Trading 212 App Review 2026 – Fees, Features, Pros & Cons Revealed

If you’re in the market for a user-friendly stock app that allows you to buy and sell shares without breaking the bank – Trading 212 might be worth considering.

The regulated broker offers more than 4,000+ stocks and ETFs – all of which you can trade without paying any commissions or fees. You will also have access to a number of CFD products – subsequently allowing you to engage in short-selling and apply leverage. But, is Trading 212 the right stock app for you?

In this review, we cover the ins and outs of what the Trading 212 app offers. We discuss everything from fees, tradable shares, account minimums, safety, payments, and more.

What is Trading 212?

The Trading 212 app is highly rated on both Google Play and the Apple Store, with a score of 4.5/5 and 4/7, respectively. This is across over 137,000 individual reviews. The main draw with Trading 212 is that you can invest in over 4,000 stocks and ETFs without paying a single penny in commission. This makes the broker super-competitive, as there are no monthly or annual maintenance fees to pay, either.

You’ll have access to stocks from several marketplaces, including the London Stock Exchange, NYSE, NASDAQ, and Euronext. The Trading 212 stock app is also popular with first-time traders. This is because the application is simple to use, and it supports fractional ownership. This means that you can invest from just £1 into your chosen stock.

Additionally, Trading 212 offers a fully-fledged CFD trading arena. This means that you can trade stocks, indices, forex, commodities, and cryptocurrencies through the app. All CFD instruments can be short-sold and traded with leverage. Crucially, the Trading 212 platform and mobile app are regulated by the UK’s Financial Conduct Authority. This means that you will be able to invest in shares in a safe and secure environment.

What Stocks Can You Trade on the Trading 212 App?

Our Trading 212 app review found that this app hosts a broad selection of shares. This includes 7 primary stock exchanges, which we have listed below:

- London Stock Exchange

- Deutsche Börse Xetra

- NYSE

- NASDAQ

- Euronext Amsterdam

- SIX Swiss Exchange

- Bolsa de Madrid

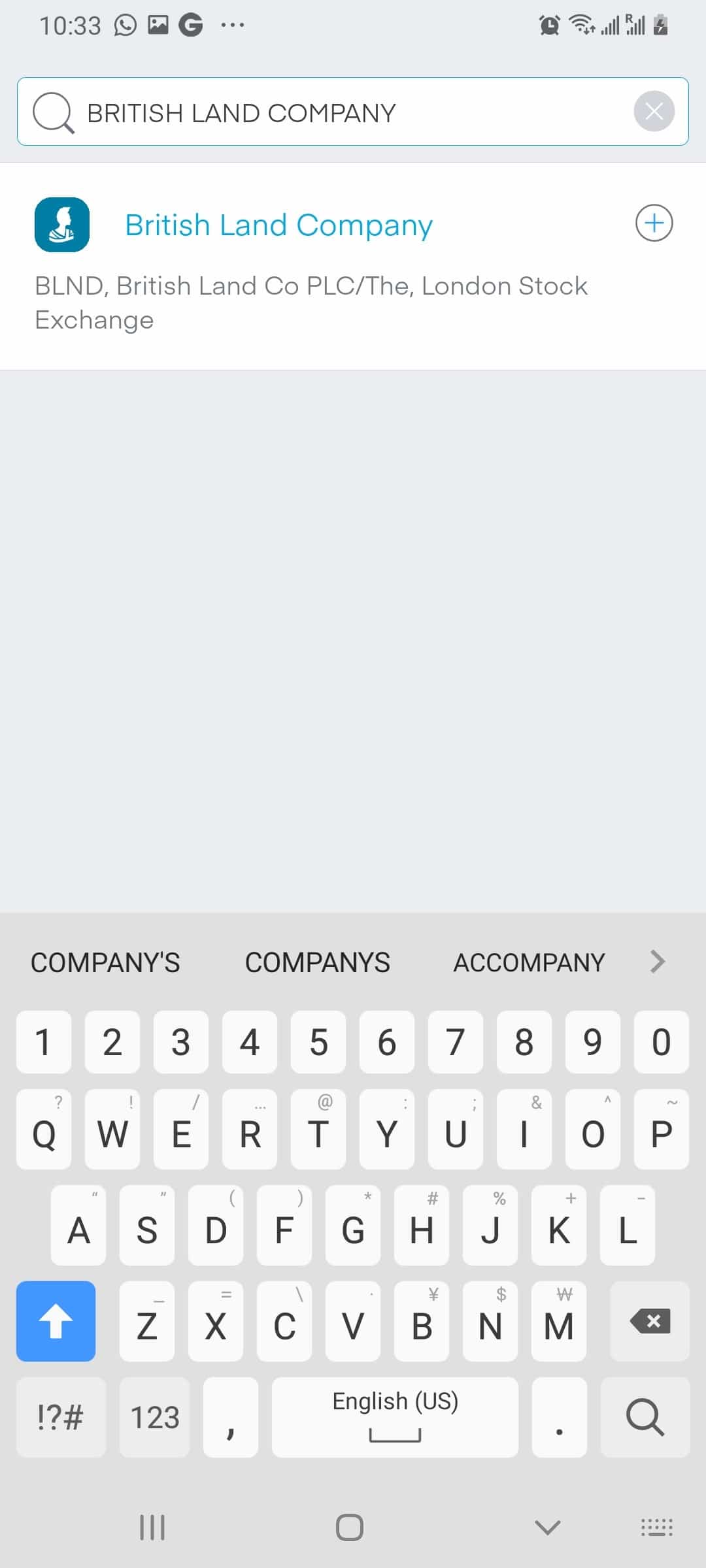

Breaking the list of tradable shares down further, our Trading 212 review found that the vast bulk of supported stocks are based in the US and UK.

