Robinhood Alternatives – Best Alternative Stock Apps 2026

Robinhood – the US-based retail stock app with over 13 million clients, is facing a significant number of lawsuits in response to the GameStop and AMC saga.

Put simply, the online broker restricted buy markets on the aforementioned stocks as per a parabolic price upswing that was fueled by Reddit forum WallStreetBets.

Like many, you might be on the lookout for a Robinhood alternative. With hundreds of stock apps now offering super-competitive commissions and low account minimums, there’s plenty of choice on the table.

In this guide, we review the best Robinhood alternatives that 2026 has to offer.

-

- 1. Stash – User-Friendly Stock App With Low Account Minimums

- 2. Webull – Commission-Free Robinhood Alternative for Buying US Stocks

- 3. TD Ameritrade – Best Robinhood Alternative for Asset Diversity

- 4. E*Trade – Best Robinhood Alternative for Automated Investment Management

- 5. Fidelity – Best Robinhood Alternative for Long-Term Investors

-

- 1. Stash – User-Friendly Stock App With Low Account Minimums

- 2. Webull – Commission-Free Robinhood Alternative for Buying US Stocks

- 3. TD Ameritrade – Best Robinhood Alternative for Asset Diversity

- 4. E*Trade – Best Robinhood Alternative for Automated Investment Management

- 5. Fidelity – Best Robinhood Alternative for Long-Term Investors

Best Robinhood Alternatives 2026

Here’s a quick overview of the best Robinhood app alternatives that you might want to consider. You can read a full review of each stock app by scrolling down!

- Stash – User-Friendly Stock App With Low Account Minimums

- Webull – Commission-Free Robinhood Alternative for Buying US Stocks

- TD Ameritrade – Best Robinhood Alternative for Asset Diversity

- E*Trade – Best Robinhood Alternative for Automated Investment Management

- Fidelity – Best Robinhood Alternative for Long-Term Investors

Best Robinhood Alternative Reviewed

A lot of Americans turn to Robinhood because it offers a simple and cost-effective way to access the stock markets. However, Robinhood isn’t the only stock app in the industry that allows you to trade stocks, options, and cryptocurrencies at the click of a button. On the contrary, there are plenty of great Robinhood alternatives that in many cases – offer a better all-round service.

Below you will find the best Robonbhood alternatives of 2026 and beyond.

