Robinhood App Review 2026 – Fees, Features, Pros & Cons Revealed

Whether you’re a newbie investor or seasoned trader – there is a good chance that you have heard of the Robinhood app. The US-based broker allows you to buy stocks, ETFs, and cryptocurrencies without paying any commissions – and there is no minimum deposit to contend with. You can also trade options in a cost-effective arena.But, is Robinhood the right broker for you?In this robinhood app review, we explain the ins and outs.

We explore what the broker offers in terms of fees, tradable stocks, supported payments, customer support, and more.

-

-

What is Robinhood?

Not only can you buy and sell assets through the Robinhood website, but the broker also offers a dedicated mobile app. This ensures that you are able to trade on the move. The core selling-point of Robinhood is that it allows you to invest without paying any fees. This is the case across thousands of stocks, ETFs, and cryptocurrencies.

In the case of the Robinhood stock library, this largely centres on US-listed firms. You can, however, also buy stocks in 250 foreign companies. The Robinhood app is also a good option if you want to trade options. Once again, the broker allows you to do this in a commission-free manner. The Robinhood stock app is also popular for the ease in which you can invest.

There are no unnecessary bells and whistles attached to the platform, subsequently making it simple for newbies to enter the stock market. All you need to do is download the app, provide some personal information, make a deposit and then choose which stocks you want to purchase. In terms of safety, Robinhood is regulated by several US-based bodies. This includes FINRA and the SEC.

What Stocks Can You Trade on the Robinhood App?

Our Robinhood app review found that this app gives you access to over 5,000 stocks. As we noted above, the vast majority of these are US-listed firms. This means that you will be buying stocks in companies listed on the NASDAQ and New York Stock Exchange.

Additionally, Robinhood also gives you access to 250+ foreign-listed stocks. This is somewhat thin on the ground, so if you are looking to diversify into several international marketplaces, you might want to consider eToro. This is because the US-friendly platform offers stocks from 17 different stock exchanges. You can also trade penny stocks on Robinhood.

If you purchase a stock at Robinhood that yields dividends, the payment will be made as and when the respective company makes the distribution. This will be credited to your Robinhood cash account.

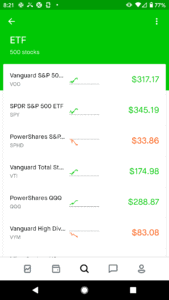

ETFs

The Robinhood app also allows you to invest in ETFs. Once again, these are ETFs listed on US marketplaces. This is a good option if you are planning to invest in a wider stock market index such as the S&P 500, Dow Jones 30, or NASDAQ 100.

Cryptocurrencies

Our Robinhood app review found that this trading app allows you to buy and sell 7 digital currencies from within the app.

This includes

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Bitcoin SV (BSV)

- Dogecoin (DOGE)

- Ethereum (ETH)

- Ethereum Classic (ETC)

- Litecoin (LTC)

Options

For those of you with a bit of experience in online trading, you might want to consider the Robinhood options department. This allows you to speculate on the future value of stocks by placing just a small amount of capital upfront.

There are very few stock apps in the US that give you access to the options market as a retail client, so this is definitely thumbs up for the team at Robinhood.

On the flip side, you should only trade options on the Robinhood investing app if you know what you are doing – as they are much more complex than traditional stocks.

Robinhood Review – Account Types

The Robinhood stock app comes with three main account types – instant, gold, and cash. Below we briefly explain what each account type offers.

Robinhood Instant

When you initially register with Robinhood, you will be offered a Standard Account by default. This gives you access to instant deposits up to $1,000. If you want to deposit more than this, you’ll need to wait a couple of days for the funds to arrive. You can trade all supported asset classes commission-free on this account.

Robinhood Gold

This particular option is the premium account at Robinhood, as it grants you access to several perks. Firstly, you will be able to trade larger amounts and benefit from extended trading hours. You will also benefit from larger instant deposits. While the other account types are limited to just $1,000 – the Gold Account is significantly higher.

The specific amount will, however, depend on the size of your portfolio. For example, if you have a portfolio of $50,000 or more, you can instantly deposit up to $50,000. If your portfolio is below $10,000, you can instantly deposit $5,000. In order to get the Gold Account on the Robinhood trading app, you will need to have a minimum account balance of $2,000.

There are also fees attached. This amounts to a flat fee of just $5 per month. But, if you have a margin balance of more than $1,000 – you will pay an annual interest fee of 5%. This is charged daily. Finally, the Gold Account also grants you access to ‘Level II’ market data – which we explain in more detail later on.

