Best Stock Portfolio Trackers in 2026

With the advent of online trading options, investors can now track their stock portfolio 24/7 from their desktop and mobile devices. There is, however, a wide range of stock portfolio tracking apps with different features and prices. This makes it difficult for investors, especially first-time investors, to discover the best apps.

Similar to our review of the best crypto app 2026 our team of experts gauged several stock portfolio apps to find the best stock portfolio tracker apps in 2023. The offerings, features, pricing, interface, and customer service of the top 8 stock tracking apps are discussed in this review.

Our team of experts also highlighted proven methods to find the perfect stock tracker to fulfill your investment needs. Enjoy the read.

The Top Stock Portfolio Tracker Tools Ranked

As indicated in the introduction, our team of experts has curated the finest stock portfolio apps in 2026. Take a look at the top 8 stock portfolio apps in 2026.

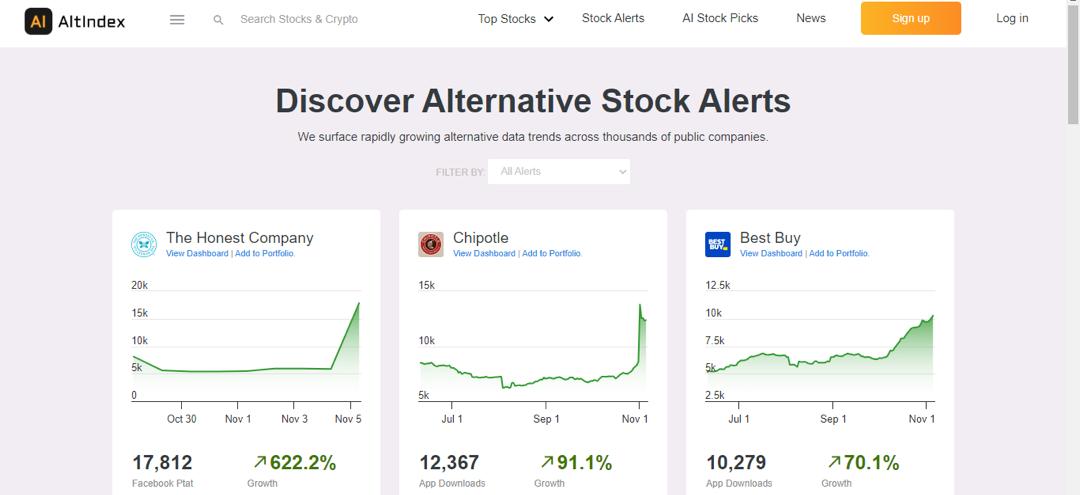

- AltIndex: AltIndex is an AI stock and cryptocurrency tracking app. The app has reputable public sentiment scores, historical recommendations with a 75% win rate, and several data sources. Its subscription plans range from a limited free plan to a pro plan at $99 per month.