1. Stash – User-Friendly Stock App With Low Account Minimums

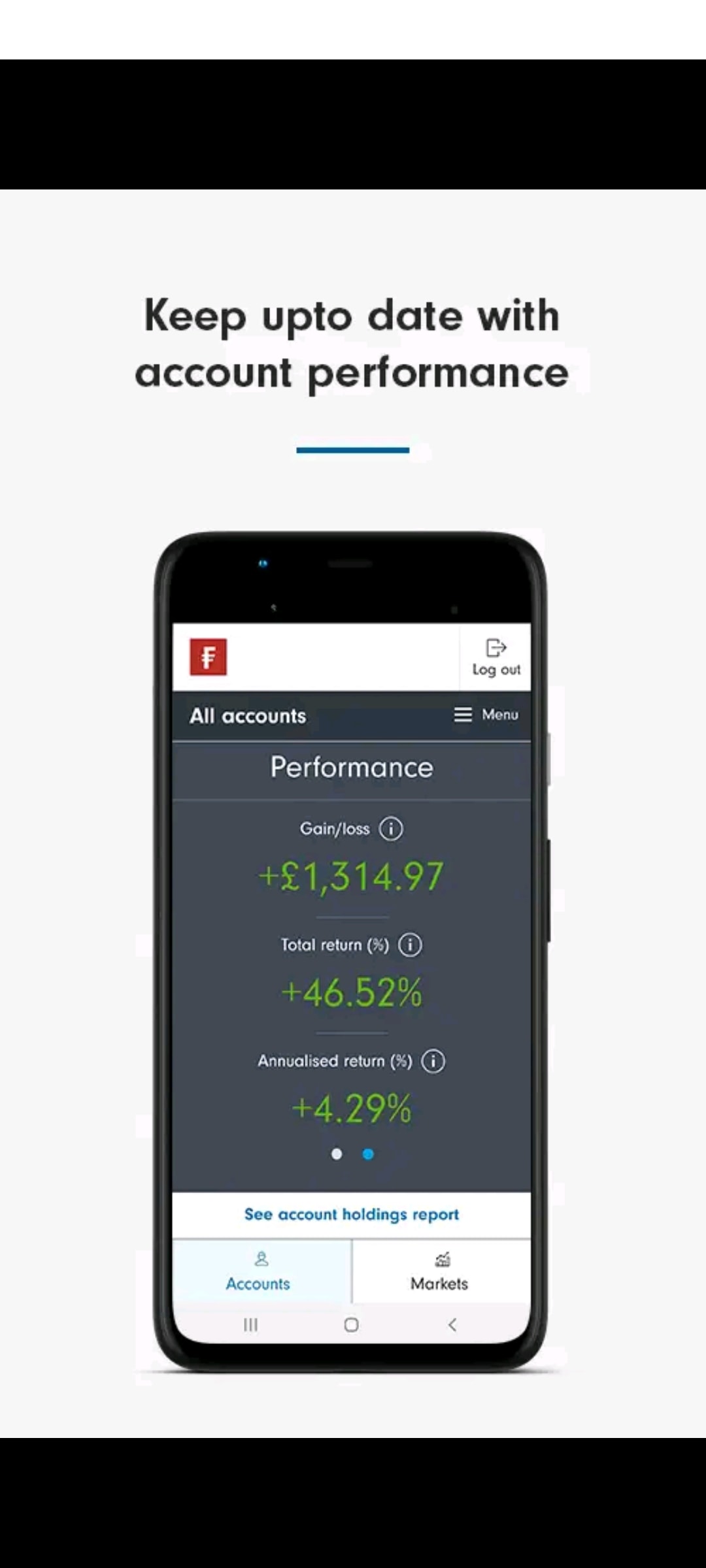

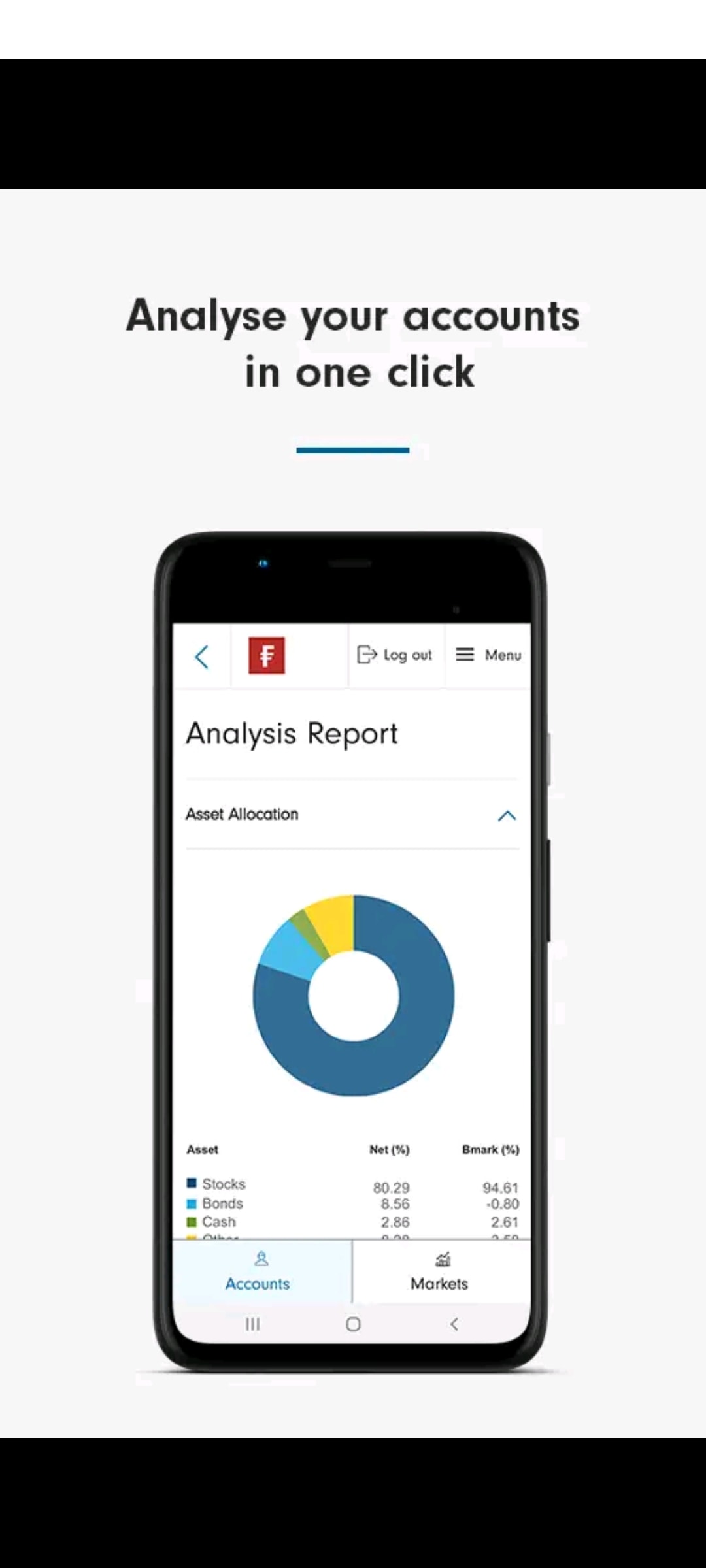

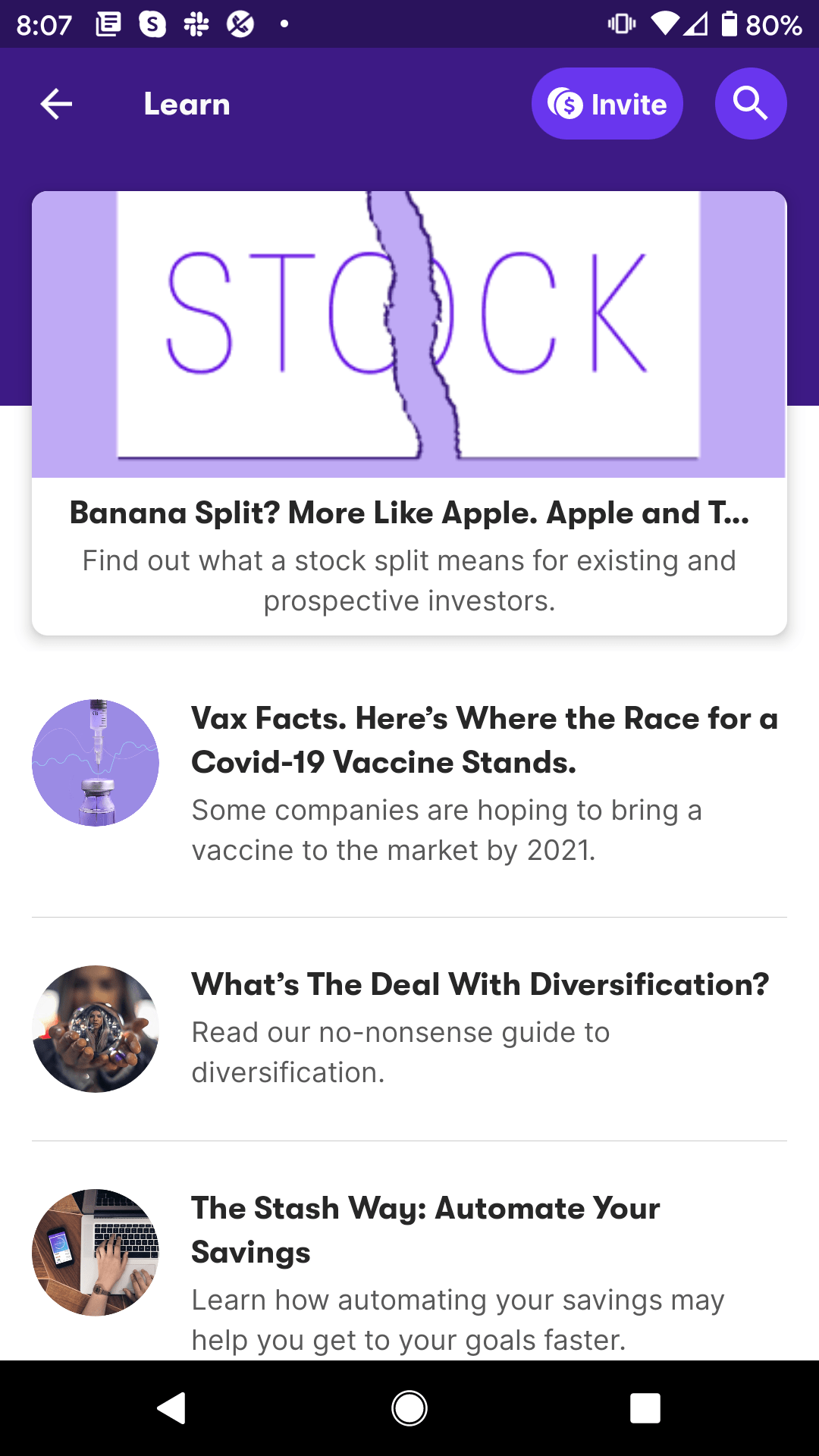

With a super user-friendly interface that has been fully optimized for both Android and iOS devices, even newbies will find the Stash app investment process a breeze. In terms of what you can trade,

Stash offers more than 1,200 stocks and ETFs. Much like Webull, this focuses on US-listed assets found on both the NASDAQ and NYSE. Stash is also a great Robinhood alternative if you want to invest with really small amounts. Not only is there no minimum account balance, but the stock app supports fractional shares.

