What is Leverage in Crypto Trading? – Complete Review 2026

The crypto market capitalization enjoyed premium highs in 2021 and 2022 before sinking into an abysmal performance in 2022. However, the market is catching up, with positive sentiments ramping up interest. Some trading apps allow traders to trade with more money, leading us to leverage in crypto trading.

Some cryptos, like Ethereum, remain out of reach for most casual traders, as they’d rather trade cheaper cryptos. With leverage, you can become an investor with little trading capital. Meet the requirements of the trading platform, and you could have up to 100 times your balance to trade.

What is leverage in crypto trading, and how does it benefit you? We’ll see how this concept can help you achieve more from your trades and how to calculate them. Most importantly, you’ll see the risks and considerations you must make to stay afloat.

-

-

What is leverage?

Those who are familiar with trading traditional securities will recognize leverage. It is a powerful tool to increase the potential returns for a position. However, it is also double-sided, increasing the potential losses.

Here’s a basic view of what leverage is in crypto trading. Consider it a loan to execute a trade beyond your equity (margin). You’ll see more use of margin on crypto trading apps than equity when dealing with leverage.

The definition of leverage and its role in crypto trading

Let’s explain what leverage is in crypto trading based on its context. Leverage in crypto trading is a tool to borrow capital from an online broker for a trade. Hence, the tool amplifies your buying or selling power of crypto assets.

The primary role of leverage in crypto trading is to amplify a trader’s position. Such positions would otherwise require more collateral than you can afford. If it goes right, you can make more money than your capital allows.

Understanding how leverage amplifies trading positions

What is leverage in crypto trading, and how does it amplify your position? The primary explanation is that you receive a loan from an online broker. This loan increases your trading position.

Let’s say you have $100 in capital with a leverage of $500. The broker has boosted your position up to $500. Hence, the trade you enter will reflect $500, including your potential profits.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

How Leverage Works

Leverage is not a one-way ticket to get more money on your trades. It also increases your losses by the same ratio. Hence, you can maintain the trade with a lesser or higher margin.

We don’t recommend jumping into real-life trades with leverage. You can practice with demo trading apps to catch up with our explanation here. With that in mind, let’s see how leverage works in crypto trading.

Leverages use ratios. For example, a 1:100 leverage amplifies your capital 100 times more. If you put $100 in, you’d have $10,000 to trade with.

To further explain what leverage in crypto trading entails, let us define two crucial terms: collateral and liquidation.

Collateral Liquidation This refers to the assets you must have in your account to take a leveraged position This involves loss of initial capital to the broker when the market moves against your leveraged position Like traditional loans, you need collateral to obtain leverage. This collateral depends on two critical elements: the leverage ratio and the position size.

When trades are live, the market can either move in your predicted direction or against it. Of course, there’s room for sideways trades.

Your collateral will only hold if the market moves in your direction. Then, the leverage will work for you by amplifying your position. If the converse occurs, your collateral may lose its ability to hold your position.

An explanation of margin trading and borrowing funds from the exchange

Margins are integral to leverage in crypto trading. As mentioned, you need the required margin to enter a leveraged trade. This is your collateral.

Leveraged trades occur in derivatives, including margin and futures trading, options trading, and leveraged tokens. You must deposit enough to cover the risk before a broker lends money to you.

In margin trading, your broker charges interest on the borrowed funds. Also, you must own a margin trading account to use this approach. It differs from the usual trading account.

Calculating leverage ratios and margin requirements

You’ll find several leverage ratios in the finance world. These include the following:

- Dept-equity ratio

- Equity multiplier

- Degree of financial leverage

- Consumer leverage ratio

So, what leverages are common in trading crypto? Leverages in crypto trading often occur at 1:X, where X represents the amount of leverage. Let’s see how to calculate the margin requirements.

Assume we want to enter a $6,000 trade with 1:10 leverage.

The margin required = (1/10) * $6,000

= $600.

