What Is An IDO? – Crypto Guide 2024

Cryptocurrency exchanges are either decentralized or centralized. Creators can use both platforms to launch new tokens, NFTs, or other assets. While in that process, they can raise funds for their projects.

IDO is a prominent method for raising funds through token launches. It is exclusive to decentralized exchanges, just as IEO (initial exchange offering) is exclusive to centralized exchanges.

You can use an IDO to generate quick liquidity for your token or crypto asset. However, you must consider a few things, like tokenomics and factors that can influence your asset’s price. We’ll explore what an IDO is in crypto and cover other aspects of this launch approach, including prominent platforms and security measures.

-

-

What is an IDO? – Introduction

Definition of an IDO

Initial DEX Offerings, or IDOs, are methods in which projects raise funds by issuing tokens through decentralized exchanges, or DEXs. Liquidity pools play an important role when discussing an IDO. All Reental users are familiar with this concept since it provides liquidity for tokenized real estate. A wide variety of projects can use IDOs, including cryptocurrencies, tokenized real estate startups, and even cryptocurrency exchanges.

IDOs are similar to IEOs, which raise capital to launch a project, allowing trading immediately and the possibility of further fundraising. Investors benefit from this fundraising method because it allows companies to accelerate their growth.

What is an IDO? – Introduction

An IDO is an approach for token creators to raise funds by issuing tokens to early investors. It is like initial public offerings (IPOs) in traditional financial markets. Companies use the latter when opening their shares for public ownership.

Like owning a company’s share through IPOs, you can own a part of a crypto project by buying its tokens at launch. IDOs bring several advantages you won’t get if you buy the tokens after launch, even with the best DeFi apps. Hence, monitoring upcoming IDOs is essential to maximizing the market.

If you are a creator looking to raise funds for your project, knowing what an IDO is in crypto is essential. The process goes beyond finding a decentralized platform to launch your token. Failing to consider regulations and AML policies can doom your project before it gains traction.

Definition of an IDO

An initial DEX offering is a fundraising approach that involves issuing your tokens on a decentralized exchange (DEX) at launch. You can use exclusive launch apps or launchpads within decentralized exchanges to launch the token. Then, investors must come to the platform to purchase your tokens.

While decentralized exchanges have no centralized regulation, creators must meet specific requirements before launching their tokens. Nonetheless, the process is a win-win for all parties when it is successful.

Token creators can offer crypto presales before the proposed IDO date. Early investors can purchase the tokens at discounted prices, positioning themselves for a profit. IDOs can achieve 100x, making them valuable for crypto investors.

These launches are in phases. Once completed, the DEX will list the token for public purchase.

Purpose and importance of IDOs in the crypto space

The primary purpose of IDOs in the crypto space is to raise funds for a crypto project. For example, crypto game creators can sell a specific quantity of the in-game tokens during launch to generate funds to continue development.

Creators and investors gain from IDOs. As an investor, you trade directly with the creator instead of through a middleman. For the creator, launching on a DEX brings instant access to a liquidity pool.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

How IDOs Differ from Other Fundraising Methods

What is an IDO in crypto, and how does it differ from other fundraising methods? IDOs debuted in 2019 and quickly rose to prominence because of their many advantages. The most prominent difference with other fundraising methods is that they use a decentralized exchange.

Comparison with ICOs, IEOs, and STOs

The table below compares IDOs with ICOs, IEOs, and STOs:

Feature Initial DEX offering Initial coin offering (ICO) Initial exchange offering (IEO) Security token offering (STO) Token type Utility tokens Utility tokens Utility tokens Security tokens Regulations Not regulated Not regulated Regulated Regulated Buyer protection Low Low High High Token exchange and distribution Decentralized Centralized Centralized Centralized Ownership No ownership No ownership No ownership Ownership rights Token value Speculative Speculative intrinsic intrinsic Advantages and disadvantages of IDOs

The technical aspects of decentralized exchanges are the major drawbacks of IDOs. You must be an expert as a creator and know things like a blockchain node and other technical aspects. For buyers, you must learn to navigate DEXs.

