What are Crypto Whales? – Complete Review 2026

Whales may be the largest mammals on earth, but the name has found a unique use in cryptocurrency. You’ve probably had articles with topics that relate to this: What crypto are whales buying? These massive purchases often shock the ecosystem, causing ripples in the price movement.

The idea of a whale entails having or holding large amounts of a circulating cryptocurrency in one account. It can also refer to the process of accumulating large amounts of cryptocurrency in one purchase, beyond that of the average trader.

We’ll explore what crypto whales are and how they relate to the trading ecosystem. You’ll learn how to see what crypto whales are buying and structure your trade accordingly. With that in mind, here’s our extensive look at what whales in crypto are.

-

-

What are Crypto Whales?—Introduction

We often identify crypto whales by their purchasing power and wallet size. These entities can sweep large amounts of cryptocurrency off the market, thereby reducing liquidity. Let’s review the definition of crypto whales and explore their significance.

Definition and explanation of crypto whales in the cryptocurrency market

A crypto whale is an entity, individual, or organization that holds cryptocurrency in large quantities. Some whales, like Brian Armstrong and Michael Saylor, are prominent. However, some remain mysterious, even in the crypto community.

Understanding their significance and impact on the market

Learning about whales in crypto is one thing, but understanding how they impact the market is more vital. Holding or transacting large amounts of cryptocurrency can cause notable price shifts. For example, whales suddenly dumping their holdings can cause other traders to go into a frenzy and frantically sell theirs.

Most experts look towards whales to figure out the best time to trade crypto. Besides that, holding and transacting large amounts of crypto affects its liquidity. With little left to trade, demand could outweigh supply, resulting in price hikes.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Classifications of Crypto Whales

The next step in exploring what crypto whales are in the blockchain economy is defining their classes. We categorize crypto whales based on their holdings and activities. Sometimes, the nature of the acquisition also matters.

Different types of crypto whales based on their holdings and activities

Retail investors, institutional whales, and exchange whales are the major types of crypto whales. These whales have varying purchasing power and holding abilities. However, even the least of them can influence the market.

For holdings and activities, you can have the following whales:

- Trader whales: They participate like normal traders but with higher purchasing power.

- Long-term holders: These whales often hold their assets for months and even years.

Regarding the form of ownership, you can have the following:

- Mining whales: These whales acquire large amounts of crypto through mining. They often have mining farms worth millions of dollars.

- ICO whales: These whales take advantage of the low prices during ICOs to purchase large quantities of crypto.

You’ll need to find the best crypto presales if you want to become an ICO whale. Grab the crypto when it is at its lowest and wait for sentiment to climb.

Differentiating between retail investors, institutional whales, and exchange whales

