What are Stocks and How Do They Work?

For decades, investment and stocks have been closely intertwined, with the latter being seen as an alternative to generate passive income. But what exactly are stocks? How do stocks work?

Stocks represent the smallest unit of a company that qualifies holders for either profit-sharing at the end of every financial year or voting rights in the company. The profitability of any stock relies on the performance of the issuing company.

In this guide, we will understand what stocks are, how they work, and how to trade them using the best stock trading apps in the market.

-

-

What Are Stocks? – Definition

Stocks, commonly known as equities, are fractions of an entire company that individuals can purchase as a sign of ownership. Individuals who own one or more of the equities are referred to as stockholders. Purchasing stocks isn’t for just ownership alone; they come with several benefits.

Stocks play a pivotal role in investment, especially when the principles of demand and supply act on the market. Knowing how stocks and the market work is essential for maintaining a balanced portfolio.

By issuing and selling stocks to investors, companies can raise funds for the smooth running of their businesses. These securities are sold and bought on stock exchanges that operate in compliance with government law and best financial practices. Examples include the New York Stock Exchange (NYSE) and Nasdaq.

The issuance of stock can be viewed as a win-win where the company can raise funds from your investment while you get specific privileges such as:

- Passive income, when the company shares yearly profits, otherwise called dividends.

- Price gains that see the company’s shares rise due to the impact of demand and supply

- Voting rights during the company’s annual general meeting for stockholders.

The benefits obtained from stocks largely depend on the type. Owning shares in a company doesn’t give you absolute power in the decision-making process. Rather, the company’s board members are more involved in the voting process and the daily management of the company.

As an investor in the company, it is believed you trust their capability and are comfortable with decisions made by the board. If a particular stock does not meet your expectations, you can choose from several other investment-worthy stocks on the market.

How do stocks work? Let’s go on to explore that in subsequent sections.

How Do Stocks Work?

The value of a stock is directly tied to the issuing company’s overall performance. If a company fails to meet top standards, there’s a great chance for its stocks to fall in value.

Investing in stocks is now one of the easiest things to do. Investors can directly visit a brokerage to either buy or sell them. While some investors strictly buy shares to have voting rights in a company and receive dividends at the end of each account year, others see it as a means of generating income through capital gains.

When a company decides to go public and issue its first stock to the public, the process is called an initial public offering (IPO). The shares then become publicly listed on stock exchanges such as the NYSE, Nasdaq, or the London Stock Exchange (LSE). Should you purchase the shares at the point of IPO, you may choose to resell them in the stock market.

The value of stocks is highly influenced by demand and supply, such that as more people sell their stocks, the likely value of such securities decreases. The reverse is the case: the value increases as more people buy them.

As a company grows, the value of its stocks increases. Provided you bought your shares at a lower price, you could sell them off when the value increases and make some profit.

While the stock market is less volatile compared to that of cryptocurrencies, the value of a stock could decline or hit zero should the issuing company underperform.

Dividend payments are another great way to make money from stock investments. However, it is time-bound—quarterly or yearly.

Your capital is at risk.

How Do Stocks work? A Practical Pathway

Companies as a whole are not tokenized in a day. It takes years of building, growth, and marketing to get to that point.

Investors must know how stocks come to be. Below, we’ll explore how stocks work in a stepwise manner.

- Tokenization: This is the act of separating an asset into smaller bits. In this case, the whole company is split into smaller parts, representing units of the company. It’s a technical process, and each of these smaller units is assigned a specific value in either pounds or dollars.

- Issuance: The company launches its IPO campaign, using its stocks to raise funds. The company’s shares are listed on popular stock exchanges.

- Trading: Once shares are listed, buyers and sellers converge at stock marketplaces to trade these securities. The prices of these assets are prone to fluctuations due to the forces of demand and supply.

- Value retention: Provided a company’s financial performance, economic conditions, and market sentiments are stable, the value of a stick can be retained. If these factors are below average, there will be a decline in the stock’s value.

