Plus500 App Review – Features, Fees, Pros & Cons Revealed

The stock CFD app from broker Plus500 has been making waves for a few years now, helping the company to attract a burgeoning following among traders of all types, risk profiles and tolerance. So should you take a look? Our Plus500 app review has all the information, research, testing and answers to help you make your decision.

Plus500 was founded in 2008 and has become one of the most visible of the so-called ‘CFD brokers’ in the UK. The company is headquartered in Israel but regulated by the financial authorities in the UK.

The company – via its website and stockapp channels – provides access to markets through contracts for differences (CFDs). CFDs are instruments issued by financial institutions that provide investors with access to an underlying asset class without the need to hold the asset directly.

This is a review of the smartphone app and is focused primarily on the retail account.

-

-

What is Plus500?

Plus500 is an online broker. Boasting stock CFD apps launched as early as 2011 (iOS) and 2012 (Android), Plus500 led the way in using CFDs to innovate in financial instruments and deliver rock solid infrastructure and software tools to the retail investment audience.

Plus500 was serving online traders long before newcomer stock apps Robinhood in the US and Trading212 in the UK even existed.

The brokerage firm has been growing rapidly, and that has accelerated of late. In the first quarter of 2020 it saw revenues jump nearly 500% (to $316 million). Volatility in the stock markets is manna from heaven for stock brokers because investors trade more to adjust their portfolio to changing circumstances.

FTSE 250 constituent company

A member of the FTSE 250 midcap index with a market capitalisation of £1.65 billion, the fully regulated company has attracted a loyal following of investors with its zero commission charging structure.

And with 2,000 CFD products to choose to trade on through its app spanning the range of asset classes, from stocks to commodities, there should be everything to meet the requirements of the most needy of traders.

This Plus500 review will use as its base the iOS app but the functionality and look and feel is similar to the Android version, albeit not exactly the same.

In addition to stock CFDs, Plus500 offers access to financial instruments that include commodities, cryptocurrencies and options (shares, indices and commodities).

The company charges no fees for many of its services. You can deposit and get live quotes for stock and indices CFDs, ETFs and forex.

So how does the broker make any money if there are minimal charges you ask? The trading venue is compensated for the provision of its service – which it achieves through the spread between the bid and offer (buy and sell) prices.

What Stocks Can You Trade on the Plus500 App?

With more than 2,000 CFD products to trade across asset classes, our Plus500 review found that the app allows customers to access 24 stock exchanges, which are as follows:

Sydney Amsterdam Vienna Oslo Brussels Warsaw Copenhagen Lisbon Helsinki Singapore Paris Johannesburg Frankfurt Madrid Athens Stockhom Hong Kong Zurich Dublin London Milan New York Tokyo NASDAQ As you can see, Plus500 covers the main exchanges such as the London Stock Exchange and the New York Stock Exchange and NASDAQ, but also smaller borses, like the Johannesburg Stock Exchange (South Africa) and the Sydney Stock Exchange (Australia).

