest in ETFs commission-free and at a minimum stake of just $50.

What is the difference between a robo-advisor and an ETF?

Robo-advisors are offered by brokerage apps and they allow you to invest passively based on your financial goals. ETFs, on the other hand, are managed investment funds that give you access to a diverse portfolio of assets. In most cases, robo-advisor platforms invest in ETFs.

Are ETFs a good investment?

ETFs are a great investment if you want to track a specific marketplace - like index funds, bonds, dividend stocks. ETFs are also beneficial if you want to create a diversified portfolio in a passive nature.

Do ETF apps pay dividends?

Yes, if your chosen ETF pays dividends - you will entitled to your share. In most cases, this will be reflected in your ETF app cash balance the day after the payment is distributed.

What are ETF CFDs?

Some of the best ETF apps discussed today specialize in CFDs. This allows you to trade the future price of the ETF without taking ownership. You can trade ETF CFDs with leverage too - which will boost the value of your position.

Kane Pepi

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane Pepistockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2026

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

Interactive Brokers has established itself as a prominent player in the digital brokerage industry over several decades. Their advanced trading technology has consistently placed them at our rankings for the best ETF app. IBRK is particularly noteworthy for its comprehensive ETF research capabilities, as its platforms and tools enable customers and non-customers to delve into real-time, global market data.

Interactive Brokers has established itself as a prominent player in the digital brokerage industry over several decades. Their advanced trading technology has consistently placed them at our rankings for the best ETF app. IBRK is particularly noteworthy for its comprehensive ETF research capabilities, as its platforms and tools enable customers and non-customers to delve into real-time, global market data.