Stash App Review 2026 – Fees, Features, Pros & Cons Revealed

If you’re based in the US and looking for an entry-level stock app to get your investment career started – it might be worth exploring Stash. The mobile application is super user-friendly and does not impose any minimum account balances.

Best of all, you can buy stocks and ETFs without paying any commissions. You will, however, need to a small monthly fee. This starts at just $1 for those of you on the standard account, which is worth paying for the commission-free offering.

But, is Stash the right stock trading app for you?

In this review, we explore everything there is to know about the Stash appg. This includes the platform’s fee structure, supported stocks, payment methods, regulation, and more.

-

-

What is Stash?

There are several features available on the Stash app that ensures it stands out from the crowd. At the forefront of this is the ability to invest in stocks and ETFs without paying any commissions.

There are no minimum account balances either, and you can invest in a company with just a few dollars. This is because the Stash investing app supports fractional stock. On the flip side, Stash does charge a small monthly fee, with the amount depending on the type of account you open.

With that said, if you simply want to take advantage of the app’s commission-free offering, you’ll pay just $1 per month. Additionally, Stash offers a fully-fledged education department that is packed with free blogs and guides. Not only does this include investment-based material, but also content surrounding personal finance, credit, and saving for your retirement.

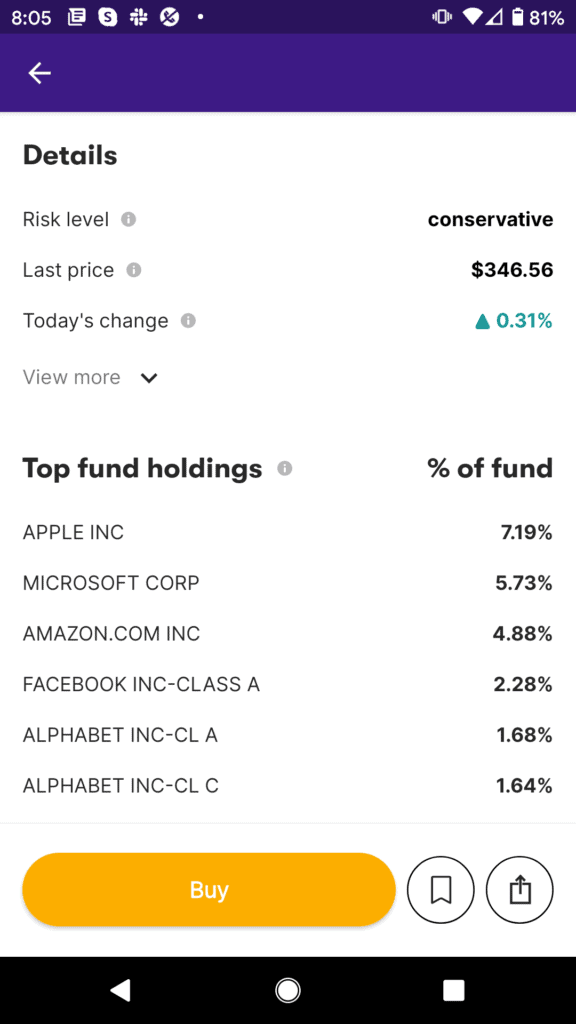

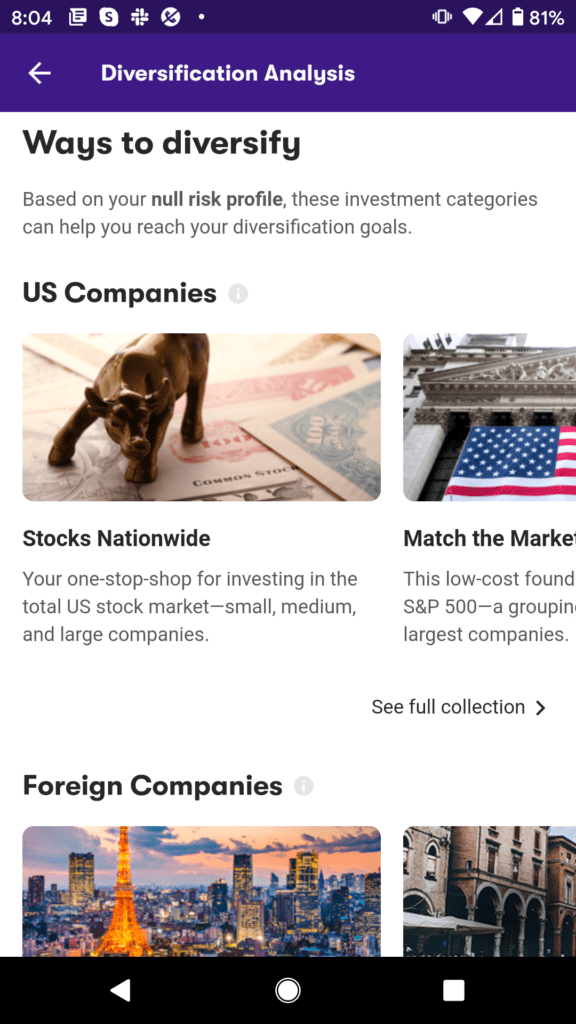

What Stocks Can You Trade on the Stash App?

Our Stash app review found that this app offers in the region on 1,800+ stocks and ETFs. Regarding the former, you will only have access to stocks listed in the US. This covers both primary exchanges – the NASDAQ and NYSE.