Regarding the former, this includes heavyweight tech stocks like Apple, Facebook, Twitter, and Amazon, as well as the likes of Tesla, Disney, and Ford Motors. In the UK, you’ll have access to large-cap firms like British American Tobacco, HSBC, and Associated British Foods.

If you purchase stocks in a company that pays dividends, you will be entitled to your share. As when the payment is received by the broker, your cash account will be reflected. You can then use the dividends to buy more stocks, or simply withdraw the funds back out to your bank account.

ETFs

The Trading 212 stock app also gives you access to hundreds of ETFs. This covers heaps of sectors and industries, so you have the opportunity to diversify your portfolio with ease. One of the most popular ETFs traded at the platform is that of the iShares Core Global Aggregate Bond.

This is an ETF that allows you to buy and sell bond instruments in a passive manner. You then have the likes of the iShares Core S&P 500 UCITS ETF. By making a single investment via the Trading 212 app, you will be buying shares in 500 of the largest US companies. Either way, ETFs at Trading 212 also entitles you to dividend payments, if applicable.

Other Asset Classes

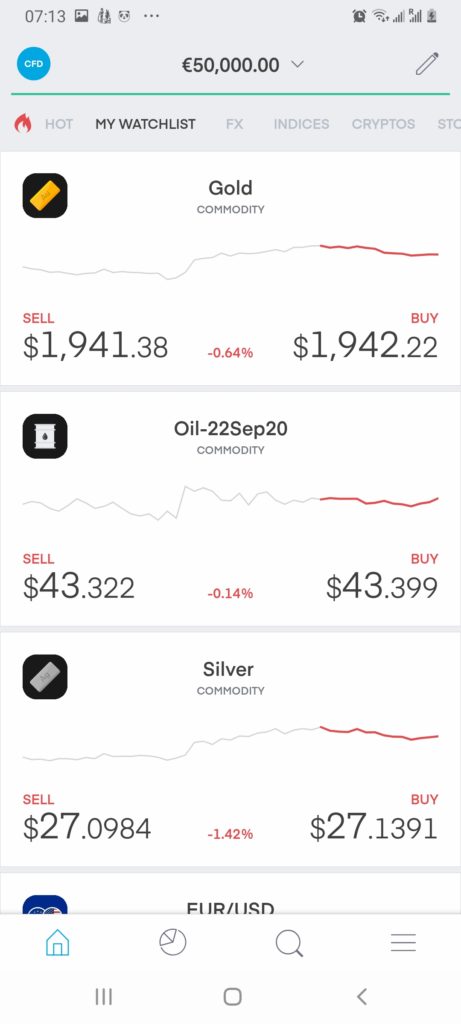

Outside of the stocks and ETF department at Trading 212, the mobile app also gives you access to a fully-fledged CFD trading facility. As we cover shortly, CFDs can also be traded on a commission-free basis.

Below we list the main CFD asset classes available on the app.

- Indices: Indices are a great way to speculate on the wider stock markets. This is because they track dozens – if not hundreds of individual companies listed on a specific exchange. At Trading 212, you can trade over 30+ stock indices at the click of a button. This includes majors indices like the S&P 500, FTSE 100, and Dow Jones 30.

We also like that the Trading 212 stock app supports less liquid indices. This includes exchanges located in South Africa, Russia, the Netherlands, Korea, and India. This ensures that you have access to the emerging markets. - Commodities: The Trading 212 app comes jam-packed with commodity CFDs. In the metals department, this covers gold, silver, and platinum. Energy-wise, oil and natural gas are supported. You can also trade food groups like wheat and sugar.

- Forex: Although Trading 212 is yet to truly make a name for itself in the forex brokerage scene – it has one of the largest offerings of currency pairs. At more than 150, you can trade all majors and minors, and dozens of exotics. This is ideal if you want to trade less liquid currencies like the Turkish lira or South African rand.

On top of the asset classes listed above, you can also trade stocks and ETFs in the form of CFDs. These are the same instruments as discussed in the sections above. All CFD instruments can be traded with leverage, and you will always have the option of going long or short.

Trading 212 Account Types

Our Trading 212 review found that the app offers three separate account types, which we elaborate on below.