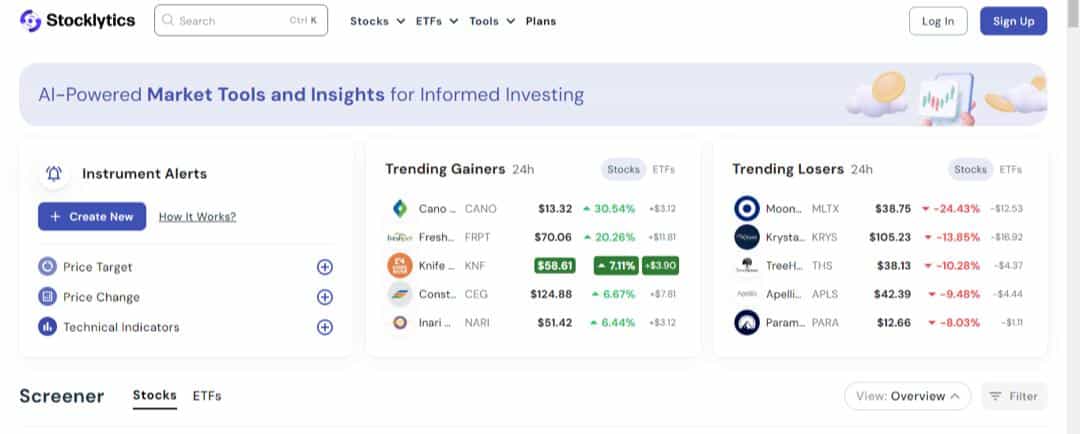

- StockLytics: Operates as a stock analysis and research platform with customizable features, personal notifications, and percentage alerts. Its data sources include 11 international exchange platforms, AI predictions, and top global investors. The app is free and available to traders in different parts of the world.

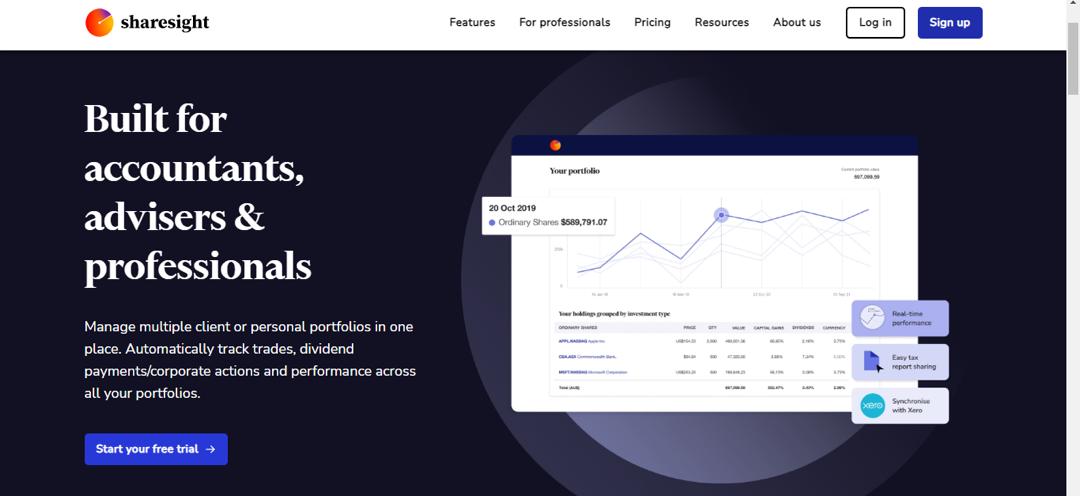

- Sharesight: This was designed for DIY investors. With a limited free version and subscription plans from $19 to $65.33 per month, sharesight provides real-time data on investment portfolio performance.

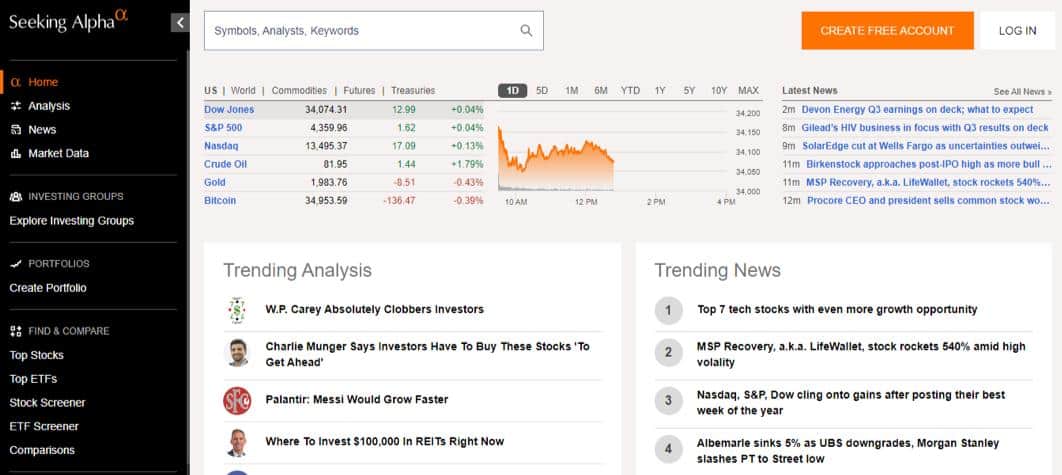

- Seeking Alpha: A popular stock website with over 20 million monthly visitors. This stock tracking software has investment ideas, customizable news dashboards, Quant Ratings, Factor Scorecards, earnings call transcripts, and a stock screener. The platform charges between $29.99 per month or $19.99 per annum to $299.99 per month or $199.99 per annum.

