Best Penny Stock Apps 2026

A lot of investors like to allocate a small proportion of their portfolio into penny stocks. This is because penny stocks are typically up and coming firms that could one day make it big. Although the upside potential is huge, as are the risks. This is why you need to ensure that you do your homework before taking the plunge.

In this guide, we explore the best penny stock app of 2026. On top of discussing our top-rated providers in great depth, we’ll also walk you through the process of making a penny stock investment today.

-

- 1. Robinhood – Best 0% Fee Penny Stock App for US Residents

- 2. Stash – User-Friendly Stock Trading App for US Residents

- 3. Interactive Brokers – Low cost penny stock app for global markets

- 4. IG – Best Penny Stock App for UK Residents (10,000+ Stocks)

- 5. SoFi – One of the Best Brokerage Apps for Penny Stocks

- 6. Ally Invest – Best Penny Stock App with banking service

- 7. TD Ameritrade – Penny stock app with low minimums

- 8. Charles Schwab – Access Penny Stocks on Over-the-Counter Markets

-

- 1. Robinhood – Best 0% Fee Penny Stock App for US Residents

- 2. Stash – User-Friendly Stock Trading App for US Residents

- 3. Interactive Brokers – Low cost penny stock app for global markets

- 4. IG – Best Penny Stock App for UK Residents (10,000+ Stocks)

- 5. SoFi – One of the Best Brokerage Apps for Penny Stocks

- 6. Ally Invest – Best Penny Stock App with banking service

- 7. TD Ameritrade – Penny stock app with low minimums

- 8. Charles Schwab – Access Penny Stocks on Over-the-Counter Markets

Top 10 Penny Stock Apps

Below you’ll find our top 10 penny stock apps of 2026. You can scroll down to find out more about what each app offers.

- Robinhood – Top penny stock app for US residents

- Stash – User-friendly US penny stock app

- Interactive Brokers – Low cost penny stock app for global markets

- IG – UK penny stock app with over 10,000 equities

- SoFi – One of the Best Brokerage Apps for Penny Stocks

- Ally Invest – Penny stock app with banking services

- TD Ameritrade – Penny stock app with low minimums

- Charles Schwab – Access over-the-counter market.

- E*Trade – Comprehensive stock app for beginners

The Best Penny Stock Apps of 2026

If you want to buy penny stocks in a cost-effective and secure manner, you’ll want to stick with a regulated broker. Most providers also offer a fully-fledged stock app, which is great for placing buy and sell orders on the move.

To clarify, the Securities and Exchange Commission (SEC) defines a penny stock as any publicly-traded company with a share price of $5 or less. With this in mind, below you will find a list of the best penny stock apps of 2022

1. Robinhood – Best 0% Fee Penny Stock App for US Residents

If you’re based in the US, there is every chance that you have heard of the Robinhood stock app. More than 10 million Americans are using the provider to buy and sell stocks – not least because you will not pay any commissions or dealing fees.

Furthermore, the Robinhood penny stock app allows you to trade from just a few dollars – meaning that you can engage in fractional ownership. In terms of its asset library, the Robinhood app covers over 5,000 stocks and ETFs. Options and cryptocurrencies are also supported.

When it comes to funding your account, Robinhood allows you to connect your US checking account. If you’re on the standard account then the first $1,000 that you deposit will be credited instantly. The platform stands out from Robinhood alternatives, having an app with great reviews on both the Google Play and Apple Stores. While the former has a rating 4.3, the latter stands at 4.8. Impressively, these ratings are based on over 2 million verified reviews.

Read our comprehensive Robinhood app review to find out more about what this firm offers.

Pros:

- Heavily regulated in the US

- More than 10 million traders using the app

- Buy and sell stocks without paying any commission

- No minimum deposit in place

- No monthly or annual maintenance fees

- More than 5,000 US stocks supported

- Also invest and trade ETFs, options, and cryptocurrencies

- Perfect for newbie traders

Cons:

- Only 250+ foreign stocks listed

- Unable to deposit with a debit/credit card or e-wallet

2. Stash – User-Friendly Stock Trading App for US Residents

Stash is a great option if you’re based in the US and want to start off with a beginner-friendly stock app. The provider has designed the application so that it appeals to newbie investors that want to buy and sell stocks in a complex-free manner.

