What is Tokenomics? – Crypto Trading Review 2026

Governments and central banks can’t just print money to cover their debts, even though they have the means and the power. Fiat currencies, whether dollars, euros, yen, etc., exist under strict rules and economics to maintain circulation and value. The same thing applies to tokens, leading us to the concept of tokenomics in cryptocurrency.

You’ve probably seen that term thrown around in new crypto projects as creators prepare their whitepapers. Tokens are peculiar to crypto ecosystems. Hence, tokenomics governs how they work, which functions they perform, and how they are distributed.

Today’s piece will explain what tokenomics is in cryptocurrency and cover the best practices. If you hope to launch your crypto project soon, this piece will be of immense value to you and your team. We’ll break it down to the simplest form and recommend the best crypto trading platform to get you started.

-

-

What is Tokenomics in Crypto?—Introduction

As tokens are to a crypto ecosystem what dollars are to the US economy, rules must exist. These rules govern their production and usage to ensure they maintain value as they fulfill their purpose. Also, all creators have an outline of how their tokens should function.

Like stock or currency trading, you need crypto apps to trade tokens. Hence, tokenomics must account for trading on crypto exchanges besides their internal use.

What is tokenomics in cryptocurrency? We hope to do more than answer this question and show you how tokens function in decentralized crypto ecosystems.

Definition and explanation of tokenomics in the context of blockchain and cryptocurrencies

Tokenomics refers to the framework that controls a coin or token’s creation, management, distribution, usage, and sometimes removal from the blockchain. The term can be used for coins or tokens. Also, all crypto projects with usable coins and tokens must have it.

The basic definition of the overall question (what is tokenomics in cryptocurrency?) can expand into different aspects, as follows:

- Minting: This aspect covers how the coins or tokens are created. Projects have different ways of creating tokens, including mining, staking, IDOs, and ICOs, etc. Some projects reward specific user actions with coins besides the above-stated processes.

- Usage: The utility is the primary existence of any token. Some projects and blockchains use them for governance, access, or rewards. For example, Polygon is available for governance and staking, while Filecoin is available as a payment medium for decentralized cloud storage.

- Distribution: Creators must maintain a balanced distribution network and framework. Users must be able to access and obtain the coins while the blockchain regulates how much is in circulation.

- Vesting: Most creators will lock tokens and schedule their gradual release to prevent volatility or inflated rates. This approach maintains stability, encouraging users to invest.

- Token burning: Token burning can improve a token’s stability. It is a deflationary approach where creators intentionally remove tokens from circulation. That increases scarcity enough to increase a token’s value.

Creators and developers implement tokenomics through codes. That makes them transparent and predictable. For example, we know that only 21 million Bitcoins will ever exist based on its tokenomics (you can’t say the same about the US dollar).

Understanding the role of tokens in decentralized ecosystems

We’ll wrap up the basics of tokenomics in cryptocurrency by exploring the role of tokens. These “assets” play crucial roles in a decentralized ecosystem. Like dollars in the US economy, you need tokens to transact in their respective ecosystems.

Fortunately, DeFi apps can help you get tokens quickly if you aren’t available to get them during ICOs or IDOs. With that in mind, here are the roles of tokens in decentralized ecosystems:

- Digital representation (access): While the Securities and Exchange Commission doesn’t recognize all coins as securities, tokens hold inherent value in their ecosystems. They represent ownership and access, allowing seamless interactions.

- Utility: Tokens have use cases within their decentralized ecosystems. Hence, users must obtain them to perform specific functions. These include services (including payments), data exchange, and data purchase.

- Market participation: You can easily exchange tokens on decentralized platforms. Hence, users can access different ecosystems through token exchanges.

These are the general roles tokens play in decentralized ecosystems. Developers might assign specific roles to them. For example, you need Axie Infinity Shards (AXS) to buy in-game NFTs in its game, one of the best metaverse blockchain games.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Tokenomics vs. Traditional Economics

The concept of tokenomics in crypto shouldn’t sway you into thinking there are many differences with traditional economics. They are the same in the general sense, although their implementation might differ.

Cryptocurrency introduces programmable assets. Although they are decentralized, developers set out their functions and existence. These presets cannot be changed once set in motion (e.g., you cannot change the number of tokens to be burned once the token goes live).