- WallStreetZen: With insights on various investment opportunities, a user-friendly interface, strong customer support, and flexible pricing plans that start from $19.99 per month, WallStreetZen is a versatile investment research platform. It also comes with a free basic plan and a 14-day free trial.

- Ziggma: Ziggma was initially an economic investment platform for medium and long-term investors. The platform offers a free plan with essential features and a Premium plan priced at $9.90 per month. The app has supplementary tools like stock scores, stock analysis, a stock screener, portfolio management, guru and model portfolios, smart alerts, KPI tracking, and backtesting.

- Morningstar: The platform was designed for active investors. It has comprehensive research covering mutual funds, stocks, ETFs, and bonds, with multiple ratings and analyses. Its pricing options include a monthly subscription at $29.95 and an annual subscription at $199.

- Kubera: This is a premium stock portfolio tracking app. It is integrated with hundreds of banks and brokerages; thus, investors can sync their financial records and institutions on the app. Its fee starts at $150 per year, but investors can get a 14-day trial for only $1.

Best Stock Tracking Apps Reviewed

1. AltIndex – The Best Stock Portfolio Tracking App 2026

AltIndex has an AI tipping service, real-time price alerts, and consumer sentiment indicators. This stock portfolio tracking app collates data from social media networks, website analytics, employee satisfaction, and job posting statistics.

The app assigns scores to stocks based on public sentiment and provides recommendations with a historical win rate of 75%.

AltIndex covers stocks from the NASDAQ and NYSE, major US-listed ETFs, and popular cryptocurrencies like Bitcoin and Ethereum; one could easily assume it is one of the best automated crypto trading app. The platform uses AI ranking scores to help investors make informed decisions. It also offers stock alerts, trend analysis, stock screeners, and daily newsletters, making it an ideal app for tracking stocks.

AltIndex offers its clientele multiple subscription plans with different functionalities. The app’s subscription plans include a free limited plan, a starter plan for $29 per month, and a pro plan for $99. The enterprise plan is available for professional traders and institutions, with pricing available only on request. With such flexibility, investors can choose a convenient price and package.

As per user experience, AltIndex provides a seamless and user-friendly platform optimized for mobile browsers. So whether you use an Android, iOS, or Windows device, you can easily access the platform. The platform also offers customer support service via email, and users can access the platform without signing up. Little wonder it’s our best stock tracker app.

| Features | Web | Mobile |

| Notifications | ✅ | ✅ |

| Stock Screeners | ✅ | ✅ |

| Score Card | ✅ | ✅ |

| Automated Trading | ❌️ | ❌️ |

| Free Trial | ✅ | ✅ |

✅What we like about AltIndex

- Tracks hundreds of stocks and cryptocurrencies.

- AI stock picking service with a historical success rate.

- Consumer sentiment and analytical insights.

- Stock portfolio alerts via email.

❌️ What we don’t like about AltIndex

- Short-term price history

2. Stocklytics – The Best Free Stock Portfolio Tracker for Beginners

StockLytics is an exceptional stock analysis and research platform with impressive customization features. This real time stock tracker app allows investors to create personalized notifications and receive alerts for stocks tailored to their preferences in real time. This way, investors can stay ahead of market trends and make profitable trading decisions.

StockLytics sources its data from 11 international exchange platforms and AI predictions of stocks and equities in the US, UK, and Europe, like other stock trading apps in the UK. Little wonder, StockLytics has earned a reputation as one of the best stock portfolio trackers in 2023.

