Best Mutual Fund Apps 2025

Looking to invest in the financial markets but don’t have the time or knowledge to pick individual assets? Then it’s well worth considering a mutual fund app. In doing so, your chosen mutual fund provider will invest on your behalf – allowing you to earn both capital gains and dividends. In this guide, we review the best mutual fund apps for 2025 and walk you through the process of making an investment today.

-

- 1. Charles Schwab – Best Mutual Fund App for Customizable Investments

- 2. E*Trade – Innovative Mutual Fund App with Industry-Standard Features

- 3. Ally Invest – Best Mutual Funds App for Zero Commission on No-load Fund

- 4. Fidelity – Best Mutual Fund App for 0% Fees

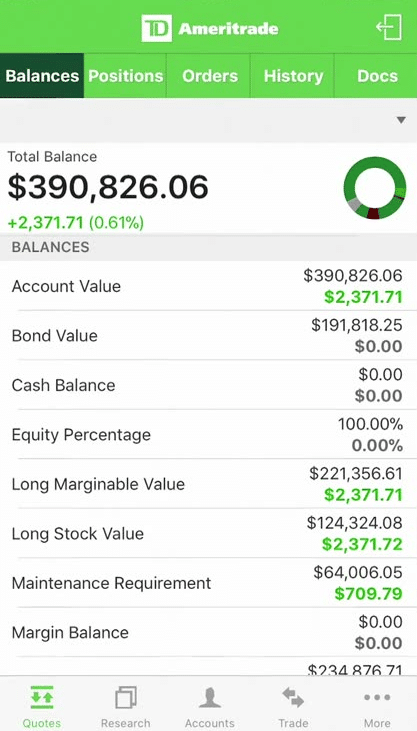

- 5. TD Ameritrade – Best Mutual Fund App for Research and Analysis

- 6. Interactive Brokers – Best Mutual Fund App for Global Investments

- 7. Vanguard Group – Best Mutual Fund App for Passive Index Funds

- 8. Merrill Edge – Best Mutual Fund App with Brokerage and Banking Services

- 9. Firstrade – Best Mutual Fund App with a Low Maintenance Portfolio

-

- 1. Charles Schwab – Best Mutual Fund App for Customizable Investments

- 2. E*Trade – Innovative Mutual Fund App with Industry-Standard Features

- 3. Ally Invest – Best Mutual Funds App for Zero Commission on No-load Fund

- 4. Fidelity – Best Mutual Fund App for 0% Fees

- 5. TD Ameritrade – Best Mutual Fund App for Research and Analysis

- 6. Interactive Brokers – Best Mutual Fund App for Global Investments

- 7. Vanguard Group – Best Mutual Fund App for Passive Index Funds

- 8. Merrill Edge – Best Mutual Fund App with Brokerage and Banking Services

- 9. Firstrade – Best Mutual Fund App with a Low Maintenance Portfolio

Top Mutual Fund Apps 2025

Below, you will find the best mutual fund apps in the market right now. Be sure to scroll down and read our comprehensive review of each app provider before signing up!

- Charles Schwab – Best Mutual Fund App for Customizable Investments

- E*Trade – Innovative Mutual Fund App with Industry-Standard Features

- Ally Invest – Best Mutual Funds App for Zero Commission on No-load Fund

- Fidelity – Best Mutual Fund App for 0% Fees

- TD Ameritrade – Best Mutual Fund App for Research and Analysis

- Interactive Brokers – Best Mutual Fund App for Global Investments

- Vanguard Group – Best Mutual Fund App for Passive Index Funds

- Merrill Edge – Best Mutual Fund App with Brokerage and Banking Services

- Firstrade – Best Mutual Fund App with a Low Maintenance Portfolio

Best Mutual Fund Apps Reviewed

When searching for the best mutual fund apps for your needs – there are several core metrics that you need to explore.

For example, not only does the app need to offer the mutual fund that you wish to invest in, but you also need to assess what fees and ongoing commissions you will need to pay. You then need to look at factors like regulation, usability, and research tools.

To help clear the mist, below we review the best mutual fund apps for 2025 and beyond.

1. Charles Schwab – Best Mutual Fund App for Customizable Investments

Even though Charles Schwab is primarily recognized as a reliable brokerage firm, it also offers a diverse range of mutual funds well-suited for long-term goals. Charles Schwab’s mutual funds provide an opportunity to construct a cost-effective and top-notch investment portfolio suitable for investors.