Although it is somewhat disappointing that you are unable to invest in foreign stocks with the app, there is a slight workaround to this. To achieve this, you will need to invest in an ETF that gives you exposure to international markets. There are many options available at Stash in this respect, so spend some time browsing through the platform’s library of assets.

Additionally, there are also ETFs that buy and sell bonds. This is a good way to gain access to corporate and government bonds in a diversified manner.

Other than stocks and ETFs, there are no other asset classes supported by the Stash investment app.

Stash Account Types

Our Stash review found that this stock app offers three account types – all of which come with a monthly fee.

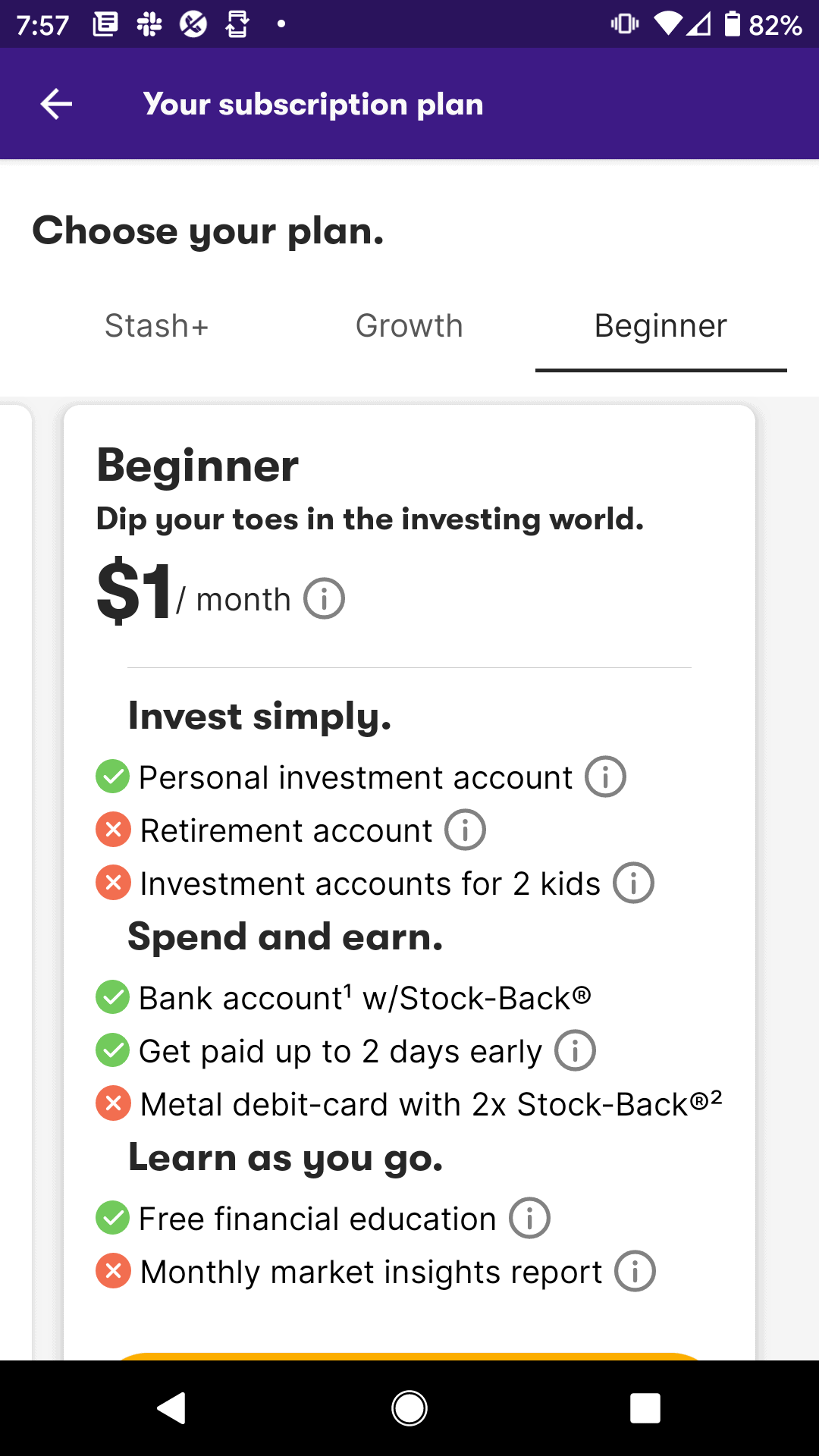

Stash Beginner Account – $1 Per Month

