Best Stock Trading Apps 2024

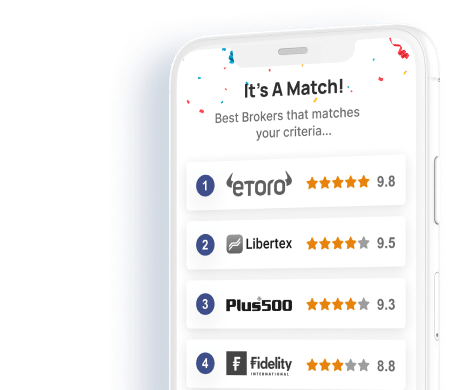

Find the best trading apps that allow you to buy and sell assets right from your mobile device with our convenient interactive finder tool.

- No signup needed – Get matched in as little as 60 seconds

- Uncover hidden costs and dig deep into trading fees

- See brokers that are thoroughly vetted for best customer service

Fully Regulated

Expertly Reviewed

Secure & Trusted

Transparent Fees

Android & iOS

Ever wondered if you could buy and sell assets directly from your mobile device? Nowadays most brokers offer a stock app that lets you do just that. But with so many stock trading apps to choose from, how do you choose the right one for your trading needs?

This comprehensive guide will cover everything there is to know about the best stock app. We’ll also explore key metrics such as fees, payment methods, security and more. Keep reading as we reveal the best stock trading apps for beginners.

The Best Stock Trading Apps in 2026

Before we take a detailed look at the best stock trading apps of 2026, here’s a snapshot overview of the best stock trading apps and the runners-up.

- eToro – Overall Best Stock Trading App. Access 3,000+ Stocks with 0% Commission

- Webull – Popular US Stock App with Zero Commission

- IG – Free Stock App with more than 10,000 stocks from dozens of international markets

- TD AmeriTrade – Top Trading Platform For Research and Analysis

- Fidelity – Best Stocking Trading App with Educational Materials

- Acorns – Best Stock Trading Platform for Cashbacks on Purchases

- Robinhood – Best Stock App for US Residents with 0% Fees

- Wealthsimple – Leading Stock App with AUM of over $10 billion

- Interactive Brokers – Best Broker For No Fee Mutual Funds

- Stash – User-Friendly Stock App for US Residents

- SoFi – US Stock Trading App with Auto Investing

- E*Trade – Best Platform For Discounted Trading

- Charles Schwab – Best Platform For Top-Notch Research

- Ally Invest – Top Platform For Low-Cost Options Trading

- Vanguard – Top Platform For Long Term Objectives

1. eToro – Overall Best Stock Trading App with 0% Commission

Overall Rating: ⭐⭐⭐⭐⭐

If you’re looking for the best all-around stock trading app in the market, look no further than eToro. Let’s take a closer look at why eToro is our number one recommended app.

Assets: For starters, eToro offers a fantastic range of tradable assets. In terms of stocks, you can invest in and trade over 3,000 stocks from 17 international markets, so there’s plenty of choice. This includes leading markets in the US, Saudi Arabia, France, Germany, and more. You can buy and sell stocks on eToro or trade them as CFDs. Beyond stocks, eToro offers forex, commodities, cryptocurrencies and ETFs.

Fees: All other assets, including stock CFDs, have a variable spread. Withdrawals are just $5, while the inactivity fee is $10 per month after one year.

Features: In terms of key tools found on the app, the eToro Copy Trading feature stands out for us. This allows you to find an expert stock investor that you like the look of by browsing through their historical trading results. Then, you can copy their portfolio like-for-like at the click of a button. You can also elect to copy their ongoing buy and sell orders.

This is ideal if you are looking to invest in the stock markets with your phone, but you don’t quite have the knowledge to pick stocks on a DIY basis.

Usability: eToro is an extremely user-friendly app that is brilliantly designed. It’s particularly good for beginners as it’s so user-friendly, but it’s also a good choice for more experienced investors. The eToro app is fast, performs well across devices and allows you to trade stocks seamlessly.

If you want to learn more about eToro, you can check out our eToro app review for a more detailed look at what this broker has to offer.

Pros:

Pros:

- Buy stocks with 0% commission

- Strictly regulated

- Trusted brand with over 30 million client accounts worldwide

- Buy stocks without paying any commission or share dealing charges

- Social Trading and copy trading

- 3,000+ stocks listed on multiple international markets

- Personalised eToro account where you can set up trading price alerts

- Best Forex Trading app

Cons:

Cons:

- Not suitable for advanced traders that like to perform technical analysis

76% of retail investor accounts lose money when trading CFDs with this provider.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

2. Webull – Popular US Stock App with Zero Commission

Overall Rating: ⭐⭐⭐

Webull is a was launched in 2017 and has quickly become one of the market’s most popular stock trading apps.

Assets: Webull offers users the chance to invest in thousands of stocks from around the globe. So whether you want to invest in top US stocks like Amazon and Netflix or stocks from Europe or Asia, Webull has got you covered. As well as stocks, Webull offers ETFs, options and ADRs.

Fees: Webull’s main selling point is that it allows you to invest in stocks, ETFs and options with zero commission, so it’s one of the cheapest stock trading apps on the market! Webull doesn’t even charge contract fees for options!

Features: Webull doesn’t offer the same innovative features as platforms like eToro, though there are some nice aspects and useful tools. For example, it offers extended hours trading, so you can trade pre-market and after-hours. There are also some useful analysis tools, including charting, technical indicators and premier Level 2 Advance (NASDAQ Total View) to help you make informed trades and investments.

Usability: Webull is a really well-designed platform that’s incredibly easy to use on your smartphone. Everything’s well laid out and the app is very beginner-friendly while also being suitable for advanced traders.