This means that you can invest just a few dollars into companies like Amazon, Apple, and Tesla. On the flip side, there is a very small monthly payment of just $1 to use Stash. If you want to benefit from the app’s Roth IRA offering, your monthly fee will increase to $3.

An additional feature that we really like with this Robinhood alternative is the dividend reinvestment tool. This allows you to automatically reinvest stock and ETF dividends, which is great for creating a long-term investment plan that is amplified by compound interest.

Still not convinced about the Stash app? Read our comprehensive Stash review to find out more about what this great Robinhood alternative offers

Pros

- No minimum deposit

- Offers fractional stock

- More than 1,200+ stocks and ETFs

- Best-suited for newbie traders

- Heavily regulated

- Avialable on both iOS and Android

- Lots of educational resources

Cons

- Monthly fee of between $1 and $9 depending account type

- Does not support instant deposits with a debit/credit card or e-wallet

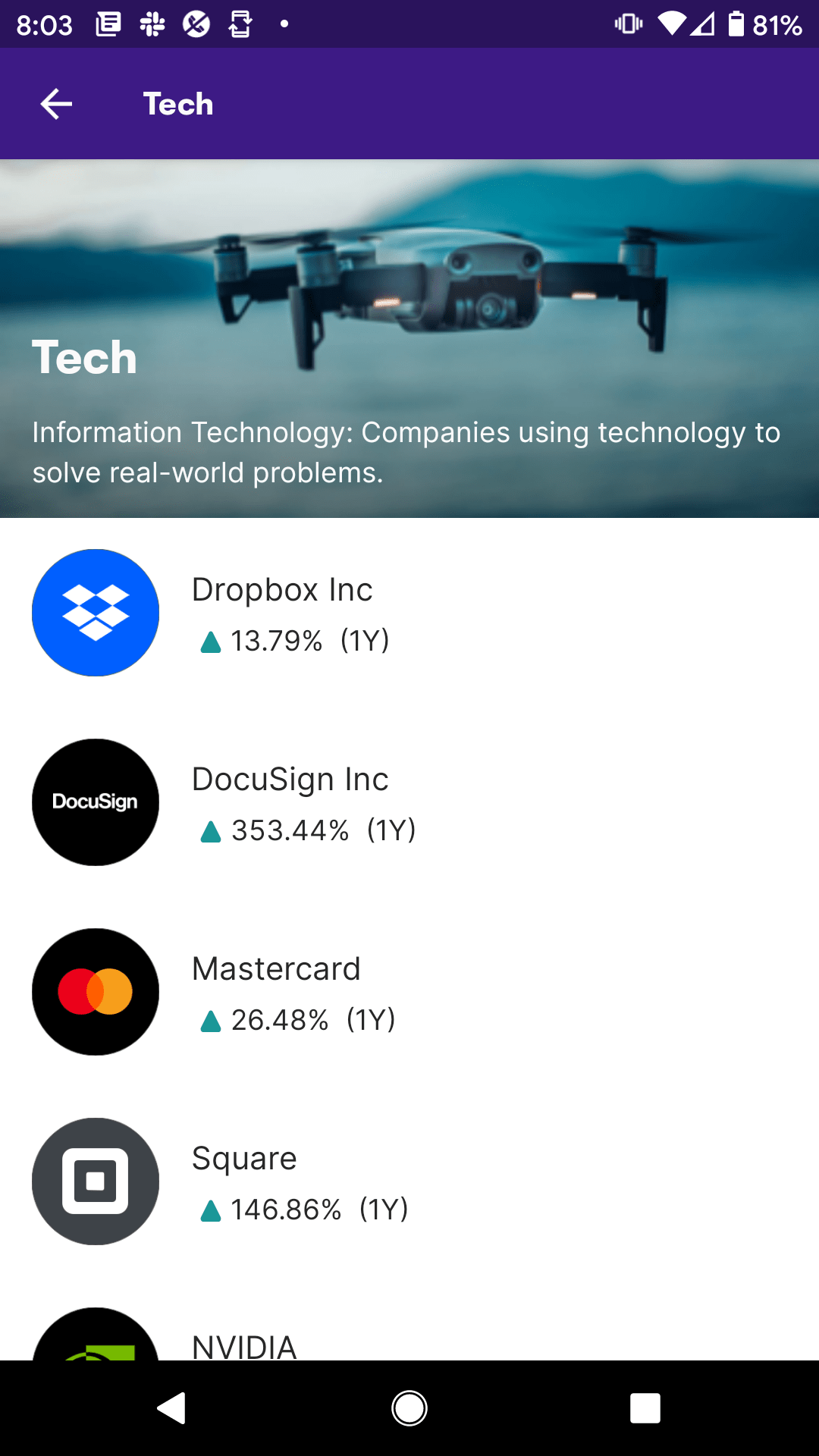

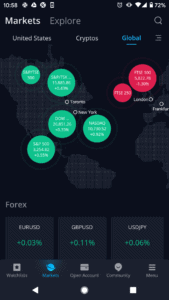

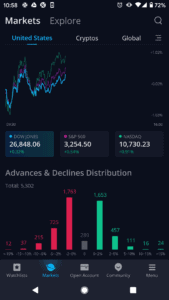

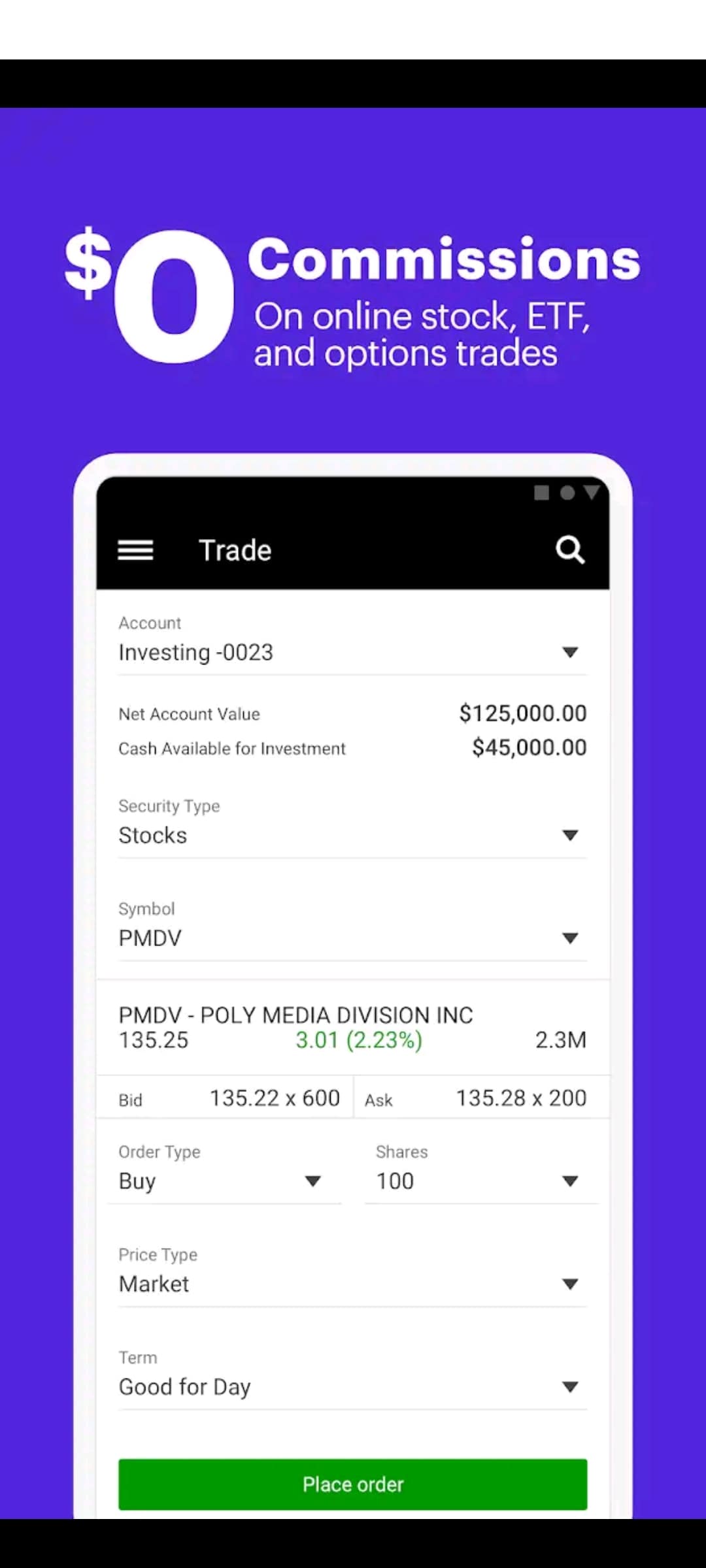

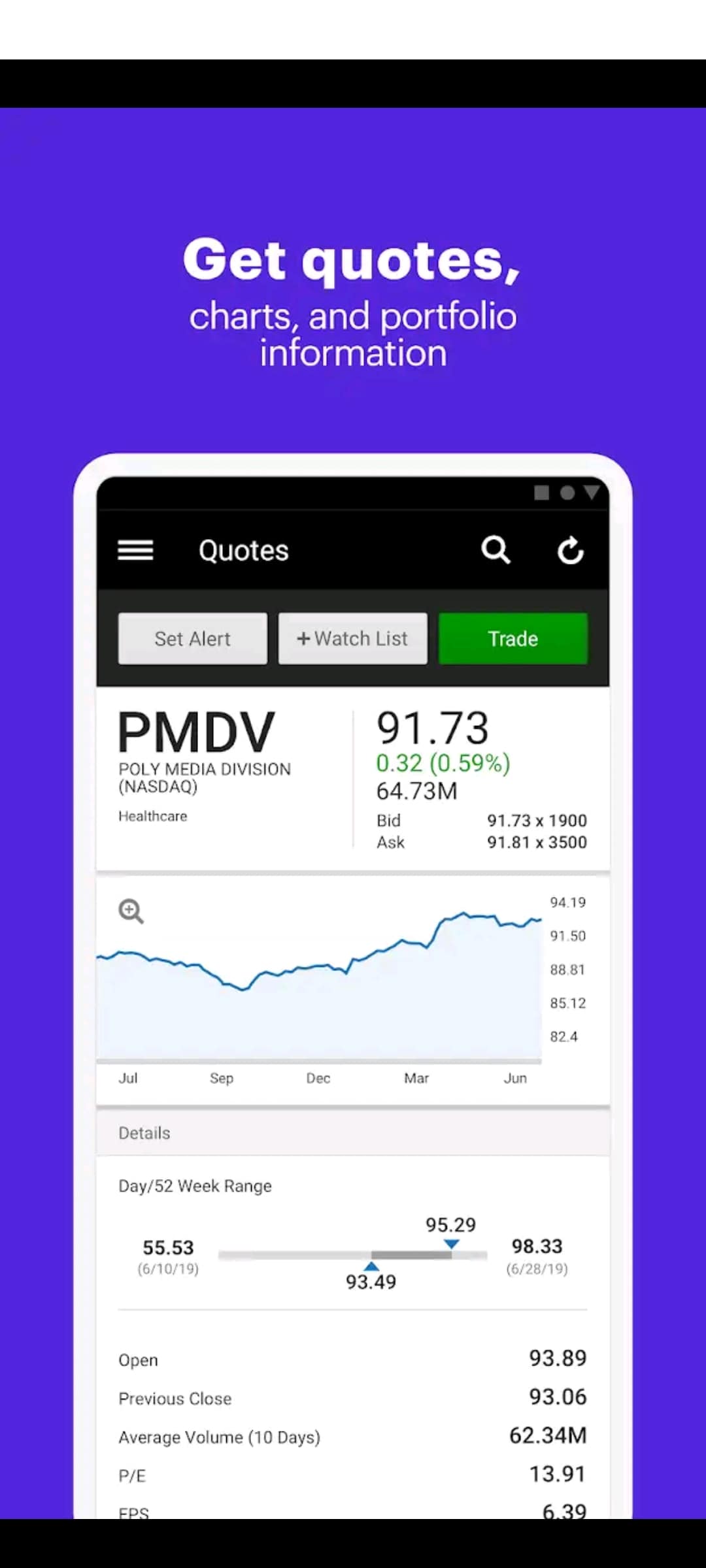

2. Webull – Commission-Free Robinhood Alternative for Buying US Stocks

Next up on our list of the best Robinhood alternatives is Webull. This user-friendly stock trading app gives you access to an abundance of US-listed shares. Much like eToro, the provider will not charge you any commissions when you buy and sell stocks. This is also the case with its library of ETFs, which again, are all US-listed.

