What Are Ordinals? (Bitcoin NFTs) – Crypto Trading Review 2024

Bitcoin took a significant leap when the Ordinals software debuted on the Bitcoin Mainnet in January 2023. It left people, especially newbies wondering what Ordinals are. To many, the move is a welcome development into Bitcoin NFTs (non-fungible tokens).

Before now, Ethereum, Binance Smart Chain, Cardano, Solana, etc., formed the supporting base for NFTs. Despite having the most expensive cryptocurrency, the Bitcoin blockchain does not support NFT development.

We will describe what ordinals are, but we’ll do more than that. You’ll see how far they have gone into the NFT community, including in gaming and virtual assets. With that in mind, let’s begin by exploring the basic definition of Bitcoin ordinals.

-

-

What are Ordinals?

The satoshi is the most basic unit of Bitcoin. Each Satoshi receives a serial number per mining order.

This unique number helps the blockchain track where every Satoshi is and who owns it. With inscribing, these Satoshis can have more content than just numbers.

Ordinals do not work like other NFTs, even though other NFTs could use their approach. Bitcoin does not natively support NFT creation. Those who want to do so mint them on Bitcoin-powered blockchains or Layer 2s.

Stacks and Counterparty are popular Layer 2 blockchain protocols for mining NFTs. Ordinals have eliminated that approach to a certain degree. Nevertheless, mining NFTs still depends on the user.

Let’s relate what Ordinals are in regards to Bitcoin NFTs.

Definition and explanation of ordinals in the context of Bitcoin NFTs

Ordinals are serial numbers attached to Satoshis when mined. They can take up additional information (content) through inscribing. Hence, users can attach images or text to create unique and scarce assets, like non-fungible tokens (NFTs).

These inscriptions or protocols allow people to create NFTs without using Layer 2 blockchain protocols. They can do that directly on the Bitcoin blockchain.

Ordinals stay in Bitcoin blocks besides being embedded directly into all Satoshi units. Hence, they inherit Bitcoin’s immutability, durability, and security.

For context, every Satoshi is worth 0.00000001 BTC. You can buy and trade Ordinals on the best DeFi apps, like other NFTs.

Ordinals developer Casey Rodarmor had this to say about Satoshis on the blockchain:

“We can identify a Sat’s position by four parameters as follows:”

- The Sat’s index in the block

- The Block’s index in the Difficulty Adjustment Period X/2016

- The Block’s Index in Halving Epoch

- The cycle number

That gives an overview of what Ordinals are in bitcoin, but there’s more. You can view Ordinals as protocols to repurpose codes and apply them as envelopes for inscribed Sat data. The maximum data size you can inscribe is 4MB, which is Bitcoin’s block size.

Sats still exist as fungible tokens, meaning you can spend them on a protocol level. However, they are also unique on a social level because of the extra information they carry.

Understanding the significance of ordinals in non-fungible tokens

The concept of ordinals in Bitcoin still leaves more to be desired. Ordinals are not NFTs in the traditional sense, like those created with smart contracts. However, you can trade and use them like regular NFTs.

The interest in NFTs may have dipped, but ordinals might just renew that interest. Coming from a cryptocurrency with the largest crypto market cap gives it an advantage.

Ordinals are fundamental to creating NFTs on the Bitcoin blockchain. Without the protocol, you cannot inscribe or store additional data like text or images on a Sat.

You don’t need a smart contract or Layer 2 blockchain protocol to create Bitcoin NFTs. Since the information becomes part of the blockchain, your NFT inherits Bitcoin’s security and immutability.

Unique Properties of Bitcoin NFTs

What are ordinals in Bitcoin, and why are they important? The answer to that question lies in the unique properties of Bitcoin NFTs.

Inscriptions don’t require a separate token or a sidechain. Instead, they are like digital artefacts using the taproot script path to store scripts for storage.

