Thanks to an upsurge in demand for notebook PCs, 5G smartphones and high-end PCs, Taiwan Semiconductor Manufacturing Co. (TSMC) had a blockbuster year in 2020.

According to the research data analyzed and published by Stock Apps, net revenue for the year totaled NT$1,339.26 billion ($47.75 billion). Compared to the 2019 figure, that marked a 25.2% increase. It was also the highest annual revenue figure in the company’s history.

Analysts attributed the company’s stunning performance to the huge demand for its 7nm processor chips. These got widespread application on emerging technology such as 5G applications and high-performance computing. There was also an increase in the shipment of the latest 5nm processor chip which was mass produced starting in Q2 2020.

Consolidated sales for Q4 2020 totaled NT$361.53 billion, marking an increase of 1.43% quarter-over-quarter (QoQ). Profits for the period totaled NT$142.8 billion ($5.1 billion), up by 23% compared to Q4 2019. The figure outperformed Refinitiv’s expected NT$135.4 billion and set a new record.

Group revenues rose to $12.68 billion, a 22% YoY increase. TSMC expects the figure to rise to between $12.7 billion and $13 billion in Q1 2021.

In December 2020, consolidated sales amounted to NT$117.37 billion. Though the figure was 13.6% higher than December 2019, it was down by 6% from November 2020. It was also the lowest sales figure since July 2020.

TSMC’s growth over the year coincided with a marked increase in notebook shipments. According to TrendForce, notebook PC sales surpassed 200 million in 2020, marking a 22.5% YoY increase. For the 2020 to 2025 period, it forecast a compound annual growth rate (CAGR) target of between 10% and 15%.

TSMC To Spend $25 Billion to $28 Billion in 2021 on Advanced Chip Production

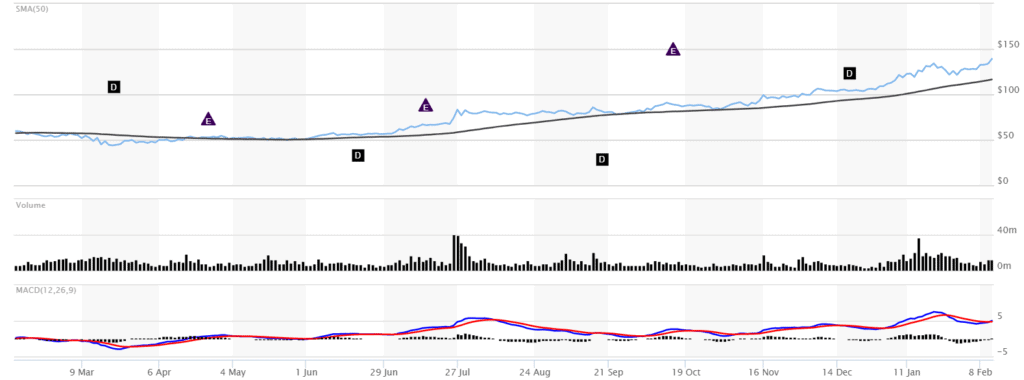

In 2020, TSMC stock soared by approximately 60% year-over-year (YoY). As of February 11, 2021, it was trading at $138, up by around 120% over the past year according to Marketwatch. Share price had increased by 27% YTD and 54% in the previous three months.

Among the factors driving TSMC’s share price growth is Intel’s shortage of chips resulting from challenges in the shift from 14nm to 10nm chips. As a testament to this, Intel has lost over 12% of its share price value over the past year.

According to a Reuters report, Intel is planning to tap TSMC for the manufacturing process of an enhanced 7nm process known as DG2. The second generation discrete graphics chip is slated for release in 2023. Additionally, the company plans to start production on more advanced semiconductors under the 3nm process later in 2021. TechNews reported that the upcoming 3nm process is already fully booked through 2024.

On the other hand, Apple, which happens to be TSMC’s largest customer, is set to claim the first wave of production. The chipmaker announced that it would spend between $25 billion and $28 billion in the production process for advanced chips in 2021.

TSMC expects high demand for high-performance computing chips, as well as a recovery in its auto chip segment to drive growth in Q1 2021. In 2020, auto companies cut orders made to TSMC due to low demand amid the pandemic. As a result, the chipmaker shifted production capacity to other clients. Demand for auto chips returned in H2 2020 but capacity was limited. The shortage in chip supply affected Toyota, Nissan, Fiat Chrysler Automobiles, Volkswagen, Subaru and Ford Motors among other automakers.

Taiwan Posts 2.98% GDP Growth in 2020, Becomes Top-Performing Asian Economy

TSMC is the world’s largest semiconductor foundry globally. In the high-end foundry market, Samsung is TSMC’s only major competitor. And in the low-end market, less advanced rivals like UMC and GlobalFoundries are the challengers.

In 2020, TSMC had a more than 50% share of the global market for contract manufacturing chips. During the year, smartphone chips accounted for 48% of TSMC’s sales, while high-performance computing chips contributed 33%. Auto chips had the lowest share, equivalent to 3% of total annual sales.

Taiwan is a global powerhouse in semiconductor production, important components for PCs, mobile phones and cars. South Korea and Taiwan account for 83% of the global processor chip production, as well as 70% of memory chip output.

According to estimates by Taiwan’s statistics office, the island’s economy grew by 2.98% YoY in 2020. The unexpected increase placed Taiwan as the top-performing economy in Asia during the year. For the first time in 30 years, it edged out China whose economy grew by 2.3% in 2020. In 1990, Taiwan’s GDP grew by 5.5% compared to China’s 3.9%.

The 2020 increase beat Taiwan’s central bank’s forecast of 2.58% growth and outperformed Vietnam’s 2.9% rise. It was attributed to the island’s robust growth in exports, mostly of semiconductors, during H2 2020. The sector’s performance helped to offset the ravages of the pandemic on the economy.

Question & Answers (0)