Webull does fall short when it comes to international stocks, so the app is best suited if you are happy to focus exclusively on the NYSE and NASDAQ. This Robinhood alternative also allows you to trade stock options, which will suit those of you with a bit of experience under your belt.

Additionally, the Webull app also allows you to buy and sell Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. once again, both stock options and cryptocurrencies can be traded commission-free at Webull. This popular stock app also allows you to trade with margin. This stands at a maximum of 4x, meaning a $2,000 deposit would get you $8,000 in purchasing power.

Webull also supports short-selling, which is ideal if you want to speculate on the value of a stock going down. In terms of reputation, Webull has excellent ratings on both the Apple and Android stores. This stands at 4.7/5 and 4.5/5, respective – which is across more than 140,000 individual reviews. Perhaps the biggest drawback is that Webull only supports bank transfers.

Although ACH is free, wire transactions cost $8 for deposits and $25 for withdrawals. Finally, as a US-based broker, you’ll want no issues when it comes to safety. Webull is authorized by FINRA and the SEC, and you’ll also benefit from the safety net of the SIPC.

Still not convinced about the Webull stock trading app? Read our comprehensive Webull app review to find out more about what this great Robinhood alternative offers.

Pros

- Commission-free trading

- Global stock, ETF, options, and crypto trading

- Includes highly advanced technical charts

- Fully customizable indicators

- Set up unlimited watchlists and complex alerts

- Includes basic social network and analyst recommendations

- Highly regulated in the US

Cons

- Only available to US traders

- No forex or commodity CFD trading

- Payments are only by bank or wire transfer

- Limited educational resources

- Less than optimal customer support

75% of retail investors lose money trading CFDs at this site.