Invest Account

The Invest Account at Trading 212 is for those of you that wish to invest in stocks and ETFs in the traditional sense. That is to say, you will own the underlying asset until you decide to exit the position. You won’t have the option of short-selling or applying leverage on this account. For this, you’ll need to open a CFD Account.

CFD Account

As the name suggests, the CFD Account offered by Trading 212 allows you to buy and sell CFD instruments. This is the account for you if you wish to place more sophisticated trades – such as applying leverage. You will also have more flexibility when it comes to placing orders. For example, OCO (One Cancels the Other) orders are available on this account, but not the Invest Account.

ISA Account (UK Only)

If you’re based in the UK and you plan to invest in stocks and ETFs, then you should take full advantage of the ISA Account offered by Trading 212. For those unaware, this allows you to shield your profits from capital gains tax up to the first £20,000.

Your allowance will reset at the start of each UK financial tax year, meaning that you can invest in the stock markets in a super tax-efficient manner. Once you have consumed your allowance for the year, any remaining assets will be placed into the traditional Invest Account.

It is important to note that you have the option of opening up multiple account types at Trading 212. That is to say, there is nothing stopping you from opening both a CFD Account and an Invest Account.

Trading 212 Fees & Commissions

Upon spending countless hours reviewing hundreds of stock apps active in the space, we found that Trading 212 is one of the most cost-effective options on the market. Crucially, the application allows you to buy and sell stocks without paying any commissions. This is also the case with ETFs.

In order to illustrate just how competitive this is, Trading 212 provides some information on its main UK competitors. For example, the likes of Hargreaves Lansdown and Halifax charge up to £11.95 and £12.50 per trade, respectively.

Even taking into account the reduced fees offered by these brokers for larger volumes, 50 stock deals throughout the year would cost you £297.50 and £625 in commission, respectively. When using the Trading 212 stock app, you will pay nothing – subsequently saving you hundreds of pounds per year This falls in-line with other leading stock apps like eToro – which also offers commission-free trading.

CFD Trading

If opting for a CFD Account at Trading 212, you will be pleased to know that the app also offers commission-free trading. With that said, you do need to factor in overnight financing costs. This is because CFDs are leveraged financial products.

As such, you might need to pay a variable fee for each day that you keep your CFD position open past standard market hours. The specific fee will, however, vary depending on the asset class.

Trading 212 Spreads

Much like overnight financing fees, spreads at Trading 212 will vary depending on:

- The type of asset you are trading

- Whether you are trading during standard market hours

- How much liquidity is available

With that said, below you will find some example spreads so that you have a brief idea of what you are likely to pay.

- When trading the S&P 500, you will pay an average spread of 0.1 pips.

- If forex is your thing, you can trade EUR/USD at an average spread of 0.8 pips.

- Major stocks come with an average spread variable of 0.2%, albeit this will be much higher when accessing less liquid marketplaces.

All in all, the spreads offered by Trading 212 are actually very competitive. Just be sure to keep an eye on what you are paying, as the spread can and will fluctuate throughout the trading day.

Non-Trading Fees

There are a couple of non-trading fees at Trading 212 that you will find listed below.

- Currency Conversion Fee: If buying stocks or ETFs through the Invest Account, you will not need to pay any currency conversion fees. This means that you can access domestic and foreign markets fee-free. However, the CFD Account does come with a 0.5% conversion fee when accessing a market that is priced in a different currency to the one attached to your account. For example, if you’re in the UK and wish to short-sell US stock CFDs, the 0.5% fee will kick-in.

- Inactivity Fee: Trading 212 is one of the very few stock apps active in the space that does not charge any inactivity fees. This means that you can leave your account dormant for as long as you wish and not have fees dedicated from your balance.

- Stamp Duty: Unfortunately, there is no way to avoid stamp duty tax if you are based in the UK. This is the case across all brokers, and it remains constant at 0.5%.

