Forex.com App Review 2024 – Fees, Features, Pros & Cons Revealed

If you’re looking to trade forex, it only makes sense to start by checking out a brokerage named Forex.com. This global broker offers all the tools and resources that forex traders in the US and UK need, including an advanced charting platform and a user-friendly mobile app. Better yet, Forex.com offers a commission-free trading account with low spreads.

Forex.com isn’t just for forex trading, either. The Forex.com app offers trading for nearly a dozen popular cryptocurrencies, plus CFDs for hundreds of stocks and ETFs. You can also trade stock index CFDs and a handful of commodity CFDs with this broker.

But is Forex.com the best trading app for you?

In this review, we explain everything you need to know about the Forex.com app. We’ll take a closer look at the account types and fees, what assets you can trade, the broker’s trading tools, and more.

-

-

What is Forex.com?

The main attraction to the Forex.com app is that it gives you access to a huge chunk of the global forex market. You can trade more than 90 forex pairs with this broker, including dozens of exotics that many of its competitors don’t offer. On top of that, Forex.com caters to a wider variety of traders by offering cryptocurrency and stock CFD trading.

Forex.com also keeps its fees impressively low, which helps it bring in and keep novice and professional traders alike. The brokerage has several account types to cater to different trading styles, including a low-spread account targeted at high-volume forex traders.

What Can You Trade on the Forex.com App?

Our Forex.com app reviewed found that it is built first and foremost for forex trading. This broker offers a whopping 91 currency pairs for trading, which is double some of its competitors. Notably, you own currency pairs outright when trading with Forex.com – this broker doesn’t sell CFDs for forex. You can still apply leverage of up to 50:1 to forex trades (the amount of leverage varies by currency pair).

CFDs are also available for popular commodities, most notably gold and silver. There are 21 commodities to trade through the Forex.com app in all, the majority of which are hard commodities. Gold trades at leverage up to 200:1, while oil trades at up to 100:1.

Finally, the Forex.com app offers trading on nine of the most highly traded cryptocurrencies as CFDs. These include Bitcoin, Ethereum, Litecoin, and Ripple, and you can trade them against specific currencies like GBP or AUD as opposed to against USD only.

Forex.com Account Types

Forex.com offers three account types: Standard, Commission, and STP Pro.

The Standard account is designed for the majority of retail traders. You get commission-free forex trading as well as access to the Forex.com and MetaTrader 4 trading platforms.

The Commission account is a better deal for high-volume traders. You pay a flat commission of $5 per 100,000 units of currency traded. However, in exchange for paying a commission, you get access to significantly reduced spreads. For the EUR/USD forex pair, for example, the Commission account comes with a spread of 0.2 pips compared to 1 pip for the Standard account.

The STP Pro account is designed for professional traders. It offers direct market access for order routing, giving you faster execution than is possible with a Standard or Commission account. You get access to advanced tools like an order book as well. However, forex trades can be expensive. There is no spread, but you pay a $60 per trade commission for your first $100 million of currency traded each month.

Forex.com Fees & Commissions

Forex.com has become one of the most popular forex brokers in the US because it offers impressively low fees. Forex trading with a Standard account is free and the EUR/USD pair trades at an average spread of just 1.8 pips. With a Commission account, the spread drops to as low as 0.2 pips in exchange for a $5 per 100,000 commission.

Notably, which type of account you choose with Forex.com only affects your fee structure for forex trading. Commissions and fees for CFD trading are the same regardless of your account type.

Our Forex.com review found that share CFD trading commissions are typically very inexpensive and can be as low as 1.8 cents for US stock trades. You should also expect to pay a spread of around 3 pips for S&P 500 stocks.

Cryptocurrency and commodity CFD trading with the Forex.com app is a bit more expensive. Spreads for Bitcoin and Ethereum are typically around 35 pips, although there is no commission for trading. Commodity pricing varies according to the product you’re trading, but expect to pay spreads of between 4 and 40 pips.

