What is Day Trading and How to Get Started

Online trading platforms have made trades easily accessible from fairly powered internet-enabled devices. Some traders have figured out what day trading is, opting for the short-term returns it offers over long-term trading. The idea is to profit within short trading windows in volatile markets.

Day trading rules do not apply to long-term investors who prefer less volatile and often blue-chip stocks. Even so, day trading stocks has massive risks, as studies show that only about 34% of day traders make a profit. Online trading tools contain tools and functions to help you mitigate risks as much as possible.

This guide will show you how to day trade and maximize the resources day-trading apps provide.

-

-

Definition and Basics of Day Trading

Price movement curves become smoother as you extend them over long periods. You can try this on any chart by lengthening the start and end periods.

Fluctuations become more noticeable during shorter trading periods. These could be uptrends or downtrends. Hence, day-trading apps support shorter time frames, unlike long-term investment platforms.

The first step in our guide is defining day trading for beginners. This approach has key terminology that’ll keep you ahead of the market. Learning them is mandatory to become an expert day trader.

Defining Day Trading in the Stock Market

Conventional knowledge shows that one day has 24 hours. However, most trading markets don’t open for 24 hours.

The US stock market, which includes the Nasdaq and the New York Stock Exchange (NYSE), opens at 09:30 and closes at 16:00. That provides a 6-hour, 30-minute window to trade stocks. Now, we can define what day trading is.

Day trading involves buying and selling financial instruments, including stocks, within the same day on one trading market. The trader can perform multiple trades in this window. Also, note that global markets operate in local time.

This process brings the need to open and close positions quickly. The market is fast-paced because your focus is on making gains within the daily trading window. Again, that calls for day trading strategies, some of which we will discuss subsequently.

The Financial Industry Regulatory Authority (FINRA) defines a pattern day trader as one who executes four or more trades within five business days. These trades must represent 6% of the total trades in the margin account within the same period.

The key to day trading is to buy financial instruments at low prices and sell them at high prices. You must skillfully determine entry and exit points to avoid losses. While the market can change due to unforeseen events, it is best to be prepared to analyze charts.

Characteristics and Objectives of Day Trading

Stability is rarely on the minds of day traders. The more fluctuations and the wider the price swings, the more profit they make.

The stock research strategies employed for day trading differ from those of long-term investors. Here are a few characteristics of day trading:

- Volatile markets: This is the foundation of what day trading is to many traders. It is where they get their chance for high returns within short periods.

- Fast-paced markets: Prices respond quickly, reflecting on charts instantly.

Day traders carry more risk than long-term investors. Of course, they must complete all trades within the day or risk broker fees for carrying over to the next day. That requires staying glued to the market (charts) for hours, hoping to determine the best entry and exit points.

The following are typical objectives of day trading:

- Profit from short-term price swings

- Focus on strategies for immediate gains

- Ride on momentum

- Make fast decisions

Some traders shorten the research process through AI stock-picking software. They narrow their options quickly and head straight to technical analysis.

Key Terminology for Day Traders

It’s best to familiarize yourself with key terminology while learning what day trading is. The following are typical terms you’ll encounter when pursuing short-term gains:

Terms Definition Trading day This term refers to the period during which financial markets remain open for trading. The United States and the UK have different trading days because of time zone variations. You might need to stay awake at night to trade in other markets outside the US. Stop-loss order This order protects traders by selling their assets when they reach specific price levels. It is an important term and function that you will likely integrate into your trading strategies. Leverage This involves borrowing from an online broker to enter a larger position beyond your primary deposit or balance. It is a function you’d want to use with care Short selling This approach involves borrowing shares from an online broker, selling them at the current market value, and buying them back at a lower price. It is a strategy to profit from price declines. Market orders These are instructions traders give to buy or sell assets immediately at the best market value. Volatility It refers to price fluctuations. Bullish This is an expectation for prices to rise. It refers to market sentiment Bearish This is an expectation for prices to fall. Again, it refers to market sentiment. Technical analysis It involves analyzing historical price and trading volume data to predict future price movements. Risks and Rewards of Day Trading

Timing is essential in day trading strategies. Miss an entry or exit point, and you might suffer losses. The short trading time and fast-paced market amplify the risks, as you have little time to decide.

Amplifying the rewards requires dealing with more volatile assets. These include small-cap stocks, cryptocurrency, forex, commodities, etc. With volatility comes risk.