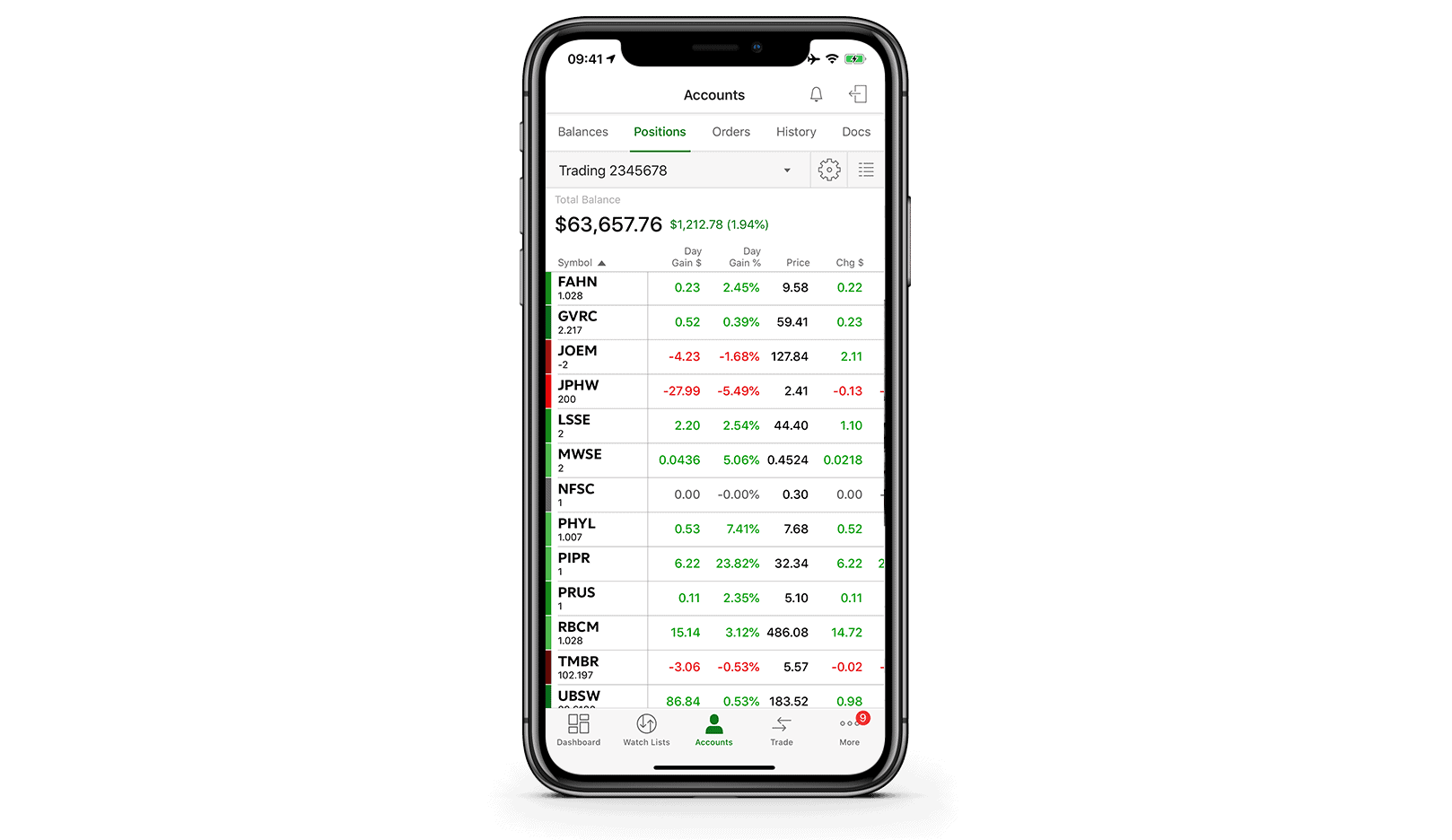

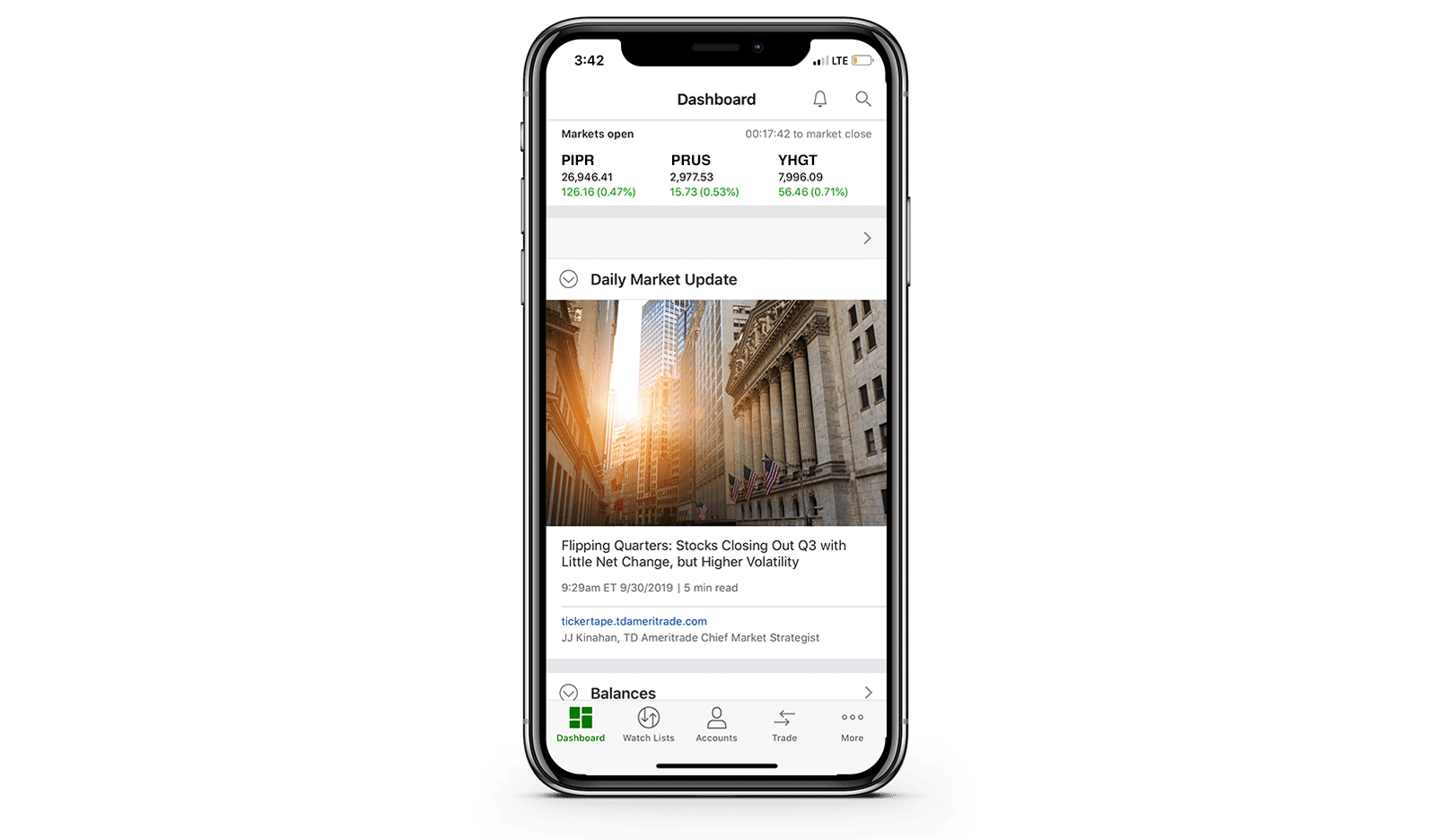

3. TD Ameritrade – Best Robinhood Alternative for Asset Diversity

TD Ameritrade is an old-school broker that has since joined the retail investment craze. Crucially, this popular stock app now allows you to buy and sell US-listed shares on a commission-free basis. This is also the case with US-listed ETFs.

With that said, you might want to consider this Robinhood alternative if you are looking to build a super-diverse portfolio of assets. This is because TD Ameritrade offers thousands of stocks from dozens of US and international marketplaces as well as being a best paper trading app, if you’re looking for an app that offers a full paper trading account.

It also offers thousands of investment funds alongside a fully-fledged forex and cryptocurrency trading facility. TD Ameritrade is also popular with stock options traders, not least because it charges just $0.65 per contract with no exercise fee.

We also like this Robinhood alternative for its in-depth research and analysis tools. This covers an abundance of financial news resources and advanced chart reading features. In terms of funding your own, TD Ameritrade only supports bank transfers. But, there is no minimum account balance requires and bank transfers can be made fee-free.

Pros

- Trusted US brokerage firm

- App is available on iOS and Android devices

- Buy stocks and ETFs commission-free

- Options can be traded at just $0.65 per contract

- Fully-fledged paper trading account

- More than 11,000 mutual to choose from

- No account minimum

Cons

- Not as user-friendly as other investing apps in the market

- The sheer size of tradable markets on offer can appear overwhelming

There is no guarantee you will make money with this provider.