It takes just minutes to get started and there is no minimum deposit. You will have access to an abundance of stocks on the app – all of which can be purchased commission-free. You will, however, need to meet a small monthly charge of $1 to gain access to the app.

Stash also offers accounts at $3 and $9 per month, which offer additional features (such as retirement accounts). Much like Robinhood and other paper trading apps, Stash supports fractional ownership on stocks and shares.

This means that you can make an investment from just a couple of dollars. This is great for diversification purposes, too. Stash requires you to deposit funds with a US checking account, which is fairly straight forward to do once you are set up

Read our comprehensive Stash app review to find out more about what this app offers.

Pros:

- No minimum deposit

- Offers fractional stock

- More than 1,200+ stocks and ETFs

- Best-suited for newbie traders

- Heavily regulated

- Avialable on both iOS and Android

- Lots of educational resources

Cons:

- Monthly fee of between $1 and $9 depending account type

- Does not support instant deposits with a debit/credit card or e-wallet

3. Interactive Brokers – Low cost penny stock app for global markets

Founded in 1978, Interactive Brokers (IBKR) prioritizes low costs, extensive market access, and efficient trade execution. IBKR is a well-established multi-asset trading app that grants traders access to global markets. It benefits penny stock investments with competitive fees and educational resources.

IBKR is designed to cater to advanced and professional traders, offering advanced configurations and trading tools that facilitate complex technical analysis. While beginners can benefit from the educational resources, the platform is primarily tailored for experienced traders.

In addition to its broad market access, IBKR is one of the best CFD trading apps. The broker offers an impressive range of asset classes that includes long-term and short-term stocks, OTC stocks, ETFs, mutual funds, bonds, futures, cryptocurrencies, and foreign exchange. This diverse portfolio allows traders to explore various investment opportunities within a single platform.

Interactive Brokers is one of the most cost-effective brokers, boasting low fees and commission rates. Notably, there is no minimum account requirement, and the platform charges as little as $0.15 to $0.65 per share in commission for Stocks and ETF trades.

Pros:

- Low commission and margin rates

- A vast array of technical and fundamental trading tools

- A wide range of asset classes

- The mobile app is highly rated

- Superior order execution

Cons:

- It can be overwhelming to less experienced investors

4. IG – Best Penny Stock App for UK Residents (10,000+ Stocks)

IG is well worth considering if you’re based in the US and UK. The brokerage firm – which was launched in the 1970s, has a stock library that consists of over 10,000 equities. This covers dozens of stock exchanges – not just in the US but overseas, too. In particular, this broker gives you access to heaps of penny stocks – all of which can be purchased online or via the mobile app.

Regarding the latter, this is available on iOS and Android devices – and can be downloaded free of charge from the IG website. In terms of fees, IG charges $8 per trade – which you will pay when you place an order and again when you cash your investment out. If you trade more than three times in a 30-day period, then this fee is reduced to just $3.

Alternatively, you might consider the spread betting or CFD trading department at IG. This covers an impressive 17,000+ financial instruments. On top of stocks, you can also trade bonds, indices, ETFs, commodities, cryptocurrencies, and more. You won’t pay any commissions in the CFD/spread bettinf department unless you decide to trade stocks. If you do, the specific fee varies depending on the exchange, albeit, this averages 0.10%.

IG is heavily regulated, with licenses from several bodies. This covers the FCA, ASIC, and others. The parent company – IG Group Holdings plc, is listed on the London Stock Exchange with a market capitalisation of just below $3 billion. You can instantly fund your account with a debit/credit card through the app if using an Android. However, iOS users must do this through the main IG website.

Read our comprehensive IG app review to find out more.