You must buckle up to bear risks if you want high returns. That is as essential as learning how to start day trading.

High Potential Returns and Quick Profits

Financial assets can have over 50% daily gains or losses. With the right timing, you can grab a 50% return in less than 24 hours.

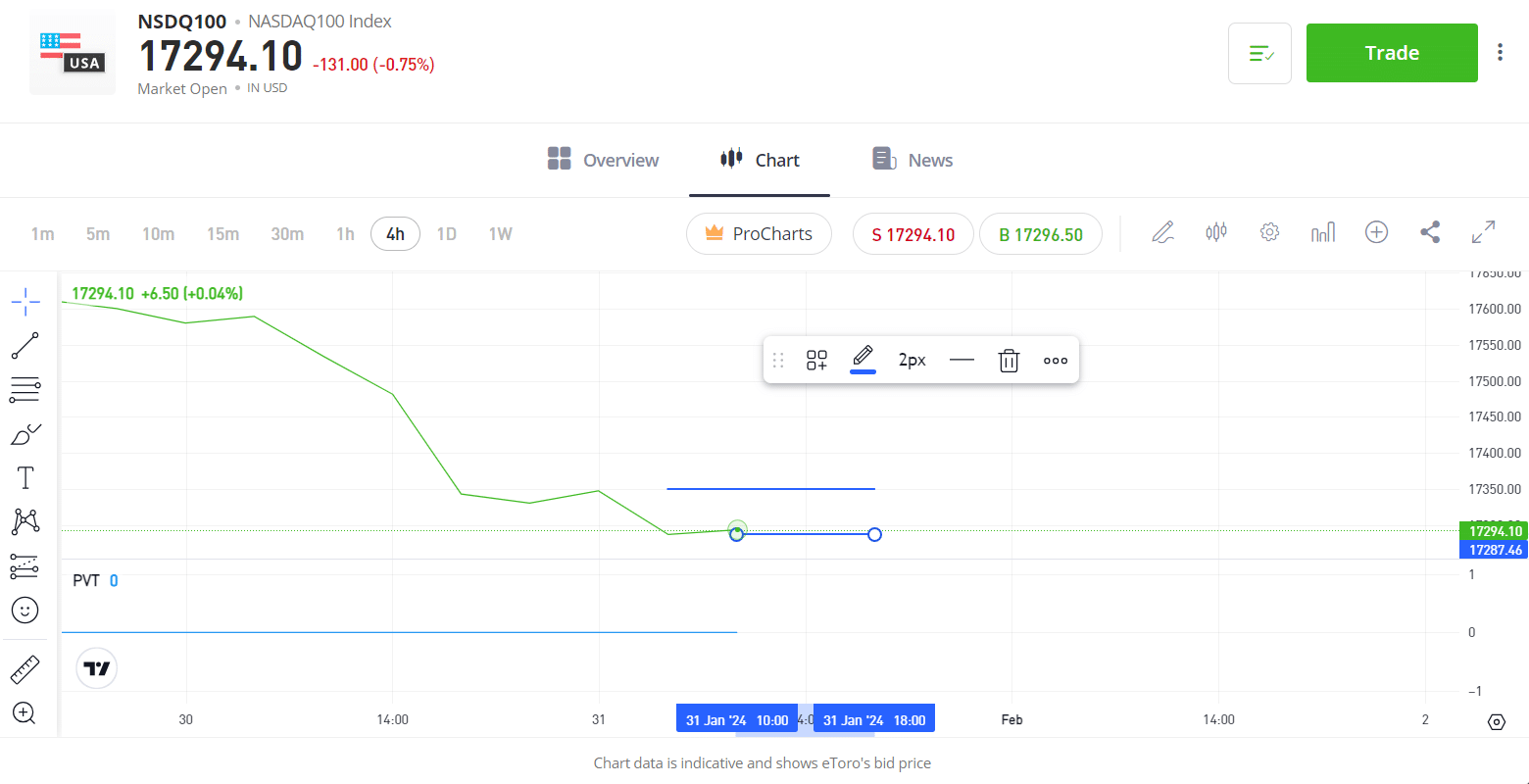

The graph below shows how prices fluctuate within hours. The NSDQ100 fell from 17,350 to 17,287 between 02:00 and 06:00. Some markets are more volatile than the example below.

Depending on your trade, you can make massive profits. Short-term traders often use leverage to maximize gains beyond their balance.

