The world of finance is quickly evolving, and it looks like cryptoassets may be driving much of this change. According to an analysis by StockApps.com, cryptocurrencies and other disruptive innovations could be responsible for as much as 68% of all risk-asset worth by 2030. This would make them a major force in the global economy.

Edith Reads from StockApps commented on the matter. “Cryptoassets and disruptive technologies are resonating well with Gen X, Millennials, and Gen Z. They provide a quick way to get rich as they ease the workload. Most investors are now looking at them as an alternative to traditional stocks and bonds. We can only expect more of this in the coming years.”

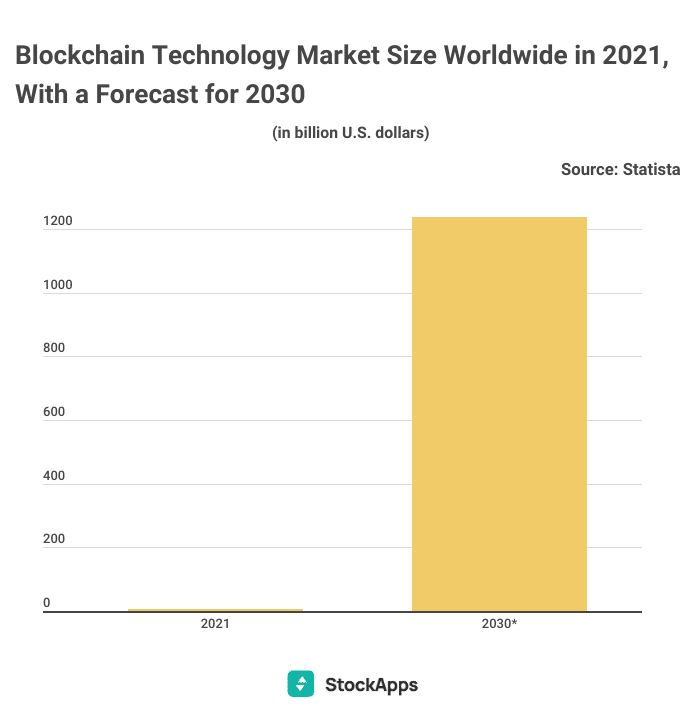

Growth of Cryptoassets

The global market capitalization of cryptoassets was $4.4B in 2021 but is likely to reach 12.1B in 2030. This represents a compound annual growth rate of 11.9%. Adoption by institutional investors and corporations fuel the growth of cryptoassets. As more people become familiar with cryptos and their potential use cases, the demand for these digital assets has risen. Also, large institutions, such as hedge funds and banks, are now investing in cryptocurrencies.

Another factor contributing to the growth of cryptoassets is the rise of decentralized finance (DeFi). DeFi is a rapidly growing ecosystem of Dapps built on blockchain technology. DeFi has driven demand for cryptos, particularly Ethereum, the leading blockchain platform for DeFi apps.

Impact of Disruptive Innovation

Disruptive innovation is another factor driving the shift in risk asset value. It refers to new technologies or business models that disrupt existing markets and create new growth opportunities. Disruptive innovation can create significant value for investors. However, it can also threaten established companies that fail to adapt.

Some examples of disruptive innovation include electric vehicles, renewable energy, and artificial intelligence. These technologies are changing the way we live and work, and they are also creating new investment opportunities. As more investors recognize disruptive technologies’ potential, traditional risk assets’ value dwindles.

Implications for Traditional Asset Classes

The rise of cryptoassets and disruptive innovation has significant effects on traditional assets. Classes such as stocks and bonds face resistance as more actors prefer cryptos. As investors shift their focus, traditional assets may become less attractive, leading to a decline in value.

Investors should consider diversifying their portfolios, including exposure to cryptoassets and disruptive innovation. These investment areas offer the potential for high returns but also come with higher risk due to their volatility and lack of regulation.

The growth of these investment areas is driven by increased adoption—besides the new use cases for blockchain technology and advances in disruptive technologies.

As investors seek higher returns, traditional asset classes may become less attractive. Therefore, it leads to a shift in the investment landscape.

Question & Answers (0)