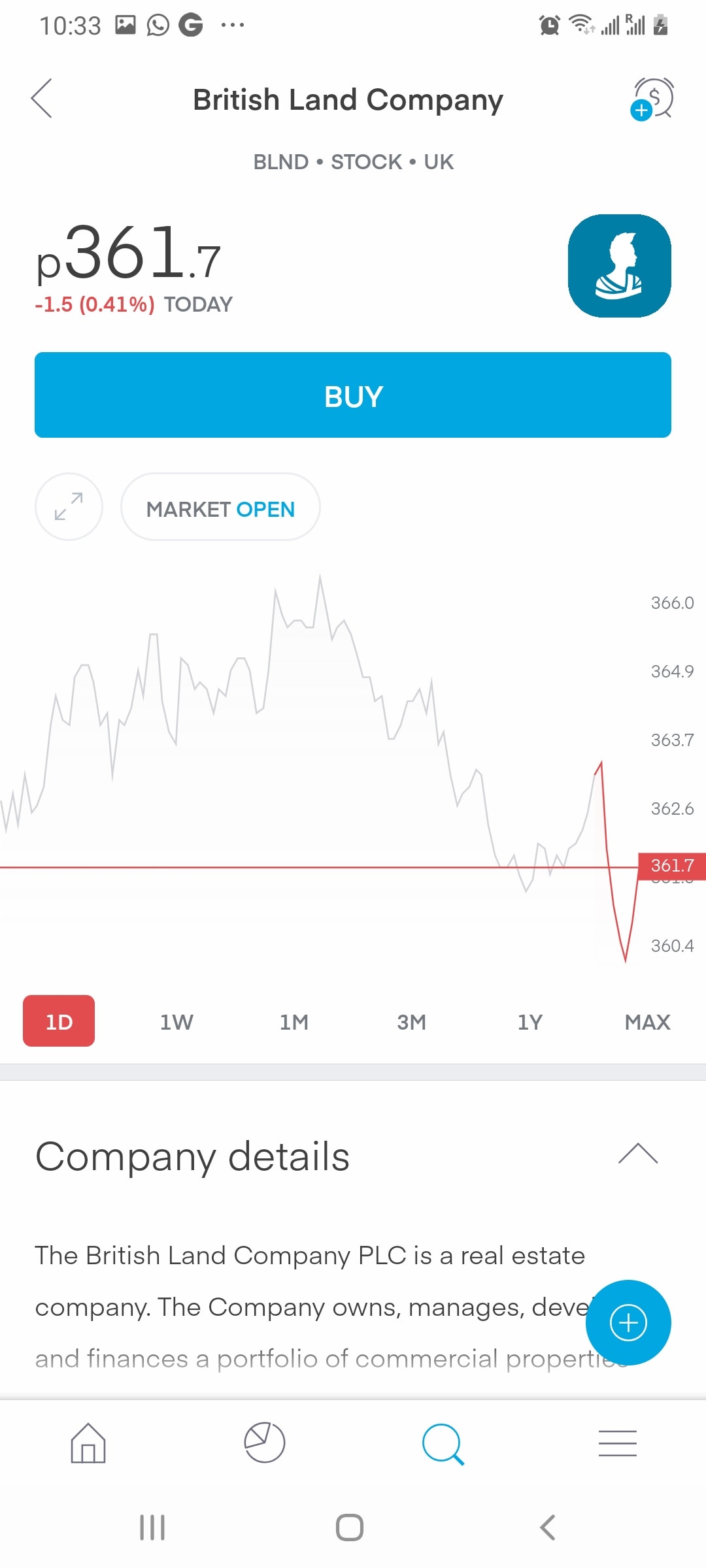

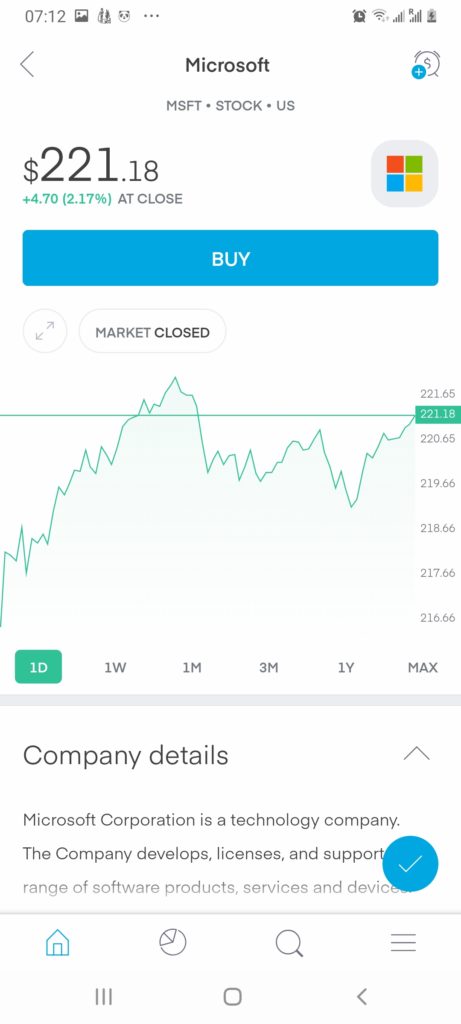

Trading 212 App User Experience

In a nutshell, the Trading 212 stock app offers an intuitive user experience. The app has a clean and crisp white background, and everything is displayed clearly. This ensures that your trading experience is not hindered by a smaller screen. This starts at the very offset with the initial account opening procedure. Depositing and withdrawing funds is also a seamless experience when using the app.

In terms of making investments, you can either browse through the Trading 212 stock library and filter down by the exchange, or simply search for the company that you wish to buy shares in. This is crucial, as the platform offers thousands of financial instruments, so it’s notable that you can find your chosen asset with ease.

