TradeZero App Review – Fees, Features, Pros & Cons Revealed

When it comes to searching for the best stock apps, traders certainly aren’t short of options.

If you are looking for a mobile trading app that works smoothly and allows you to buy and short sell stocks, it’s worth exploring the TradeZero stock trading app. This broker offers free commission stock trading with an intraday leverage of up to 6:1 and enables clients to get access to three desktop trading software and mobile trading app.

In this review, we explore the ins and outs of TradeZero. We’ll analyse the broker’s regulatory framework, the safety of funds, features, tradable assets, fees, mobile app, payment methods, and more.

-

-

What is TradeZero?

TradeZero was founded in 2014 in the Bahamas as an online brokerage firm that offers users to trade the stock market with extremely competitive fees and a wide range of additional extras for day trading activity. The broker is headquartered at 204 Church Street, SandyPort West Bay Street, Nassau Bahamas, and is authorized and regulated by the Securities Commission of the Bahamas.

TradeZero is a DMA (Direct Market Access) broker, meaning it gives its users direct market access to the interbank market or top US trading routes such as ARCA, NSDQ, BATS, or EDGX. TradeZero offers three software platforms, plus a mobile stock app that is aimed for more experienced traders. TradeZero’s users get access to insight into a stock’s price action using the level 2 data, a high day trading leverage ratio, and pre & post-market trading.

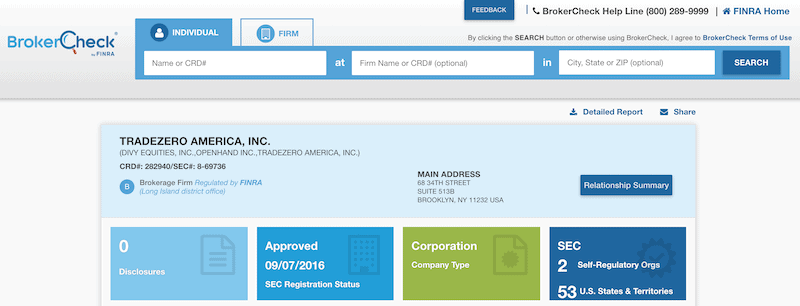

An important thing to mention is that TradeZero accepts US clients through another branch, TradeZero America Inc. The company is located in 68 34th Street Suite 513B, Box 47, Brooklyn, NY. 11232 and is a member of FINRA and SIPC.

What Stocks Can You Trade on the TradeZero App?

Our TradeZero app review found that it is offering a brokerage service called Direct Market Access (DMA), which allows you to place your orders directly on the stock exchange. This means that TradeZero enables users to trade on all securities listed in the US markets, including stock, penny stocks, Exchange Traded Funds (ETFs), and options.

On the negative side, TradeZero does not enable you to trade foreign-listed stocks, so if you are looking to diversify your trading strategy, you might have to find another brokerage firm like IG Markets, Robinhood, or eToro.

TradeZero Account Types

On TradeZero, the account type depends on the amount you wish to deposit and the type of trading you wish to apply. As such, the broker offers two account types – Cash Account and Margin Account.

Cash Account

A cash account requires a minimum of $300 and simply allows investors the buying and selling of securities using cash rather than margin trading or borrowed capital. You should note, however, that you cannot short sell stocks if you are trading via a cash account.

Margin Account

The second account is the most plausible of the two. A margin accounts with at least $1000 are approved for margin trading and investors can day-trade without any restriction. The minimum amount required for the margin account is $600.

TradeZero Fees & Commissions

As mentioned previously, one of the key points of trading with TradeZero is the pricing model it offers. This applies to all assets, including both share and options trading. With that in mind, the pricing model is complex so it’s crucial that you understand the fees and commissions charged by the broker before you start trading.

Platform fees: TradeZero charges a monthly fee for two of its platforms – the ZeroPro ($79), and the ZeroWeb with level 2 ($59). The ZeroWeb without the level 2 order book and the ZeroMobile are both free of charge. Keep in mind, however, that TradeZero does not charge any platform fees if a trader meets a minimum volume of 80,000 shares per month. and 100,000 shares per month for the ZeroWeb Level 2 and ZeroPro respectively.