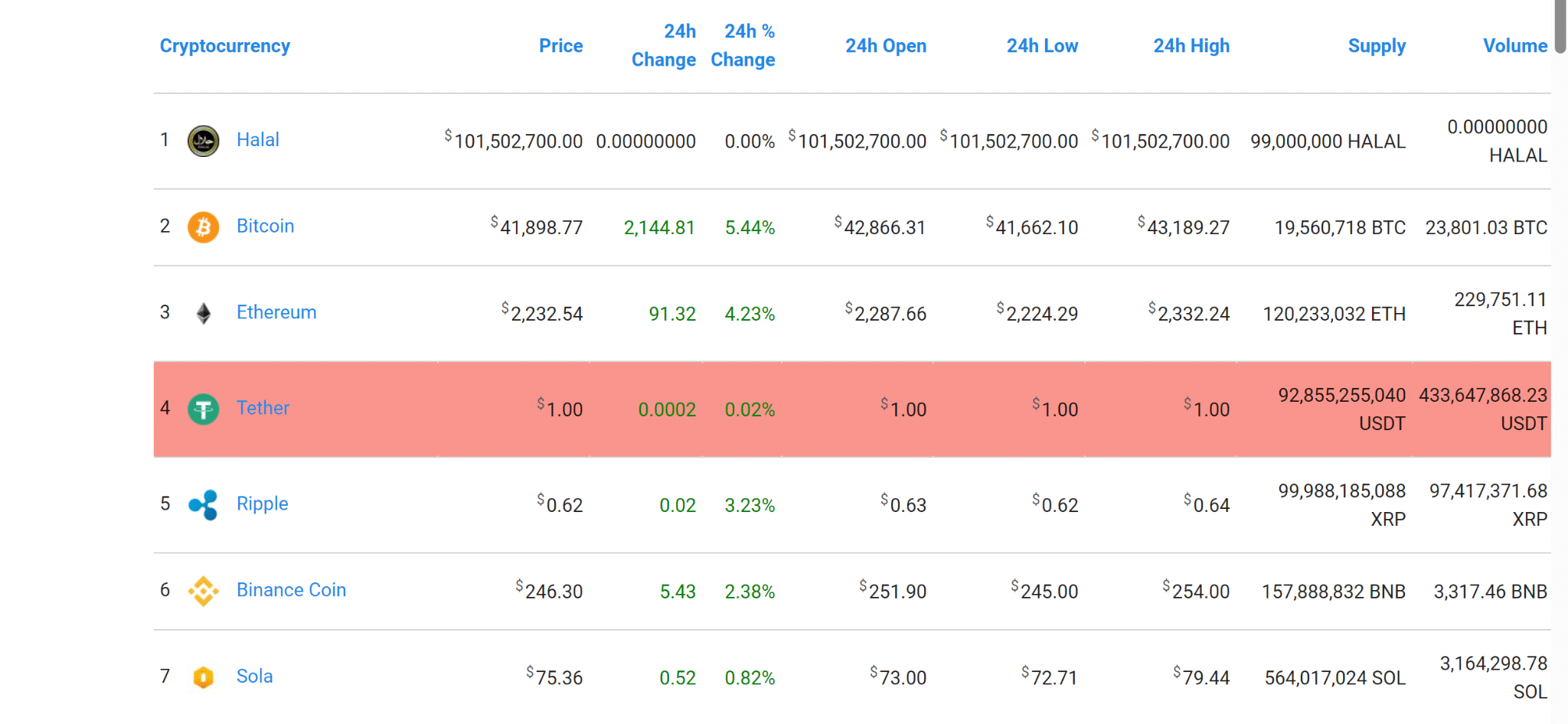

The table below shows the major differences between crypto whales:

Retail investors Institution whales Exchange whaless Holding They generally have the fewest investments because they use their funds They often have large holdings because they have substantial funds They have large holdings but within an exchange network. Acquisition process Small but substantial trades Large purchases Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Whale Accumulation and Distribution

The impact of crypto whales in trading is enormous. However, we must identify the accumulation and distribution models. This is the prerequisite for how to see what crypto whales are buying.

Accumulation refers to the processes whales use to acquire large amounts of cryptocurrency. They can still use the same Bitcoin trading app you use, provided the platform supports large transactions.

Distribution refers to the percentages of a cryptocurrency that whales own. For example, whales own 39% of Ethereum. The fractions each whale owns vary.

How whales accumulate large amounts of cryptocurrency

An integral part of what crypto whales are covers how these large-scale buyers acquire crypto. They do that in several ways, including the following:

- Early adoption through presales

- Participating in ICOs and IDO projects

- Mining

- Acquiring exchanges or purchasing large stakes

- Trading on the open market

Concerned traders often scour the internet to answer the basic question of what crypto whales are buying. You can set up news alerts on reputable platforms to see when whales make unusually large purchases. That will show you which cryptos they are buying.

Strategies used by whales to distribute their holdings

With large acquisitions comes the burden of distribution. A whale might purchase a large quantity of crypto. However, that might not be the only crypto in its portfolio.

Whales use different wallets to distribute their crypto. Other strategies for distribution include:

- Gradual sales

- Trading on discreet pools

- OTC trading with individuals and institutions

- Conversion to cryptocurrency bonds

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Impact on Price Movements

You can review price movements after learning how to see what crypto whales are buying. Whale activity can have a significant impact on price movements, especially when done in one fell swoop. The impact can drive prices upward or downward.

Analyzing how whale activities can influence cryptocurrency prices

To analyze the impact of whale activities, we must answer the question, What crypto are whales buying? Here is how whales influence prices:

- Market sentiment: Traders often associate whale purchases with upcoming price swings. For example, a whale suddenly dumping its crypto holdings might mean an eminent crash. Retail traders will lower their prices to sell off their holdings.