Robinhood Gold

The Cash Account removes your ability to trade with leverage. This might not be a bad thing, as leverage can be dangerous for those that do not understand the associated risks. The Cash Account still allows you to benefit from commission-free stock and ETF trades. But, you won’t be able to deposit funds instantly.

Other than the above, there are no other account options on the Robinhood app. This means that you will miss out on the IRA, joint, and custodial accounts that are available on other stock apps.

Robinhood Review – Fees & Commissions

As mentioned throughout this robinhood app review, one of the main attractions of opening an account with Robinhood is that it offers commission-free trades. This is the case across all of its supported assets – meaning that you can buy and sell stocks, ETFs, cryptocurrencies, and options without paying a single cent in fees.

This does make the Robinhood stock app one of the cost-effective stock brokers in the space. So that begs the question – how does Robinhood actually make money if it doesn’t charge any trading commissions?

Put simply, the broker will make money when traders utilize margin on the app. It also makes money by sending customer positions to third-party market makers. It will then profit off of the price that you pay, against that of the entity that takes on the position.

Hidden Fees

We scanned the Robinhood platform from top to bottom and found that the app does not charge any hidden fees. This means that there are no monthly or annual maintenance fees, nor will you need to pay anything if your account is marked as dormant. The only fee that you need to be made away of is a $75 withdraw charge when cashing out via ACH.

Robinhood Stock App User Experience

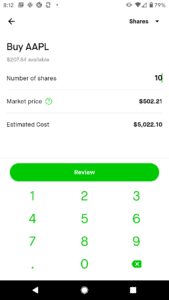

Our Robinhood app review found that it is suitable for traders of all shapes and sizes. In particular, first-time stock investors will find the application useful. This is because it is super-easy to navigate yourself through the app. For example, if you wanted to buy stocks in Tesla, all you would need to do is enter the name of the company into the search box at the top of the screen.

Then, by clicking on the result that loads up, you will be taken straight to the page for buying Tesla stock. It’s then just case of entering how much you wish to invest. As the Robinhood app supports fractional ownership, you don’t even need to specify an exact number of stocks to buy. Instead, if you want to buy $1 worth of stock, you can buy exactly $1 of a stock!

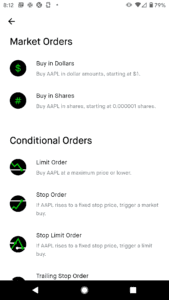

The ease in which you can trade on the Robinhood investing app is also applicable to its other supported asset classes. This is especially useful when it comes to investing cryptocurrencies, as traditional online exchanges are known to be somewhat cumbersome to use. We should also note that Robinhood supports several market order types through the app.

Whether you want to set up a market, limit, or stop-loss order on your stock trade – the app allows you to do this in a seamless manner. And of course – the process of opening an account and adding funds is also straightforward. Ultimately, just because you will be buying and selling stocks on a smaller screen, this isn’t to say that your trading experience will be hindered. Not when using the Robinhood app, anyway.

Robinhood Review – Trading Tools and Features

Although Robinhood makes the process of buying and selling stocks through its app simple and convenient, you will still have access to a number of additional features that are worth mentioning.

Robinhood Margin

The margin trading feature at Robinhood is extremely popular with US investors. This is because you will have the ability to invest more than you have in your account. Firstly, in order to trade with leverage, you will need to open a Robinhood Gold Account. As noted earlier, this means that you will need to deposit at least $2,000.

In terms of how much margin you will be offered, this is determined on a case-by-case basis. However, most Robinhood stock app users claim that this initially stands at 2x. In other words, if you have an account balance of $2,000 – then you can buy $4,000 worth of stocks.

In this sense, the more you have in your Robinhood account, the more you will be able to borrow from the broker. Don’t forget, if your leveraged trade goes against you by a certain amount, you do stand the risk of being liquidated. This means that Robinhood will be forced to close your trade automatically and thus – you will lose the amount that you have in your margin account.

Before this happens, the broker will send you a ‘Margin Call’. This simply means that you will be notified when you are approaching ther point of liquidation and that you have the option of adding more funds to your margin balance.

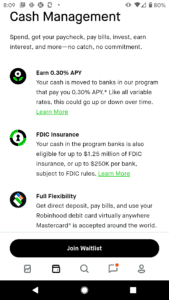

Banking Card and Interest

The Robinhood app allows you to apply for a savings account. This comes with a fully-fledged MasterCard debit card, which you can use online or in-store. This also allows you to make instant deposits into your Robinhood brokerage account. The savings account also allows you to earn interest on your funds – which stands at 0.30% APY.

Although this is nothing to write home about, it does at the very least allow you to earn something on idle money. Best of all, the Robinhood savings account is protected by the FDIC – which covers you up to the first $250,000.