Price swings occur quickly during intra-day trades. High potential returns are possible but so are high losses.

Inherent Risks and Challenges in Day Trading

We’ve already identified the potential for massive losses within a short period. Still, day trading has other risks and challenges, as follows:

- High market volatility

- Steep learning curve because of the fast-paced nature

- Leverage introduces risk for higher losses

- Intense time commitment to monitor the market

- Commissions and fees from brokerages

Besides these, day traders face regulations and laws. The most prominent is the restriction on frequent trading for accounts with less than $25,000.

Staying glued to your screen is another challenge in day trading. Also, you need sophisticated devices to monitor the market in real-time.

Diversification is challenging, even with the best day trading strategies. Your focus will be on a few instruments as you seek to master their markets. Less diversification increases investment risk.

Psychological Aspects of Day Trading

Day trading comes with psychological pressure. We recommend assessing your risk tolerance after going through this guide on what day trading is.

The emotional pressure comes from making split-second decisions. While you can use technical indicators and other analytical tools, the uncertainty will always be there. That leaves you on the edge until you exit the trade.

Other psychological aspects of day trading include the following:

- Loss aversion bias that restricts you from entering potentially profitable positions because of the potential losses

- Frustration that comes from losing trades, especially when you don’t make a profit soon enough

- Impulsive trading decisions that ignore cognitive decisions

- Overconfidence that can result in taking more risks than necessary

Day trading for beginners can be a rollercoaster of emotions. Hence, you should begin with virtual trading accounts.

Disclaimer: Your capital is at risk.

Setting Up a Day Trading Workspace

Your workspace is the first major step in learning how to day trade. You might not have the finances to grab all the gadgets and software. However, getting what delivers the market and allowing trades with minimal latency is best.

The process often begins with computers and monitors. Then, you need a stable internet connection to get you through the trading day. Remember, you might be on your screen for hours, gauging the market and looking for opportunities.

Choosing the Right Computer and Monitors

Smartphones have grown into reliable and robust minicomputers. They can handle real-time market data, with online brokers rolling out mobile apps to complement their PC platforms.

However, you’ll need more than one tiny screen to carry the information you need for day trading. Those who know what day trading is understand the need for multiple computer monitors.

One screen might carry news, another for charts, and another for execution platforms. These should be high-definition monitors.

Here are some tips when shopping for a computer and monitor:

- Opt for monitors with at least a full HD+ resolution (1920 x 1080). 2K and 4K monitors are also recommended, although they may be above budget for most beginners.

- Consider larger monitors of at least 27 inches. Remember, these may carry several charts simultaneously.

- Have extra monitors to track other information, like order books and news.

- Pick monitors that can display technical indicators clutter-free.

- Computers with 4 to 6 cores are advisable. You can opt for higher processing power.

- 16GB should be the minimum. Nevertheless, you can get away with 8GB for low-intensity trading.

- Use SSD drives

- Pick desktops if you don’t intend to move often. Laptops are ideal for traders on the move (not recommended to be on the move often).

Reliable Internet Connection and Back-Up Solutions

Real-time data is crucial to executing trades quickly. The only way to guarantee that is through a reliable internet connection. 5G speeds are optimal, but you can get away with 4G speeds.

Get high-quality routers with high upload and download speeds. Adjust your router size based on the projected number of users. You don’t want slowdowns as more people connect to it.

Set up backups, like a secondary router or your mobile data. These will ensure you don’t miss an exit point and throw away your gains.

Software Platforms for Day Trading

The final setup is installing software platforms. These can help you automate analysis, back-test strategies, recognize patterns, and view real-time news. Hence, you should give the selection process your best shot.

We’ve provided our top recommendations for day trading apps on our site. eToro remains the best for beginners because of its simplicity and handy features.

Install the software programs and run them with their virtual accounts. Test the features, user interface, execution speeds, etc. Other considerations include the following:

- Costs and fees

- Charting tools

- Tools for technical analysis

- Customer support

- stability

Technical Analysis and Charting Tools

Day traders are not the only ones who conduct technical analysis using charts and indicators. Banks, financial institutions, Wall Street investors, and brokerages have analytical teams for the market. They review the analysis and trade accordingly.

Technical analysis involves past price data and trading volume. Fortunately, online brokerages have integrated several tools to quicken the process. They’ve incorporated several mathematical calculations into a few button clicks.