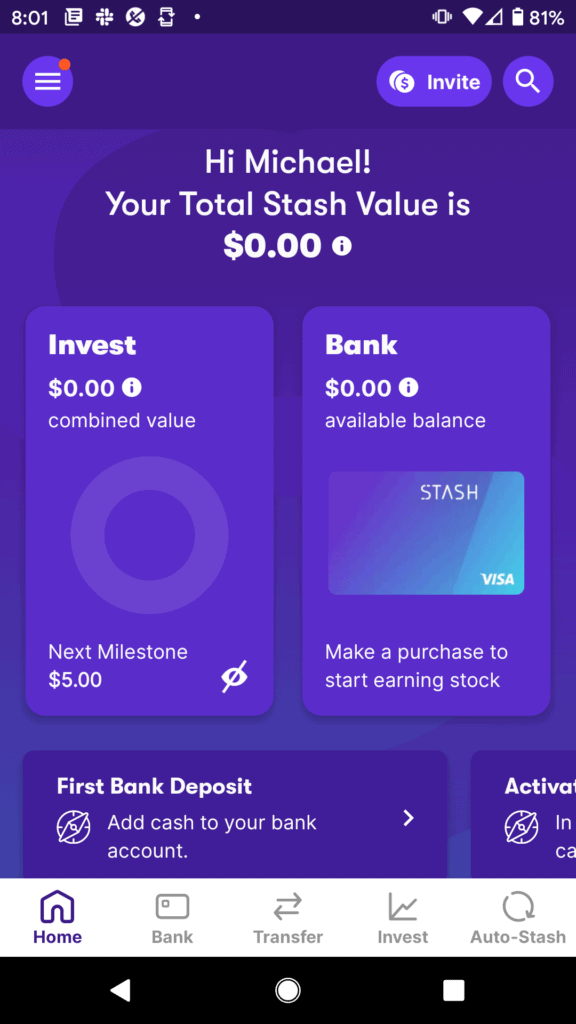

The Stash Beginner Account will set you back a mere $1 per month. This gives you access to all stocks and ETFs hosted by the app – all on a commission-free basis. You will also be offered a personal bank account, budgeting and savings tools, and the Stash debit card. If taking advantage of the free bank account, you might be eligible to receive your paycheck two days early.

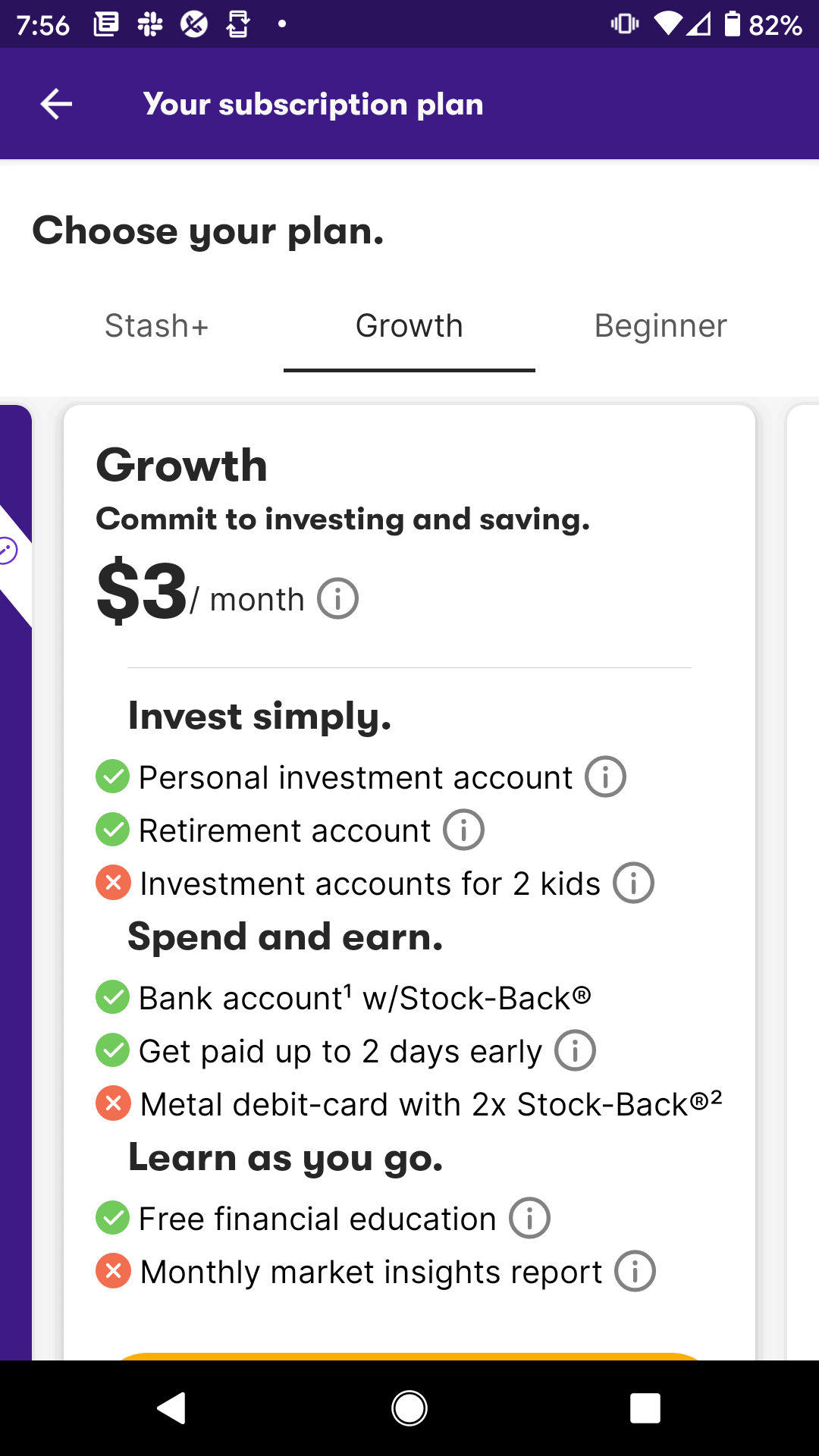

Stash Growth Account – $3 Per Month

The Stash Growth Account costs $3 per month. You will get everything that is included in the Stash Beginner Account, plus a couple of extra perks. This includes a traditional retirement account (IRA) or Roth, which both come with certain tax benefits. You will also be entitled to personalized retirement advice.