The calculation is simple, but that tells half of the story. You must also calculate your percentage losses. Let’s assume the trade gains or loses 20%

If it loses 20%, then you’ve lost = (20/100) * $6,000

= $1,200

Your margin cannot support the position. Before that happens, the broker will ask you to liquidate. It can also force you to liquidate.

The position will continue if the losses are still within your margin. Like stock alert services, you should set up alerts for price movements. That will help you exit any unprofitable position before losing your margin.

Perpetual Swaps and Futures

We’ve taken a systemic approach to how to apply leverage in trading crypto. One thing that stands out is that leverage is popular among derivatives. Perpetual swaps and futures are derivatives that allow leveraged trading.

Both speculate on an asset’s price movements. However, they have significant differences in execution timelines. With the latter, you might need to examine the best time to trade crypto before initiating it.

Understanding perpetual swaps and their relationship to leverage

Perpetual swaps are derivative contracts that allow you to speculate on an asset’s price. There is no timeframe for the contract. Hence, you can open long positions and not worry about monitoring the contract expiration date.

You can maintain an indefinite leverage position when trading crypto, although we don’t recommend that. That requires a sufficient margin with potential losses.

Perpetual swaps support leverage. However, you must be careful not to hold your position too long. The broker will lend you money to amplify your position, provided your margin can hold it.

Explaining leverage in futures contracts

Futures contracts involve speculating on an asset’s price within a fixed period. You agree to sell or buy the security at a specified price.

If your crypto or stock market research and analysis software shows positive sentiments, you may prefer using more money. The best approach is to leverage your position.

Instead of buying a few units with your margin, you can leverage the trade for a higher premium. This approach can give you more profits, but there’s also a downside to losses.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Exchange-Specific Leverage Offerings

Let’s review and compare crypto exchanges and their leverage options for crypto trading.

Comparison of leverage options across different crypto exchanges

The table below shows several crypto exchanges and their leverage options:

Crypto Exchange Leverage ratio Coinbase 1:3 Kraken 1:50 Gemini 1:100 eToro 1:2 Pros and cons of using high leverage vs. low leverage

You can pick high-leverage crypto trading or a lower one. Let’s see the pros and cons on both sides.

For high leverage, here are the pros and cons:

Pros:

- Potential for higher profits

- Access to highly-priced markets

- It can be used to hedge losses in other positions

Cons:

- Potential for higher losses

- Margin calls may occur

For low leverage, here are its pros and cons:

Pros:

- Potential for lower losses

- Reduced fees when holding your position

- Easier to manage in a portfolio

Cons:

- Lower potential return

- No access to highly-priced markets

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Benefits of Leverage in Crypto Trading

Leverage crypto trading can be beneficial. You can make strategic gains with leverage despite the risk and associated fees. Here are its most significant benefits:

Leveraged trading for potential higher returns

Let’s assume you enter a $5,000 trade with a leverage of 1:10. Your margin will be $500. If the trade gains a 20% profit,

Profit 1 = (20/100) * 5,000

= $1,000

If you traded with your margin alone,

Profit 2 = (20/100) * 100

= $20.

You can see the significant difference in profit. Of course, your net profit comes after repaying your loan. Still, the difference in profits 1 and 2 is massive.

Access to increased market exposure with limited capital

What is leverage crypto trading in market exposure? You don’t need to risk a large amount of capital to gain increased market exposure. Instead, leverage lets you pick a small portion of your capital and still get the same market exposure.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Risks and Considerations

Risk is integral to leveraged crypto trading. Picking leverage should never be rash because of the potential high returns. It must be well calculated and compared to your portfolio and capital.

You can use investment tools and analysis software to remove highly volatile assets. Notwithstanding, trading boils down to how much risk you can tolerate.

Exploring the risks associated with trading on leverage

Consider the following when trading with leverage:

- Crypto volatility: Cryptocurrencies are inherently volatile. The absence of a central regulator makes it more volatile than traditional assets.