Finding stocks

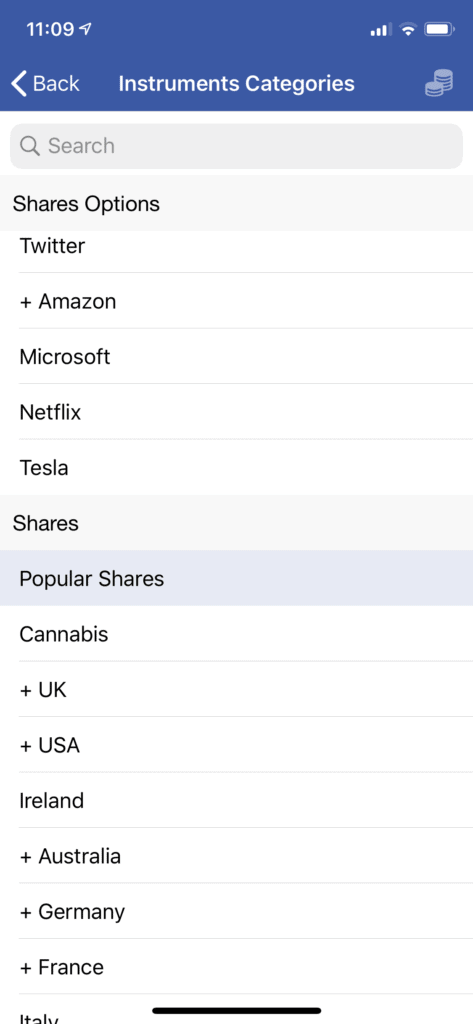

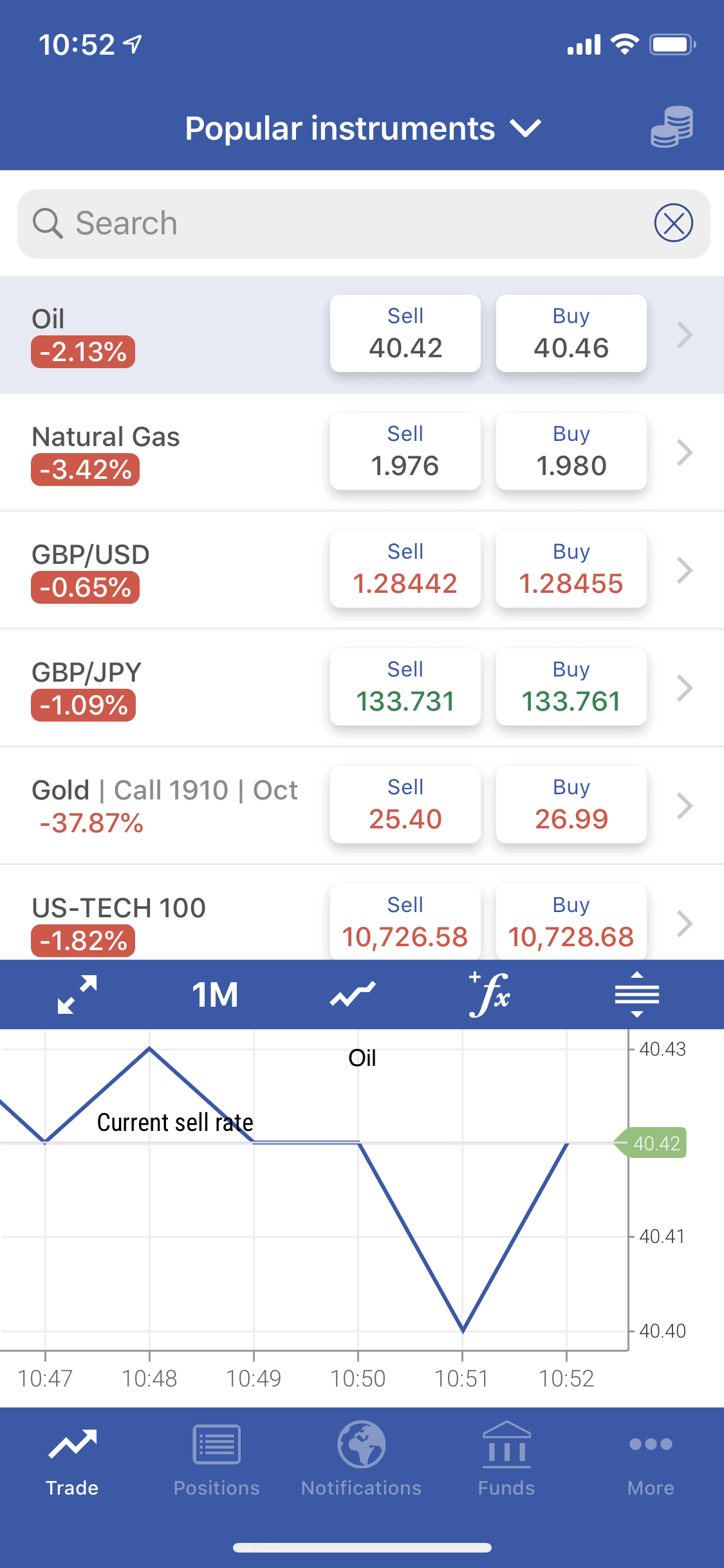

At the top of the screen is the blue bar with the title of the section you are in – the title is clickable, allowing the user to drill down into a particular instrument category.

This is where you will find the full universe of financial products that are tradeable on the app (see screenshot below).

Just underneath the title is the search bar – enter the name of the stock you want to trade. Note how you can add the stock to your watch list (star icon) and set up a push notification alert (bell icon)

Select the stock – in this example, Barclays – and you are sent to the trading page for that stock.

ETFs

The exchange traded funds industry has been growing rapidly in the past 10 years, with $6 trillion in assets under management.

ETFs are cheap (low management fees) and provide access to asset classes by tracking and/or creating indices for assets, be they the FTSE 100 and NASDAQ, or commodities such as oil and cotton.

Today areas that have traditionally been hard to gain exposure to for ordinary traders and investors are now in reach, thanks to ETFs.

To cater for investor demand, Plus500 has been steadily increasing its listing ETFs. Research by stockapps shows 95 ETFs currently listed.