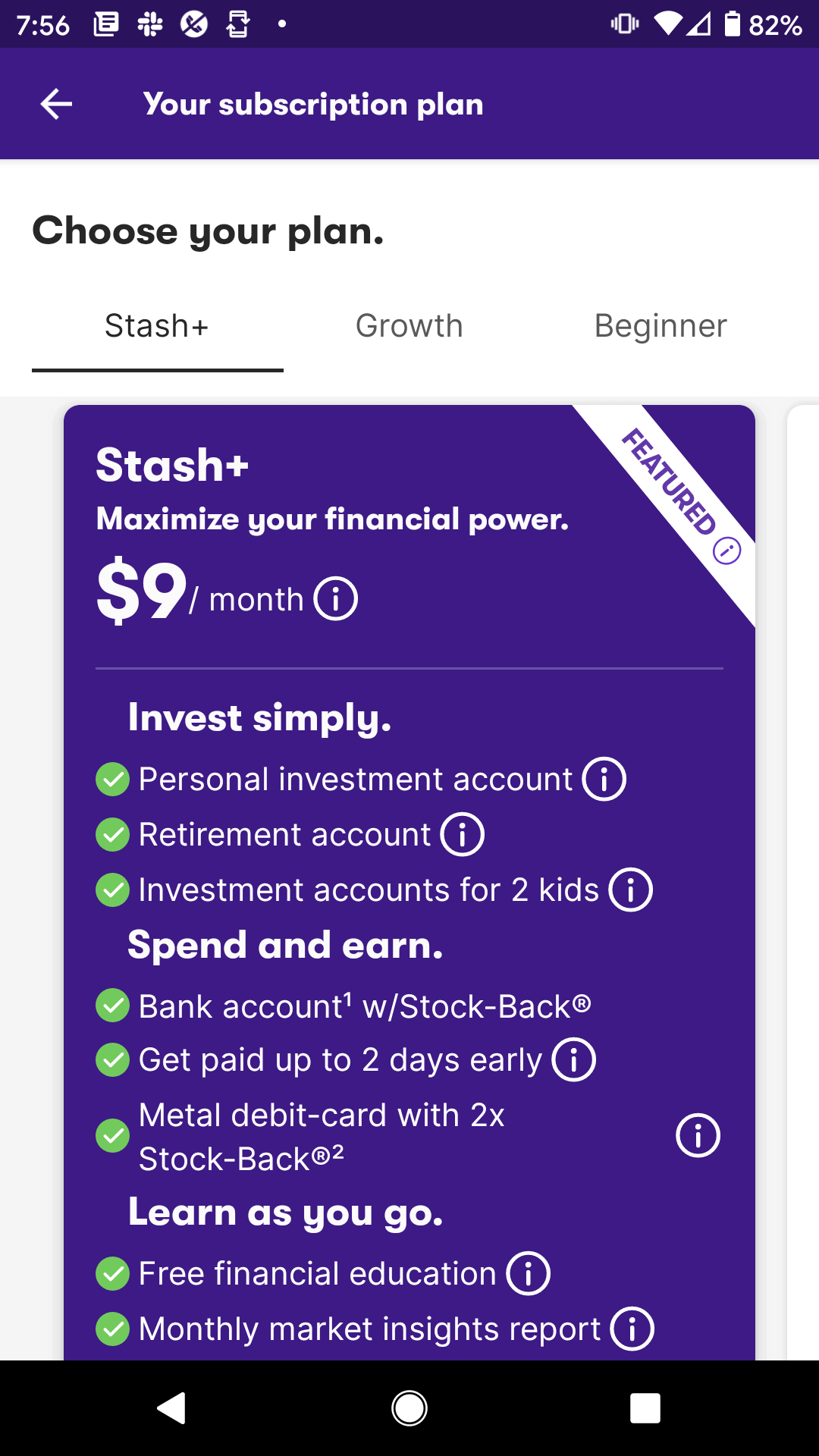

Stash+ Account – $9 Per Month

The Stash+ Account is the most expensive option on the app and will set you back $9 per month. This includes everything in the previously mentioned account types, plus more. For example, you can open up to two individual investment accounts for your children, and you will receive monthly market insight reports. Additionally, you will be sent a ‘Metal’ Stash Card, which comes with a number of rewards and cash-back benefits.

All in all, if you simply want a stock app that allows you to buy and sell stocks in a commission-free manner, the Stash Beginner Account will suffice.

Stash Fees & Commissions

As we have noted throughout our review, the Stash stock app does not charge any fees or commissions when you trade. That is to say, you can buy and sell stocks and ETFs without being charged a dime. However, you do need to factor in the monthly fees that we discussed above.

For example, let’s suppose that you decided to invest just $10 into Apple stocks. You can do this on the Stash investing app, as the platform supports fractional ownership. However, if you failed to invest anything else over the coming 10 months, you would likely end up losing money.

This is because you would have amounted monthly fees worth $10 (10 months x $1), subsequently making the trade unviable!

Non-Trading Fees

Our Stash app review revealed that there are no inactivity fees charged, albeit, you will need to pay the monthly fee for as long as you have an account. There are no fees to deposit or withdraw funds, either. As such, the only fee that you need to take into account when using the Stash investing app is the monthly account charge.

Stash App User Experience

When you consider that Stash allows you to invest from just a few dollars per trade – it makes sense that the app is tailored to newbies. After all, experienced investors are going to be looking for something a bit more comprehensive. With this in mind, Stash is likely to be your go-to stock app if you have never placed a single trade in your life.