- Unit of ownership and voting power: Owning shares in a company signifies that you own a fraction of the company. Depending on the type of shares, you may hold some voting power needed for decision-making.

- Dividends and capital gains: Investors often look forward to favorable returns. For stock investments, returns could be in the form of dividends, where shareholders partake in the quarter or annual profit sharing, or capital gains, where investors buy stocks at a lower price and sell them at a higher price. Should the company underperform, there will be no return on investment.

- Understanding the risks, diversification, and indices: The stock market has its risks, which are due to the volatility that causes rapid price changes. Investors can lose money when volatility drives the price of an asset downward.

Diversification is a prominent strategy used to mitigate the risks associated with stock trading. Diversification involves holding different stocks to cushion losses.

Additionally, tracking the stock market to understand its performance is crucial. One way of doing this is using indices. With indices such as the Standard and Poor’s 500 (S&P 500), Dow Jones Index, and Nasdaq 100 index, as well as notable stock analysis apps, investors can monitor the performance of stocks for profitable long-term investment.

How Do Stocks Work? Pros and Cons

Pros

- Anyone can start investing in stocks. The market is easy to navigate, especially when you devote time to understanding and analyzing stocks.

- Investors can generate profit from stocks in the form of dividends or capital gains, where a stock bought at a lower price is sold for a higher one.

- You need not invest huge sums in stocks. You can start small based on your risk level.

- You can own more than one stock at a time, helping you to hedge against severe losses.

Cons

- It requires a lot of time, patience, and a long-term investment. Unlike cryptocurrencies, where you may be lucky to gain up to 10% or more in a week, the stock is less volatile, requiring more time.

- Returns are not guaranteed because if a company’s overall performance is below average, the underlying value of the stock could be lost.

- Investing in just one stock isn’t ideal. To minimize your losses, you may consider diversifying your portfolio.

How Does The Stock Market Work? A Step-by-Step Approach

The stock market is a secure environment where investors trade shares and other financial securities, following regulatory and industry best practices, without fear of encountering any operational risks.

Stock markets are of two types: primary markets and secondary markets. In primary markets, companies can issue and sell stocks to the public for the first time through IPOs. In secondary markets, investors buy and sell stocks using a brokerage and not from the company.

Below, we will be using a stepwise approach to explore how the stock market works.

