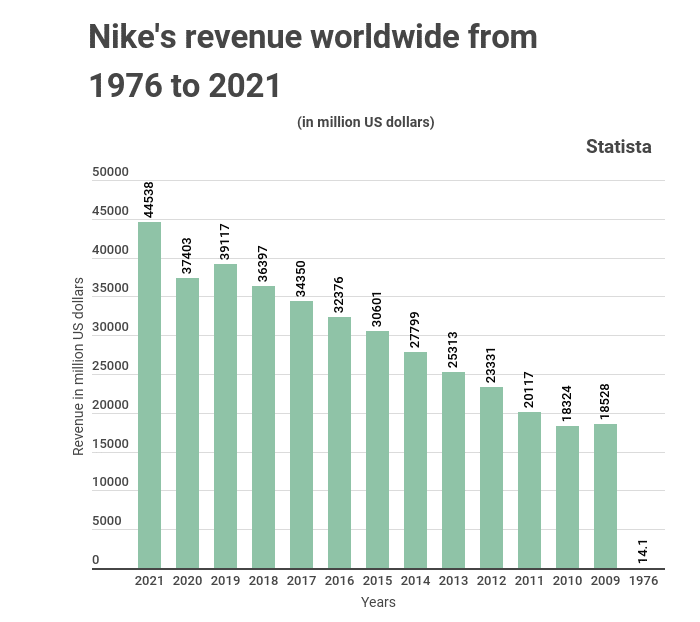

Stockapps.com has been evaluating the journey of Nike through its annual revenue since 1972. According to their data presentation, it currently takes Nike around 15 minutes to sell the same amount of merchandise that it did in 1972 in a year.

Blue Ribbon Sports was perpetually cash-strapped in 1972, with annual revenues of $1.3 million. However, with $44.5 billion as annual revenue in 2021, Nike is the world’s largest sportswear brand today.

Nike, established in the United States, is the world’s largest athletic footwear and apparel manufacturer. The brand is listed on the NYSE as NKE. Over time, Nike has acquired several reputable athletic wear companies such as Cole Haan, Bauer Hockey, Converse, Hurley International, Starter, and Umbro. The Nike swoosh is one of the most well-known trademarks globally and a famous athletic sponsor.

The company marked its 50th anniversary this week. The event made them share a letter written by Phil Knight, the founder, on all their social media platforms. The letter showed the twists and turns that the company has been through to be where it is today.

According to Edith Reads from stockapps.com, “Much of Nike’s success may be traced to its global marketing strategy, which enlists superstar athletes, elite sports groups, and school athletic programs to promote its technology and design through sponsorship deals.”

Mergers and acquisitions in sporting goods industries

Many mergers and acquisitions have occurred in the athletic goods business. Reebok, Adidas, Puma, and Under Armour are among the industry’s other major participants. Some of these businesses collaborate with fashion designers to create new apparel styles and expand their product offerings. As a result, a trend toward casual work attire and demand from specific segments such as teenagers and baby boomers will fuel consumption.

Sports and fitness gear is highly diversified, with many manufacturers vying for attention, ranging from low-cost discounters to high-end couture labels. Even the most well-known firms must work hard to maintain their market share. Consumers are expecting more versatile clothing with greater usefulness. Thus retailers are continuing to develop new sportswear styles for men and women.

Despite the economic hardships triggered by the COVID-19, the sportswear brands are showing an upward trajectory. For Instance, Adidas and Puma are among the most valuable sports business brands. Adidas has a market cap of $23.5 billion, while Puma has $6.2 billion.

Keeping up with the growing market

While major sportswear firms grew, smaller sportswear brands grew faster. Skechers’ brand worth climbed by 68 per cent to $3.2 billion, while Li-Ning’s increased by the same percentage to $2 billion.

However, Nike is not taking any chances with its business. They are crafting innovative designs to keep them in the market. Besides, Nike has ventured into virtual assets as investments. These include the latest Nike NFT sneakers.

The firm has always relied on continuous adverts. Nike has released some of the best striking advertisements to date, including ads starring former NFL quarterback Colin Kaepernick in 2018, the Dream Crazier campaign showcasing female athletes in 2019, and the “Courage” ad commemorating the 2008 Beijing Summer Olympics.

Question & Answers (0)