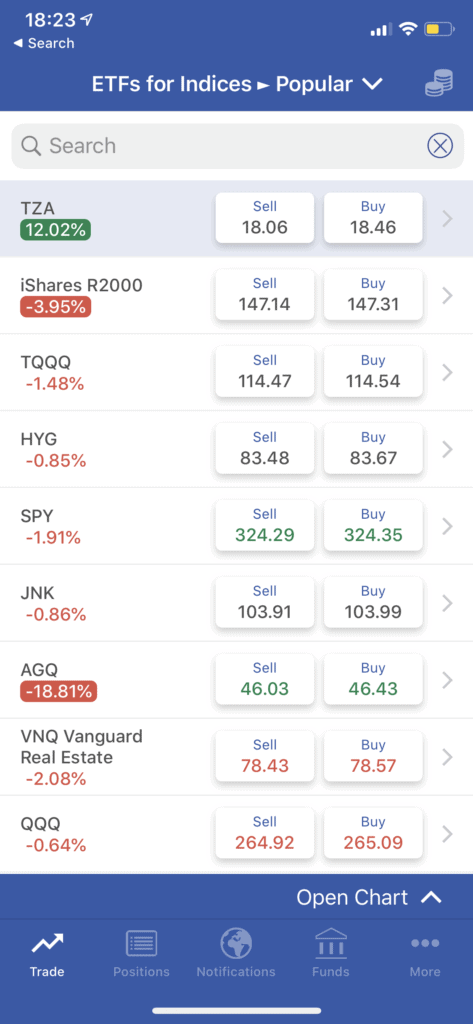

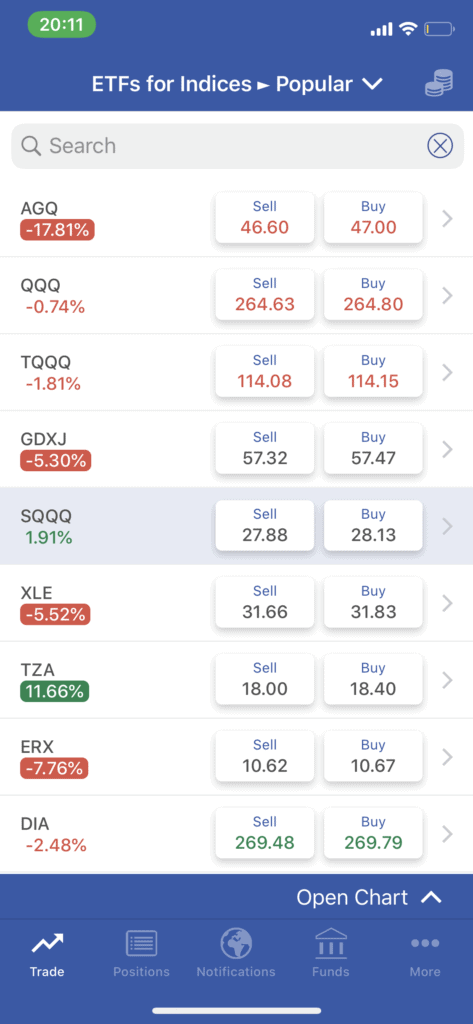

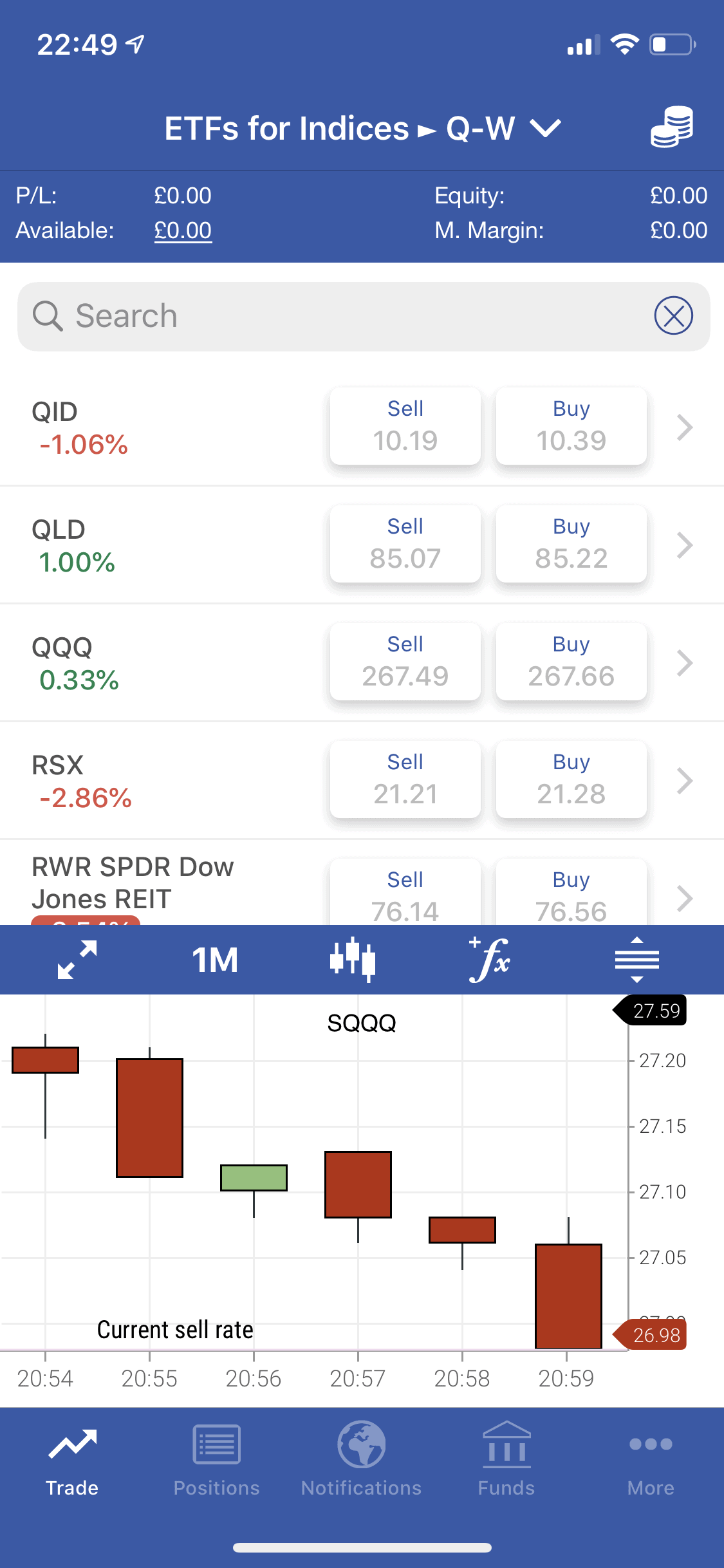

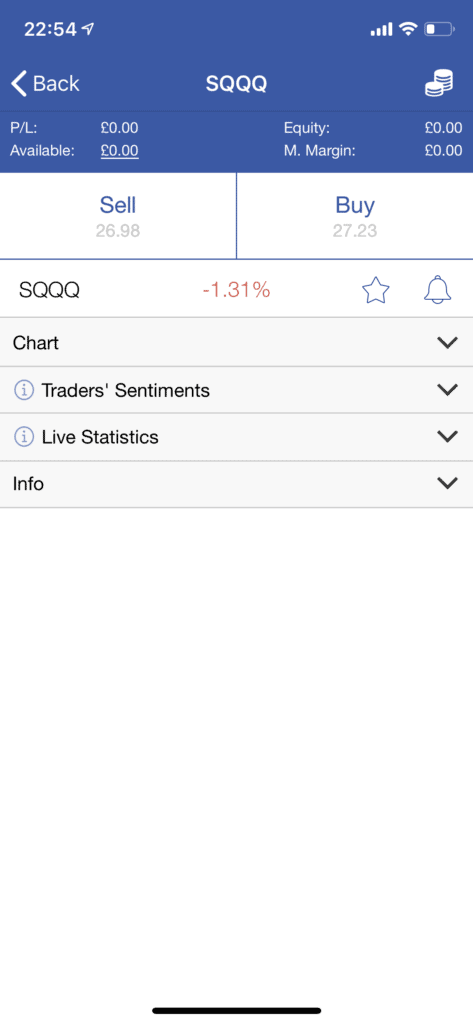

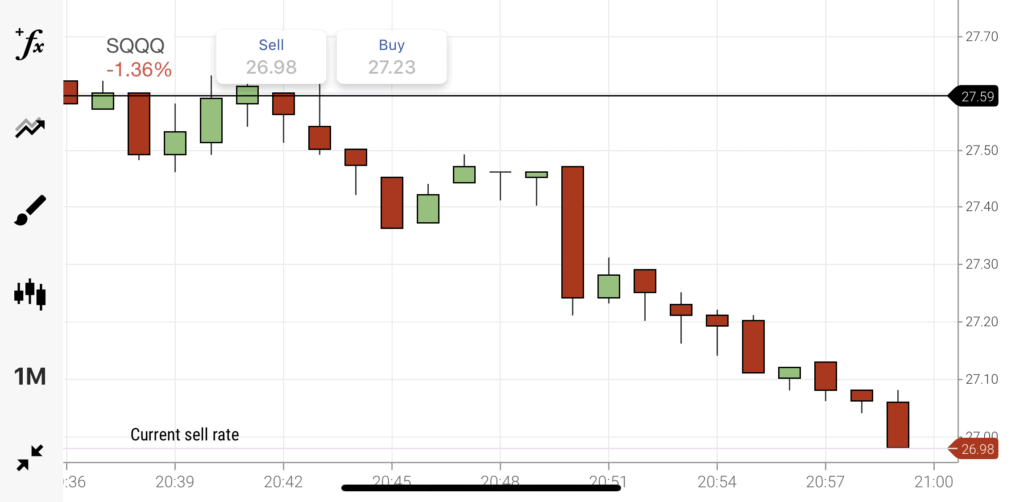

Below is a screenshot of the SQQQ instrument highlighted:

Listed ETFs include the massively popular SPY (tracks the S&P 500) and QQQ (tracks the NASDAQ).

There are also inverse leveraged trackers such as the SQQQ (highlighted in screenshot above) for more sophisticated investors and traders who want to short stocks or other asset class instruments.

SQQQ gains when the NASDAQ falls in value with 1:5 leverage.

Most traders’ first port of call will be stocks and ETFs but that is by no means the limit of the CFD app’s product range.

Other Asset Classes

In addition to stocks and ETFs, our Plus500 app review found that it also covers commodities, indices, cryptocurrencies, forex, commodities options, indices options and share and futures options.