Pros

- 0% commission on all stocks, ETFs and options

- Extended trading hours

- Advanced analysis tools

- User-friendly stock trading app

- Retirement savings accounts

- Low cost is ideal as the best day trading app

Cons

- Only bank and check deposit options

- Some deposit and withdrawal fees

Your capital is at risk.

3. IG – Top-rated Stock App for US Residents

Overall Rating: ⭐⭐⭐⭐

IG is a great option to consider if you’re looking for a US-centric stock trading app. First and foremost, the broker traces its roots back to 1974 – so it’s built a formidable reputation that now spans over four decades.

Assets: You will then have access to a substantially large library of stocks. In fact, this includes over 10,000 equities across heaps of stock exchanges. This covers thousands of FTSE and AIM stocks, including new stocks like Deliveroo stocks, as well as companies listed in the US, Japan, Canada, South Africa, Australia, New Zealand, and more. You will also have access to an abundance of other asset classes, including ETFs, CFDs, indices, bonds, cryptocurrencies, hard metals, oil, and more.

Fees: When it comes to pricing, you will initially pay $8 per trade – which is charged when you buy stock and again when you sell then. But, if you placed three or more trades in the prior 30 days, your commission will be dropped to just $3. Fees for international markets will differ and are entirely dependent on which marketplace you wish to access. For example, US stocks cost $0.02 per share, with a $15 minimum.

Features: IG has a range of useful features for stock investors. One of the standout features is the IG Community where you can interact with other trades. IG accounts are also compatible with advanced trading platforms such as MT4 and ProRealTime, which provide access to a range of charting and analysis tools. There’s even the separate IG Academy app which contains fantastic learning resources like courses and webinars!

Usability: Both the iOS and Android stock application allow you to buy and sell stock with ease. It’s simple to navigate through the app and find the company you wish to invest in. The process of placing a buy and sell order is also straightforward and requires no prior experience.

Overall, all functions and featured of IG make it one of the best paper trading apps.

Want to learn more about the IG trading app? Check out our expert IG review.

Pros

- Trusted broker with a long-standing reputation

- More than 10,000 stocks listed

- Good value share dealing services – fees as low as $3 per trade

- Leverage and short-selling also available

- Access to dozens of international markets

- Great research department

Cons

- US stocks have a $15 minimum commission

66% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

4. TD Ameritrade – Top Trading Platform For Research and Analysis

Overall Rating: ⭐⭐⭐⭐

TD Ameritrade has a lot of things going for it. For one, TD Ameritrade offers free research tools from reputable sources like the Federal Reserve Economic Database, Center for Financial Research and Analysis, Morningstar and 12 other renowned sources.

Another major feature is the platform’s high-end educational content for new traders. This stock trading app is a zero-commission trading platform offering everything from stocks, bonds, Bitcoin futures and ETFs. It’s even considered as one of the best ETF apps in the market.

Assets: TD Ameritrade offers the entire spectrum of financial investment services. You can easily trade over 3,700 no-transaction-fee mutual funds, options, FX currency pairs, stocks, bonds, ETFs, Bitcoin futures for approved clients, foreign ADRs, and IPOs for qualified accounts.

Fees: TD Ameritrade has recently followed suit in the drive among stock trading apps to offer zero-commission trades. The Charles Schwab-owned broker charges zero fees for online equity and ETFs. However, you will be charged a $0.65 fee for options trades, while deep-pocketed investors can easily negotiate for more suitable discounts. Futures trading also takes out $2.25 per contract, and TD Ameritrade makes up for this with zero annual and inactivity fees. You will also not be charged for transferring a portion of your account to another broker but will pay $75 if you want to complete an entire account.

Features: The best thing about using TD Ameritrade is the multiple platforms and tools on tap. For one, TDAmeritrade.com serves as an on-ramp platform for new investors to identify, research, screen, and trade stocks easily. TD Ameritrade comes with screeners, a customisable landing page, and a GainKeeper’s tool, which allows you to track your gains and losses for your tax obligations.

Aside from this, TD Ameritrade offers a more sophisticated trading platform through the thinkorswim, which comes with more advanced trading capabilities, technical, and analytical tools, backtesting capabilities, real-time news, and several other useful tools.

Usability: TD Ameritrade scores high here as it offers a mobile version for both of its platforms. Both are easy to use and traders can make both more personalised for ease of use.

Key Fact: Charles Schwab announced the acquisition of TD Ameritrade in Q4 2019. As the deal was finalized in 2020, the broker announced that most trading accounts will be consolidated by Q4 2023.

Pros

- Full spectrum of financial assets

- Zero commission trades

- No inactivity fee

- GainKeeper’s tool useful for tax purposes

- Best Options Trading app

Cons

- High account transfer of $75

5. Fidelity – Best Stocking Trading App with Educational Materials

Overall Rating: ⭐⭐⭐⭐

Since launching on the internet in 1995, Fidelity has remained one of the top destinations for trading in the financial markets. Its preference for educating users with videos, articles, and webinars makes it an ideal platform for new users. However, Fidelity also offers advanced trading tools for the more advanced trader.

Assets: In this department, Fidelity caters to the most popular financial assets, including 2,800 stocks, including penny stocks, 3,500 mutual funds, bonds, 16 major FX pairs, fractional shares, ETFs, ETPs, preferred shares, Treasury Inflation-Protected Securities (TIPS) and several others. However, futures, cryptocurrencies and commodities are missing from the line-up.

Fees: Fidelity leans towards a more cost-efficient approach and offers 0% commission trades on stocks, penny stocks, and ETFs. Options trading attracts $0.65 per contract. Meanwhile, the top US broker does not charge any inactivity and transfer fees. However, the live broker fee is pegged at a high of $32.95 per trade.