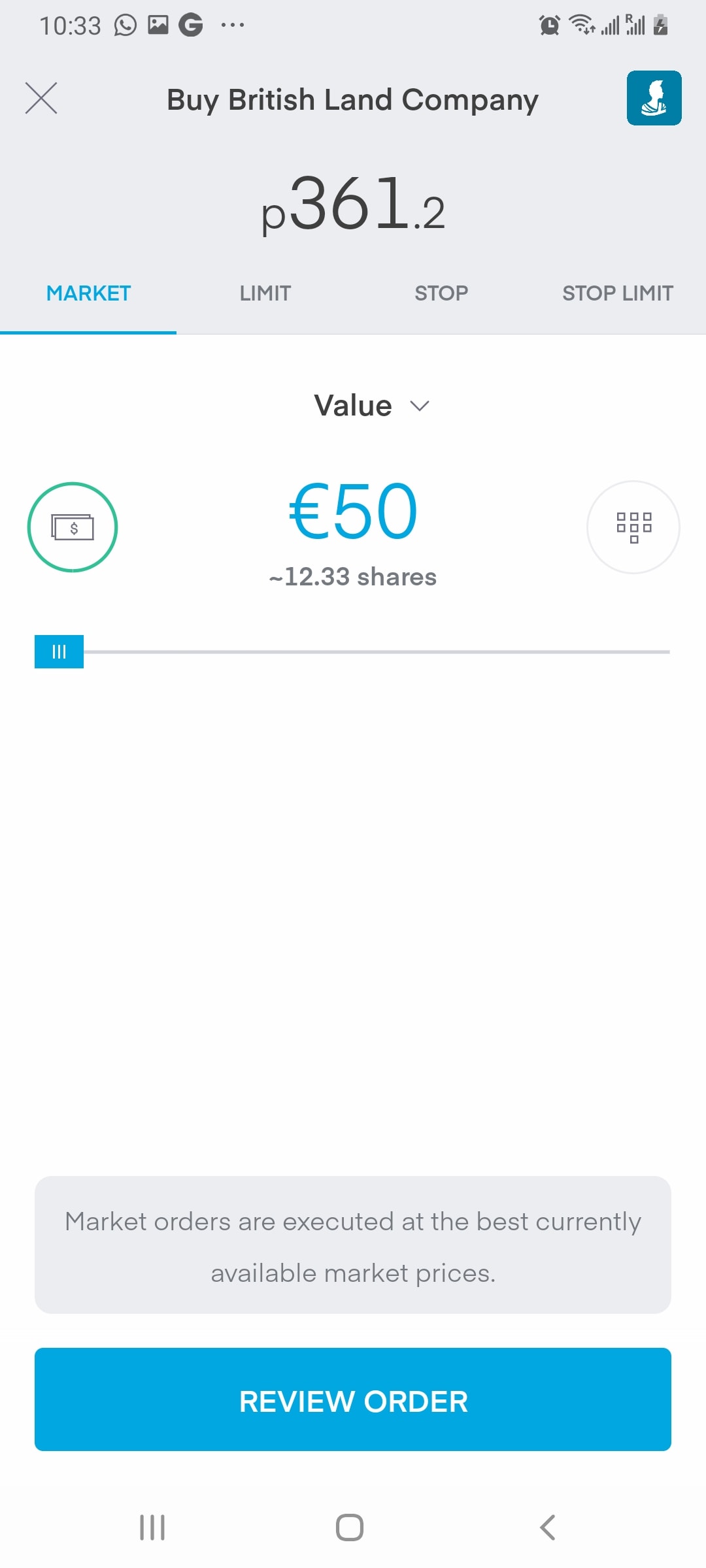

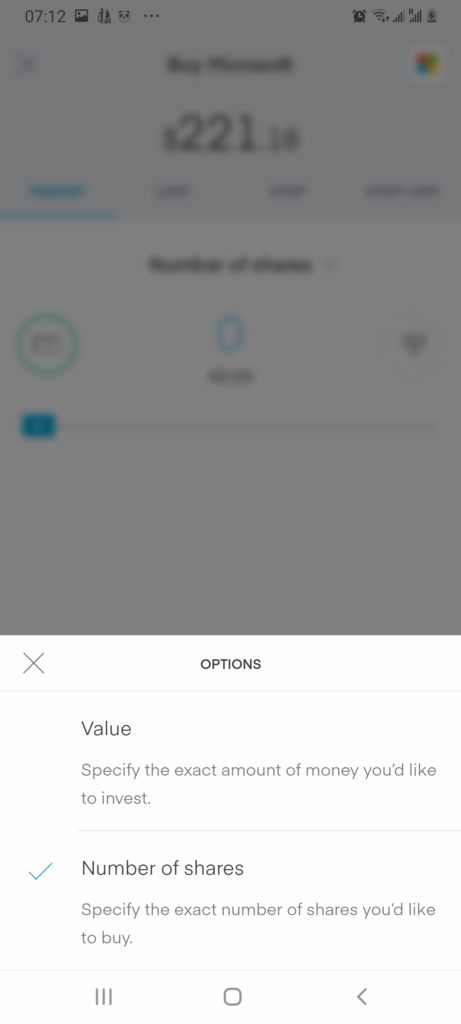

When it comes to placing an order, this couldn’t be easier. All you need to do is determine how much you wish to invest, and then confirm the position before it goes live. You even get to base your investment amount on the number of shares or a fixed value.

