Freetrade App Review 2026 – Pros & Cons Revealed

Freetrade is the latest UK stock app to join the commission-free marketplace. That is to say, the platform allows you to buy and sell shares without you needing to pay a single penny in dealing fees.

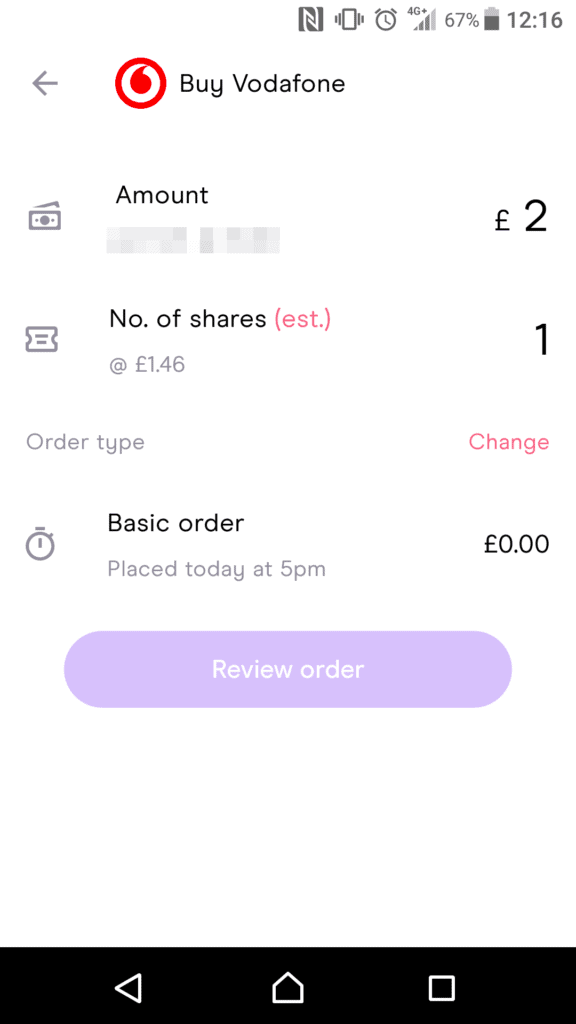

Not only does this include UK and US stocks, but various ETFs and funds, too. Best of all, the Freetrade app supports fractional ownership. This means that you can buy shares from just £2 – irrespective of the company’s stock price.

But, is Freetrade the right stock app for you? In this Freetrade review, we cover everything you need to know. We’ll unravel everything from fees and commissions, tradable assets, supported payment methods, user-friendliness, and regulation.

-

-

What is Freetrade?

Freetrade is a mobile-only stock broker application that allows you to buy and sell shares at the click of a button. This covers over 1,600 stocks from both the UK and US markets.

Regarding the former, not only does this include shares listed on the FTSE 100 – but smaller markets like the FTSE 350 and AIM. If you’re interested in US stocks, Freetrade gives you access to some of the biggest American firms listed on the NYSE and NASDAQ. This includes companies like Apple, Amazon, and Tesla.

On top of stocks and shares, the Freetrade app also allows you to invest in ETFs and funds. This is great for those of you that don’t quite understanding how the financial markets work and thus – wish to invest passively. Irrespective of what you decide to invest in, Freetrade is a fee-free stock trading app.

In simple terms, this means that you can invest without paying any share dealing fees, commissions, or ongoing account charges. The Freetrade app is also notable for its fractional share offering. This means that you can buy a ‘fraction’ of a stock. As long as you meet a £2 minimum investment – you can purchase an amount that you feel comfortable risking.