Features: Fidelity offers top-notch research and charting tools. The stock trading app comes with asset screeners, which helps with making better investment decisions. Added to this is a low latency rapid execution platform and a cash management app that enable clients to improve their investment returns.

Usability: The Fidelity platform is split across two separate entities, with the mobile platform catering to a more streamlined trading process. The web trading platform is user-friendly and casual investors can easily find several quotes, charts, and watchlists neatly arranged. Coupled with this, the Active Trader Pro (ATP) caters to more active investors and comes with a more customisable interface.

Pros

- Zero-commission stock trading

- Large library of tradable assets

- Strong educational focus

- Best Penny Stocks app

- Rapid trade executions

- Powerful research tools and asset screeners

Cons

- No crypto or commodities trading

Your capital is at risk.

6. Acorns – Best Stock Trading Platform for Cashbacks on Purchases

Overall Rating: ⭐⭐⭐⭐

Acorns is a new-generation stock trading app that leverages heavily on the cashback system. The US-based stock trading app allows users to round up their purchases on their credit or debit cards then put the balance into the stock trading app for easy investment. It is uniquely ideal for those who are looking to streamline their investing process.

Assets: Acorns operates like a savings platform and can be useful if you need a nudge in saving for retirement. Acorns’ major asset is its robo-advisor tech that enables users to round up their purchases while investing the balance in their investment account. These funds are then spread across ESG ETF portfolios.

Fees: Acorns has been often criticised for its flat-fee structure. After a $10 signup bonus, you will be charged $3 for a personal account that includes an IRA and a checking account. You will have to pay $5 monthly for all of the personal account features, inclusive of your kids for the family option. Other fees include the investment expense ratios, which is pegged between 0.05% to 0.18%.

If you want to transfer your account to another broker, you will be taxed $50 per ETF transferred to a secondary provider.

Features: Acorns is a robo-advisor investment app which means there is no human advisor support on tap. Aside from this, the investment broker offers five major savings and investment plans. These include the Acorns Invest, Later, Spend, Found Money and Early.

Each saving product comes with unique features, with the Invest and Later products offering the same taxable investment account. The Spend account operates like a checking account and eliminates minimum balance fees. Acorn Found Money is an online marketplace that ensures users get cashback on their purchases in select retailers. Acorn Early allows parents to set up accounts for their kids easily.

Usability: Acorn focuses on user-friendliness, and the investment app is tuned to the maximum on this aspect. Users can easily complete tasks on the platform and have the robo advisor to help them out if they are ever in a sticky position.

Pros

- User-friendly platform

- Has a streamlined investment process

- Socially responsible investment platform

- Cashback systems

Cons

- High fees compared to other stock trading apps

Investing involves risk, including loss of principal.

7. Robinhood – Best Stock App for US Residents with 0% Fees

Overall Rating: ⭐⭐⭐⭐

Make no mistake about it – if you’re based in the US and looking to invest in stocks via a dedicate stock app – Robinhood is now the out-and-out market leader. As of mid-2020 – the application is home to over 10 million Americans. So why is Robinhood the most popular stock trading app for US investors?

Assets: In terms of what markets you can access, Robinhood offers over 5,000 equities. The vast bulk of this is made up of US companies listed on the NASDAQ and NYSE, making it one of the best mutual fund apps. You will, however, also have access to 250 foreign stocks. Outside of its share dealing services, Robinhood also gives you access to US-listed ETFs and options contracts. If you have a slightly higher appetite for risk, the Robinhood stock app also allows you to trade cryptocurrencies.

Fees: Robinhood allows you to buy stocks without paying a dime in commission. Much like eToro, the Robinhood stock app does not charge any monthly or annual account fees, either. Instead, the only fee that you need to consider is that of the spread.

Features: As you’d expect from a top stock app, Robinhood has some useful features. For starters, it has excellent resources, including beginners guides and in-depth feature articles, which are super helpful for newbie investors. Another useful feature is Robinhood’s cash management, which allows you to earn 0.30% APY on your uninvested cash.

Usability: On top of an extensive asset library and 0% commissions, the application is attractive to those with little to no experience of trading. This is because Robinhood is super-easy to use, and it takes just minutes to get an account set up. Moreover, Robinhood is one of the few free stock trading apps in the market that does not ask for a minimum deposit. Instead, you can start investing straight away no matter how small your budget is.

Want to find out more about this stock app? Check out our Robinhood app review.

Pros

- Heavily regulated in the US

- More than 10 million traders using the app

- Buy and sell stocks without paying any commission

- No minimum deposit in place

- No monthly or annual maintenance fees

- More than 5,000 US stocks supported

- Also invest and trade ETFs, options, and cryptocurrencies

- Perfect for newbie traders

- Only 250+ foreign stocks listed

- Unable to deposit with a debit/credit card or e-wallet

Your capital is at risk.

8. Wealthsimple – Leading Stock App with AUM of over $10 billion

Overall Rating: ⭐⭐⭐⭐

Assets: Although Wealthsimple is well-known for its automated investing service, this stock app will also allow you to invest in individual asset classes. These include equities and cryptocurrency – with over 1.5 million customers opting to use Wealthsimple for their trading activities.

Fees: Wealthsimple charges a 0.5% management fee per month, which is based on your account balance at the time. If you wish to trade individual assets, Wealthsimple offers a ‘Basic’ and a ‘Plus’ plan. The former is free of charge and allows commission-free trading with no account minimums. The latter costs $10 per month and provides a higher deposit threshold and no FX fees on US trades.

Features: Alongside the automated investing service, the Wealthsimple app also offers a service that allows users to send and receive money instantly – with no fees. The app is also secured with two-factor authentication, with funds insured by the CDIC up to a specified limit.