You need two steps to complete an inscription. The first step is using the content to create the taproot output. Then, spending the output reveals the inscription.

As we progress with what ordinals are in Bitcoin, we must compare them to other traditional NFTs.

How do Bitcoin NFTs differ from traditional NFTs on other blockchains?

The table below shows the difference between Bitcoin NFTs and other traditional NFTs

Parameter Bitcoin NFTs Traditional NFTs Tokenization Bitcoin NFTs are essentially Sats These are minted as new tokens outside the cryptocurrency On-chain nature Bitcoin NFTs are not entirely fungible, although they contain the actual raw file on the Bitcoin blockchain They can have reference points to files hosted outside their native blockchains Multi-vector NFTs Although not done, Ordinals can create multi-vector NFTs since they can carry several inscriptions Limited to only one piece of information Lost NFTs Accidental spending loses the NFT Losing your wallet address means losing your NFT Benefits and challenges of using Bitcoin as a base layer for NFTs

The following are the benefits and challenges of ordinals:

Benefits

- They create more block space demand

- They attract new users and developers

- Ordinals have better security, decentralization, and censorship resistance than traditional NFTs

Challenges

- Most enthusiasts see them as a waste of scarce Bitcoin blockchain resources.

- The large amount of data and increased block space demand could result in higher fees.

- Ordinals can be used for scams, questioning their ethics and legality.

- The original Bitcoin vision was to be a P2P electronic cash system

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

The Bitcoin NFT Standard

The next section of our guide on what ordinals are in Bitcoin leads us to the Bitcoin NFT standard. Moreover, all NTFs have a standard they operate on.

The Bitcoin NFT standard is the protocol to create NFTs on the blockchain. Here’s an overview and the technical features:

An overview of the technical standard used for creating NFTs on the Bitcoin blockchain

The BRC-721E token standard is the official Ordinals Collection Protocol. It allows users to burn and convert ERC-721 NFTs to ordinals. However, it has a few rules you must follow, including the following:

- You must burn your ERC-721 NFT with the ETH call function. This creates an irreversible on-chain inscription.

- You must inscribe the BRC-721E data on a Satoshi to mesh both chains.

Once complete, you will receive the new NFT with its metadata. This standard is in its early stages and might be complex for newbies. The tokenomics differs from traditional NFT creation.

Key features and functionalities of the Bitcoin NFT standard

What are ordinals in Bitcoin, and how does the BRC-721E standard fit in? The standard’s primary purpose is the conversion of ERC NFTs to Bitcoin. However, it has other features that make it achieve this purpose seamlessly.

The features include the following:

- It migrates verifiable ERC-721 NFTs to ordinals without any changes

- Feature to enable permissionless bridging (on-chain inscription request)

- Automatically show burned NFTs

- The metadata presentation is in full quality

- Can inscribe 100 JSON bytes during low fees

Ordinal Generation and Verification

The best crypto trading apps are working to integrate Ordinals into their trading structures. You can generate ordinals, but you’ll need Bitcoin nodes (at least one) to do that. Other ways include buying and using a third-party service.

Explaining the process of generating ordinals for Bitcoin NFTs

We can generate ordinals in Bitcoin. The process includes the following:

- Use an Ord wallet with a full Bitcoin node and 500 GB for inscriptions. You can also freeze your Satoshis to avoid accidental spending.

- Use a no-code tool to inscribe an ordinal.

Ensure your wallet has enough Bitcoin for the transaction fee for no-code tools. You can also buy Ordinals from dedicated Discord channels.