Here are the advantages and disadvantages of IDOs:

Advantages:

- IDOs provide quick access to liquidity.

- Decentralization reduces oversight and regulations

- The process eliminates middlemen

Disadvantages:

- Few regulations leave room for scams

- High volatility can occur immediately after the launch

- Token holders don’t have any ownership rights

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

IDO Launch Platforms

An IDO in crypto cannot occur without a launch platform. The result would be nothing, as launch platforms give rise to IDOs. These are primarily decentralized exchanges with specific features to support a token launch.

Popular platforms hosting IDOs

DEXs might not have a central authority, but they have community members who vet projects. That serves as a check to screen out poor projects and scams. Some DEXs do the job better than others.

Popular platforms that host IDOs include the following:

- DAO Maker

- BSCPad

- Solarium

- PulsePad

While extending beyond what an IDO in crypto is, it is worth noting that IDO launch platforms are based on blockchains. For example, BSCPad is exclusive to the Binance Smart Chain.

Key features and functionalities of IDO platforms

What is an IDO crypto launchpad, and what are its features? The primary function of this platform is to facilitate token sales. However, other features ensure creators and investors get the best service.

The key features include the following:

- Smart contract integration: These contracts automate the token distribution.

- Tokenomics: This feature covers the economics of the token, including its use case, distribution model, and overall supply. A well-implemented tokenomics can boost demand and increase its long-term value to investors.

- Customization: Creators can customize the platform and use their projects’ names, logos, and branding materials.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Token Allocation and Distribution

Allocation and distribution are based on the project’s tokenomics. So, what is an IDO crypto tokenomics? The tokenomics covers the distribution models and extends to the lock-up periods.

Token distribution models

Projects often adjust their distribution models based on their engagement strategy and regulations. The typical distribution models used include the following:

- Fair distribution: This model distributes the token as investors buy in, giving preference to initial investors. It promotes fairness and transparency. Hence, investors won’t feel like they are cheated out of purchases.

- Staking: This model aims at long-term investments. It encourages investors to stake their tokens for a chance to earn more.

- Auction: The highest bidder goes home with the tokens in this model. It is designed to maximize investment.

- Lottery: This model uses tickets in a lottery format. Investors purchase tickets hoping to win tokens.

Token vesting and lock-up periods

Investors won’t mind pumping and dumping a crypto project. This section will address two crucial questions: What is an IDO crypto vesting? And what is an IDO crypto lock-up period?

- Token vesting: This approach involves the gradual release of tokens to stakeholders. Creators often determine how long it will take to complete the token vesting period. The goal is to encourage long-term investment.

- Lock-up periods: Once received, investors may not be able to sell their tokens for a specified period. This feature prevents token dumps that can change the market significantly. Also, creators can determine which stakeholders get a lock-up period.

Understanding IDO Tokenomics

What is an IDO crypto tokenomic? Tokenomics covers the utility and use cases of a token. It is crucial to our guide on what an IDO in crypto is.

Token utility and use cases

IDOs assess the utility and use cases of tokens before approving them for launch. These depend on a project’s objectives. Nevertheless, typical use cases include the following:

- Platform access: Most utility tokens allow holders to access their parent platforms. It could be a game or a decentralized service.

- Governance: Token holders can vote before decisions are made. For example, you can vote on the allocation of funds.

- Staking rewards: Holders can stake their tokens to earn extra rewards.

Factors Influencing Token Value

Creators often invest in marketing campaigns to drive up the price of their tokens before launch. On the other end, you decide if a token is worth it based on its utility, innovation, and ecosystem.

The following are typical factors that influence token value:

- The tokenomics, including the total supply and distribution model

- The market demand before the launch

- The presence of competing tokens with more utility and innovation

- The launch environment and regulations

- Investor sentiment

Sentiments are challenging to capture. Like alternative data services for stocks, you can turn to social DeFi apps to see what investors say.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Token Sale Metrics

What are the IDO crypto token sales metrics? Prices and perceived value are crucial to a project’s success. Hence, we must review the token sales metrics for any project.