Financing fees: TradeZero does not charge an inactivity fee, however, the deposit and withdrawal fees are a different story. The broker charges a withdrawal fee of $70 and a deposit fee of $30 for international clients. Further, placing a trade with an agent costs $20.

Trading fees: TradeZero offers commission-free trades though there are certain conditions under which a trade may be eligible for executing free trades. Otherwise, you’ll have to pay a fee of $0.005 per share for international traders and 0.002 for US traders. For orders less than 200 shares, TradeZero charges a flat fee of $0.99.

Options cost 0.068¢ for international investors and 0.0938¢ for clients from the US.

TradeZero App User Experience

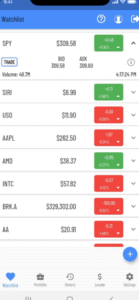

Overall, the TradeZero stock trading app is a solid choice for traders and investors. The ZeroMobile is included with all platforms – the ZeroPro, ZeroWeb, and ZeroFree – and comes with several features that allow you to monitor the account and view real-time streaming quotes. You will also be able to watch market news, create a watch list, search for symbols, find fundamental data related to different assets, and use the direct stock locates.

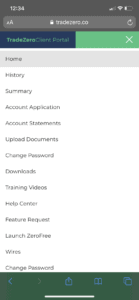

Additionally, you can use the ZeroWeb platform, which is available on any web-browser or manage your account via the TradeZero ClientPortal.

TradeZero Trading Tools and Features

As TradeZero has been designed for professional active day traders, it has a lot to offers in terms of unique trading tools and features, which we present in more detail below.

Level 2

Level 2 is a tool in trading platforms that enables users to view the bid and ask prices and quantities for a certain security. In that sense, it stimulates the market action and gives you a better indication of the sentiment in the market. Unlike the majority of CFD brokers and investment firms, TradeZero gives investors a direct access to exchanges and as such, it allows you to trade through the level 2 order book.

No Pattern Day Trading Limitation

A pattern day trader is a regulatory restriction for traders who execute at least four day trades over a five-day period using a margin account. According to the US law, investors must have at least $25,000 to be able to day trade, however, with TradeZero users can day trade with a minimum account balance of $500.

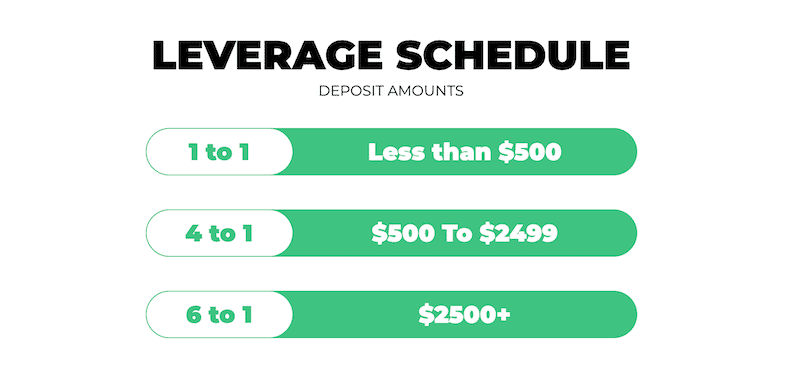

Leverage

TradeZero allows users to trade stocks with an intraday leverage of up to 6:1, and to hold overnight positions with a leverage of 2:1. Yet, the leverage depends on your deposit and you’ll have to deposit at least $2500 to be eligible for a leverage ratio of 6:1. This is higher than most investment apps and CFD brokers in the industry that typically allow traders to leverage their position with up to 5:1.

Pre & Post Market Trading

Our TradeZero review found that traders at TradeZero can trade stocks and options during the pre and post market hours. The Pre-market trading begins at 4am EST, and Post-market trading ends at 8pm EST.

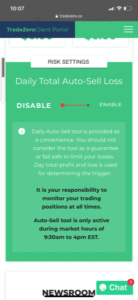

Daily Total Auto Sell Loss

The daily total auto sell loss is a tool designed specifically for day traders. It works similarly to a stop-loss order on a singular position but with this feature, you can set a daily profit and stop-loss that can be triggered anytime during the market hours of 9:30am to 4pm EST.

TradeZero App Education, Research and Analysis

Even though TradeZero stock trading app is tailored for expert traders, it is packed with educational resources. This helps is stand out against other stock apps.