The Schwab app provides access to over 8,000 mutual funds and offers some of the most competitive expense ratios through its range of index funds and ETFs. Over 2,400 funds available on Schwab’s platform have expense ratios of 0.50% or less.

When investing in mutual funds through the investment tool, there are two primary fees: expense and transaction fees. You can invest in mutual funds from the Schwab Mutual Fund OneSource Select List to avoid transaction fees. However, you may be charged up to $49.95 for other mutual fund trades.

The trading app offers solutions for customers interested in socially responsible investments (SRI). Through Schwab’s advanced mutual fund and ETF screeners, customers can utilize an SRI filter to create personalized searches that narrow their results to include certain investments.

Pros:

- No commission fees for stock, ETF, and options trades.

- No transaction fees for over 3,400 mutual funds.

- Abundant educational tools and resources.

- 24/7 customer service.

- Over 100 brick-and-mortar branches across the U.S.

Cons:

- Small cash sweep rate for uninvested funds.

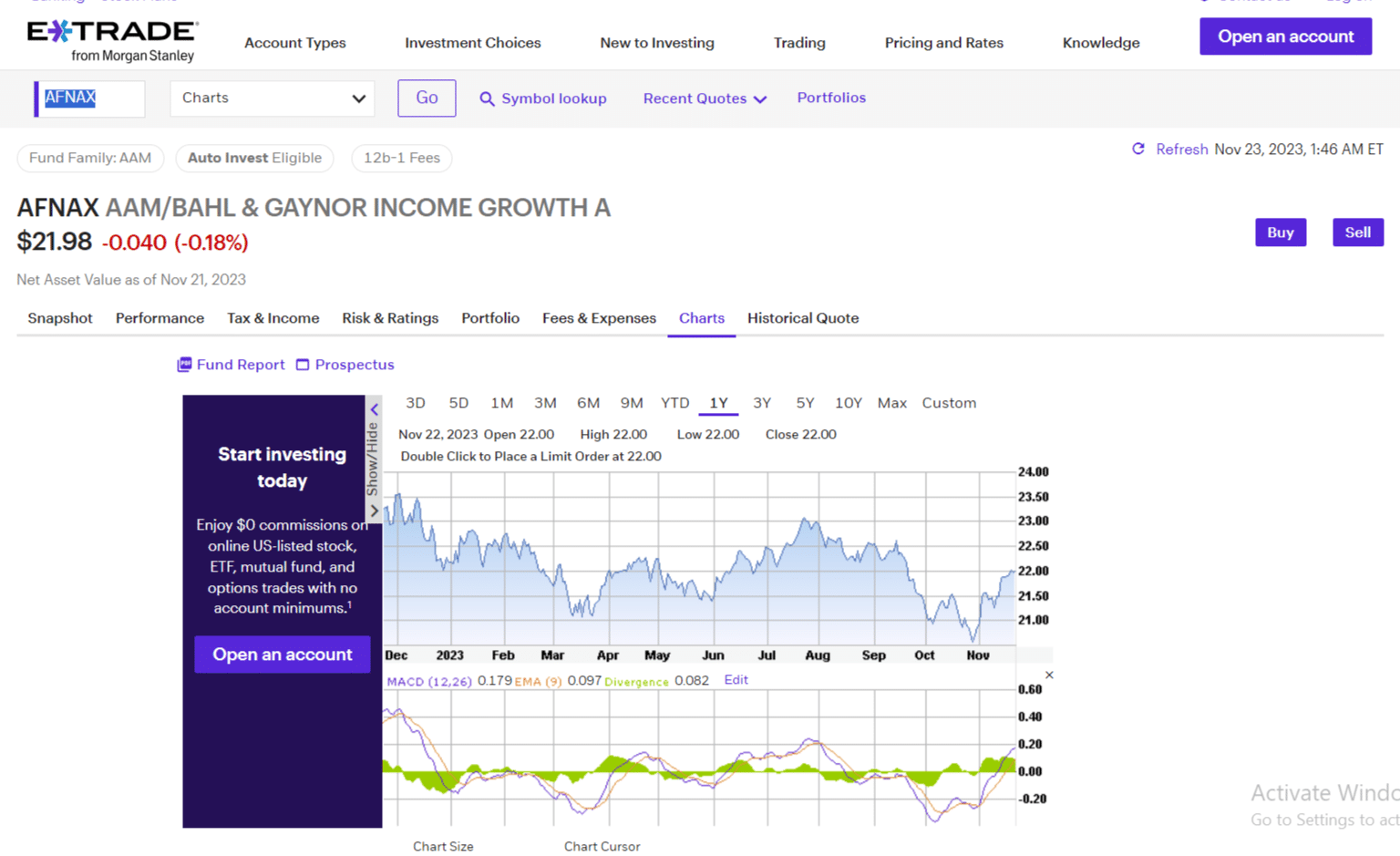

2. E*Trade – Innovative Mutual Fund App with Industry-Standard Features

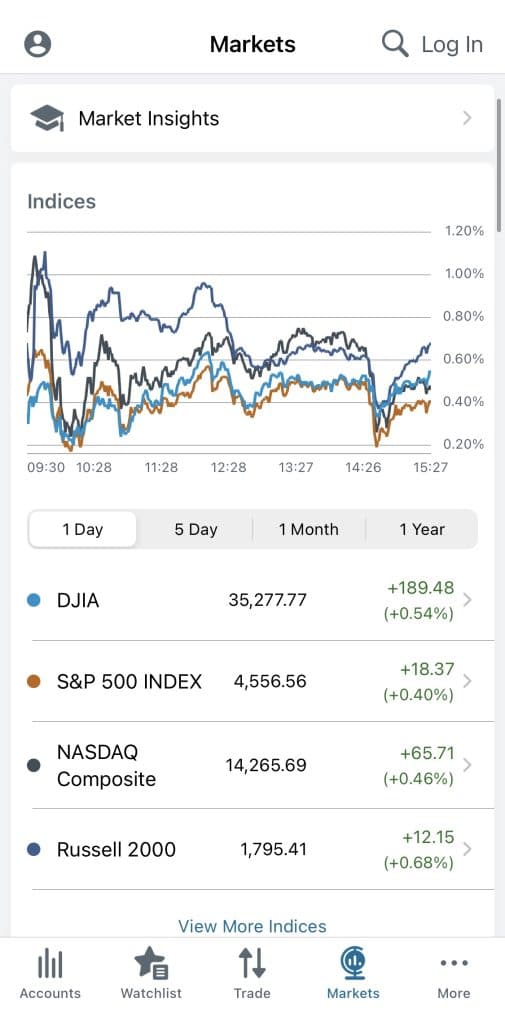

E*TRADE, known for its innovation in the investment brokerage industry, is a subsidiary of Morgan Stanley and offers a wide range of investment options, including mutual funds. With over 6,000 mutual funds, users have various choices available to them.