The first step is interpreting charts. Several chart patterns will appear as you review price movements. Then, you can use technical indicators to make out what the patterns mean and recognize potential entry and exit points.

Introduction to Candlestick Charts and Patterns

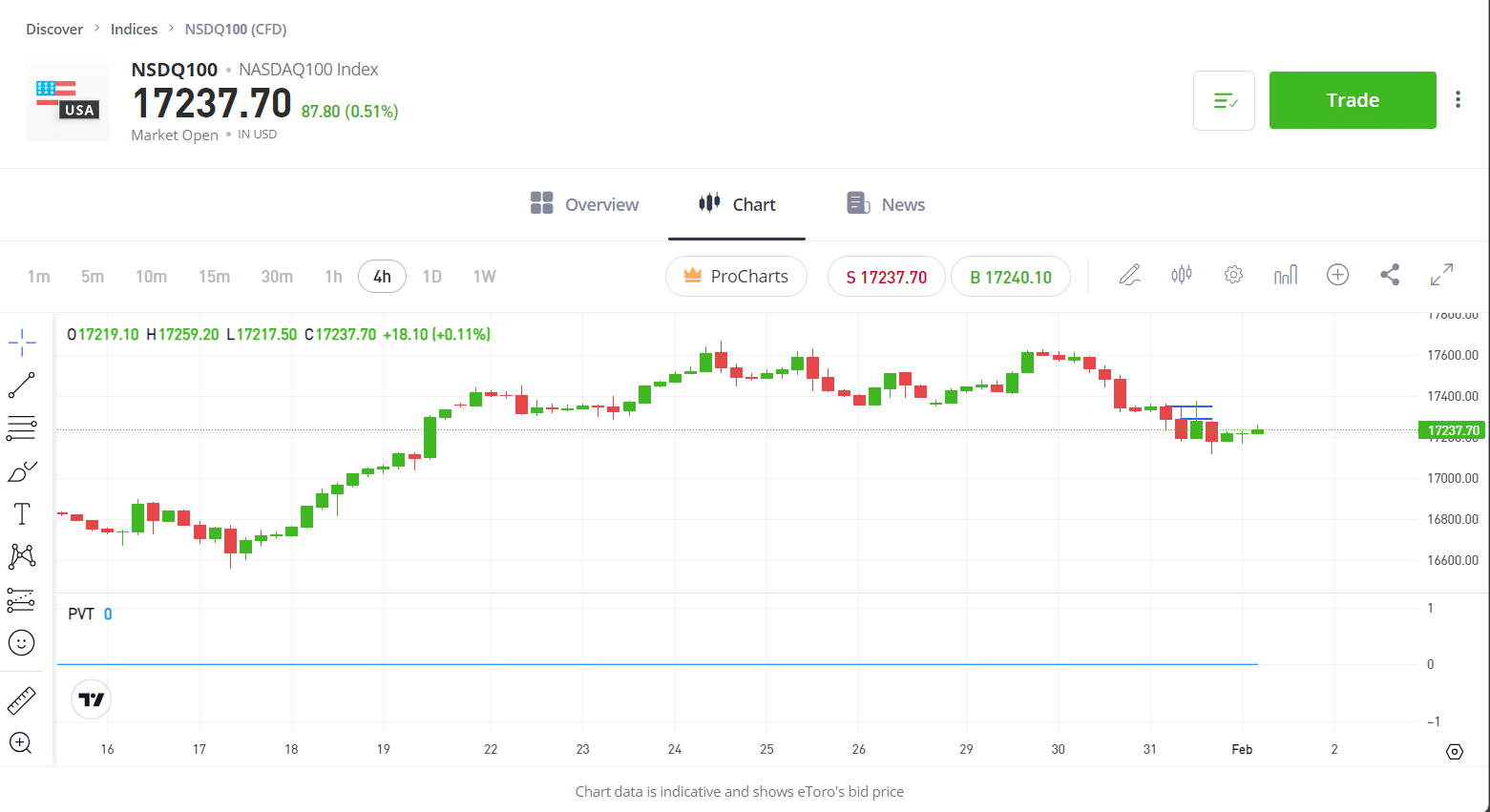

Charts reflect price movements. Fortunately, many online brokers provide several functions to customize them to your taste. One way is through candlesticks and patterns.

The diagram above shows a typical candlestick chart. You’ll find the price on the right side of the chart. Hover your mouse at any point to catch the price on that specific day and hour.