First, you get access to a huge selection of training videos on the broker’s ClientPortal, explaining how to use the platforms, how to place orders, how to locate stocks, and more.

On top of that, the broker has a great education center with important material for beginners and experts alike.

When it comes to research and analysis features, we were a bit disappointed. The mobile app is equipped with a scrolling news feed and an advanced charting package and it is intuitive but it does not come with any out-of-the-box features.

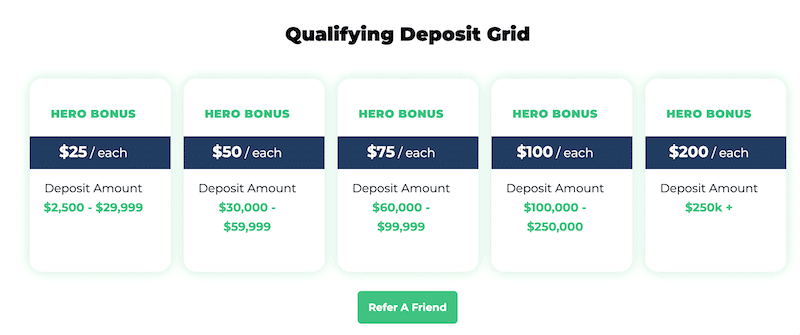

TradeZero App Bonus

TradeZero does not currently offer a welcome bonus but it does have a generous referral program for active users. As such, when you refer a friend or family member to join TradeZero, the broker rewards you with up to $2500 per month in credits.

TradeZero Demo Account

Like most of the best stock trading apps, TradeZero offers a free demo account for the ZeroPro software and gives you access to the ZeroWeb free version. Keep in mind that it takes 3-5 days for the account to be approved, and then you can log in to the ZeroWeb demo account. However, the broker does not currently allow users to test the mobile app on a demo account unless they sign up for the paid demos.

Payments on the TradeZero Stock App

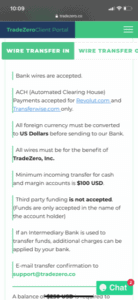

TradeZero does not provide clear information about the available payment methods, but it appears that you can fund your account using the following payment options:

- Credit card

- Bank transfers

- Skrill

- Neteller

This is a relatively small amount in comparison to some other stock apps. Nonetheless, we suggest that you contact the support team for more information about the funding methods in your country.

TradeZero Minimum Deposit

In the US, investors must meet a minimum deposit requirement of $250. Users from other countries will have to deposit at least $300 for a cash account with a 1:1 leverage account, between $500 to $2499 for the 4:1 leverage account, and at least $2500 for a 6:1 leverage account.

TradeZero Contact and Customer Service

When it comes to customer support service at TradeZero, our TradeZero app review found that you can contact the broker through email, live chat, phone, or submit a ticket form. The customer support team is available seven days a week between 8am to 5pm Eastern Time and 24/7 for web live chat. Additionally, the broker maintains an FAQ section on their website where investors can get plenty of information about the account creation process, trading terms, and conditions, fees and commission, etc.

Is TradeZero Safe?

Overall, it appears that TradeZero is safe and secure. Even though the broker does not currently hold licenses from top-tier regulators like the FCA, CySEC and the SEC, it is regulated by the Securities Commission of the Bahamas. This means that Bahamian and U.S. citizens cannot open an online trading account via the international branch of TradeZero. However, the company recently has gained the necessary regulatory approvals, and it now also accepts U.S citizens under FINRA and SPIC.

In terms of clients’ safety of funds, all accounts are protected up to $250,000 as TradeZero has insurance through Lloyd’s of London affiliate Argenta Group.

How to Use the TradeZero App

If you want to join the TradeZero stock trading app, follow the guidelines outlined below to get started.

Step 1: Download and Install the TradeZero AppFirst, you need to download the app on your mobile phone. To do that, you can visit the TradeZero homepage or search for TradeZero on the App Store or Google Play. Click on the ‘Install’ button to download the app and install it on your device.

Step 2: Open an AccountNow that the app is installed on your smartphone, you can sign up for an online trading account. TradeZero enables you to complete the registration process directly from your phone, as you can see in the image below.

It’s worth mentioning that the registration process is long and requires you to complete a long questionnaire that includes your personal information, trading experience, and financial background. You’ll also have to upload your passport ID to verify your identity. As such, we advise you to sign up via the broker’s website for your convenience.