For example, the process of opening an account and depositing funds is seamless. Everything is laid out clearly, and there are no overly complex bells and whistles to intimidate you.

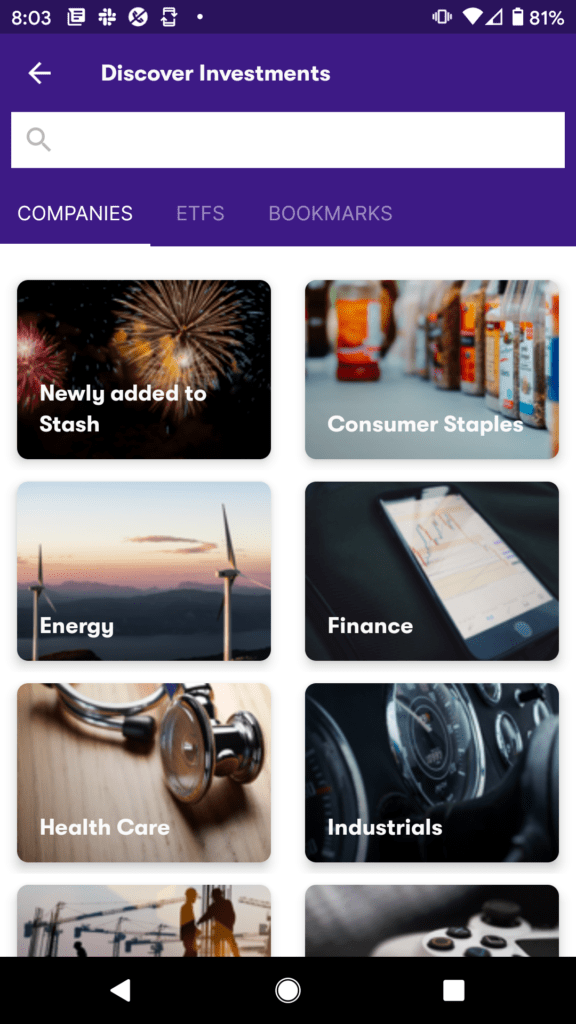

When it comes to making an investment, you can search for the stock that you wish to purchase. Alternatively, you can browse through its 1,800+ stocks and ETFs manually. Either way, you shouldn’t need any assistance to use the app – even if you’re a first-timers.

Stash App Tools and Features

As Stash App has been designed for the entry-level investor, the platform does lack more sophisticated features and tools. This is why the app might not be suitable for your needs if you are a seasoned investor.

Nevertheless, there are still a number of core benefits that the Stash investment app offers, which we outline in more detail below.

Fractional Ownership

More and more new-age stock apps are offering the ability to buy fractional stocks – and Stash is no different. This means that you are no longer required to invest in full stocks. Instead, you can invest as little as you like. This is going to appeal to those of you on a tight budget – or if you want to start off with small amounts until you get more comfortable.

For example:

- Let’s suppose that you wanted to invest in Amazon

- But, with a current stock price of $3,400 – this is way more than you want to invest

- By using Stash, you decide to invest $68

- This means that you own 2% of an Amazon share

On top of making the investment process more affordable, fractional ownership at Stash is also ideal for diversification. For example, let’s suppose that you have $100 to invest. In theory, you could buy stocks in 100 different companies at just $1 each. You can do this with ease on the Stash app as all investments are commission-free.

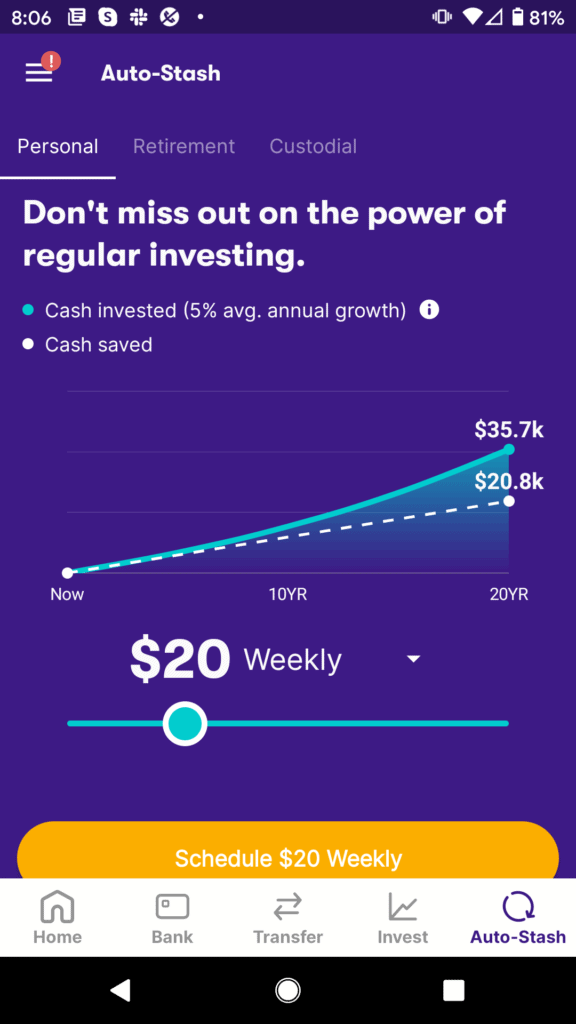

Auto-Invest

Another great tool found on the Stash app is its auto-invest feature. This covers several angles, such as the ability to have your dividend payments automatically reinvested into other stocks.