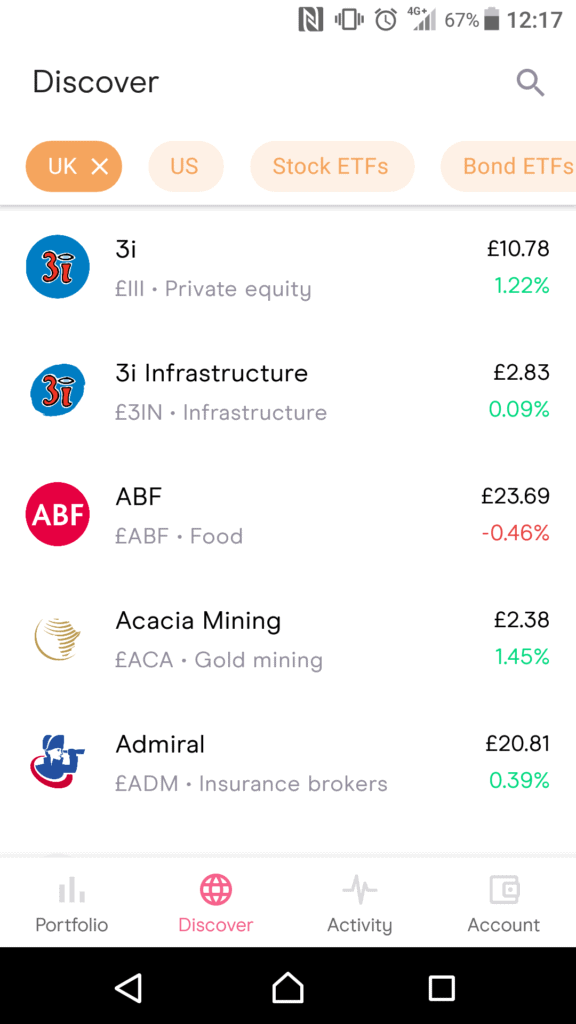

What Stocks Can You Trade on the Freetrade App?

As noted above, the Freetrade investment app gives you access to two main marketplaces – the UK and US. If you’re looking to invest in domestic companies, this includes blue-chip stocks listed on the FTSE 100.

Think along the lines of BT, BP, AstraZeneca, and GlaxoSmithKline. You then have smaller stocks that are found on the FTSE 250, FTSE 350 and AIM. This includes Boohoo, Greggs, and hundreds more.

Over in the US, the Freetrade app supports the NYSE and NASDAQ. Regarding the latter, this covers all Big Tech stocks – such as Facebook, Twitter, Netflix, Apple, and Amazon. All in all, the Freetrade stock library gives you access to over 1,600 stocks, including many of the best stocks to buy.

Note: Freetrade notes that it adds new stocks each and every week – with thousands more planned for 2020.

ETFs and Index Funds

The Freetrade app also allows you to invest in ETFs and Index Funds. These are backed by major fund providers such as iShares, Vanguard, and SPDR. This allows you to invest in the stock markets passively – as the provider will buy and sell shares on your behalf. In turn, you will receive quarterly dividend payments that are sent straight to your Freetrade cash balance.

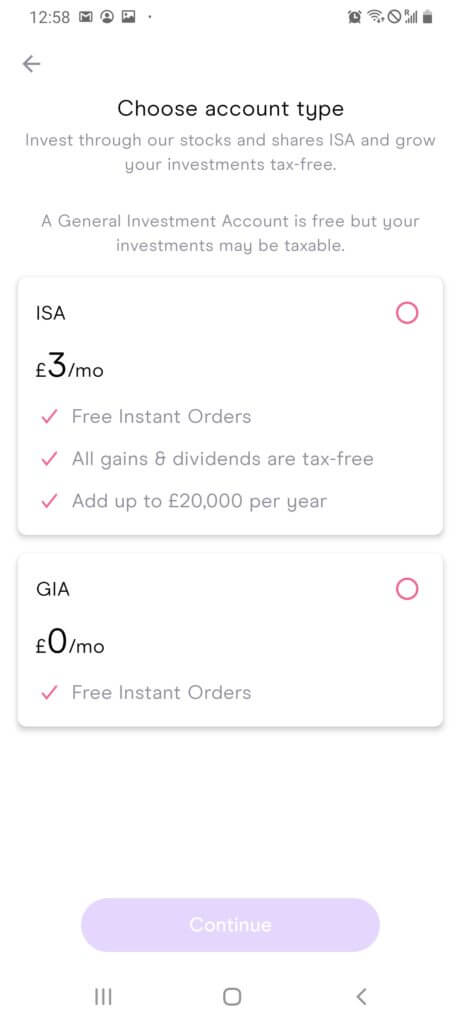

Freetrade Account Types

Freetrade currently offers two account plans to choose from – with one more planned for Autumn 2020.

General Investment Account – FREE

Most investors will opt for the General Investment Account at Freetrade. This is a free account that comes with no monthly or annual fees. Crucially, this account gives you access to each and every stock and ETF on a commission-free basis. You’ll also have access to fractional shares, a minimum investment amount of £2, and top-notch customer support.

Stocks and Shares ISA – £3 Per Month

This Freetrade account type is for those of you that to invest via an ISA. For those unaware, by investing in shares and ETFs through a dedicated Stocks and Shares ISA, the first £20,000 is shielded from capital gains tax. This amount to reset annually – with the 2021/22 tax year also permitted £20,000.

To take advantage of this on the Freetrade app, you will pay £3 per month. Whether or not this is worth it will ultimately depend on how much you make from your investments.