- Margin calls: The market may not go your way even with the best analysis. A significant event can occur and swing the market in the opposite direction.

- Counterparty risk: Downtimes and network congestion can stop you from exiting a trade on time.

We cannot emphasize this section enough. Leverage in crypto trading presents high-earning opportunities but also comes with risks.

Understanding the importance of risk management

Risk management can save you capital. Expert traders can also use high-risk trades as hedges. However, you’ll need an adequate understanding of the market before doing so.

Review your portfolio and recognize your risk tolerance. The latter refers to how much money you can lose without affecting your finances. Once that happens, you’ll know how much to put in as a margin.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

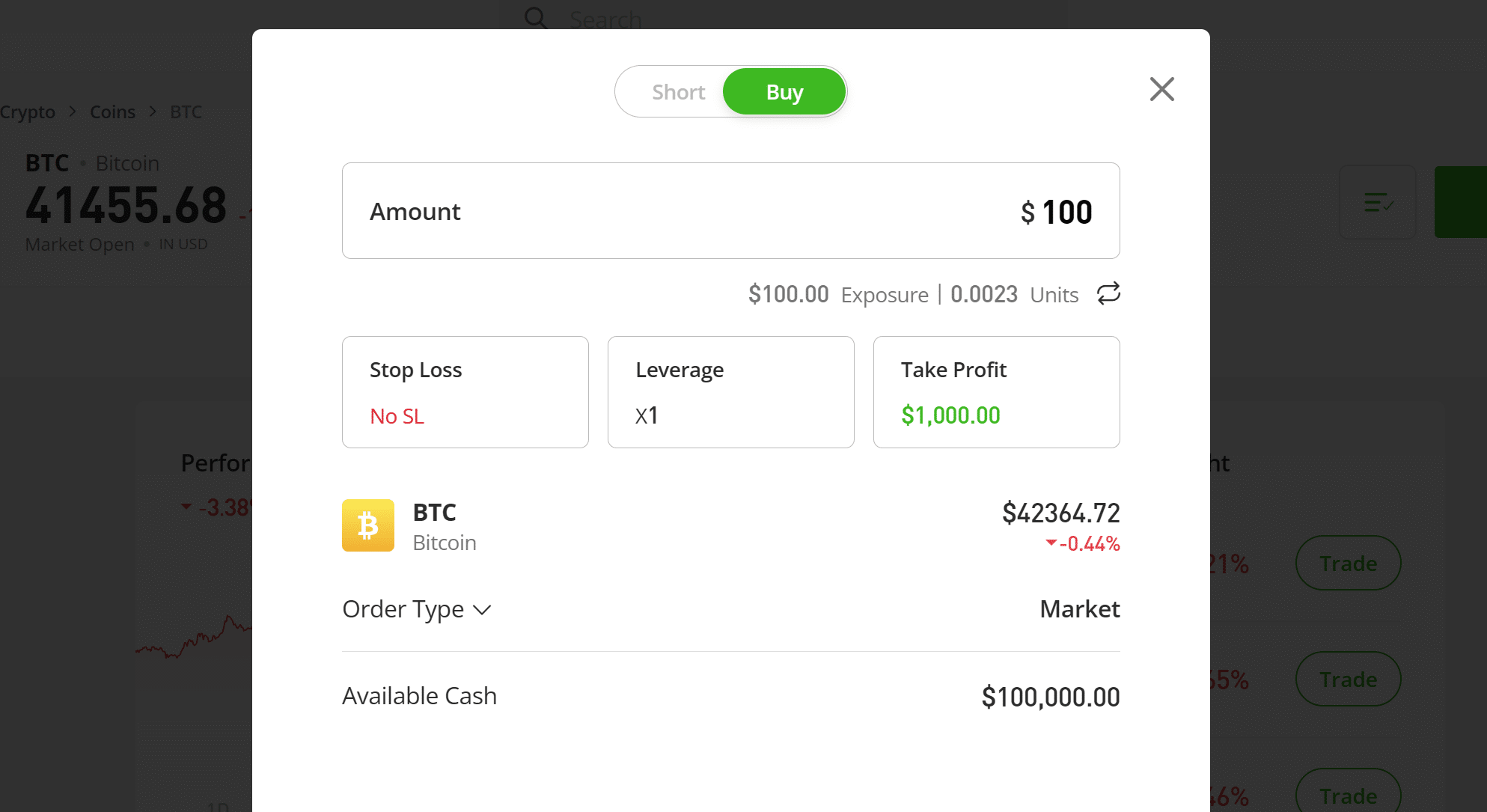

How to Use Leverage in Trades

Knowing what leverage is in crypto trading is one half, while applying it is the other half. We encourage practicing this approach on simulated trades (use eToro). Hence, this section will show you a step-by-step guide and tools to reduce losses when trading with leverage.

A step-by-step guide on placing leveraged trades on exchanges

Here is our step-by-step guide to placing leveraged trades on exchanges:

- Register with any of our recommended crypto trading apps offering leverages

- Fund your account with the amount you want to trade with

- Open a separate margin account

- Transfer money to your margin wallet

- Find your preferred derivative

- Select the leverage you want. Some apps will keep it at a default level.

- Enter the margin

- Place the trade

Setting stop-loss and take-profit levels for leveraged positions

Stop-loss and take-profit options are available when trading crypto with leverage. These tools are essential, especially when you are not actively monitoring the trade. They can end the trade without your active participation.

A stop-loss exits the trade when your losses have reached your set point. Conversely, a take-profit exits the trade when your profits have reached your set point. Consider the following when setting them:

- Use a percentage of your capital as the threshold for losses. Then, set the TP to exceed it.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Strategies for Leveraged Trading