Most candlesticks have green and red colors by default. However, you can customize them.

The green color represents bullish movements, while the red color represents bearish movements. That’s one way to gauge price movements briefly. Further analysis requires technical indicators.

Utilizing Technical Indicators for Analysis

Prominent technical indicators you’ll use in day trading include the following:

- on-balance volume

- Moving average convergence divergence (MACD)

- Stochastic Oscillator

- Relative Strength Index

- Accumulation/Distribution line (A/D)

- Average Directional Index (ADX)

Technical indicators can appear as overlays on the price movement. Alternatively, they can appear on a separate graph below the primary graph.

Open any trading app and go to the chart for the financial instrument you want to trade. Click on the “Technical Indicator” icon to bring out the drop-down menu. Then, click any indicator to apply it to the graph.

Real-Time Market Data and Level 2 Quotes

Charts and technical indicators are robust tools. However, you’ll need more, given what day trading is.

Real-time market data extends beyond your analysis to other traders, especially whale investors. This data includes bid and ask prices, live stock quotes, market indices, and volume traded. You can monitor market trends and identify opportunities.

Level 2 quotes contain the order book. The latter shows the best bid and ask prices by market participants and market makers. In a nutshell, Level 2 quotes show you the traders that buy or sell a stock and the short-term trend.

You won’t find Level 2 quotes on free subscriptions. For example, Nasdaq provides Leve 2 quotes on subscriptions.

Platforms you can use for real-time market data include Google Finance and Nadex. Google Finance provides international exchanges, analytics, financial news, and real-time market quotes.

Disclaimer: Your capital is at risk.

Risk Management and Trading Strategies

We’ve explored what day trading is and its attendant risks. Its short-term and volatile nature makes the risks pronounced. Hence, emotional pressure and frustration are common in day trading.

Fortunately, you can work around these risks and minimize them. We recommend approaching risk management in two ways, before trading and during trading.

Setting Stop-Loss Orders and Risk Tolerance

Stop-loss orders automatically sell off your asset when the price hits a specific threshold. You determine what the price is (the loss you can take). Then, the trading platform ends the trade automatically.

Follow the steps below to set stop-loss orders:

- Select the stock or asset from your dashboard

- Choose the stop-loss order type

- Enter the stop price or threshold

- Enter the number of assets to trade

- Place order

Assess your risk tolerance when using stop-loss orders. Ask yourself how much you can lose without ending up in a financial fix.

Developing and Testing Day Trading Strategies

Here’s how to develop and test your day trading strategies:

- Define your trading goals, including risk tolerance, assets to trade, capital, etc.

- Research the market and analyze it.

- Have a signal for entry and exit points

- Backtest your trading strategy. This process involves testing your entry and exit signals and their efficiency.

- Evaluate the results

The Importance of Paper Trading for Skill Development

Paper trading involves trading in a simulated environment. eToro provides a $100,000 virtual account for simulated trades. The importance of paper trading includes the following:

- You can practice risk-free

- You’ll have real-time market trading experience

- You can quickly test new strategies.

- You can track your progress, including your profits and losses

- Paper trading helps you build confidence

This approach is the best to test all ideas on how to day trade. Practice until you understand how your preferred market works.

Scalping as a Day Trading Strategy

Publicly traded assets often have price jumps and declines during the day. You can profit from these short movements with an adequate margin. Also, you can execute trades to profit from price increases or decreases.

Scalping is among the day trading strategies that can provide significant gains at the close of the market. However, it is even more fast-paced than the average day trader. You can execute up to 100 trades within a day.

Overview of Scalping and Its Objectives

Scalping involves trading around small price changes. Traders buy and sell assets quickly after the price jumps or decreases. The compounding power of these small trades adds up to producing significant profits at the end of the day.

The objectives of scalping include the following:

- To maximize small price movements

- To maximize profit by carrying out as many trades as possible within a day

Your account equity must be higher than $25,000 to place more trades. Also, four-to-one margins are typically used to maximize gains.

Identifying Scalping Opportunities in the Market

Price swings are necessary for efficient scalping. A sideways market presents very little opportunity to profit from small, compounding trades.

Here are ways to identify scalping opportunities:

- Look for stocks with high liquidity

- Monitor trends and patterns

- Set price alerts for specific prices

- Use technical indicators

Executing Quick Trades with Precision

Momentum indicators are often essential in scalping. These include the moving average convergence divergence (MACD), the stochastic oscillator, the relative strength index (RSI), etc. You can also use Bollinger bands, moving averages, and pivot points to find support and resistance levels.