Pros:

- Trusted investment app with a long-standing reputation

- More than 10,000 stocks listed

- Good value share dealing services – fees as low as £3 per trade

- Leverage and short-selling also available

- Spread betting and CFD products

- Access to dozens of international markets

- Great research department

Cons:

- Minimum deposit of £250

- US stocks have a $15 minimum commission

5. SoFi – One of the Best Brokerage Apps for Penny Stocks

The company’s extensive membership base of over 3.5 million and its membership in FINRA and SIPC underscore its legitimacy and credibility within the investing world. These factors indicate that the company operates within regulatory guidelines, prioritizes investor protection, and has garnered the trust of many investors.

It is particularly attractive to novice investors who are beginning their investment journey. SoFi provides a comprehensive mobile application for Android and iOS users. The SoFi mobile app boasts an intuitive design and user-friendly interface, allowing seamless navigation. It is essential to mention that the app’s range of investing tools is somewhat restricted in scope.

SoFi provides transparent information regarding its trading expenses. Customers can purchase and sell stocks, ETFs, options, and fractional shares without incurring fees, while cryptocurrency transactions involve a 1.25% markup. Additionally, SoFi offers its clients unrestricted access to the company’s financial advisors at no additional cost, providing valuable assistance.

Pros:

- 0% commission on all stocks, ETFs and options

- Advanced analysis tools

- User-friendly stock trading app

- Automated investing

- No withdrawal fees

Cons:

- Only offers US stocks

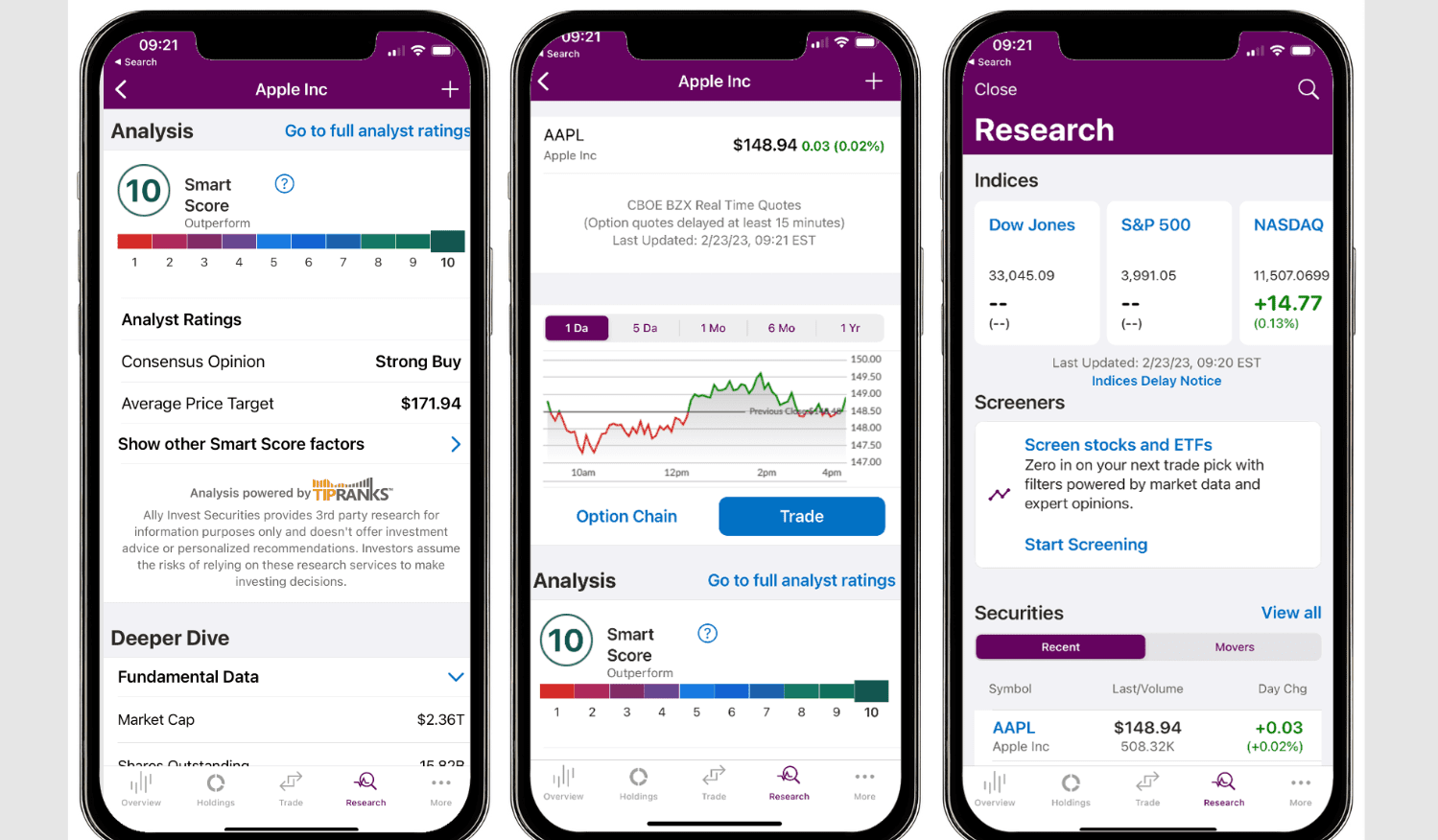

6. Ally Invest – Best Penny Stock App with banking service

Ally Invest, a subsidiary of Ally Bank, is a US stock trading app that offers a range of features for penny stock trading. It provides investors with the fundamental and technical tools to specialize in trading penny stocks. Traders looking for self-directed accounts with no minimum balance requirement can benefit from using Ally Invest for penny stock trading.

The broker offers commission-free trading, which is particularly advantageous for penny stock traders who aim to maximize their potential returns. The platform provides various investment options, including stocks, ETFs, and options. Additionally, Ally Invest offers educational resources such as advanced charting tools to help investors.

The user experience on Ally Invest is designed to be intuitive and user-friendly. Ally Invest’s mobile app is a convenient option for on-the-go trading, allowing users to place trades and conduct limited research compared to the online platform. The app provides a wide selection of resources to help investors at all experience levels.

The Ally Invest platform does not impose a minimum deposit requirement and offers commission-free stock trading. While option trades also do not incur commissions, there is a fee of $0.50 per contract. Traders are not subject to annual maintenance or inactivity fees; however, a $50 charge applies for full outgoing transfers.

Pros:

- $0 minimum deposit for Self-Directed Trading

- Offers informational articles about market trends

- There are no commission fees for stock, ETF, and options trades

- Includes charts and calculators to help investors analyze their trades

- 24/7 live customer service with brokers

Cons:

- Trading is available only for the US market

7. TD Ameritrade – Penny stock app with low minimums

TD Ameritrade has established itself as a premier broker for penny stocks since its inception in 1971. This highly regarded online broker and mobile trading app offers extensive research materials, empowering investors to make informed decisions based on thorough analysis.

With $0 trades, exceptional trading platforms, comprehensive market research, beginner-friendly educational resources, and reliable customer service, TD Ameritrade provides an exceptional all-around trading experience, solidifying its position as one of the top platforms available.

When it comes to trading penny stocks specifically, TD Ameritrade offers two distinct mobile apps: TD Ameritrade Mobile, catering to casual investors, and Thinkorswim Mobile, designed for active traders seeking advanced features. Both apps deliver outstanding performance.

As one of the best stock analysis app, TD Ameritrade excels in stock research, offering a wide range of options. Their ResearchTeam reports consolidate third-party research into a single ranking, stock scanners in Thinkorswim can be personalized, Market Edge provides valuable insights into technical analysis and various webcasts and research articles further enhance the comprehensive offering.

Pros:

- Commission-free trading

- Enormous selection of stocks and options

- Fully customizable indicators

- Two mobile apps are available

- Great for investors at all levels

Cons:

- Margin rates are high

8. Charles Schwab – Access Penny Stocks on Over-the-Counter Markets

Charles Schwab is one of the largest brokerage firms globally. This US-based platform stands out for us as it is one of the few options available when it comes to accessing the OTC (Over-the-Counter) marketplace. After all, this is where penny stocks typically trade – especially those with super-low market capitalisations.