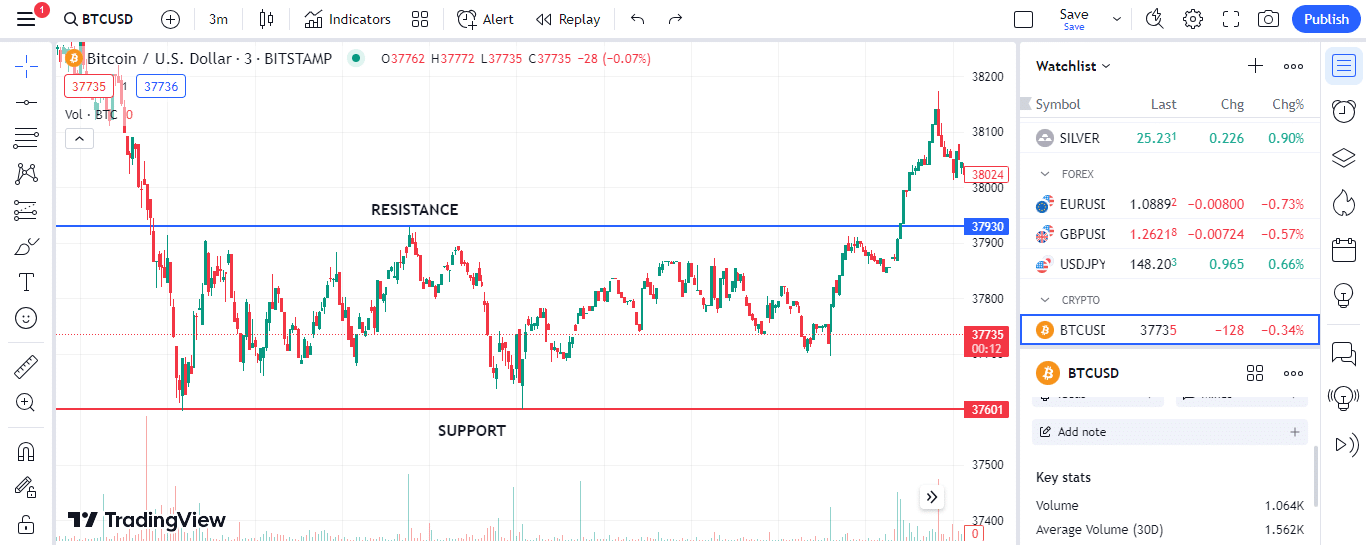

Step 1: Accumulation

Investors initiate the first step of the stock market, which is characterized by price movements within a specific range. Price action is evident during this stage, but it neither goes above the resistance nor below the support levels. This phase lasts a while.

Institutional investors leverage this phrase, accumulating several stocks in their portfolios. They use the drip strategy to buy the stocks, splitting their purchases into different periods. Even though they buy larger portions of the stock, they don’t do so at once—only when the shares reach their desired purchase price.

Retail investors don’t find this stage appealing due to the unremarkable price action. Long-term investors, on the other hand, can maximize value by either selling their positions when prices don’t favor them or holding their shares to earn capital gains when the stocks reach new highs.

Investors don’t just dabble in the market at this stage. Rather than buying everything, they may choose to buy little by little to prevent losing out if the prices get better in a few days or weeks.

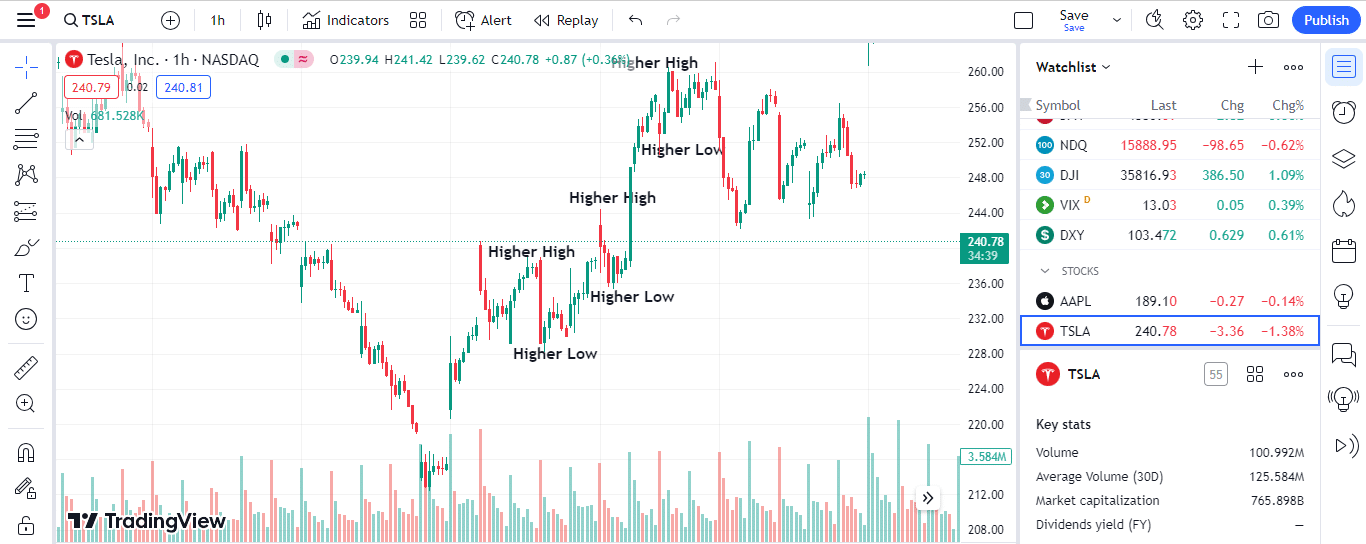

Step 2: The Markup

During the markup phase, stock prices rally, breaking through the resistance level. Price rallying comes with spikes in trade volumes. This is because both institutional and retail investors who didn’t buy the shares during the accumulation stage raced to buy them.

