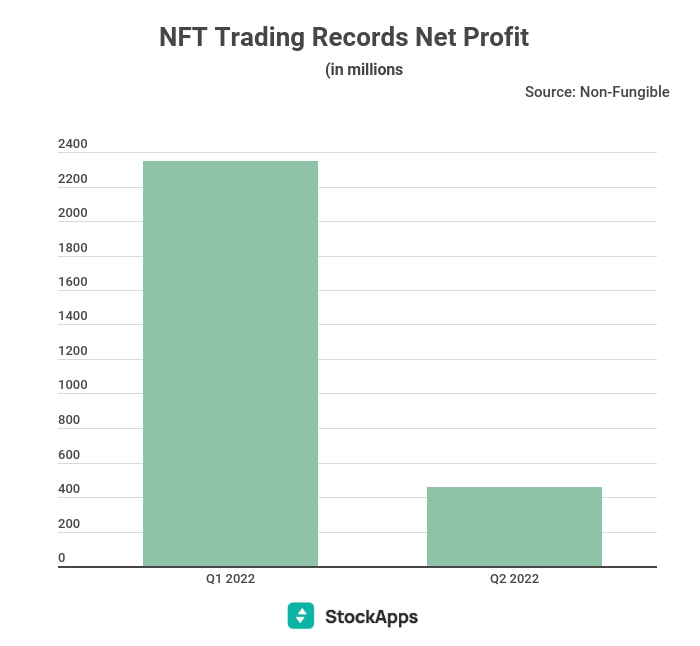

The NFT Market is still in a state of flux, with many investors feeling uncertain about the future. According to StockApps reports, NFT is going through a recession with a profit fall. The Q2 of the NFT market has seen a decrease in profit margins and increased losses. Profit at reselling decreased by 80 percent between Q1 and Q2, 2022, to stand at $460 million. This is in comparison to the first quarter of the year, where net profits were much healthier at $2,347M.

The collectibles recorded the highest resale loss with at least $100 million weekly. However, they have the highest profits in Q2, 2022.

Besides profits, other market indicators also recorded a massive drop. The volume of sales, volume of USD traded, number of buyers and sellers, active wallets, total profit at resell, and the average price all recorded a drop. For instance, NFT recorded a total volume sale of $10,734,200,304 in Q1, 2022. However, the volume dropped to $8,070,349,275 in Q2, 2022, signifying a 25 percent drop.

StockApps financial analyst Edith Reads says, “The drop in profits and increase in the resale loss is attributed to a drop in NFT market volumes and prices which made profit-making in the second quarter of 2022 almost impossible. The USD traded volume and other market indicators also dropped in Q2, 2022, due to a loss of interest in collectibles. This loss began at the start of Q1, 2022, and picked pace in Q2, 2022. This trend has left the “blue chip” collections as the only item of interest in the market.”

The centralization process of the NFT market resulted in the USD traded drop. Meebits, CryptoPunks, and the Bored Ape Yacht Club own a total of 30 percent of the USD volume traded in the global NFT market. Given that the three are linked to the Yuga Lab’s projects, it is no doubt that the NFT market centralization is taking place around the said project.

NFT Liquidity and Building

The NFT liquidity rate is stagnating, while the building rate is rising. With the global NFT supply growing at only four percent, the market has issued fewer new NFTs in Q2, 2022. All market segments have experienced a diminished NFT liquidity, with the second market dominating 80% of the USD traded volume. However, the primary market has had a downward trend over the same period.

On the contrary, Metaverses and Utility NFTs have increased liquidity, despite having a challenging market. The increasing liquidity in Metaverses is attributed to the Meta hype and OtherSide drive.

What’s NFTS’ Future?

The NFT market has changed dramatically in Q2, 2022 eliminating NFTs from the spotlight. However, all is not lost as the bull markets come with higher profits. The bear markets only build the actual value as far as NFT is concerned.

Question & Answers (0)