Alternatively, you can also elect to purchase a specific stock on a recurring basis. For example, you might decide to buy $50 worth of Apple stocks at the end of each month. This is great for dollar-cost averaging purposes, as you will be able to ride out volatile market waves.

Saving For Your Retirement

If you are looking to invest in the stock markets as a means to save for your golden years, our Stash app review found that there are a couple of options.

-

- Roth IRA: Get started with a Roth IRA from just $0.01 at Stash. You will pay no tax on any investment earnings, and maximum contributions are capped to $6k ($7k for those ages 50 and above).

- Traditional IRA: Traditional IRAs at Stash can also be opened from just $0.01. This allows you to deduct contributions from taxable income. Much like the Roth IRA, your annual contributions are capped at 6k, or 7k if you’re over 50.

Don’t forget, you will need to upgrade your account to have access to retirement tools, which will cost either $3 or $9 per month.

Stash App Education

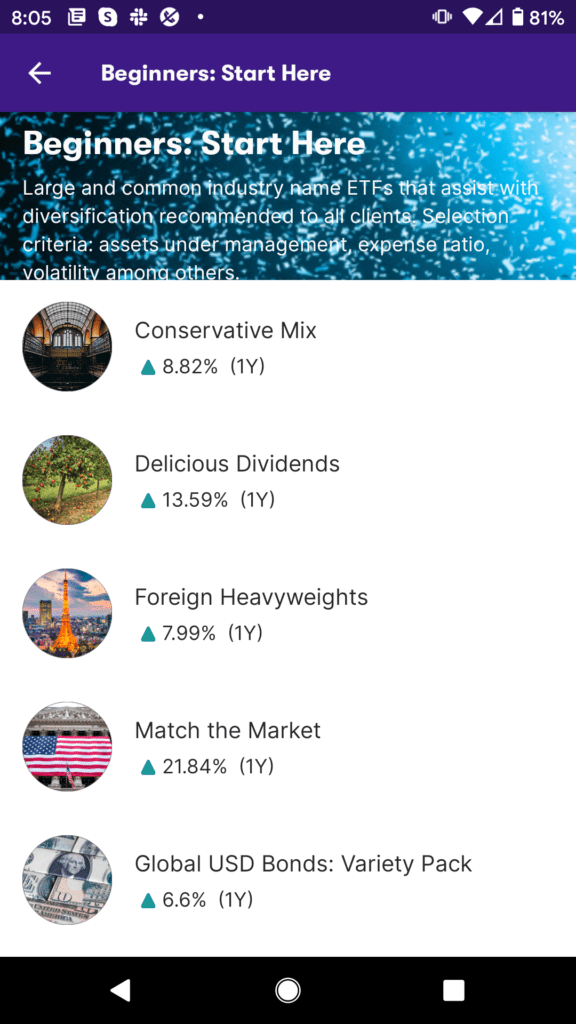

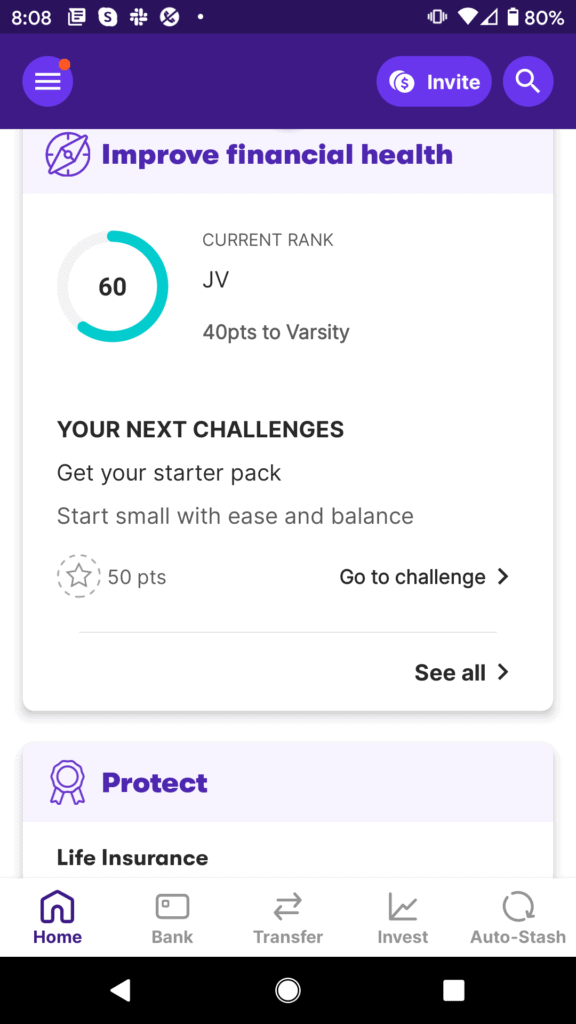

As an investment app tailored to newbies, it makes sense that Stash offers a comprehensive learning department.