Fractional Stock

Fractional stocks are all the rage in the stock app space, as they allow you to invest really small amounts. As the name suggests, this allows you to purchase a ‘fraction’ of a share, as opposed to being forced to invest more than you can afford. This is especially useful in gaining exposure to high-value stocks like Tesla, Apple, Alphabet and Amazon.

In fact, the likes of Berkshire Hathaway has a current stock price of over $325k – which is going to be out of reach for most of us. The good news is that by using the Robinhood app, you can invest from just $1. Your ownership of the share will, therefore, be proportionate to the amount you invest, against that of the current stock price.

Robinhood App Education

If you’re looking for a stock app that also offers educational resources, you are going to be disappointed. This is because our Robinhood review found that the app is more suited for those of you that know which stocks you wish to invest in. As a result, you will need to use a third-party platform to learn how the stock markets work. This isn’t a major flaw anyway, as the app does exactly what it says on the tin – commission-free investing.

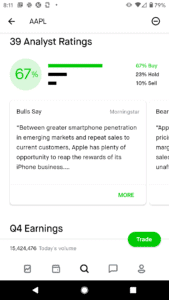

Robinhood Review – Research and Analysis

If you are on the Instant or Cash Account at Robinhood, access to fundamental research is going to be very limited. This is why you might want to consider upgrading to the Gold Account if you are looking to perform analysis from within the app.

Before we get to that, let us quickly explain what you get with the free accounts at Robinhood.

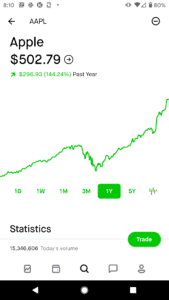

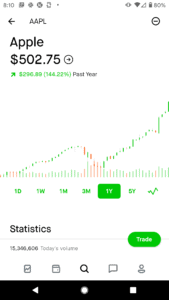

Charts

All stocks, ETFs, and cryptocurrencies come with pricing charts. This allows you to assess which way the markets are likely to go, based on the technicals. This isn’t, however, anywhere near as elaborate in comparison to other trading platforms in the space.

As such, if you’re an advanced trader that likes to perform in-depth technical analysis, the Robinhood stock app won’t be for you. With that said, performing technical analysis on a mobile phone is extremely cumbersome anyway – regardless of which provider you are using.

Earnings Reports

We really like the earnings reports that the Robinhood investing app offers. Not only do you get to view a calendar of up and coming publications, but you can also listen to the earnings announcement in real-time. You can also listen to your chosen earnings report at a later date.

The following two research tools are only available to those on a Robinhood Gold Account.

Level II Market Data

Level II Market Data is a research feature powered by NASDAQ TotalView. In a nutshell, this provides you with real-time data on bid and ask prices. This can be useful if you understand how to evaluate the data, as it gives you an idea of which way the markets are moving. With that said, if you’re a stock market newbie, this particular research tool is likely to be of very little use.

Morningstar Research Reports

The Gold Account also gives you unfettered access to professional research reports published by Morningstar. This is premium, top-notch material that will provide you with all of the data, commentary, and market insights that you would need to be able to make an informed investment decision.

Robinhood App Bonus

Robinhood offers a generous signup bonus for those that are opening an account for the very first time. Put simply, the app will give you 1 free stock. The stock is selected at random, and can be valued anywhere between $2.50 and $200. However, the Robinhood app does note that there is a 98% probability that your free stock will be valued between $2.50 and $10.

Robinhood Demo Account

Unfortunately, our Robinhood app review found that it is yet to offer a demo trading facility. This is also the case with its main desktop platform.

Payments on the Robinhood App

In terms of funding your Robinhood account, the app does not support debit/credit cards, e-wallets, or Google/Apple Pay. Instead, you will need to execute a bank transfer. Depending on your account type, you might benefit from instant deposits.

The Instant Account permits an instant deposit of $1,000 – while the Gold Account can be as high as $50,000. However, this will depend on the value of your portfolio.

There are no fees to make a deposit. However, ACH withdrawals cost $75 per transactions.

Robinhood Minimum Deposit

There is no minimum deposit at Robinhood, which is great if you wish to start off with a small amount of capital. The only exception to this is if you open a Gold Account, which requires a minimum account balance of $2,000.

Robinhood Customer Service

Our robinhood app review found that unfortunately, the app does not offer support in the form of live chat. There is no telephone support line, either. Instead, all account queries will need to be executed via email or a support ticket.

Is Robinhood Safe?