Step 3: Deposit FundsNow, you will be asked to deposit funds. As mentioned previously, TradeZero primarily accepts bank wire transfers. In order to transfer funds, navigate to the ‘Wires’ tab on the app’s menu.

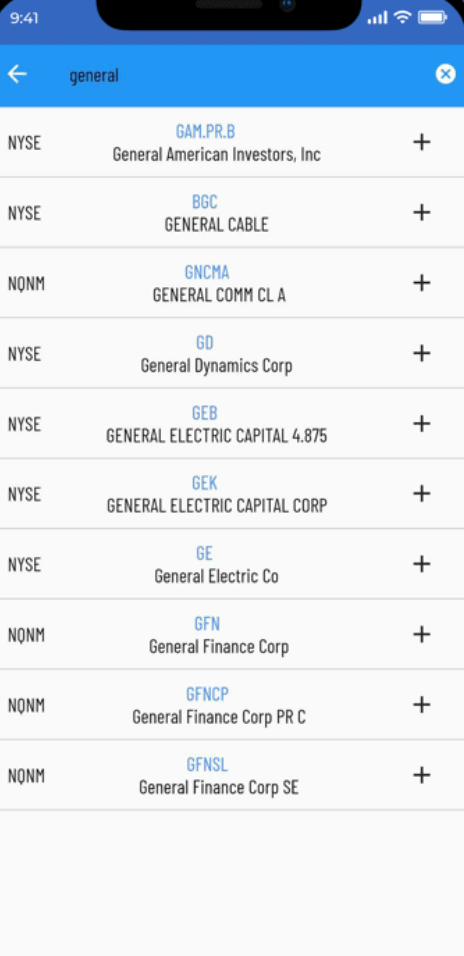

Step 4: Trade Stocks and OptionsNow that the funds have reached their destination, you can start trading. As you enter the mobile app, search for a stock using the Symbol Search and click on the results that pop-ups. You will then be transferred to an order form where you’ll be able to insert a buy or short sell order. To view your open order, navigate to your portfolio where you can monitor the order execution.

TradeZero Stock App Pros & Cons

Below you will find an overview of our TradeZero stock app findings.

Pros

- Allows users to trade stocks and options

- Regulated by the Securities Commission of the Bahamas

- No Pattern Day Trading (PDT) rules

- Low trading fees and commissions

- A selection of three trading platforms and a mobile app

- The broker offers rebates

- Accepts US clients via TradeZero America Inc

- An intraday leverage of up to 6:1

Cons

- Not regulated by top tier regulator

- Not for beginners, suitable for professional traders only

- The information on the website is not clear

- Long and complicated registration process

The Verdict

In summary, TradeZero is a great trading platform for active day traders that want to trade stock and options. In less than six years, this broker has developed three trading platforms, a mobile trading app, and a direct connection to top trading routes. Best of all, it offers free commission stock trading and high intraday leverage. So if you want to jump into the day trading ring with a powerful and advanced trading platform, TradeZero might be an ideal solution for you.

FAQs

Is TradeZero available in the US?

Yes, TradeZero America, Inc. accepts US clients as the US-based broker is a member of FINRA.

What stocks does TradeZero offer?

TradeZero connects traders with ARCA, NSDQ, BATS or EDGX, meaning that it gives users access to all stocks, ETFS, and options listed on the US stock markets.

Can you short-sell stocks on the TradeZero app?

Absolutely, TradeZero is a day trading app and as such, you will be able to short sell stocks. However, you should note that you will not be able to short sell if you have a cash accounts or any account with less than $500

Is TradeZero regulated?

Yes, TradeZero is authorized and regulated by the Securities Commission of the Bahamas.

Can you buy international stocks on the TradeZero stock trading app?

No, TradeZero only offers stocks from US stock exchanges.

Tom Chen

Tom Chen

Tom is an experienced financial analyst and a former grains derivatives day trader specializing in futures, commodities, forex, and cryptocurrency. He has over 10 years of experience in the Finance industry spanning across a day trader position at Futures First, and a web content editor and writer at FXEmpire. Tom has has also written for The Motley Fool, FX Empire, Yahoo Finance InsideBitcoins, and Learnbonds.View all posts by Tom Chenstockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2026

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up