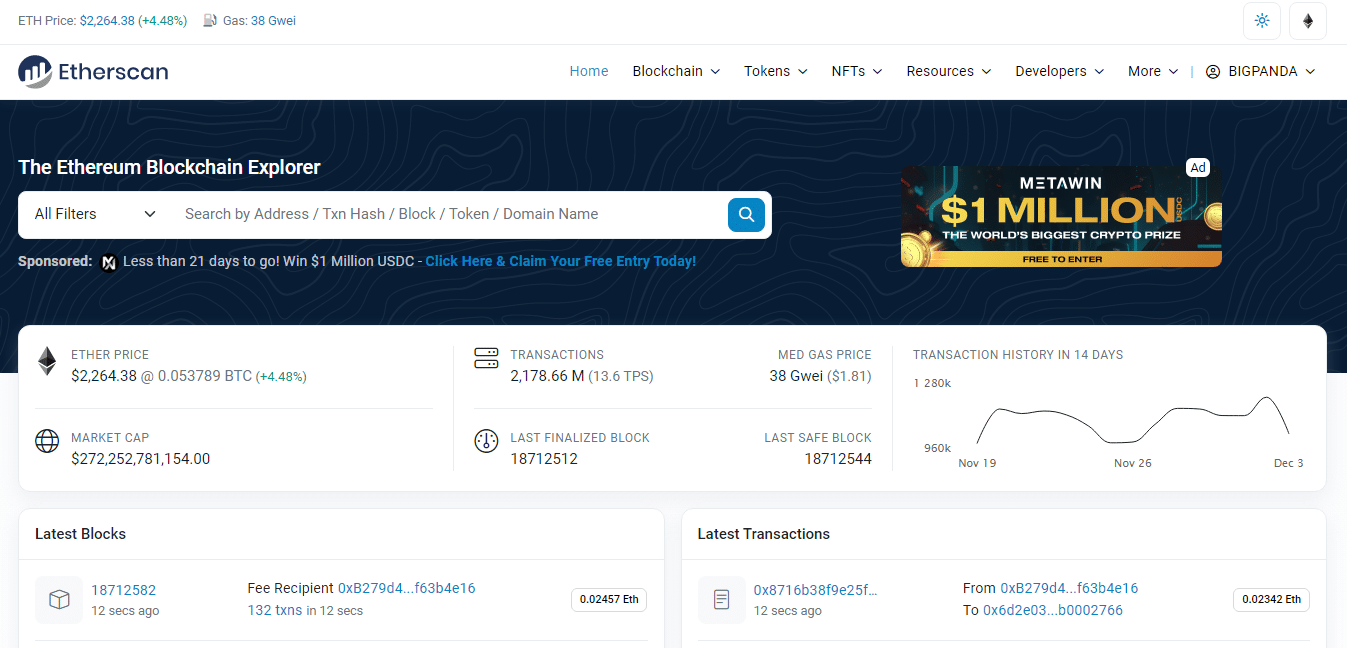

Verifying the uniqueness and authenticity of ordinals

You can use blockchain explorers like Etherscan to view the metadata and historical data. NFT-verification tools are also available. If there’s a need for extra checks, review the creator’s social media profiles.

All tokens should have one inscription. Also, the call data for the burn transaction should be the same as the Genesis address. You can use an indexer to verify these.

Collectibles and Digital Art

Collectors and artists are prominent in the NFT marketplace. Investors also come in to profit from the digital art market. This section will answer the question, What are Ordinals Bitcoin and how are they significant to digital art?

How artists and creators leverage ordinals in their NFT artworks

Connecting to the blockchain network is a unique property for ordinals. Hence, artists can leverage blockchain properties to create more expensive ordinals.

This increased value will see more demand for Bitcoin NFTs. Hence, creators can hone their craft to profit from sales.

Collectible items and their value in the NFT space

NFTs tie their value to demand and supply. The more people want an NFT and the less available it is, the more expensive it becomes.

With increased demand for Bitcoin NFTs, these items will become more valuable as time passes.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Gaming and Virtual Assets

Take a trip to the best crypto game app and you’ll discover that NFTs play a massive role. As creation and demand grow, developers will put more Ordinals into their games and virtual assets. Let’s explore the roles ordinals in Bitcoin play in games and virtual assets.