Initial token price and valuation

Buyers at launch obtain the token at the token’s price. The project team sets this value before the launch date. Preliminary valuations of the project will depend on its price and supply.

Investors often review the viability of returning a profit. Hence, creators must adequately price their tokens. A price too high could collapse interest and lead to a lower valuation.

Total token supply and circulating supply

- Token supply: What is an IDO crypto token supply? This relates to the total number of tokens that will ever exist. It might not be the total number launched, as more are mined. Once fully available, the token supply becomes the sum of the circulating supply and the locked tokens.

- Circulating supply: This refers to the number of tokens available for trade in the market. It doesn’t matter whether the holder wants to sell it or not. You can use the circulating supply to calculate the market capitalization.

Regulatory Challenges and Compliance

Unlike stocks and other traditional assets, classifying crypto is challenging. That poses several risks for offering IDO services in tightly regulated areas.

Jurisdictional issues and the global regulatory landscape

Licensing and taxation are prominent regulatory issues for IDOs. This domain is rapidly evolving and preparing to offer tighter regulations. Other global regulatory issues include investor protection, security features, and AML/KYC requirements.

AML and KYC requirements for participants

IDOs may be decentralized, but they are bound by AML and KYC requirements. These are efficient in preventing money laundering from the country of operations. Creators escape this by inserting sections for KYC requirements.

Buyer’s information should be verified and transactions monitored. AML and KYC policies can help restore confidence in a failing project.