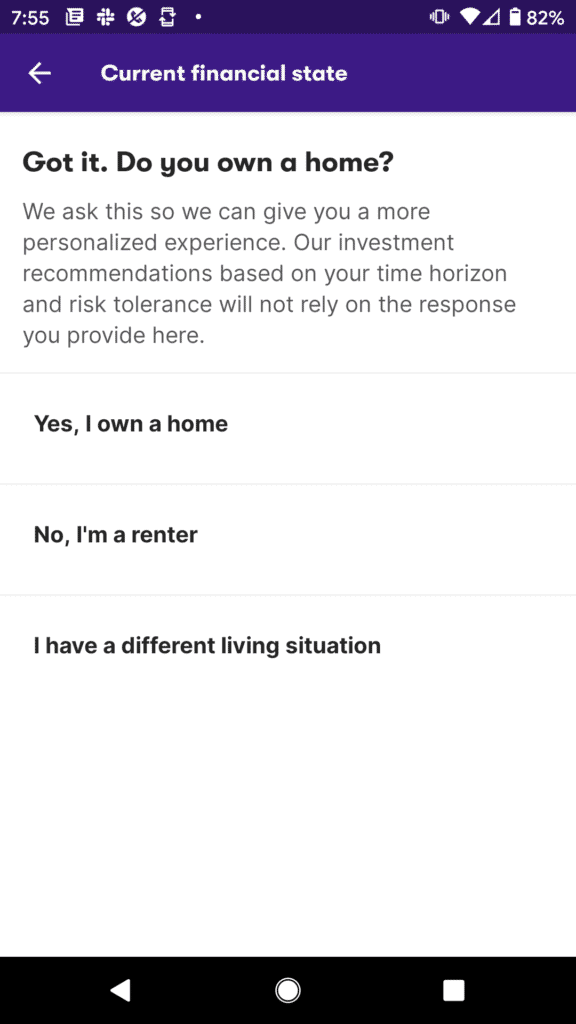

This includes investment guidance, which gives you suggestions on where your money should go. We say ‘guidance’ as opposed to ‘advice’, as Stash is unable to tell you which stocks to invest in specifically.

Instead, the app will ask you a few questions about your investing goals, and then suggest ETFs based on your appetite for risk. You are under no obligation to follow the guidance offered by the app, albeit, it is useful nonetheless.

Additionally, the Stash app offers heaps of guides and blogs on all things finance. This includes explainers on investment jargon, and how to build a risk-averse portfolio of assets. Outside of the investment space, Stash also offers guides on everything from personal finance, credit cards, debt, insurance, and income.

Stash App Research and Analysis

Although the Stash app is super-strong in the educational department, it does fall short when it comes to research tools. The app does offer the occasional blog that covers the current state of the financial markets, but this is nothing elaborate. For example, you won’t find company earnings reports, market insights, or economic analysis on the app.

For this, you will need to look elsewhere. Morningstar and Yahoo Finance are both good in this respect. The latter, in particular, also offers a dedicated app that is jam-packed with research tools and real-time new developments.

Stash App Bonus

From time to time, our Stash investment app review found that it will run sign up bonuses for those that are yet to open an account. You typically need to obtain this through a third-party affiliate. For example, the app is currently running a promotion that offers you $10 in investment funds when you initially deposit $5. Then, if you invest more than $100,000 in your first year, you’ll get $500.

Stash also offers a promotion in which it calls the ‘Stock-Back Bonus’. This is an innovative gimmick that allows you to earn a bonus in the form of free stocks when you make a purchase at the respective company.

For example, if you buy goods from Disney, you will be given free fractional stock in the company. The specific amount depends on the company in question.

At the higher end, you can get a 3% bonus when making a purchase at Sprouts Farmers Market or BJ’s Wholesale Club. The 3% is paid in stocks and will be added to your Stash investing app portfolio. Take note, the Stock-Back Bonus is a periodic promotion that can be removed at any given time.

Stash Demo Account

Our Stash review found that this app does not offer a demo account facility. However, this is somewhat reasonable when you consider that:

- There is no minimum deposit in place

- You can invest from just $1 into your chosen stock

As such, you can test the ins and outs of Stash by depositing a small amount and investing just a few dollars into your chosen stocks and ETFs.

Payments on the Stash Stock App

It is a shame that Stash does not accept debit/credit cards or e-wallets. It also fails to offer support for Google and Apple Pay. As such, the only way that you will be able to get money into and out of your Stash account is via a bank transfer.

Stash Minimum Deposit

As we have noted throughout our review, there is no minimum deposit in place when using the Stash stock app.

Stash Supported Countries

Our Stash app review found that it is only available to users based in the US. At the time of writing, there are no plans for the broker to expand into other territories. If you’re based outside of the US and looking for a commission-free stock app, it might be worth checking out eToro.

Stash Contact and Customer Service

If you need to speak with a member of the Stash team, customer support is available 7 days per week. You can catch an agent between 8.30 am and 6.30 pm Monday to Friday, and between 11 am and 5 pm over the weekend – Eastern Time.

There is no live chat facility, but you can obtain real-time support by calling (800) 205-5164. Alternatively, you can also email Stash at [email protected].

Is the Stash App Safe?

Stash is a member of FINRA and SIPC, and registered with the SEC. It meets and complies with all laws surrounding anti-money laundering, which is why it is required to verify your identity when you first sign up. Such a strong regulatory standing ensures that your investment funds are kept safe at all times.

How to Use the Stash App

Ready to buy stocks from Stash on a commission-free basis? If so, follow the guidelines outlined below to get started with a Stash app account right now!

Step 1: Download and Install the Stash AppYour first port of call will be to head over to the Stash website and download the app to your phone. The app is available on both iSO and Android.

Step 2: Open an AccountYou will now be asked to open an account. As is the case with all regulated brokers operating out of the US, you will need to provide some personal information. This covers the basics – such as your full name, home address, and date of birth.