As a US-based broker, it will come as no surprise to learn that the Robinhood app is safe and is heavily regulated. This includes a license from FINRA.

Robinhood is also registered with the SEC, and is a member of the SIPC. All in all, you should have no concerns about the safety of your funds when using the Robinhood app.

Robinhood App Device Compatability

Currently, you can download the Robinhood Android app and the Robinhood iPhone app for free from the app store of your smartphone or tablet. There is also a Robinhood web app. To download the Robinhood desktop app, simply visit the Robinhood website and follow the instructions.

How to Use the Robinhood App

Fancy joining over 10 million Americans by opening an account with Robinhood? If so, follow the guidelines outlined below to get started right now.

Step 1: Robinhood App DownloadVisit the Robinhood website and download the mobile app. This is available to download free of charge and is compatible with iOS and Android devices.

Step 2: Open a Trading AccountYou will now be asked to open a trading account. As is industry-standard, you’ll initially need to provide some personal information. This should include your social security number and contact details.

Step 3: Wait for Verification EmailYou will receive an email from Robinhood within one day letting you know the status of your application. If approved instantly, you can proceed to the next step.

In some cases, Robinhood will ask you to provide some additional information. This will be because the compliance team was unable to verify your identity from the details you provided. If this is the case, you might be asked to upload a copy of your government-issued ID.

Step 4: Deposit FundsYou will now be asked to deposit some funds. Remember – there is no account minimum.

The only option available to you will be a domestic bank transfer. The first $1,000 will benefit from an instant deposit, while the balance might take a couple of days. If you want a higher instant deposit limit, you’ll need to upgrade to the Gold Account.

Step 5: Trade or Buy StocksOnce your Robinhood account has been funded, you can proceed to buy some stock. First, enter the name of the company that you wish to invest in, and click on the result that loads up.

Then, you need to enter the amount that you wish to invest, before confirming the order.

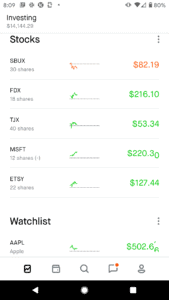

How to Sell on Robinhood App

You can sell your stocks on the Robinhood app at the click of a button. Head over to your portfolio, and then select the stock that you wish to sell. You then need to decide whether you want to sell all of your stocks, or just a small amount. As soon as you confirm the sale, the funds will be added to your cash account balance.

Robinhood Stock App Pros & Cons

Below you will find an overview of our Robinhood app review findings.

Pros

- Does not charge any fees to invest

- Supports 5.,000+ US-listed stocks

- Also hosts cryptocurrencies, ETFs, and options trading

- No minimum deposit

- Super-easy to use

- Heavily regulated

- Great reputation

- US-based

Cons

- Lacks in the educational and research department

- Only 250+ foreign stocks available

Robinhood App Review – The Verdict

In just 7 years of trading, the Robinhood app has attracted over 10 million account users. This isn’t surprising when you consider that the app allows you to invest in over 5,000 US stocks without paying a single dime in commission. This is also the case with ETFs, cryptocurrencies, and options trading.

Best of all, the app is very easy to use, so you don’t need to have any prior experience of buying and selling assets. Instead, you simply need to open the app, decide which company you wish to invest in, and select the number of stocks. You don’t need to meet a minimum deposit or investment amount either, so you can buy just a few dollars worth of stocks at the click of a button.

Taking all of this into account, the verdict of our robinhood app review is that this is one of the best stock apps of 2026. If you want to get started with an account right now – click on the link below!

Robinhood – US Stock App with 0% Commission

75% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

Is Robinhood available in the UK

Robinhood had plans to launch a Robinhood UK app in 2020, however these plans have now been cancelled and it remains restricted to US users.

What stocks does Robinhood offer?

Robinhood offers over 5,000+ stocks – most of which are listed on US exchanges. You can also invest in 250+ foreign-listed stocks.

How do you deposit funds into the Robinhood app?

You will need to execute a domestic bank transfer. On the Instant Account – which is offered to all new customers by default, you can deposit up to $1,000 instantly.

Is Robinhood regulated?

Yes, Robinhood is regulated by FINRA, and registered with the SEC.

What is the Robinhood minimum deposit?

There is no minimum deposit amount at Robinhood, so you can get started with just a few bucks.

Kane Pepi

Kane Pepi

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane has also written for websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.View all posts by Kane PepiVisiter eToroYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2026

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

As a US-based broker, it will come as no surprise to learn that the Robinhood app is safe and is heavily regulated. This includes a license from FINRA.

As a US-based broker, it will come as no surprise to learn that the Robinhood app is safe and is heavily regulated. This includes a license from FINRA.