All of these asset classes are accessed through CFDs.

Commodities: There are 22 commodities products to choose from, including oil, gold, silver, coffee and palladium. But in addition to the ‘normal’ commodities there are also ‘commodities options’ (oil, gold natural gas).

Forex: Plus500 lists 29 major and minor currency pairs. Major pairs are those of the most heavily traded currencies globally. There are 13 major pairs to be traded and 16 minor and exotic currencies.

Indices: 28 indices of various types are available through the app. Be careful when you are selecting from the instruments drop down list that you select ‘all indices’ under ‘indices’ and not top level category ‘indices options’. Indices are split into country and sector.

There are four sector ETFs to choose from, including athe Cannabis Stock Index, the Crypto 10 Index and the NYSE FANG+ Index.

Cryptocurrencies: Cryptocurrencies are highly volatile, which is why traders have taken to the asset class. Again, not wanting to see demand go unaddressed, Plus500 has expanded it listing of cryptocurrencies to 11. Top crypto assets Bitcoin and Ethereum are joined by lesser known coins such as Monero, NEO, Tron and Cardano.

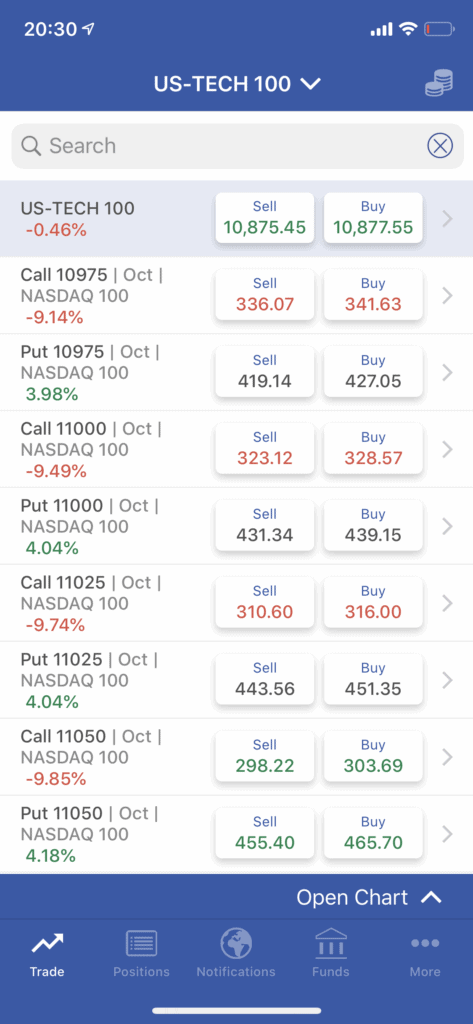

Options: Plus500 has also been expanding rapidly ino the futures options space, again by using CFDs to access the movement of the underlying instrument. To repeat, you are not buying the asset directly.

An option provides the owner with the right (but not the obligation) to buy/sell an asset at a given price.

A trader opens a call option if they think the price is going to go up.

A put option on the other hand would be bought if you wanted to profit from a fall in price.

Plus500 splits options into: commodities options, indices options and shares options.

Options trading was once confined to the professionals but thngs hhahave changed since the advent of stock CFD apps to drive retail demand.

Plus500 – never slow to see an opening – is going all-in on options. The company lists 598 put and call contracts on everything from Facebook and Apple to gold and the DAX (the German senior stock market).

Plus500 Account Types

Plus500 has a retail and professional account. The retail account is the base one but depending on your answers in the app sign up process, you may be eligiblefor the professional account. To qualify you must demonstrate through answers to questions such as trading frequency and how much you have to invest.

You may be in the lucky position to qualfy for a professional if you can answer yes to the following: conduct more than 10 trades of a significant size per quarter, have a portfolio worth €500,000 or more and have worked in a relevant role for a year or more.

The retail account has most of the power of the Pro account – the main difference is the levels of leverage that can be used in trades.

Plus500 Fees and Charges

Plus500 has zero commission fees for trading. So how does it make its money?

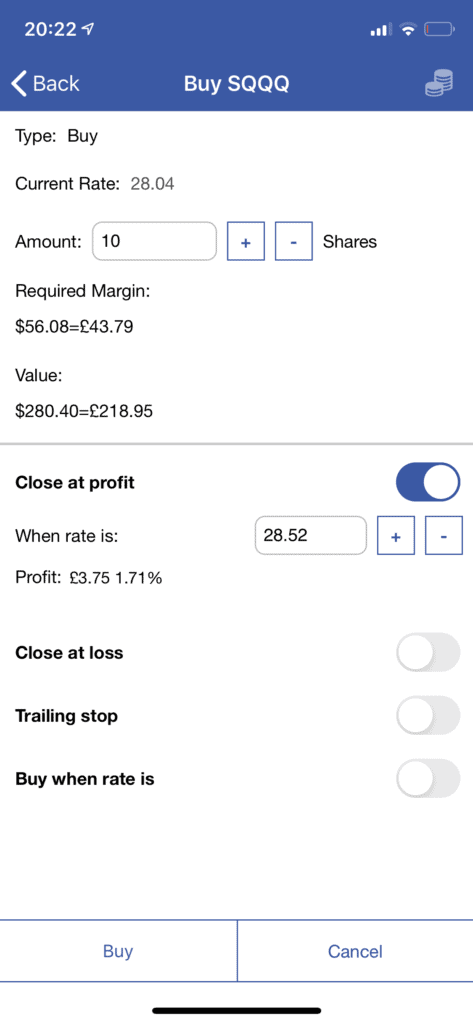

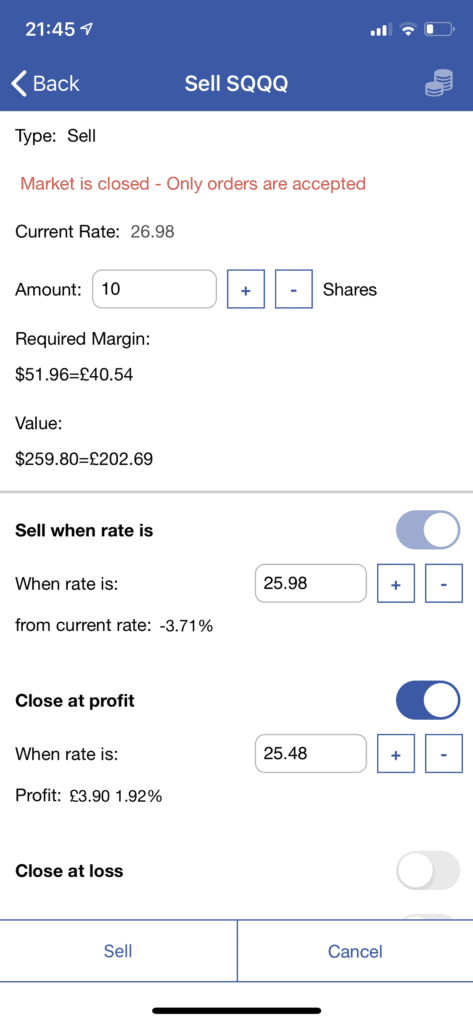

In common with the rest of the CFD broking community the main way through the spread on the quoted price. The bid-offer (bid-ask) spread is the difference between the buying and selling price and is shown on the order screen for the SQQQ ETFshown below.