You will also need to provide your social security number. This ensures that Stash is able to verify your identity and thus – comply with US regulators.

Step 3: Choose a PlanStep 4: Connect Bank AccountYou will now be prompted to link your US bank account to the Stash stock app. Search for the respective financial institution, and insert your routing and account numbers.

Stash will then send two micro-deposits into your bank account, which you will need to verify. Depending on your bank, this can show up on your digital statement instantly, or can take up to 3 working days. Once your bank has been linked, you can make a deposit.

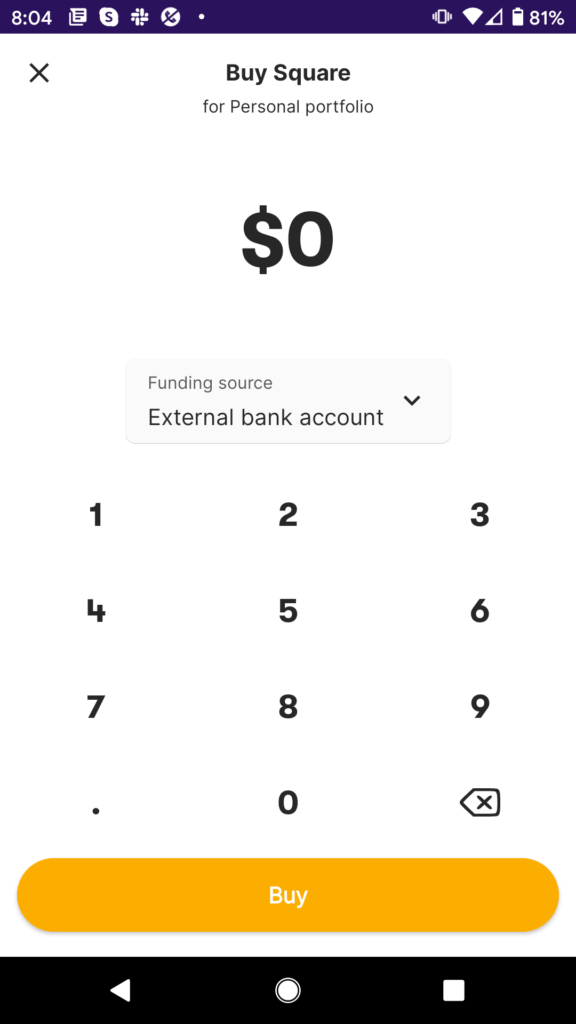

Step 5: Buy Stocks or ETFsOnce your Stash investment app has been funded, you can buy your chosen stock or ETF. Search for the asset you wish to invest in, or simply browse the app to find something that you like the look of. Then, you simply need to click on the ‘Buy’ button and enter the amount that you wish to invest.

You can invest on a one-time basis, or set up a recurring investment plan. Once you confirm the order, the funds will be taken from your Stash account balance and the stocks added to your portfolio.

How to Sell on Stash App

If you want to sell your stocks, the process takes less than a minute at Stash.

- First, click on the ‘Invest’ button and click on the stock that you wish to sell.

- Then, click on the ‘Buy/Sell’ button, followed by the reason you are offloading the stocks.

- Specify the amount you wish to sell, click on ‘Continue’ and finally – the ‘Sell’ button.

The proceeds will then be placed into your real money account balance.

Stash Stock App Pros & Cons

Below you will find an overview of our Stash app findings.

Pros

- Designed specifically for newbie investors

- No minimum deposit

- Invest from just $1 into your chosen stock

- No commissions to trade

- Over 1,800+ US-listed stocks and ETFs

- Great educational tools

- Heavily regulated

- No fees to deposit or withdraw funds

Cons

- Does not accept debit/credit cards or e-wallets

- No international stocks

- Monthly fee of between $1 and $9

The Verdict

If you’re a seasoned investor that is looking for a stock app that allows you to place sophisticated trades – then the Stash app won’t be for you. But, if you’re looking to access the US stock market for the very first time, the app is well worth considering. This is because the app is super-easy to use, and you can get started without needing to meet a minimum deposit policy.

Furthermore, there are no commissions to buy and sell stocks, and you can invest from just $1 via fractional ownership. On the flip side, you will need to pay a small monthly fee of at least $1 – but this is worthwhile when you factor in the commission-free offering.

Ultimately, if you’re a newbie investor that wants to access US-listed stocks in a simple and cost-effective manner, Stash is one of the best stock apps of 2026 to meet these objectives. You can get started straight away by clicking on the link below!

Stash – US Stock App with 0% Commission

There is no guarantee you will make money with this provider.

FAQs

What countries is Stash available in?

The Stash app is only available to users based in the US. To date, there have been no plans to expand into other countries.

What stocks does Stash offer?

The Stash invest app gives you access to over 1,800+ stocks and ETFs. All financial instruments are U.S-listed.

Can you buy international stocks on the Stash app?

No, Stash only offers stocks listed in the US. However, you can gain exposure to international stocks by investing in an ETF that tracks foreign-listed companies.

What is the Stash minimum deposit?

There is no minimum deposit at Stash, so you can get started with as little or as much as you like.

Does Stash charge any trading fees?

No, you can buy and sell stocks and ETFs without paying any commission. However, all accounts are charged a monthly fee, which can be as low as $1.

Kane Pepi

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane PepiVISIT ETOROYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2026

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up