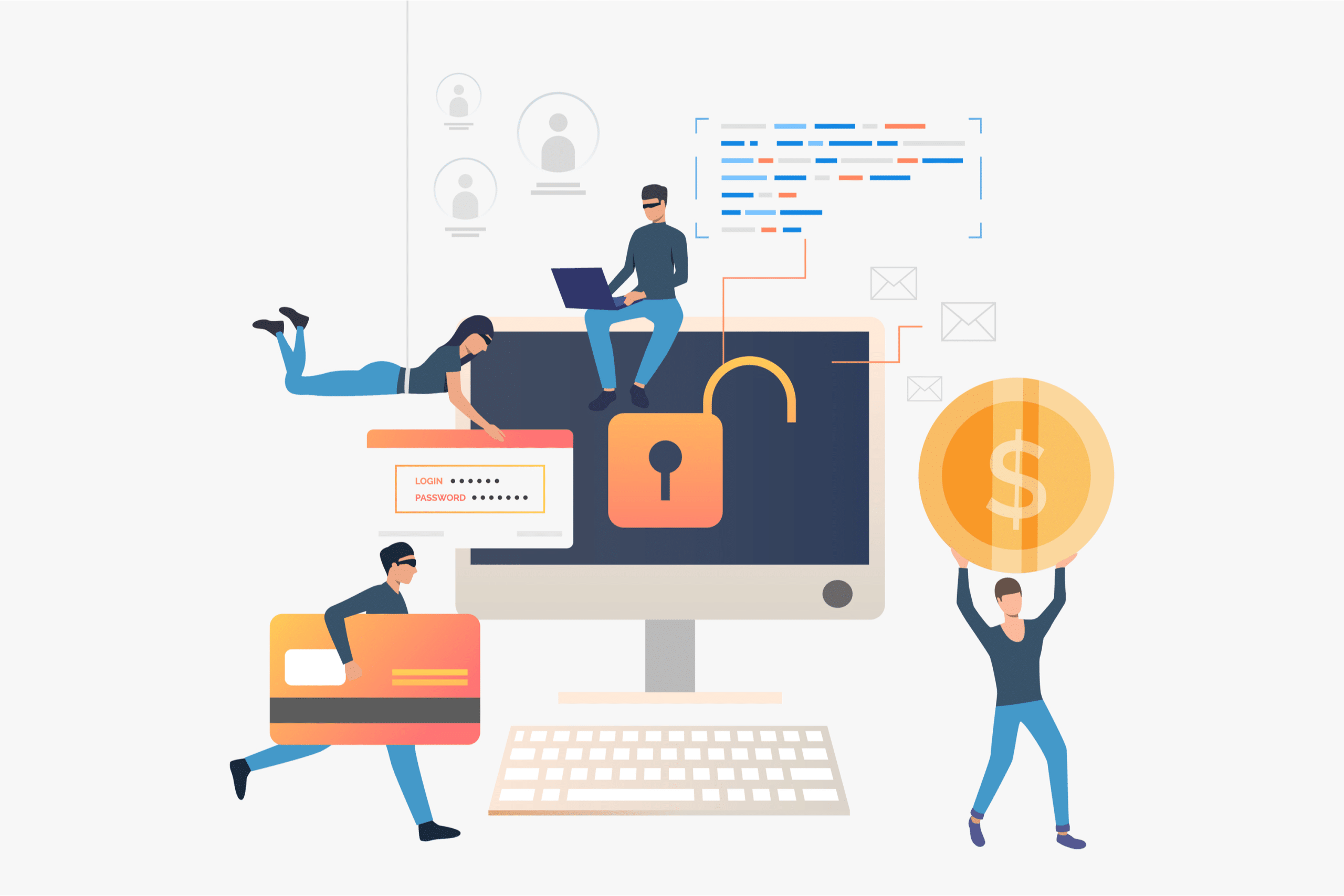

Investor Protection and Security Measures

Product launches leave room for IDO crypto investor protection. Most IDOs request a security audit and verify smart contacts. The audit identifies weaknesses and backdoors in a project’s codebase that hackers can exploit.

Security audits and smart contract verification

Third parties must perform audits on projects to ensure transparency. Besides the codebase, protocols, infrastructure, and smart contracts are also included in the audits.

Independent testers must verify the smart contracts for security and correctness. Investors trust audited projects more. With that trust, creators can build a safe environment to encourage investors to use their tokens.

Measures to protect investors from scams and fraudulent projects

IDOs must protect themselves and their users from scams and fraudulent projects. The prominent ways they do this include the following:

- Thorough research on the project, including the team and their track record.

- Smart contract audits by independent bodies

- Using a whitelisted sale to ensure only approved investors can participate in the launch

- Community vigilance through individual reports

Researching IDO Projects

Projects must be evaluated using two approaches. First, the project should be analyzed to ascertain its genuineness. Then, you can examine the team behind the projects for credibility.

Evaluating project fundamentals and team credibility

Ask questions about IDO projects and the team behind them. Review the team’s plans to allocate the funds raised during the launch. You can also review the track record of members of the team.

Rug pulls are typical in project launches. Do your background research on the proposed utility.

Analyzing the market and potential for growth

You need in-depth market analysis to determine a project’s potential for growth. You can start by evaluating the project’s goals and the market’s needs. That can help you gauge preliminary adoption.

Analyze the project’s offerings and the competition. Does it have anything to stand out? Review the unique selling points to ensure they are truly unique.

Risk Management and Diversification

Investing in IDOs is risky. Projects can fail, sending the token’s price crashing. Hence, you must take active steps for IDO crypto risk management.

You must use risk management strategies and diversify your investment portfolio to minimize losses. Invest in different projects on different launchpads.

Mitigating risks associated with IDO investments

Thorough research is your best chance at identifying risky IDO investments. Stick to properly audited IDOs and avoid those with few regulations. Ensure your investments are well-diversified and aligned with market trends.

Start with modest investments if you are new to IDOs. Also, prepare an exit strategy and be vigilant.

Building a diversified IDO investment portfolio

Here is a brief guide to diversifying your portfolio:

- Invest in NFTs, DeFis, and Web 3.0

- Pick tokens with different utilities

- Ensure the communities are engaged before investing

- Use news analysis services to stay up-to-date with technological advancements

- Review the tokenomics (you can read our extensive cover on “What is tokenomics?”)