The E*TRADE trading platform has amassed a significant following of users who appreciate its browser and desktop-based platforms. The free Power E*TRADE platform has gained a solid and dedicated fan base among traders.

Active traders can take advantage of the platform’s various tools, such as free screeners to identify suitable companies for their portfolios, real-time streaming market data, interactive charts, and stock ticker pages.

E*Trade provides a substantial selection of mutual funds, consisting of 4,400 funds that do not impose any load or transaction fees. However, it is essential to know that if you sell these specific no-load, no-transaction-fee funds within 90 days of purchasing them, E*Trade applies an early redemption fee of $49.99.

Pros:

- $0 commissions on mutual funds

- Powerful and intuitive platforms, including the E*Trade Mobile

- Offers a full range of investments, including stocks

- Provides market insights and timely market analysis

- Offers automated investment management

Cons:

- Low interest rate on uninvested cash

3. Ally Invest – Best Mutual Funds App for Zero Commission on No-load Fund

Ally Invest is a compelling option for mutual fund investors, offering access to an extensive selection of over 12,000 mutual funds. In a significant move, the broker recently eliminated its commission on no-load mutual funds, reducing the cost from $9.95 per trade to a remarkable $0.

One of the key features that makes Ally Invest appealing is its user-friendly mutual fund screener. This powerful search engine is conveniently accessible on the company’s website, allowing investors to easily find and evaluate different funds based on their preferences and investment goals.