Comparing tokenomics principles with traditional economic concepts

Tokenomics and traditional economics both obey the law of supply and demand. You can turn to exchange rates in traditional society. Similarly, tokens gain value when the demand is greater than the supply.

Investors decide based on perceived value and potential returns. However, tokens introduce staking, which further incentivizes investors to buy.

Key differences and similarities between tokenomics and traditional economics

The table below shows the key differences between tokenomics and traditional economics:

Parameter Tokenomics Traditional economics Supply and inflation control Token burning Raising interest rates to discourage borrowing Control and governance Developers provide codes to govern the token in the ecosystem Central banks and governments Cap on circulation Tokens often have a maximum cap on their existence. The central bank can print more when needed. Utility determination Tokens are programmable, limiting their uses and the things they can purchase. Users can use the money to purchase anything in the economy, provided the perceived item has value Global availability People worldwide can access and use blockchain tokens Official currencies are often limited to certain countries. Supply and demand Obeys the law of supply and demand Obeys the law of supply and demand Token Utility and Use Cases

Exploring the various use cases of tokens within blockchain projects

For the most part, blockchain ecosystems will remain inaccessible until you have their native tokens. Even after gaining access, specific functions can only be achieved through these tokens.

Let’s look at various use cases as we explore what tokenomics is in crypto further.

- Membership and access

- Governance, where holders can vote on changes to the token’s protocol.

- Security tokens

- Staking for future rewards

- Payments within the ecosystem

- Cryptocurrency for decentralized finance

Understanding how tokens enable specific functionalities in decentralized networks

What is tokenomics in crypto and how do tokens allow us to perform specific functions? You can use the US dollar to buy anything in any store in the country. Tokens have similar power in their respective blockchains.

Developers program token functionalities into smart contracts. Here’s how you use tokens to perform specific functions:

- The tokens first provide access

- Smart contracts allow you to trigger specific functions by sending tokens to crypto addresses

- The tokens provide voting rights in decentralized autonomous organizations (DAOs). You can increase your voting power by owning more tokens.

- Tokens can serve as collateral on DeFi lending platforms.

Token Distribution and Allocation

We mentioned distribution in the initial foundation of tokenomics in crypto. Developers must introduce tokens into the ecosystem in a way that maintains their value. Then, they must decide how to distribute it among users (some developers keep back tokens, like Satoshi Nakamoto, who owns about 1 million bitcoins).

Developers use different models to allocate tokens. These allocations, when done correctly, maintain or even increase the token’s value.

How tokens are distributed during ICOs, token sales, or airdrops

Tokens are distributed in the following ways:

- ICOs: These refer to initial coin offerings, the earliest way to distribute tokens to the public. You can get ahead of the pressure with the best crypto presales and sell them during ICOs. During ICOs, buyers swoop to purchase the coins.

- Token sales: ICOs are not the only avenue to sell tokens. Developers can sell them during the projects’ development. Some do it to raise funds for their projects.

- Airdrops: You’ve probably seen creators announce airdrops on their Twitter and Discord channels. Airdrops are free token distributions to specific crypto addresses (the beneficiaries). You don’t need to pay to own the coins.

Different allocation models and their impact on the token economy

Developers use different allocation models to prevent hoarding, which may cause price instability. They are free to decide what’s best for their projects. However, most allocation models fall into the following categories:

- Fixed supply: The developers can fix the total supply from the beginning and pre-mine it before launch. Investors can easily assess the scarcity and value of such tokens. Also, this model is easier to regulate.

- Proof of stake (PoS): This allocation model only applies to PoS-based crypto projects. Participants who hold and stake their tokens can validate transactions and build new blocks. The more tokens they have, the higher their participation in the ecosystem.

- Proof of work (PoW): In this model, miners earn tokens as they contribute computing power to secure the network. They also earn tokens as they validate transactions. Developers establish consensus rules to determine how many tokens miners receive.

Some developers implement vesting periods to prevent ICO buyers from selling their tokens within a fixed period. This approach can help stabilize the token’s value and prevent panic buys or rug pulls.