Importantly, the Forex.com app doesn’t charge any deposit or withdrawal fees, and there’s no monthly charge no matter which type of account you choose. The only non-trading fee to worry about is an inactivity fee, but this only kicks in after one year without placing trades. The inactivity fee is $15 per month until you place a trade.

Forex.com App User Experience

The Forex.com app is well-designed and easy to navigate. One thing that prospective traders will appreciate is that it’s possible to fully test drive the app even before you open a Forex.com account. This is something that most competing stock apps don’t offer.

To start off, the organization of the Forex.com app makes it easy to find your way through the trading platform. There’s a left-hand menu that allows you to quickly access you dashboard, watchlist, and current orders and alerts. Research tools that most traders won’t access as frequently are pushed down in the menu, keeping them out of the way.

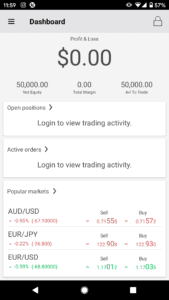

The dashboard does a nice job of offering an overview of everything you need to know about your trading account. You can see your total equity, margin, and cash available to trade at a glance. Right below that information, you’ll find details about your current positions and active orders.

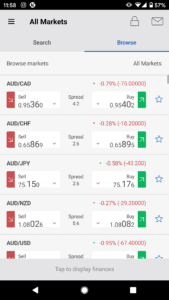

The Forex.com app also allows you to easily keep an eye on price changes. You can browse specific markets or search for an asset by name. When you find a forex pair or CFD that you’re interested in, simply tap a star icon to add it to your watchlist. The app displays the buy, sell, and spread prices for every listed asset so that you can easily see how much it will cost to trade a specific forex pair or CFD.

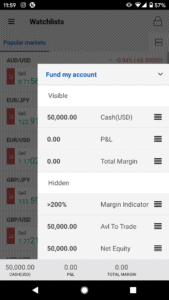

One of the best things about the app’s layout is that as you move throughout the app and dive into the available analysis tools, your account details are always just a tap away. At the bottom of the screen, a small bar displays details like your cash balance, current profit and loss, and total margin. You can even customize what data is displayed in this bottom bar if you’re more interested in seeing, say, your net equity or cash available to trade.

Forex.com App Tools and Features

Our Forex.com app review found that it offers a number of handy features for trading. We particularly like the app’s watchlist function, which allows you to add any combination of assets to a readily accessible list. You can create multiple watchlists, too, to separate assets based on strategy or market type.

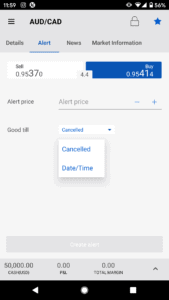

The Forex.com app also offers basic price alerts that are quite handy. Alerts can be active until cancelled or set to expire at a specific time. There’s no limit to the number of alerts you can create, and we appreciated that the app pushes them to your phone’s home screen so that you never have to worry about missing a trading opportunity.

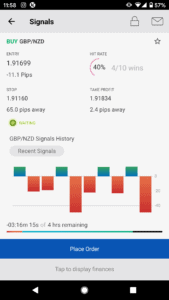

Perhaps the best feature of the Forex.com app is its forex signals module. Signals are premade by the team at Forex.com based on trading setups that have historically been successful. You can quickly browse a list of available trading signals and add any that you like to a signals watchlist. If you tap on a signal, you can also see details like how frequently it has triggered and how well it performed in the past. Signals can be used to create alerts or to place active orders that are triggered based on the signal.

Forex.com App Education

Forex.com offers a number of educational tools for new forex traders, including a series of articles and videos that cover the basics of forex trading. The broker also has a detailed glossary to help you stay on top of trading terminology and a quiz that you can use to test out your knowledge.

However, few of these educational resources are available inside the Forex.com mobile app. You must go to the broker’s web platform to access them.