Tax treatment depends on individual circumstances and change or may differ in a jurisdiction other than the UK.

Similarly, it will also depend on your current income tax obligations. In other words, if you are on a low income and only plan to invest small amounts – then the Stocks and Shares ISA might not be worth it. At the other end of the spectrum, if you plan to invest reasonable amounts over the course of the year – then opting for an ISA at Freetrade could be a no-brainer.

In terms of other ISA accounts available in the UK, Hargreaves Lansdown is more expensive at 0.45% per year. As such, a £20,000 investment would cost £90 annually – or £7.50 per month. Interactive Investor is even more costly at £9.99 per month.

Freetrade Plus – £9.99 Per Month (Coming Soon)

The Freetrade Plus account is planned for launch in Autumn 2020. At £9.99 per month, this will give you access to additional perks. For example, you will be able to place limit and stop-loss orders. This isn’t particularly exciting, as this is something that all stock apps should be offering.

Additionally, you will have access to a wider library of shares and priority customer service. The Freetrade Plus account will also include a Stocks and Shares ISA.

The key problem is that some of these so-called ‘extras’ are available at other FCA stock apps.

Freetrade Fees & Commissions

One of the main attractions of using Freetrade is its fee department. Put simply, you will not pay a single penny when you buy and sell shares. This means no commissions or shares dealing fees whatsoever. In comparison to, say, Hargreaves Lansdowne – this will save you £11.95 on each order that you place.

Share dealing services offered by high street banks are often even costlier, so Freetrade is well worth considering if you’re looking to invest without getting hammered by constant fees. Additionally, Freetrade does not charge any ongoing fees – so you keep your investments open for as long as you wish completely commission-free.

Other Fees

The Freetrade app is completely transparent in what it charges. For example, you will need to pay a 0.5% stamp duty fee when purchasing stocks – which is the case across all UK brokers. You can, however, avoid this fee if you invest in AIM-listed stocks, UK ETFs, or non-UK assets.

There are no fees to deposit or withdraw funds – nor transfer assets from an external ISA provider. The only other fee that you need to look out for is when investing in US stocks. This comes in the form of an FX fee – which is charged at 0.45% above the current spot rate.

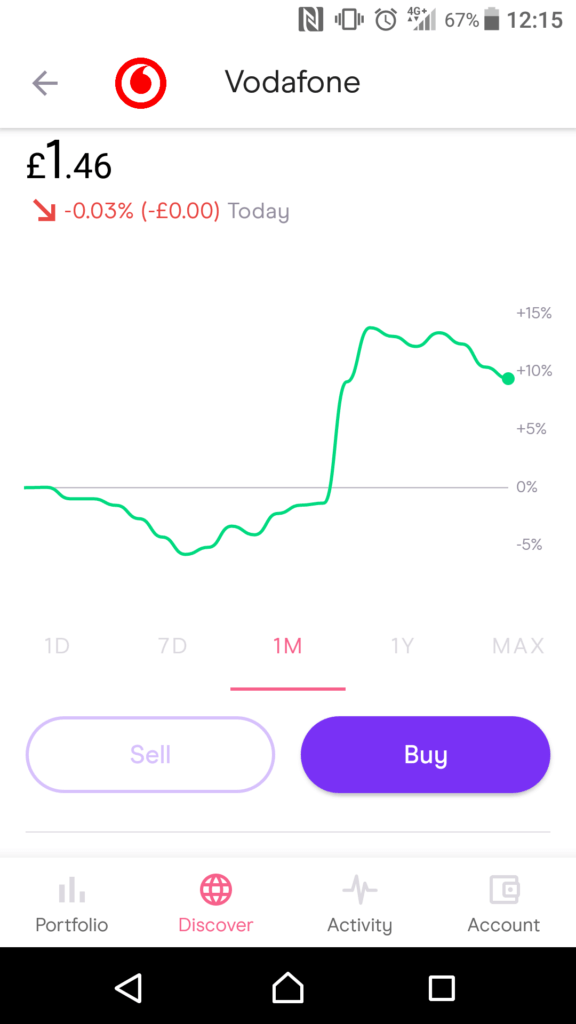

Freetrade App User Experience

When it comes to user experience, the Freetrade app is super easy to navigate. You’ll instantly see that the platform has opted for clear and crisp colours, and everything has been optimised effectively. You can easily browse the stocks or ETFs that you have available to you, or utilise the search function if you already know what you want to invest in.

In terms of placing orders, this is also straightforward. You simply need to specify how you want to invest and by confirming the order – the trade will be executed instantly.