For example, if you simply want to invest £50 in IBM shares, the Trading 212 app will ensure that you can do this to the ‘penny’. This is because the broker supports fractional ownership, so there is no need to purchase a full share. Finally, if opting for the CFD Account, you will have no issues performing technical analysis through the app – as everything has been optimized for your specific operating system.

Trading 212 Trading Tools and Features

In this part of our Trading 212 app review, we are going to discuss some of the key tools and features that ensures the provider stands out from the crowd.

Trading 212 Leverage

Leverage allows you to trade stocks and other assets with more money than you have in your account. All clients at Trading 212 are offered leverage, albeit, you will need to open a CFD Account. The specific amount that you will be offered will depend on where you are based.

Crucially, those of you based in the UK and Europe will be restricted by the limits imposed by the European Securities and Markets Authority (ESMA).

For those unaware, ESMA limits stand at:

- 30:1 for major currency pairs

- 20:1 for non-major currency pairs, gold and major indices

- 10:1 for commodities other than gold and non-major equity indices

- 5:1 for individual equities and other reference values

- 2:1 for cryptocurrencies

The only way to get higher limits than this is if you are based in a country that ESMA does not govern.

Short-Selling

The Trading 212 stock app allows you to short-sell companies. This means that you will be speculating on the firm’s share price going down. Much like the aforementioned leverage facilities, you will need to do this via a CFD Account. You can short-sell each and every stock offered by Trading 212 across all 7 exchanges.

Don’t forget, you might incur overnight financing fees when trading CFDs, so short-selling is potentially more suitable for short-term positions. The only exception to this rule is if you expect a major stock market crash. That is to say, if you think that the potential gains will outweigh the expected financing fees, then longer-term short-selling might be worthwhile.

Fractional Shares

As we briefly touched on earlier, the Trading 212 stock app allows you to buy shares and ETFs on a ‘fractional’ basis. Put simply, this means that you are not required to purchase a share in full. This is ideal if you are looking to invest small amounts. In fact, Trading 212 allows you to invest from just £1 into your chosen shares – irrespective of its current stock price.

Let’s take Amazon as a prime example.

- At the time of writing, a single share will cost you over $3,400.

- As most brokers require you to buy at least one share, this means that you would need to fork out $3,400 just to have the opportunity to invest in Amazon.

- However, this isn’t the case at Trading 212.

- For example, let’s say that you decided to invest just $34.

- In doing so, you would own 1/100 of an Amazon share.

Fractional ownership is available on all of the stocks and ETFs offered by the Trading 212 app.

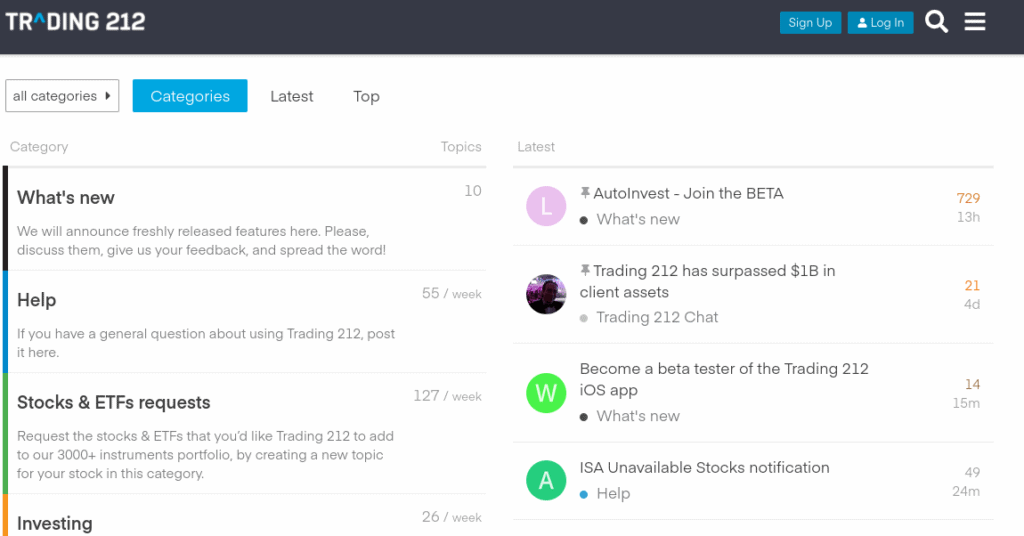

Community Forum

The Trading 212 app also offers a community forum. This allows you to discuss trading ideas and market insights with other investors at the platform.

You can post your own threads, reply to other messages, or simply take a back seat role by seeing what other people comment on. Additionally, the community forum is useful for obtaining assistance.

Trading 212 App Education, Research and Analysis

Whether you’re a newbie investor or an experienced trader – Trading 212 offers several tools that can help you improve your stock market knowledge.