It’s important to note that while Ally Invest provides the option to trade mutual funds within self-directed accounts, they are unavailable within robo accounts. The company’s automated trading service exclusively invests in exchange-traded funds, which may be a drawback for investors looking for mutual fund options.

Pros:

- Strong mutual fund platform

- Low costs and fees

- Wide variety of investment options

- Cash-Enhanced Managed Portfolios

- 24/7 customer support by phone and live chat

Cons:

- Limited educational resources on app

- Inconsistencies across platforms

4. Fidelity – Best Mutual Fund App for 0% Fees

Fidelity is an old-school brokerage firm that has since entered the age of mobile investing. The app – which is available on both iOS and Android, is packed to the rafters with financial markets.

This includes bonds, IPO access, ETFs, options, and of course – mutual funds. Regarding the latter, you will have access to over 10,000 funds – listed not only in the US but across several global marketplaces. Additionally, Fidelity is one of the best free stock apps in the global financial market. When it comes to fees, this is where Fidelity really stands out.

This is because the app does not charge any commissions when you buy or sell mutual funds – other than the respective expense ratio. In fact, if you invest in a Fidelity mutual fund – you will pay 0% in expense ratio fees – which is unheard of in the trading scene.

In addition to fee-free investing, this mutual fund app does not have a minimum account balance in place. This ensures that Fidelity is suitable for investors of all budget levels. If you are also looking to perform ongoing financial research – Fidelity offers a highly extensive set of analytical and fundamental tools.

Pros:

- Great selection of long-term investment products

- Access US-listed stocks, ETFs, and investment options commission-free

- Covers thousands of markets in 25 different countries

- Excellent reputation and heavily regulated

- No minimum lump sum requirement

- Top-rated research and educational materials

- Advanced analysis tools available for seasoned pros

Cons:

- Account opening process can be slow

- No debit card deposits/withdrawals

5. TD Ameritrade – Best Mutual Fund App for Research and Analysis

In total, TD Ameritrade gives you access to over 13,000 direct mutual funds – so you won’t be short of options. When it comes to fees, you wont pay any commissions to invest in a load mutual fund at TD Ameritrade.

You will, however, need to pay a commission of $49.99 on no-load funds – which is expensive. In terms of research tools, you might find the mutual fund screener of interest. This allows you to find a mutual fund that meets your financial goals based on pre-defined factors.

You can also compare mutual funds at the click of a button – with key metrics including past performance, expense ratios, and Morningstar ratings. TD Ameritrade also offers an up-to-date list of top-rated mutual funds that its team of in-house analysts like the look of. The brokerage firm is also a go-to option for technology-savy investors, as it’s one of the best AI stock apps around.

Pros:

- Enormous selection of stocks and options

- Commission-free trading

- Two mobile apps available

- Fully customizable indicators with thinkorswim scripts

- Analyze 4-leg options trades

Cons:

- Only accepts bank transfers for payment

- Relatively pricey margin rates

6. Interactive Brokers – Best Mutual Fund App for Global Investments

Launched in 1978 and active across dozens of countries – Interactive Brokers is a highly established brokered firm. You can invest and trade online or via the provider’s Android/iOS mobile app.

In total, Interactive Brokers gives you access to over 40,000 mutual funds – which is huge. Not only does this include popular funds listed in the US – but around the world. What we really like about this broker is that more than 8,300 funds can be invested in commission-free.