The only exception to this rule is if you attempt to invest outside of standard market hours. If you do, you’ll need to wait until the markets reopen. This is because Freetrade does not currently support limit orders. This will become available when its Freetrade Plus account is launched, albeit, this will cost you £9.99 per month.

Freetrade App Tools

It must be noted that the Freetrade app won’t be for you if you are looking for advanced trading tools. This is because the app offers a somewhat ‘skin and bones’ service. That is to say, the app allows you to invest in stocks and ETFs with ease – but that’s pretty much it. You won’t have access to fundamental news or technical indicators – nor will you will be able to apply leverage or short-sell stocks.

With that said, the stand-out tool at Freetrade is arguably its fractional share offering – which we discuss below.

Fractional Shares

Fractional share dealing is the latest phenomenon in the ever-growing stock app arena. In a nutshell, this allows you to purchase a ‘fraction’ of a stock. On the one hand, this isn’t overly beneficial when investing in UK shares – as the London Stock Exchange and AIM are priced in pence.

For example, the likes of Royal Mail, BP, and BT will cost you just £2.37, £2.30, and £0.97 per share, respectively. However, if you have an interest in large-cap US stocks – then fractional ownership is crucial. This is especially the case if you plan to invest smaller amounts.

For example:

- At the time of writing, Amazon shares are priced at $3,144 per stock. This amounts to about £2,450.

- Most investors in the UK will likely want to invest a lot less than this – queue fractional ownership.

- Let’s say that you want to invest just £245 into Amazon.

- By utilising the fractional share tool at Freetrade, this would mean that you own approximately 10% of a single share.

The above example remains constant across all 1,600+ shares at Freetrade. Furthermore, you can invest from just £2 per stock. As such, if you purchased a share that was priced at £4, you would own 50% of the stock!

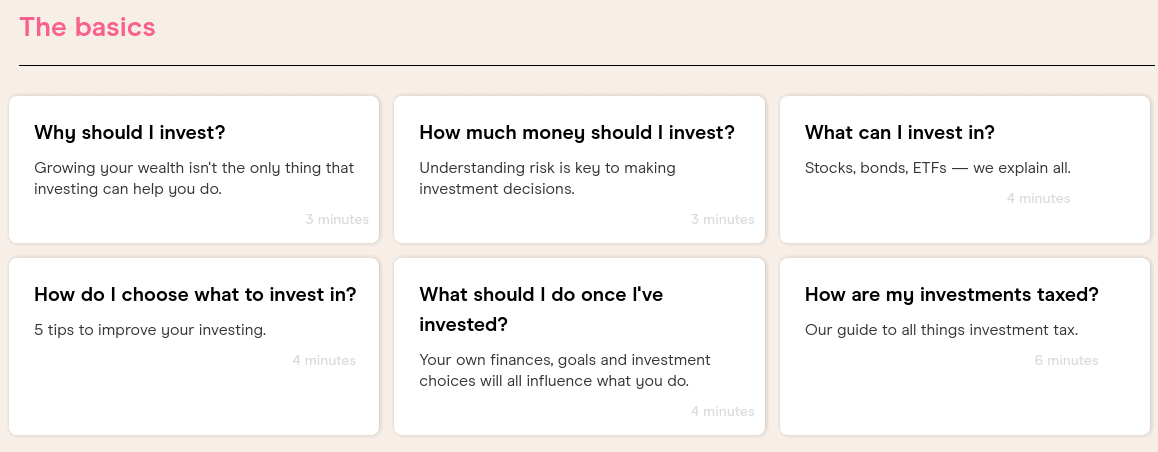

Freetrade App Education

While it is true that the Freetrade stock app lacks advanced trading features and tools – it more than makes up for this with its educational materials. The application itself notes that it believes in “educating everyone about the benefits of long-term investing”.

Most of its education material can be found in the ‘Invest Hub’. This covers a plethora of handy articles and blogs that explain basic investing principles. This includes everything from the different asset classes that you can invest in, investment taxes, and how to pick a stock.

Tax treatment depends on individual circumstances and change or may differ in a jurisdiction other than the UK.

There are also guides on creating a diversified portfolio, stock market volatility, and an explainer on ISAs. The content itself is tailored to the stock market novice, which we really like.

Freetrade Market News

Although Freetrade does offer a market news section on the app, it’s extremely lacking. In fact, the platform will publish just a few news developments per week, which isn’t going to be sufficient enough to keep abreast of what is happening in the markets. As such, you will need to use an external provider to obtain your market news.

Freetrade App Bonus

Freetrade is currently running a promotion that allows all new Stocks and Shares ISA account holders to earn a free £15 share. Upon signing up, you’ll need to deposit at least £100 into your account. In doing so, Freetrade will award your free £15 share within 14 days.