Usability: The app itself is beginner-friendly, featuring a sleek interface that clearly showcases all available services. The Wealthsimple app also displays your portfolio composition in an easy-to-understand manner, with a dedicated customer support option enabling you to get help when you need it.

Pros

- Used by over 1.5 million people

- Canada’s first regulated crypto app

- Beginner-friendly app interface

- No commissions on stock purchases

- Automated investing services offered

Cons

- Ongoing account management fee

- It doesn’t offer IPO stocks

Your capital is at risk.

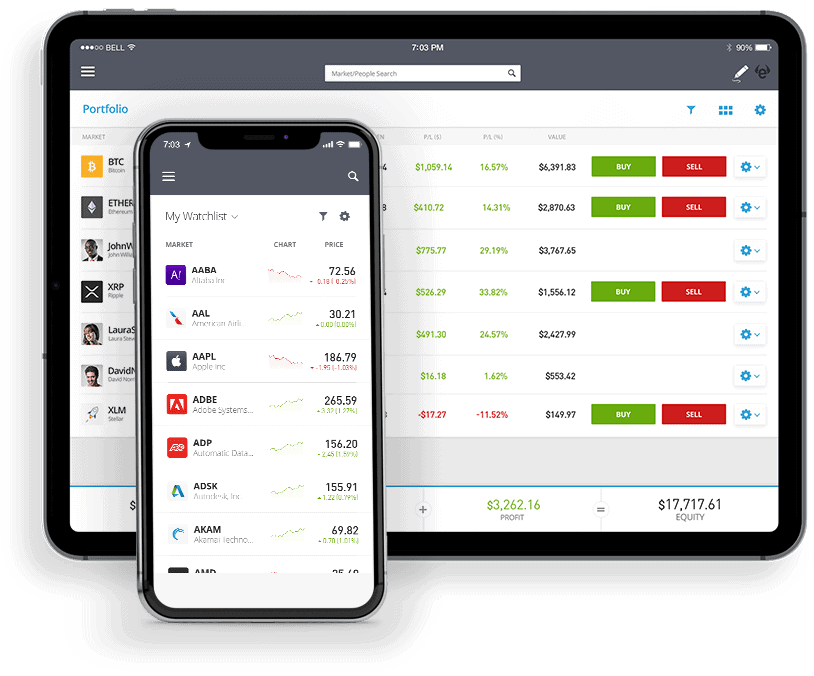

9. Interactive Brokers – Best Broker For No Fee Mutual Funds

Overall Rating: ⭐⭐⭐⭐

Interactive Brokers is the best trading app suitable for day trading that focuses on a broad market with low costs and a sophisticated trade execution plan.

Assets: Interactive Brokers provides customers with a wide range of options to trade with, such as stocks, futures, forex, bonds, Fractional shares, ETFs, mutual funds and others. The platform also offers access to trades in Bitcoin, Ethereum, Litecoin and Bitcoin Cash. These features are available on 135 markets across 33 countries and can be accessed from a single integrated account using 23 currencies. The broker also accepts clients from over 220 countries.

Fees: Interactive Brokers offers one of the lowest fee and commission rates among brokers. The platform has no account minimum and offers as low as $0.15 to $0.65 per share as commission for Stocks and ETF projects. The broker’s Options are available for North America, Europe and the Asia-Pacific with commission rates at fixed or tiered pricing rates that differ for each country listed. However, fees ranging from $0.15 to $0.65 apply. The firm charges no commissions for Mutual Funds but charges $14.95 per transaction.

Features: The Interactive Brokers platform is built up with the IBKR Lite and IBKR Pro, granting users access to the Client Portal trading platform. Users also have access to the Trader Workstation platform at zero charges.

Usability: The Interactive Brokers is an intuitive platform that is easy to understand. The onboarding process is relatively easy, and users can fund their wallets 90 days after opening the account. The broker supports multiple trading platforms, which include desktop, web and mobile versions. Users can access the platform using Androids or IOS devices, trade the same assets on any version of choice. They can also access real-time streaming data, drawing tools, charting, research, and news.

Pros

- Superior order execution

- Great trading tools

- Low margin interest rates

Cons

- No backtesting for custom trading algorithms

- Intimidating for less-experienced traders

IBKR’s SmartRouter unavailable for Lite clients.

Your capital is at risk

10. Stash – User-Friendly Stock App for US Residents

Overall Rating: ⭐⭐⭐⭐

Looking to invest in stocks via a dedicated stock app, but have little to no knowledge of how the financial markets work? If this sounds like you are you’re based in the US, then you might want to consider Stash.

Assets: On top of stocks, Stash also supports ETFs. This is great for diversifying. The stock app also supports Roth IRAs, which is ideal if you want to save for your retirement. What we also like about Stash is that you can elect to have your dividends reinvested automatically.

Fees: When it comes to fees, the mobile application does come with a monthly maintenance charge. The specific amount will depend on your account type. This starts at $1 per month on the standard account, and $9 when opting for a custodian account.

Features: The Stash mobile app is popular with newbies because it supports fractional stock. This means that you are not required to purchase a full stock. Instead, you can invest as little as you like. The Stash stock app also offers a useful investment feature that is based on ‘values’. That is to say, if you don’t want to invest in specific industries or sectors based on personal values, Stash allows you to take full control over where your money goes.

Usability: Stash Invest is another stock app that scores high in terms of usability. The app is clearly designed and well organised, making it very easy to navigate your way around. Overall, you’ll have no issues with buying and selling stocks on the Stash app.

To find out more about the Stash investing app, read our detailed Stash review.

Pros

- No minimum deposit

- Offers fractional stock

- More than 1,200+ stocks and ETFs

- Best-suited for newbie traders

- Heavily regulated

- Avialable on both iOS and Android

- Lots of educational resources

Cons

- Charges variable monthly fee

- Does not support instant deposits with a debit/credit card or e-wallet

Your capital is at risk.