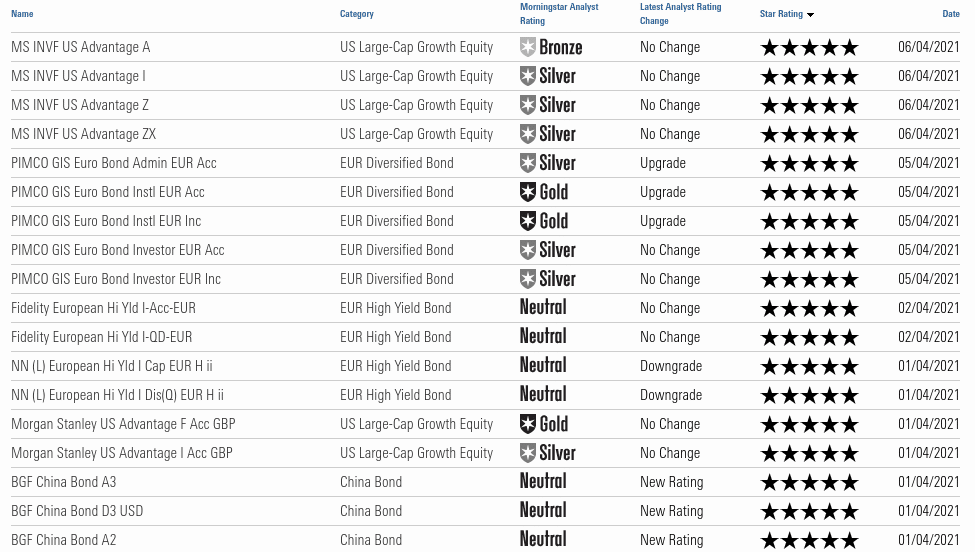

If your chosen mutual fund is located outside of the US, you will pay a fee of EUR 4.95 per trade. Either way, Interactive Brokers gives you the option of investing on margin – subsequently giving you additional purchasing power. Some of the most sought-after mutual funds available at Interactive Brokers are backed by the likes of Invesco, BlackRock, PIMCO, and Fidelity.

If you’re also interested in other asset classes, Interactive Brokers has you covered. Apart from being among the best ETF apps, it also covers everything from stocks, options, and futures to ETFs, bonds, and robo-advisor portfolios. Perhaps the main drawback with Interactive Brokers is that the initial account opening process is a bit long-winded. But, once you are set up – you’ll have unfettered access to the global financial markets.

Pros:

- Huge library of traditional stocks

- Dozens of exchanges and markets covered

- Also a CFD trading app is supported

- No account minimum

- Low fees starting from $0.005 per share

Cons:

- More suitable for experienced investors and traders

- No debit/credit cards – bank transfers only

7. Vanguard Group – Best Mutual Fund App for Passive Index Funds

Vanguard is a financial institution specializing in asset management, providing individuals with opportunities to open investment accounts and access a range of securities. With an impressive portfolio, the Vanguard trading app has developed over 430 funds, catering to more than 30 million investors.

The range of mutual funds the financial institution provides includes passive index funds and actively managed funds. The institution oversees widely diversified stock funds, bond funds, and balanced portfolios within its portfolio. Additionally, the institution offers diverse funds from various industries and geographic markets.

The mutual funds are top-rated due to their well-established reputation for being affordable and offering exceptional quality. According to Vanguard, the average expense ratio for their index mutual funds and ETFs is 0.07%, significantly lower than the industry’s standard.

Vanguard’s mutual funds have consistently outperformed similar funds due to their low-fee management approach. In fact, over the last decade, an impressive 223 out of 300 Vanguard funds have surpassed the average performance of their peer group.

Pros:

- Large number of ultra low-cost Vanguard mutual funds

- Offers a wide range of low-cost index funds

- Emphasis on passive investing

- Cash sweep with a low expense ratio

Cons:

- High minimum investment requirements for many fund options

8. Merrill Edge – Best Mutual Fund App with Brokerage and Banking Services

Merrill Edge is a financial platform owned by Bank of America and offers a comprehensive suite of online and advised investing, trading, brokerage, and banking services through its user-friendly app. The app provides a convenient way for US citizens to invest in various financial instruments, including mutual funds.

One notable feature of investing in Mutual funds on Merrill Edge is its extensive selection of no-load, no-transaction fees. Investors have access to thousands of these funds, making it easier to build a diversified portfolio without incurring additional costs. It’s worth noting that mutual fund trades for funds outside the No Transaction Fee program come with a fee of $19.95.

The app’s “Research/Mutual Funds” page is designed to assist investors in making informed decisions. It offers user-friendly screeners that allow users to filter through available funds using various criteria, including Morningstar and Lipper ratings.

Merrill Edge prioritizes investor education through its Investor Education Center. The center caters to investors of all levels, allowing them to choose their preferred learning format. Whether it’s articles, videos & webinars, courses, or calculators, investors have a range of educational resources to enhance their understanding of mutual funds.