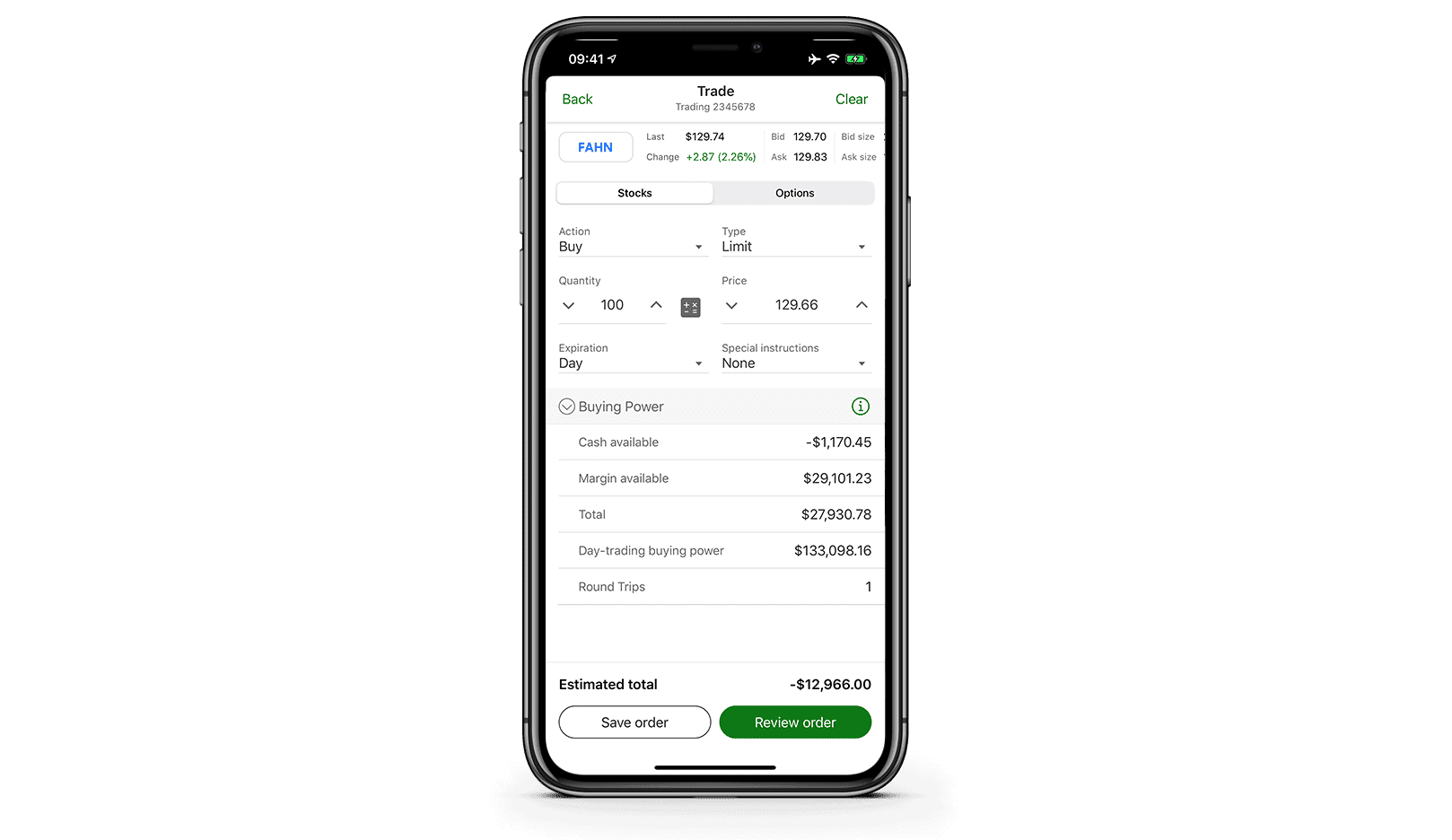

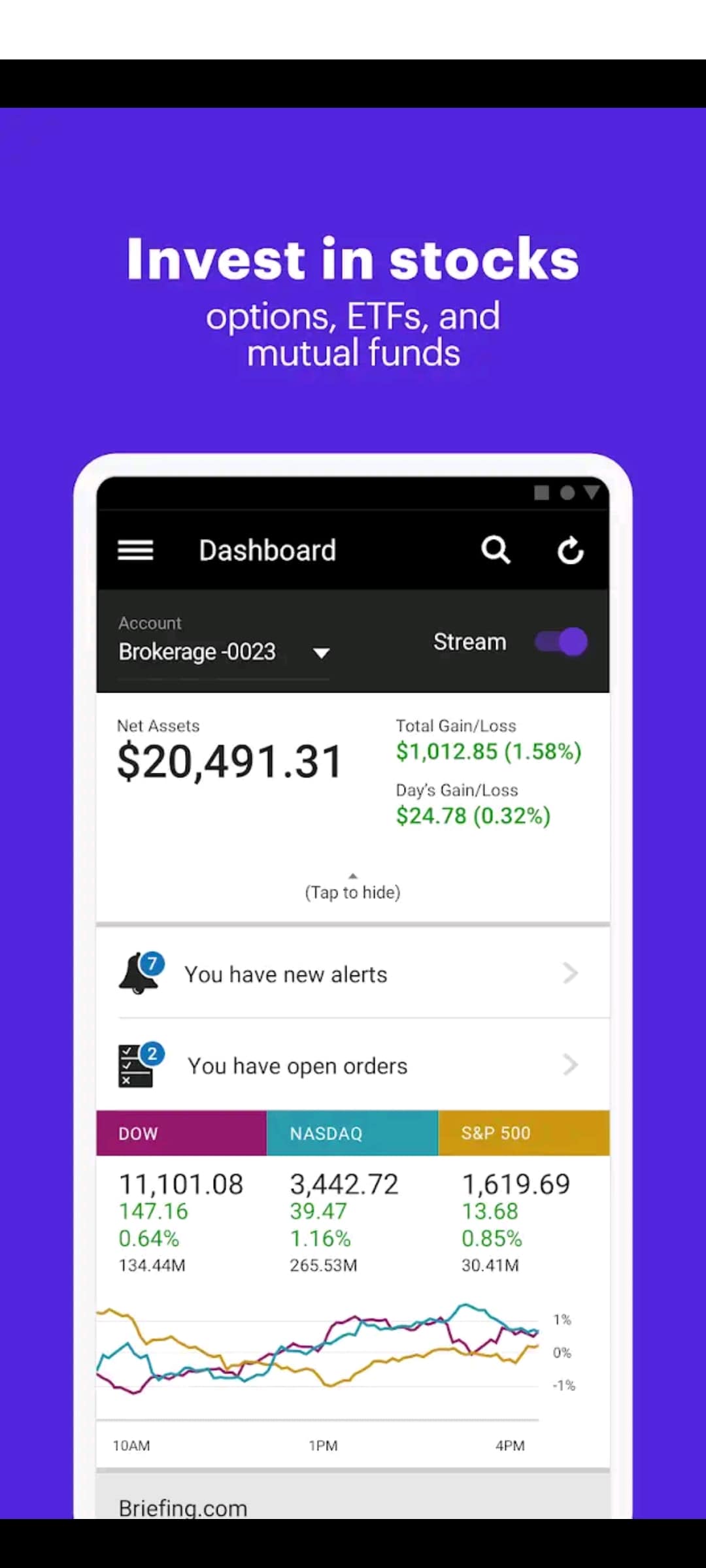

4. E*Trade – Best Robinhood Alternative for Automated Investment Management

Either way, E*Trade is one of the best Robinhood alternatives if you are seeking automated investment management. Launched way back in 1982, E*Trade is a retail investment platform that allows you to trade online and via a native mobile app. By meeting a modest minimum investment of $500, this top-rated online brokerage will build a ready-made portfolio for you.

The assets that are added to your portfolio will be determined based on your financial goals and attitude to risk. After that, the team of in-house traders at E*Trade will monitor your portfolio for you – ensuring that assets are rebalanced and reweighted when need. Although this will cost you 0.30% in management fees, it’s worth remembering that you won’t need to lift a finger.

Instead, you can sit back and allow E*Trade to manage your money for you. With that being said, E*Trade also offers a huge library of assets that you can add to your portfolio at the click of a button. For example, it offers thousands of US-listed stocks and ETFs – all of which can be purchased and sold without paying any commission.

This great Robinhood alternative also gives you access to stock options, it’s one of the best mutual fund apps, as well as giving you access to futures and bonds. In terms of deposits, there is no minimum account balance in place when you open a non-margin account. If you want to trade on margin, this requires a minimum of $2,000 as per US securities laws. The easiest way to fund your account is via a bank transfer – which is fee-free.

