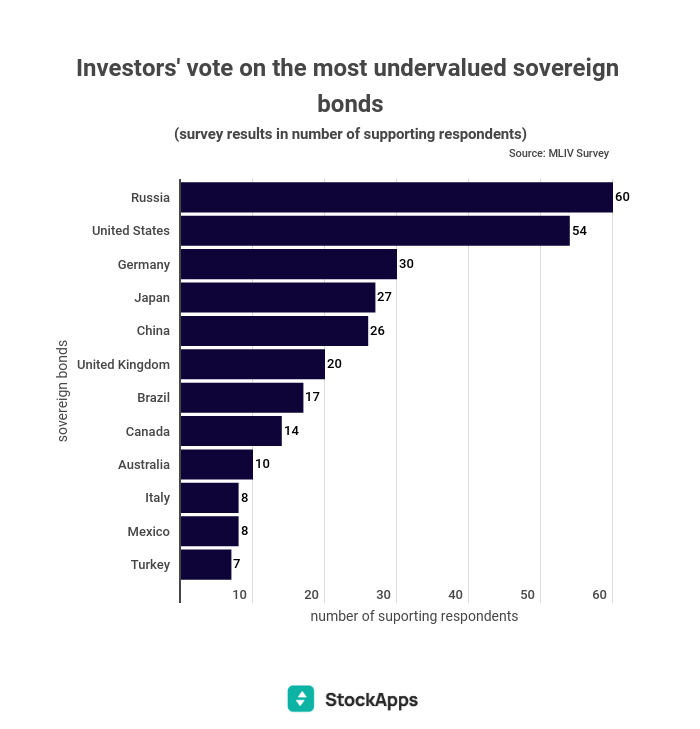

Investors looking for the best place to put their money needn’t look further than Russia. That has come out in a StockApps.com data presentation that ranks Russia’s sovereign bond market better than any other. The site drew its conclusions from analyzing responses from 525 respondents to a survey. 60 of these picked Russia’s sovereign bond as the most favorable globally.

Most of the survey’s respondents (60%) were from Canada and America. Additionally, all the polled individuals have rich backgrounds in finance and investments. As such, their sentiments carry weight within investment circles. The poll results will come as welcome news to investors seeking new opportunities beyond our borders.

Best bang for your buck

“Russia is a great place to invest,” said StockApp’s Edith Reads. She reiterated that “Investors looking for value in the world of sovereign debt, have Russia as their best bet. The country has the most underpriced sovereign bonds in the world right now. That means that it’s the place where you’ll get a lot of bang for your buck.”

Russia’s sovereign bond yields are all into double figures. At the time of writing, its 10Y bond has a yield rate of 10.8%. Similarly, its 5Y and 2Y bonds have yield rates of about 11%. Its one-year product offers returns of over 12 percent.

The respondents also identified other markets they thought had good returns for investors. The U.S closely followed Russia, with 54 of the respondents picking it. Another 30 chose Germany, while Asian Giants Japan and China received 27 and 26 votes respectively.

Is it worth the risk?

The Russian bond market seems appealing at the moment. But should you invest in it? Like all investments, there are risks inherent in investing in Russian sovereign bonds. Whether or not it’s a risk worth taking depends on your capacity to take risks.

It’s sound investment practice to only invest in what you can bear losing. The bond price isn’t guaranteed; it may fluctuate over time depending on the prevailing macroeconomic conditions. Other factors include changes in interest rates and the perception of the issuer’s creditworthiness.

Fears of Russia defaulting on its debt obligations

One concern that may impact the uptake of Russia’s bond offering is the nation’s stability. The country has historically been volatile politically and government-wise. The upheavals have been not only internal but also external. At the moment, for instance, it’s invading Ukraine, an action that has made it a pariah state internationally.

Besides Russia’s frosty relationships with its neighbors and the international community, its economy is weakening. The country is reeling under a barrage of sanctions from the developed world that have seen its economy take a beating. The sanctions are tailored at forcing its exit out of Ukraine.

The U.S has, for example, blocked its bond payments in USD denominations held at U.S banks. That has heightened the possibility of the nation defaulting on its debt obligations. Should that happen, Russia’s flailing economy will come under severe stress exacerbating its current grim investments prospects.

Question & Answers (0)