In particular, Charles Schwab allows you to buy penny stocks that are listed on the Pink Sheets and Over the Counter Bulletin Board (OTCBB). You can do this online or via your mobile device. In terms of fees, this brokerage house charges just $4.95 per trade – which is very competitive.

Charles Schwab also stands out as it does not have a minimum account balance is place. This is ideal if you want to buy penny stocks but you don’t want to risk large amounts of capital. Charles Schwab accepts several payment methods – including the ability to deposit checks via the mobile app. The application is available to download free of charge on Google Play and the Apple Store.

Pros:

- Gain access to the Pink Sheets and OTCBB

- Buy penny stocks from just $4.95 per trade

- Thousands of financial instruments supported

- Mobile app available on iOS and Android devices

- One of the largest brokerage firms globally

- No minimum account balance

Cons:

- The platform isn’t overly user-friendly

9. E*Trade – Comprehensive stock app for beginners

When it comes to fees, E*Trade stands out by not charging users for stock trading and having no set minimum investment amount. While there are no base commissions for options trades, users are charged $0.65 per contract. Annual maintenance and inactivity fees are not charged, though users must pay $75 for full transfer out and $25 for partial transfers.

E*Trade provides several quality trading platforms, including the E-Trade Web. While the platform may not be the easiest to use, its interface can be customized to suit individual preferences. With two web-based platforms, E*Trade caters to both beginner and advanced traders.

Pros:

- Zero commissions and fees

- Advanced mobile app

- Excellent customer support

- Highly reliable trade execution

- Robust research and educational materials

Cons:

- Website can be difficult to navigate

- Limited trading tools

How to Choose the Best Penny Stock App for You

So now that we have reviewed the best penny stock trading apps of 2022 – we are now going to discuss some of the factors that you need to look out for before opening an account. After all, you are going to be risking your own capital, so it’s crucial to assess whether or not the app is right for you.

This includes:

Regulation

It goes without saying that your chosen penny stock app provider should be in full possession of a license. This license should be issued by a reputable regulatory body – such as the SEC (US), FCA (UK) or CySEC (Europe). These bodies provider a wealth of regulatory protections – such as client fund segregation.

The free stock trading app in question will also need to comply with anti-money laundering and KYC requirements – and will have its books audited on a regular basis. Ultimately – if you come across a penny stock app that isn’t regulated – or one that holds a license from a shady location, avoid it.

Penny Stock Assets

Once you are confident that your chosen penny stock app is regulated by a reputable body, you then need to look at its asset library. More specifically, explore what penny stocks you will have access to. As we briefly mentioned earlier, the SEC defines a penny stock as a publicly-listed firm with a share price of $5 or less.

Interestingly, this covers the vast bulk of the London Stock Exchange – as UK shares are priced in pennies as opposed to pounds. Some penny stock trading apps – notably Charles Schwab, also give you access to the OTC markets. This includes both the Pink Sheets and OTCBB – which is where most US-based penny stocks are listed.

Fees

You do, of course, also need to look at what fees you will be expected to pay to invest in your chosen penny stocks. This can vary quite wildly depending on the penny stock app you sign up with. For example, the likes of Robinhood and Plus500 allow you to trade without paying any commission.

The aforementioned brokers also refrain from charging a monthly fee. With that said, some penny stock investment apps will charge a flat commission that is payable at both ends of the trade. For example, Charles Schwab charges $4.95 and Fineco charges £2.95. Additionally, you need to look at other fees that might come into play – such as those linked to deposits and withdrawals.

Platform & Usability

Some penny stock apps are designed specifically for the everyday investor. That is to say, the application will be simple to use and requires no prior knowledge of trading.

Education, Research & Analysis

Research and analysis software tools like user-friendly guides, blogs, and video explainers are crucial if you have little to no knowledge of how penny stocks work. Webinars are also useful, as they allow you to tap into the mind of an experienced investor.

When it comes to analysis, some penny stock apps will give you access to technical indicators and chart drawing tools. However, this is often difficult to deploy when using a mobile app – due to the smaller screen size. It’s handy to have nonetheless.