Like AltIndex, StockLytics has a wide range of technical ratings for stocks and ETFs, facilitating the identification of potentially profitable assets. The platform also offers in-depth analysis that helps investors decide when to buy, hold, or sell their investments.

StockLytics’ real-time analysis, technical grading, and free-to-use model establish the app as a leading tool and analysis software for top investors. Like some other providers, StockLytics stock tracking software is integrated with major financial news websites like Yahoo and Barrons, so investors stay up-to-date with the latest market developments and receive notifications of news related to stocks or ETFs in their portfolio.

The platform’s features include online support and 100 percent free access. This means that investors can get tailored notifications, detailed insights from 11 international exchanges, custom notifications, stock screening, and AI predictions at no cost. These free offerings have earned StockLytics a place among the best stock tracking apps.

| Features | Web | Mobile |

| Notifications | ✅ | ✅ |

| Stock Screeners | ✅ | ✅ |

| Score Card | ❌️ | ❌️ |

| Automated Trading | ❌️ | ❌️ |

| Free Trial | ✅ | ✅ |

✅What we like about StockLytics

- Free stock portfolio tracker

- Access to hundreds of stocks and ETFs

- Technical scores and price predictions

- Integrations with financial media platforms like Yahoo and Barrons

❌️ What we don’t like about StockLytics

- Limited investment options

3. Sharesight – Total Automated Real-time Stock Portfolio Tracking App

Sharesight is a stock portfolio tracking tool designed for DIY investors. It is not a trading platform but a tool to monitor and analyze investments and trading options. The free version allows tracking up to 10 holdings, with subscription fees ranging from $19/month for 20 holdings to NZ$49/month for unlimited holdings.

Sharesight has a user-friendly interface that works on desktop and mobile devices, with an app available for mobile users. This platform is easy to navigate, even for first-time investors. The platform’s sleek and modern layout, color scheme, and patterns make Sharesight an investor’s favorite.

Sharesight is best for DIY investors who want real-time information about their investment portfolio’s performance and need accurate tracking of their investments. While the free version suits first-time investors, the platform requires more fees for larger portfolios. With Sharesight, you have to pay more to get more.

This real time stock tracker app is widely used in New Zealand, Australia, the UK, Singapore, Canada, and the USA. So, many players from different countries can access the platform without a VPN.

| Features | Web | Mobile |

| Notifications | ✅ | ✅ |

| Stock Screeners | ✅ | ✅ |

| Score Card | ✅ | ✅ |

| Automated Trading | ❌️ | ❌️ |

| Free Trial | ❌️ | ❌️ |

✅What we like about Sharesight

- Integrated with Xero for transaction reconciliation.

- Price alerts for stock price changes.

- Automatic dividend reporting.

- Convenient tax reporting.

❌️ What we don’t like about Sharesight

- Glitches with manual data transfer

4. Seeking Alpha – Best Stock Portfolio Tracking App with Investment Research

Seeking Alpha is a well-known stock research website with over 20 million monthly visitors. With a vast community of over 7,000 contributors, this platform produces over 10,000 stock-related articles monthly. Its key features include investment ideas, IPO analysis, fund letters, and quick picks.

This app is an all-time investors’ best stock tracking app.

Seeking Alpha’s proprietary Quant Ratings system grades stocks on a scale from “Strong Buy” to “Strong Sell.” Factor Scorecards are another feature on the platform, with ratings ranging from “A+” to “F.”

Premium users can access call transcripts, presentations, and recordings. Seeking Alpha Premium also offers analysts’ forecasts and earnings surprises, which help users assess how companies perform compared to their earnings expectations.

To assist its investors in buying the best stocks, Seeking Alpha is one of the few stock tracking websites with a stock screener that allows them to incorporate proprietary ratings and author analysis into their criteria. Seeking Alpha Premium also provides portfolio monitoring that enables users to sync their brokerage accounts. With these features, Seeking Alpha could easily become the best stock tracker app.