- Volatility: A sudden supply of crypto in large quantities can affect the market’s volatility. With volatility changes come price movements.

- Liquidity: Purchasing large amounts of crypto reduces its market liquidity. There are fewer coins in circulation. Hence, prices can increase.

Examples of price manipulation and its effects on the market

Observing and predicting price manipulation boils down to tknowing what crypto whales are buying. Here are examples of price manipulation and its effects on the market:

- Buy walls: A buy wall involves opening massive buy orders at above-market prices. Other traders will increase their prices as people buy due to the fear of missing out. The price can go even higher as sentiment and enthusiasm increase.

- Sell walls: A sell wall involves opening massive sell orders at below-market prices. Other traders will be forced to reduce their prices since these whales have more supply. Once the price has dropped, these whales can stop buying, stabilizing the price.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

On-Chain Analysis

Learning how to see what crypto whales are buying is essential to profit from their activities. On-chain analysis is one way to identify whales. This involves looking at transaction data and wallet balances on the public blockchain.

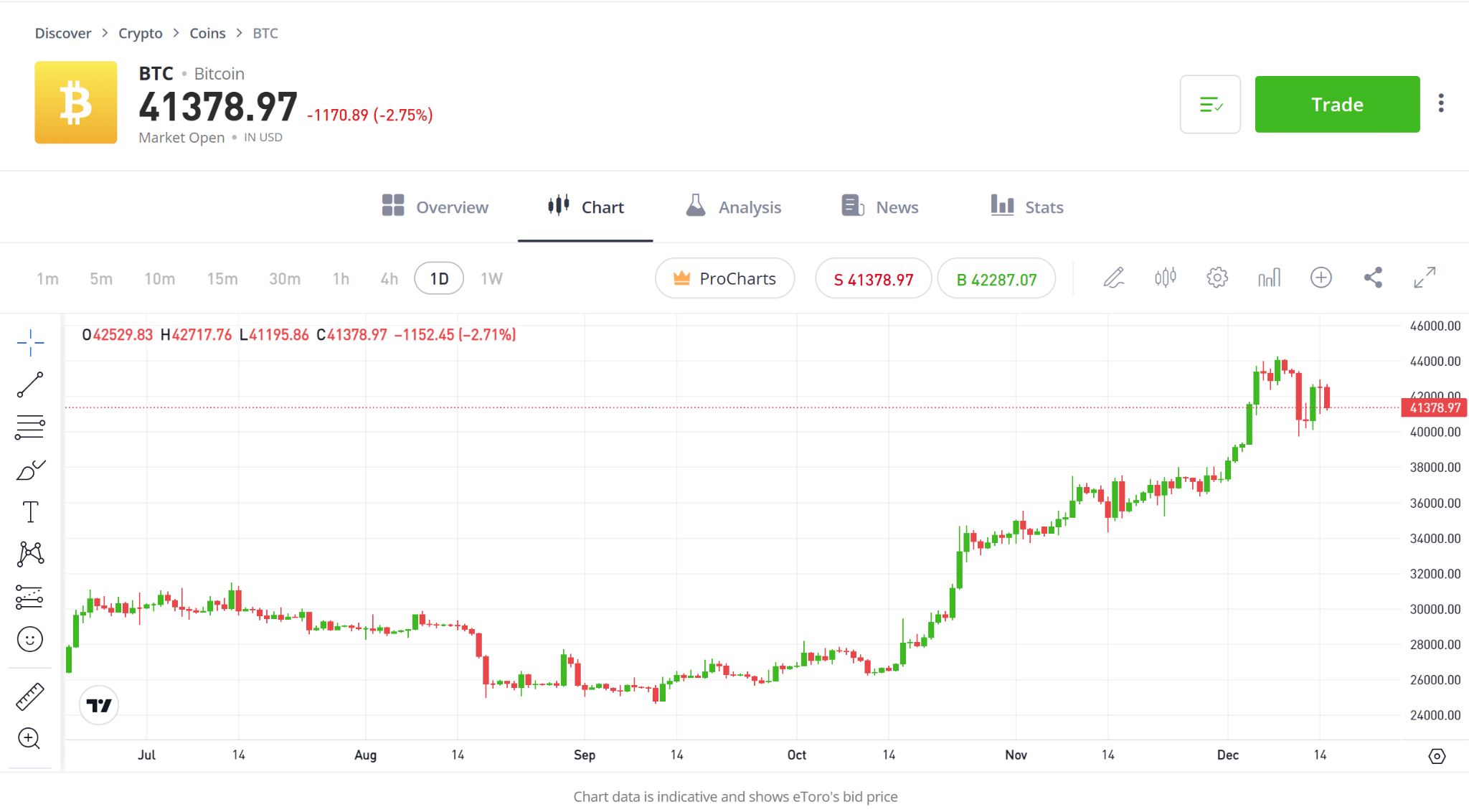

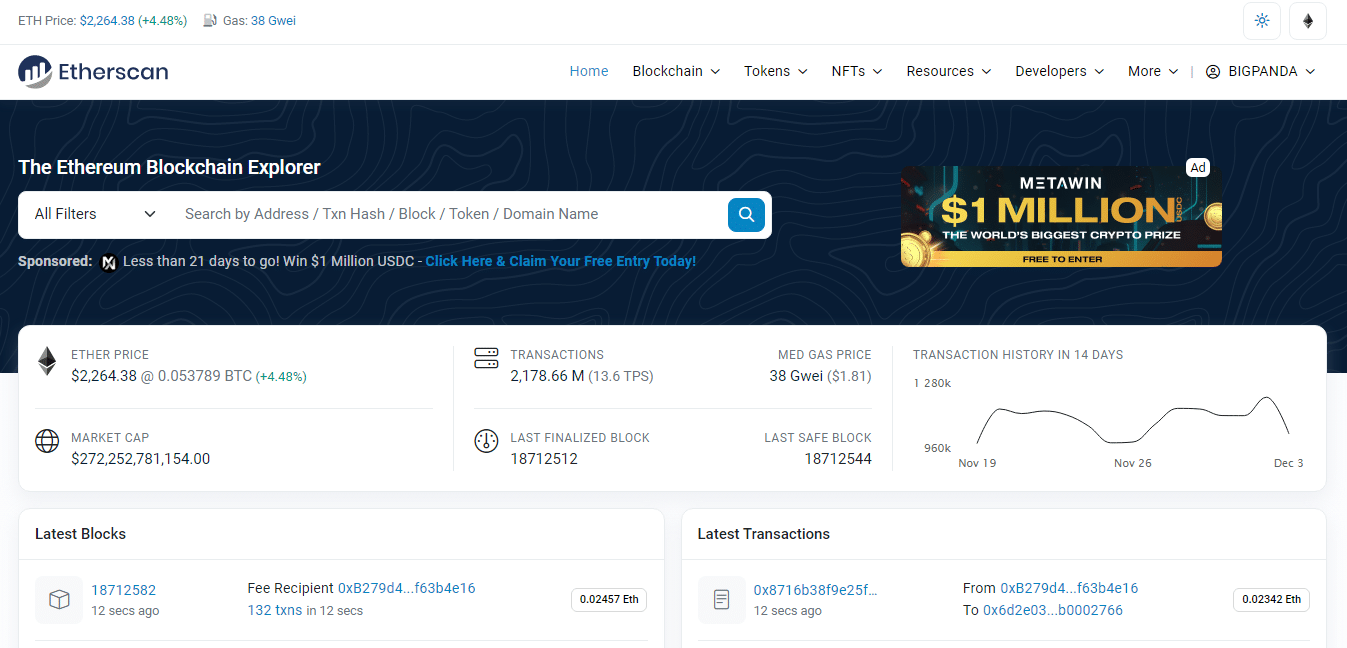

You can use tools like Etherscan to recognize whale wallets. Opt for tools with better charts and visualizations for easy tracking.

Using on-chain data to identify whale addresses

Identifying whale addresses will also determine what crypto whales are buying. Here are the steps to using on-chain analysis:

- Identify the cryptocurrency’s blockchain.

- Register with a reliable and effective on-chain analysis platform or tool.

- Look for large transactions by analyzing crypto wallet balances and transaction data

- Track the addresses involved in the large transaction

One or more of these addresses will belong to crypto whales. You can quickly identify the traded cryptocurrencies or tokens after identifying their addresses.