Forex.com App Research and Analysis

The Forex.com app is packed with research and analysis tools. The most important of these for many traders will be the interactive technical charting interface, which is quite comprehensive. It comes with more than 60 built-in indicators, many of which can be customized to adjust the timeframe of your analysis. There are also numerous drawing tools, including specific tools for identifying complex Gann and Fibonacci patterns.

The charts themselves are available over a wide variety of time intervals, all the way from one minute to one month. One thing to note, however, is that you cannot load bars on intervals less than one minute. Any chart can be saved if you want to return to it in the future, and it’s also possible to compare price data for multiple assets on a single chart.

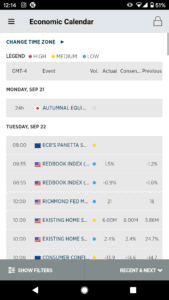

Our Forex.com app review found that it also offers market news feeds and an economic calendar. The news feeds are relatively basic, with headlines pulled from major outlets like Reuters. The economic calendar is impressively robust, with events color-coded according to whether they are expected to have a low, medium, or high impact on the forex market. The calendar can also be filtered according by country or news type.

Forex.com App Bonus

There is no bonus for signing up for a Forex.com account or for using the mobile app. However, high-volume traders are eligible for rebates through the broker’s Active Trader program.

With this program, you get $2 back per $1 million traded once you trade more than $25 million worth of forex in a month. If you trade more than $500 million in a single month, you can receive up to $9 per $1 million traded in rebates.

Forex.com Demo Account

Forex.com offers a comprehensive demo account that’s accessible through the desktop, web, and mobile app interfaces just like a live account. You can test out all of the app’s features including the charting and order entry tools without risking real money. One thing to note is that demo accounts only last for 30 days – after that, your demo account disappears and you’ll be forced to create a new one.

Payments on the Forex.com Stock App

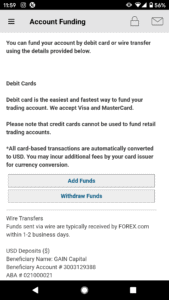

The Forex.com app makes it easy to deposit funds to your account. You can access the deposit page by tapping the bottom account display bar and then tapping ‘Fund my account.’

Forex.com accepts payment by credit or debit card (Visa or Mastercard), bank transfer, or wire transfer, and you can withdraw cash using any of the same methods. You can set up your account in any of seven different base currencies, including USD, GBP, AUD, EUR, CAD, JPY, and CHF. There are no deposit or withdrawal fees to worry about with Forex.com.

Forex.com Minimum Deposit

Forex.com requires a minimum deposit of $50.

Forex.com Supported Countries

Our Forex.com review found that this app supports traders in a wide variety of countries around the world, including in the US, UK, Canada, Europe, Australia, and Japan. That said, Forex.com doesn’t offer accounts in Hong Kong or New Zealand.

Forex.com Contact and Customer Service

Forex.com offers customer support by phone, email, and live chat 24 hours a day, 5 days a week – following the same Sunday to Friday hours as the forex market. The company’s phone and live chat support are very quick and helpful, and we found that responses to emailed questions typically came within a day.

The only downside to Forex.com’s customer service is that it’s not immediately available from within the app. If you want to use live chat, for example, you’ll need to exit the app and head to Forex.com’s website. You also won’t find the support phone number inside the mobile app.

You can get in touch with Forex.com’s support team by calling (800) 032-1948 or emailing [email protected].

Is the Forex.com App Safe?

Our Forex.com app review found that it is regulated by some of the most widely respected government authorities in the world. In the US, the broker is monitored by several agencies, including the Commodity Futures Trading Commission and National Futures Association. In the UK, Forex.com is regulated by the Financial Conduct Authority. In Japan, the broker is under the watch of the Financial Services Authority.

US investors will want to take note that while Forex.com accounts are protected by the Securities Investor Protection Corporation (SIPC), many of the assets that Forex.com offers are not. For example, forex trading is typically not covered under SIPC insurance.

How to Use the Forex.com App

Ready to get started trading with the Forex.com app? Follow these steps to create an account and place your first trade:

Step 1: Download and Install the Forex.com AppThe Forex.com app is available on the Google Play Store or Apple App Store. Just search for ‘Forex.com’ and click ‘Install.’