Seeking Alpha fees range from the basic plan to the pro plan. The basic plan is free, while the premium plan is $29.99/month or $19.99/year, and the pro plan goes for $299.99/month or $199.99/year.

| Features | Web | Mobile |

| Notifications | ✅ | ✅ |

| Stock Screeners | ✅ | ✅ |

| Score Card | ✅ | ✅ |

| Automated Trading | ❌️ | ❌️ |

| Free Trial | ✅ | ✅ |

✅What we like about Seeking Alpha

- Unlimited investment articles and ideas

- Variety of proprietary tools for tracking stocks

- Personal portfolio performance tracking

- Screening and Comparison tools

- Personalized notifications.

❌️ What we don’t like about Seeking Alpha

- No stock recommendation features

- Subscription fees are non-refundable

5. WallStreetZen – The Best Stock Portfolio Tracker for Premium Investors

WallStreetZen is a versatile investment research and analysis platform for beginners and seasoned investors. Like the best mutual fund apps, this platform provides valuable insights into various investment opportunities, from stocks to ETFs, mutual funds, and options.

Its key features include a user-friendly interface, a stock screener of company profiles, financial statements, stock charts, real-time data, and timely news updates. WallStreetZen affords investors the option of modeling portfolios tailored to different risk profiles and investment objectives. These range from conservative to moderate and aggressive portfolios. The platform also covers investment themes and trading strategies of emerging markets, technology, healthcare, and social investment options.

WallStreetZen customer support is available via live chat, email, and phone. The platform also has a comprehensive help center with many frequently asked questions.

The platform’s pricing structure is flexible, with multiple plans to suit various investors’ needs. It includes a free basic plan with essential features and premium plans from $19.99 per month. Premium plans grant users access to advanced research tools and investment strategies.

| Features | Web | Mobile |

| Notifications | ✅ | ✅ |

| Stock Screeners | ✅ | ✅ |

| Score Card | ❌️ | ❌️ |

| Automated Trading | ❌️ | ❌️ |

| Free Trial | ✅ | ✅ |

✅ What we like about WallStreetZen

- A repertoire of investment research tools and services

- User-friendly and intuitive interface

- Excellent customer support

- Tailored investment themes

- Basic plan and a 14-day free trial

❌️ What we don’t like about WallStreetZen

- No mobile app

| Different stock portfolio tracking apps have different fees and features. To get the most out of any app, gauge the fees and the offerings to see if it is worth the financial cost and the proposed benefits. |

6. Ziggma – Best Stock Portfolio Trackers For Fresh Investment Opportunities

Ziggma is an economic investment platform designed to uncover fresh investment prospects and oversee portfolios. This platform is well-suited for investors with medium to long-term investment goals.

Ziggma has a scoring stock mechanism of 0 to 100 based on 32 fundamental financial metrics like growth, profitability, valuation, and financial standing in the industry. Users can readily view the overall scores for stocks, with Premium subscribers gaining the privilege to access category-specific scores and comparisons with other industry competitors. Ziggma has a comprehensive analysis of US companies with a market capitalization of over $100 million.

Ziggma is one of the few stock tracking websites that also has an adaptable stock screener, which allows investors to filter stocks based on a spectrum of financial metrics, Ziggma scores, and industry categories. Users of Ziggma are equipped with a comprehensive suite of portfolio management tools with data from several brokers and watchlists from Yahoo! Finance.

For notifications, users can configure “Smart Alerts” of price movements, P/E ratios, beta, volatility, RSI, and MACD. Ziggma also incorporates KPI tracking, thus monitoring shifts in key performance indicators (KPIs) of investments over time.