Integration of ordinals in gaming NFTs and virtual asset ownership

You can own Bitcoin NFTs in the blockchain gaming space. While you may be unable to grow Ordinals like other NFT characters, you will enjoy their uniqueness and value. These games can offer multiple ways to monetize your virtual assets.

Benefits for gamers and game developers in using Bitcoin NFTs

Using ordinals in game development can increase engagement. Gamers enjoy the tokenized rewards, which they can monetize, while developers enjoy higher patronage. Bitcoin NFTs provide secure and transparent access to game asset transactions.

Proof of Authenticity and Rarity

What are Ordinals in Bitcoin and how are they authentic? Being tied to a Satoshi makes each Bitcoin NFT authentic.

How ordinals serve as proof of ownership and rarity in NFTs

Ordinals are time-stamped with unique identifiers (numbers). These numbers serve as the unique inscription data on the Bitcoin blockchain. Hence, you can track their transactions and verify their owners.

Every Satoshi is unique and not all Satoshis have ordinals. Hence, they are rare among other NFTs.

The role of ordinals in establishing the uniqueness of digital assets

Ordinals establish uniqueness by inscribing unique data on Satoshis. They ensure a verifiable record of ownership on the Bitcoin blockchain.

Inscriptions cannot be changed or copied. Hence, each ordinal remains unique.

Scarcity and Market Value

We’ve covered the technical parts of what ordinals are in Bitcoin. However, most users will be interested in how much value they can add. Besides collecting, you can flip it for profit.

Like other NFTs, the scarcity of Ordinals influences market value. The value can increase even more based on the artist’s marketing techniques.

The connection between ordinals, scarcity, and market value of Bitcoin NFTs

Ordinals Punk sold for 9.6 BTC a few weeks after the protocol was launched. That was an impressive record and a pointer to what was to come. Today, crypto exchanges have ramped up support for Ordinals.

Bitcoin already has a limit of 21 million coins. Also, it gets harder to create a new block after every 2016 block is created. Hence, Ordinals enjoy even more scarcity than other NFTs.

This scarcity will inadvertently drive market value upward. Moreover, you can only place one NFT in one Satoshi.

Factors influencing the pricing of NFTs with specific ordinals

Generally, the following factors influence NFT prices:

- The artwork

- The supply scarcity

- The base network

With Bitcoin maintaining its lead in the crypto market, ordinals have even more utility and benefits for their owners. Hence, they are priced higher than average NFTs.

Security Considerations with Bitcoin NFTs

Non-fungible tokens present investment and security risks. An essential component of ordinals in Bitcoin is security. Hence, we’ve outlined several practices to stay safe when investing in Bitcoin NFTs.

Potential security risks related to ordinals and Bitcoin NFTs

Scams are the most prominent risks to ordinals and Bitcoin NFTs. Fake Bitcoin NFTs are already flying around on NFT marketplaces.

Another security risk is the potential for loss of privacy. Inscribing an Ordinal with private information leaves you at risk if it is stolen. That could also compromise the entire network’s security.

Malleability and double spending are also security risks. NFTs are not equal. Hence, some may be more susceptible to these risks.

Best practices for users to safeguard their NFT assets

What are ordinal best practices? We recommend the following:

- Use a VPN when using a public network

- Trade on reliable exchanges and marketplaces

- Do not share your password or seed phrase

- Don’t inscribe sensitive when creating a Bitcoin NFT

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Future Innovations and Applications

Bitcoin NFTs may have launched in early 2023, but they have already shown possibilities for future innovation. They have introduced an unconventional way to create NFTs.

Exploring potential future developments and use cases for Bitcoin NFTs and ordinals

The sentiment on Bitcoin NFTs remains bullish. We believe the following will be part of their future development:

- Creation of unique and scarce digital collectibles like stamps

- Applied in identity verification (passports, IDs, etc.)