The market enters a trending state during the markup. Should higher highs and higher lows occur after a breakout, it signifies the markup is just starting in an uptrend.

Investors are drawn to the market at this point, making the stocks stronger. To effectively monitor and track the performance of the market, investors can make use of technical indicators such as moving averages, relative strength indexes, and chart patterns. These indicators help investors keep an eye on the resistance and support levels, giving them insight into when to sell or keep holding.

While trading can be attractive at this point, investors must hold onto their trading strategies.

Step 3: Distribution

The distribution phase signals the point where the stock is getting to its peak while prices rebound to a neutral point. At this point, those who bought shares at the accumulation and early markup stages seem to be selling off their stakes and exiting the market.

This stage is characterized by high volumes with little to no increase in the value of the stock. Even if buying power increases, the strength may not be sufficient to hold the market. The stock may end up crumbling or resulting in a bubble.

Investors often use the head and shoulder or double top chart patterns to know if the market is in the distribution phase. This gives them an insight on how to react, which is often to exit the market.

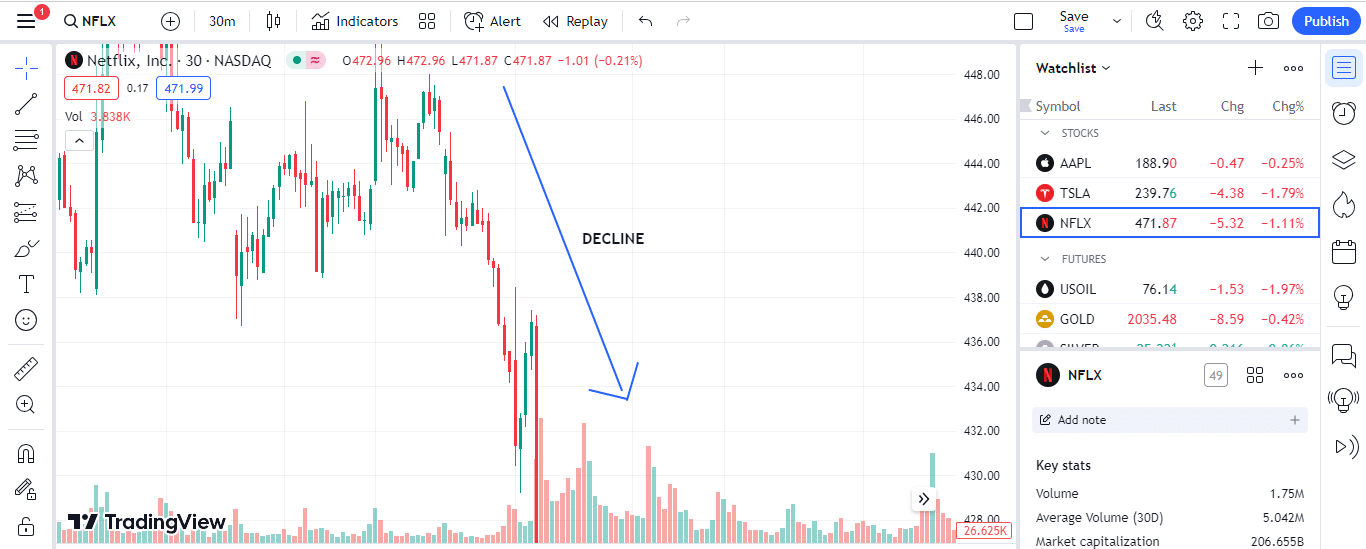

Step 4: Decline

This stage represents the end of a trading cycle and is marked by a decline in the prices of stocks. This is the stage investors dread the most. Early buyers—those who bought shares during the accumulation step—let go of their positions and started selling massively. Institutional traders often sell their holdings during the markup and distribution stages.