- Split your investments

Notable IDO Success Stories

Case studies of projects that achieved significant success through IDOs include the following:

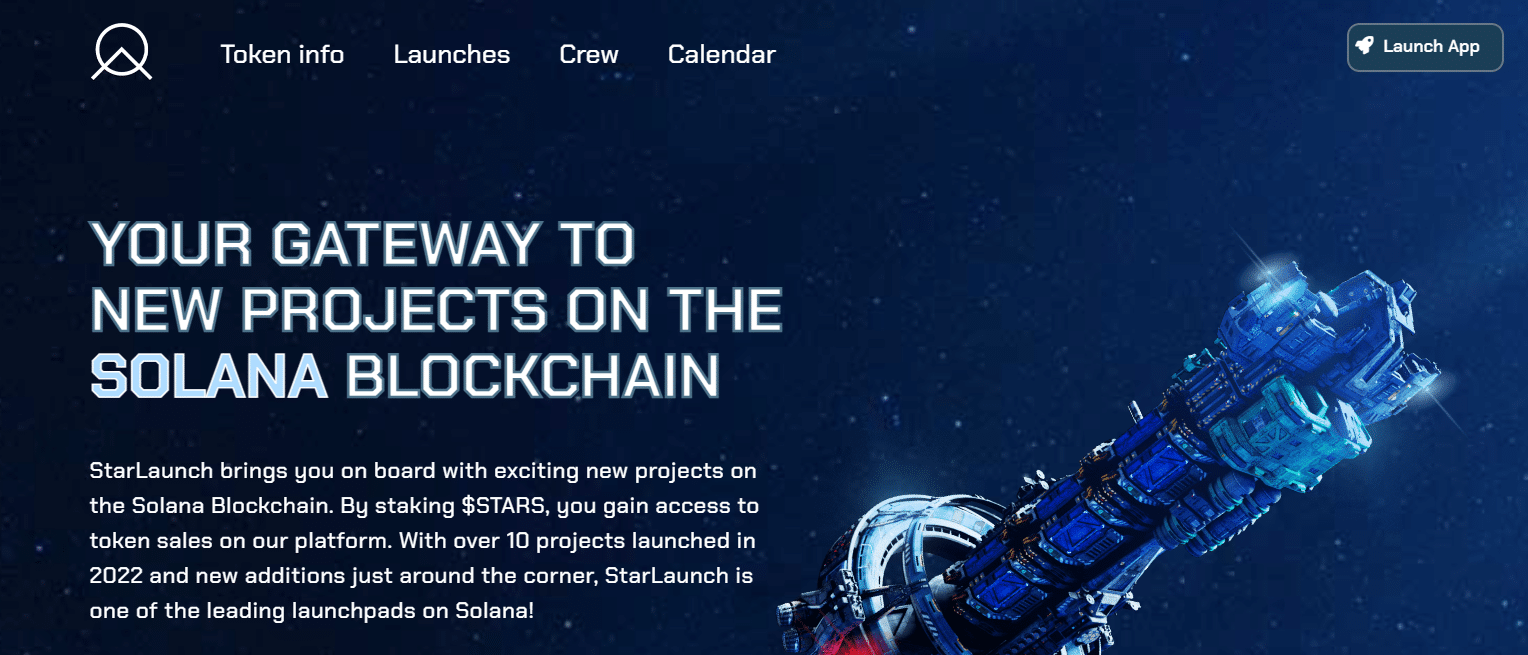

Starlaunch

This leading launchpad made an impressive start with its IDO in 2021. The insured launchpad for Solana projects returned 270x to its initial investors at its IDO. Several innovative features contributed to its success, including the following:

- Provision of insurance for Solana-based projects

- A dual-token model with a deflationary governance token

- Market momentum in 2021

Velhalla

This play-to-earn blockchain game returned 189.6x profits to its IDO investors. With many games in the crypto space, Velhalla distinguished itself with an immersive metaverse. Players can do several things, including purchasing and selling virtual pieces of land.

Lessons learned from successful IDO projects

Having innovative features and utility gives IDO an edge over others. Investors must see that the new platform is not regurgitating old features in a new skin. Nevertheless, Starlaunch struck us with something more.