Pros:

- Integrated with Bank of America

- High order execution quality

- No-transaction-fee (NTF) mutual funds

- User-friendly trading platforms

- Strong execution quality

Cons:

- Limited to US clients and products

- No demo account

9. Firstrade – Best Mutual Fund App with a Low Maintenance Portfolio

Firstrade is a mutual fund app that offers investors a wide range of options to diversify their portfolios and find the best mutual fund fit. With over 11,000 mutual funds available, investors can choose funds based on sectors, risk levels, and beta. This extensive selection allows for greater flexibility in creating a professionally managed portfolio with affordable fees.

Investors widely acclaimed the Fund Commentary on Firstrade as it provides valuable information such as performance history, asset allocation, and manager details, enabling investors to make informed investment decisions.

The app also offers a user-friendly search function that allows investors to enter specific criteria for the mutual funds they seek. Whether it’s minimum investment amounts, load types, risk categories, or beta, investors can easily filter through the available funds to find a list of appropriate options.

Another notable advantage of Firstrade is that all mutual funds traded through the app come with no trading commissions, although some funds may carry loads. This fee structure provides cost-effective options for investors to build and manage their mutual fund portfolios.

Pros:

- $0 contract fee on mutual funds

- Easy-to-use trading platform

- Solid research tools

- Quality educational tools

Cons:

- You can trade only on US markets

- No live chat or 24/7 availability

What are Mutual Funds?

Mutual funds allow you to invest in the financial markets in a 100% passive nature. This is because you will be investing your capital with a large financial institution that is tasked with buying and selling assets on your behalf. Some of the biggest fund houses in this industry include Fidelity, Vanguard, BlackRock, and PIMCO – which collectively manage trillions of dollars worth of investment capital.

Crucially, by investing in a mutual fund, you can sit back and allow your money to work for you. There is no requirement for you to spend countless hours research which assets to invest in. Nor do you need to worry about timing the markets. Instead, mutual funds are managed by experienced traders that have access to vast resources.

Here’s a simple example of how a mutual fund investment works:

- You invest $5,000 into a mutual fund that focuses on high-yield dividend stocks

- At the time of the investment, the mutual fund is priced at $50 per share

- At the end of year one, the value of the mutual fund has increased to $75 per share

- This means that on an investment of $5,000 – your capital is now worth $7,5000

- Throughout the year, you also receive four dividend payments from the mutual fund at a yield of 4%

- As such, you received a total payment of $200 (4% of $5,000 investment)

There are two key points to note about the above example. Firstly, your mutual fund investment is represented as a share price. Mutual funds don’t, however, trade on a public stock exchange. Instead, the share price is based on the NAV (Net Asset Value) of the mutual fund.

The NAV is simply the total amount of assets held by the mutual fund – at the current market value. As such, when the NAV increases – as will the respective share price and thus – the value of your investment will rise. You will only be able to realize this increased NAV when you sell your mutual fund investment.

Secondly, mutual funds also pay dividends. This is usually distributed every three months and your share will be based on the amount you have invested. These payments are a result of assets that generate regular income – such as dividend stocks, real estate holdings, or bonds.

Why Invest in Mutual Funds?

There are many reasons why investing in a mutual fund is a much better idea than attempting to manage your capital on a DIY basis.

This includes:

Passive Investment

The main attraction of a mutual fund is that once you make an investment – you can sit back and enjoy a passive stream of income. This is because the mutual fund financial advisor makes all investment decisions.

For example – based on the underlying strategy, the fund manager will decide which assets to buy and when to sell them. Each fund will usually have a large team of analysts, researchers, and in-house traders that have a vast amount of experience in the financial markets.

The only decisions that you need to personally make are what mutual fund to invest in and subsequently – when to cash out.

Mutual Funds are Actively Managed

When you invest in an ETF or index-tracking fund, your money is being managed in a passive nature. This means that the fund provider will simply look to track the respective market.

- In other words, if you invest in an index fund that generates annual returns of 10% – you will make the same (less fees).

- Similarly, if the index fund losses are 10% over the course of the year, your investment will also decline by the same amount.

- This is in stark contrast to how most mutual funds work – as they are typically actively managed.

- In simple terms, this means that the mutual fund manager will look to outperform the market by making smart investment decisions.

For example, if the mutual fund is focused on UK-based blue-chip stocks – it won’t take the easy option by simply tracking the FTSE 100. On the contrary, the mutual fund manager will determine which FTSE 100 stocks should be added to its portfolio and which companies don’t quite make the cut.