SQQQ gains when the NASDAQ falls in value with 1:5 leverage. You must open a buy order in order to gain this exposure.

In this deal ticket the price of the SQQQ ETF is $28.04. Because the leverage is 1:5 the minimum is automatically set as 5 (1 share multiplied by 5).

Top marks for transparency should be afforded for the clear display of the margin cost, $56.08 and the total value of the deal ($28.40).

Most traders’ first port of call will be stocks and ETFs but they are by no means the limit of the Plus500 stock CFD app’s instrument listings.

Spreads

Spreads average about 0.5 pips but the exact level will depend on the instrument traded.

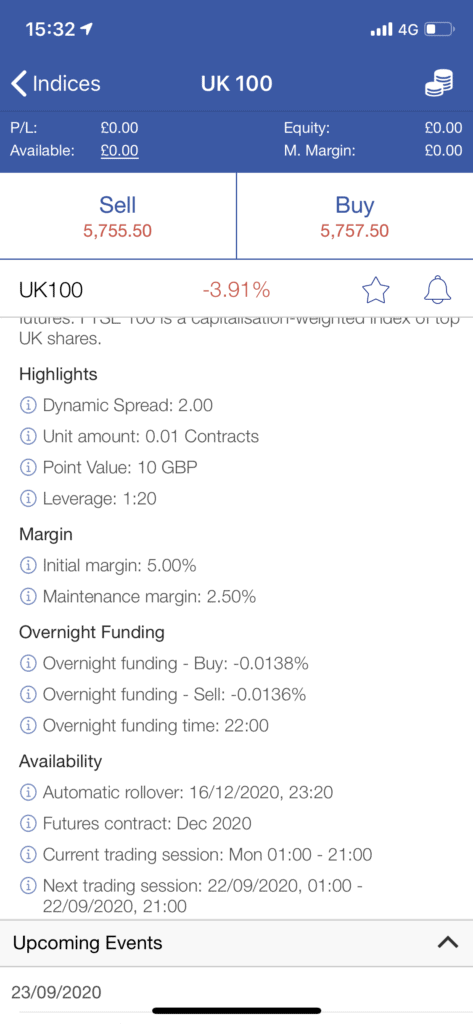

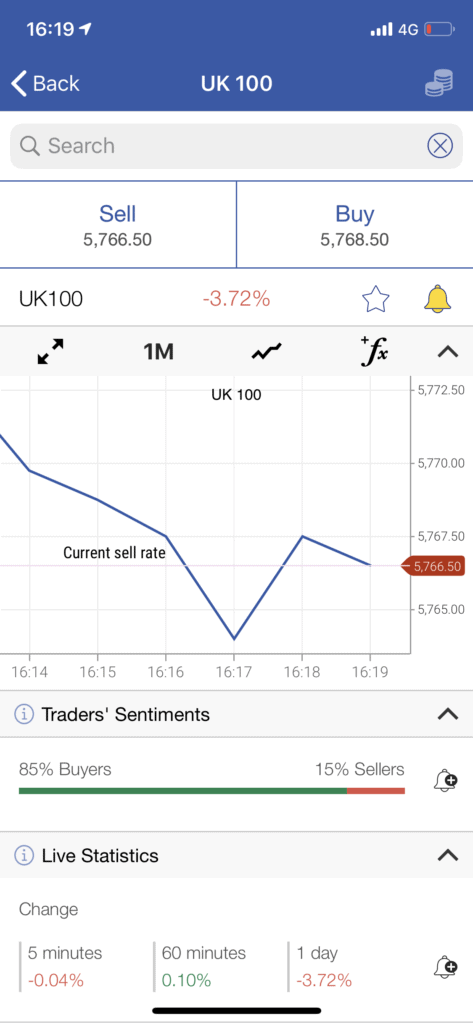

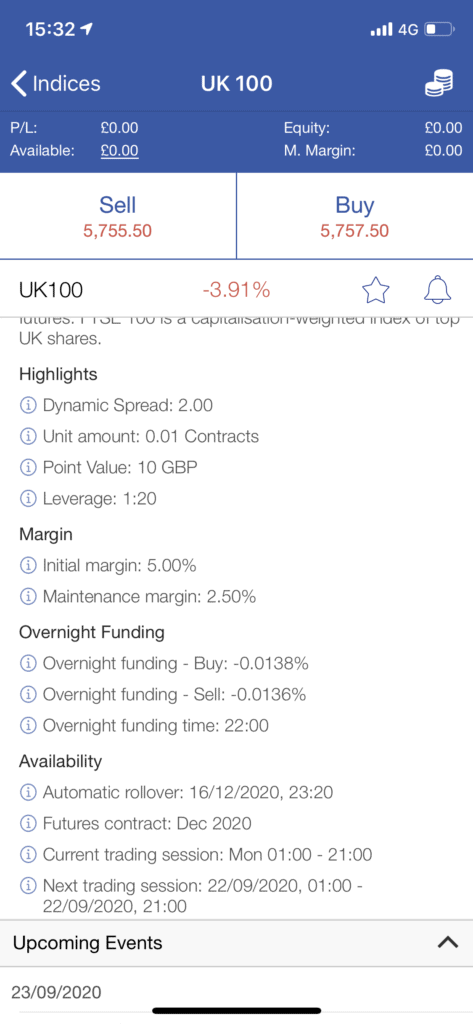

You can find the fee details in the info section for the FTSE 100 CFD instrument below:

CFD Trading

CFD trading is commission-free but there is the spread and non-trading fees, such as overnight charges and currency conversion to pay.

Because a CFD is issued by a financial institution and is a contract for a specificed time, there is effectively an interest charge levied by the trading platform, known as the overnight charge.

Non-Trading Fees

Overnight Funding

Keeping positions open overnight incurs a charge. The amount to be paid goes on your account and the amount to be paid depends on how long after the Overnight Funding Time a postion is left open. The exact charges vary for each instrument.