How do stocks work concerning a markdown? Fear creeps in, forcing investors to flood the market, selling off their shares. As the volume of stocks increases with fewer people buying them, support levels will be breached, resulting in lower lows. This makes the stocks lose their value, resulting in losses for investors who still hold their shares.

Within a few weeks, the market could likely return to the accumulation stage, ushering in institutional investors. Successful traders are those who spend time researching the stock market. Studying past trading charts and understanding the stock market gives insight into its operation. Knowing the stepwise operation of the market and effectively tracking your portfolio with the best stock portfolio trackers teaches you when to invest and when to sell.

Having explained in detail the phases of a stock’s movement, you must do your own research before picking any stock to invest in, as there are risks involved.

Your capital is at risk.

Long and Short Positions

To effectively navigate the stock market and make the most of it, investors maintain two kinds of positions. These positions, which are either long or short, are the basic principles of margin trading.

Let’s briefly explore the long and short positions below and see how well they position investors in the market.

-

Long Position

When you buy a particular stock and own it, you are said to hold a long position. Provided you bought the stock and paid for it in full, you have the sole right to do whatever you please. If you buy 100 Apple shares (AAPL), your portfolio is said to be long on the stocks. You may choose to sell them as soon as the value increases to make an additional profit.

-

Short Position

This is said to happen if you don’t completely own your stocks—you may have borrowed them. You may choose to borrow 100 AAPL shares from a brokerage using a margin account, hoping that the value will decline before returning them.

You may appear to hold the coin, but you owe it as an obligation to the lender to return it. The bottom line of holding a short position is to sell the shares at a higher price, rebuy them at a lower price, and repay the real owner. If the stock price fails to drop, you risk receiving margin calls from the broker who lent you the shares.

Margin calls often occur when the value of funds in your account falls below the broker’s required minimum value. These calls signal you to deposit more funds to match the investors’ required minimum value.

How do stocks work with longing and shorting? The table below compares the requirements for longing and shorting stocks.

Longing Shorting A margin account is not needed since you buy the shares from the onset A margin account is required since you will be borrowing against the equity in the account. Stocks are bought at lower prices and sold when there is a hike in price. Stocks are borrowed at higher prices, sold at higher prices, and then bought at lower prices and returned to the lender Besides the transaction fees, there’s no additional cost. Additional cost since interest must be paid to the lender. Your capital is at risk.

How Do You Make Money from Stocks?

Besides the voting rights that may likely come with owning stocks, generating income is a major goal for investors. But how can investors make money from the stock market? Let’s explore a few below.

Buying and Holding Stocks

Several investors believe that holding stocks for longer periods yields more than just monitoring the market’s cycle from accumulation to markdown. The fact remains that every investor has a strategy. While some prefer to buy stocks during the accumulation period and sell them during the markup or distribution phase, others prefer to buy and hold.

Now, not everyone knows when to buy or sell, and that’s where the use of the best stock trading signals comes in. These updates can greatly enhance the investment journey of individuals who use them.

How do stocks work with this strategy, and are there some unique benefits?