- Tracking of goods in supply chain management

- Representing property ownership rights

The role of Bitcoin’s layer 2 solutions in enhancing NFT functionality

What are ordinals, and how are they related to Bitcoin’s Layer 2? The introduction of Ordinals and the creation of Bitcoin NFTs have not eliminated layer 2 solutions. Instead, the latter can assist in improving the functionality of Bitcoin NFTs.

Layer 2 solutions have two significant roles to play in enhancing NFT functionality. These include efficiency and scalability. They offer faster NFT transactions by leveraging optimization techniques and off-chain processing.

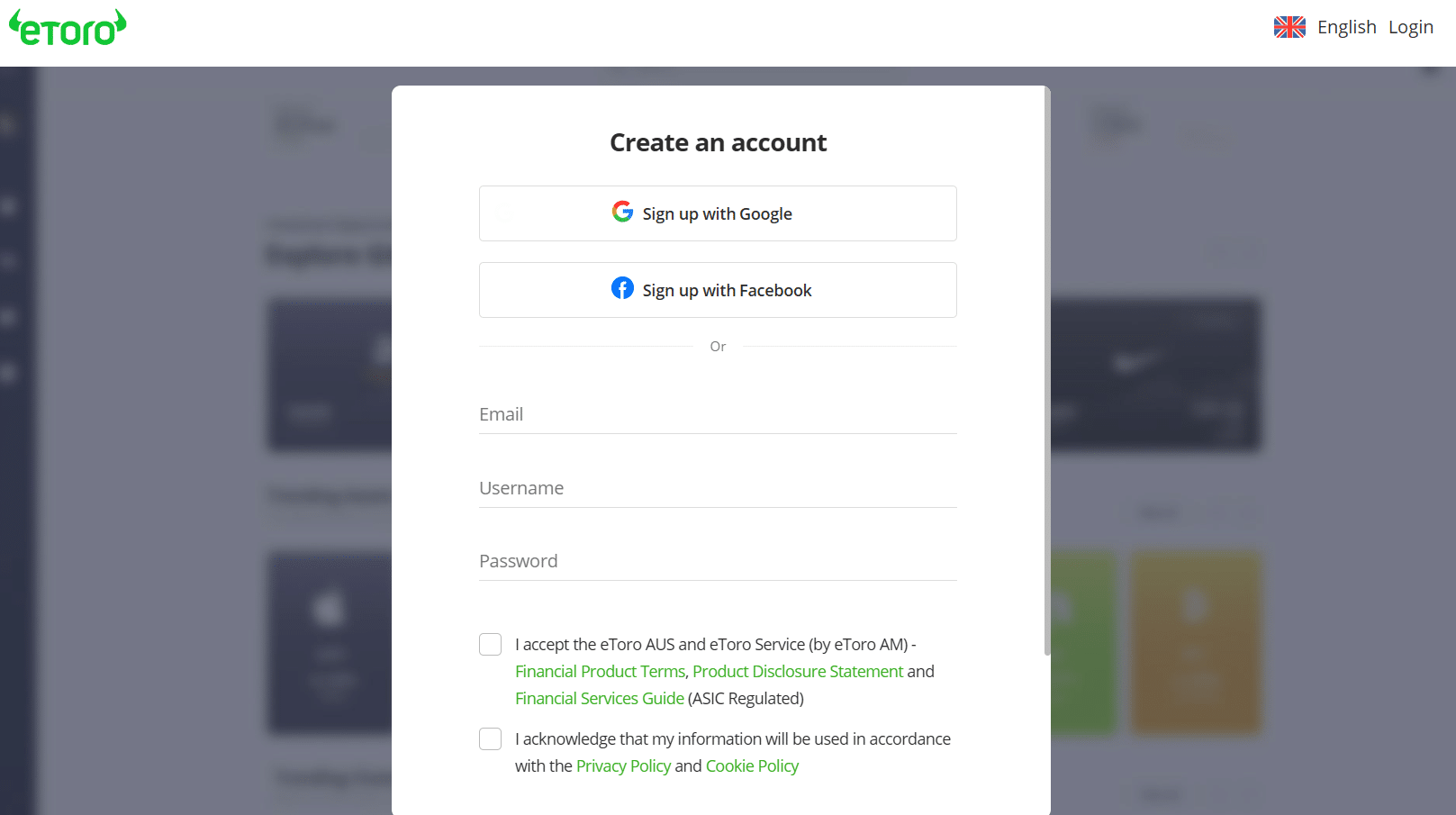

What are Bitcoin ordinals? eToro Complete Guide

Crypto trading is closely related to Bitcoin ordinals. Moreover, the endpoint is to buy and sell our crypto assets comfortably. We recommend eToro to all beginners and experts looking for simplicity.

Beginners can start with the $100,000 virtual trading account. Conversely, experts can explore eToro’s wide range of technical indicators and tools for trading.

Here are the steps to register and start trading Bitcoin on eToro:

Step 1: Create an account as a new traderUse our link to open the official eToro website on your mobile device or PC. Ensure you are on the home page of the website.

Click “Join Now” or “Join eToro” to open the registration page. You don’t need any ID for the initial registration.

Step 2: Fill out the registration formYou will see a registration form on the next page. The details required include your email, password, and username. eToro also supports direct account opening with Google and Facebook.

Step 3: Privacy and terms of serviceTwo boxes will appear on the registration page. These include the privacy and cookie policies and the product terms. Check the checkboxes to continue your registration.

Step 4: Verify your emailOpen your email inbox and find the verification code sent during registration. Input the code to complete the registration process.

Step 5: Download the app or start practicingYou can download the app or trade on the mobile platform. Go to the home page to download the app. Use the $100,000 virtual account to start trading.