To work out the overnight funding cost:

Trade size x opening rate x daily overnight funding percentage.

See screenshot in CFD trading section above for the FTSE 100 CFD. See the details of the deal under ‘info’. Overnight funding percentage for sell orders is 0.0136% and 0.0138% for buys.

Currency Conversion Fee

If you deal in shares domiciled listed abroad then you will need to pay a currency conversion charge to change the foreign currency into the currency used in your account. The fee is shown in realtime in the profit and loss drop down. Touch the coins icon on the right of the blue app navigation bar at the top of the screen.

There are 14 base currencies for account: USD, GBP and EUR.

The conversion fee is 0.5%.

Guaranteed Stop Order

Manage risk by setting the price at which you want to sell if your trade s in the red. The guaranteed stop order once set cannot be removed but its level can be edited during maket hours. This ia powerful feature but using it will see the trade spread widen (larger cost to trader).

Inactivity fee

If you do not trade for three months or more then you will pay an inactivity charge which is levied at $10 a month. To avoid paying the fee, simply log into your account at least once every three months.

Plus500 App User Experience

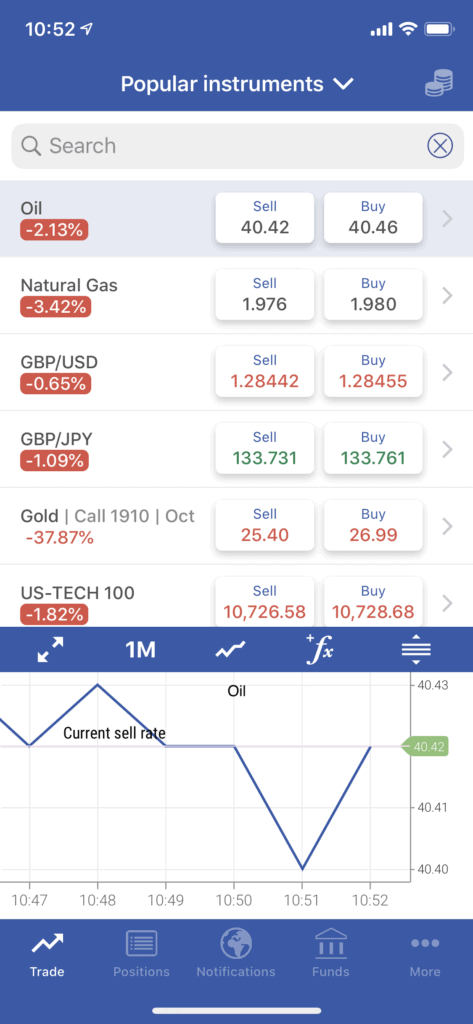

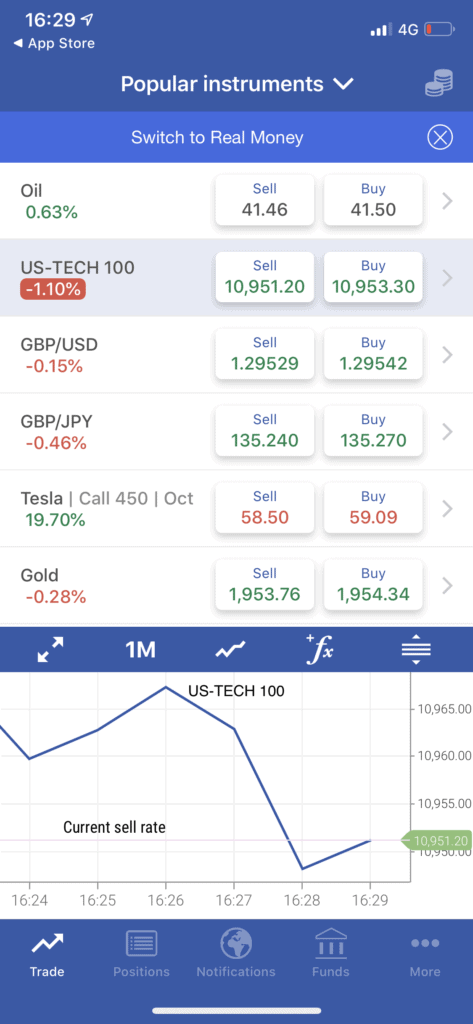

Finding stocks is a breeze. When you open the app you are presented with a ‘tabbed’ layout as seen in the screenshot of the home screen below. The buttons are: trade; positions; notifications; funds and more, and can always be reached from anywhere in the app.

The button (the piles of coins icon – top blue bar, to right of title) showing the profit and loss for your account, the amount of equity and marginis also always in view for the user (see screenshot below).

The user experience is unfusy and functional, which is just what we want in a trading app.

When you land on the ‘popular instruments’ entry page, which is under the ‘trade’ button (bottom left), the screen is divided 60/40 horizontally, with a list of instruments at the top and the charting features undeneath.

Buttons for ‘positions’, notifications and ‘funds’ are alongside the trade button atthe foot of the app screen and always in view for the user.

The chart module can quickly be put away or resized by dragging the icon on the right of the blue charting navigation bar (see screenshot below) up and down.

The other parts on the view – chart; traders’ sentiment; live statistics and info can be closed and open by touching the arrow in the grey header, enabling convienent reclaiming of screen real estate as required.

In the screenshot below the information, charting, sentiment indicator are all closed on the instrument page. You get to the instrument page from the listings page by clicking the right-pointing arrow after the name of the instrument in the row.

If you haven’t locked your handset to portrait, then a convenient way to get the fullscreen view of charts (see screenshot below) is to orientate your smartphone to landscape. Alternatively, click the two-arrow widen icon on the left of the charting navigation bar

Go to the ‘more’ button and find the ‘switch’ section listed and you can effortlessly switch between demo and live accounts. There are other sections, including: orders, closed positions, alerts and manage favourites.

Now lets dig deeper into the trading interface and features.

Plus500 Trading Tools and Features

Charting tools: tick all the must-have boxes and the features are easily accessible from the charting menu: changing chart type, setting time periods, and adding indicators indicators via the drawing tools.

Double tap the chart screen to turn crosshairs off and on. The crosshair allows you to pinpoint a position on the price chart and get a clear price read out of close/open/high/low prices. See screenshot below.

Instrument trading: When you are viewing an instrument listing page, click the arrow to the right of the cell row for the instrument – this bring you to the information page for the instrument.

Above the the chart at the top of the screen are the sell and buy buttons laid out clearly, and below it a chart view followed by traders sentiments, live stats, info and relevent upcoming events all cleanly presented.