Trading with strategies is essential to winning while reducing losses as much as possible. Take your understanding of what leverage is in crypto trading to the next level with a few strategies. We encourage trading strategically, especially in highly volatile markets.

Trading strategies designed for leveraged positions

Our recommended strategies for leveraged positions include the following:

- Momentum trading: This strategy involves trending cryptos. You can quickly leverage a short trade during high sentiments to grab the quick bull run.

- Reversal trading: It involves trading when the market swings in the opposite direction. However, you must understand in-depth analysis to gauge how long the swing will be.

- Scalping: You don’t need to make long trades to start profiting. Small trades can still bring profits. However, the profits won’t be much.

Diversification and risk mitigation in leveraged trading

Another strategy for using leveraged positions is diversification. You shouldn’t throw all your eggs (capitals) in one basket. Instead, spread them among different assets.

We recommend portfolio trackers when using leverage in crypto trading. Have a mix of highly volatile crypto and low-volatility assets.

Leverage and Its Impact on Volatile Markets

Some studies indicate that leverage has a significant influence on market volatility. Increased leverage can raise volatility. Nonetheless, other factors can play decisive roles.

How leverage can amplify gains and losses during market fluctuations

Your leverage amplifies gains during fluctuations, regardless of how little. A 1% price increase can cause a 10% gain if you leverage 1:10. However, we can say the same about your losses.

Tips for navigating high volatility when using leverage

If you must use leverage in highly volatile crypto trading, then do the following:

- Invest according to your risk tolerance.

- Pick a comfortable leverage that won’t be too close to a margin call

- Set take-profits or stop-loss

- Use alternative data services to examine market sentiment

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Long vs. Short Leverage Trading

Long and short positions are different approaches when applying leverage in crypto trading. The crypto market can be bullish or bearish. Sideways markets are possible, but that won’t do much for profit.

You should determine your preferred position before entering a trade. That comes after carefully studying the market (still risky, though).