Two Streams of Income

As we briefly covered in our example above, most mutual funds offer two streams of income. Firstly, when NAV of the fund increases, so will the value of your investment.

These capital gains will be realized once you cash out. Secondly, most mutual funds pay dividends every three months. If you’re looking to build a long-term investment plan – this is great. The reason for this is that on each dividend payment, you can reinvest the money back into the mutual fund (or another asset).

In doing so, you are constantly increasing the size of mutual fund investment. As you do, the size on your quarterly dividend payments will also increase – as the yield is based on a large stake in the mutual fund.

Great for Diversification

When you invest in a mutual fund, there is every chance that you will be indirectly gaining access to hundreds of different assets. For example, the mutual fund might hold a highly diversified basket of stocks from a variety of markets. Or, the fund might invest in a large collection of corporate and government bonds.

Either way, you only need to make a single investment into the mutual fund to create a balanced and well-diversified portfolio. Attempting to replicate a mutual fund portfolio on a DIY basis would not only be time-consuming, but costly.

Fees are Very Reasonable

Although mutual funds are actively managed – this doesn’t mean that you will be hit with hefty investment fees. Instead, you will find that the vast majority of mutual funds are priced at less than 1% per year.

When you consider what goes on behind the scenes in terms of research and analysis – this is very reasonable. Take note, you might also need to pay a brokerage commission to invest in your chosen mutual fund. With that said, the best mutual fund investment apps that have been discussed today typically offer a commission-free service.

How to Choose the Best Mutual Fund App for You

In searching for the best mutual fund app, you need to perform lots of research to ensure the provider is right for you. For example, some mutual fund apps only service residents of selected countries. Additionally, you also need to look at what mutual funds are supported, as well as regulation, payments, and commissions.

Here’s a breakdown of the most important considerations that need to be made in your hunt for the best mutual fund app.

Regulation

It goes without saying that your chosen mutual fund app be authorized and regulated by a reputable financial body. Make no mistake about it – all of the best mutual fund investment apps discussed on this page are heavily regulated.

User Experience

On the one hand, the process of investing in a mutual fund is very straightforward. Typically, all you need to do is open an account with a mutual fund app, make a deposit, and then allocate some funds to your chosen investment.

However, you will also come across mutual fund apps that have been poorly designed. For example, the process of opening an account might take up to a week – largely because of a cumbersome KYC process that needs to be manually processed. We also come across mutual funds apps that are difficult to navigate – especially when it came to finding an investment.

Supported Mutual Funds

You don’t want to go through the process of opening an account with a trading app only to find that it doesn’t support your chosen mutual fund. In many cases, you are unable to view what mutual funds the app supports until you register an account – which can be problematic.

With that said, if you know that the app supports thousands of mutual funds from a variety of international marketplaces – then there is every chance that there is an investment that meets your financial goals. This is especially the case with the likes of Fineco Bank, TD Ameritrade, and Interactive Brokers.

Fees

When investing through a mutual fund app – there are several fees that you might be exposed to.

This includes the following:

- Commission: Some mutual fund apps charge a commission when you invest. If they do, this will be charged when you initially invest in the mutual fund and again when you cash out. Commissions are usually flat – meaning they remain the same irrespective of how much you invest.

- Minimum Redemption: Although your chosen mutual fund app might offer a commission-free service – you need to check whether a minimum redemption clause is in place. This refers to a flat fee that is charged if you sell your mutual fund investment within a certain time period – say 60 days.

- Expense Ratio: The expense ratio is charged by the mutual fund provider and not the trading itself. This covers the fees involved in managing investor funds. Just make sure that your chosen mutual fund app doesn’t charge a mark-up on the expense ratio. In other words, if the mutual fund charges 0.5% per year – the app should also charge you 0.5% per year.

The best mutual fund apps are very transparent when it comes to fees. As such, refer to the provider’s website to get a full breakdown of what fees and charges will be applicable when investing in a mutual fund.