Token burns are also implemented to reduce token supply. They are essential in maintaining and increasing a token’s value.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Deflationary vs. Inflationary Tokens

What is tokenomics in crypto and how does it relate to deflationary and inflationary tokens? This aspect is essential, whether you are a developer or an investor. You must understand the nature of the tokens as they relate to their total supply.

Explanation of deflationary and inflationary token models

A deflationary token model involves decreasing the token’s net supply over time. Token burns (permanent destruction) are the primary approach to achieving this deflationary model. This model can also exist if the number of tokens entering the market is less than the number leaving.

Conversely, an inflationary token model involves increasing the token’s net supply over time. Issuance, staking, and mining are typical ways to increase supply.

Inflationary and deflationary models have advantages and disadvantages. For example, increasing the supply can result in a loss of value. Let’s review their pros and cons.

Pros and cons of each model and their effects on token value

Pros of deflationary models:

- Increase in value over time

- Investors can profit during bull markets

- It helps remove unsold tokens

Cons of deflationary models:

- It can result in hoarding

- It can discourage ongoing adoption

- Too much scarcity can block practical use

Pros of inflationary models:

- It encourages participation and network activity

- It demonstrates its viability and reduces doubt

- It accommodates growing demands and promotes liquidity

- It discourages hoarding and encourages spending

Cons of inflationary models:

- It can cause a loss of value over time

- There is a risk of devaluation.

- There is uncertainty about long-term value

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Staking and Governance Mechanisms

We can’t fully explore what tokenomics in crypto entails without mentioning staking and governance. Some ecosystems allow holders to stake their tokens, contributing to the blockchain’s security.

The role of staking in tokenomics and its impact on network security

Staking provides blockchain networks with enough tokens to use as collateral for operations. Holders that participate in this act can validate transactions and create new blocks. They become involved in the network’s security.

A boost to the network’s security comes because more people become involved in validating transactions. Attacks become more challenging and less likely for malicious actors. They must deal with more validators and block creators.

Understanding token-based governance and decision-making processes

Specific token holders can participate in the decision-making processes of blockchain projects. This approach comes from token-based governance. Hence, the tokens grant voting power to the holders.

As a holder, you can vote on significant aspects, including protocol upgrades, funding allocations, and feature proposals. DAOs, DeFi projects, and blockchain upgrades are primary examples of ecosystems that use token-based governance.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Tokenomics and Network Security

We are slowly wrapping up what tokenomics is in crypto. This concept can improve or decrease network security, but we are more interested in how it improves security.

How tokenomics aligns incentives for network security and participation

Tokenomics aligns incentives for network security and participation in the following ways:

- By providing rewards to those who stake their tokens

- The staked tokens provide collateral for the network’s operations.

- More people are involved in validating transactions and creating new blocks, tightening the security

- Attackers would need to own significantly more tokens. Hence, attacks are discouraged.

The relationship between token value and network security

The token value affects network security in the following ways:

- As an incentive: A high token value incentivizes holders to act more transparently, as they have more to lose. Also, miners will mine more, securing the network better.

- Attack cost: Attackers will need to spend more to attack networks with high-value tokens. This discourages attacks and improves security.

- Market value: More users are attracted to valuable tokens. Hence, a robust network forms.

Token Burning and Buybacks

Altcoins and smaller tokens often resort to token burning to maintain their value. This deflationary approach permanently reduces the units in circulation. Similarly, buybacks reduce circulation but do not permanently destroy the tokens.

The concept of token burning and its impact on token supply

Token burn is a deflationary tactic that aims to reduce supply. With sustained demand, the remaining tokens should have an increased value. The process involves sending tokens to a frozen address.

Once sent to the burn address, no one can recover the tokens. Token burns are planned events.

Analyzing token buyback programs and their effect on tokenomics

Buyback programs reduce token supply, like token burns. However, they are not permanently destroyed but kept away from circulation for a limited time. Developers often implement buyback programs on their tokens.

Like token burns, buyback programs can increase a token’s value. They can also boost investor confidence in the project’s long-term viability.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Analyzing Token Metrics

You asked what tokenomics is in crypto and we answered. One thing to remember when analyzing crypto projects and ecosystems is the token metrics. These give a healthy outlook on the project and token.

Key token metrics to consider when evaluating tokenomics

The following are key token metrics to consider:

-

- Market capitalization: This metric covers the total token supply.