Understanding the implications of long and short-leveraged positions

Each trade can either be a long or short position. Long positions mean speculating that the crypto price will increase, while short positions imply a decrease.

Going long in a leveraged position presents a significant risk. The market can turn and become bearish. We can say the same for short-leveraged positions.

Pros and cons of each strategy in different market conditions

Your everyday trades, when using leverage in crypto trading, boil down to long and short positions. These positions serve several markets, with pros and cons, as follows:

Pros and cons of long-leveraged position in a bullish market

Pros:

- It increases your potential gains

- You can control more significant amounts than your capital

- You can hedge against losses through inverse trades

Cons:

- Interest on leverage

- Volatility can eat away at your profits

Pros and cons of a short-leveraged position in a bearish market

Pros:

- Opportunity to profit from falling prices

- Hedging against falling prices for trades in a long position

Cons:

- Bearish markets can be more volatile.

- Interests on leverage can outweigh the profits

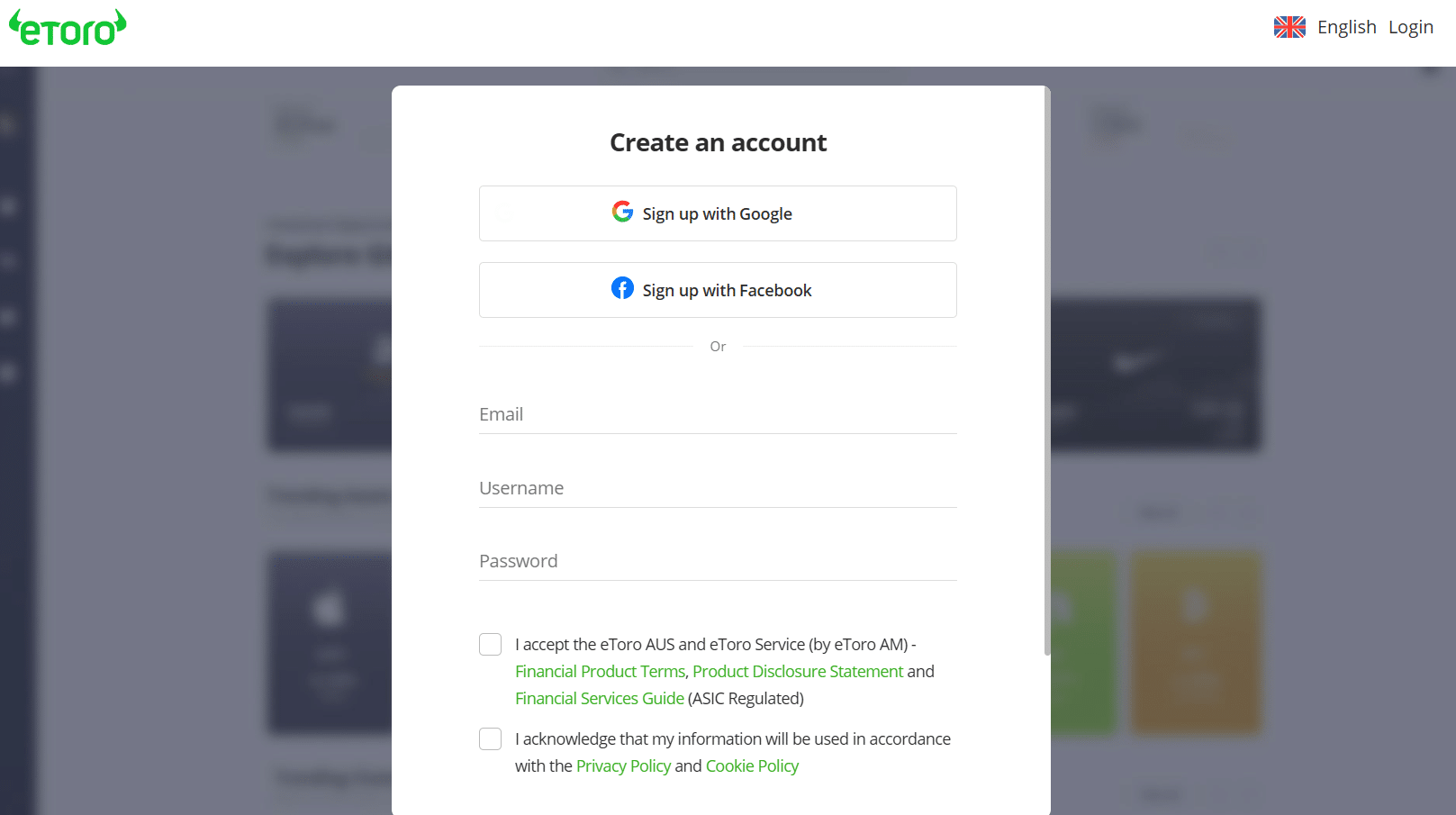

Leverage in Crypto Trading: The eToro Complete Guide

It is time to apply your knowledge of leverage in crypto trading to the right app. eToro provides an ideal platform for analytical trading. It has technical indicators and trader posts to update you on market movements and sentiments.

This crypto trading app will get you started with a $100,000 virtual account. You can skip it if you are a professional trader.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

Here are the steps to register with eToro:

Step 1: Open a trading accountWe’ve provided several links to eToro on our page. Follow them to the official eToro website. You can download the mobile app or continue registration on the website.

Step 2: Register with the appClick the buttons provided for new traders. A registration page will appear with sections to fill in your name, email, and password. Quick registration through Facebook and Google is also available.

Step 3: Consent to the platform’s policieseToro has policies on your privacy and its terms of service. Ensure you tick these boxes to proceed to the next stage of the registration. You can read both policies to be sure of what you will sign.