11. SoFi – US Stock Trading App with Auto Investing

Overall Rating: ⭐⭐⭐

SoFi is another mobile-first trading platform that’s specifically aimed at smartphone traders. This US stock app boasts low fees, a great selection of assets and some really useful features – let’s take a closer look.

Assets: SoFi boasts a decent selection of US stocks to trade and invest in, although you can’t invest in companies from other countries. You can trade stocks on the NYSE, NASDAQ and AMEX exchanges. As well as stocks, SoFi offers ETFs and cryptocurrency.

Fees: Similar to the likes of eToro, Robinhood and Webull, SoFi doesn’t charge any commissions for trading stocks and ETFs. There’s no inactivity fees or withdrawal fees either, although you do need to pay a markup fee if you want to trade crypto.

Features: SoFi has several features that make it an attractive choice for beginner trades and those working on a budget. For starters, you can invest in fractional shares for just $1, meaning you can invest in companies like Amazon at a fraction of the normal price. SoFi also has a useful Automated Investing feature. You can choose for the app to build and manage a portfolio for you, with no management fees to worry about!

Usability: As a mobile-first broker, SoFi has a really impressive app in terms of design and usability. It’s very intuitive, and it runs well with no lagging or performance issues.

Pros

- 0% commission on all stocks and ETFs

- Fractional shares

- Automated investing

- Very intuitive app

- No withdrawal fees

Cons

- Only offers US stocks

- Limited research materials

12. E*Trade – Best Platform For Discounted Trading

Overall Rating: ⭐⭐⭐⭐

E*Trade is the pioneer online trading platform optimised for beginners, experienced traders and investors.

Asset: The platform offers a wide range of investment options for both beginner and experienced investors. E*Trade offers 4,300 mutual funds and futures and stocks, bonds, options and ETFs. Fractional shares are also available for investors with little money but intending to build a highly diversified portfolio.

Fees: The E*Trade broker platform does not charge users fees for stock trading, and there is no set minimum amount for investments. There are no base commissions for options trades; however, users are charged $0.65 per contract. The broker charges a discounted $0.50 for users who trade up to 30 or more times per quarter. E*Trade does not charge annual maintenance or inactivity fees, but users are required to pay $75 for full transfer out and can pay $25 for partial transfers out of the platform.

Features: The platform is equipped with several quality trading platforms on the E*Trade Web where registered users have access to free streaming market data, live market commentary, news, charts and as well as other market updates. E*Trade Pro is among the available trading platforms only available to traders with at least $250,000 or 30 trades per quarter. These traders have access to strategy scanners and back-testing capabilities as part of the advanced features.

Usability: E*Trade is not so easy to use, but the platform’s interface can be easily customised according to the user’s preference. The platform has two web-based platforms which cater to the needs of both beginner and advanced traders.

Pros

- Commission-free stock, options and ETF trades.

- Access to extensive research

- Large investment selection

- Easy-to-use tools

Cons

- Website can be difficult to navigate

- Options trading is expensive for less active traders

- Fractional shares are only available through a dividend reinvestment plan

Your capital is at risk.

13. Charles Schwab – Best Platform For Top-Notch Research

Overall Rating: ⭐⭐⭐

Charles Schwab is a brokerage platform that offers a full range of brokerage services, banking and financial consultancy services. The platform provides an array of trading services for different types of investors.

Assets: Charles Schwab offers tradable securities in stocks, bonds, CDs, ETFs, options and futures. The platform offers Fractional shares of S&P 500 stocks and 4,200 non-transaction-fee mutual funds and is notable as one of the best commodity trading apps in 2026. Clients cannot trade cryptocurrencies, but they can trade crypto-based products like Bitcoin futures.

Fees: The broker’s $0 minimum deposit fee serves as an advantage for low-cost investors. The platform does not charge transaction fees for stock trading and no base commission fees for option trades. However, a $0.65 per contract fee is applicable for Option trades. There are no annual maintenance fees or inactivity fees required, but $25 is compulsory for full or partial transfers out of assets, and an additional $15 is required if the transfer is done online.

Features: Charles Schwab has three trading platforms: the StreetSmart Edge and Schwab.com operate solely as desktop platforms, while StreetSmart Central offers web and mobile support.

The platform also has two intuitive apps, which are the Schwab Mobile and the StreetSmart Mobile.

Usability: The team behind the Charles Schwab platform has spent considerable time working on usability. You can easily create a new account in less than 10 minutes and locate the asset you are looking for through the watchlist or directly searching for them. Charles Schwab has low latency, which means you can easily complete your trading order within minutes. You will also monitor such details as your earnings and the economic calendar all on your dashboard.

Pros

- Above-average mobile apps

- Commission-free stocks, options and ETF trades

- Robust research and educational materials

- Large mutual fund selection

Cons

- Low default cash sweep rate

- Crypto trading is limited to Bitcoin futures

- Margin rates are high

Your capital is at risk.