The info section below shows fee amounts such as the point values, leverage, margin and overnight funding charging rates:

To add an instrument to your watchlist click the star button and it turns yellow after being set; likewise for the button next to it, the alerts button bell icon. (see screeshot above)

Plus500 App Education, Research and Analysis

There isn’t a dedicated education centre that includes a news feed for example. However the app has all the tools to conduct technical research.

The demo version is a valuable educational tool. However, after you’ve done the demo and want to get trading it would be useful if there was analytical coverage.

Then again, playing to your strengths is no bad things and these days online traders will be taking analysis, news and data from many sources, with notifications no doubt set up for realtime alerts.

There is an economic and corporate calendats section that you can get to from the ‘more’ menu button. Some apps let you set alerts for calendar events, but this app isn’t one of them.

Plus500 App Bonus

Our Plus500 app review found that it does not have a referral programme so there is no bonus to be earned for downloading or referring.

Plus500 Demo Account

The demo account is found under the ‘more’ button and then by clicking ‘switch to demo mode’ in the sections view.

Everything in the app is the same except for a deposit of £40,000 of fantasy money.

You can get back to the live version by selecting ‘switch to real money mode’ in the sections view.

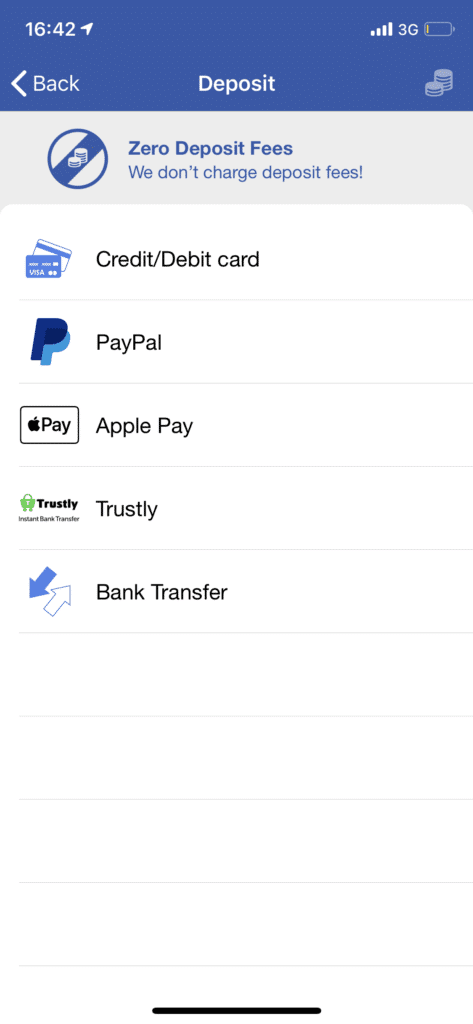

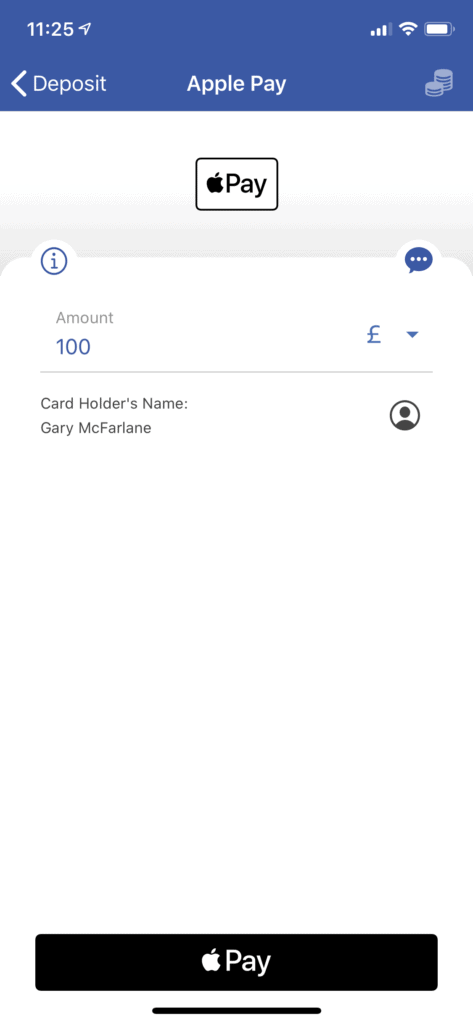

Plus500 Payments on the Stock CFD App

To make a deposit, click on the ‘funds’ button. At the top of the view are two large deposit and withdraw buttons. Click on ‘deposit’ and you will see the deposit page as shown in the screenshot above.

Deposits are accepted via five payment types (for UK customers), although these will vary depending on region:

- Credit card/debit card

- PayPal

- Apple Pay/Google Pay

- Trustly

- Bank Transfer

The minimum deposit amount is £100 and there are no deposit fees. (see screenshot below).

Plus 500 Contact and Customer Service

Customer support is available 24/7. Contact can be made with support via the live chat or email and can be reached from inside the app. (see screenshot below).

Telephone support is lacking. For serious issues such as problems with your account email is probably the best channel to make use of.

Is Plus500 Trusted?

Your funds are covered up to $85,000 by the Financial Services Compensation Scheme. The company s regulated by the UK’s Financial Conduct Authority. Plus500UK Ltd authorized & regulated by the FCA (#509909).

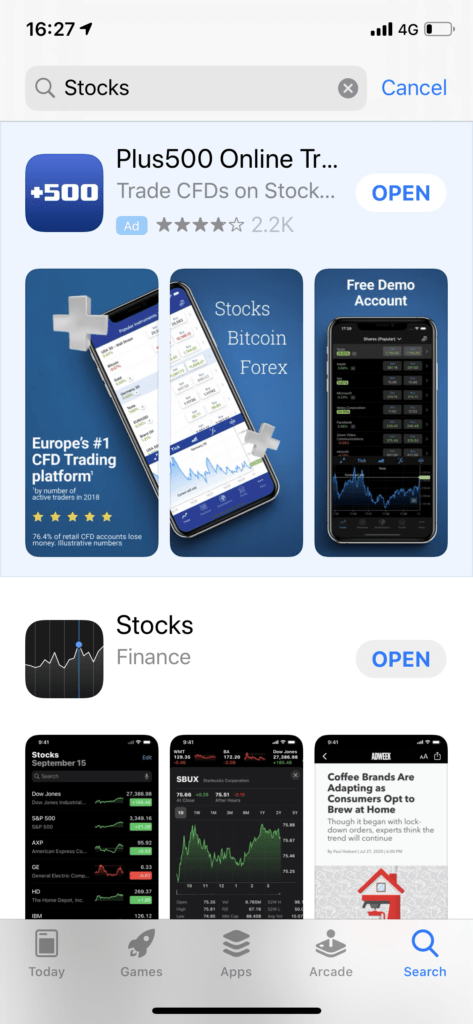

How to Use the Plus500 App

If the Plus500 app is looking increasingly like the one for you, then it’s time for the stockapps step-by-step walkthrough of doing the sign up.