For pricing, Ziggma extends a free plan incorporating essential portfolio management features, a stock screener, and stock scores. The premium subscription plan starts at $9.90 monthly or a discounted annual rate of $89.

| Features | Web | Mobile |

| Notifications | ✅ | ✅ |

| Stock Screeners | ✅ | ✅ |

| Score Card | ✅ | ✅ |

| Automated Trading | ❌️ | ❌️ |

| Free Trial | ✅ | ✅ |

✅What we like about Ziggma

- Free research and tracking tools

- Portfolio simulator and backtesting

- Links to multiple brokerage accounts

- Indicates the top 50 stock list and model portfolios

❌️ What we don’t like about Ziggma

- Limited Backtesting features

7. Morningstar – Best Stock Portfolio Tracker for Professional Trading Analysis

Morningstar is a renowned investment research service that caters to the needs of active investors. Its key features include broad research coverage for mutual funds, stocks, ETFs, and bonds. The platform furnishes users with detailed analyses and comprehensive reports of different investment options.

Morningstar provides investors with curated lists of the best investments and top-performing stocks.

With a vast database of over 620,000 investment options, Morningstar offers investors a suite of tools tailored for portfolio analysis, among which is the Portfolio X-Ray tool for conducting asset allocation analysis. The platform also offers stock screening features and integrates environmental, sustainability, and governance (ESG) criteria into its investment decision-making suggestions.

Morningstar users can effectively manage their portfolios and receive timely alerts to stay updated even with the platform’s mobile app. Morningstar is ideal for investors who seek to know the fundamental aspects of their investments.

Morningstar’s monthly subscription is available at $29.95 per month. On the other hand, the annual subscription is $199 per annum, while the two-year subscription is a discounted rate of $349. The three-year subscription is available at $449. The platform also has a 7-day free trial period for first-time traders who are not ready to make a fee commitment.

| Features | Web | Mobile |

| Notifications | ✅ | ✅ |

| Stock Screeners | ✅ | ✅ |

| Score Card | ❌️ | ❌️ |

| Automated Trading | ❌️ | ❌️ |

| Free Trial | ✅ | ✅ |

✅What we like about Morningstar

- In-depth research of multiple investment options

- Highlights top investment lists for various categories and asset options

- Tools for asset allocation and investment selection

❌️ What we don’t like about Morningstar

- Software glitches

- Limited price analysis

8. Kubera – Extensive Stock Portfolio Tracking App

Kubera is a top-tier platform designed for tracking portfolios. It has many features for monitoring investments, real estate, and assets. The app is synced with a network of over 20,000 banks and brokerages. While Kubera doesn’t have budgeting tools, it has other key features. Kubera is ideal for investors with intricate portfolios because of its solid privacy policy.

Upon signing up on the Kubera app, investors get a 14-day trial for just $1. Kubera simplifies the process of adding assets by partnering with various banks, brokers, and exchanges. Thus, the platform is versatile and accommodates manual entry of assets like cryptocurrencies, NFTs, and even real estate. To gain a comprehensive overview of one’s net worth, investors can incorporate liabilities such as loans and credit card bills into the platform.

The platform tracks changes in net worth over time with visual representations and portfolio summaries to provide insights into financial growth or decline.

As per pricing, Kubera offers investors a Personal plan at $150 per annum. For CPAs, financial advisors, and family offices, Kubera provides an Institutional plan with custom pricing, necessitating direct contact with the company. Undoubtedly, Kubera has all the ingredients of the best investment apps.

| Features | Web | Mobile |

| Notifications | ✅ | ✅ |

| Stock Screeners | ✅ | ✅ |

| Score Card | ❌️ | ❌️ |

| Automated Trading | ❌️ | ❌️ |

| Free Trial | ✅ | ✅ |

✅What we like about Kubera

- Integrated with over 20,000 banks and brokers

- Provides in-depth crypto and DeFi tracking

- Data and privacy protection

❌️ What we don’t like about Kubera

- No mobile app

How Do Stock Portfolio Trackers Work?

Stock portfolio trackers run a system that helps investors monitor and manage their portfolios. Its sequence of system operations is as follows:

✅ Real-Time Data Aggregation

Stock portfolio tracking apps collaborate with financial institutions and brokers to consolidate and organize a user’s investment holdings. This partnership allows investors to conveniently monitor the overall performance and allocation of their portfolio. By integrating with these institutions, the stock trackers provide real-time updates on current stock prices and market indices, enabling investors to assess the status of all their investments at once.