What are ordinals? – Conclusion

Miners face a dilemma with ordinals. We identified them as inscriptions while exploring what Bitcoin ordinals entail. These inscriptions take up space that would otherwise go to transactions.

What are Bitcoin Ordinals used for, if not for the blockchain’s benefits? Many argue that the demand for Bitcoin NFTs is healthy for the blockchain.

This development is worth pursuing. Use eToro for all your crypto trades to ensure security and efficiency.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

References

- https://www.statista.com/statistics/655511/leading-virtual-currencies-globally-by-purchase-volume/#

- https://www.forbes.com/sites/paultassi/2022/03/10/interest-in-nfts-and-the-metaverse-is-falling-fast/?sh=488c49e21ebb

- https://www.msn.com/en-us/money/other/how-ordinal-nfts-could-impact-the-bitcoin-ecosystem/ar-AA1laboz

- https://www.reuters.com/technology/cryptoverse-new-breed-bitcoin-nfts-sell-millions-2023-03-14/

- https://theconversation.com/are-nfts-really-dead-and-buried-all-signs-point-to-yes-214145

FAQs

What are Ordinals in NFT?

For NFTs, ordinals represent the protocol to inscribe images and other information to Satoshis to create NFTs.

What are Ordinals in blockchain?

Ordinals are serial numbers attached to Satoshis when mined. They can take up additional information (content) through inscribing.

What is an Ordinal in Bitcoin?

This refers to a mined unit of Bitcoin (Satoshi) used to store data. Each ordinal is unique and carries the properties of the blockchain.

What is an example of a Bitcoin Ordinal?

A Bitcoin ordinal can be anything, from images to text. However, the data must not exceed 4MB.

Jeremiah Awogboro

View all posts by Jeremiah AwogboroJeremiah Awogboro is an experienced content writer with over 8 years of experience. He has a qualified MBChB degree and a keen interest in the stock market and the finance industry. His background in the industry has provided him with valuable experience in this field. Awogboro is dedicated to assisting and reaching out to as many people as possible through his writing. In his spare time, he enjoys music, football, traveling, and reading.

VISIT ETOROYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2024