Popular crypto website deficoins.io have just launched their long-awaited guide on the top 10 best DeFi coins available on the market. There has been significant interest in this sector over recent years due to its potential to disrupt the way the financial markets operate currently.

DeFi (short for decentralised finance) is defined by top cryptocurrency exchange CoinDesk as a global, open alternative to the financial services customers use in contemporary society. DeFi projects utilise services known as dApps (decentralised applications), which are built using decentralised technology – such as that offered by Ethereum.

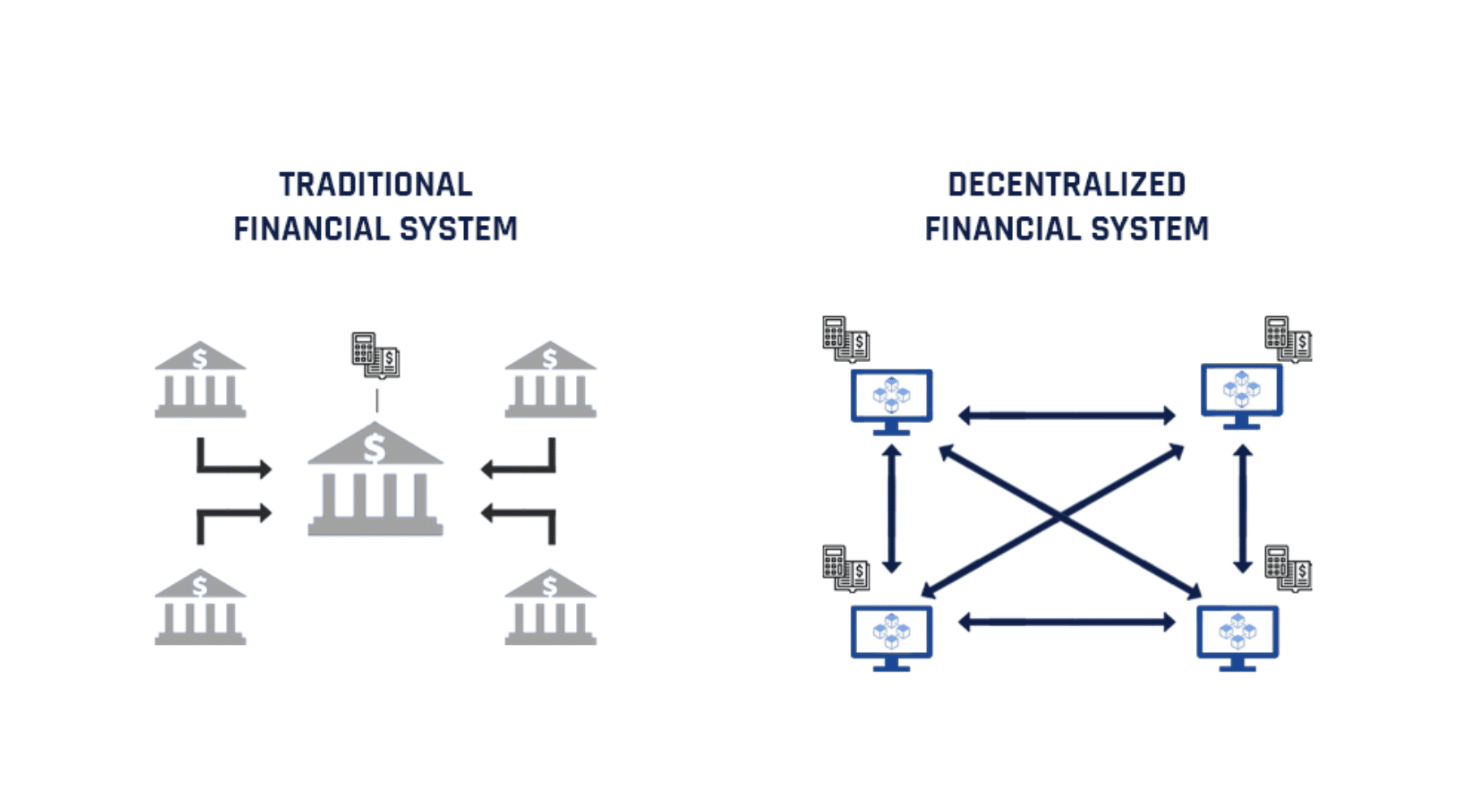

One of the reasons DeFi has grown in popularity in recent times is that it aims to eradicate the need for intermediaries. Processes such as bank loans and property purchases involve middlemen (such as banks and real estate agents) who usually take a cut of the money involved. With DeFi projects, this isn’t the case – no intermediary is necessary to conduct DeFi processes, which reduces costs and streamlines the whole system.

DeFi Token Market

DeFi platforms function using their native currency – known as DeFi tokens. These tokens can be traded in the markets in the same way as cryptocurrencies such as Bitcoin and Ethereum. The laws of supply and demand drive price movements and investors can profit from both bullish and bearish momentum.

DeFi Coins aims to inform market participants with their practical guide on the best DeFi coins available in the market. Throughout the guide, the best DeFi coins are explored in great detail so that investors gain a comprehensive overview of how these coins work and their recent price history. In turn, this ensures investors have the critical information they need to make efficient trading decisions.

Through the guide’s coverage of top DeFi tokens such as Uniswap (UNI) and Chainlink (LINK), DeFi Coins explores the potential that this sector of the market has and provides insight into areas of future growth. Furthermore, the guide discusses the best DeFi platforms in operation today, providing investors with a breakdown of where they can invest in a decentralised and safe manner.

Additional DeFi Features

It’s not just DeFi tokens that are covered in Defi Coin’s comprehensive guide. Insight is also provided into areas that are growing at a rapid rate, such as crypto lending. This niche market is becoming increasingly popular as the DeFi market expands – lenders and borrowers can connect without an intermediary, all through the use of dApps and Smart Contracts.

The guide from DeFi Coins covers this area of the market in detail, exploring how it works and how investors can get involved safely. In addition, DeFi Coins’ guide also provides an easy-to-follow walkthrough showing readers how to invest in a DeFi token using a regulated broker.

The writers of the DeFi Coins guide even touch on crypto savings accounts and discuss how investors can earn interest on their holdings. The guide’s comprehensive nature ensures that all of the essential elements concerning the DeFi market are covered, providing investors with the crucial information they need to trade DeFi coins safely and efficiently.