✅ Transaction History

Stock portfolio trackers are designed to automatically capture and record various investment actions, like purchases, sales, and dividends. By doing so, these trackers create a reliable and precise record of all trades and transactions, enabling investors to maintain a comprehensive audit trail of their investment activities. Stock tracking apps also calculate and provide insights into the returns of an investment portfolio, allowing investors to assess the profitability and performance of their investments.

✅ Stock Performance Analysis

Stock portfolio tracking apps offer complete information on stock performance, sector allocation, and benchmark investment comparisons, thus providing investors with insights into the performance of each investment option and areas for potential improvement. These trackers furnish detailed data on the historical and current performance of individual stocks, enabling investors to evaluate the profitability and volatility of each investment option.

The tracking apps also provide a breakdown of the portfolio’s sector allocation, allowing investors to evaluate the distribution of their investments across sectors. Furthermore, these trackers compare the performance of the portfolio against relevant benchmarks, hence providing investors with indices of how their investments stack up against other market indices. With these details, stock portfolio trackers allow investors to make informed decisions and optimize their investment strategies.

✅ Notifications

Stock portfolio trackers have customizable features, one of which is its notifications or alerts. This keeps investors informed about price movements, news updates, and market trends. Because these notifications are customizable, investors can tailor them to meet their preferences and individual trading goals. By receiving such customized timely alerts of price fluctuations, investors can stay updated on the performance of their investments and act swiftly when necessary.

Stock tracking apps are generally designed to provide news updates on companies in the portfolio, as well as the broader financial market. Thus, investors have access to the latest important information that may impact their investment decisions.

Stock portfolio trackers also analyze market trends and provide valuable insights that can help investors identify potential investment opportunities or risks. Hence, with the help of these customizable notifications, investors can stay well-informed about the dynamic nature of the market and make swift and informed investment decisions.

P.S: All of these factors were considered in selecting the top 8 apps. So you can rest assured that these 8 apps are the very best stock tracker apps anywhere.

| The best stock portfolio trackers have data aggregation features, transaction history, stock performance analysis tools, and swift notifications that ensure investors make smart trading decisions over time. |

How to Pick a Stock Tracker App

While we have identified 8 ideal tracking apps, it’s important that you not only know stocks and how they work but also know the stock tracker app that best works for you. These are the factors to consider in your selection:

✅ App Features

In choosing a stock tracking app, it is important to identify the features that align with your investment goals. We recommend that you prioritize apps that offer a comprehensive set of functionalities that you will find useful. Basic features to look out for include real-time stock quotes that enable you to stay up-to-date with the latest market prices and to monitor the performance of your investments and overall portfolio progress.

To stay well-informed, choose apps that provide news updates, this ensures you are aware of any significant developments that may impact your investments. Customizable alerts are another important feature, as they allow you to set notifications for specific events or price movements that you consider important. This ensures that you are promptly notified of any changes that require your attention or prompt action.

Also, look out for performance analysis tools. These are valuable for evaluating the performance of your portfolio and individual investments. These tools can provide insights into your investment returns, risk metrics, and other key performance indicators.

✅ App Security

As far as stock tracking apps are concerned, security is a top priority. A stock tracker is a financial tool with access to your financial records and holdings. To protect your data, it is important to find stock tracking apps with robust security measures such as encryption, 2-step verification, and secure login methods. These features are formidable barriers against potential cyber threats and third-party breach of data.

Before signing up on any platform, ensure that you understand the app’s data protection terms and conditions, as well as its privacy policy. This way, you will be able to gauge the safety of your personal financial data.

✅ User Interface

A user-friendly interface plays a pivotal role in every investor’s trading journey, especially if you are just starting out. To determine the user-friendliness of a stock tracking app, look out for the following:

Easy Navigation: Look for apps with effortless navigation that will allow you to swiftly access desired features and functionalities without any confusion or frustration. This will enable you to focus on your trades and investment decisions without worrying about complex menus.