Education

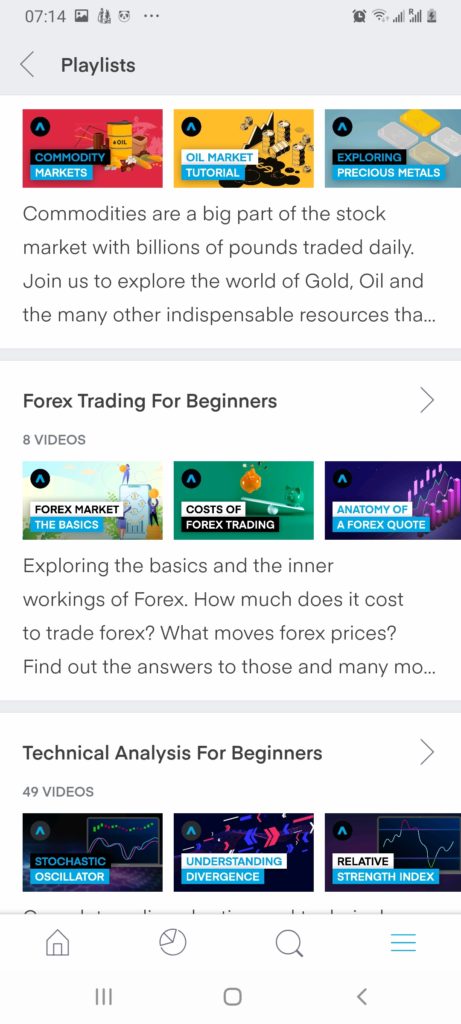

The Trading 212 app comes packed with educational material, which is super-useful if you are just starting out in the world of mobile investing. At the forefront of this is a range of videos that explain key terms.

There are also videos on how to read charts. This includes understanding trends such as the divergence and how to effectively use stochastic oscillators. Additionally, Trading 212 provides several guides that aim to make you a better all-around trader.

Research and Analysis

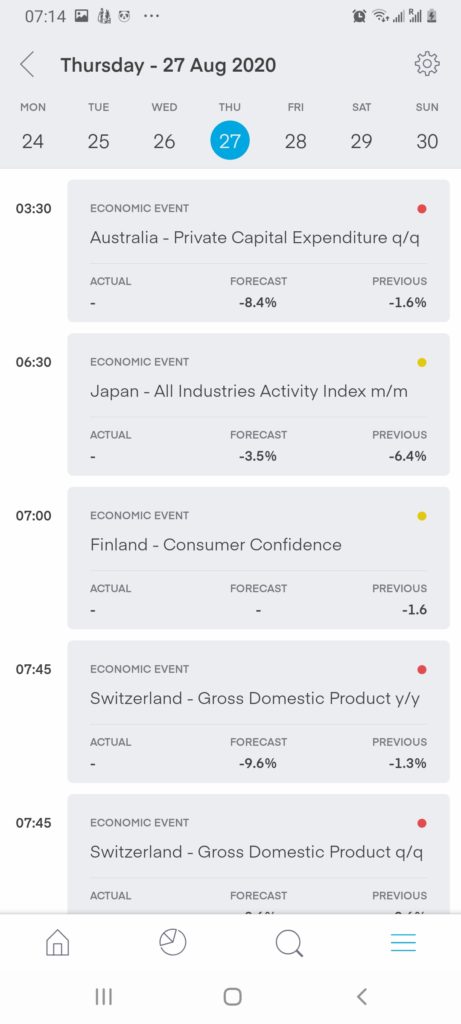

When it comes to analysis, our Trading 212 app review found that it is a bit thin on the ground. You will have access to some economic news stories, but this is somewhat minute in comparison to other stock apps in the space. As such, you will need to get your fundamental updates from an external source.

You will also find an economic calendar, which outlines key dates to look out for with respect to financial reports. Additionally, Trading 212 does offer daily analysis reports on currencies and commodities, which is useful if you are looking to trade CFDs. This includes a brief analysis of how the asset in question traded in the previous session.

Trading 212 App Bonus

Trading 212 does not offer a bonus or sign-up package of any sort. The platform does, however, offer a generous referral program – which you can utilize up to 20 times.

In a nutshell, for each person that joins the Trading 212 platform through your link, you will receive a free stock. The stock will be selected at random and can be valued at as much as $/£ 100. The free stock will be credited to your account 3 days after the user in question has made a deposit.