An initial sign up literally takes just a couple of minutes or so.

Step 1: Download and Install the Plus500 AppSearch for ‘stocks’ in the app store (iOS pictured above). Download the Plus500 app.

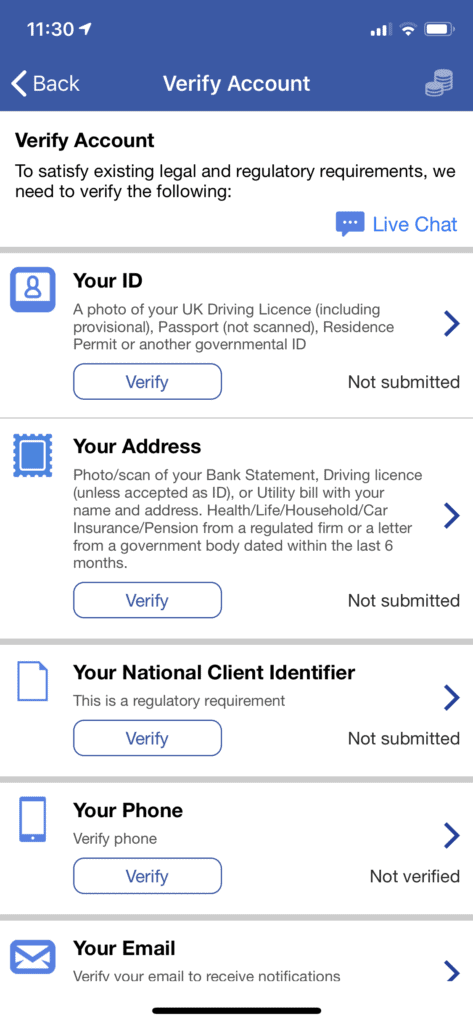

Step 2: Open a Stock CFD Trading AccountYou go through the typical account opening processto compy with know your customer and anti-money laundering regulations. Account is super easy and fast.

Enter the following information:

- Full Name

- Country of Residence

- Home Address

- Date of Birth

- National Insurance number (e.g. social security number)

- Utility Bill

- Contact Details

- Username and Password

You don’t have to upload the passport or driver’s licence photo at this stage. Instead, you can do it later by going to the account section of the app. The same applies for national insurance number and utility bills (see below), which can also be verified later:

When you are all done you arrive to the welcome screen.

Step 3: Deposit FundsYou will now be asked to deposit some funds but you can skip and do this later. If you did skip here, then after you have got into the app you can swtich back and forth bewteen the ‘real money’ account and the demo version.

You can choose from a debit/credit card, e-wallet, or bank transfer.

Deposit will be processed instantly unless you opt for a wire transfer.

Customers receive five free withdrawals a month and thereafter the charge is $10 for each withdrawal. Minimum withdrawal amount is $50 for PayPal and £100 for bank transfer and credit/debit cards.

Step 4: Trade Stock CFDsYou can now ready to trade with the app. Note in th screen shot above that we are showing the demo version, but the real version has the same view.

Click on the top bar where it says ‘Popular Instruments’ and a drop down opens up where you can search the different categories for the financial instruments you are interested in.

How to Sell on Plus500 App

Once you have bought some shares you can dispose of them when you wish providing it is with in market hours. For UK investors it is worth bearing in mind that the although the Uk session closes at 4.30pm, the US markets carry on trading on Eastern Standard Time (GMT +5) until 9pm GMT.

To sell a instrument go to the ‘positions’ section of the app and select the an instrument from the list and click the sell button and set the unit amount to sell. If you are closing the position then you must sell the entire holding.

Plus500 Stock CFD App Pros & Cons

Pros

- Excellent user experience

- Smooth and fast customer onboarding

- Pay 0% commission when trading stocks, ETFs, and cryptocurrencies

- 2,000 CFD financial instruments to choose from

- No monthly or annual maintenance fees

- Publicly listed company means it is heavily regulated

- Fully featured demo account

Cons

- Non-trading fees such as inactivity and overnight charges

The Verdict

Plus500 is expanding rapdily for at least one very good resaon - a slick app that delivers the goods.

The app is pain-free to navigate and the information you need is always to be found in the right place, such as the fees and margin information shown upfront. Perhaps we might be giving Plus5oo too much credit because many of the transparency changes have been forced on CFD and binary options brokers because of the large losses retail investors can rack up when not monitring risk properly.

Finding the stock CFD or index you want to trade with minimum trouble is achieved admirably by this CFD app, although the categorisation nesting could be more clearly delinated - the light grey divider could be a heavier tint. But these are minor issues.

Providing you are aware of the risks of CFD trading, then this app is an excellent place to meet all your trading needs.

Nothing comes free in this world, so it should not be a disappointment to most that there are charges to be even if there is no upfront dealing ccommission charge. Providing you are aware of the non-trading charges - as you are now after reading this review - then you could do a lot worse than to make Plus500s app your trusty investment companion.

FAQs

Is Plus500 available in the US?

No, Plus500 isn't available in the US.

What stocks does Plus500 offer?

Plus500 offers over 2,000 CFD financial instruments across 24 international markets.

Can you buy/short-sell stocks on the Plus500 app?

You certainly can. In fact, you can buy/short-sell each and every financial instrument offered on the app. On top of stocks, this also includes indices, ETFs, cryptocurrencies, bonds, and more.

Is Plus500 regulated?

Yes, Plus500 is regulated by the UK Financial Conduct Authority and by financial regulators in Cyprus, Australia, New Zealand and South Africa. You are protected from platform failure up to the value of £85,000 through the UK government's Financial Services Compensation Scheme.

Is Plus500 available on iOS?

Yes, the Plus500 CFD app is available on both iOS and Android.

Gary McFarlane

Gary McFarlane

Gary is financial editor and analyst at Finixio. Until July 2020 he was the cryptocurrency analyst at the UK's second-largest investment platform, Interactive Investor. He also worked for respected investment magazine Money Observer where he wrote on subjects as diverse as social trading and intellectual property protection. At Money Observer Gary initiated coverage of bitcoin in 2013. He writes widely on finance and investment and provides expert commentary to the national media. Other publications Gary has written for include The FinTech Times, City AM, Coin Desk, Ethereum World News, and InsideBitcoins.View all posts by Gary McFarlaneVISIT ETOROYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2026

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up