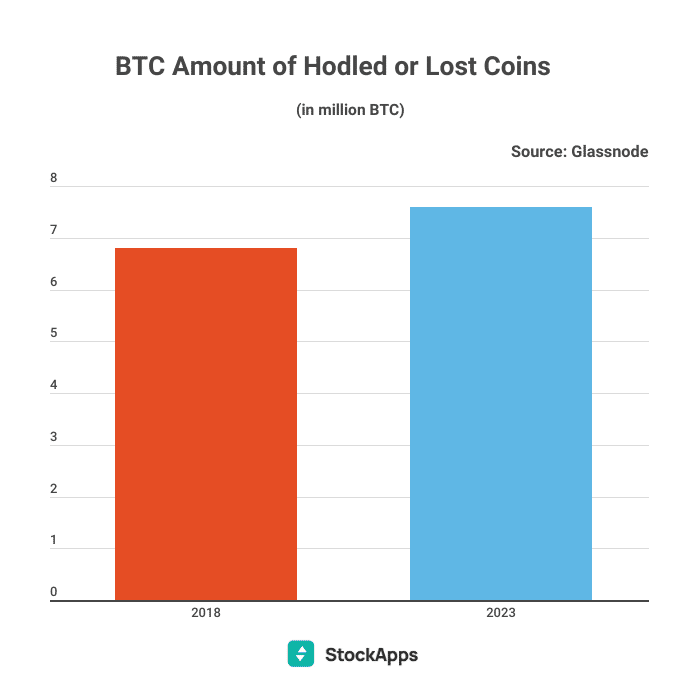

The crypto market’s appreciation has encouraged more people to ‘hodl’ their coins instead of spending them. This is evidenced by the fact that there are now 7.6 million Bitcoin that have not been moved from their wallets in over 5 years, according to data provided by StockApps.com.

As Bitcoin continues to increase in popularity and value, more coins will likely be ‘hodled’ rather than spent. However, it is also worth noting that with such a high number of lost or forgotten keys, there could be a significant amount of Bitcoin out there that is permanently lost. This could further affect the market and add to the scarcity of coins in circulation, driving up the price even further.

StockApps financial expert Edith Reads commented on the data, “The number of Bitcoin that have been ‘hodled’ or lost to time shows the strong interest in the cryptocurrency market. People are taking a long-term view of their investments and not looking to cash out quickly, which is likely due to its performance over the last few years. However, this data also indicates that a significant amount of Bitcoin will likely never be recovered, which could potentially lower the market cap significantly.”

Third-Party Security Risks

Bitcoin custodians are an essential part of the Bitcoin community, providing a secure way to store digital assets. They offer a variety of services to help protect individuals from third-party security risks. In addition, they can provide cold storage for coins, advanced anti-fraud measures, and even insurance coverage in case of theft or loss.

However, it is still crucial for users to remain aware of the risks associated with custodial services. For example, if a custodian is hacked or an individual’s private key is compromised, their funds could still be at risk. Therefore, users should thoroughly research potential custodians before entrusting them with their coins.

The “Not Your Keys, Not Your Coins” mantra is as important today as ever. With the rise of custodians and increased security measures, it is still critical for individuals to take responsibility for their digital assets. By keeping this in mind, users can maximize their safety and security when working with Bitcoin.

Therefore, it is essential for people to store their Bitcoin securely, whether that is through self-storage or by using a third-party custodian. Users can ensure that their funds remain protected and secure by exercising caution and taking the necessary precautions.

The increasing number of coins being ‘hodled’ or lost to time indicates many people’s strong faith in the cryptocurrency market. By keeping security and safety at the forefront of their minds, Bitcoin users can ensure that their coins remain safe and secure.

Question & Answers (0)