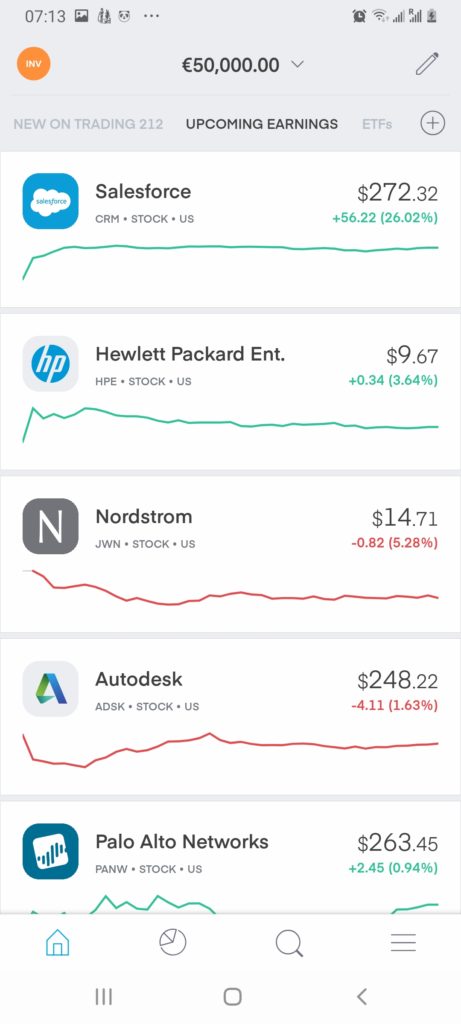

Trading 212 Demo Account

As soon as you download and install the Trading 212 app, you will be asked whether you want to open a real money account or practice via a demo facility. Regarding the latter, this allows you to trade without risking a single penny of your own money. In fact, the demo account comes with a paper money balance of £50,000 – which is more than enough to get to grips with how the app works.

The demo account at Trading 212 excels for several reasons. First and foremost, we like the fact that you are not required to actually open an account. Instead, you can start using the demo facility straight away. We also like that you get to choose from the Invest Account or CFD Account.

This ensures that you get comfortable with both account types before upgrading to a real money account. Crucially, the Trading 212 demo account mirrors that of real market conditions. In other words, whether its stock prices, trading volumes, or liquidity levels – you will be accustomed to the same market activity as if you had a real money account.

Payments on the Trading 212 Stock App

Once you decide to upgrade to a real money account, Trading 212 accepts several payment methods.

Our Trading 212 review found that this includes:

- Bank Transfers

- Credit / Debit Card Payments

- Skrill

- Dotpay

- Giropay

- Carte Bleue

- Direct eBanking

- Apple / Google Pay

- PayPal

- iDEAL

In particular, it is notable that the app is compatible with both Google and Apple Pay. This ensures that you can safely and conveniently deposit funds at the click of a button. Best of all – and irrespective of which payment method you opt for, there are no deposit or withdrawal fees charged by Trading 212.

Trading 212 Minimum Deposit

Trading 212 does not have a minimum deposit policy in place. This is great for those of you that wish to start off with really small amounts. In effect, you only need to deposit £1 – as this is the minimum investment amount when buying stocks and ETFs!

Trading 212 Supported Countries

Although Trading 212 is super-popular in the UK, many of its 500,000+ clients are located in other countries.

Trading 212 Contact and Customer Service

When it comes to customer support at Trading 212, you can send an email to [email protected]. Unfortunately, there is no direct telephone support line or live chat facility.

In fact, when you click on the ‘Help’ button from within the app, you will be re-directed to the Trading 212 FAQ page. Alternatively, you might consider asking for help in the community forum – which was discussed in more detail earlier.

Is Trading 212 Safe?

Put simply, Trading 212 is completely safe. The broker was first launched in 2013 and has since amassed a loyal customer base of over 500,000 traders. Crucially, the app is regulated by the Financial Conduct Authority (FCA). This is the licensing body responsible for regulating the multi-trillion pound UK financial services sector.

By holding an FCA license, the Trading 212 app is required to keep client money in segregated bank accounts. In theory, this should protect your funds in the event of a brokerage collapse. An FCA license also means that all new accounts must be verified with a government-issued ID, and the risks of trading must be clearly presented.

Additionally, Trading 212 keeps all client funds in a UK bank account that is protected by the FSCS. This means that each deposit is covered by up to £85,000. You will, however, need to be based in the UK to benefit from this.

How to Use the Trading 212 App

If you want to benefit from commission-free trading and a minimum investment policy of just £1 – we are now going to show you how to get started with Trading 212 today!

Simply follow the steps of this Trading 212 app tutorial to set up an account and begin trading.

How to Sell on Trading 212 App

Much like the process of making an investment at Trading 212, selling stocks is super-easy. All you need to do is head over to your portfolio via the app, and click on the ‘Sell’ button. You will be asked if you want to sell all of your shares, or a select amount. As soon as you submit the sell order, the funds will be placed back into your cash account.

Trading 212 Stock App Pros & Cons

Below you will find an overview of our Trading 212 stock app findings.

- No commissions charged when buying or trading on the app

- No monthly/annual maintenance fees

- Over 4,000+ stocks and ETFs to invest in

- CFDs supported – including forex, indices, cryptocurrencies, and commodities

- No foreign exchange fee when using the Invest Account

- ISA Accounts supported for UK investors

- Regulated by the FCA

- Very user-friendly app

- 0.5% fee when trading CFD instruments that are priced in a different currency to your own

- Analysis department is too basic

The Verdict

In summary, although Trading 212 is a stock market app that you might not have heard of – the provider certainly stands out from the crowd. After all, you will be able to buy stocks and ETFs without paying any commission, and no maintenance fees are charged. Its commission-free offering is also available when trading CFDs.

We like the fact that there is no minimum deposit in place, and that you can invest from just £1. There are lots of supported payment methods, too – all of which are fee-free.