The market momentum at the launch date can contribute to a project’s success. Investors are likely to buy tokens when the general market sentiment is good.

Lessons from IDO Failures

Analyzing the reasons behind failed IDOs

Here are a few reasons behind failed IDOs:

- Lackluster community engagement

- Unattractive tokenomics

- A weak whitepaper and unproven concepts for utility

- Legal troubles from non-compliance with regulations

- No plans to list on exchanges

How to avoid common pitfalls in IDO investments

We’ve come far on what IDO means in crypto. Many projects debut, but only a few make it to the finish line with significant returns to IDO investors.

Evaluate tokenomics and consider market trends before investing in IDOs. Invest when the general sentiment and speculation are good. Avoid investing during bearish seasons, as fewer investors will pay attention to IDOs.

Invest only in audited and regulated platforms. Don’t overestimate or overvalue the IDO. Stay modest and keep an exit strategy nearby.

How to Buy Cryptos: A Complete Guide

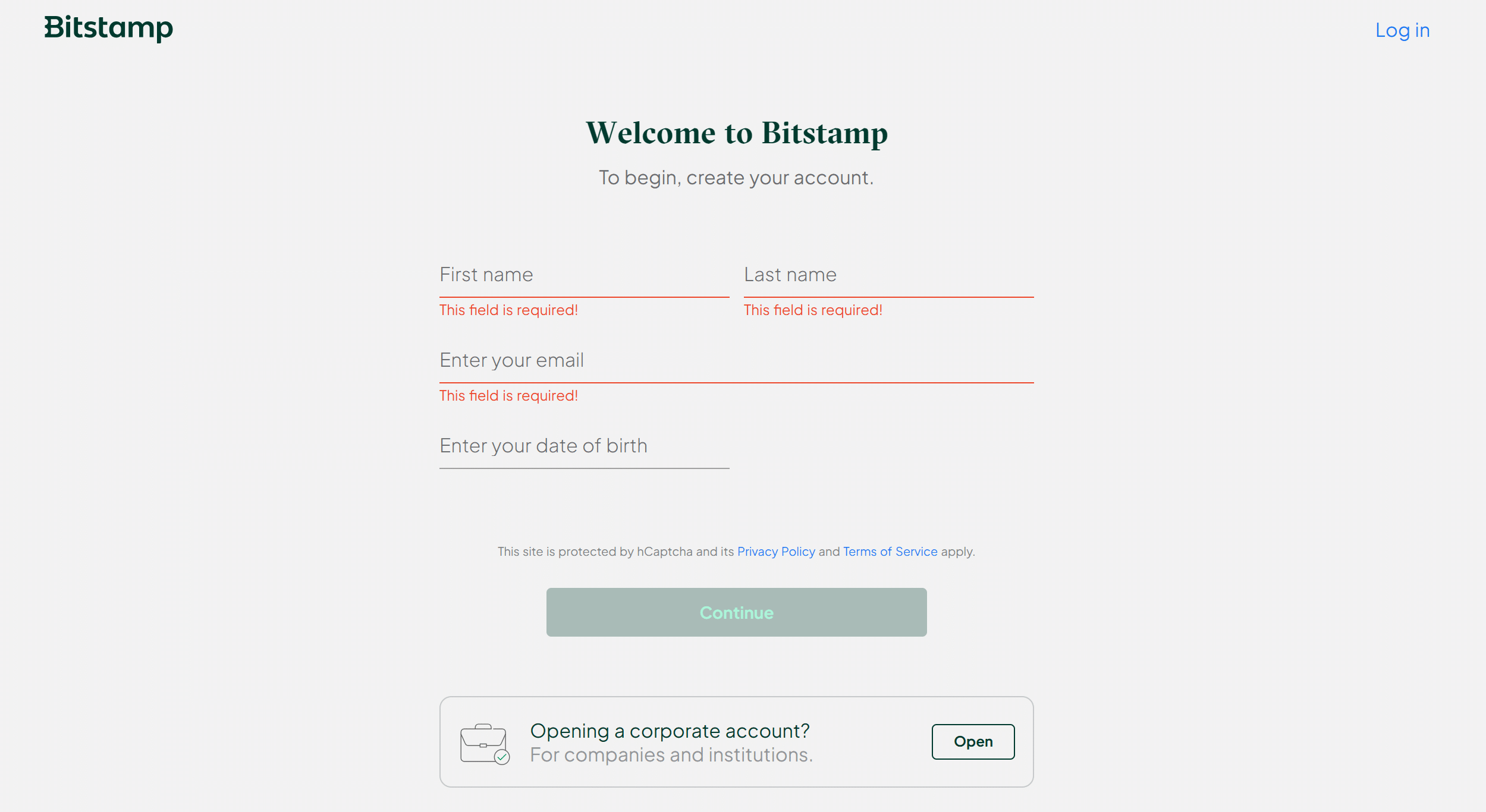

Bitstamp offers low fees and high liquidity. It is a reliable, centralized exchange where you can trade crypto easily. Also, it is available on mobile devices for easier and quicker access.

This trading platform has an intuitive interface with institutional-grade security. The following are the steps to buy cryptos with it:

Step 1: Create an Account on BitstampFollow our link to access the Bitstamp official website. Once onboard, you can create an account for instant crypto purchases or opt for the pro-trader tools. Click “Get Started” to open the registration page.

Enter your first and last names with your email. Enter your date of birth and click “Continue.” Input your country of residence and agree to Bitstamp’s privacy policy and terms of use.

Step 2: Verify IDCheck your email for the confirmation link. This link will expire in two hours. Click it to open the registration page.

Enter and confirm your password. Then, click “Start Verification” to verify your ID. Follow the steps from your phone number to your ID.

Step 3: Deposit FundsLog into your account and go to your deposit page. Pick bank transfer as your preferred banking option and select the currency. Click “Deposit” and follow the instructions to approve the payment.