Investment Tools

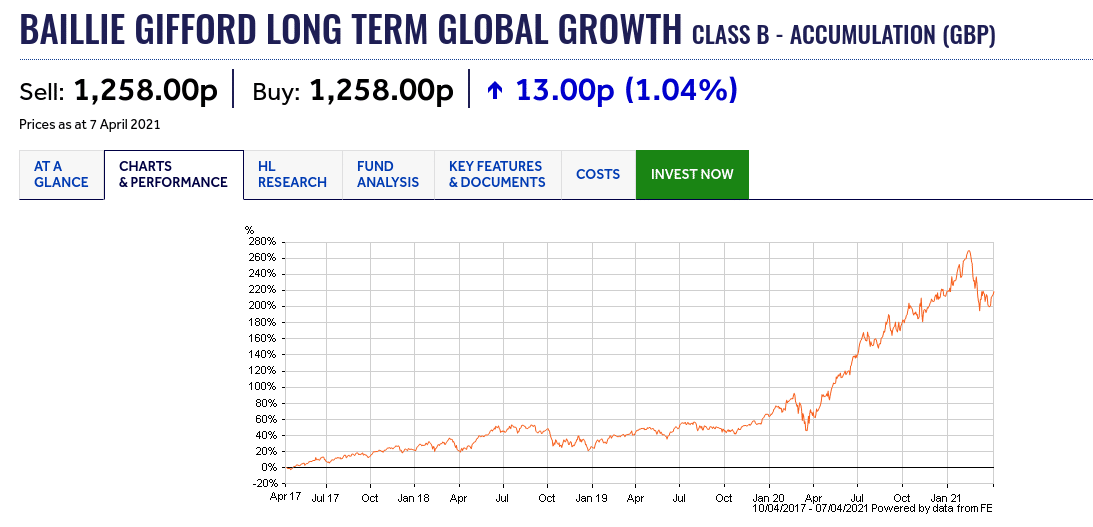

Although mutual funds allow you to invest passively – it’s a major bonus when trading apps offer research tools. After all, there are tens of thousands of mutual funds in operation from all over the world. As such, you need to invest some time to ensure your chosen mutual fund meets your financial objectives and attitude to risk.

We found that the best mutual fund investment apps offer an in-house research facility. This might include ratings from major financial platforms like Morningstar, information regarding past performance and expected returns, and the level of risk associated with the fund.

Toro Copy Trading feature. This allows you to invest in individual traders as opposed to a broader mutual fund.

We like the fact that you can view a full suite of data about the trader you are considering copying – such as financial performance, risk rating, and maximum drawdown. Best of all, the social trading app doesn’t charge anything to utilize its Copy Trading tool – so this offers a great alternative to conventional mutual funds.

Payment Methods

The best mutual fund brokers allow you to deposit and withdraw funds directly through the app.

At the other end of the scale, some mutual fund apps only support bank transfers. Depending on your location, this means that it might take a few days for the funds to arrive.

Customer Service

Finally, it’s also a good idea to check what customer support channels the mutual fund app offers. Ideally, if you need assistance, you will be able to get real-time support via a live chat facility.

References

- https://www.investor.gov/introduction-investing/investing-basics/investment-products/mutual-funds-and-exchange-traded-1

- https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/mutual-funds/

- https://www.finra.org/investors/investing/investment-products/mutual-funds

- https://www.cnbc.com/select/what-are-mutual-funds/

- https://www.schwab.com/mutual-funds/understand-mutual-funds

FAQs

Which financial markets do mutual funds invest in?

With tens of thousands of mutual funds in operation – it will come as no surprise to learn that you can gain exposure to a wide variety of international markets. Whether you are interested in the US, Europe, India, South East Asia, or Australia – there is sure to be a mutual fund that meets your financial objectives..

Which mutual fund is best for ELSS?

Perhaps the best ELSS mutual funds at the time of writing are the Tata India Tax Savings Fund, L&T Tax Advantage Fund, and BNP Paribas Long Term Equity Fund.

Which is better Etmoney or Groww?

Both Etmoney and Groww are popular mutual fund apps that are targetted to Indian traders. The former might be the better option if you are a newbie investor.

What are AMCs in mutual funds?

AMCs is an abbreviated term to describe to Asset Management Companies – such as mutual funds. .

How do I find stocks to day trade?

The best apps for day trading tools to help you find potential stocks to trade. For example, some apps have a stock screener, while others have a social network or daily trade ideas. You can also use third-party tools and services to find day trading ideas.

Tax treatment depends on individual circumstances and change or may differ in a jurisdiction other than the UK.

Kane Pepi

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane Pepi

stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2025

Scroll Up