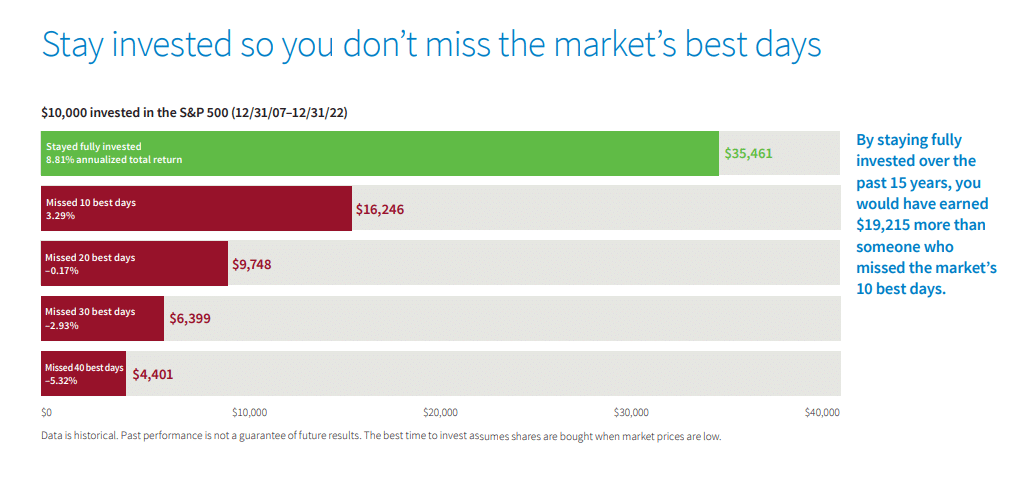

Data from Putnam Investment show that those who were fully invested and did not leave the market between December 2007 and December 2022 gained 8.81% in annual returns. The same couldn’t be said for investors who swung in and out of the market at every opportunity. The data further showed that investors who missed the best 40 trading days of these 15 years lost over 5.3% of their investment.

Additionally, the strategy helps you, especially if you commit to paying fees whenever you add to or sell from your portfolio.

Reinvesting Dividends

Many companies pay shareholders at the end of each financial year, and these payments are called dividends. Dividends range from 2% to 4% of the total shares held. The dividends, however, are tied to the company’s overall performance.

Dividends may be next to nothing, especially for new investors. Reinvesting them is another way of indirectly multiplying the profits. While it is not mandatory to reinvest in the same shares, some of the best stock market research software can help you choose a high-performing one.

Reinvested dividends help to increase profit—through dividends themselves or capital gains. The long-term reinvestment of dividends is quite profitable; hence, most trading platforms give investors the option to reinvest dividends or withdraw them as cash automatically.

Prioritizing Index Funds over Individual Stocks

Index-traded funds consist of hundreds of stocks that imitate indices such as the Nasdaq 100 or S&P 500. Investing in index funds does not require you to have intrinsic knowledge of the stock market. Generally, index funds present an easier way to earn profits.

Index funds allow you to invest in diverse assets without necessarily managing them individually, helping you to manage your risks. Investors who manage diversified stocks of between 3 – 5 different companies could face certain risks should any of the firms go bankrupt.

While index funds allow you to make money from some of the best ETF apps with little to intermediate knowledge of the stock market, individual stocks give you the potential to earn higher profits.

Leverage Long and Short Positions

Longing and shorting stocks are strategies used by short-term investors to earn profit. How do stocks work in this situation?

Longing involves buying stocks at a lower price and selling them at a higher price. Shorting, on the other hand, is the act of borrowing stocks from a broker, selling them at a higher price, and repaying the stocks when the price drops.

This strategy works for short-term investments. However, investors in a short position can get margin calls when the balance in their margin account swings below the broker’s minimum value.

Affiliate Programs

Investors looking to earn passively from stocks can also participate in several affiliate programs. Brokers such as eToro, Robinhood, and Revolut all have affiliate programs you can benefit from. You earn some dollars for every investor you refer to the platform. For instance, you earn $25 per referral on the Robinhood app.

How to Buy Stocks: Step-by-Step

Understanding how the stock market works lays the foundation for your investment journey. Buying stocks involves several steps, and the presence of several online brokerages makes the process easier.

In this section, we will be exploring the steps to buying stocks using eToro as a reference brokerage. Want to learn more? Check out our eToro app review for more details.

Step 1: Visit eToro to signupThe first step to buying stock on eToro is visiting the website. The platform is a secure and regulated brokerage where you can join over 30 million people worldwide to trade over 3,000 instruments using the best investment tools in the market.

Once you’re on the website, click “Join eToro,” and the system will redirect you to set up an account using either your email address, Google account, or Facebook. It’s essential to use the best medium that works for you.

After signing up, you will need to set up a username.

Ensure to read the terms of the agreement and data privacy contract to see if they align with you. Go ahead and accept the terms if you have no problems with them.