Step 4: Conduct Research and AnalysisBitstamp offers an analytical trading interface through Tradeview. This section has trading charts, boxes, order books, depth charts, and active orders. These tools provide extensive analysis to find promising cryptos.

Step 5: Explore CryptosBitstamp offers a guide for those who are new to trading. Alternatively, you can go to the trading dashboard and explore more cryptos. Use our extensive review of what is an IDO in crypto? to find promising tokens.

Step 6: Execute a tradeOnce you’ve found a promising cryptocurrency, latch onto it and execute the trade. You can do that on your PC or through your mobile device.

What is an IDO in Crypto? – Conclusion

IDOs are prominent in crypto fundraising. They join IEOs and ICOs but bring several advantages. The primary benefit is the decentralized nature of IDO launches.

Ensure you invest only in audited projects. Research a project’s utility and promises before investing. Also, gauge market trends for that sector.

References

https://finbold.com/revealed-historys-10-biggest-crypto-rug-pulls/

https://consumer.ftc.gov/articles/what-know-about-cryptocurrency-and-scams

https://medium.com/overlaydao/investors-checklist-evaluating-ido-projects-a76312466676

https://www.weforum.org/agenda/2022/09/why-crypto-businesses-need-anti-money-laundering-regulations/

FAQs

What is IDO, and how does it work?

IDO is a fundraising approach where tokens launch on decentralized platforms. Investors buy the tokens when released, raising money for the project.

What are examples of IDO in crypto?

Velhalla, Starlaunch, PulsePad, GameFi, etc., are popular IDOs. These returned above 200x, with a few just below that figure.

What is IDO vs ICO?

IDOs occur on decentralized platforms like PancakeSwap. Conversely, ICOs happen on centralized platforms.

Jeremiah Awogboro

View all posts by Jeremiah AwogboroJeremiah Awogboro is an experienced content writer with over 8 years of experience. He has a qualified MBChB degree and a keen interest in the stock market and the finance industry. His background in the industry has provided him with valuable experience in this field. Awogboro is dedicated to assisting and reaching out to as many people as possible through his writing. In his spare time, he enjoys music, football, traveling, and reading.

VISIT ETOROYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2024