Tools and platforms for tracking whale transactions

We’ve shown you how to see what crypto whales are buying. However, you need robust tools and platforms to track these transactions. Our recommendations include the following:

- Etherscan

- Whale Tracker

- Whale Alert

- Whalemap

- ClankApp

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Order Book Analysis

This approach works best after discovering what the concerned crypto whales are buying. However, it can also help identify largely traded cryptos.

Order book analysis involves examining the buy and sell orders of a specific crypto. You can use order books to identify participants in large trades. However, some traders remain anonymous.

Understanding how order book data reveals whale presence

We’ve moved on from what whales are in crypto. Now, it is left for us to employ strategies to identify them. Here is how you can use order books to identify a whale:

- Through buy and sell orders: Whales place enormous buy and sell orders. These trades will stand out from other retail trades.

- Quick transfers: Whales often work quickly. Large orders that transact quickly can signify the presence of a whale.

- Order cancellations: Some whales test the market by placing large orders and canceling them quickly.

- Order clusters: If orders cluster around huge prices, that can signify a whale presence.

Spotting whale-sized buy-and-sell walls

We’ll keep asking: What crypto are whales buying? Whales will pop up every now and then. However, some whales actively manipulate the market through buy-and-sell walls.

These trades aim at causing specific market reactions. The trades end once the reaction occurs.

Having learned what whales in crypto are, here’s how you can spot their buy-and-sell walls:

- Buy-and-sell walls often appear and disappear rapidly. They come in to manipulate price movements and disappear once they are achieved.

- Buy and sell walls don’t stay long on order books.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Pros and Cons of Whale Watching

Crypto whale watching comes after identifying the whales. Then, you can observe their actions to see what they buy or sell.

Here are the pros and cons of crypto whale watching:

Benefits of monitoring whale activities for market insights

The benefits include the following:

- You’ll have insight into market sentiment

- It provides early warnings on price movements

- It lets you join the whales for potential profits

- You’ll have valuable information for market transparency

- You can identify market manipulators

Risks and potential drawbacks of relying on whale data

The risks include the following:

- Market manipulation might not favor you

- It does not favor low-volume trades

- Reduced liquidity

- Increased volatility

- There is a high potential for market manipulation

Market Sentiment and Following the Whales

What are crypto whales, and should we follow them? Whale activity often generates market sentiment. Just like alternative data in stock trading, gauging market sentiment can be beneficial.

Whale activities should be secondary. The primary thing is knowing what the market says. Moreover, you might not have enough funds to challenge the whales.

While identifying whales in crypto and gauging market sentiment can be helpful, you must do it with caution.

How retail investors can gauge market sentiment by observing whale actions

Ruling out manipulation, whales often move based on their projections. The sudden dumping of crypto can generate negative sentiment about crypto. Most traders might see the coin or asset as worthless since whales are dumping it.

Similarly, sudden acquisitions can increase a coin’s value. Market sentiment will be positive as traders think a bullish season is near.

Whales often have access to information that average traders don’t. Hence, you can use their trades to gauge market sentiment and prepare for upcoming swings.

This takes us to the next point of following or ignoring crypto whales.

The importance of avoiding blind following of whale moves

You can gain insight into market sentiment and other events by following crypto whales. However, you shouldn’t rely wholly on their transactions. We mentioned market manipulation earlier.

Whales can engage in pump-and-dump schemes. Also, they often have information that is unknown in the regular trading market. You might end up trading blindly with the little capital you have.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Strategies for Trading Around Whales

The endpoint of what crypto whales are ends in how to trade around them. They can present profit opportunities, but the risk of losses will always be there. That is partly because you are not in their class with enough capital to spare.

Risk management should be at the center of your trade. Then, you can develop strategies to align your trades with whale movements.