- Token velocity: This metric measures how frequently tokens move from one hand to another within the network.

- Network usage

- Total supply: It refers to the total supply that will ever exist.

- All-time high: It refers to the highest price the token has reached.

- Token distribution

How to assess the potential long-term sustainability of a token project

Here’s how to assess a token project’s long-term sustainability:

- Review the project’s vision and ensure it is strong and achievable.

- Consider the problem the project solves

- Review the token’s utility and distribution

- Review the technical details and economic models in the whitepaper

- Assess the current adoption

- Investigate the security architecture

- Assess the project’s community engagement.

Tokenomics Best Practices

Let’s wrap up our answer to the question (what is tokenomics?) with best practices for developers. This section will help you design successful tokenomics models. You’ll also learn about projects with well-designed tokenomics.

Common practices for designing successful tokenomics models

Here are the best practices for successful tokenomics models:

- The token should have a defined purpose and utility in the ecosystem

- Shape your model with market demand

- Reward early adopters but position your distribution model for long-term

- Foster community engagement

- Use period token burns and buybacks to induce scarcity

- Design a system to provide sufficient liquidity for transactions, like staking

- Adapt and adjust based on real-world feedback

Case studies of projects with well-designed tokenomics

Our final lap for today on what tokenomics entails takes us to crypto projects with successful tokenomics. These include the following:

- MakerDAO: The MKR token caters to governance and stability fees. Token holders participate in governance, which in turn maintains the stability of its stablecoin, DAI.

- Thorchain: This project designed its native token, RUNE, for cross-chain liquidity. Holders provide liquidity by participating in network governance and earning rewards.

- Chainlink (LINK): The tokenomics incentivizes node operators, boosting their network as holders participate.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