Device Compatibility

If you’re looking for the best penny stock app for Android, then you’ll want to make sure that your chosen provider is compatible with your device. Similarly, if you’re after a penny stock app for iPhone, check that the provider covers iOS devices.

If your chosen penny stock app isn’t compatible with your phone, you might be able to access the investment suit via your standard mobile web browser.

Payments

You will be required to deposit funds into your penny stock trading app – so check to see what payment methods the provider supports. If you’re looking to deposit funds instantly, it’s best to stick with platforms that support debit/credit cards and e-wallets like Paypal.

After all, bank transfers can take several days to arrive. You should also explore whether the penny stock app charges fees to deposit with your preferred payment method, and how long it takes to authorize withdrawal requests.

Trading Tools & Features

Whether you are planning to invest on a long-term basis or day trade via CFDs – it’s important that you choose a penny stock app that gives you access to financial tools and features. This might include a wide selection of order types or the ability to apply leverage.

Customer Service

Last but not least, have a quick look at what customer support channels the penny stock app offers. If you want to stick exclusively to your mobile phone, then the best contact method available is live chat. This is because you can speak with a live agent via the app without needing to pay for a telephone call.

In some cases, penny stock apps will limit their support line to email. This can be frustrating for users are you won’t benefit from real-time support. Finally, check to see what hours the customer service team is available. At a minimum, this should be on a rolling 24/5 basis to mirror the penny stock markets.

Payment Options at Penny Stock Apps

When depositing funds into a penny stock app, there are several ways you can do so. Here are some standard methods:

- Bank Transfers: Many penny stock apps allow users to deposit funds through bank transfers. This typically involves linking your bank account to the app and initiating a transfer from your bank. The specific process may vary depending on the app, but it is usually done within the app’s settings or account section.

- Credit/Debit Cards: Some penny stock apps may also accept deposits through credit or debit cards. This allows you to fund your account using your card details, and the funds are typically available for trading immediately. Again, the availability of this option may vary depending on the specific app.

- Mobile Check Deposit: Certain apps offer the convenience of mobile check deposits. This feature allows you to deposit checks by simply taking a photo of the check using your smartphone and submitting it through the app. The deposited funds will then be available for trading.

- Wire Transfers: In some cases, penny stock apps may also support wire transfers as a deposit method. This involves transferring funds electronically from your bank account to the app’s designated bank account. Wire transfers are typically used for larger deposits and may involve additional fees.

- Other Payment Services: Depending on the app, additional payment services may be available for depositing funds. These could include popular digital payment platforms like PayPal or other similar services.

The Verdict

Penny stocks are great for those of you that seek a higher risk/reward ratio. In other words, while the risks of investing in penny stocks are much higher than established blue-chip companies, the potential rewards follow suit.

With that said, you’ll need to find a reliable penny stock app if you wish to invest on your phone. Your chosen provider needs to be regulated, offer heaps of tradable markets, and support your preferred payment method.

References

- https://m.economictimes.com/definition/penny-stock

- https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/penny-stock/

- https://www.fidelity.com/viewpoints/active-investor/trading-penny-stocks

- https://www.td.com/ca/en/investing/direct-investing/articles/penny-stocks

- https://www.bankrate.com/investing/what-are-penny-stocks/

FAQs

What are penny stocks?

According to the SEC, penny stocks are equities with a share price of $5 or less.

How do you buy penny stocks?

You will need to go through a third-party broker if you wish to buy penny stocks. There are many options in this respect – 10 of which you will find on this page.

Are penny stock apps safe?

Most penny stock apps are safe. But, this is on the proviso that your chosen app is licensed by a reputable regulatory body. Think along the lines of the FCA, SEC, or ASIC.

Can you buy penny stocks from the OTC markets?

You can, but very few brokers give retail clients access to the OTC markets. With that said, US-based broker Charles Schwab gives you access to both the Pink Sheets and OTCBB at a commission of just $4.95 per trade.

What is the best penny stock app for iPhone?

The best penny stock app for iPhone is arguably eToro. The app is home to over 12 million investors and has an Apple Store rating of 4.8/5.

Kane Pepi

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane Pepistockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2026

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up