Pros

- Trade US stocks and ETFs commission-free

- Wide range of alternative assets including bonds, futures, and stock options

- No minimum deposit

- Great selection of automated investment strategies

- Margin available

- Perfect for those seeking passive investment products

Cons

- Not suitable for short-term traders

- No debit/credit cards supported

There is no guarantee you will make money with this provider.

5. Fidelity – Best Robinhood Alternative for Long-Term Investors

If you’re the type of trader that is looking to create a long-term investment plan, Fidelity is a great Robinhood alternative to consider. You will have access to a wide variety of long-term investment products – including stocks, ETFs, and mutual funds.

In fact, these asset classes can be purchased from 25 US and international marketplaces. To amplify your long-term investment strategy, Fidelity also offers retirement accounts. This covers IRAs, annuities, and even life insurance.

If you are planning to perform research on a regular basis, this Robinhood alternative offers a highly comprehensive analysis department. This covers financial news, market insights, and general investor sentiment. In terms of trading fees, Fidelity has joined the commission-free phenomenon on US-listed stocks. This is also the case with domestic options and ETFs.

As Fidelity is looking to attract long-term investors, it charges a rather excessive commission of $49.95 if you sell a fund investment within 60 days. As such, this top-rated Robonhood alternative is best for those of you looking to deploy a long-term buy and hold strategy. Finally, there is no minimum deposit at Fidelity.

Pros

- Great selection of long-term investment products

- Access US-listed stocks, ETFs, and options commission-free

- Covers thousands of markets in 25 different countries

- Excellent reputation and heavily regulated

- No minimum account balance

- Top-rated research and educational materials

- Advanced analysis tools available for seasoned pros

Cons

- Account opening process can be slow

- No debit card deposits/withdrawals

Your capital is at risk.

Why are Traders Looking for Robinhood Alternatives?

There are several reasons why you might be looking for the best Robinhood alternatives of 2026 and beyond. At present, much of this is a focus on the recent GameStop, which we cover in more detail below.

Robinhood and GameStop Shares

GameStop – the US-based video game retailer, made international headlines in January 2020. In a nutshell, a group of Reddit users – via the subforum WallStreetBets, collectively decided to go ‘all-in’ on the struggling stock. They did this by purchasing shares of GameStop in their droves.

One of the main justifications for this was that several multi-billion dollar hedge funds were ‘shorting’ GameStop stocks at the rate of knots. In fact, it is widely believed that hedge funds collectively had short positions worth 150% of floating shares.

- This means that the hedge funds were so aggressive with their attempt to bring the video game retailer down that they were ‘shorting the short positions’.

- To the dismay of the wider markets, those behind WallStreetBets were able to push GameStop shares from just $17 at the turn of January 2020 to a peak of $483 by the end of the month.

- This represents a 4-week upsurge of over $2,741.

So how does this relate to Robinhood? Well, alongside a number of other retail investment platforms, Robinhood decided to ‘temporarily’ halt new GameStop stock purchases. In turn, this has led to waves of lawsuits against the broker – with claimants arguing that Robinhood is itself involved in market manipulation by preventing access to the stocks.

As such, many investors – particularly those in the US, are now looking for a Robinhood alternative in protest.

Lack of International Stocks

It is important to note that the GameStop saga isn’t the only reason why people are looking for the best Robinhood alternatives. On the contrary, other metrics – such as a lack of access to international stocks, is playing a part.

Sure, the platform does allow you to buy and sell 250-ish non-US stocks, but this is far from extensive. Plus, even if your chosen international stock is listed by Robinhood, you will be making a purchase via an American Depositary Receipt (ADR).

Ultimately, there are plenty of alternatives to Robinhood – such as those listed on this page, that allow you to invest in thousands of international stocks from dozens of marketplaces.

No Copy Trading Tools

Another drawback of Robinhood is that it does not offer Copy Trading tools.

You will have access to thousands of verified investors that part of the Copy Trading program, meaning you can elect to copy someone that mirrors your financial goals.

Crucially, every time the trader enters or exits a position, the same trade will be echoed in your own account. This is great for those of you that want to actively trade but don’t have the time or financial know-how.

Poor Customer Support

With more than 13 million brokerage account holders under its belt, you would expect Robinhood to offer world-class customer service. However, this couldn’t be further from the truth.

Even to this day, the platform only offers support via email.

Other alternatives to Robinhood that we have discussed on this page also offer a telephone support line.

Best Robinhood Alternative – Conclusion

With more and more people now searching for the best Robinhood alternatives, this page has presented a selection of top-rated platforms to consider. Whether you are looking for a cheaper provider, access to international assets, or you are simply looking to leave Robinhood in protest – there is sure to be a stock trading app that meets your needs.

FAQs

Is there anything better than Robinhood?

Yes! There are plenty of Robinhood alternatives that offer free trades on stocks, ETFs, and more. eToro, for example, offers heaps of financial markets that can be traded without you needing to pay a cent in fees.

Is Webull better than Robinhood?

Both Webull and Robinhood allow you to buy US-listed stocks and ETFs commission-free. With that said, Webull is more user-friendly than Robinhood – making it a great choice for beginners.

How does Robinhood make money?

As a commission free stock trading platform, Robinhood makes money in other areas. This includes a premium ‘Gold’ account, spreads, and margin fees.

Does Robinhood offer international stocks?

Yes, but the platform only offers 250-ish international stocks. These are offered via American Depositary Receipt (ADR), so you also need to bear this in mind. This is why many traders are looking for Robinhood alternatives, as they seek a more diversified portfolio of assets.

Can you buy mutual funds on Robinhood?

No, Robinhood does not offer mutual funds. There are many Robinhood alternatives that do though – such as those listed on this page.

What is the best Robinhood alternative for cryptocurrencies?

If you’re looking for the best Robinhood alternative for digital currencies like Bitcoin, eToro is your best bet. The platform – which is registered with FINRA and regulated by the FCA, CySEC, and ASIC, allows you to buy and sell 16 cryptocurrencies commission-free.

Kane Pepi

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane Pepi

stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2026

If you’re the type of trader that is looking to create a long-term investment plan, Fidelity is a great Robinhood alternative to consider. You will have access to a wide variety of long-term investment products – including stocks, ETFs, and mutual funds.

If you’re the type of trader that is looking to create a long-term investment plan, Fidelity is a great Robinhood alternative to consider. You will have access to a wide variety of long-term investment products – including stocks, ETFs, and mutual funds.