Clear Visuals and Lettering: Opt for apps that have clear and visually appealing graphics, charts, and lettering. This ensures that you can easily interpret and analyze the data and information relevant to your trades.

Customizable Layouts: Personalization is key when it comes to trading apps. Hence, find tracking apps with customizable layouts that will allow you to tailor the interface to your preferences.

✅ Device Compatibility

To ensure a seamless trading experience with your chosen stock tracking app, it is important that you verify its compatibility with your mobile device’s operating system. To decode this compatibility, take the following steps:

Step 1: Identify Your Device’s Operating System: Determine the operating system of your mobile device, which could be iOS, Android, or Windows. You can find this information in your device’s settings.

Step 2: Check the App’s Compatibility: Once you have identified your device’s OS, check whether the stock tracking app is available for that specific OS. Some apps may be exclusively designed for iOS, while others are developed for Android or Windows.

Step 3: Store Verification: For iOS users, visit the Apple App Store and search for the stock tracking app. Confirm that the app is compatible with your iOS version and device model by checking the app’s system requirements listed in the app’s description or within the store listing. Android users can head to the Google Play Store and search for the stock tracking app.

Ensure that the app supports your Android version and device model by reviewing the app’s system requirements mentioned in the app’s description or Play Store listing. If you are using a Windows device, navigate to the Microsoft Store and search for the stock tracking app. Verify that the app is compatible with your Windows version and device model by reviewing the app’s system requirements provided in the app’s description.

✅ Integration

To effectively manage your investment portfolio and transactions, it’s important for you to select an application that synchronizes well with your brokerage account and financial institutions. By doing so, you gain the invaluable benefit of having direct oversight over your investments. With this synchronization in place, you can effortlessly monitor and control your portfolio, ensuring that every transaction is accounted for and managed effectively.

✅ Fees

While some stock tracker apps are free, others have a subscription fee or offer premium features at an additional cost. To make the best choice, it is important to consider both your budget and the features that the app offers. By selecting an app within your budget that provides valuable features that justify its fees, you ensure that you are getting the most value for your investment.

This approach allows you to strike a balance between affordability and functionality, enabling you to track your stocks effectively without straining your pocket. So, take the time to assess your requirements, evaluate the available options, and opt for an app that offers a compelling combination of affordability and features that meet your investment goals.

The table below highlights the fees of our top 8 stock tracking apps.

| App | Fees |

| AltIndex | $0- $99 per month |

| Stocklytics | Free |

| Sharesight | $0 – $31 per month |

| Seeking Alpha | Premium: $189 per annum / Pro: $2,400 per annum |

| WallStreetZen | $19.50 – $59 per month |

| Ziggma | $7.50 per month |

| Morningstar | $20.75 per month |

| Kubera | $150 per annum |

| The popular saying “different strokes for different folks” plays true in choosing a stock tracking app. Choose the app that best suits your investment goals, trading style, and budget. |

Conclusion

Having a reliable stock portfolio tracking app in 2026 is indispensable. Our top 8 stock portfolio tracker apps have been carefully selected and reviewed so investors don’t have to go through the hassle of finding the best apps.

Our top apps have a range of features and flexible pricing, which makes them a good choice for beginners and professionals alike. You can read through our review to choose the app that best suits your investment needs and preferences.

If you are still unsure of what works best for you, we recommend AltIndex. If you want to try it for free, then try Stocklytics. Whichever you pick, you can rest assured that your data is secured and that you will get premium benefits.

References

- https://www.cnbc.com/2023/09/25/large-us-companies-outperformed-other-investments-over-last-20-years.html

- https://www.reuters.com/markets/stocks/

- https://www.researchgate.net/publication/267408370_INVESTMENT_PORTFOLIO_MANAGER-MOBILE_APPLICATION

- https://www.researchgate.net/publication/343396167_An_Application_Of_Stock-Trak_In_’Investments’_What_Common_Mistakes_Do_Students_Make_While_Studying_Socioeconomic_Processes

- https://www.cnbc.com/2023/09/25/large-us-companies-outperformed-other-investments-over-last-20-years.html