Freetrade App Demo Account

Unlike other commission-free stock apps in the space like Capital.com or Plus500 – Freetrade does not offer a demo account. This is somewhat disappointing – especially when you consider that the app has tailored its platform to novice investors.

Payments on the Freetrade App

When it comes to payments, Freetrade once again falls short. Sure, you can deposit funds through a UK bank transfer – but you won’t have access to debit/credit cards or e-wallets. This means that you won’t benefit from instant payments.

Instead, it can take a few working days for the funds to be credited into your Freetrade account. On the flip side, the stock app does allow you to deposit and withdraw funds on a fee-free basis.

Freetrade Minimum Deposit

There is no minimum deposit amount at Freetrade, which is great. As long as you meet a £2 minimum investment per trade, you can stake as much or as little as you wish.

Freetrade Contact and Customer Service

You can speak with a member of the customer service team via the Freetrade app. This is facilitated via live chat – which is arguably the most convenient way of communicating with an agent.

You are, however, out of luck if you wish to speak with someone over the phone – as live chat is the only option.

Is Freetrade Safe?

Although Freetrade is a relatively new stock app – you should have no concerns about safety. Crucially, the provider is authorised and regulated by the Financial Conduct Authority (FCA). Additionally, the app is partnered with the Financial Services Compensation Scheme (FSCS).

For those unaware, this means that the first £85,000 held at the broker is protected by the government in the event the app went bankrupt. Other notable safeguards include segregated bank accounts. This means that client funds are held in separate accounts to that of Freetrade. Once again, if the app were to go bankrupt, this should keep your money safe.

How to Use the Freetrade App

As a stock trading app that is tailored to newbies, it makes sense that the platform is simple to use. Nevertheless, if you’re looking for a bit of guidance – follow the steps outlined below.

Step 1: Freetrade App DownloadVisit the Freetrade website via your mobile web browser and proceed to download the app. You will then be directed to either the Google Play or Apple Store.

Step 2: Open a Trading AccountYou will now be asked to open an account. This requires some basic personal information from you – including your national insurance number. Additionally, you’ll need to provide some contact details.

Step 3: Confirm Email Address and Choose PasscodeYou will also be asked to confirm your email address and choose a 4-digit passcode.

Step 4: Deposit FundsThe only way to deposit funds into the Freetrade app is via a bank transfer. The app will advise you of the respective account details – alongside your unique reference number. Don’t forget to add this – as your deposit will likely be delayed.

Step 5: Buy SharesAs soon as your bank account deposit arrives, you can buy some shares. All you need to do is search for the stock that you wish to buy and enter the investment amount. Once you confirm the order, the shares will remain in your Freetrade account until you cash them out.

How to Sell on Freetrade App

Selling shares on the Freetrade app is also a breeze. Simply select the share that you want to sell during standard market hours, and enter the amount that you want to offload. As on as the sale is confirmed, the cash proceeds will be placed into your Freetrade account.

Freetrade Stock App Pros & Cons

Below you will find an overview of our Freetrade stock app findings.

Pros

- 100% commission-free trading app

- Invest in over 1,600+ stocks and ETFs

- Access to companies in the UK and the US

- Stocks and Shares ISA accounts offered

- Very simple to use

- FCA and FSCS protections

- No account minimums

Cons

- Does not support debit/credit cards or e-wallets

- Lacking in fundamental and technical research

- No Copy Trading features

- No access to leverage or short-selling facilities

The Verdict

In summary, there is much to like about the Freetrade stock app. First and foremost, the platform is super easy to use and requires no prior knowledge of the financial markets. You will have access to over 1,600+ stocks and ETFs – all on a commission-free basis.

On the flip side, the Freetrade app does come with various short-fallings. For example, you can’t deposit funds with a debit/credit card or e-wallet, there is virtually nothing in the way of technical or fundamental research, and you can’t apply leverager or short-sell assets.

FAQs

What device is the Freetrade app available on?

Freetrade is available on iOS and Android devices.

What shares can you buy on the Freetrade app?

Freetrade offers over 1,600+ shares. This covers companies listed in both the UK and US.

Is the Freetrade app legit?

Yes, the Freetrade app is legit. It is licensed by the FCA and partnered with the FSCS. It also has excellent ratings on iOS and Android.

What payment methods does Freetrade support?

Freetrade only supports bank transfers.

Can you trade with leverage on the Freetrade app?

No, Freetrade does not offer leverage.

Kane Pepi

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane Pepistockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2026

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up