Step 4: Verify and fund your accountYour new account will be temporarily locked until you input the verification code. eToro will send the code to your email. Enter it on the website and click “Complete Registration.”

eToro supports credit card transactions. Go to your account and follow the payment prompts to deposit into it.

Step 5: Practice with the demo or start trading with real moneyNew traders should practice with the demo. Professionals can quickly begin trading with real money.

What is Leverage in Crypto trading?—Conclusion

We’ve given the most well-rounded answer to what leverage is in crypto trading. However, you must use this approach with caution. Apply risk management strategies before leveraging your position.

Use analytical tools to research the underlying cryptocurrencies for your derivatives. Register on eToro for access to technical indicators.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

References

- https://www.statista.com/statistics/730876/cryptocurrency-maket-value/

- https://www.cnbc.com/select/how-to-figure-out-your-risk-tolerance-investing/

- https://www.cambridge.org/core/journals/journal-of-financial-and-quantitative-analysis/article/abs/leverage-effect-volatility

- https://pro.bloomberglaw.com/brief/cryptocurrency-laws-and-regulations-by-state/

- https://www.forbes.com/uk/advisor/investing/what-is-diversification/

FAQs

Is crypto leverage trading profitable?

The practice is profitable, with the potential to return more than your margin could’ve produced.

Is leverage trading crypto illegal?

You can use leverage in crypto trading, provided your country approves crypto trading. Also, the broker or exchange should be licensed to operate in your country..

What is 20x leverage on $100?

A 20x leverage on $100 means 20 times 100, which is $2,000.

How does leverage trading work?

In leverage trading, you use a small amount of capital to hold a larger position while obtaining leverage to fund that position.

Jeremiah Awogboro

View all posts by Jeremiah AwogboroJeremiah Awogboro is an experienced content writer with over 8 years of experience. He has a qualified MBChB degree and a keen interest in the stock market and the finance industry. His background in the industry has provided him with valuable experience in this field. Awogboro is dedicated to assisting and reaching out to as many people as possible through his writing. In his spare time, he enjoys music, football, traveling, and reading.

VISIT ETOROYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2026