What is Tokenomics? – eToro Complete Guide

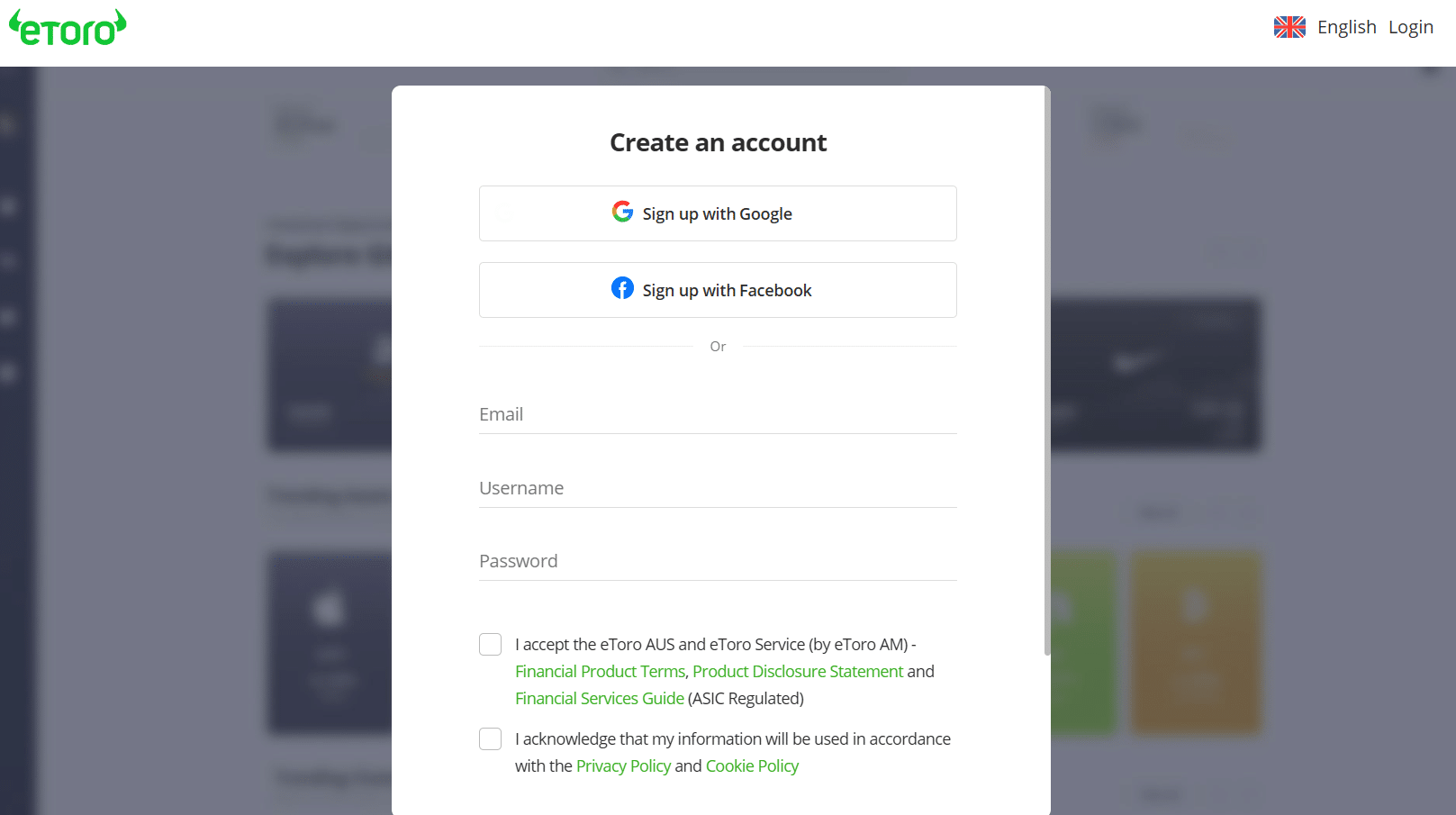

Once you have grasped our guide on what tokenomics is, you can dive in and start trading. Projects debut now and then, and you can buy in during presales. We recommend eToro for seamless crypto trading.

eToro has new and experienced traders covered with easy-to-use features. Here’s how to get started with eToro:

Step 1: Create a new accountVisit the eToro homepage. We’ve provided links to ensure you open the official website. Click “Join eToro” to begin the registration process.

Step 2: Register and verify your emailProvide the necessary details, and ensure you use an active email. Accept the terms and conditions and proceed to the verification page.

Go to your inbox and copy the verification code. Paste it on the verification page to complete registration.

Step 3: Deposit or use the virtual accountWe encourage new players to use the virtual account. eToro offers $100,000 to help you learn to trade. Once you’ve grasped enough skills, you can deposit and start trading.

Step 4: Start tradingFund your account and go to the trading dashboard. Find cryptos and click to see their market stats.

What is Tokenomics in Crypto? – Conclusion

We’ve provided enough details to cover what tokenomics is and get you started. This guide caters to developers and investors looking for the next big thing. Outline the generation and distribution models before investing or developing.

Visit eToro to start trading crypto today.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

References

- https://www.econ.iastate.edu/node/652

- https://coinmarketcap.com/academy/article/how-many-bitcoin-are-there

- https://www.bloomberg.com/news/articles/2022-07-29/why-crypto-flinches-when-sec-calls-coins-securities-quicktake

- https://marketrealist.com/p/satoshi-nakomoto-net-worth/#:

- https://www.cnbctv18.com/cryptocurrency/ethereum-token-burns-making-deflationary-cryptocurrency-explained-15747281.htm

FAQs

What is an example of tokenomics?

Bitcoin is a prominent example where the creation of tokens is done through mining. Then distribution comes through mining rewards and exchanges.

What is tokenomics in simple words?

Tokenomics refers to the framework that controls a coin or token’s creation, management, distribution, usage, and sometimes removal from the blockchain.

What is cryptocurrency tokenomics?

Cryptocurrency tokenomics entails economic principles that guide the crypto’s creation and distribution.

What is the theory of tokenomics?

The tokenomics theory studies the creation, management, distribution, usage, and removal of tokens from an ecosystem.

Jeremiah Awogboro

View all posts by Jeremiah AwogboroJeremiah Awogboro is an experienced content writer with over 8 years of experience. He has a qualified MBChB degree and a keen interest in the stock market and the finance industry. His background in the industry has provided him with valuable experience in this field. Awogboro is dedicated to assisting and reaching out to as many people as possible through his writing. In his spare time, he enjoys music, football, traveling, and reading.

VISIT ETOROYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2026