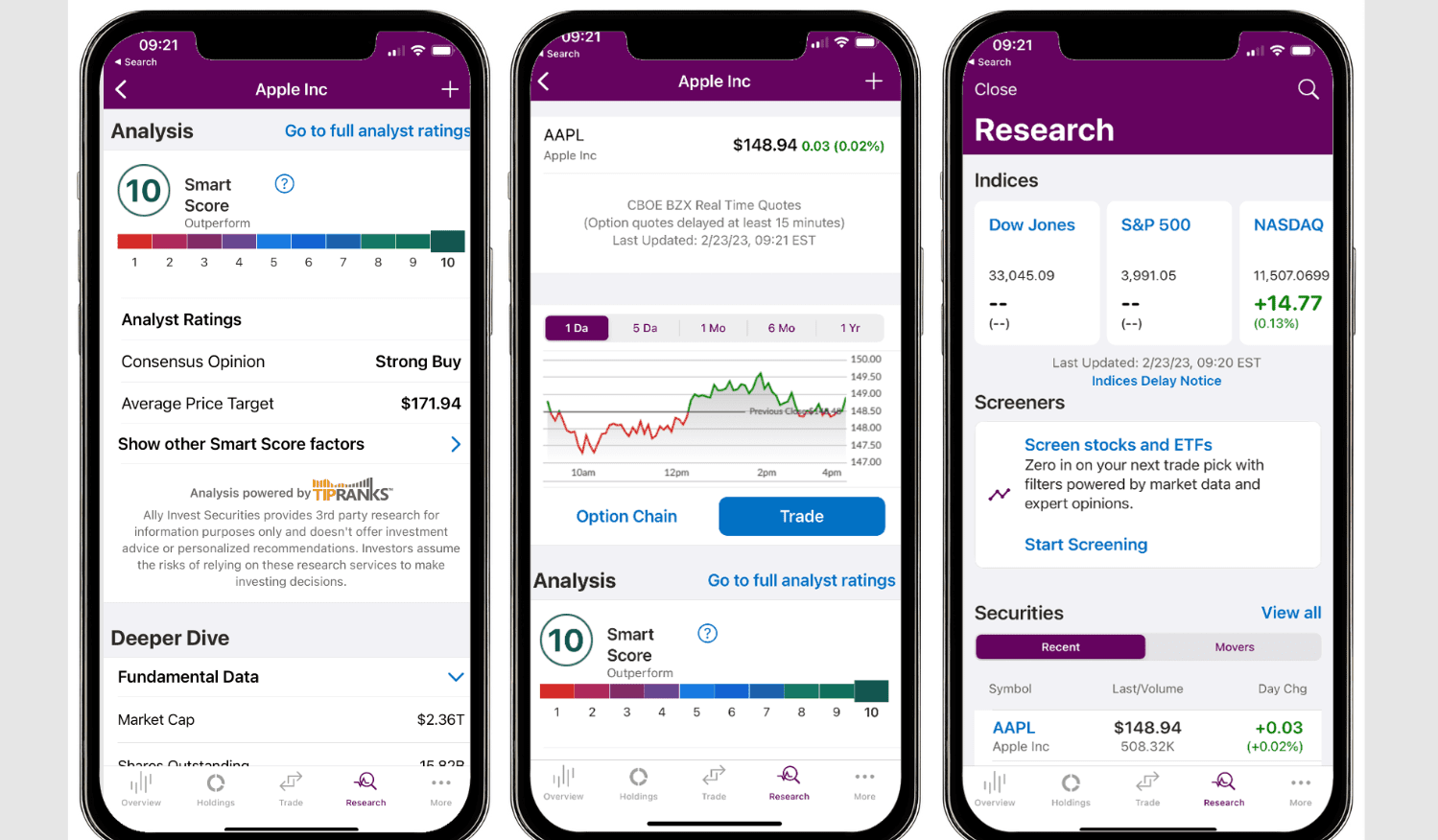

14. Ally Invest – Top Platform For Low-Cost Options Trading

Overall Rating: ⭐⭐⭐

Ally Invest is a U.S stock trading app and a subsidiary of Ally Bank, which provides investors with the fundamental and technical tools to specialise their trade options. Traders looking for self-directed accounts with no minimum balance requirement ought to invest using Ally Invest.

Assets: On the list of tradable assets on the Ally Invest platform are stocks, bonds, mutual funds, ETFs, options and forex. Ally Invest does not offer access to crypto trading, but users can trade crypto-based OTC products such as Bitcoin trusts. One point to note here is that you can only trade on US markets.

Fees: The Ally Invest platform does not have a minimum deposit bar and provides zero commission on stock trading. Option trades are without commissions, but $0.50 is required for each contract. Traders do not need to pay for annual maintenance or inactivity fees but are required to pay $50 for full outgoing transfers.

Features: Ally Invest offers a browser-based trading platform with free screening tools, customisable charting and real-time data for those who prefer the large screen. The platform’s mobile app allows traders to access their holdings, order status research, and watchlists on the go. Investors can also access research data made available from sources such as Morningstar, Lipper and Zacks Investment research.

Usability: The Ally Invest live platform has a modern and robust design with user customisation options for optical convenience. However, there are some quirks. There is no two-factor authentication available. And the Live platform only supports the ETF screener tool, which leaves many other functionalities out of grabs.

Even though the platform is a bit dated, Ally Invest still works fine, and you should have no issues. The platform can be intuitively navigated and toggled through.

Pros

- No account minimum

- Zero commission on U.S stocks

- Intuitive trading platform

- Interest bonuses on cash balances

Cons

- No cryptocurrency trading

- Trading available only for US market

- No two-factor authentication

15. Vanguard – Top Platform For Long Term Objectives

Overall Rating: ⭐⭐⭐

Vanguard is a well-established US-based stockbroker that provides an enticing opportunity for investors to trade stocks without paying commissions. Since 1975, Vanguard has been assisting investors in reaching their long-term objectives. Presently, it offers investors access to a diverse range of investment services through its user-friendly mobile application.

Assets: When you become a client of Vanguard, you will have the opportunity to trade a decent selection of assets, including stocks, mutual funds, bonds, Vanguard Personal Advisory Services, Vanguard Digital Advisor, and foreign securities transactions. If your objective is to construct a well-diversified portfolio that you will periodically rebalance, Vanguard is a fitting option.

