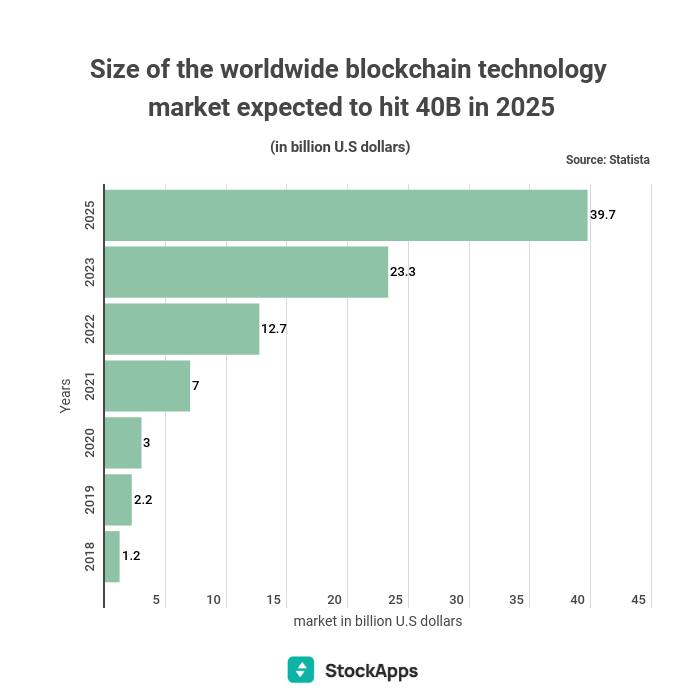

Just a few years ago, blockchain (BC) technology was little more than a punchline. Now, it’s poised to be a $40 billion industry by 2025. That’s according to a StockApps.com data presentation. What started as an open-source method for securely recording crypto transactions has evolved into a viable alternative to traditional finance.

StockApps’ Edith Reads has been following up on events in the sector. When asked to comment on the findings, here’s what she said:

“Blockchain technology has taken the world by storm. We’ve seen it take over the cryptocurrency market and completely change the way we think about making payments, but it’s also become a force in many other sectors, from healthcare to real estate to entertainment. And as it grows, the blockchain industry is projected to have a massive impact on the global economy.”

The banking sector’s centrality in Blockchain adoption

StockApps.com projects that the banking sector will be the main driver of growth in BC tech. That’s because it is already one of the largest adopters of the technology today. BC technology promises to solve many issues within the banking industry.

The technology enables the recording of transactions and data on a decentralized ledger in multiple places. It, therefore, improves transparency and reduces the need for a central authority to verify transactions. This feature makes BC technology valuable for applications that require transparency as banking demands.

Moreover, it’ll facilitate faster cross-border settlements. Its P2P nature eliminates intermediaries who are an impediment to faster transactions. Following its adoption, users can complete their transactions almost instantaneously.

Secure and affordable transactions

Besides, the tech helps secure transactions while cutting down the costs of engaging in them. As indicated earlier, it captures exchanges in real time over an open ledger. That and its immutability make it a good ally in mitigating fraudulent activity.

It cuts down transaction costs by eliminating the go-betweens. Besides slowing transactions, intermediaries charge fees for every transaction they help verify. Their removal, therefore, will see those charges drop significantly.

Where else can we use Blockchain tech?

BC tech isn’t finding applications in the banking circles only, though. Other industries are also making significant investments in its adoption. For instance, it is becoming a vital tool for managing the supply chain as it facilitates the traceability of raw materials and finished products too. Likewise, it betters fleet management services.

Again, BC tech is finding its home in Healthcare. The traditional system of keeping records is inadequate as it can lead to the loss of sensitive patient information. Blockchain Tech eliminates that by creating a digital and immutable copy of that info. That discreetly enhances patient management.

Management of government functions

Many countries are also using the technology to manage and automate government services. These include the public service management and the issuance of critical information like property ownership and transference. It does so by eliminating redundant record keeping.

All in all, Blockchain Tech has wide applications across every facet of our lives. The examples given don’t even scratch the surface. Moving forward, the technology will gain even greater prominence in human affairs.

Question & Answers (0)