Step 2: Verify Your AccountBeing one of the best investment apps out there, it is sure that eToro is a regulated platform. This makes it mandatory for you to meet know-your-customer (KYC) requirements. Upon signing up, the platform will prompt you to verify your account to gain access to its services. Requirements for verification include your government name, email address, home address, snapshot, social security number, and government-issued identity cards. Requirements may vary by country.

Step 3: Deposit Money into Your AccountOnce your account has been verified, you are just a step away from your stock trading journey. You will need funds in your account to start buying stocks. To add funds, click on “Portfolio” and then “Deposit.” There are several ways to add funds, notably through the use of credit or debit cards. The minimum deposit is $10 for U.S. and U.K. residents and $50 for those residing in other parts of the globe.

Step 4: Explore and Trade on the goWith funds in your account, you can start exploring the stock market. You can buy a stock using the funds in your account once it aligns with your short- or long-term goals. eToro, one of the best copy trading apps, offers several tools that can make your stock trading journey easier. With several investors contributing to the platform, you can easily copy their trading strategies to limit your risk and maximize profit.

The platform also has a watchlist section where you can see which stocks are trending and possibly invest in them. eToro’s demo trading feature helps you acclimate to the stock market based on your experience level. It simply allows you to practice before investing.

The table below contains some valuable information about eToro.

Minimum Trading Deposit Features Referral Program Availability $50 Secure, regulated, copy trading, watchlist, demo trading, ease of use, and more Yes. You can share a personalized link to invite new investors to the platform. Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

What Are Stocks and How Do They Work? – Conclusion

Understanding how the stock market works sets a precedent for a successful trading journey. The company tokenizes itself into smaller units, commencing the issuance of stocks, before listing on popular marketplaces such as the LSE and NYSE.

It is crucial to understand that the overall performance of the issuing company directly links dividends and other capital gains. It makes investors aware of certain risks and makes value decisions such as portfolio diversification and maximization of index funds.

Online brokers now present an easier way for individuals to participate in stock trading. It is safe to say that eToro is the best demo trading app around, and its demo trading features make it easy for even rookies to join the market and make the most of it.

Your capital is at risk.

References

- https://www.bankrate.com/investing/long-and-short-stock-positions/#:~:text=While%20going%20long%20involves%20buying,the%20sell%20and%20buy%20prices

- https://www.freshbooks.com/en-gb/hub/accounting/dividend-payout-ratio#:~:text=The%20average%20dividend%20yield%20is,growth%20have%20lower%20dividend%20yields

- https://www.schwab.com/stocks/understand-stocks

- https://www.fca.org.uk/investsmart/should-you-invest

- https://www.fca.org.uk/investsmart/5-questions-ask-you-invest

How do stocks work? Frequently Asked Questions and Answers

Are stocks high-risk?

Stocks can generate returns annually. Every investment has an underlying risk. The value of stocks is closely tied to the performance of the issuing company. Should the company underperform, the value of the stock depreciates. Essentially, stocks are high-risk.

Do stocks make you a lot of money?

The stock market is one of the best places to generate income through dividends and capital gains. Despite making you money in different ways, it comes with its risks.

Can 1 Share of stock make you rich?

Buying a company’s stock can make you rich, especially when you resell it at a higher price. But this will unlikely happen with just a single stock. Assuming you buy an AAPL share at $168, the maximum dividend you get at the end of the year is $6.72 – which isn’t sufficient to make you rich.

Do stocks make millionaires?

Yes, stocks make millionaires. However, it is not as easy as it sounds. It requires a lot of time, hard work, research, and of course, finding the best strategy.

Lucy Adegbe

View all posts by Lucy AdegbeLucy Adegbe is an accomplished personal finance, crypto, stock, and tech writer who has an extensive portfolio of over 200 articles, guides, and market insights.

Based in London and with over five years of experience, Lucy has built a reputation for providing clear explanations of complex financial and tech topics. Lucy has appeared on Investopedia, The Balance, Top10.com, and Black Woman Great.

VISIT ETOROYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2026

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up