Risk management techniques in a volatile market influenced by whales

What are crypto whales and their associated risks? Here are some techniques to manage risks in a volatile market:

- Use research tools to find out as much as possible about the market

- Implement stop-loss orders on your trades

- Diversify your crypto portfolio

- Monitor news and events

- Have a risk-reward ratio

- Apply leveraged trades prudently

Strategies for aligning trades with potential whale movements

You can identify what crypto whales contribute to trading and align your trades with them. This aspect requires better technical understanding. Here are strategies you can use to align your trades:

- Monitor order books

- Identify support and trend lines using technical analysis

- Use trackers for real-time price monitoring

- Look for sudden volume spikes in sell or buy orders

Market Evolution and Regulation

If you thought this article’s exploration of what crypto whales are affected evolution, you are right. Crypto whales play crucial roles in evolving markets. However, such purchasing power should be regulated to prevent abuse.

The role of whales in the maturing crypto market

We dedicated this guide on what crypto whales are to explaining their influence. Notwithstanding, these entities can influence a maturing crypto market positively. Here’s how they can do that:

- Provide liquidity by offloading significant cryptos when needed.

- Reduce liquidity by purchasing significant cryptos when needed

- Stabilize prices by creating buy-and-sell walls.

- Fund innovation, including IDOs, blockchain projects, ICOs, etc.

Regulatory implications and measures to mitigate whale manipulation

We’ve seen how much whales can manipulate the market. The previous sections on what crypto whales are have explored their far-reaching influence. Hence, we believe the market should be regulated to prevent abuse.

Here are a few measures to mitigate whale manipulation:

- Transaction limits on one trade

- Transparency requirements from exchanges

- Transaction monitoring

- Market monitoring for abuse

Trade Cryptos Now

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto Whales: eToro Complete Guide

We can’t wrap up on what crypto whales add to crypto markets without identifying the best trading platform. eToro is our recommended app for trading cryptos. It is available for Android and iOS devices, but you can use the web version.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