Be disciplined and stick to your regimen. However, be flexible with market changes.

Momentum Trading Strategies

Uptrends and downtrends are the prime movers of day trading. These strong movements refer to momentum. However, they call for identification strategies.

We recommend using stock screeners or scanners to find momentum stocks. Then, buy them as their prices rise and sell them before they hit a downtrend.

Riding Market Momentum for Quick Gains

Glances at charts may reveal trends. However, we recommend reinforcing your observation with indicators. Trend indicators include moving averages, the relative strength index, the Bollinger bands, the average directional index, etc.

Recognizing and Reacting to Price Swings

Once price swings are recognized, the next step is delving in for a purchase or a sale. Buy during uptrends and sell during downtrends. These movements can occur quickly, within an hour or a few.

Strategies for Capitalizing on Trend Strength

A few strategies on trend strength include the following:

- Breakout trading: It involves buying stocks at above-resistance levels and selling them at below-support levels

- Trend following: Buy stocks that trend higher and sell those that trend lower

Disclaimer: Your capital is at risk.

Breakout and Reversal Strategies

Breakouts in trading refer to resistance and support levels. They reveal potential trends in the direction of the breakout.

The presence of resistance and support levels makes breakout and reversal strategies subjective. That is because you might use a different support level from mine.

Identifying Breakout and Reversal Patterns

The first step is finding support and resistance levels. Then, combine technical indicators with trading volume. Breakouts with high volume often result in a trend in that direction.

Reversals follow a similar approach. A drop or increase in trading volume can be hints for a trend reversal.

Entry and Exit Points for Breakout Trades

You can wait for the breakout to occur before entering the market. However, the breakout can fail. Adding a breakout confirmation strategy (waiting for the price to cross a specific level) can minimize the risk.

Stop-loss orders are ideal exit strategies. Nonetheless, you can exit at key levels of support and resistance.

Risk Mitigation in Breakout and Reversal Trading

The best risk mitigation in breakout and reversal trading is a stop-loss order. You should still monitor the market to exit before things go south. Notwithstanding, keep the stop-loss order as a backup if you miss the market for a split second.

Creating a Trading Plan and Setting Goals

Importance of Planning in Day Trading

The following are the benefits of planning:

- Planning helps to manage risk

- It improves time management

- You have time to improve your strategy

- Goal setting establishes milestones to track performance

Defining Risk-Reward Ratios and Profit Targets

The risk-reward ratio is derived by dividing the potential loss by the potential gain after closing the position. Going in for more risk increases the reward. However, you must weigh your tolerance (and financial capacity) before carrying more risk.

Set profit targets. Once defined, enter the trade, and immediately calculate the risk-reward ratio.

Adapting Plans to Changing Market Conditions

Markets can swing beyond your expectations, even with the most intense technical analysis. Hence, you must adapt quickly.

Price swings may become rewarding, providing opportunities to reinforce your position (add more money or trade more assets). Conversely, the swings can be detrimental, requiring you to shed some weight.

Choosing a Reliable Brokerage

Expert and professional traders have the resources to get the best services. We recommend simple and robust platforms, like eToro, for beginners. eToro has a virtual account to practice paper trading until you gain confidence in real-money trades.

Factors to Consider in Selecting a Day Trading Broker

The following are factors to consider when selecting a day trading broker:

- The fees and commissions (this aspect is essential, especially for scalping

- The advanced charting tools and customizations

- Customer support

- Legal regulations

- Asset catalog

- Execution speed

- User interface

Evaluating Commission Structures and Fees

The commissions and fees to consider include the following:

- Trade commissions

- Account opening and holding fees

- Margin interests

- Level 2 subscriptions

- Currency conversions

- Withdrawal fees

Demo Accounts and Learning Platforms

Find platforms with demo accounts. You don’t want to make costly mistakes during real trades. Instead, let those mistakes occur on the demo accounts.

Some online brokers have learning sections with videos and materials to bring you up to speed with day trading. Explore these resources before registering.

Developing Discipline and Emotional Control

The last significant issue is discipline and emotional control. You’ll be tested, some days, to the extreme. Losses will come, but they aren’t the end of things.