Fees: Vanguard offers commission-free trading for both stocks and its own mutual funds and ETFs. While broker-assisted trades of Vanguard funds are free, there is a $25 fee for third-party trades. However, if you have more than $1 million in assets under management with Vanguard, you won’t incur any fees for broker-assisted trades. Vanguard does not charge fees for account inactivity, account closure or transfer.

Features: The trading platform offers a wide range of do-it-yourself resources that you can add to your financial toolkit. This includes a web-based trading platform featuring free screening tools, customizable charting, and real-time data for those who prefer using a larger screen. Additionally, with the platform’s mobile app, traders can conveniently access their holdings, check order statuses, conduct research, and manage watchlists while on the move.Usability: Vanguard’s website provides a trading experience that may be considered outdated. While the trading pages, security profile, and research pages utilize real-time quotes, the website displays delayed quotes for market and security information. This means that the information on the website may not reflect the most up-to-date market conditions.

Pros

- Trading with no commissions at all

- Investing in ETFs and mutual funds at low costs

- Useful investor education for long-term goal planning

- Automated robo-advisor integration

- A variety of account types are available

Cons

- Limited platform capabilities and features

- Only US assets available

What Key Features to Look for in the best stock trading apps?

As the name suggests, a stock trading app is a mobile application that allows you to buy and sell stocks via your mobile phone. Most people don’t know this – but stock apps are backed by fully-fledged brokerage firms.

In this sense, stock market apps and online brokerage sites are virtually like-for-like. That is to say, you will be required to open an account, deposit some funds with a debit/credit card, e-wallet, or bank account – and then decide which stocks you wish to buy.

The only key difference here is that stock investing apps allow you to do this through your mobile phone – as opposed to being sat at your desktop device. Below we list some of the key benefits of having a stock trading app installed on your phone:

- Last Minute Trades: Imagine discovering a stock trading opportunity, only to miss out because you were away from your desktop device? This doesn’t need to be the case with a trading app, not least because you can buy stocks at the click of a button irrespective of where you are.

- Exit a Losing Position: Similarly, you might be away from your desktop device, only to find out that your investment in Facebook is tanking. If you were to wait until you get home to exit the position, your losses could be significant. However, by quickly logging into your chosen stock app, you can sell the stocks immediately.

- Instantly Deposit/Withdraw Funds: The best stock market apps make it super easy to fund your trading account. Once you have set up a payment method (like a debit/credit card or e-wallet), you can instantly deposit funds. Withdrawing funds is just as seamless when using a stock app.

- Access the Global Markets: Don’t make the mistake of thinking that you are missing out on potential investment opportunities by using a stock app. On the contrary, your chosen brokerage firm will offer you the very same assets as found on its desktop website. This means that you have access to the global stock markets 24/7.

- Regulation and Safety: Most of the best stock trading apps are backed by regulated brokerage firms. For example, this might be the SEC in the US or ASIC in Australia. Either way, by sticking with a regulated stock app, your funds are safe at all times. You also have the safeguards offered by the app itself – such as biometric login and two-factor authentication.

All in all, stock market apps are a must if you are planning to invest in the financial markets.

The Best US Stock Apps Compared

| Minimum Trade | No. of Shares | Trading Fees | Inactivity Fees | Leverage | |

| eToro | $25 | 800+ | Commission, Spreads | $10 per year after 12 months | 1:30 |

| WeBull | $1 | N/A | N/A | N/A | N/A |

| IG | $1 | 12,000+ | Commission, Spread | N/A | 1:30 |

| TD Ameritrade | N/A | 1,500+ | $0 | $0 | From 2:1 |

| Fidelity | N/A | 50+ | $0 | $0 | 1:12 in Margin Accounts |

| Acorns | N/A | N/A | $50 per ETF (Asset Transfer) | $0 | N/A |

| Robinhood | N/A | N/A | N/A | N/A | N/A |

| Wealthsimple | N/A | N/A | Commission, Spread | N/A | N/A |

| Interactive Brokers | N/A | All US-listed Companies | $0 | $20 per month | Up to 50:1 |

| Stash | $0 | 3,700+ | $0 | $0 | N/A |

| SoFi | N/A | N/A | N/A | N/A | N/A |

| E*Trade | $0 | All US-listed Stocks | $0 | $0 | Up to 4:1 |

| Charles Schwab | $0 | All US-listed Stocks | $0 | $0 | 2:1 |

| Ally Invest | N/A | All US-listed Companies | $0 | $0 | Up to 50:1 |

| Vanguard | $0 | All US-listed Stocks | $0 | $0 | N/A |

How do We Rate Stock Apps on our Website?

Although we have discussed the best stock trading apps active in the space, it is important that you perform some research of your own. This will ensure that the stock app is right for your personal investing goals – as no-two providers are the same. Similarly, there might come a time when you come across a stock app that we haven’t reviewed – and you want to explore whether or not it is suitable.

Either way, we would suggest making the following considerations before downloading a new stock trading app.

Regulation

It goes without saying that the first and most important metric that you need to verify is with respect to the broker’s regulatory standing. The specific licensing body, however, will depend on where you are located. For example, British and European traders will typically sit within the remit of the Financial Conduct Authority or CySEC, while in the US it’s the SEC and FINRA. Crucially, if your chosen stock app is not regulated by a tier-one licensing body that covers your region, you should avoid it at all costs.

User Experience

Nevertheless, you still need to explore how user-friendly the mobile app is, as some are more suited to beginners than others. Crucially, you should be able to navigate through the stock library and make an investment without being hindered by a smaller screen size.

Tradable Stocks

The best stock market apps of 2026 now allow you to access a wide variety of international stocks. This isn’t always the case though, so you need to check what markets the app supports before opening an account.