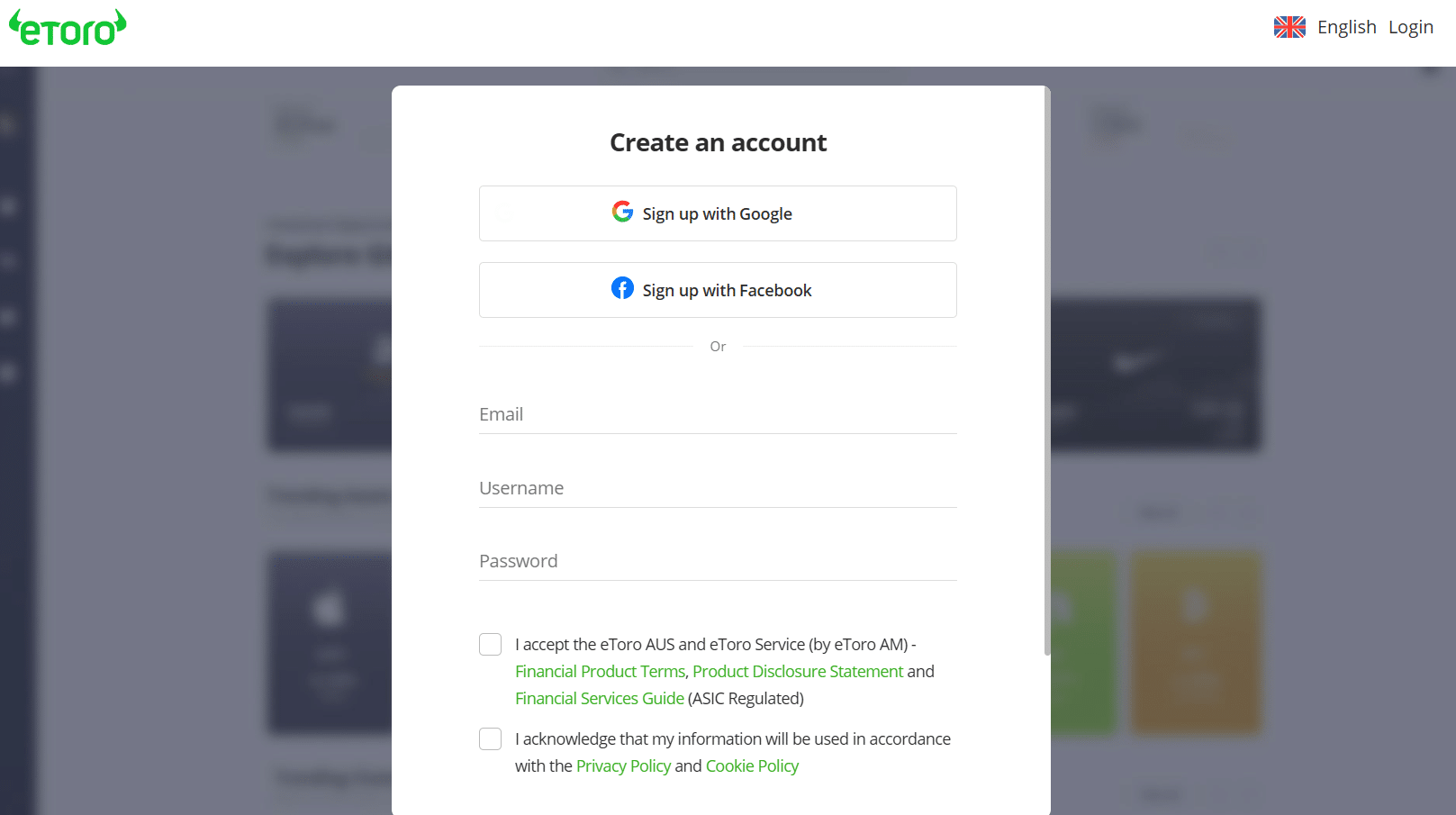

You can practice your strategies to trade around crypto whales with the virtual account. Here’s how to start using eToro:

Step 1: Open a new trading accountEnsure you are on the official eToro website. You can use your smartphone or register with a PC. Click “Join eToro” to begin registration.

Step 2: Complete the registration formProvide the required information. That includes your email (active account), password, and username. We recommend using an active email to receive the account verification code. This verification is preliminary and does not cover your subsequent identity verification.

You can skip this process and opt for registration through Facebook or Gmail. That will pull your user data from these channels.

Step 3: Consent to eToro’s policiesCheck the privacy policy and terms of service. This step is necessary to complete registration and move to the verification page.

Step 4: Verify your email addresseToro will send a code to your email address to verify if it’s active. Input this code into the verification box to complete registration.

Step 5: Start tradingEnjoy seamless access to technical tools and indicators. Fund your account with your credit card to follow Crypto Whales. Alternatively, switch to the virtual account and adjust your strategy to trade around crypto whales.

What are Crypto Whales? Conclusion

We’ve covered the meaning and influence of crypto whales in this article. While we encourage monitoring whales, we don’t recommend following them blindly. Use their activities to gauge market sentiment before trading.

Manage risks and diversify your portfolio. Use eToro to manage your portfolio and keep up with the thoughts of other traders.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

References

- https://www.cnbctv18.com/cryptocurrency/who-are-the-biggest-bitcoin-whales-in-the-worldcheck-here-16703101.htm

- https://finbold.com/39-of-ethereum-supply-is-held-by-whales-compared-to-bitcoins-11/#:

- https://www.financemagnates.com/cryptocurrency/interview/crypto-market-manipulation-is-still-alive-and-well-says-orbs-ilan-sterk/

- https://corporatefinanceinstitute.com/resources/cryptocurrency/liquidity-in-cryptocurrency/

- https://www.forbes.com/sites/oliverrenick/2021/09/11/crypto-regulation-should-begin-with-whales-not-tokens/

FAQs

Who is the biggest whale in crypto?

Satoshi Nakamoto is regarded as the biggest crypto whale because of its 45% share of Bitcoin. That gives the entity a value of $4.5 billion.

How do you identify crypto whales?

You can identify them through large-volume trades. These trades often occur suddenly and quickly.

Is it good when whales buy crypto?

Their action in this regard can stabilize prices by reducing liquidity.

What happens when crypto whales sell?

The cryptocurrency’s price often declines as other traders move to sell off their assets.

Jeremiah Awogboro

View all posts by Jeremiah AwogboroJeremiah Awogboro is an experienced content writer with over 8 years of experience. He has a qualified MBChB degree and a keen interest in the stock market and the finance industry. His background in the industry has provided him with valuable experience in this field. Awogboro is dedicated to assisting and reaching out to as many people as possible through his writing. In his spare time, he enjoys music, football, traveling, and reading.

VISIT ETOROYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2026

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up