Dealing with Losses and Emotional Challenges

Here are a few tips to deal with losses and emotional challenges:

- Accept losses cheerfully and don’t pursue them by investing more money

- Trade with a budget

- Regular breaks to avoid fatigue and frustration

Establishing Trading Routines and Consistency

Normalize booting your systems at the same time every day. Except you trade as a hobby, you should establish a routine like a full-time job. That means getting in at specific times and leaving at specific times.

You don’t have to open and close at market times. However, find the best times you are the most active and focused to trade.

Continuous Learning and Skill Enhancement

Knowing what day trading is doesn’t end in one day. Even after making profits, you must continue to improve. Hop on different learning platforms and listen to other experts for more insights.

Best Day Trading Stocks

The following are the best day trading stocks:

Nvidia Corporation (NVDA)

This stock has been on the rise for the past year. It was $198.57 on January 30, 2023, and $620.96 on January 30, 2024. The overall trend remains bullish.

Disclaimer: Your capital is at risk.

Meta Platforms (META)

This company has gotten over its disappointing 2022 bear run with some consistent uptrends in the past year. It punched through $396.21 in January 2024, higher than the 2022 peak price of $384.22.

Disclaimer: Your capital is at risk.

Tesla Motors Inc. (TSLA)

This stock might not have a consistent uptrend. However, it has enough price swings that favor day trading.

Disclaimer: Your capital is at risk.

Visa (V)

This stock has stayed bullish since the turn of 2023. The consistent price jumps provide opportunities for potential day-trade profits.

Disclaimer: Your capital is at risk.

Microsoft (MSFT)

You’ll find enough liquidity in this market. The stock has maintained a bullish trend, enough to scalp or push with momentum trading strategies.

Disclaimer: Your capital is at risk.

Summary of Key Considerations for Day Traders

The key considerations include the following:

- Get powerful PCs and extra monitors to host different charts and windows

- Learn technical analysis with candlesticks and indicators

- Use stop-loss strategies to minimize losses

- Scalp if you have more than $25,000

- Recognize breakouts and reversals

How to Start Day Trading – eToro Complete Guide

eToro is among the best day trading platforms. It has charts and indicators to get you through any trading day. Also, you can view the thoughts of other traders to gauge market sentiment.

Here are the steps to open an eToro account:

For illustration purpose only

Step 1: Visit the websiteClick our link to visit the eToro official website. You can use your PC or mobile device to register.

Step 2: Open the registration pageClick “Join Now” or “Join eToro” to open the registration page. The button is at the top of the home page or just below the top buttons.

Step 3: Fill in your detailsProvide your username, password, and email address. eToro allows quick registration through Google.

Step 4: Verify your email and loginInput the email verification code and log in to start trading.

Conclusion

Exploring what day trading is as a beginner can be challenging. However, you can ace it with the right equipment and a beginner-friendly trading app. Use paper trading to practice until you have tested trading strategies.

Disclaimer: Your capital is at risk.

References

- https://www.currentmarketvaluation.com/posts/the-data-on-day-trading.php

- https://www.finra.org/investors/investing/investment-products/stocks/day-trading

- https://www.glassdoor.com/Salaries/day-trader-salary-SRCH_KO0,10.htm

- https://www.zippia.com/day-trader-jobs/demographics/#degree-level-types

- https://www.reuters.com/business/retail-traders-account-10-us-stock-trading-volume-morgan-stanley-2021-06-30/

FAQs

How much does an average day trader make?

GlassDoor estimates an $87,000 base salary. However, the amount differs based on experience, market conditions, and strategy.

How much money do I need to start day trading?

The amount depends on your preferred equipment and trading app subscriptions.

Can I day trade as a beginner?

You can day trade as a beginner. eToro offers a virtual account for practice

How do people start day trading?

The first step is getting a capable device. You can start with your smartphone, but we recommend using a laptop or desktop. Then, register with a day trading app.

Can you really day trade for a living?

You can day trade for a living. However, we recommend having substantial capital and emergency funds before starting.

Jeremiah Awogboro

View all posts by Jeremiah AwogboroJeremiah Awogboro is an experienced content writer with over 8 years of experience. He has a qualified MBChB degree and a keen interest in the stock market and the finance industry. His background in the industry has provided him with valuable experience in this field. Awogboro is dedicated to assisting and reaching out to as many people as possible through his writing. In his spare time, he enjoys music, football, traveling, and reading.

stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2026

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up