For example, the likes of eToro and IG give you access to thousands of stocks across lots of different stock exchanges. On the other hand, Stash is focused exclusively on US-listed companies. Furthermore, you also need to explore whether your chosen stock app supports traditional share ownership or CFDs.

Fees

The days of paying stock trading fees are slowly but surely coming to an end. This is why new-age platforms like eToro, Robinhood, and Stash, are becoming more and more popular with the next generation of stock investors. Ordinarily, brokers charge either a flat or variable fee when you buy stocks.

If they do, this will always be charged at both ends of the trade – meaning that you pay a fee when you buy stocks and again when you sell them. But, the best stock market apps, like those we’ve reviewed, charge no trading fees at all. In fact, eToro and Robinhood do not charge any monthly or annual fees, either.

Spread and Overnight Financing

Although there are several commission-free stock apps to choose from, you do need to look out for the spread. This is simply the difference between the buy and sell price of a stock. The gap in pricing is known as the spread – and it’s an indirect fee that you pay to access the market. If you decide to trade stocks in the form of CFDs, then you also need to keep an eye out for overnight financing.

Trading Tools & Features

The best stock investment apps active in the space will offer a range of tools and features to stand out from the crowd. One feature, in particular, that is worth a mention is the eToro Copy Trading tool. As we briefly noted earlier, this allows you to copy the stock trades of an experienced investor.

Not only is this ideal if you have no experience in choosing stocks, but also if you don’t have time to actively trade. Best of all, you can invest in an eToro Copy Trading feature from just $200.

Research & Analysis

Investing in stocks without performing research is just as high risk as spinning a roulette wheel in a casino, so you need to choose a stock app that gives you access to fundamental research tools.

At the forefront of this is real-time news developments and the ability to set pricing alerts. When it comes to analyzing charts, you’ll want to choose the best stock app that gives you access to drawing tools and technical indicators. This is especially the case if you plan to trade stock CFDs.

Education

If you are a complete novice in the world of stocks and shares, then it is important that you begin to brush up on your investment knowledge. In this respect, we prefer stock investing apps that offer educational materials within the application. For example, eToro offers a wealth of guides, videos, and even webinars that can take your trading skills to the next level.

Device Compatibility

As we covered just a moment ago, you need to check whether or not your chosen stock app is compatible with your phone’s operating system. Most brokers will offer Android stock apps (also referred to as Google stock apps) and iPhone stock apps, so most of you will be covered. If you have an alternative operating system, then you might be forced to use the broker’s browser-based platform.

Payment Methods

Unfortunately, some stock apps still only support bank transfers. Although this might suffice for some of you, it won’t if you are looking to deposit and invest instantly. This is because bank transfers can take a few days to arrive.

Customer Service

Don’t forget about customer service, as there might come a time when you need assistance on your stock trading account. The best stock apps of 2026 will offer in-house live chat via the application. This avoids the need to send an email or make a telephone call. We also prefer stock apps that offer customer service on a 24/7 basis.

What is the Best Practice Stock Trading App?

If you’re new to stock trading, it’s a good idea to use a practice stock trading app so that you can get used to trading and try out strategies without the risk of losing money. Even if you’re experienced, using a practice stock trading app is a good way to try out an app and see whether it’s right for you.

These days, many brokers offer demo trading accounts. For example, eToro offers a $100,000 demo account that has the full functionality of the real money app, so you can even try out its copy trading tool in the demo mode.

How to Get Started with the Best Stock Trading App

Once you have chosen the best stock trading app for you, the next stage is to open an account and make a deposit. If this is something that you have never done before, then we are now going to show you a step-by-step guide of what you need to do.

If you wanted to practice the process first then you could always use a mock stock trading app, like eToro’s $100,000 demo app, to get yourself familiar. eToro is our top pick in terms of the best stock trading apps for beginners, but the process remains similar across other brokers. If your device also plays a factor in your decision then eToro is also our recommended best stock trading app for iPhone and Android.

What Are ‘Bull’ and ‘Bear’ markets?

Once you have found a good trading platform to use, you may want to begin analyzing the markets to make trading decisions. One key factor to consider before placing any trades is what type of condition the market is currently in.

The two most common types of market conditions are ‘bull’ and ‘bear’ markets.

A bull market is a market condition in which the prices of assets is on the rise. To be categorized as a bull market, prices must rise by at least 20% from two consecutive lows. Some traders use bull markets to make a profit by buying the dip and selling when the price reaches a new high.

A bear market is a market in which prices are falling. A bear market condition is identified by a decrease of 20% after a previous high. Some traders choose to take advantage of bear markets by short selling.

Best Stock Trading App 2026 – Conclusion

So there we have it, the best stock trading apps available right now. If you’re outside the US, we think the best stock trading app is eToro, due to it’s 0% commission, great range of stocks, and fantastic copy trading tools. For US investors we recommend Robinhood, a stock app that offers a huge range of stocks and, like eToro, doesn’t charge commission.

eToro – Best Stock Trading App with 0% Commission

76% of retail investor accounts lose money when trading CFDs with this provider.

References

- https://www.nerdwallet.com/article/investing/stock-trading-how-to-begin

- https://corporatefinanceinstitute.com/resources/equities/stock-exchange/

- https://www.forbes.com/advisor/investing/how-stock-trading-works/

- https://time.com/personal-finance/article/bear-vs-bull-market/

- https://www.babypips.com/learn/forex/forex-vs-stocks

Frequently Asked Questions on Stock Trading Apps

How do I re-download stock apps on iOS 10?

Do stock apps allow you to make real money?

Are there any stock apps for Windows?

The is the cheapest stock app?

Find The Best Broker For You

Best Stock, Forex, CFD, Crypto, Social or Day Trading Apps that meet your trading goals and needs.