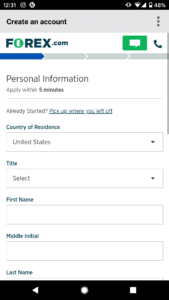

Step 2: Open an AccountWhen you open the Forex.com app for the first time, tap ‘Create an account’ to set up a new trading account. You’ll need to enter personal details like your name, address, email, and phone number, as well as answer some questions about your trading experience. You’ll also need to verify your identity using your social security number in order to complete the account opening process.

Step 3: Fund Your AccountFund your new account with a credit or debit card, bank transfer, or wire transfer. You must deposit at least $50 to get started with Forex.com.

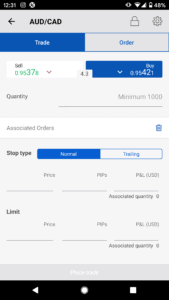

Step 4: Place Your First TradeNow you’re ready to open your first trade with the Forex.com app. From the app’s dashboard, tap on any asset to open its trading page. Then tap Buy or Sell to open a new order form. Enter the amount you want to trade along with a stop or limit price if desired. When you’re ready, click ‘Place trade’ to open your new position.

How to Sell on Forex.com App

Selling a position through the Forex.com app is extremely simple. Tap ‘Positions’ in the app menu to see your open positions, and then tap the one you want to sell. This will bring up a pre-filled sell order, which you can modify if you want to place a limit or stop on your order. Click ‘Place trade’ when you’re ready to close out your position.

Forex.com Stock App Pros & Cons

Pros

- 91 forex pairs and 4,500 stock CFDs for trading

- Supports forex trading signals

- Multiple accounts with different fee structures

- Rebates for high-volume traders

- Very user-friendly mobile app with quick access to account details

- Excellent mobile charting interface

- 24/5 customer support

Cons

- Stock CFD trades are not fully commission-free

- Moderate spreads for stock CFD trades

- Educational tools are not available on mobile app

The Verdict

On the whole, there’s a lot to like about the Forex.com app and very little to dislike. You get a powerful mobile trading platform at low cost and access to a wide variety of assets.

The Forex.com app is one of the top mobile platforms for forex trading. The broker offers multiple account types to suit beginner and expert forex traders alike with different pricing structures. It also offers advanced tools like forex signals that many of its competitors don’t support.

Importantly, the Forex.com app is also a strong choice for stock trading. You can access more than 4,500 stock CFDs through the app along with powerful technical charts and news feeds. The Forex.com also supports watchlists and price alerts that can be used to spot stock trading opportunities. We’d like to see fully-commission free stock CFD trading with this broker, but the commissions are low enough that this isn’t a huge barrier for many traders.

Frequently Asked Questions on Forex.com

Can I buy stocks directly with Forex.com?

Forex.com does not allow you to buy and sell shares directly. You can only trade stock CFDs with this broker.Does Forex.com offer any alternative trading platforms?

Forex.com integrates with MetaTrader 4, which offers its own mobile app. You can trade forex through MetaTrader 4, but this platform does not support stock CFD trading.Are there deposit or withdrawal fees at Forex.com?

No, Forex.com does not charge any deposit or withdrawal fees.How do I qualify for Forex.com’s Active Trader program?

You automatically qualify for Forex.com’s Active Trader program if you have at least $10,000 in your trading account or trade more than $25 million worth of currency in a single month.What are pips in forex trading?

A pip in forex trading is a way to measure spreads. One pip is one one-hundredth of a percentage point, or 0.01%.Michael Graw

Michael Graw

Michael Graw is a freelance finance and trading journalist based in Bellingham, Washington. Michael’s expert trading guides and investment analysis articles have featured in many leading publications, such as TechRadar, Tom’s Guide, LearnBonds, and BuyShares.View all posts by Michael Grawstockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2024

Scroll Up